Is UNIGLOBE markets safe?

Pros

Cons

Is Uniglobe Markets A Scam?

Introduction

Uniglobe Markets is a forex broker that has positioned itself as an accessible trading platform for both novice and experienced traders. Established in 2015, it claims to offer a diverse range of trading instruments, including forex, CFDs, commodities, and cryptocurrencies. However, with the increasing prevalence of scams in the forex market, traders must exercise caution and thoroughly assess the credibility of brokers before committing their funds. This article aims to provide a comprehensive evaluation of Uniglobe Markets, focusing on its regulatory status, company background, trading conditions, and customer experiences. The analysis is based on a review of multiple sources, including user feedback, regulatory databases, and expert evaluations.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor that determines its legitimacy and the safety of client funds. Uniglobe Markets operates under the regulatory framework of the Marshall Islands, a jurisdiction known for its lax regulatory requirements. This raises significant concerns regarding the broker's credibility and adherence to international standards.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Marshall Islands | 78101 | Marshall Islands | Unverified |

The lack of regulation by reputable authorities like the FCA (UK) or ASIC (Australia) means that Uniglobe Markets is not subject to the stringent oversight that protects traders from fraud and malpractice. Moreover, recent warnings from the Cyprus Securities and Exchange Commission (CySEC) indicate that Uniglobe Markets has been providing financial services without proper authorization, further casting doubt on its legitimacy. The absence of robust regulatory oversight is a red flag for potential investors, as it suggests that the broker may not prioritize client protection.

Company Background Investigation

Uniglobe Markets was founded by a group of traders and financial professionals with extensive experience in the forex and CFD markets. While the company claims to have a transparent approach to trading, its ownership structure and management team details remain vague. The company's website states that it operates from a London address, yet it is registered in the Marshall Islands, which raises questions about its operational transparency.

The management teams background is not well-documented, making it difficult to assess their qualifications and experience. Transparency in a broker's operations is essential for building trust with clients. Uniglobe Markets has not provided sufficient information regarding its corporate governance or the qualifications of its leadership team, which is a significant concern for potential investors.

Trading Conditions Analysis

The trading conditions offered by Uniglobe Markets are a vital aspect to consider when evaluating its reliability. The broker claims to offer competitive spreads and various account types tailored to different trading styles. However, the overall fee structure requires careful scrutiny.

| Fee Type | Uniglobe Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1.0 pips |

| Commission Model | $0 - $10 | $5 - $15 |

| Overnight Interest Range | Variable | Variable |

While the spreads appear attractive, the commission structure is less favorable compared to industry standards. Additionally, traders have reported unexpected fees and charges that were not clearly disclosed, which can significantly impact profitability. Such practices are often indicative of a less-than-reputable broker, leading to questions about whether Uniglobe Markets is truly safe for trading.

Client Funds Security

The security of client funds is paramount in the forex trading environment. Uniglobe Markets claims to implement measures such as segregated accounts to protect client deposits. However, the effectiveness of these measures is questionable given the lack of regulatory oversight.

The broker does not provide clear information regarding investor protection schemes or negative balance protection policies. This absence of safety measures raises concerns about the potential risks associated with trading through Uniglobe Markets. Historical complaints from users regarding withdrawal issues further highlight the potential dangers of trading with an unregulated broker.

Customer Experience and Complaints

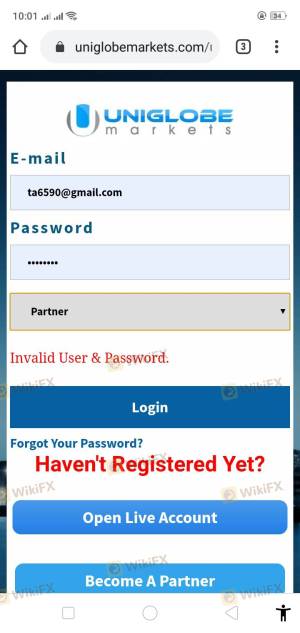

Customer feedback plays a crucial role in assessing the reliability of a broker. Uniglobe Markets has received mixed reviews, with many users expressing frustration over delayed withdrawals and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

Several users have reported that their withdrawal requests were not processed in a timely manner, leading to suspicions of fraud. Furthermore, the lack of effective communication from the support team has compounded these issues, leaving clients feeling neglected and unprotected. These patterns of complaints are significant indicators that Uniglobe Markets may not be a safe choice for traders.

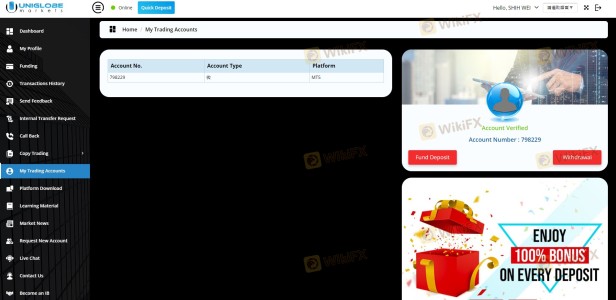

Platform and Trade Execution

The trading platform provided by Uniglobe Markets is essential for evaluating its overall performance. The broker offers MetaTrader 4 and MetaTrader 5, which are popular among traders for their functionality and user-friendliness. However, concerns have been raised about the platform's stability and execution quality.

Issues such as slippage and order rejections have been reported by users, suggesting that the broker may not provide a reliable trading environment. Any signs of platform manipulation or inconsistent execution can severely impact trading outcomes, further questioning the safety of trading with Uniglobe Markets.

Risk Assessment

Utilizing Uniglobe Markets for trading carries inherent risks, primarily due to its unregulated status and past complaints.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight and protection |

| Withdrawal Risk | High | Reports of delayed or blocked withdrawals |

| Platform Risk | Medium | Potential issues with execution and stability |

Given these risks, potential traders should approach Uniglobe Markets with caution. It is advisable to conduct thorough research and consider alternative brokers with stronger regulatory frameworks and better customer feedback.

Conclusion and Recommendations

In conclusion, while Uniglobe Markets presents itself as a viable trading platform, the evidence suggests that it may not be a safe choice for traders. The lack of robust regulation, coupled with numerous customer complaints regarding withdrawals and support, raises significant red flags. Potential investors should be wary of the risks associated with trading through Uniglobe Markets.

For traders seeking safer alternatives, it is advisable to consider brokers regulated by reputable authorities such as the FCA or ASIC, which offer better protection and transparency. Overall, while Uniglobe Markets may have some appealing features, the potential risks and concerns surrounding its operations warrant careful consideration before engaging in trading activities.

Is UNIGLOBE markets a scam, or is it legit?

The latest exposure and evaluation content of UNIGLOBE markets brokers.

UNIGLOBE markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UNIGLOBE markets latest industry rating score is 2.26, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.26 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.