orbin markets 2025 Review: Everything You Need to Know

Abstract

This article gives a critical orbin markets review that shows why Orbin Markets gets a negative rating overall. The broker offers CFDs as its main trading tool, but it has made many users unhappy with serious problems about safety, reliability, and how well trades work. Retail traders who want to bet on price changes through CFDs should be very careful when thinking about this broker. Many user reports and reviews on sites like Trustpilot have shown problems from bad customer service and trouble with managing funds to poor order execution and slippage. Also, several independent sources have given fraud warnings about Orbin Markets. The platform mainly targets retail CFD traders, but the constant negative feedback shows that both new and experienced traders might face big challenges and money risks. This orbin markets review uses detailed market research and combined user feedback, telling potential investors to carefully think about the risks before working with the broker.

Notice

This review uses user feedback and market survey data. No specific details about differences between regions have been mentioned in the source materials. Readers should know that some information, such as regulatory details, may not be fully current and that the review relies on the reports available now. Please remember that the truth and timeliness of the information are based on multiple sources collected during our research.

Scoring Framework

Broker Overview

Orbin Markets is a broker that focuses mainly on giving CFD trading services. This lets users bet on the price movements of different assets without owning the actual instruments. The exact founding year and detailed company background are not given in the available sources, but it is clear that the business model centers on CFD trading. This allows traders to engage in derivative speculation which can be appealing for those looking for leverage and market exposure. However, the lack of clear information about account conditions, regulatory oversight, or detailed background raises more red flags for potential clients. So while the platform aims to attract retail CFD traders with its diverse offering, the lack of transparency makes it hard for investors to trust the firm.

The orbin markets review shows that the platform seems to use a basic trading interface without the advanced features found in better brokers. The asset offering is limited only to CFDs, and without any details on other investment instruments, traders are left with few options. The details about platform technology, trading terminals, and mobile access remain unclear, adding to the overall uncertainty. Also, key information about the company's regulatory compliance, supervisory frameworks, and operational transparency is notably missing, leading to widespread doubt about the firm's legitimacy. In essence, while CFD trading is available, potential investors must be careful about engaging with a broker that lacks detailed and credible supporting information.

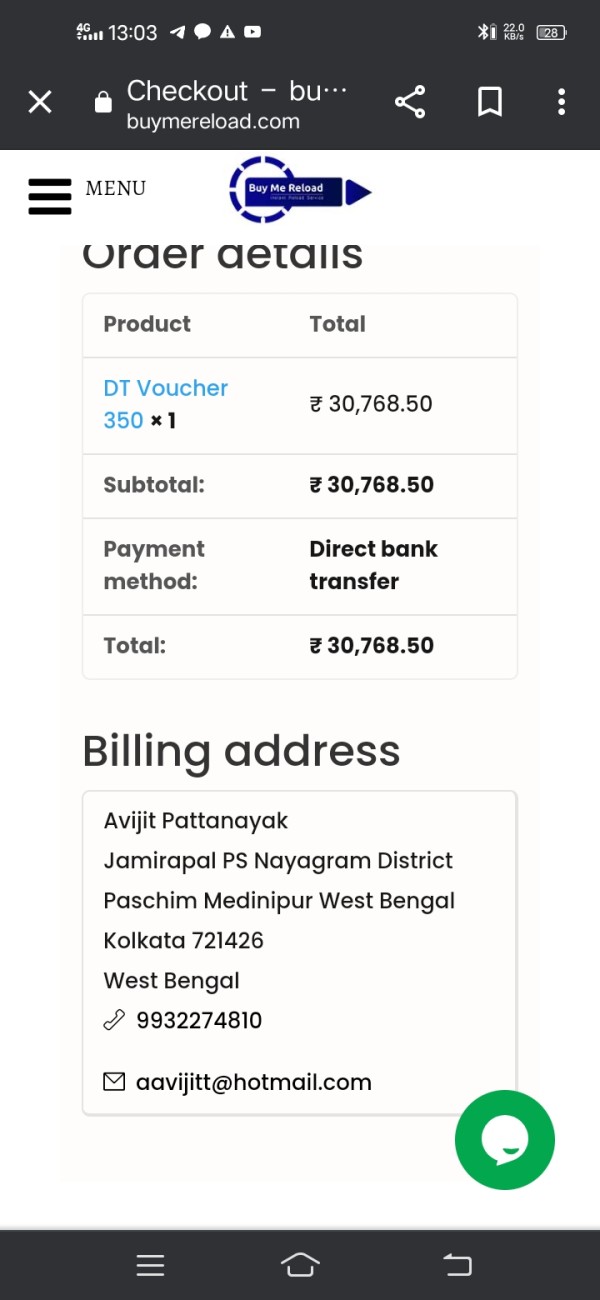

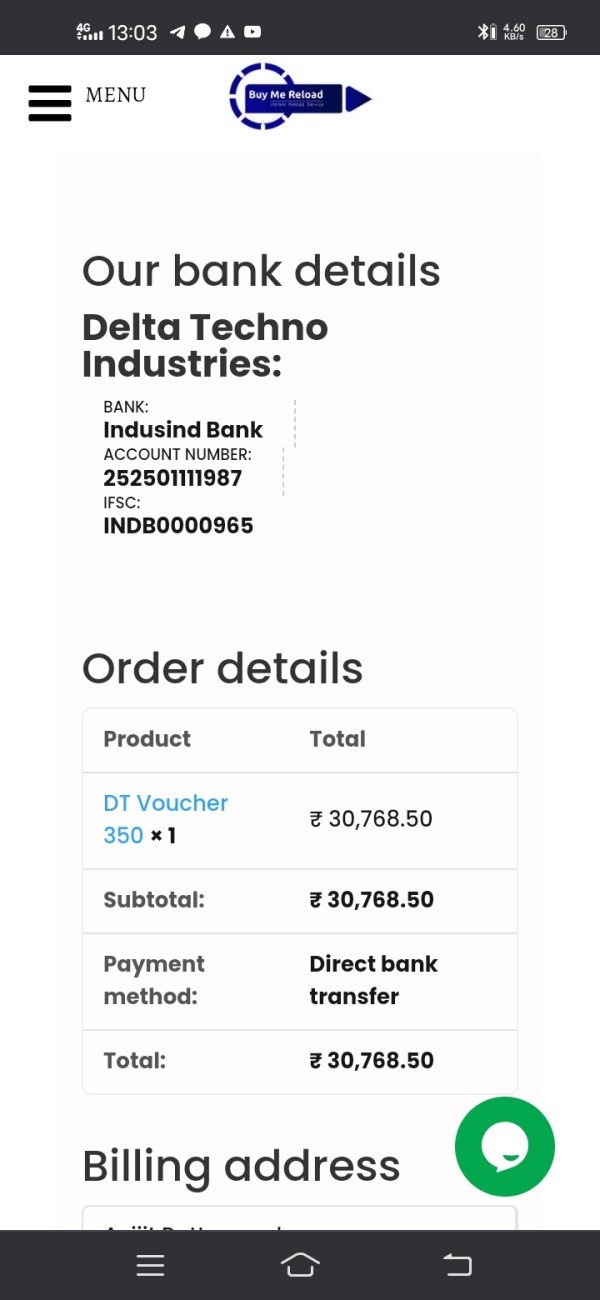

The regulatory details for Orbin Markets are not given in the available source material. There is no mention of any specific regulatory body or compliance measures, which leaves clients uncertain about the firm's legal standing. Deposit and withdrawal methods are also not explained, making it difficult for traders to verify the efficiency or security of funds transfers. The minimum deposit requirement is also not disclosed, showing that specific client entry conditions remain unclear.

There is no information given about any bonus promotions or incentive programs. This is a factor that brokers often use to attract clients. The only clear asset available for trading through Orbin Markets is CFDs, with no list of additional instruments like forex, stocks, or commodities. When it comes to cost structure, details about spreads, commissions, or any fee schedules are not mentioned, leaving traders unaware of potential hidden costs. Also, there is no data about the operating leverage ratios, which further clouds the overall cost transparency.

Platform choice details, including the type of trading interface or available software platforms, are notably missing from available documents. Information about regional restrictions or supported languages on customer support is also absent. Overall, this orbin markets review highlights a concerning lack of detail on critical aspects such as regulatory compliance, deposit/withdrawal methods, minimum deposits, bonus offers, cost structures, and platform options—each of which is important for thorough research.

Detailed Rating Analysis

1. Account Conditions Analysis

The account conditions of Orbin Markets remain poorly described in the available sources. Specific account types, minimum deposit requirements, and the overall account setup process are not clearly addressed. Users have reported a lack of clarity and transparency when trying to understand the account terms, resulting in frustration and dissatisfaction. There is no mention of specialized account functions such as Islamic accounts or segmented account types to meet different trading needs. The absence of detailed account information coupled with negative user feedback about difficulties in opening and managing accounts reflects poorly on the broker's overall offering. This gap leaves potential traders with unanswered questions about fees, fund segregation, and account protection measures. The current state of account conditions, as gathered from various reports, points toward non-standard industry practices and contributes significantly to the low score. The issues surrounding account terms underscore the overall concerns raised about Orbin Markets.

Orbin Markets provides CFD trading as its primary tool. However, the array of research and analytical resources available to traders appears severely limited. There is little evidence of detailed educational materials, webinars, or advanced charting tools that are standard among reputable brokers. Although the platform does allow users to trade CFDs, essential components such as trading calculators, market news feeds, or automated trading support are noticeably absent. Users have commented on the basic nature of the available resources, noting that the overall trading toolkit does not help with advanced market analysis. This lack of extra features reduces the utility of the trading platform, particularly for those requiring in-depth market insights. The lack of supportive resources certainly plays a role in the overall negative feedback, and prospective clients may find themselves ill-equipped to make informed decisions. While the provision of CFDs offers some functionality, the overall toolset falls short of the industry standard.

3. Customer Service and Support Analysis

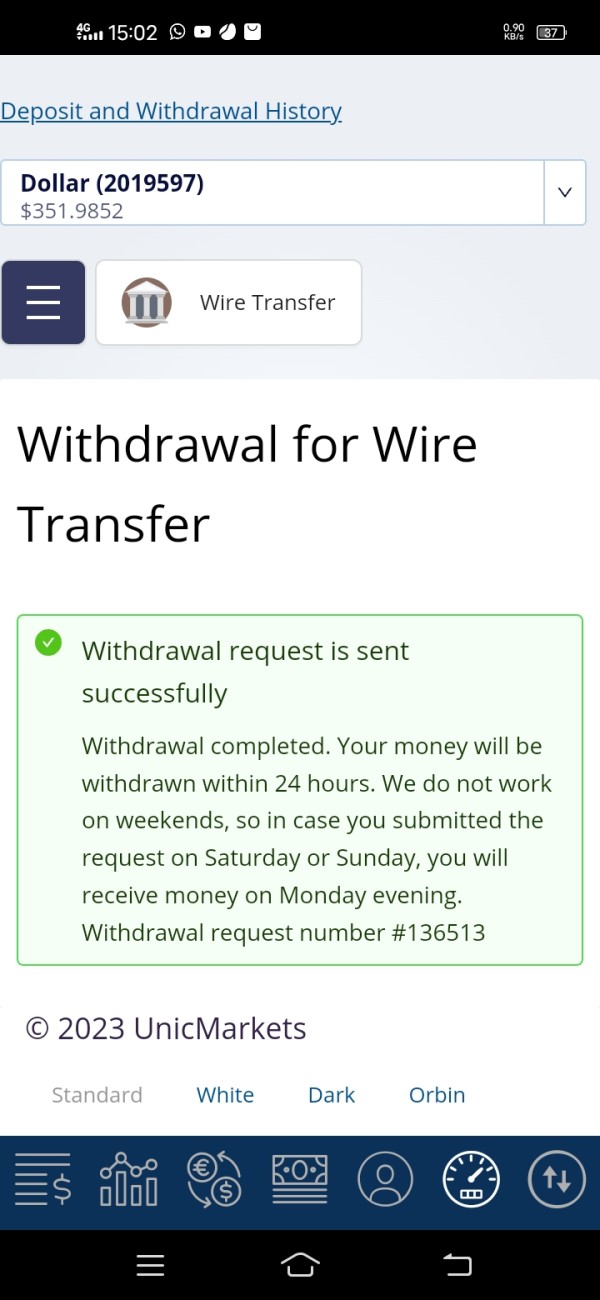

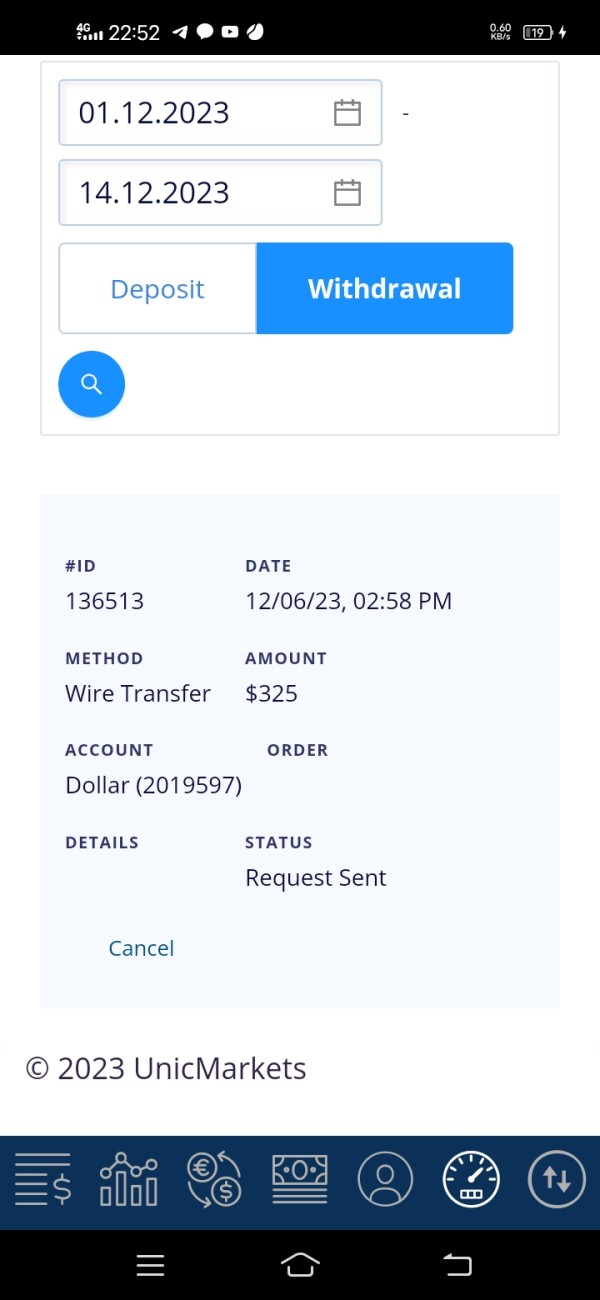

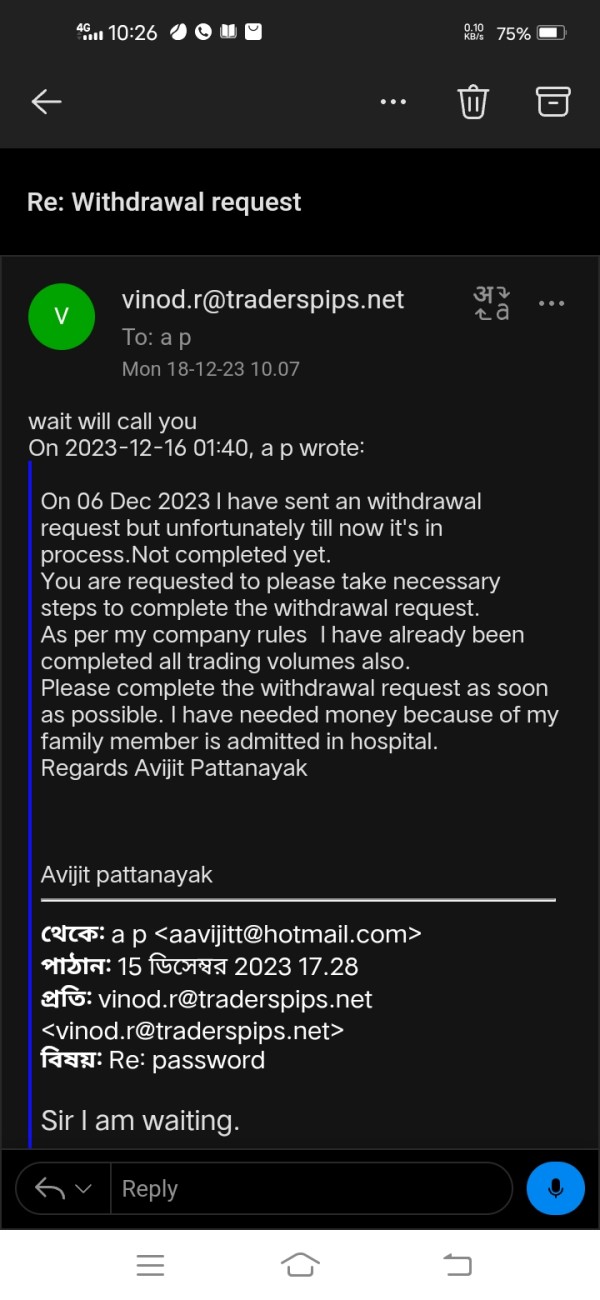

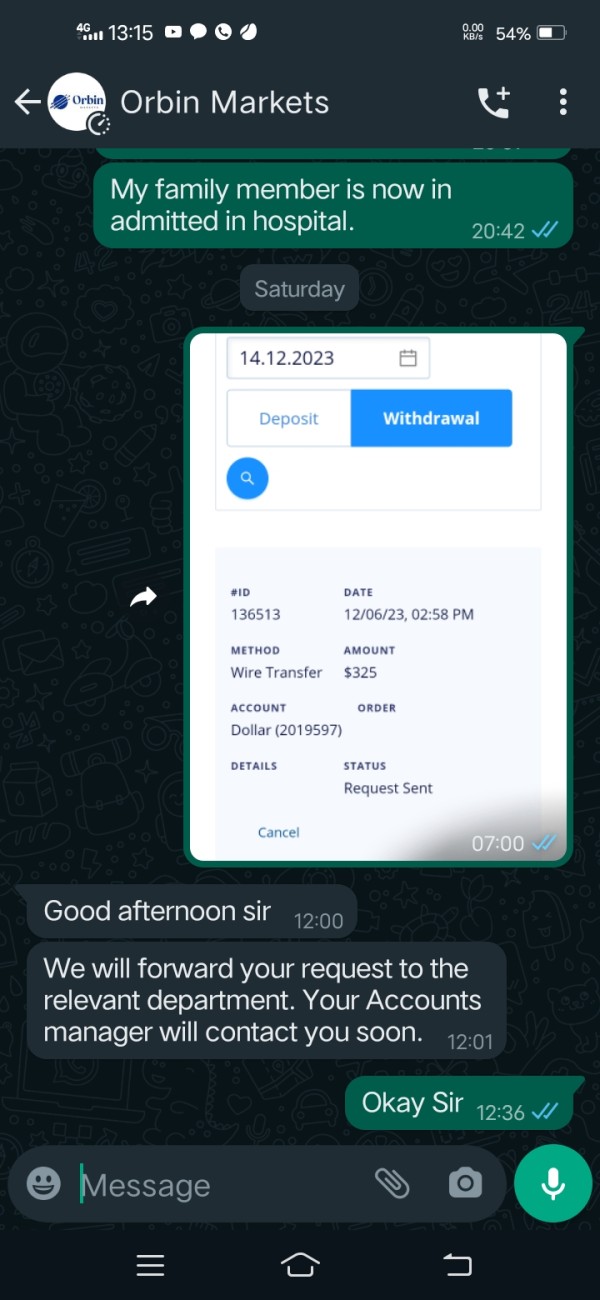

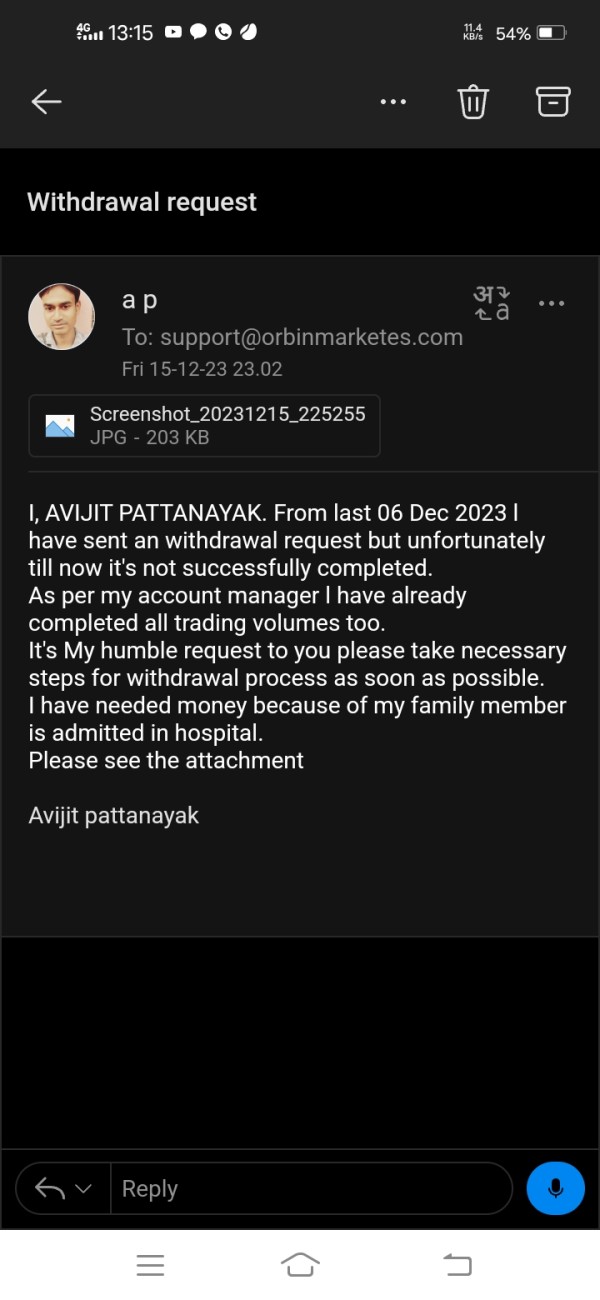

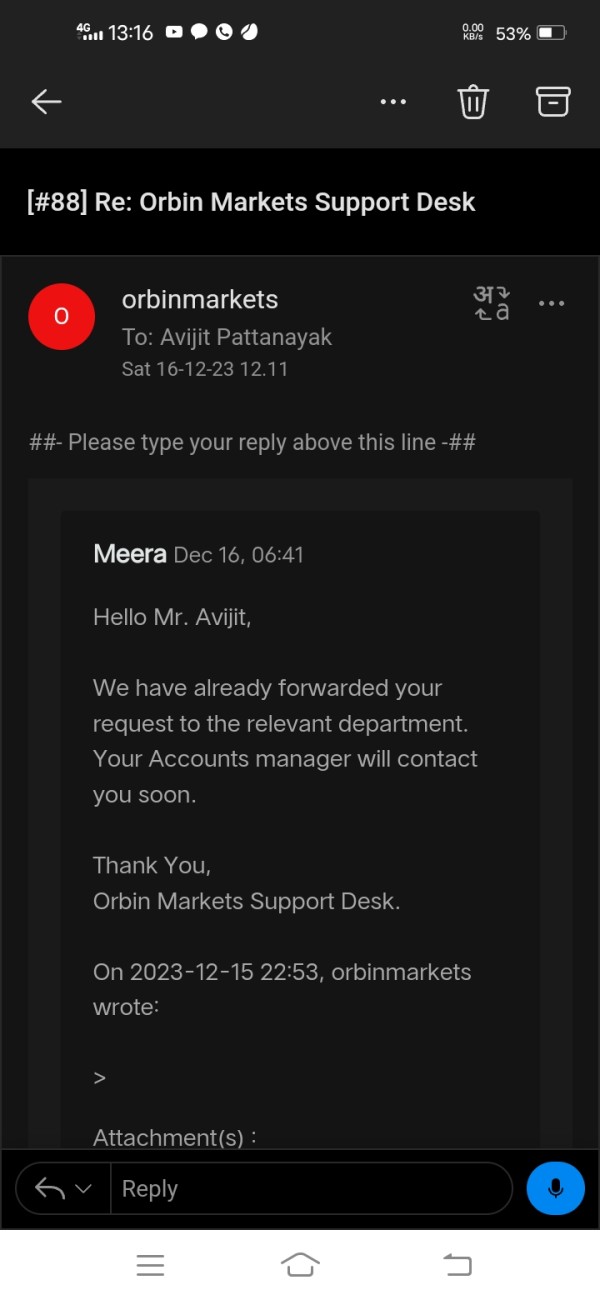

Customer service and support at Orbin Markets have been major points of complaint in user reviews. Clients frequently report unsatisfactory experiences, citing slow response times, inadequate support channels, and unresolved issues related to account management and funds. Users have expressed frustration with the inability to get timely assistance, which, in some cases, led to prolonged difficulties with trading and withdrawal processes. The broker's support team appears to lack the necessary resources to address common concerns effectively, and the absence of clear multi-language support or round-the-clock service further worsens these issues. The negative customer service feedback significantly impacts the overall reputation of the broker, as prompt and reliable support is critical in high-stakes trading environments. With several reports showing that account-related instructions and fund issues remain unresolved for extended periods, the overall customer support structure appears lacking. The unsatisfactory customer service experience contributes heavily to the low score in this dimension.

4. Trading Experience Analysis

The trading experience on Orbin Markets is hurt by several reported problems that significantly compromise usability. Users have documented persistent issues such as slippage, re-quotes, and inconsistent order executions when attempting to place trades. The platform's technological framework appears unstable, with frequent interruptions during high-volatility periods, a condition that can be harmful in fast-moving markets. These technical problems were highlighted repeatedly in user reviews, and they strongly impact the overall trading confidence. The lack of detailed information about mobile trading capabilities or enhanced charting functionalities further reduces the trader's experience. The minimal technological support and the inability to offer a robust trading environment ultimately lead to a less than satisfactory experience. This orbin markets review strongly suggests that traders might encounter significant obstacles during their trading sessions due to the current platform limitations. Such consistent negative feedback on trade execution and platform reliability marks a major setback for the broker.

5. Trust Analysis

Trust in Orbin Markets is extremely low, as highlighted by multiple independent reviews and reported experiences. There is a clear lack of transparency about regulatory oversight, and no detailed information is available concerning the broker's licensing or supervisory bodies. Several sources have issued warnings about potential fraudulent practices, and users frequently report unresolved issues related to funds recovery and account safety. The absence of robust security measures and adherence to industry best practices has severely hurt confidence among traders. Not only is there an apparent lack of regulatory validation, but there are also significant concerns about whether client funds are appropriately segregated or insured. Negative reports and public warnings in various online platforms have contributed to an overall distrust of the firm. In the current landscape, where trust and security are paramount, the obvious shortcomings observed in Orbin Markets' operations serve as a critical deterrent for prospective traders.

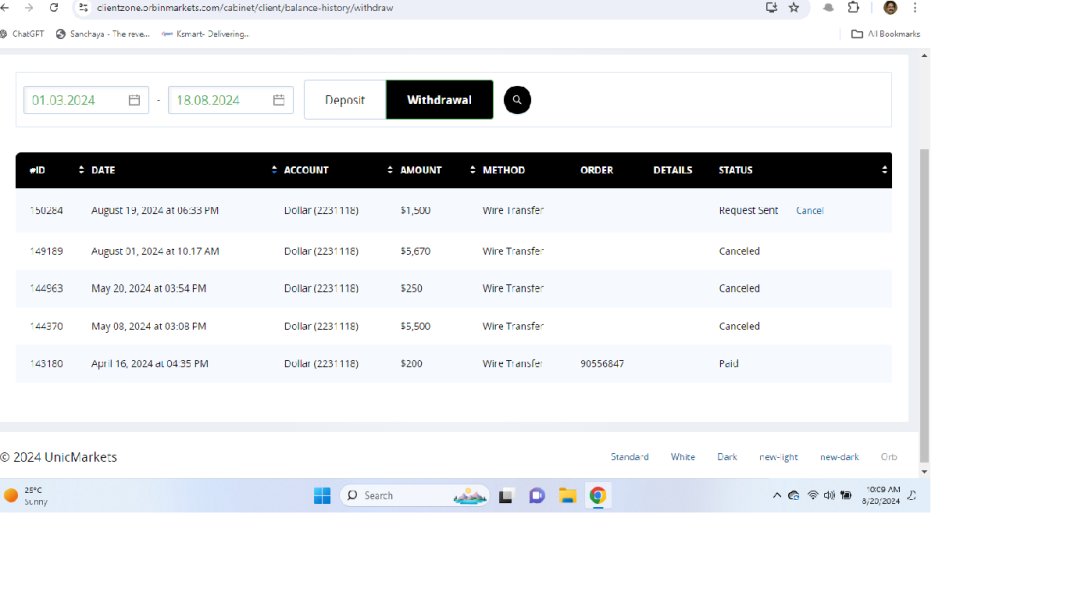

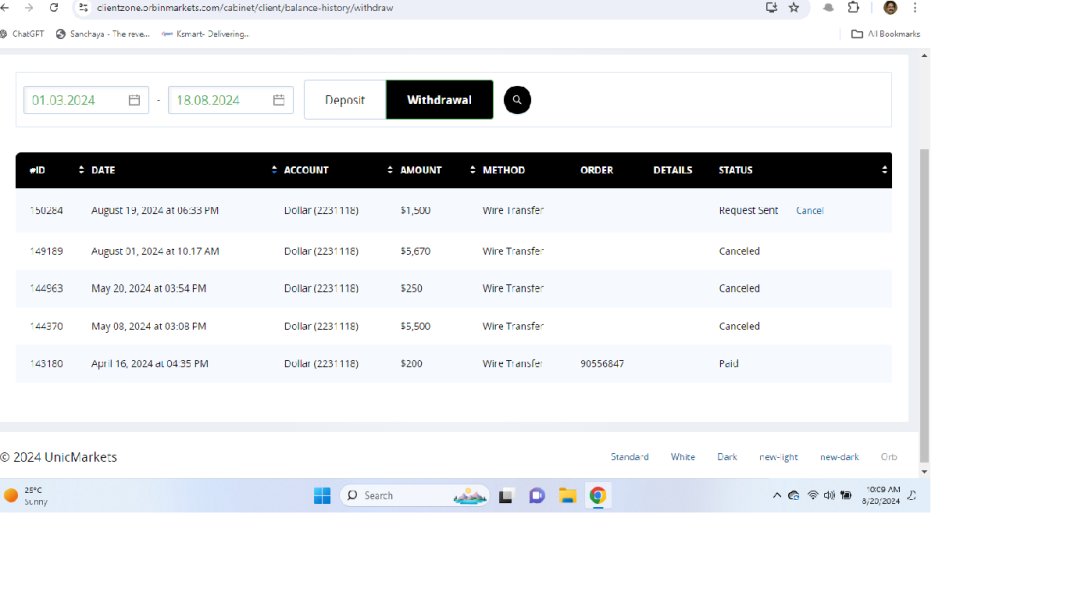

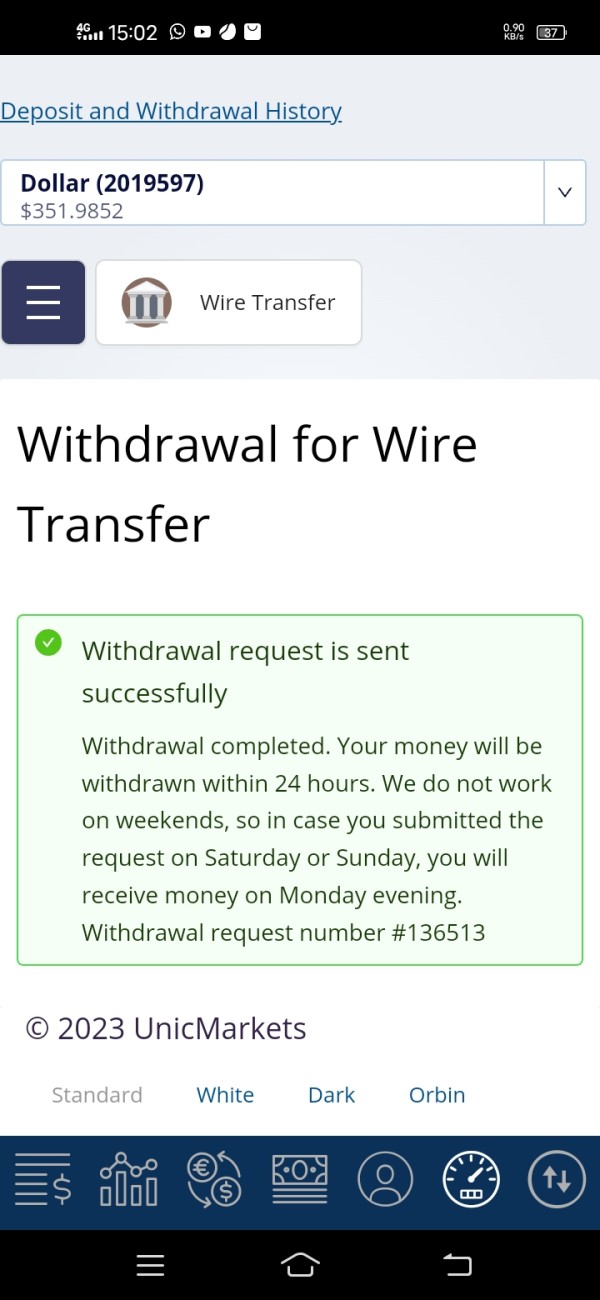

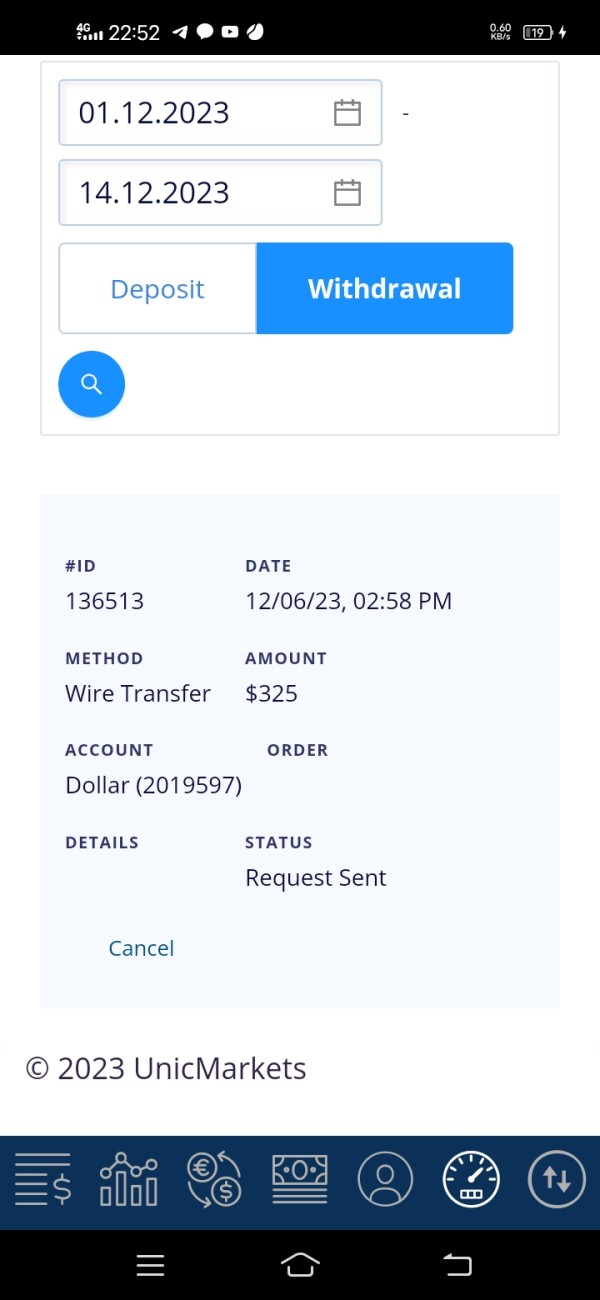

6. User Experience Analysis

The overall user experience at Orbin Markets is largely unsatisfactory, as reflected in negative reviews from traders. Many users report a difficult and confusing interface that complicates the registration and account verification processes. The platform appears outdated, with a design that lacks the intuitive navigational features found in more reputable brokers. There are numerous complaints about difficulties in managing deposits and withdrawals, leading to frustrations and delays in fund access. This lack of a streamlined, user-friendly experience extends to various aspects of the trading operation, including subpar execution quality and inconsistent platform performance. The critical feedback shows that most users feel the overall experience does not meet the industry standards expected of modern CFD brokers. For traders with even moderate expectations about ease of use, the current issues pose significant obstacles and suggest that major improvements are necessary. The low score in this category is a direct consequence of the persistent and widespread user dissatisfaction.

Conclusion

In conclusion, Orbin Markets presents an overall negative picture as supported by extensive user feedback and multiple independent sources. This orbin markets review finds significant concerns about trust, regulatory transparency, and customer service, while the sole offer of CFD trading does little to reduce these issues. The broker is not recommended for novice traders or those with low risk tolerance, given the repeated reports of execution problems and account management difficulties. While the platform does provide basic CFD trading tools, the numerous shortcomings and negative user experiences overshadow any potential benefits. Prospective traders are advised to exercise extreme caution and consider alternative brokers with more robust regulatory supervision and transparent operational practices.