Is Block VC safe?

Business

License

Is Block VC Safe or Scam?

Introduction

Block VC is a forex broker that has garnered attention in the trading community for its claims of providing robust trading opportunities in the foreign exchange market. As with any trading platform, it is essential for traders to conduct thorough due diligence before committing their funds. The forex market is rife with opportunities, but it also presents various risks, including the potential for scams. This article aims to objectively analyze whether Block VC is a safe trading platform or if it raises red flags that warrant caution. The investigation is based on a comprehensive review of multiple sources, including user feedback, regulatory information, and industry analysis.

Regulatory and Legitimacy

One of the primary factors that determine the safety of a forex broker is its regulatory status. Regulatory bodies impose strict guidelines to ensure that brokers operate transparently and fairly. In the case of Block VC, it is crucial to examine its regulatory framework and compliance history.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

Currently, Block VC does not appear to be regulated by any recognized financial authority. This lack of regulation raises significant concerns regarding the legitimacy of the broker. Without regulatory oversight, traders may be exposed to higher risks, including the possibility of fraud and mismanagement of funds. Furthermore, the absence of a regulatory license means that there are no established protocols to protect traders' interests in case of disputes or financial crises.

The quality of regulation is paramount in assessing a broker's reliability. Established regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US, enforce stringent rules that protect traders. The lack of such oversight for Block VC is a significant red flag, indicating that traders should exercise extreme caution.

Company Background Investigation

Block VC was founded in 2016 and is based in Beijing, China. The company positions itself as a blockchain investment and advisory firm, focusing on various aspects of the blockchain ecosystem. However, details regarding its ownership structure and management team are limited, raising questions about transparency.

The management team's professional background is critical in evaluating the credibility of any financial institution. Unfortunately, there is scant information available about the individuals behind Block VC, which further complicates the assessment of its legitimacy. A lack of transparency in company ownership and management can be indicative of potential risks, as it becomes challenging to hold individuals accountable for their actions.

Moreover, the company's website does not provide comprehensive information regarding its operational history or milestones, which are essential for establishing trust. A broker that is unwilling or unable to disclose such information may not have the best interests of its clients at heart. In the context of assessing whether Block VC is safe, this lack of clarity is a cause for concern.

Trading Conditions Analysis

Understanding the trading conditions offered by Block VC is vital for potential traders. The broker claims to provide competitive spreads and low fees, but a closer examination reveals inconsistencies in its fee structure.

| Fee Type | Block VC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

While the specific fees are yet to be disclosed, feedback from users indicates that there may be hidden charges that could significantly increase the overall cost of trading. Traders should be wary of any broker that does not provide a clear and transparent fee structure, as this can lead to unexpected expenses that erode profits.

Moreover, the absence of a detailed explanation of commission models and overnight interest rates raises further questions. A reputable broker typically provides comprehensive information regarding all associated costs, enabling traders to make informed decisions. The lack of clarity in Block VC's trading conditions is a potential indicator that traders should proceed with caution.

Client Fund Security

The security of client funds is of utmost importance when evaluating a forex broker. Block VC's measures for safeguarding client funds are not well-documented, which raises concerns about the safety of deposits.

Typically, reputable brokers implement strict protocols for fund segregation, ensuring that client funds are kept separate from the company's operational funds. This practice protects traders' money in the event of the broker facing financial difficulties. However, there is no clear information regarding Block VC's policies on fund segregation or investor protection.

Additionally, the absence of negative balance protection is a significant risk factor. Negative balance protection ensures that traders cannot lose more than their deposited funds, providing an extra layer of security. Without such measures in place, traders may find themselves liable for debts beyond their initial investment.

Given the lack of transparency regarding fund security measures, it is prudent for potential traders to question whether Block VC is safe for their investments. Historical issues related to fund security or disputes with clients could further exacerbate these concerns.

Client Experience and Complaints

Analyzing customer feedback is crucial in assessing the overall experience of trading with Block VC. Reviews indicate a mixed bag of experiences, with some users reporting satisfactory interactions, while others have raised serious complaints.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresolved |

| Customer Support | Medium | Slow Response |

| Transparency Concerns | High | Ignored |

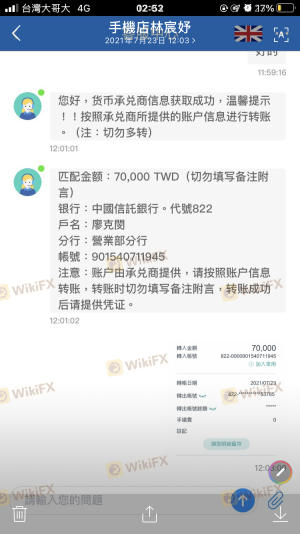

Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and concerns over transparency in operations. The inability to resolve withdrawal issues is particularly alarming, as it suggests potential liquidity problems or operational inefficiencies within the broker.

In one notable case, a user reported being unable to withdraw their funds after multiple attempts, leading to frustration and mistrust. This type of experience is detrimental to a broker's reputation and raises significant concerns about whether Block VC is safe for traders.

Platform and Trade Execution

The trading platform's performance is another critical aspect to consider. Block VC claims to offer a user-friendly trading interface, but reviews indicate mixed experiences regarding platform stability and execution quality.

Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes. A reliable broker should provide a seamless trading experience, with minimal disruptions and high execution speed. The presence of slippage or frequent rejections raises questions about the broker's operational integrity.

Furthermore, any signs of platform manipulation, such as artificially widening spreads during volatile market conditions, should be closely scrutinized. Traders must ensure that they are dealing with a broker that prioritizes fair trading practices.

Risk Assessment

Using Block VC involves various risks that traders must consider. The lack of regulation, limited transparency, and unresolved customer complaints contribute to an overall risk profile that is concerning.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight raises fraud concerns. |

| Transparency Risk | High | Limited information about management and operations. |

| Withdrawal Risk | High | Reports of unresolved withdrawal issues. |

To mitigate these risks, traders should conduct thorough research and consider using alternative brokers with established regulatory oversight and a proven track record of customer satisfaction. It is also advisable to start with a small investment to gauge the broker's reliability before committing larger amounts.

Conclusion and Recommendations

In conclusion, the evidence suggests that traders should approach Block VC with caution. The lack of regulatory oversight, transparency issues, and unresolved customer complaints indicate potential risks that may outweigh the benefits of trading with this broker.

For traders seeking a safe and reliable trading environment, it may be prudent to consider alternative brokers that are regulated and have demonstrated a commitment to customer service and transparency. Always ensure that your chosen broker has a solid reputation and a proven track record in the industry.

In summary, while Block VC may offer trading opportunities, the potential risks associated with its operations raise significant concerns about whether Block VC is safe. Traders are encouraged to prioritize safety and due diligence when selecting a forex broker.

Is Block VC a scam, or is it legit?

The latest exposure and evaluation content of Block VC brokers.

Block VC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Block VC latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.