easyMarkets 2025 Review: Everything You Need to Know

Summary

This detailed easymarkets review looks at one of the well-known players in online trading. easyMarkets started in 2001 and works as a multi-asset trading platform that gives access to forex, commodities, and indices. Our research shows worrying trends in how happy users are, with the broker getting just a 2.1/5 rating from 149 customer reviews where only 25% would recommend it.

The broker offers maximum leverage up to 400:1 for Australian clients and has oversight from CySEC and FSA. easyMarkets aims to help traders who want access to global financial markets through forex and CFD trading. But people thinking about using them should carefully look at the mixed user feedback and different rules across countries before putting money in.

Even though it has been around for a long time and offers many assets, the consistently low user ratings show big areas that need improvement in service and making customers happy.

Important Notice

This easyMarkets review shows regional differences in rules and what services they offer. The broker works under different rule systems across countries, with Australian clients getting higher leverage limits (400:1) compared to European clients (30:1) because of different rules from CySEC and FSA.

Our review method includes looking at user feedback, checking rule compliance, and evaluating trading conditions. This review uses public information and user testimonials from 2025, giving an objective look at easyMarkets' current market position and service quality.

Rating Framework

Broker Overview

easyMarkets started working in financial markets in 2001, building over twenty years of experience in online trading services. The company sees itself as a complete multi-asset trading platform that gives global market access to retail and institutional clients. Based on what we know, easyMarkets built its business around forex trading while expanding into commodities and indices to meet different client needs.

The broker works across multiple countries with different rules, letting it serve international clients while following local financial regulations. easyMarkets focuses on giving trading opportunities across major asset classes, though specific details about their own platform development and tech innovations are limited in available information.

According to regulatory filings, easyMarkets works under dual oversight from the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Authority (FSA). This multi-country approach lets the broker offer different leverage ratios and trading conditions based on regional rules. The company's assets include foreign exchange pairs, commodity CFDs, and equity indices, targeting traders who want diversified market exposure through one platform provider.

Key Details

Regulatory Coverage: easyMarkets follows rules through CySEC registration number HE203997 and FSA license 079/07, ensuring oversight across European and Australian markets.

Deposit Requirements: While standard account minimum deposits are not listed in available materials, VIP account access needs a minimum deposit of $2,500, suggesting different account levels based on how much money you put in.

Promotional Offerings: Specific bonus and promotional information is not detailed in current available documentation.

Trading Assets: The platform gives access to forex currency pairs, commodity CFDs, and major equity indices, though exact numbers and specific offerings need direct platform checking.

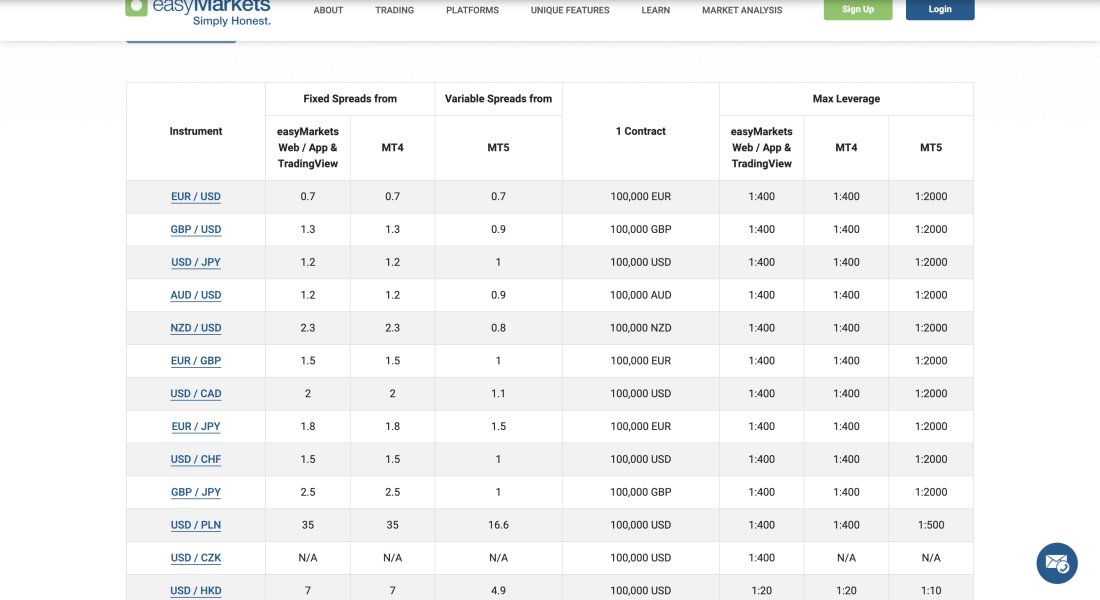

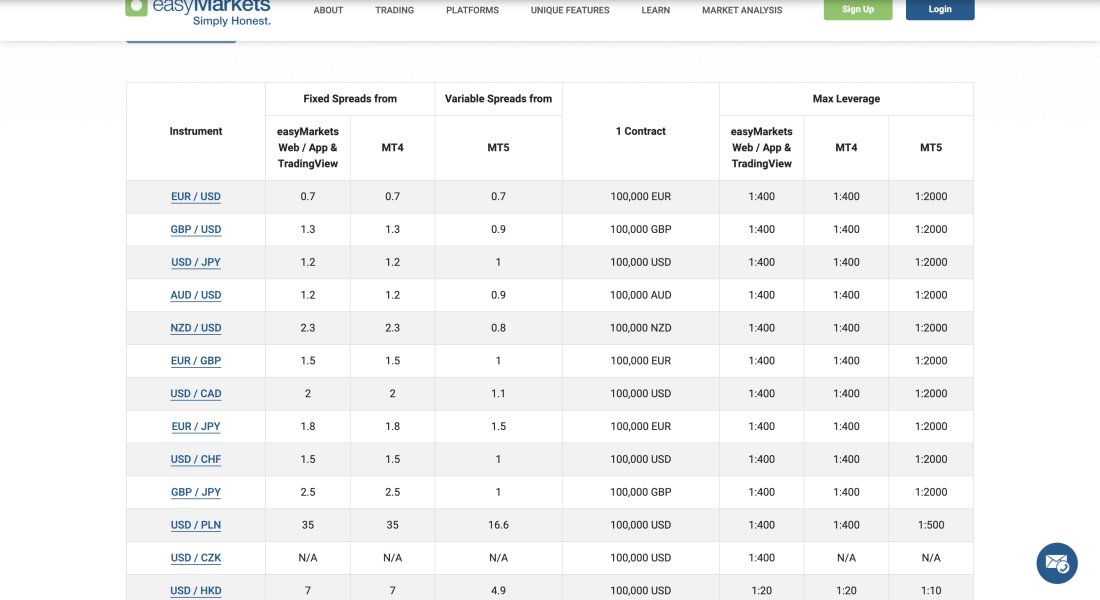

Cost Structure: Detailed spread and commission information is not clearly outlined in available materials, requiring potential clients to ask for specific pricing details directly from the broker.

Leverage Options: Maximum leverage reaches 400:1 for Australian-regulated clients, while European clients face restricted leverage of 30:1 following ESMA regulations.

Platform Technology: Specific trading platform details and tech specifications are not fully covered in current available information.

Geographic Restrictions: Cross-regional regulatory differences create different service levels and trading conditions depending on client location and applicable regulatory framework.

Support Languages: Customer service language options are not specifically detailed in available documentation.

This easymarkets review section shows the need for direct broker contact to get full details about specific trading conditions and service offerings.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

easyMarkets' account condition review shows limited transparency about standard account requirements and features. The available information shows a tiered account structure with VIP accounts needing a minimum deposit of $2,500, but details about entry-level account options remain unclear. This lack of clarity about basic account parameters creates uncertainty for potential clients trying to understand initial capital requirements.

The broker's account opening process specifics are not detailed in available materials, making it hard to judge the complexity or efficiency of client sign-up procedures. Also, information about specialized account types, such as Islamic accounts for Sharia-compliant trading, is not addressed in current documentation.

User feedback suggests dissatisfaction with account-related services, adding to the overall low customer satisfaction ratings. The absence of clear information about account benefits, features, and requirements reflects poorly on the broker's transparency standards. This easymarkets review finds that potential clients may struggle to make informed decisions without full account condition disclosure.

The regional variations in leverage and regulatory compliance add complexity to account management, particularly for international clients who may face different terms based on where they live.

The evaluation of easyMarkets' trading tools and educational resources shows significant information gaps that impact the overall assessment. Available documentation does not give detailed information about proprietary trading tools, market analysis resources, or educational materials offered to clients. This absence of comprehensive tool descriptions makes it challenging to evaluate the broker's competitive position in terms of trader support and platform functionality.

Research and analytical resources that are typically crucial for informed trading decisions are not specifically outlined in current available materials. The lack of information about market research, economic calendars, technical analysis tools, or fundamental analysis resources suggests either limited offerings or poor communication of available services.

Educational resource availability, including webinars, tutorials, trading guides, and market education materials, remains unspecified in available documentation. For new traders, this represents a significant concern as educational support often determines trading success rates and overall user satisfaction.

Automated trading support, including Expert Advisor compatibility, algorithmic trading options, and API access for institutional clients, is not addressed in current materials. User feedback indicates below-average satisfaction with available tools and resources, supporting the lower rating in this category.

Customer Service and Support Analysis (5/10)

Customer service evaluation for easyMarkets presents mixed signals based on available user feedback and operational information. While specific customer service channels, response times, and service quality metrics are not detailed in available documentation, user reviews indicate areas of concern regarding support effectiveness and problem resolution.

The broker's customer service infrastructure, including available communication channels such as live chat, email support, phone assistance, and callback services, requires direct verification as this information is not fully covered in current materials. Response time commitments and service level agreements are similarly unspecified.

Multilingual support capabilities, crucial for international brokers serving diverse client bases, are not detailed in available documentation. This represents a significant information gap for potential clients seeking support in languages other than English.

User feedback compilation suggests frustration with service quality and problem resolution effectiveness. The 2.1/5 overall rating partially reflects customer service shortcomings, though specific complaint categories and resolution success rates are not detailed in available materials. Operating hours and global support coverage remain unspecified, making it difficult for international clients to assess service accessibility.

Trading Experience Analysis (4/10)

Trading experience evaluation for easyMarkets faces significant limitations due to insufficient detailed information about platform performance, execution quality, and user interface design. Available user feedback suggests below-average satisfaction with overall trading experience, contributing to the low 2.1/5 rating from customer reviews.

Platform stability and execution speed metrics are not specifically documented in available materials, making it impossible to provide concrete performance assessments. Order execution quality, including slippage rates, requote frequency, and fill rates during volatile market conditions, requires direct testing or more comprehensive user feedback analysis.

Platform functionality completeness, including charting capabilities, order types, risk management tools, and customization options, is not detailed in current documentation. This information gap significantly impacts the ability to assess the broker's technological competitiveness.

Mobile trading experience, increasingly crucial for modern traders, is not addressed in available materials. The absence of mobile app reviews, functionality comparisons, or cross-platform synchronization details represents a significant evaluation limitation. Trading environment factors such as typical spreads, liquidity provision, and market depth are not fully covered, requiring direct broker contact for specific details.

Trust Factor Analysis (6/10)

easyMarkets demonstrates relative strength in regulatory compliance and trust factors compared to other evaluation categories. The broker maintains dual regulatory oversight through CySEC registration HE203997 and FSA license 079/07, providing institutional credibility and regulatory accountability across multiple jurisdictions.

However, specific fund safety measures, including client money segregation policies, deposit insurance coverage, and negative balance protection, are not detailed in available documentation. This information gap limits the comprehensive assessment of client fund security measures.

Company transparency regarding financial reporting, ownership structure, and corporate governance is not extensively covered in available materials. Industry recognition, awards, or third-party certifications that could enhance trust credentials are not mentioned in current documentation.

The broker's handling of customer complaints and dispute resolution procedures, while not detailed in available materials, appears to face challenges based on user feedback patterns. The relatively low user satisfaction ratings suggest room for improvement in trust-building measures and customer relationship management. Despite regulatory compliance, the overall user experience appears to impact perceived trustworthiness negatively.

User Experience Analysis (4/10)

User experience evaluation reveals significant challenges based on available feedback and satisfaction metrics. The 2.1/5 customer rating from 149 reviews, with only 25% recommending easyMarkets, indicates substantial user dissatisfaction across multiple service areas.

Interface design and platform usability information is not specifically detailed in available documentation, making it difficult to assess the user-friendliness of trading platforms and account management systems. Registration and account verification processes, crucial for first-time user experience, are not fully covered in current materials.

Fund operation experience, including deposit and withdrawal processes, processing times, and fee structures, requires direct verification as this information is not detailed in available documentation. User feedback suggests frustration with various aspects of the service delivery, though specific complaint categories are not systematically documented.

The broker appears suitable for traders seeking forex and multi-asset exposure, but the consistently negative user feedback suggests significant service delivery challenges. Common user complaints, while not specifically categorized in available materials, appear to span multiple service areas based on the overall low satisfaction ratings. Improvement opportunities exist across most service categories to enhance overall user experience and satisfaction levels.

Conclusion

This comprehensive easymarkets review reveals a broker with established market presence but significant challenges in user satisfaction and service delivery. With over two decades of operational experience and regulatory compliance through CySEC and FSA oversight, easyMarkets demonstrates institutional credibility. However, the concerning 2.1/5 user rating from 149 reviews, where only 25% recommend the platform, indicates substantial areas requiring improvement.

The broker may suit traders specifically seeking multi-asset exposure through forex, commodities, and indices, particularly those comfortable with varying regulatory conditions across jurisdictions. However, potential clients should carefully weigh the consistently negative user feedback against their trading requirements and risk tolerance.

easyMarkets' primary advantages include diverse asset offerings and regulatory compliance, while significant disadvantages encompass poor user experience ratings and limited transparency in service specifications. Prospective clients should consider alternative brokers with stronger user satisfaction records unless specific features unique to easyMarkets align with their trading objectives.