UNIGLOBE markets Review 7

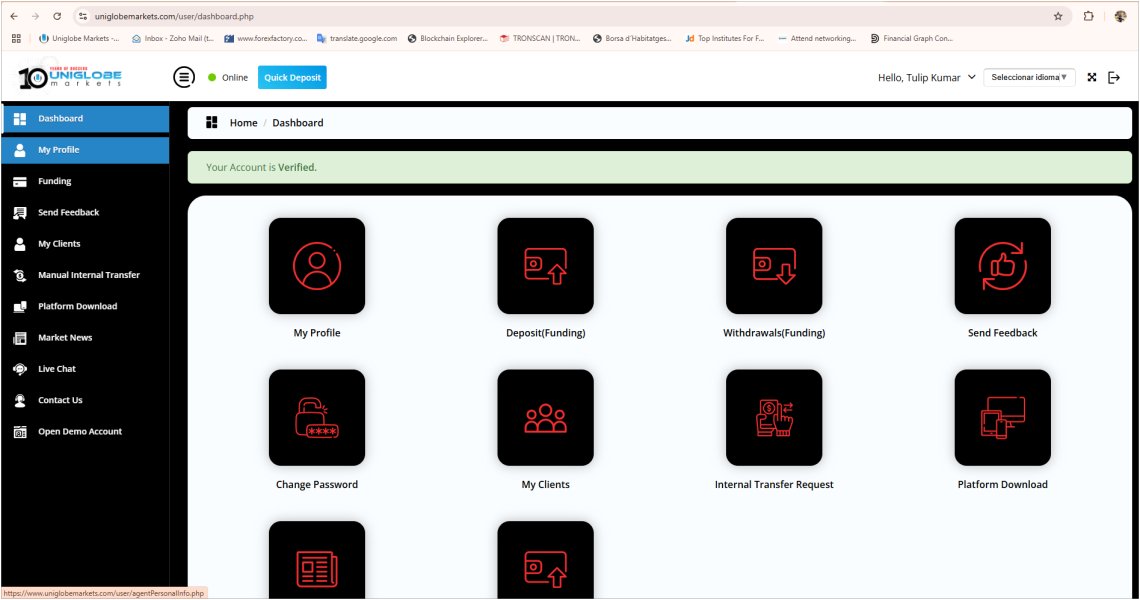

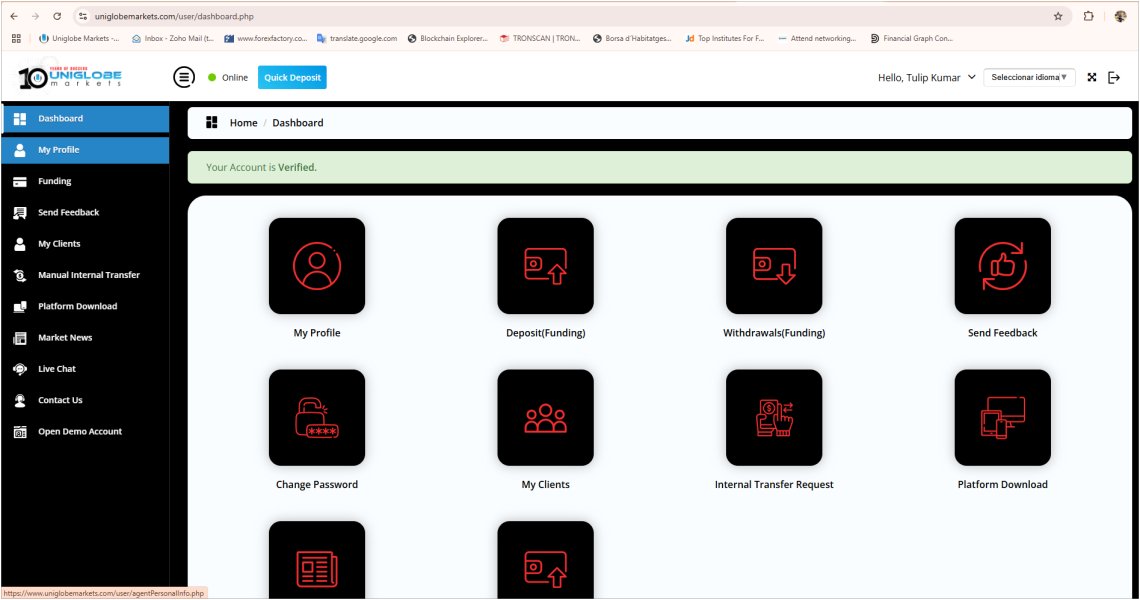

Uniglobe a scam broker. if you open an account and you have 100+ clients, Uniglobe will block your IB account. very bad broker and response. I have 1300+ clients in Uniglobe. Uni blocked my account without any reason. don't trust on this scam broker.

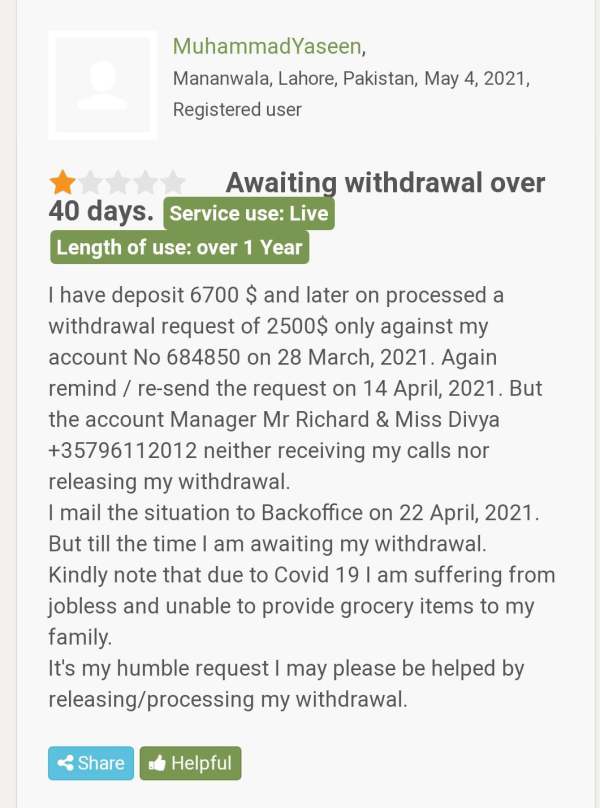

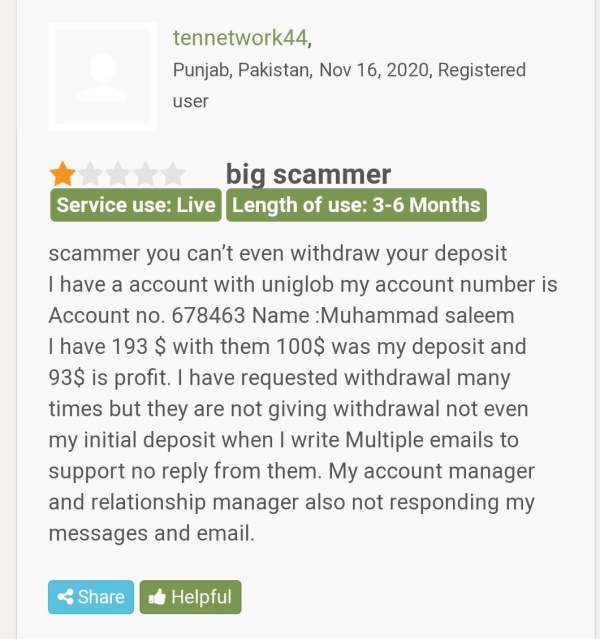

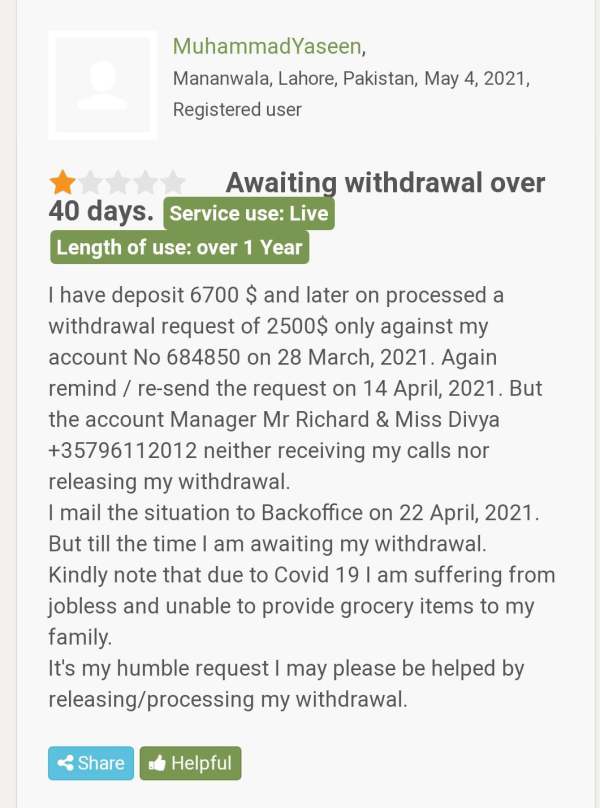

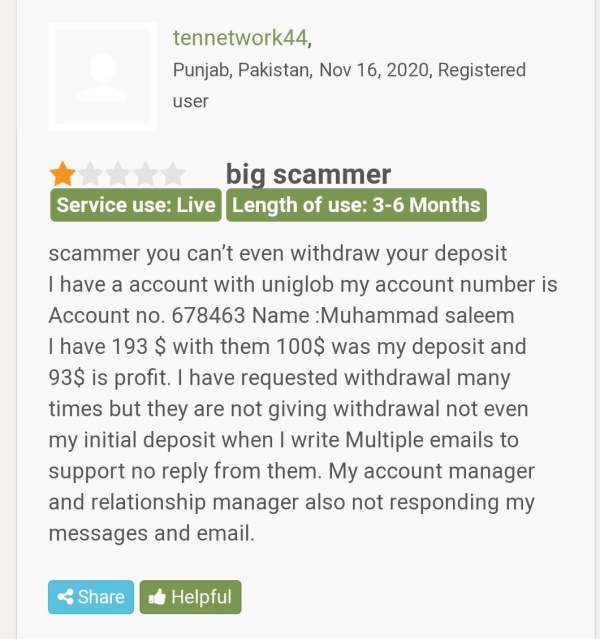

Multiple clients have complained that this broker does not let them withdraw from their account and also doesnt't respond to their emails.

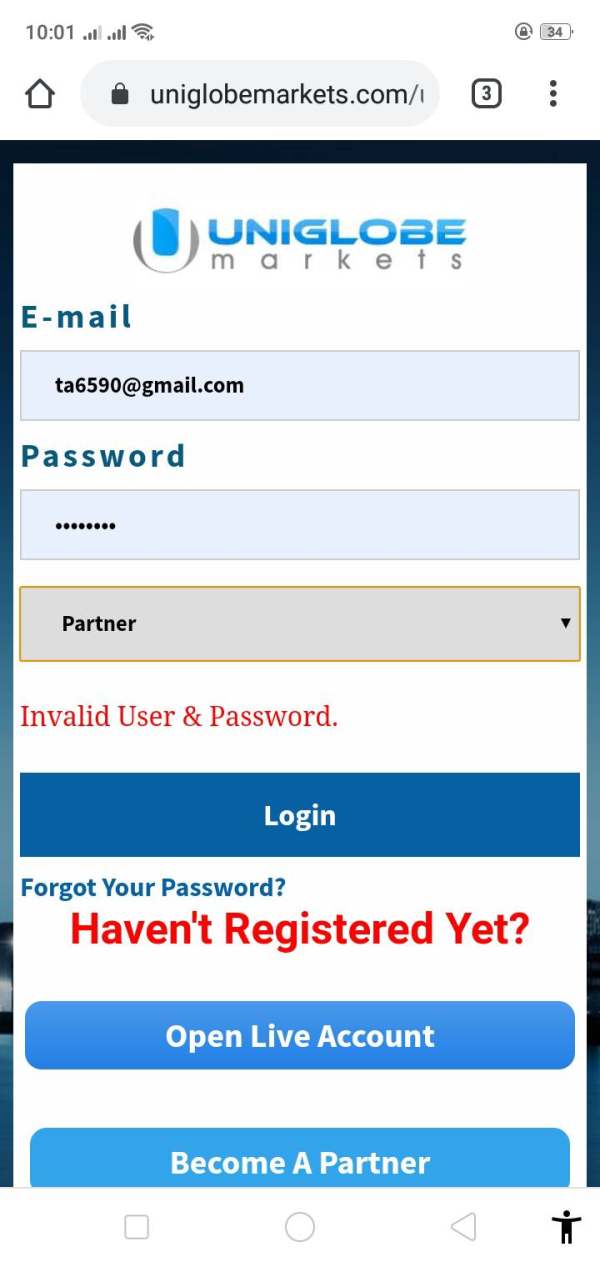

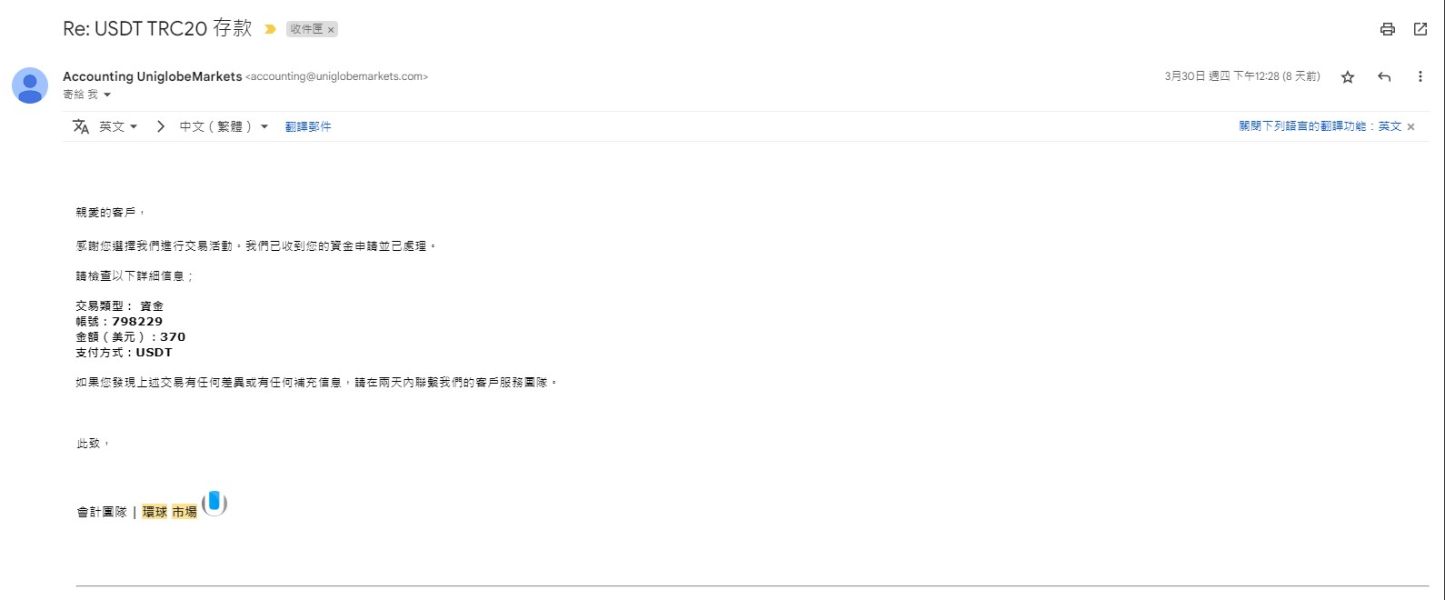

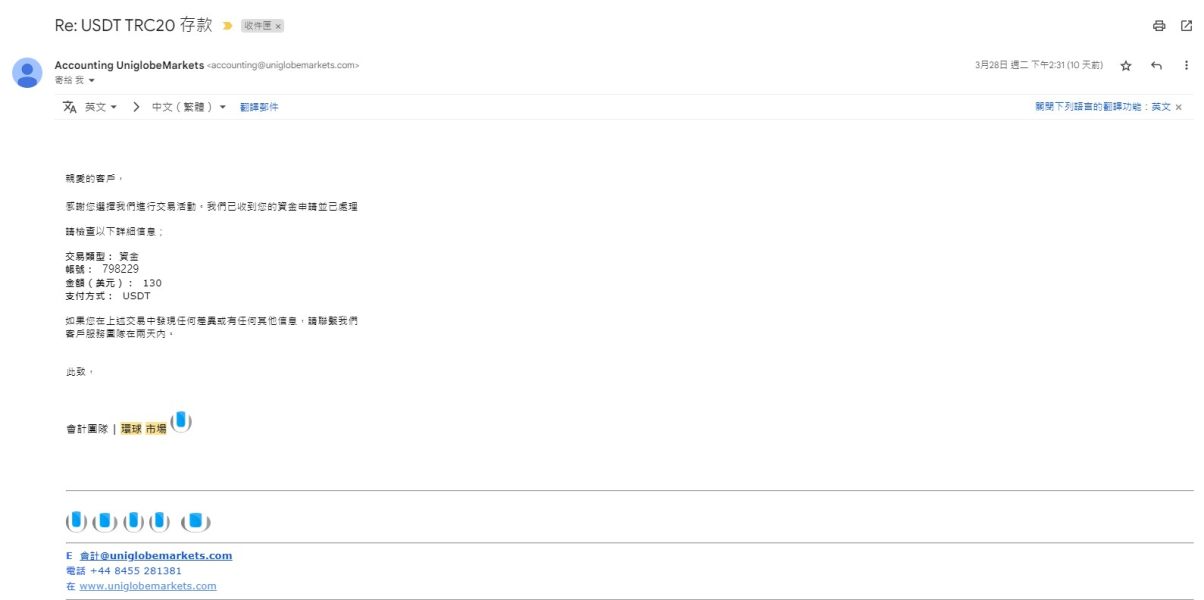

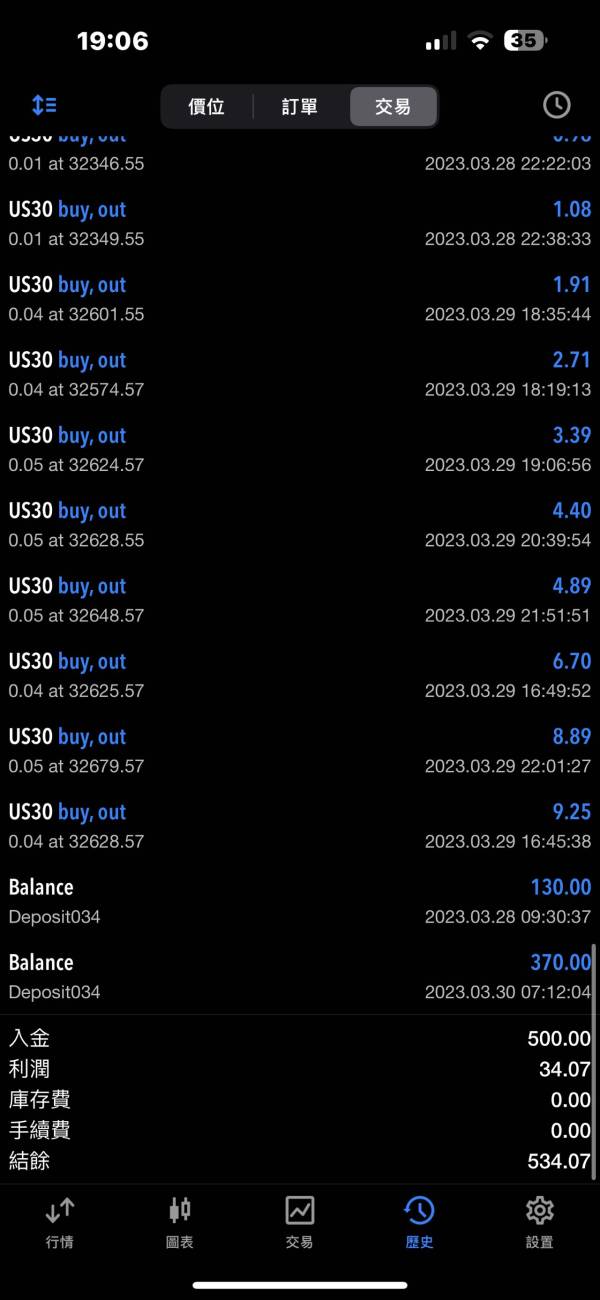

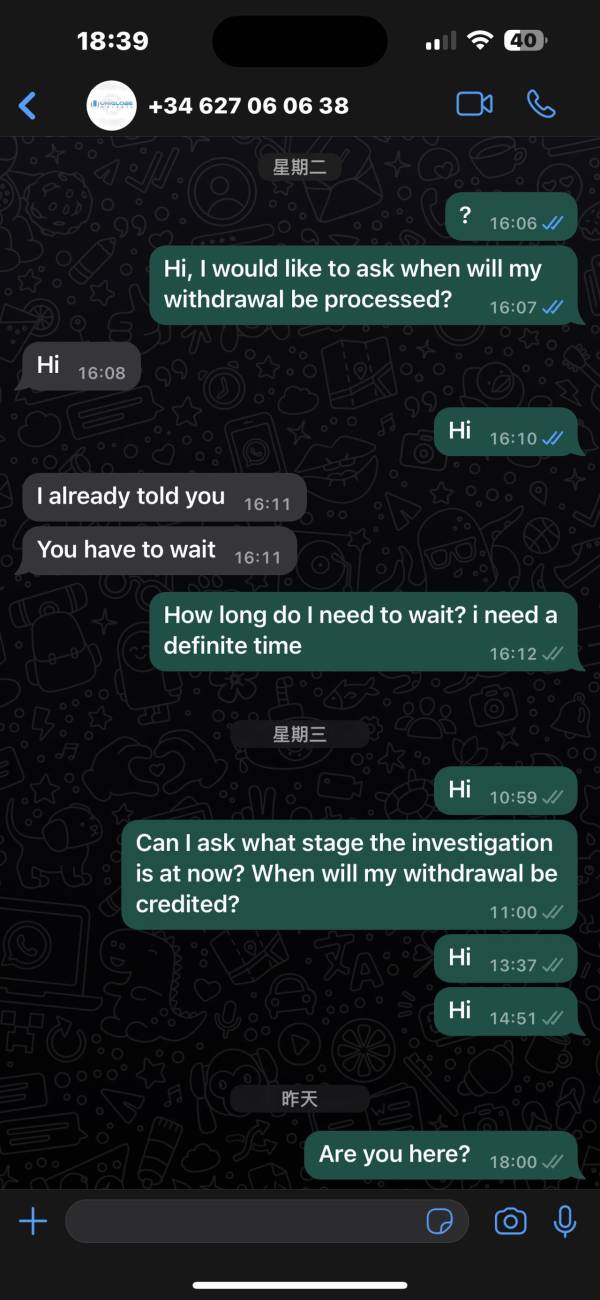

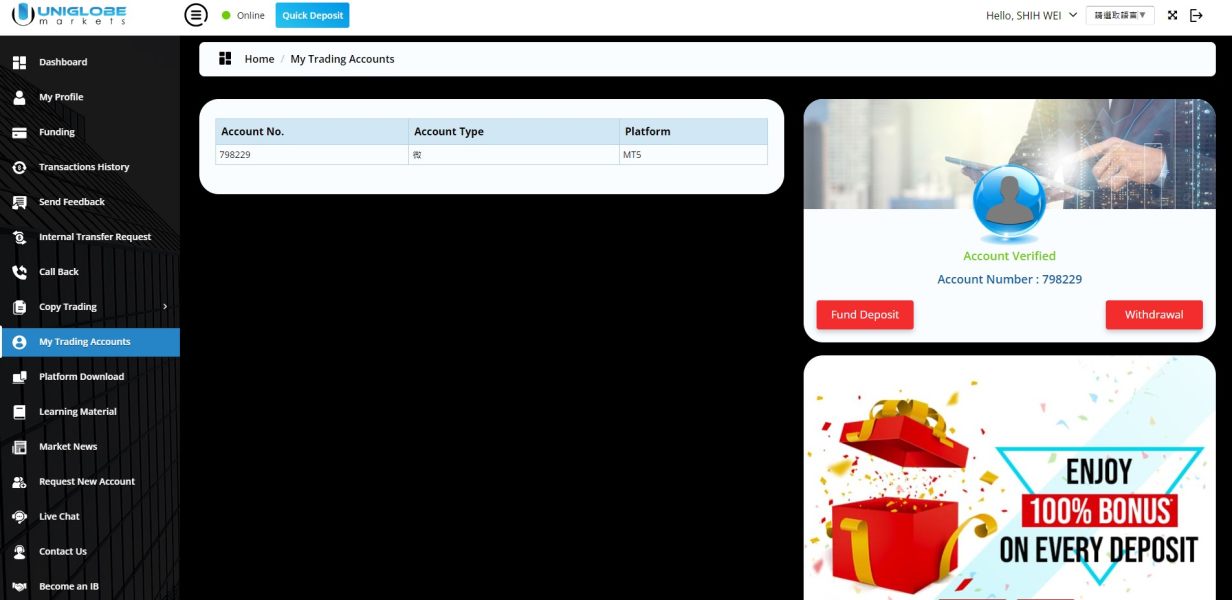

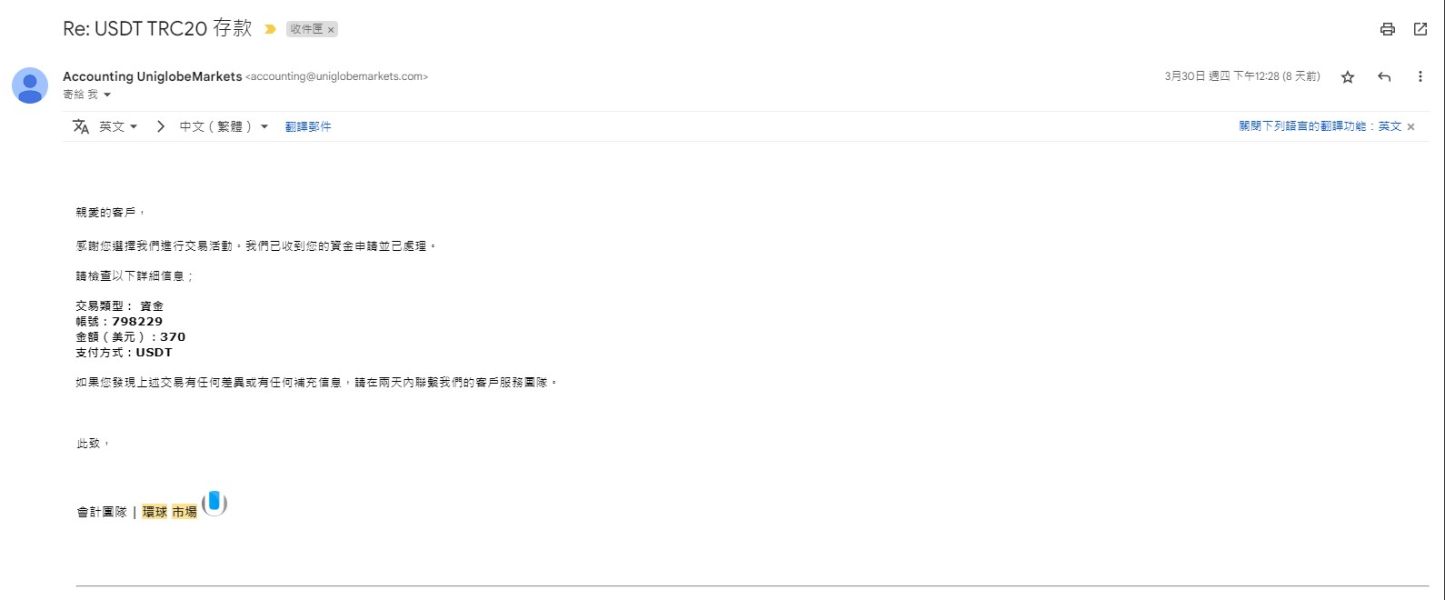

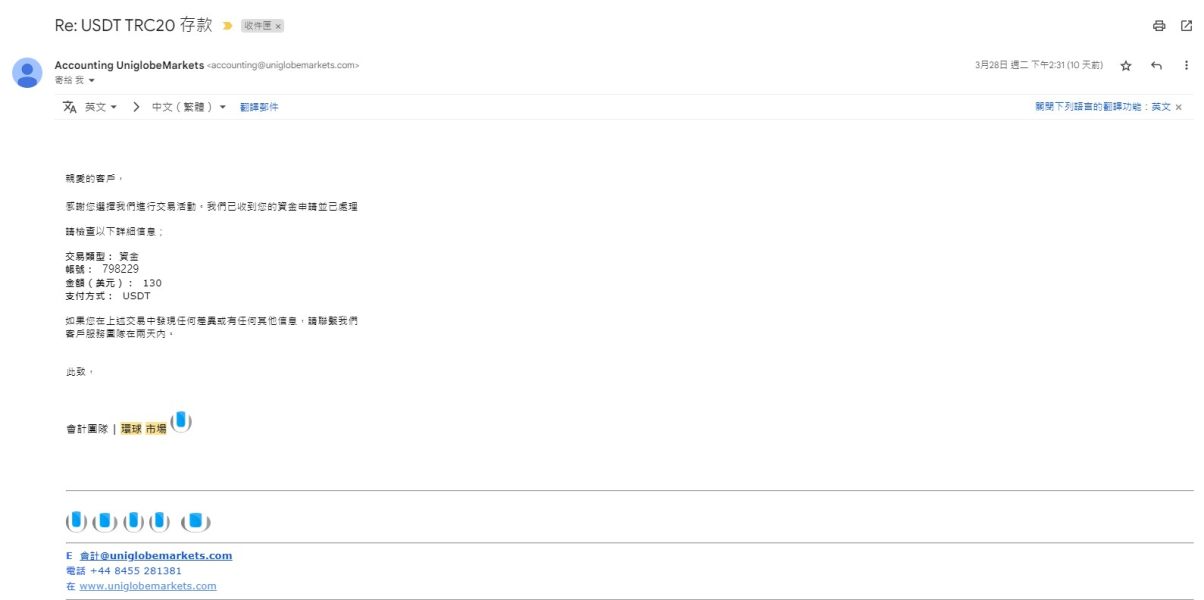

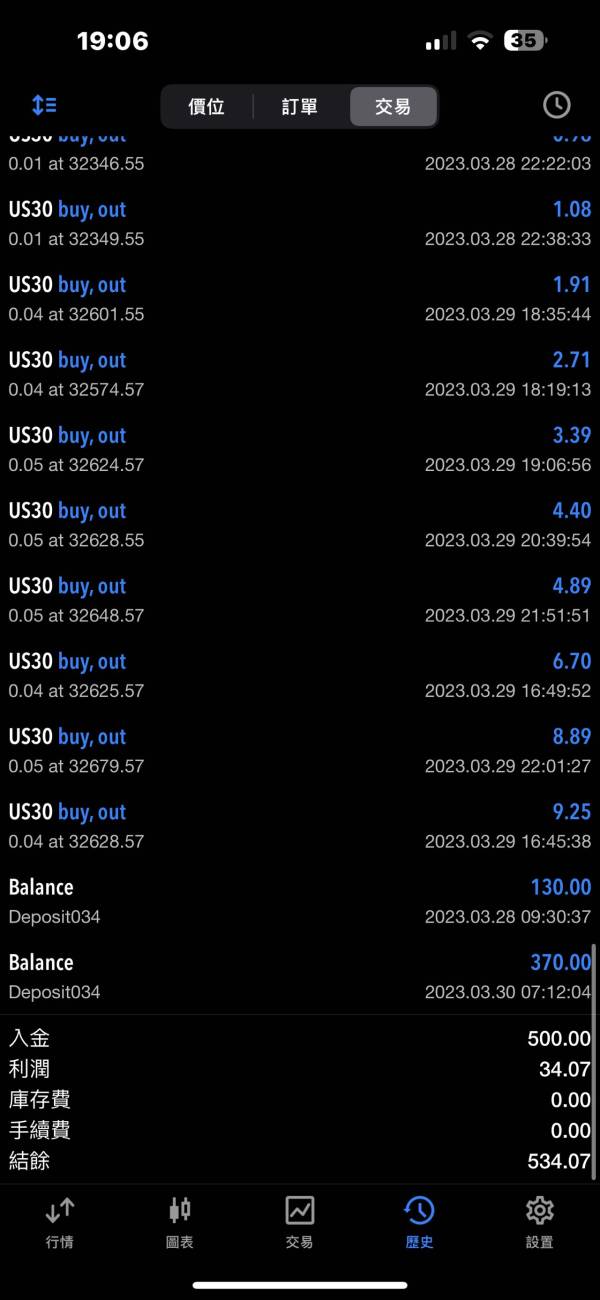

I opened a uniglobemarkets trading account on 2023/03/23, deposited 130 USD through USDT-TRC20 on 2023/03/28 (as shown in the photo), and deposited 370 USD through USDT-TRC20 on 2023/03/30 (as shown in the photo) ,2023/03/30 withdrew 534 USD through USDT-TRC20, until today 2023/04/07 no withdrawal has been processed, the customer service has not responded to the message since 2023/04/05, and the background has not displayed any deposit and withdrawal records , only mt5 records can be provided

My experience with Uniglobe Markets has been genuinely impressive. The platform is smooth, well-structured, and easy to navigate, making trading efficient even during high-volatility sessions. What really stands out is their customer support—responsive, knowledgeable, and always willing to help without unnecessary delays. Execution speed is solid, spreads are competitive, and the overall trading environment feels transparent and professional. Uniglobe Markets shows a strong commitment to trader satisfaction, and it’s clear they focus on building long-term trust rather than short-term gains. A reliable broker that delivers both performance and support.

I am an IB from India with Uniglobe Markets from 2 years now. And I reffered around 460+ clients till now, I am now expanding my IB business more only because of Uniglobe Markets because they offer me Good commission, Good payout almost at same time without miss I am really enjoying and now I m working as full time IB⏰

I have been working with Uniglobemarkets.com from last 5 years an an IB and my clients are happy with their deposit and withdraw services. Customize IB commission regarding to active clients. I dont know why people are writing bad reviews even though with good services...Highly receommed to all traders and IBs...

Good broker and spreads are fantastic! I have really good experience with their support staff. I am fully satisfied with this company. Thanks for the good service.