Is CKBL safe?

Pros

Cons

Is CKBL Safe or a Scam?

Introduction

CKBL, a forex broker based in Hong Kong, has been attracting the attention of traders looking for reliable trading platforms. As the forex market continues to expand, the need for traders to assess the legitimacy of brokers has never been more critical. With numerous reports of scams and fraudulent activities within the industry, traders must exercise caution before committing their funds. This article aims to provide an objective analysis of whether CKBL is a safe trading option or a potential scam. The evaluation will be based on regulatory compliance, company background, trading conditions, customer safety measures, client experiences, platform performance, and risk assessment.

Regulation and Legitimacy

Regulatory oversight is a fundamental aspect of any financial service provider, particularly in the forex market. A broker's regulatory status not only impacts its credibility but also provides a layer of protection for traders. Unfortunately, CKBL has been flagged for operating without adequate regulatory oversight, raising significant concerns about its legitimacy and safety.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Hong Kong | Not Verified |

The absence of a valid regulatory license is a red flag for potential traders. Regulatory bodies enforce strict rules to ensure fair trading practices and protect investors. Without such oversight, CKBL's operations are shrouded in uncertainty, and the risk of encountering fraudulent practices increases significantly. Furthermore, reports indicate that CKBL has a suspicious regulatory history, which further undermines its credibility.

Company Background Investigation

CKBL's history and ownership structure provide insight into its operational integrity. Established in 2022, CKBL operates under the name Cheung Kong Bullion Limited. However, the lack of transparency regarding its ownership and management team raises questions about its legitimacy. A thorough investigation reveals that the management team lacks significant experience in the forex industry, which may negatively impact the broker's operational competence.

Moreover, the company's transparency levels are concerning. The absence of detailed information about its operations, financial status, and management practices makes it difficult for potential traders to make informed decisions. A trustworthy broker should provide clear and accessible information to its clients, ensuring that they are well-informed about the risks and rewards associated with trading.

Trading Conditions Analysis

The trading conditions offered by CKBL are another critical factor in determining its legitimacy. While the broker claims to provide competitive spreads and low trading costs, the actual fee structure appears to be less favorable when compared to industry standards.

| Fee Type | CKBL | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | High | Moderate |

High spreads and unclear commission structures can significantly affect a trader's profitability. Traders should be wary of brokers that do not provide a transparent fee structure, as this could indicate hidden charges or unfavorable trading conditions. Additionally, CKBL's overnight interest rates seem to be higher than the industry average, which could further erode traders' profits.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker's reliability. CKBL's measures for protecting client funds are questionable at best. Reports suggest that the broker does not adequately segregate client funds, which poses a significant risk to traders' investments.

In a reputable brokerage, client funds should be held in separate accounts to protect them from the broker's operational risks. Moreover, the absence of investor protection mechanisms, such as negative balance protection, further exacerbates the risks associated with trading with CKBL. Traders must be cautious, as any historical issues regarding fund safety could indicate a pattern of negligence or malpractice.

Customer Experience and Complaints

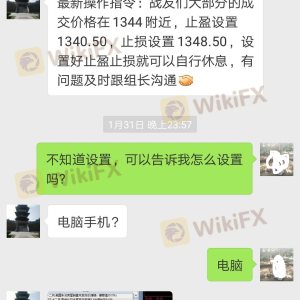

Analyzing customer feedback is essential for understanding a broker's reliability. CKBL has garnered a mix of reviews, with many clients expressing dissatisfaction with the broker's services. Common complaints include difficulties in withdrawing funds, poor customer service, and lack of transparency in trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Average |

| Transparency Concerns | High | Poor |

Several clients have reported that their withdrawal requests were either delayed or denied, raising significant concerns about the broker's operational integrity. Furthermore, the quality of customer service has been criticized, with many users noting that their inquiries went unanswered or received vague responses. Such patterns are indicative of a broker that may not prioritize client satisfaction or transparency, which are critical factors for a trustworthy trading environment.

Platform and Execution

The performance and reliability of a trading platform are vital for a successful trading experience. CKBL's platform has been described as moderately stable, but users have reported issues with order execution, including slippage and rejections.

A reliable broker should ensure that trades are executed promptly and at the desired prices. Any signs of platform manipulation, such as frequent slippage or rejected orders, can significantly impact a trader's profitability and overall experience. Traders should be cautious of brokers that do not provide clear evidence of their platform's reliability and performance.

Risk Assessment

Using CKBL as a trading broker comes with several risks that traders must consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight increases fraud risk. |

| Financial Risk | Medium | High fees and spreads can erode profits. |

| Operational Risk | High | Poor customer service and withdrawal issues. |

The overall risk associated with trading with CKBL is significant. Traders should be aware of the potential for losing their investments due to regulatory failures, high trading costs, and operational inefficiencies. To mitigate these risks, it is advisable to conduct thorough research and consider alternative brokers with established reputations and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that CKBL presents several red flags that indicate it may not be a safe trading option. The lack of regulatory oversight, questionable company background, unfavorable trading conditions, and poor customer experiences all contribute to a troubling assessment of this broker.

For traders seeking reliable alternatives, it is recommended to consider brokers that are regulated by reputable authorities, have transparent fee structures, and demonstrate a commitment to customer satisfaction. Some reputable alternatives include brokers like IG, OANDA, and Forex.com, which have established themselves as trustworthy options in the forex market.

Ultimately, traders should exercise caution and conduct thorough due diligence before engaging with any broker, especially those like CKBL, which may not meet the necessary standards for safety and reliability.

Is CKBL a scam, or is it legit?

The latest exposure and evaluation content of CKBL brokers.

CKBL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CKBL latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.