CFE 2025 Review: Everything You Need to Know

CFE, or Cantor Fitzgerald Europe, is a well-established forex broker that has garnered mixed reviews from users and analysts alike. While the broker is regulated by the Financial Conduct Authority (FCA) in the UK, user experiences raise concerns about withdrawal issues and customer support. Moreover, CFE provides a range of trading options, yet some users have reported difficulties in accessing their funds, which could be a red flag for potential clients.

Note: It is important to note that CFE operates under different entities across various regions, which may affect the user experience and regulatory compliance. This review aims to provide a balanced perspective based on multiple sources to ensure fairness and accuracy.

Ratings Overview

We rate brokers based on user experiences, regulatory compliance, and the overall trading environment they provide.

Broker Overview

Founded in 2001, CFE is the European branch of Cantor Fitzgerald, a prominent financial services firm. The broker is headquartered in London and operates under the regulatory oversight of the FCA, which adds a layer of credibility. CFE offers a variety of trading platforms, although it does not support popular platforms like MT4 or MT5. Instead, it provides its proprietary trading platform, which allows access to multiple asset classes including forex, CFDs, commodities, and indices.

Detailed Analysis

Regulated Geographical Areas

CFE is regulated in the United Kingdom by the Financial Conduct Authority (FCA), which is known for its strict regulatory standards. However, the broker has received mixed feedback from users regarding their experiences, particularly concerning withdrawal issues and customer support.

Deposit/Withdrawal Currencies

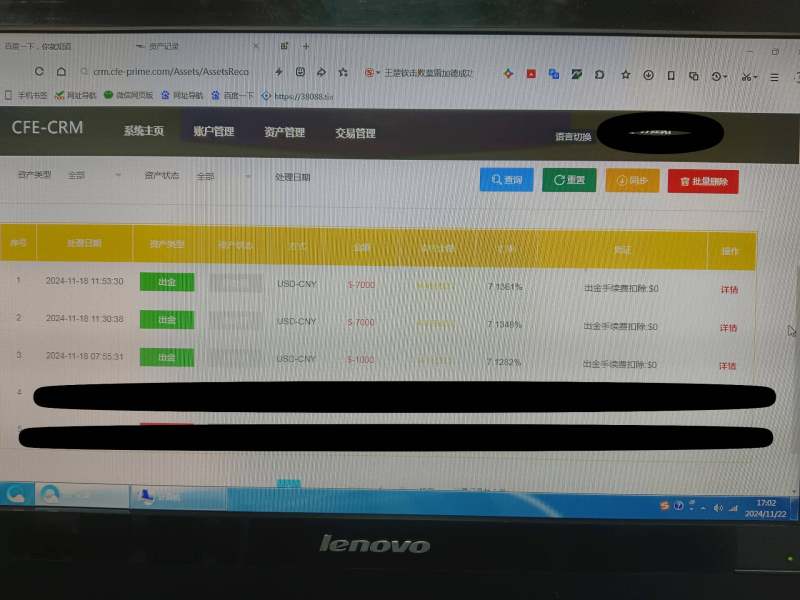

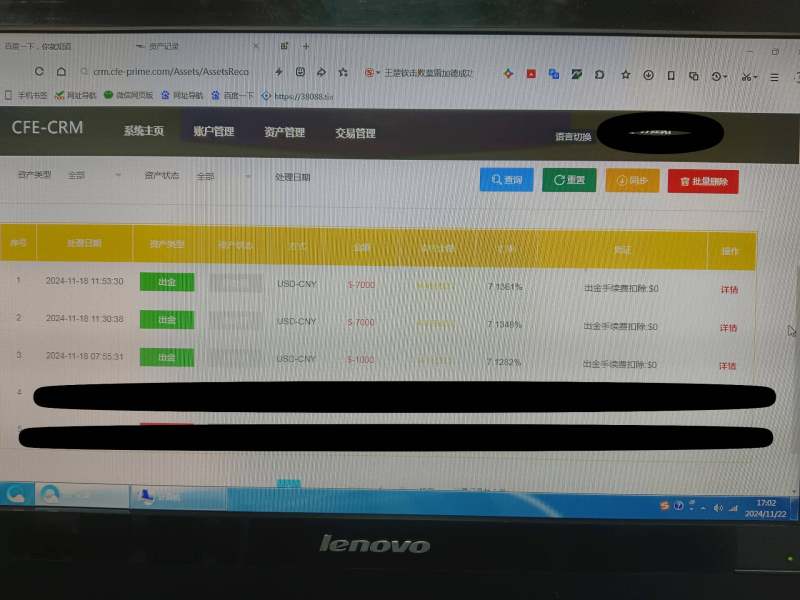

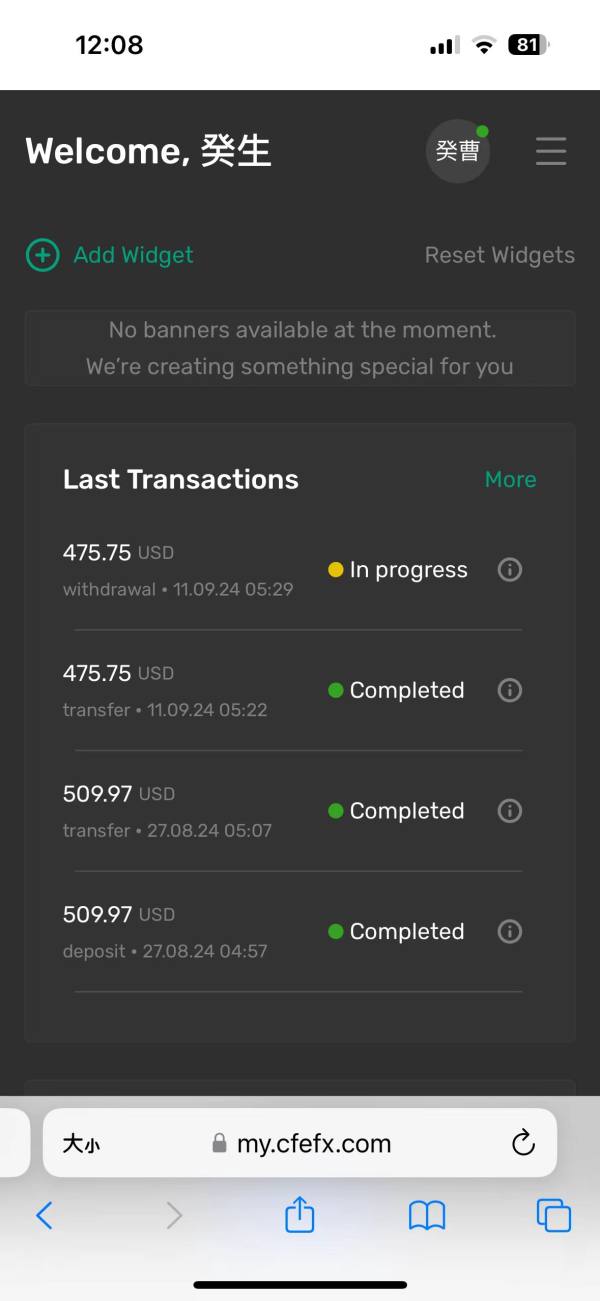

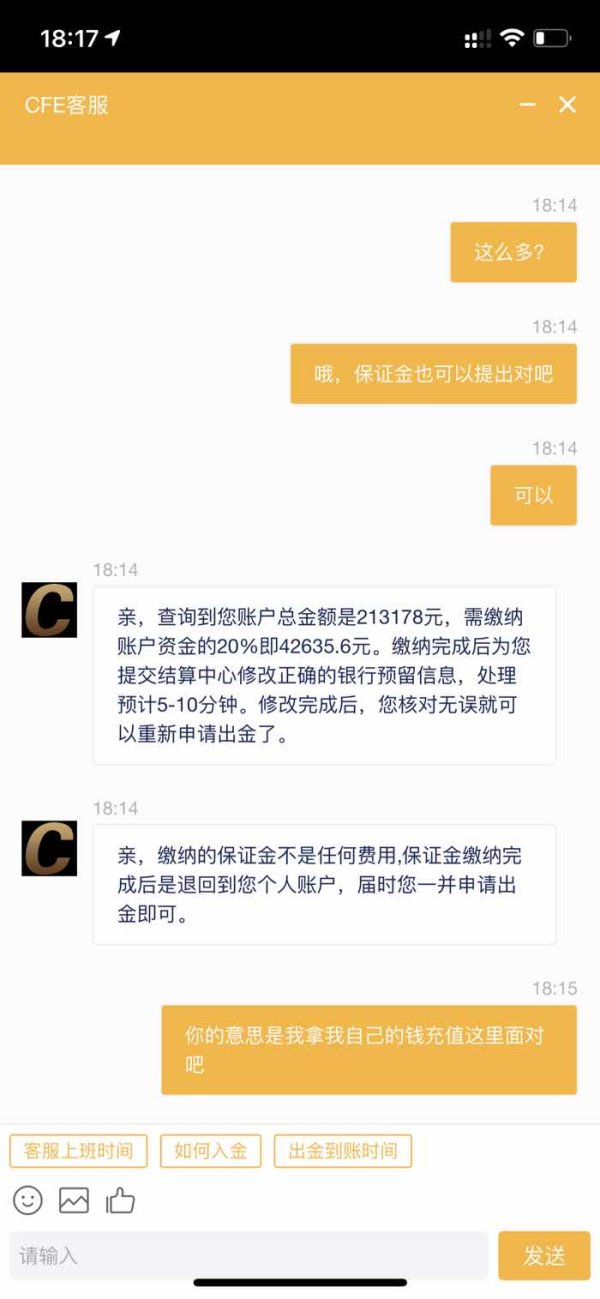

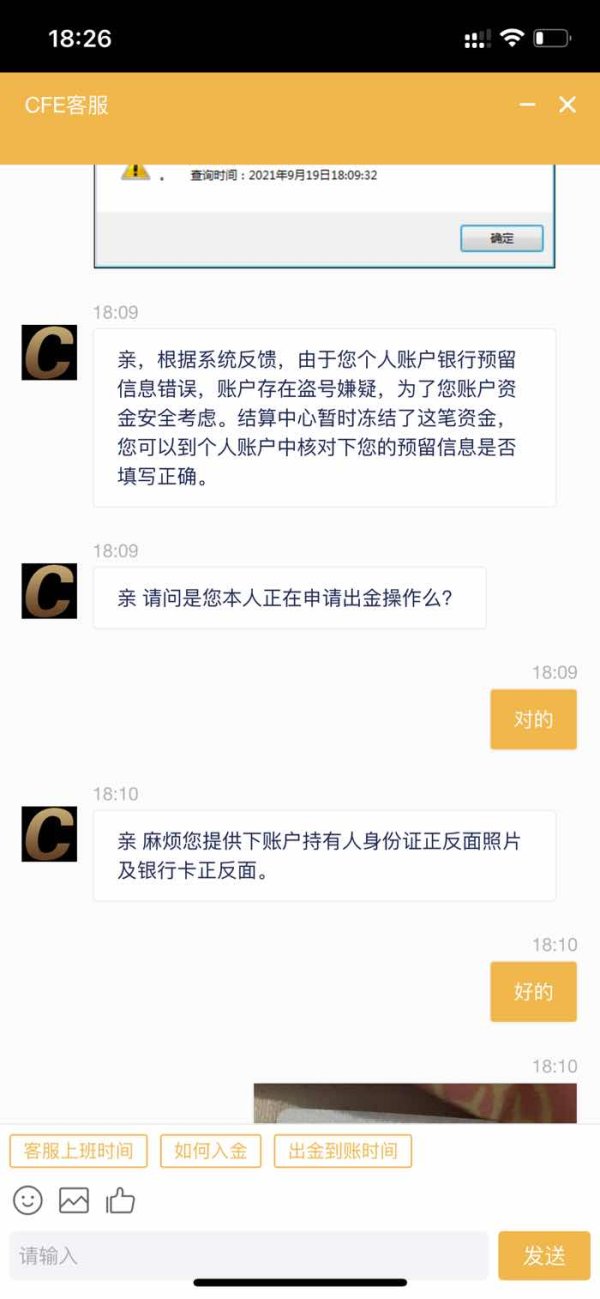

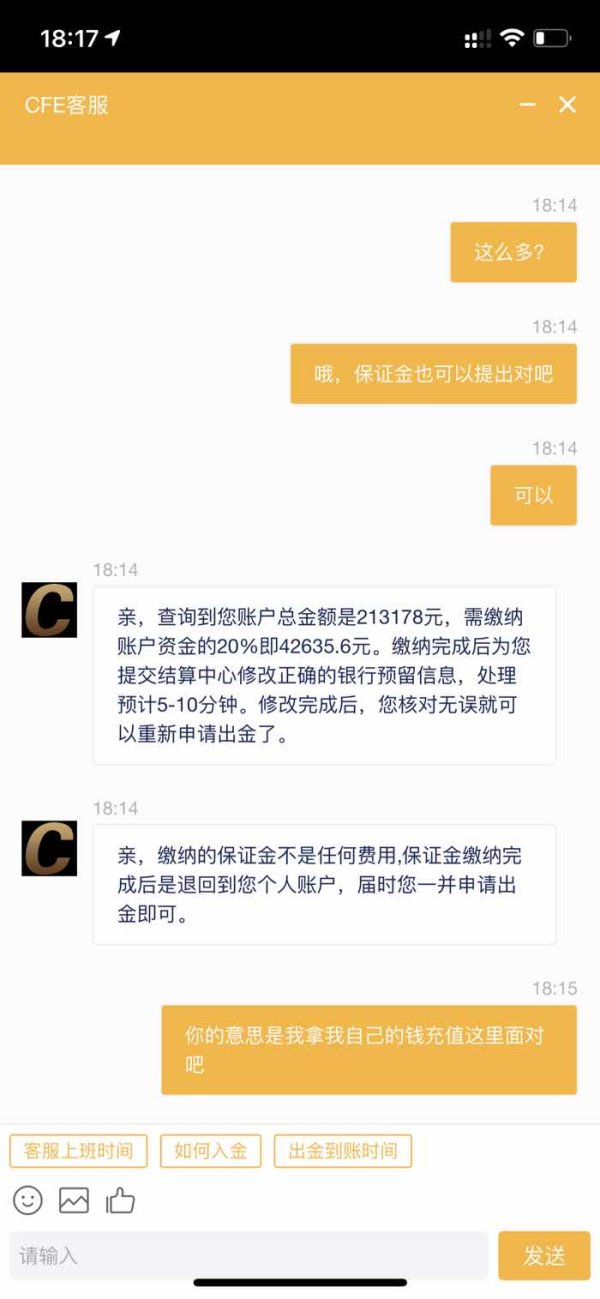

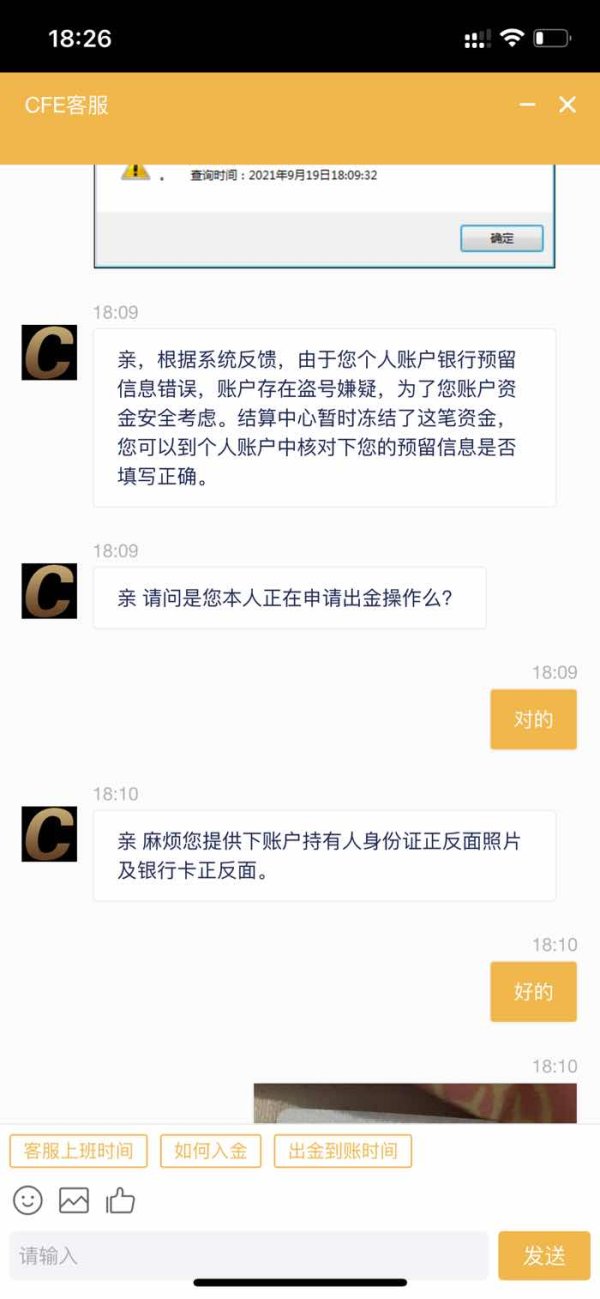

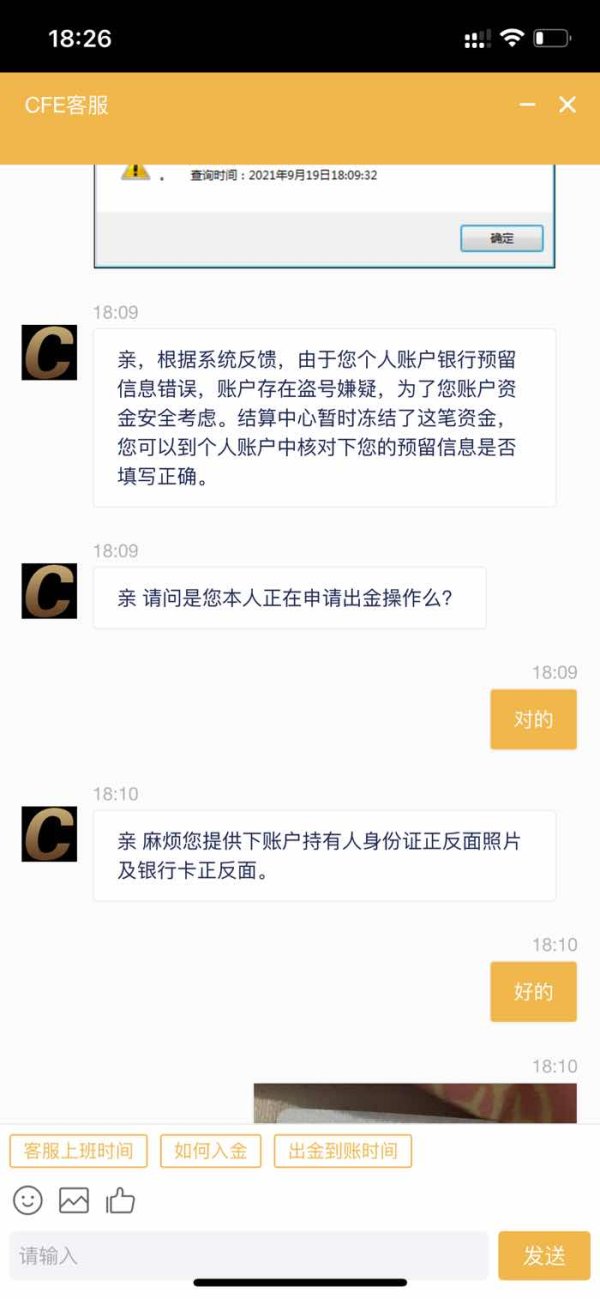

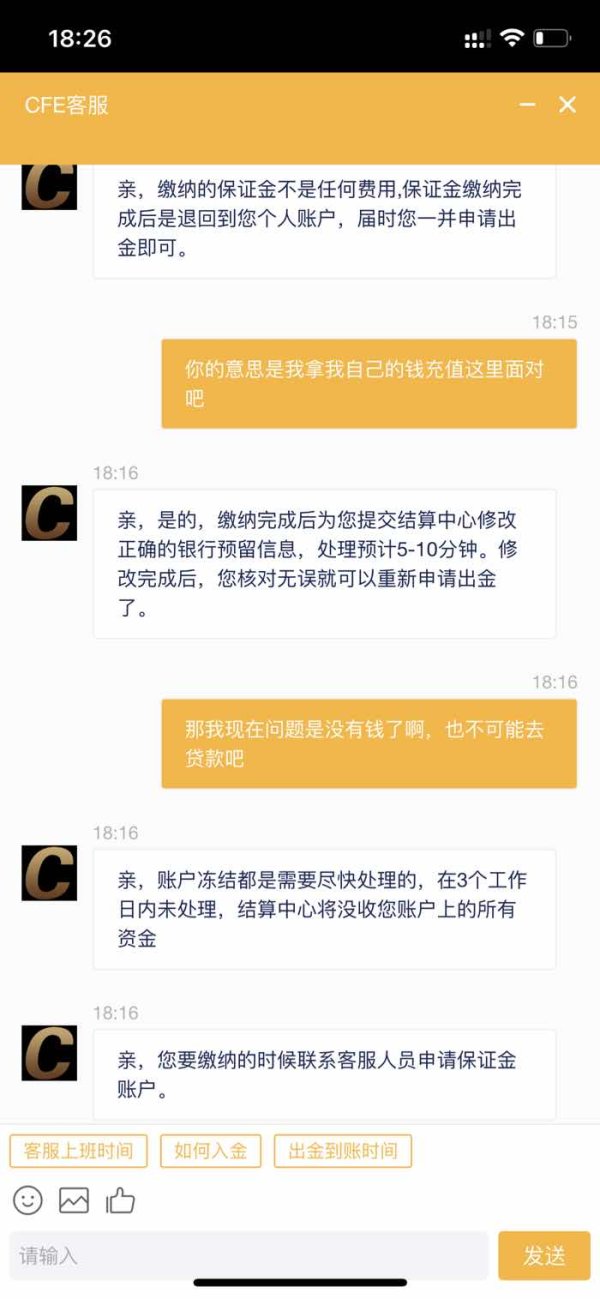

CFE supports several currencies for deposits and withdrawals, including major currencies like USD, GBP, and EUR. However, users have reported issues with the withdrawal process, leading to concerns about the broker's reliability.

Minimum Deposit

The minimum deposit required to open an account with CFE is $250, which is relatively accessible for new traders. However, users have expressed concerns that lower deposit amounts may limit access to certain account features.

CFE does not prominently advertise any bonuses or promotional offers, which could be a disadvantage for traders looking for incentives to join. This could be indicative of a more straightforward approach to trading without the complexities often associated with bonus structures.

Tradable Asset Classes

CFE offers a wide range of tradable assets, including forex pairs, commodities, indices, and CFDs. The diversity of available instruments allows traders to engage in various markets, although some users have noted that access to certain cryptocurrencies is limited.

Costs (Spreads, Fees, Commissions)

The broker offers competitive spreads starting from 0.5 pips, but users have reported hidden fees and unclear commission structures, which can lead to confusion. It is crucial for potential clients to clarify these costs before committing.

Leverage

CFE provides leverage options up to 1:500, which can be appealing for traders looking to maximize their trading potential. However, high leverage also comes with increased risk, and traders should exercise caution.

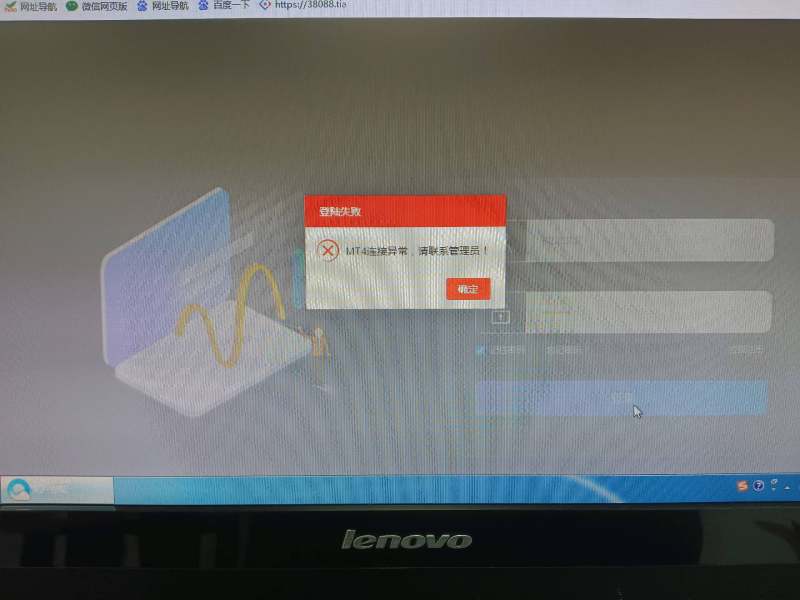

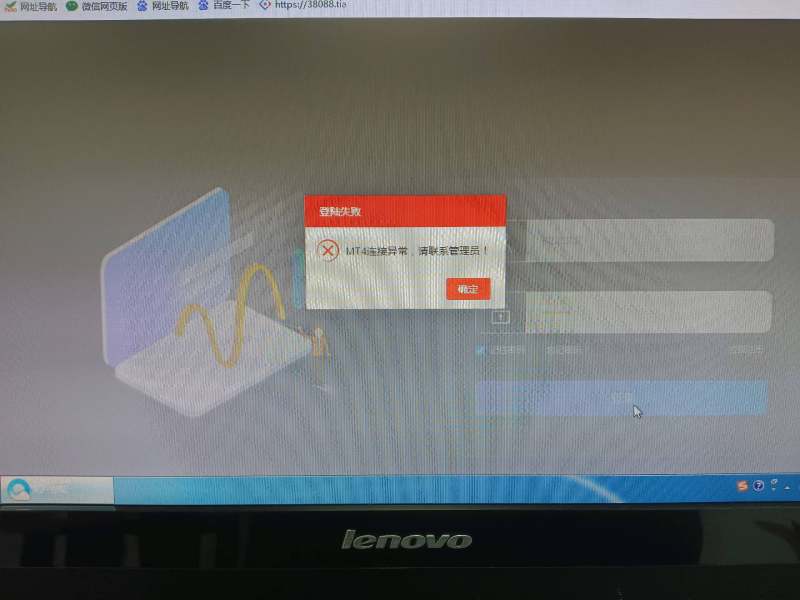

CFE primarily uses its proprietary trading platform, which lacks the familiarity of popular platforms like MT4 or MT5. This could be a drawback for traders accustomed to those platforms.

Restricted Regions

While CFE is regulated in the UK, users in certain regions have reported difficulties in accessing their accounts or withdrawing funds, raising questions about the broker's operational transparency.

Available Customer Support Languages

CFE offers customer support in English and simplified Chinese, catering to a diverse clientele. However, users have expressed dissatisfaction with the responsiveness and effectiveness of customer support, particularly in resolving withdrawal issues.

Repeated Ratings Overview

Detailed Breakdown

Account Conditions

CFE offers a minimum deposit of $250, which is quite accessible. However, the user experience indicates that lower deposits may limit access to certain features. This aspect has received mixed feedback, with some users noting that the account conditions could be improved.

The broker provides educational resources, including webinars and tutorials, which can be beneficial for traders looking to enhance their skills. However, the trading platform's limitations compared to MT4 or MT5 may hinder some users from fully utilizing available resources.

Customer Service and Support

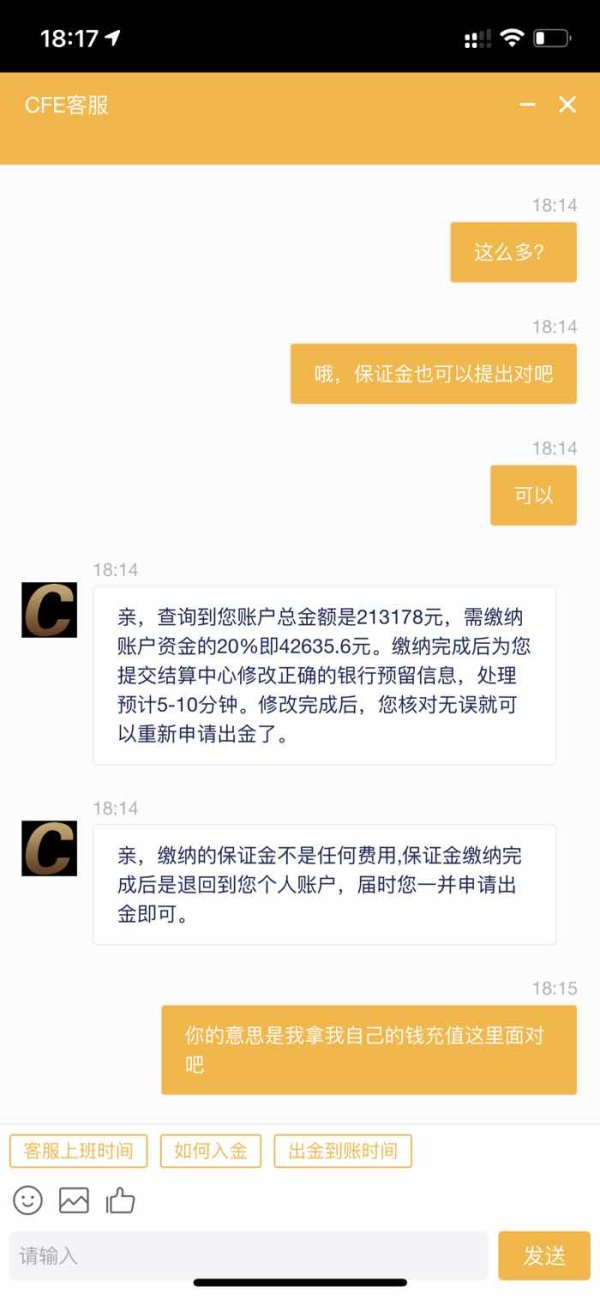

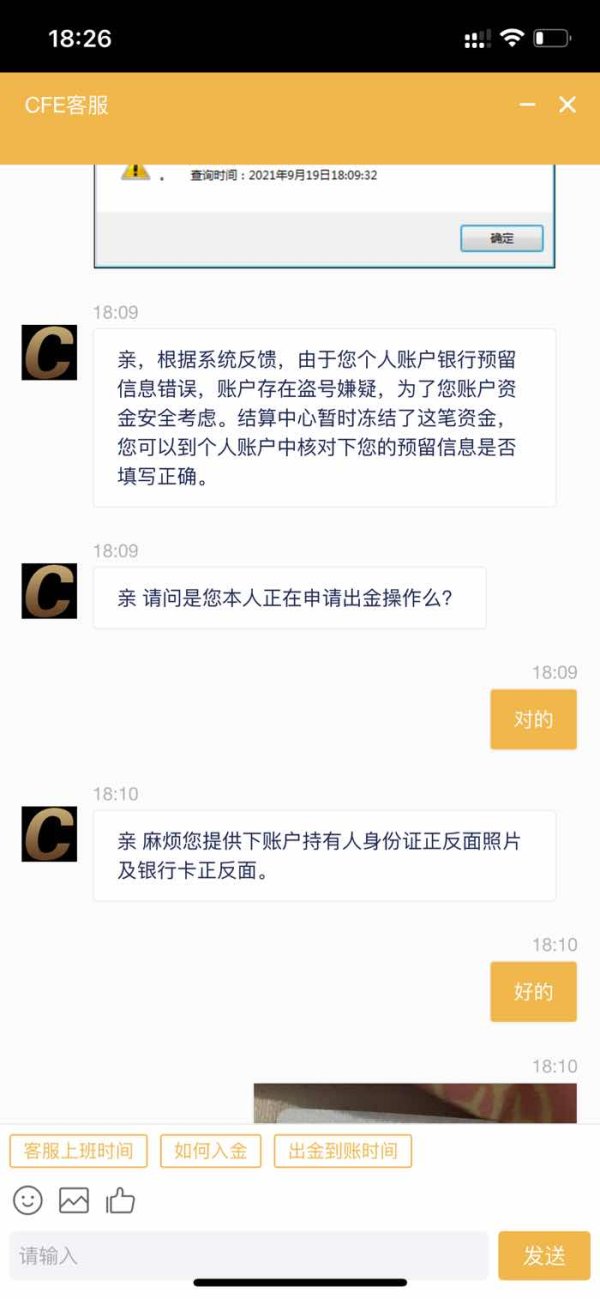

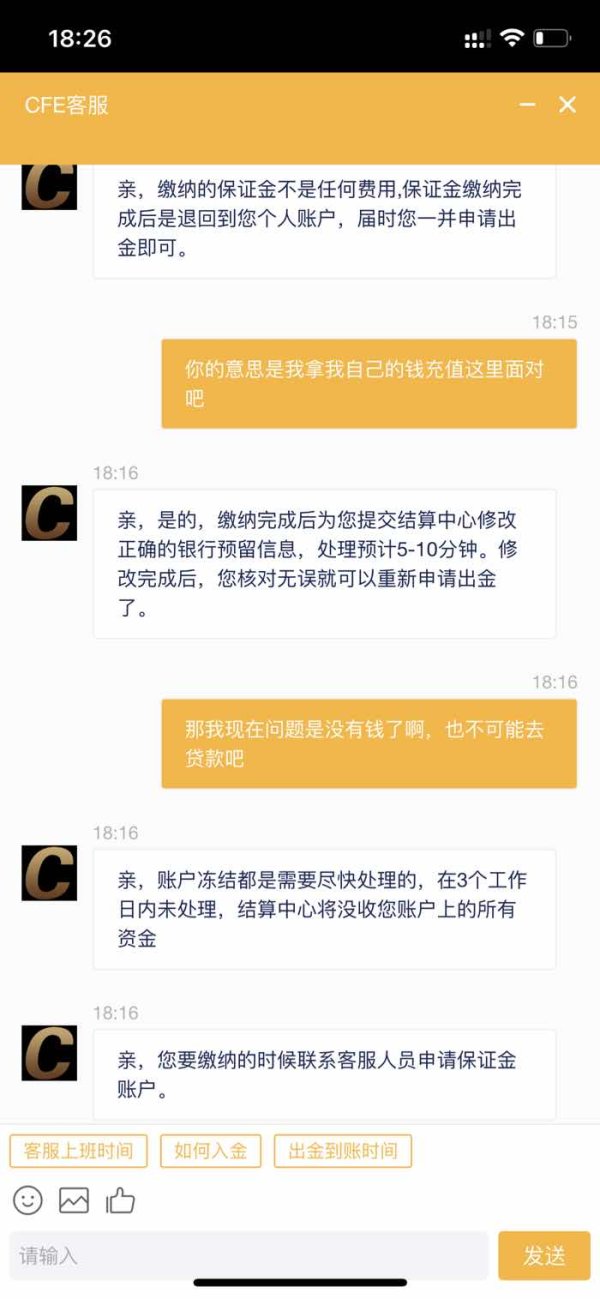

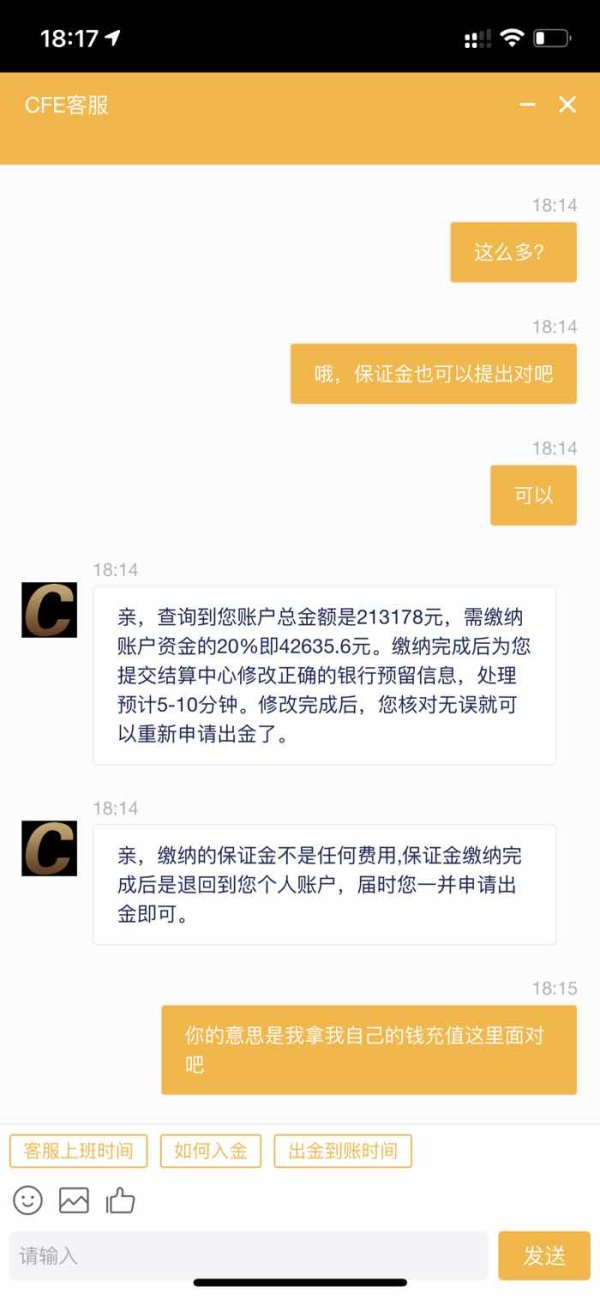

Customer service has been a significant pain point for many users. Reports of delayed responses and unresolved withdrawal requests have raised concerns about the broker's reliability. This aspect has been rated the lowest among all categories, reflecting user dissatisfaction.

Trading Setup (Experience)

While CFE offers a user-friendly interface, the lack of popular trading platforms like MT4 or MT5 may deter experienced traders. User experiences suggest that the trading setup could be improved to enhance overall trading satisfaction.

Trustworthiness

CFE is regulated by the FCA, which adds a layer of trust. However, user reports of withdrawal issues and poor customer service have led to a mixed perception of the broker's trustworthiness.

User Experience

Overall user experience has been rated below average due to the reported issues with withdrawals and customer support. While the broker offers a variety of trading options, the challenges faced by users can overshadow these benefits.

In conclusion, while CFE presents itself as a regulated and diverse trading platform, potential clients should approach with caution, particularly regarding customer service and withdrawal processes. As always, thorough research and consideration of personal trading needs are essential before engaging with any broker.