Is BRI safe?

Business

License

Is BRI Safe or Scam?

Introduction

BRI, or Beraring International, is a forex broker that has emerged in the competitive landscape of online trading since its establishment in 2021. Positioned in the United Kingdom, BRI aims to attract traders with a variety of financial instruments, including forex, commodities, and contracts for difference (CFDs). However, as the forex market is rife with both legitimate opportunities and potential scams, traders must exercise caution when selecting a broker. The need to thoroughly assess the credibility and safety of a broker cannot be overstated, as the risks of financial loss and fraudulent activities loom large in the industry.

This article aims to provide an objective analysis of whether BRI is a safe trading platform or a potential scam. The investigation draws on various sources, including regulatory information, customer reviews, and industry analysis, to evaluate BRI's legitimacy. By examining BRI's regulatory status, company background, trading conditions, customer experiences, and risk factors, this article aims to offer a comprehensive overview of the broker's trustworthiness.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical factor in determining its safety and reliability. BRI claims to be regulated by several financial authorities, which can lend credibility to its operations. However, the presence of both regulated and suspicious clone statuses raises questions about its legitimacy.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| ASIC | 001304187 | Australia | Regulated |

| FCA | N/A | United Kingdom | Suspicious Clone |

| CySEC | N/A | Cyprus | Suspicious Clone |

| FSA | N/A | Seychelles | Suspicious Clone |

| FSC | N/A | British Virgin Islands | Suspicious Clone |

The Australian Securities and Investments Commission (ASIC) is noted as a regulatory authority for BRI, which typically enforces strict compliance standards. However, the presence of a "suspicious clone" status from the Financial Conduct Authority (FCA) and other regulatory bodies raises significant concerns. Such a dual status could indicate that while BRI may be attempting to operate legitimately, there are underlying issues with its business practices that warrant scrutiny.

A broker without a clear regulatory framework can expose traders to significant risks, including mismanagement of funds and lack of recourse in case of disputes. Therefore, while BRI may appear regulated on the surface, the mixed regulatory status suggests that traders should be vigilant and conduct thorough due diligence before engaging with the platform.

Company Background Investigation

BRI was founded in 2021, which makes it relatively new in the forex brokerage space. This short history can be a double-edged sword; while it may indicate innovation and adaptation to modern trading needs, it also raises concerns about the broker's ability to weather financial storms and maintain a solid reputation over time.

The ownership structure of BRI is not extensively documented, which can hinder transparency. A lack of information regarding the management team and their professional backgrounds can lead to distrust among potential clients. The absence of detailed disclosures about the company's operations and ownership raises red flags regarding its commitment to transparency and accountability.

Furthermore, the company's website and customer service channels indicate that they provide support in English, which is a positive aspect for international traders. However, the overall lack of information about the management team and their qualifications may lead to skepticism about the broker's reliability. In an industry where trust is paramount, BRI's limited transparency regarding its leadership and operational history is a significant concern.

Trading Conditions Analysis

When evaluating whether BRI is safe, it is essential to analyze its trading conditions, including fees and spreads. A broker's fee structure can significantly impact a trader's profitability, making it a crucial aspect of any evaluation.

BRI's fee structure is competitive, but traders should be aware of any hidden costs that may not be immediately apparent. The following table summarizes the core trading costs associated with BRI:

| Fee Type | BRI | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.5 pips | 1.2 pips |

| Commission Model | $5 per lot | $7 per lot |

| Overnight Interest Range | 1.5% | 1.2% |

The spreads offered by BRI are slightly higher than the industry average, which could eat into traders' profits. Additionally, the commission structure is relatively competitive, but it is essential to ensure that these fees do not come with additional, undisclosed charges.

Traders should also be cautious of any unusual or excessive fees, particularly those related to withdrawals or account maintenance. A broker that imposes high withdrawal fees or complicated processes for accessing funds may indicate a lack of commitment to customer satisfaction and transparency. Therefore, potential clients should carefully review BRI's fee schedule and any associated terms before opening an account.

Customer Funds Safety

The safety of customer funds is paramount when evaluating whether BRI is a safe broker. BRI claims to implement measures to protect client funds, including segregating client accounts from company funds. This practice is crucial as it ensures that client funds are not used for operational expenses, thereby offering a layer of protection in case of financial difficulties faced by the broker.

However, the lack of detailed information regarding additional investor protection measures, such as negative balance protection or compensation schemes, raises concerns. Traders should be aware that without these protections, they may be at risk of losing more than their initial investment in volatile market conditions.

Furthermore, the absence of any historical issues regarding fund safety is a positive sign. However, traders should remain vigilant and monitor any future developments related to BRI's financial practices. The broker's commitment to safeguarding client funds should be continuously assessed, as any lapses in this area could indicate a lack of integrity.

Customer Experience and Complaints

Understanding customer experiences and feedback is crucial when evaluating whether BRI is a scam or a legitimate broker. A review of online forums and feedback platforms reveals a mixed bag of opinions regarding BRI's services.

Common complaints include difficulties in withdrawing funds and slow customer service responses. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service Delays | Medium | Somewhat responsive |

| Platform Stability | Medium | Mixed feedback |

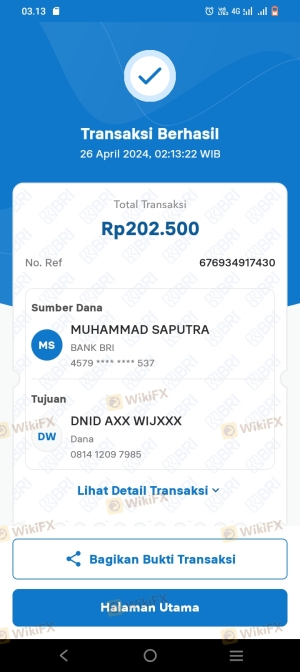

Two notable cases highlight the concerns surrounding BRI. In one instance, a trader reported significant delays in processing a withdrawal request, leading to frustration and distrust. Another user expressed dissatisfaction with the platform's stability during high volatility periods, which can be detrimental to trading performance.

While some users have reported positive experiences, the recurring themes of withdrawal issues and customer service delays warrant caution. Traders should be prepared for potential challenges when dealing with BRI, particularly regarding accessing their funds and receiving timely support.

Platform and Execution

The trading platform's performance is another critical factor in assessing whether BRI is safe. BRI offers access to popular trading platforms, such as MetaTrader 4 and 5, which are known for their user-friendly interfaces and extensive features. However, the platform's stability and execution quality are paramount for successful trading.

Users have reported mixed experiences regarding order execution. Some traders have noted instances of slippage and delays during high-impact news events, which can severely affect trading outcomes. A thorough analysis of execution quality, including metrics on slippage rates and order rejection incidents, is essential for evaluating BRI's reliability.

Additionally, any signs of platform manipulation or irregularities in trade execution should be scrutinized. A broker that engages in practices such as stop-hunting or unfairly manipulating spreads during volatile periods can undermine traders' trust and lead to significant losses.

Risk Assessment

When considering whether BRI is safe, it is crucial to evaluate the overall risk associated with trading on the platform. Factors such as regulatory status, customer feedback, and trading conditions contribute to the comprehensive risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Mixed regulatory status raises concerns. |

| Fund Safety | Medium | Segregation in place, but lacks full protections. |

| Customer Support | Medium | Complaints regarding slow responses. |

| Platform Stability | Medium | Reports of slippage and execution delays. |

Traders should be aware of the heightened risks associated with using BRI, particularly regarding regulatory compliance and customer support. To mitigate these risks, it is advisable to start with a smaller investment, monitor trading performance closely, and maintain open lines of communication with the broker.

Conclusion and Recommendations

In conclusion, the investigation into whether BRI is safe or a scam reveals a complex picture. While the broker has some regulatory oversight and offers a range of trading instruments, the mixed regulatory status, customer complaints, and transparency issues raise significant concerns.

Traders should approach BRI with caution and conduct thorough research before committing any capital. It is crucial to be aware of potential withdrawal issues and customer service delays that may arise. For those seeking more reliable alternatives, consider brokers with strong regulatory credentials and positive customer feedback.

In summary, while BRI may offer trading opportunities, the associated risks warrant careful consideration. If you are considering trading with BRI, ensure you are well-informed and prepared for potential challenges.

Is BRI a scam, or is it legit?

The latest exposure and evaluation content of BRI brokers.

BRI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BRI latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.