BRI Review 1

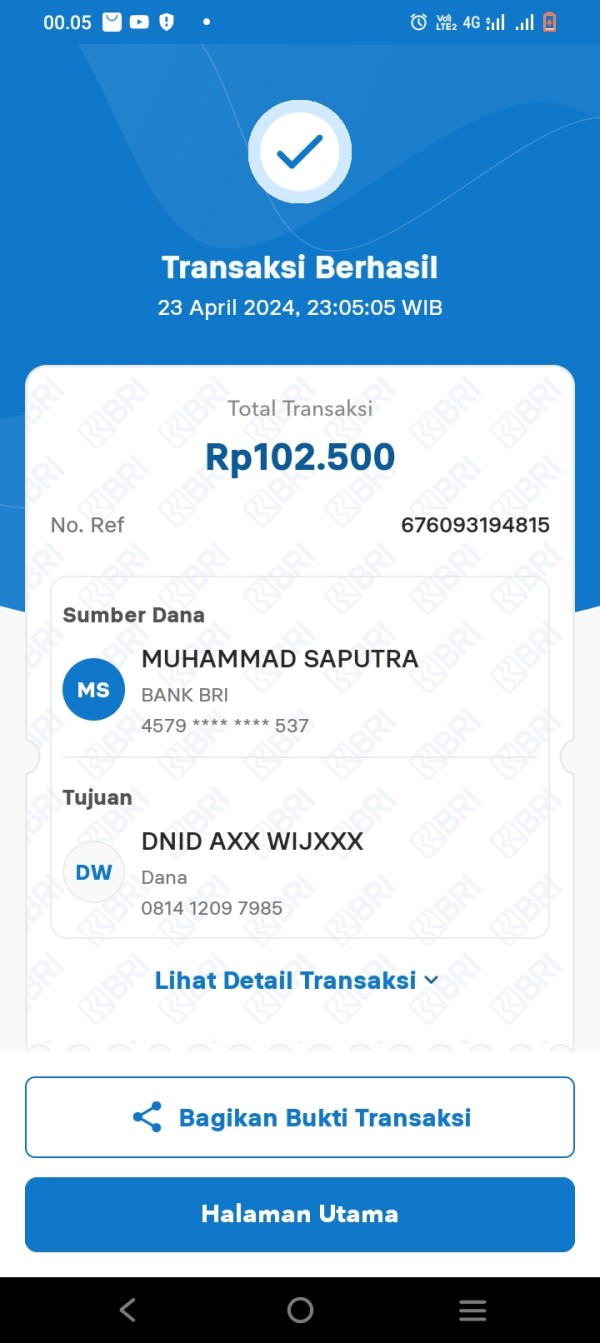

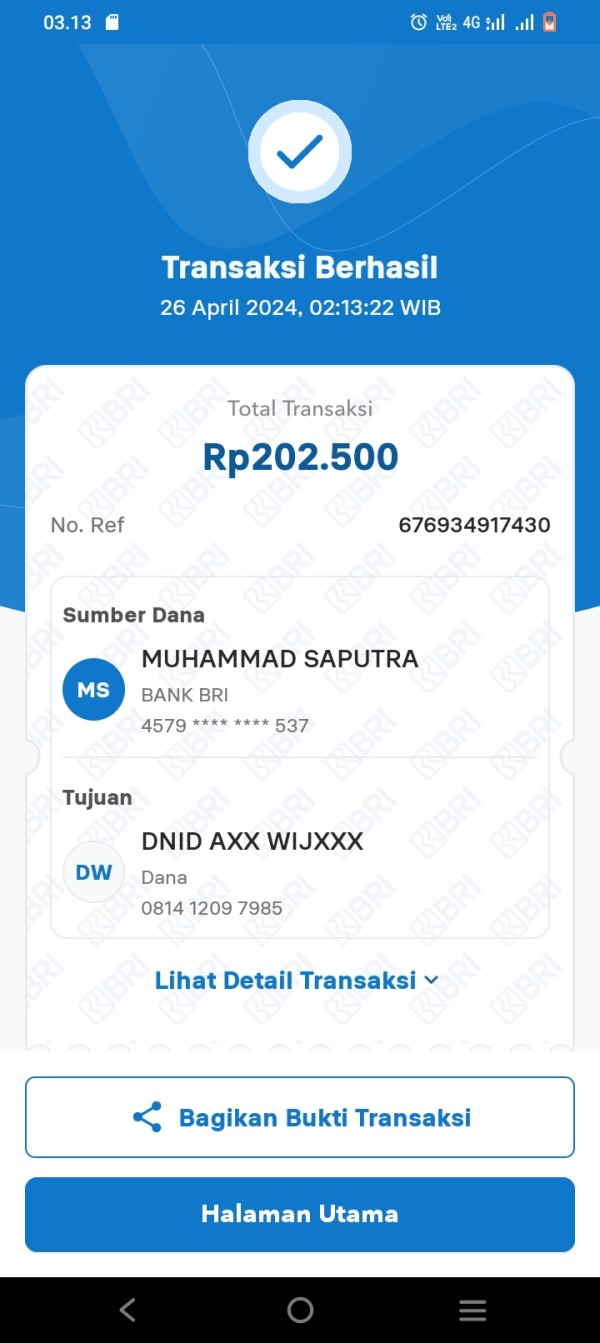

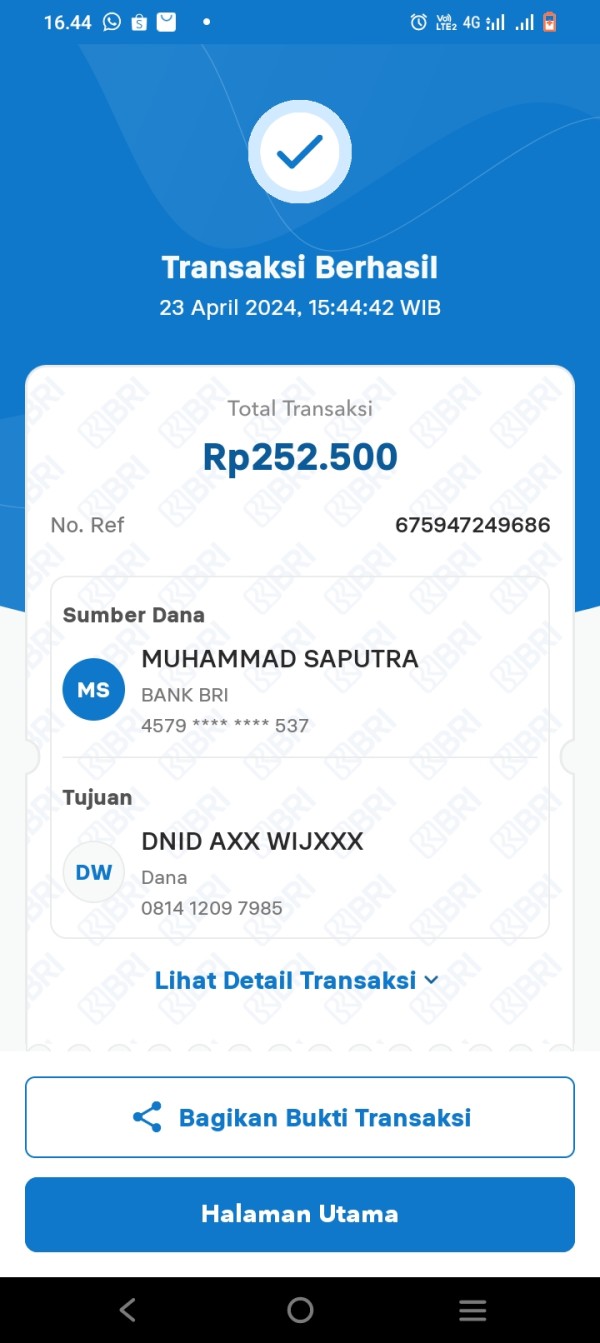

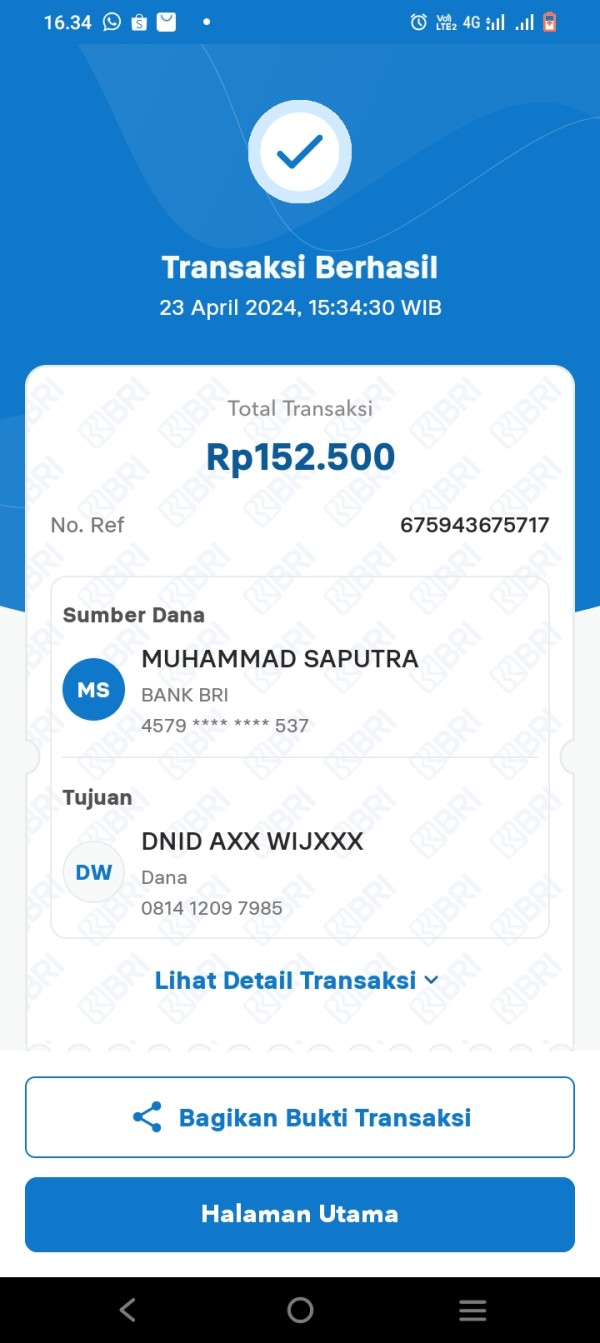

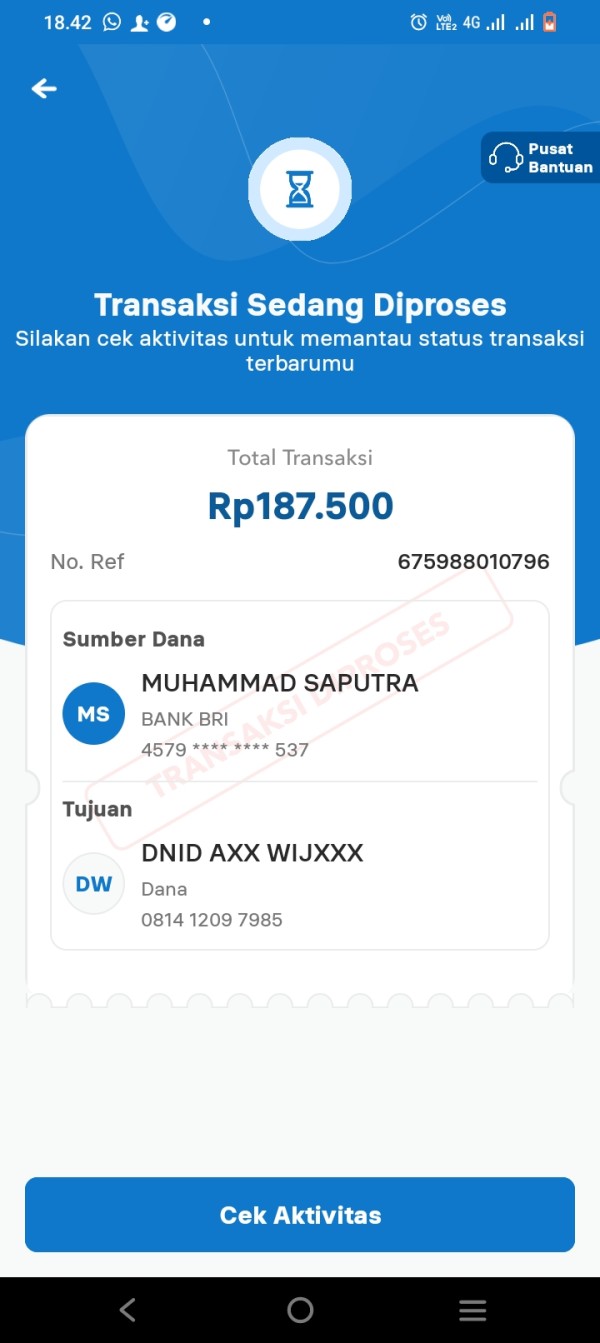

Please help, I've been cheated out of 2,5000,000

BRI Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

Please help, I've been cheated out of 2,5000,000

This comprehensive bri review evaluates BRI Brokers, Inc., a forex brokerage firm based in Brooklyn, New York. The firm has received mixed feedback from traders and industry observers. Based on available user ratings and feedback, BRI receives a neutral overall assessment with particular strengths in customer service responsiveness despite some operational challenges.

The broker's standout features include excellent customer service that promptly addresses client concerns. However, response times can occasionally be longer than expected. According to JobStreet data, BRI maintains an employee rating of 3 out of 5 from 88 reviews, indicating moderate workplace satisfaction that may reflect the company's operational standards.

BRI appears to target traders who prioritize strong customer support and personalized service over cutting-edge trading technology or extensive educational resources. The broker's approach suggests a focus on relationship-building with clients. This makes it potentially suitable for traders who value human interaction and responsive problem-solving in their trading experience.

However, prospective clients should note that detailed information about trading conditions, regulatory status, and specific platform features remains limited in publicly available sources. This may require direct inquiry with the broker for comprehensive evaluation.

Regional Entity Differences: BRI Brokers, Inc. operates from Brooklyn, New York. Specific regulatory information and oversight details are not extensively documented in available sources. Traders should verify regulatory compliance and licensing status directly with the broker before opening accounts.

Review Methodology: This evaluation is based primarily on user feedback, employee reviews, and limited publicly available company information. Due to the scarcity of detailed operational data, potential clients are advised to conduct thorough due diligence and request comprehensive information directly from BRI before making trading decisions.

| Evaluation Criteria | Score | Justification |

|---|---|---|

| Account Conditions | N/A | Specific account terms and conditions not detailed in available sources |

| Tools and Resources | N/A | Trading tools and educational resources not specified in current information |

| Customer Service | 8/10 | Excellent customer service with prompt issue resolution, though response times occasionally longer than expected |

| Trading Experience | N/A | Platform performance and execution quality not detailed in available sources |

| Trust and Reliability | N/A | Regulatory information and compliance details not comprehensively available |

| User Experience | 6/10 | Employee rating of 3/5 from 88 reviews suggests moderate satisfaction levels |

BRI Brokers, Inc. operates as a forex brokerage firm headquartered in Brooklyn, New York. The company provides foreign exchange trading services to retail and potentially institutional clients. The company positions itself in the competitive forex market by emphasizing customer service excellence and personalized support, though comprehensive details about its founding date and corporate history are not extensively documented in available sources.

The broker's business model appears to focus on traditional brokerage services. It facilitates foreign exchange transactions while maintaining a strong emphasis on client relationship management. According to user feedback, BRI's approach prioritizes responsive customer support, with the company demonstrating commitment to addressing client concerns promptly. However, operational efficiency sometimes faces challenges with response timing.

BRI's trading infrastructure likely supports standard forex and CFD trading. This follows typical industry practices for retail forex brokers. The company's operational base in New York suggests familiarity with US market conditions and potentially US regulatory requirements, though specific platform types and trading technologies employed are not detailed in current available information. This bri review finds that while the broker maintains a presence in the competitive New York financial services market, comprehensive operational details require direct inquiry with the firm.

Regulatory Jurisdiction: Specific regulatory oversight and licensing information for BRI Brokers, Inc. is not comprehensively detailed in available sources. This requires direct verification with the broker.

Deposit and Withdrawal Methods: Payment processing options and banking partnerships are not specified in current available information.

Minimum Deposit Requirements: Entry-level funding requirements are not detailed in accessible sources.

Promotional Offers: Current bonus structures and promotional campaigns are not documented in available materials.

Tradeable Assets: Based on standard forex brokerage operations, BRI likely offers foreign exchange pairs and potentially CFD products. However, specific asset coverage requires confirmation.

Cost Structure: Spread configurations, commission rates, and fee schedules are not detailed in current available information. This necessitates direct inquiry for comprehensive cost analysis.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in accessible sources.

Platform Options: Trading platform technology and software solutions are not detailed in current available information.

Geographic Restrictions: Service availability and regional limitations are not comprehensively documented.

Customer Support Languages: Multilingual support capabilities are not specified in available sources.

This bri review highlights the need for prospective clients to request detailed operational information directly from the broker to make informed trading decisions.

The evaluation of BRI's account conditions faces significant limitations due to the lack of detailed information in publicly available sources. Standard forex brokerage operations typically include multiple account tiers designed to accommodate different trader profiles. These range from beginner-friendly options to advanced trading accounts with enhanced features.

Without specific documentation of account types, minimum deposit requirements, or special account features such as Islamic accounts for Sharia-compliant trading, potential clients must rely on direct communication with BRI to understand available options. The absence of transparent account condition information in this bri review represents a significant gap that may concern traders who prefer to research thoroughly before committing to a broker.

Industry standards suggest that reputable brokers provide clear, accessible information about account structures, funding requirements, and associated benefits or restrictions. The limited availability of such details for BRI may indicate either a preference for personalized consultation approaches or potential areas for improvement in marketing transparency.

Prospective clients should specifically inquire about account opening procedures, verification requirements, minimum balance maintenance, and any special features or restrictions associated with different account levels when contacting BRI directly.

The assessment of BRI's trading tools and educational resources encounters substantial limitations due to insufficient publicly available information. Modern forex brokers typically provide comprehensive suites including technical analysis tools, economic calendars, market research, and educational materials to support trader development and decision-making.

Standard industry offerings usually encompass charting packages, automated trading support, market analysis from third-party providers, and educational content ranging from beginner tutorials to advanced trading strategies. However, specific details about BRI's tool availability, research partnerships, or educational program scope are not documented in accessible sources.

The absence of detailed information about trading tools and resources in available materials suggests that BRI may either provide these services without extensive public marketing or may focus on personalized service delivery rather than standardized tool packages. This approach could appeal to traders who prefer customized support but may concern those who value self-service resources.

Potential clients should directly inquire about available trading tools, research access, educational materials, automated trading support, and any proprietary resources when evaluating BRI's suitability for their trading needs.

BRI's customer service emerges as a notable strength based on available user feedback. It earns an 8/10 rating in this evaluation. According to user reports, the broker's customer service is described as "excellent" with the company demonstrating commitment to "promptly addressing concerns" raised by clients.

However, the customer support experience shows some inconsistency in response timing. While the support team is characterized as "helpful," users report that "sometimes it takes longer than expected to get a response." This suggests that while BRI's support quality is generally high, operational efficiency in response management may face occasional challenges during peak periods or complex inquiry handling.

The positive feedback regarding problem resolution indicates that BRI invests in training support staff and maintaining service quality standards. The willingness to address client concerns promptly suggests a customer-centric approach that prioritizes relationship maintenance and client satisfaction over purely transactional interactions.

For traders who value responsive human support and personalized problem-solving, BRI's customer service approach appears well-suited. However, clients requiring immediate responses for time-sensitive trading situations should consider the potential for longer response times when evaluating the broker's suitability for their trading style and support expectations.

The evaluation of BRI's trading experience faces significant constraints due to limited user feedback and technical performance data in available sources. Critical aspects of trading experience including platform stability, execution speed, order processing quality, and mobile trading capabilities are not detailed in current accessible information.

Modern forex trading requires reliable platform performance, competitive execution speeds, and comprehensive functionality across desktop and mobile environments. Without specific user reports about platform reliability, slippage experiences, or technical issues, this bri review cannot provide definitive assessment of BRI's trading infrastructure quality.

The absence of detailed trading experience feedback may indicate either limited user base sharing experiences publicly or potentially that BRI's clients prefer direct communication channels over public review platforms. This situation requires prospective traders to rely heavily on direct inquiry and potentially demo account testing to evaluate platform suitability.

Key areas requiring direct verification include platform uptime statistics, typical execution speeds, order processing capabilities, available order types, mobile app functionality, and any reported technical issues or limitations that might affect trading performance.

The assessment of BRI's trustworthiness encounters significant limitations due to insufficient regulatory and compliance information in publicly available sources. Trust evaluation typically relies on regulatory licensing verification, fund security measures, corporate transparency, and industry reputation assessment.

Without detailed regulatory status information, verification of licensing compliance, or documented fund protection measures, this evaluation cannot provide comprehensive trust assessment. Industry standards emphasize the importance of regulatory oversight, segregated client funds, and transparent operational practices as fundamental trust indicators.

The limited availability of regulatory and compliance information may concern traders who prioritize regulatory protection and fund security in broker selection. Reputable brokers typically provide clear regulatory status disclosure, fund protection details, and compliance documentation to build client confidence.

Prospective clients should specifically verify BRI's regulatory status, fund segregation practices, insurance coverage, compliance procedures, and any regulatory actions or industry recognition when conducting due diligence. Direct verification with relevant regulatory bodies may be necessary to confirm licensing and oversight status.

BRI's user experience receives a 6/10 rating based primarily on employee satisfaction data indicating moderate overall satisfaction levels. The employee rating of 3 out of 5 from 88 reviews on JobStreet suggests mixed experiences that may reflect broader operational characteristics affecting client experience.

Employee satisfaction often correlates with service quality delivery, as satisfied employees typically provide better customer service and maintain higher operational standards. The moderate rating suggests potential areas for improvement in workplace environment, training, or operational procedures that could indirectly impact client experience quality.

The target user profile for BRI appears to be traders who prioritize personalized customer support and are willing to work directly with broker representatives for information and service delivery. This approach may appeal to traders who prefer relationship-based service over self-service digital platforms.

However, the mixed employee feedback suggests that service consistency may vary, and prospective clients should consider requesting references or conducting thorough evaluation through direct interaction before committing significant trading capital. The moderate satisfaction levels indicate room for improvement in overall user experience delivery.

This bri review reveals a forex broker with notable strengths in customer service delivery but significant gaps in publicly available operational information. BRI Brokers, Inc. demonstrates commitment to client support excellence, with users reporting prompt problem resolution and helpful service interactions. However, response timing occasionally exceeds expectations.

The broker appears most suitable for traders who prioritize personalized customer support and are comfortable with relationship-based service delivery over extensive self-service resources. However, the limited availability of detailed information about trading conditions, regulatory status, and operational specifics requires prospective clients to conduct thorough direct inquiry.

Key advantages include excellent customer service reputation and responsive problem-solving approach. Primary limitations involve insufficient transparency regarding regulatory compliance, trading conditions, and comprehensive operational details that typically inform broker selection decisions.

FX Broker Capital Trading Markets Review