Regarding the legitimacy of CFE forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is CFE safe?

Pros

Cons

Is CFE markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Cantor Fitzgerald Europe

Effective Date:

2001-12-01Email Address of Licensed Institution:

compliance-cfe@cantor.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.cantor.com/global/europe/Expiration Time:

--Address of Licensed Institution:

110 Bishopsgate London EC2N 4AY UNITED KINGDOMPhone Number of Licensed Institution:

+4402078947000Licensed Institution Certified Documents:

Is CFE A Scam?

Introduction

CFE, or Cantor Fitzgerald Europe, is a well-established player in the foreign exchange (forex) market, claiming to provide a wide range of trading services including forex, contracts for difference (CFDs), and various financial instruments. Founded in 2001 and based in the United Kingdom, CFE has positioned itself as a reputable broker catering to a global clientele. However, as with any financial service provider, it is crucial for traders to exercise caution and conduct thorough evaluations before engaging with the platform. The forex market, known for its volatility and complexity, often attracts both legitimate firms and potential scams, making due diligence essential.

This article aims to provide an objective analysis of CFEs legitimacy, utilizing data from various sources including regulatory disclosures, customer reviews, and financial performance metrics. We will explore the broker's regulatory status, company background, trading conditions, customer safety measures, and user experiences to determine whether CFE is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical indicator of its legitimacy and reliability. CFE operates under the oversight of the Financial Conduct Authority (FCA) in the United Kingdom, which is known for its stringent regulatory framework designed to protect traders. Below is a summary of CFE's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 149380 | United Kingdom | Verified |

The FCA requires brokers to adhere to strict guidelines, including maintaining segregated accounts for client funds, ensuring transparency in operations, and providing a fair trading environment. CFEs compliance with FCA regulations indicates a commitment to safeguarding customer interests.

Moreover, there have been no negative regulatory disclosures found against CFE during the evaluation period, suggesting a clean compliance record. However, it is important to note that while the FCA is a reputable regulator, not all regulatory bodies are equally stringent. Traders should always verify the credibility of the regulatory authority governing their broker to ensure adequate protection of their investments.

Company Background Investigation

CFE has a rich history dating back to its establishment in 2001. As a subsidiary of Cantor Fitzgerald, a global financial services firm, CFE benefits from a robust corporate structure and extensive industry experience. The firm specializes in various trading services, including equities, options, futures, and forex, catering to a diverse clientele across multiple regions.

The management team at CFE comprises seasoned professionals with extensive backgrounds in finance, risk management, and trading. This expertise is crucial for navigating the complexities of the forex market and ensuring that the firm operates effectively within regulatory frameworks. The transparency of the company's ownership structure and its affiliation with a well-known financial institution lend additional credibility to CFE.

In terms of information disclosure, CFE provides comprehensive details about its services, trading conditions, and regulatory compliance on its official website. This level of transparency is essential for building trust with potential clients, as it allows traders to make informed decisions based on reliable information.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for evaluating its competitiveness and fairness. CFE provides access to various financial instruments with a fee structure that includes spreads, commissions, and overnight interest rates. Below is a comparison of CFE's core trading costs against industry averages:

| Cost Type | CFE | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.5 pips | 1.0 pips |

| Commission Model | $3 per lot | $5 per lot |

| Overnight Interest Range | Variable | Variable |

CFE's spreads start from 0.5 pips, which is competitive compared to the industry average of 1.0 pips. Additionally, the commission structure appears favorable, with lower fees per lot than many competitors. However, traders should be cautious about any unusual or hidden fees that may not be immediately apparent.

While CFE presents attractive trading conditions, it is essential for traders to read the fine print related to fees and commissions. Understanding the full scope of costs associated with trading on the platform can prevent unexpected expenses that may impact profitability.

Customer Funds Security

The safety of customer funds is a paramount concern for any forex trader. CFE implements several measures to ensure the security of client funds, including segregated accounts that keep customer deposits separate from the company's operational funds. This practice is crucial for protecting traders in the event of financial difficulties faced by the broker.

Additionally, CFE adheres to the FCA's requirements for maintaining a high level of financial integrity and transparency. The broker also offers negative balance protection, which safeguards clients from losing more than their deposited funds during volatile market conditions.

Despite these security measures, it is essential to investigate any historical issues related to fund safety. While CFE has not reported significant security breaches or fund mismanagement, potential clients should remain vigilant and conduct their own research to ensure that their investments are safe.

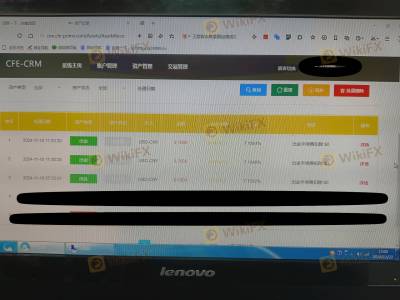

Customer Experience and Complaints

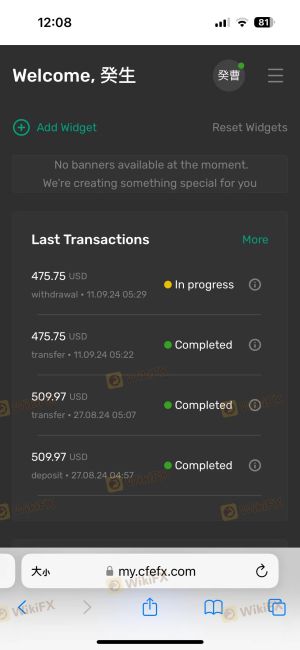

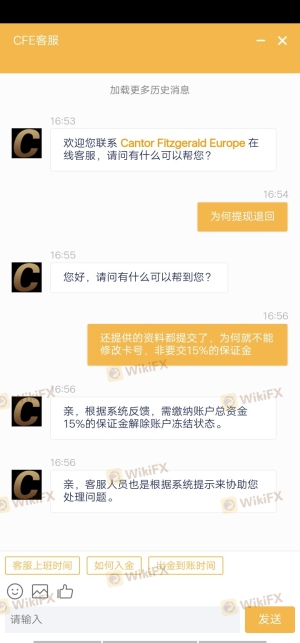

Customer feedback is a valuable resource for assessing a broker's reliability and service quality. CFE has received mixed reviews from users, with some praising its trading platform and customer support, while others have reported issues related to withdrawal delays and account management.

The following table summarizes the primary complaint types associated with CFE, along with their severity and the company's response:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response time |

| Account Blocking | Medium | Inconsistent support |

| Customer Service | Medium | Mixed reviews |

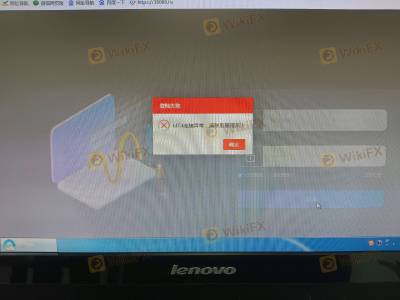

Typical complaints include difficulties in withdrawing funds and account access issues. For instance, some users have reported being unable to withdraw their funds for extended periods, which raises concerns about the broker's responsiveness to client needs.

In one case, a user reported that their account was blocked due to a minor error, and customer support did not resolve the issue promptly, leading to frustration. Such complaints highlight the importance of evaluating a broker's customer service quality alongside its trading conditions.

Platform and Execution

The performance of a trading platform is a critical factor in a trader's overall experience. CFE offers a user-friendly platform designed for efficient trading, with features that cater to both novice and experienced traders. However, the platform's execution quality, including order fill rates and slippage, is equally important.

Users have reported varying experiences regarding order execution, with some noting instances of slippage during volatile market conditions. While minor slippage is common in the forex market, excessive slippage can significantly impact trading results.

Moreover, there have been no substantial reports of platform manipulation, but traders should remain cautious and monitor their trades closely to ensure fair execution. A reliable platform should provide clear and timely execution of orders, which is essential for maintaining trader confidence.

Risk Assessment

Engaging with any forex broker entails certain risks, and CFE is no exception. Below is a summary of key risk areas associated with trading with CFE:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | FCA regulation, but not all regulators are equally strict. |

| Operational Risk | Medium | Complaints about withdrawal issues and account management. |

| Market Risk | High | Forex trading is inherently volatile and risky. |

To mitigate these risks, traders should consider implementing risk management strategies, such as setting stop-loss orders and diversifying their trading portfolio. Additionally, conducting regular reviews of the broker's performance and compliance status can help traders stay informed about potential risks.

Conclusion and Recommendations

Based on the evidence presented, CFE appears to be a legitimate forex broker with a solid regulatory framework and a commitment to customer fund security. However, potential clients should be aware of ongoing concerns regarding customer service and withdrawal processes. While there are no clear signs of fraud, traders should approach CFE with caution and remain informed about their rights and responsibilities.

For traders considering whether to engage with CFE, it is advisable to start with a demo account to familiarize themselves with the platform and its features before committing real funds. Additionally, exploring alternative brokers with strong reputations, such as those with higher customer satisfaction ratings and fewer complaints, may provide a more secure trading environment.

In summary, while CFE does not exhibit overt signs of being a scam, traders should remain vigilant and conduct thorough research to ensure that their trading experience aligns with their expectations and risk tolerance.

Is CFE a scam, or is it legit?

The latest exposure and evaluation content of CFE brokers.

CFE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CFE latest industry rating score is 6.88, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.88 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.