admfx 2025 Review: Everything You Need to Know

Summary

This comprehensive admfx review reveals significant concerns about this forex broker that investors must consider before committing their funds. Based on available data and user feedback, admfx presents a troubling picture for potential traders looking for reliable trading services. The broker was established in 2022 and has its headquarters in Hong Kong, offering high leverage up to 1:500 and claiming to provide access to multiple asset classes including forex, futures, CFDs, and cryptocurrencies. However, these apparent advantages are overshadowed by serious operational issues and user complaints that raise red flags.

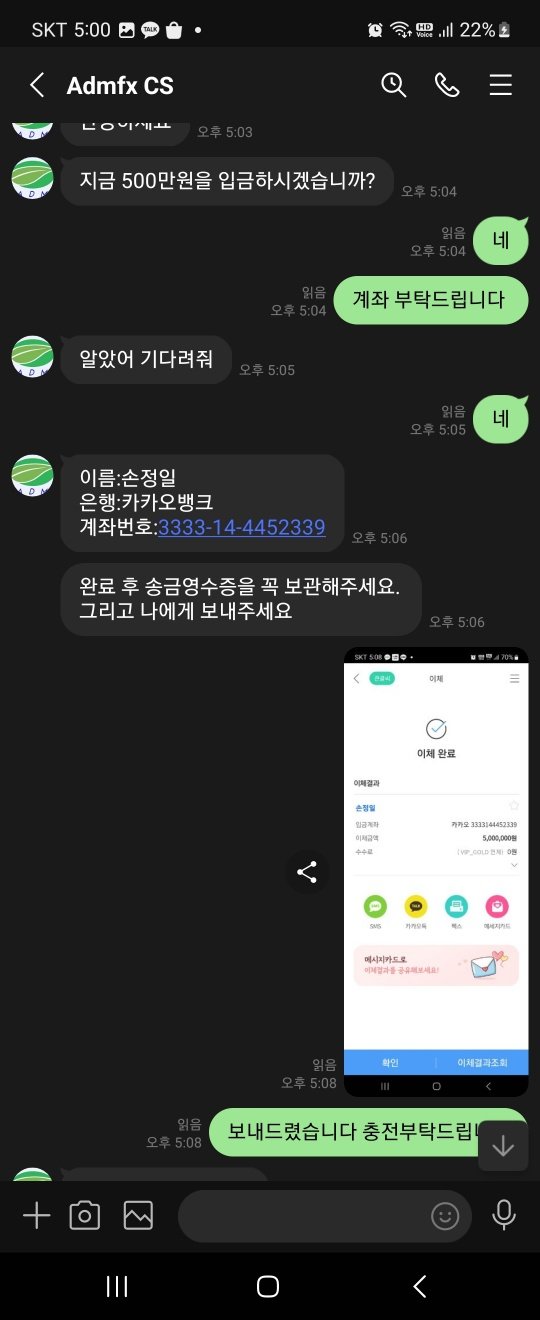

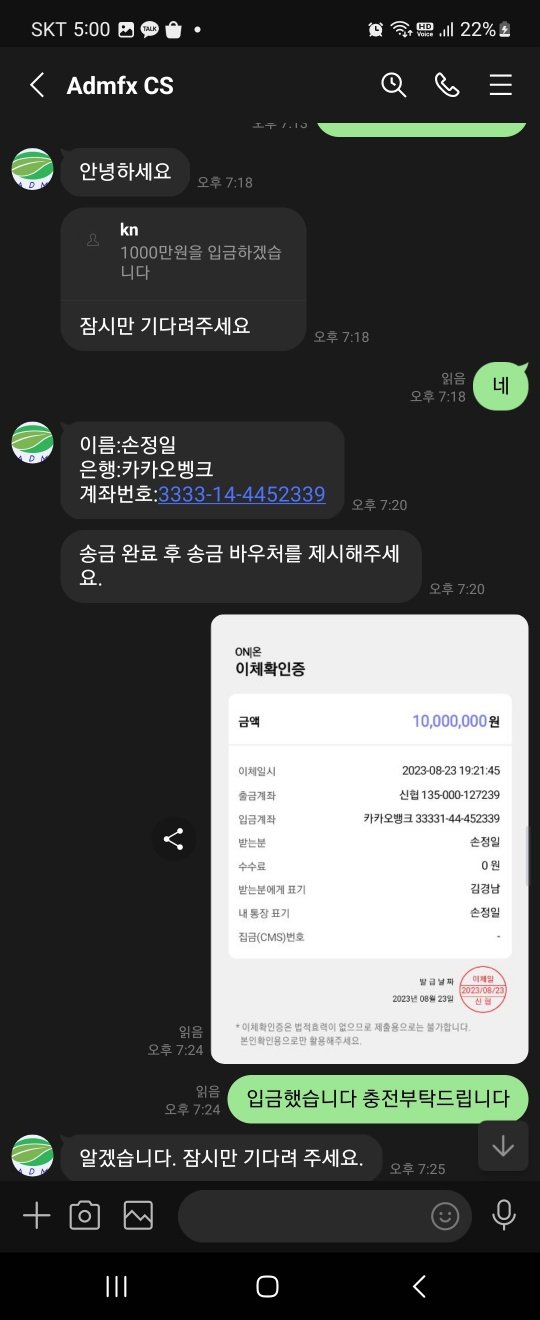

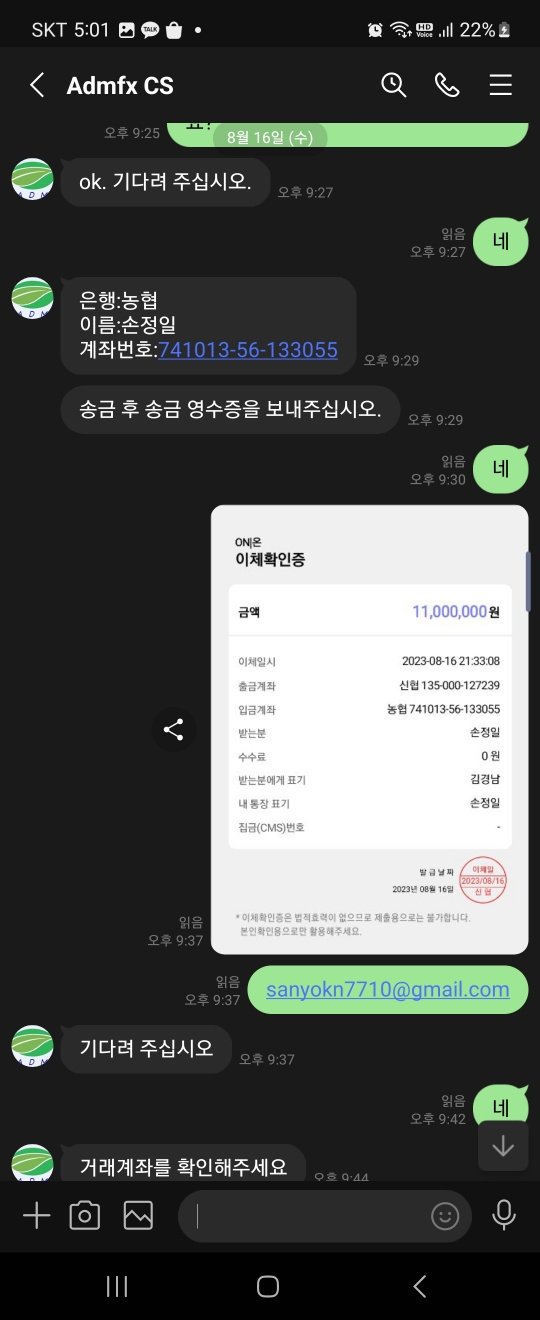

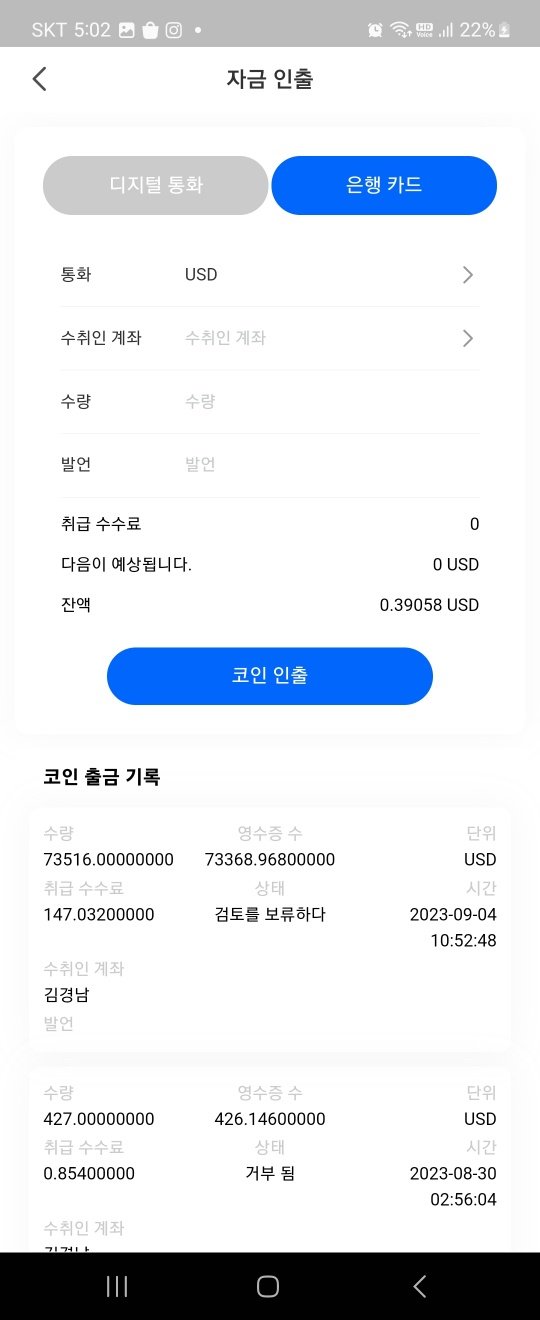

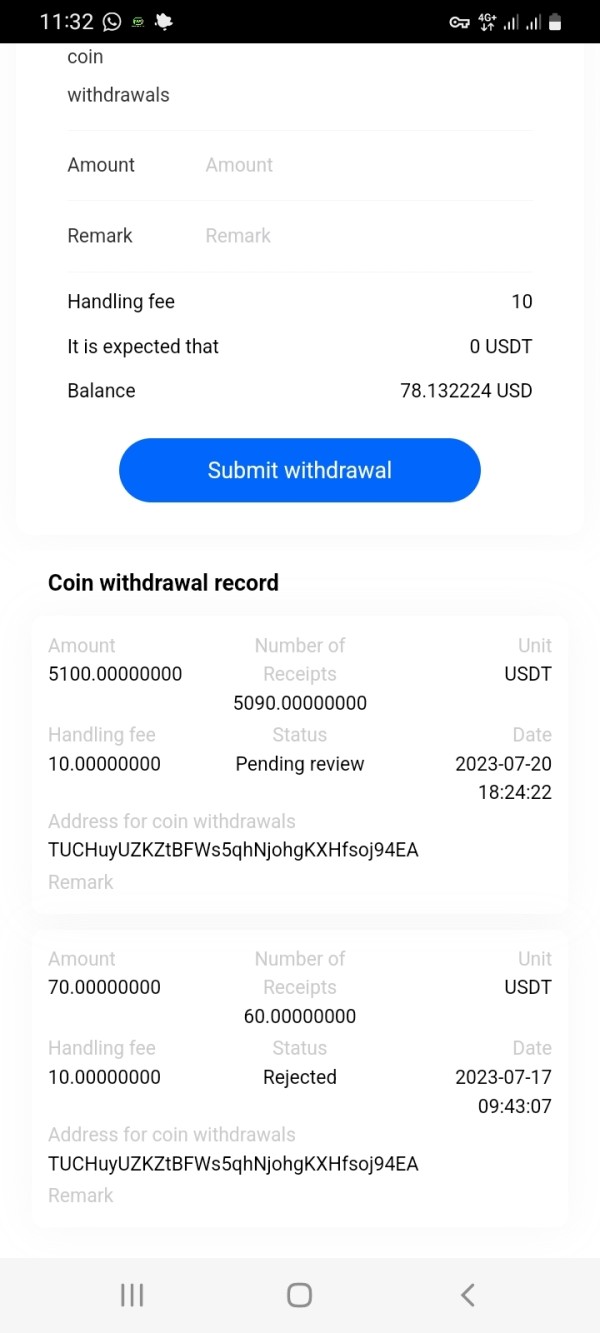

According to industry monitoring platforms, admfx has received overwhelmingly negative feedback from users, particularly regarding fund withdrawal difficulties and allegations of fraudulent activities. The broker targets ordinary investors seeking high-yield investment opportunities, but the reality appears far from the promised returns that they advertise. User reports consistently highlight problems with customer service responsiveness, platform stability issues, and most concerning of all, challenges in accessing their deposited funds. This admfx review aims to provide traders with essential information to make informed decisions about whether this broker meets their trading needs and risk tolerance.

Important Notice

Regional Entity Differences: The information presented in this review is based on available public data and user feedback. Specific regulatory information for different jurisdictions was not detailed in available sources, and investors should exercise extreme caution when considering this broker for their trading activities. Trading conditions, available services, and regulatory oversight may vary significantly across different regions.

Review Methodology: This admfx review is compiled based on user feedback analysis, available market data, and industry monitoring reports. All information has been gathered from publicly available sources and user testimonials to provide an accurate assessment. Investors are strongly advised to conduct their own due diligence and verify all information independently before making any investment decisions.

Rating Framework

Broker Overview

admfx entered the forex trading market in 2022, positioning itself as a Hong Kong-based financial services provider. The company markets itself as offering ordinary individuals access to high-yield investment opportunities through forex trading and related financial instruments that promise substantial returns. According to available information, admfx operates with a business model focused on providing retail traders access to international financial markets, though specific details about the company's corporate structure and founding team remain limited in public documentation.

The broker's stated mission involves democratizing access to forex trading by offering what they describe as competitive trading conditions and diverse investment opportunities. However, the gap between these stated objectives and actual user experiences has become a significant concern for industry observers and potential investors alike who have researched the company thoroughly.

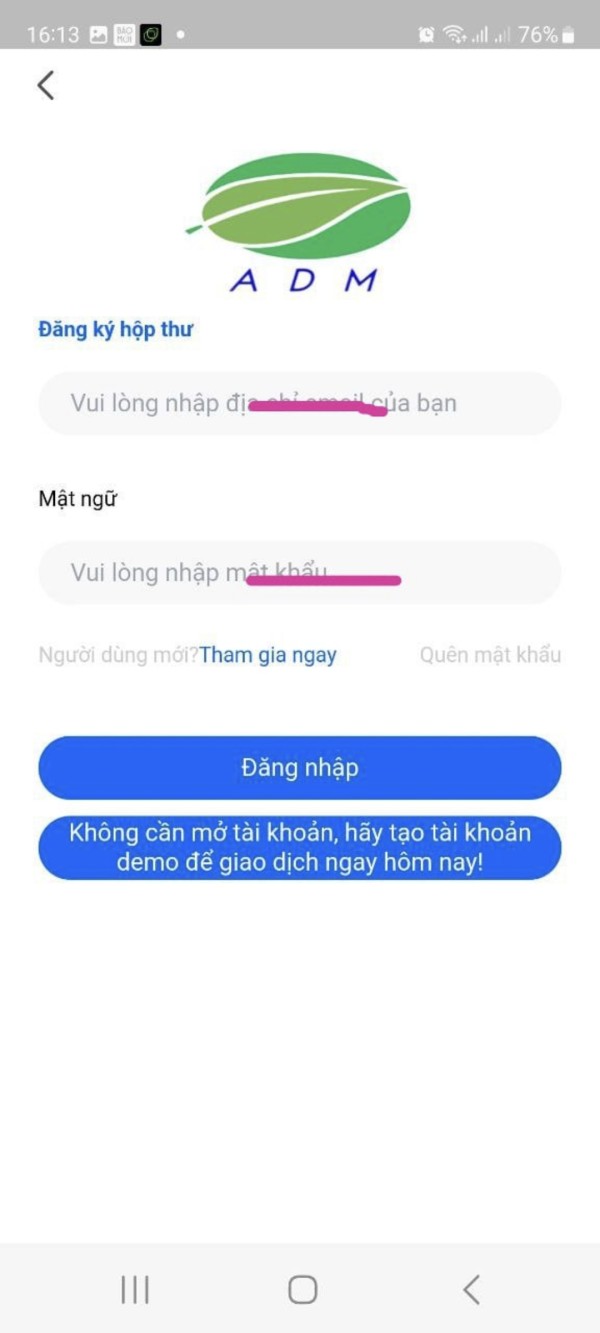

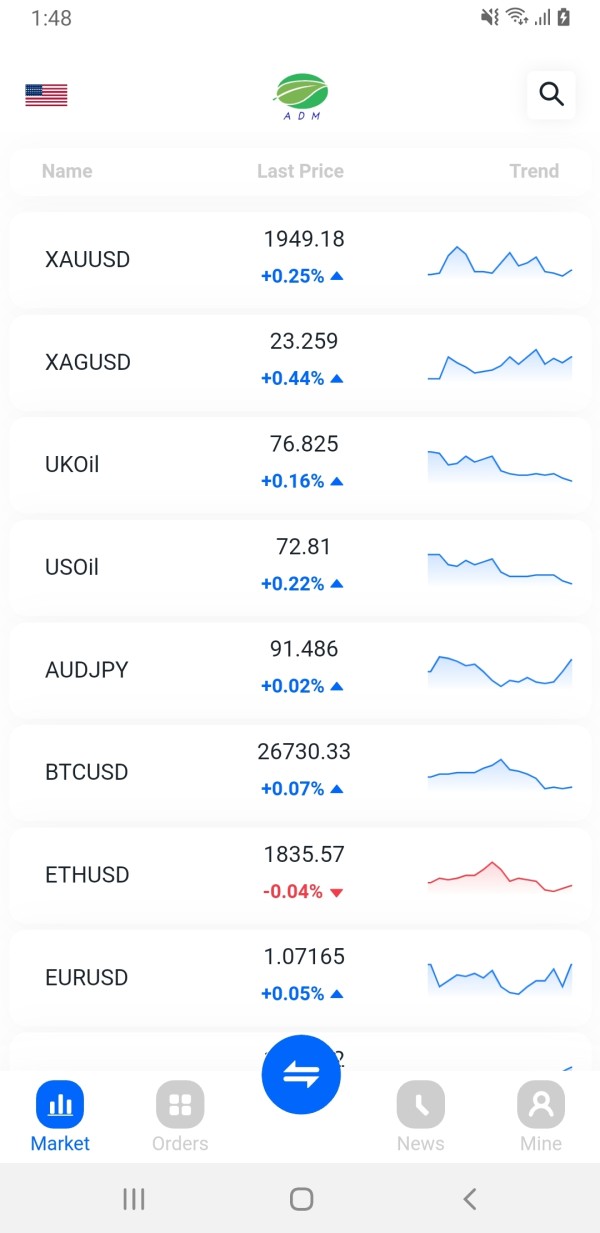

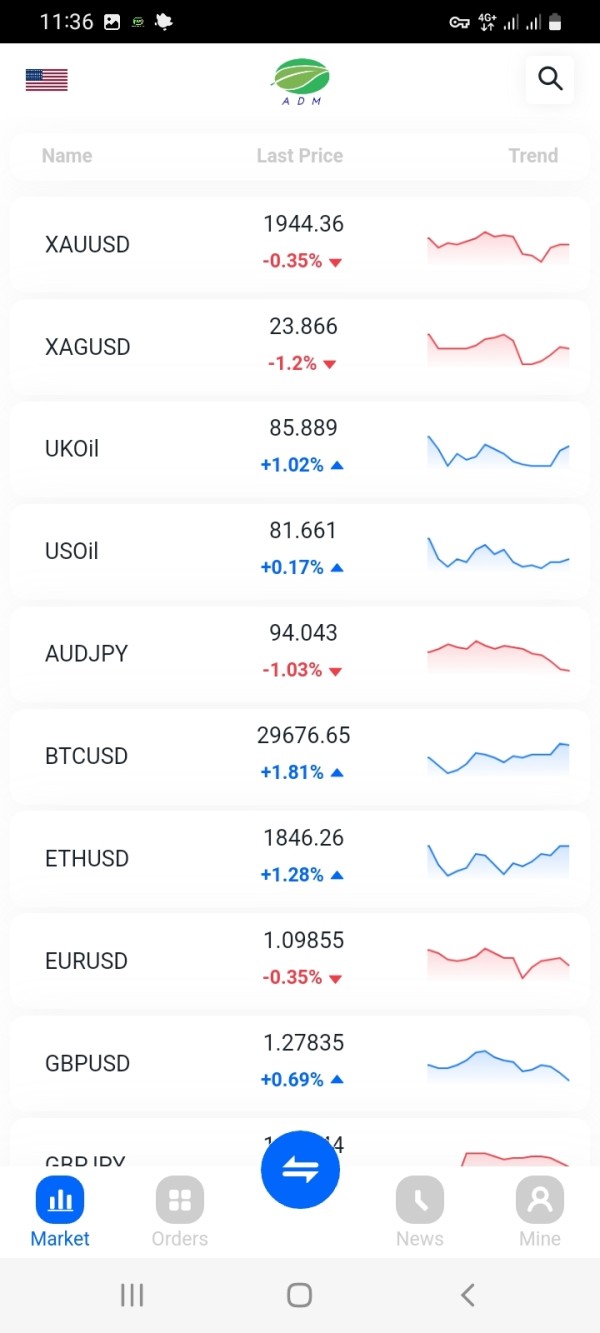

admfx offers trading services across multiple asset categories, including traditional forex pairs, futures contracts, contracts for difference, and cryptocurrency trading options. The broker advertises leverage ratios up to 1:500, which appeals to traders seeking amplified market exposure for potentially higher profits. However, specific information about trading platforms, regulatory compliance, and operational infrastructure was not detailed in available sources, raising questions about the broker's transparency and operational standards that potential clients should carefully consider in this admfx review.

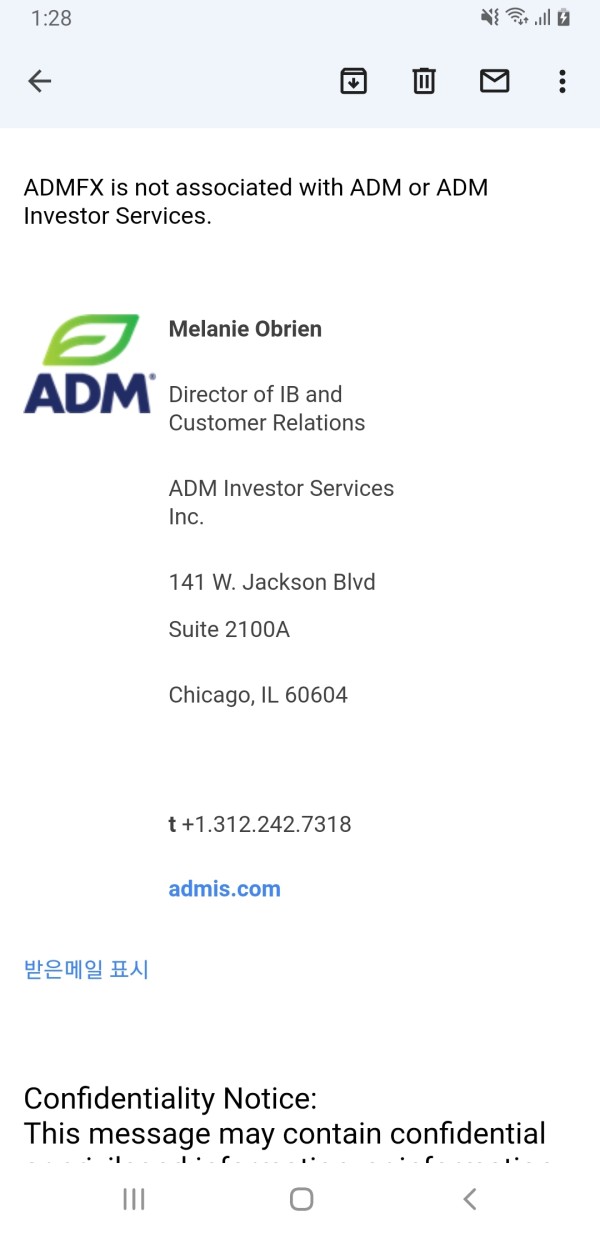

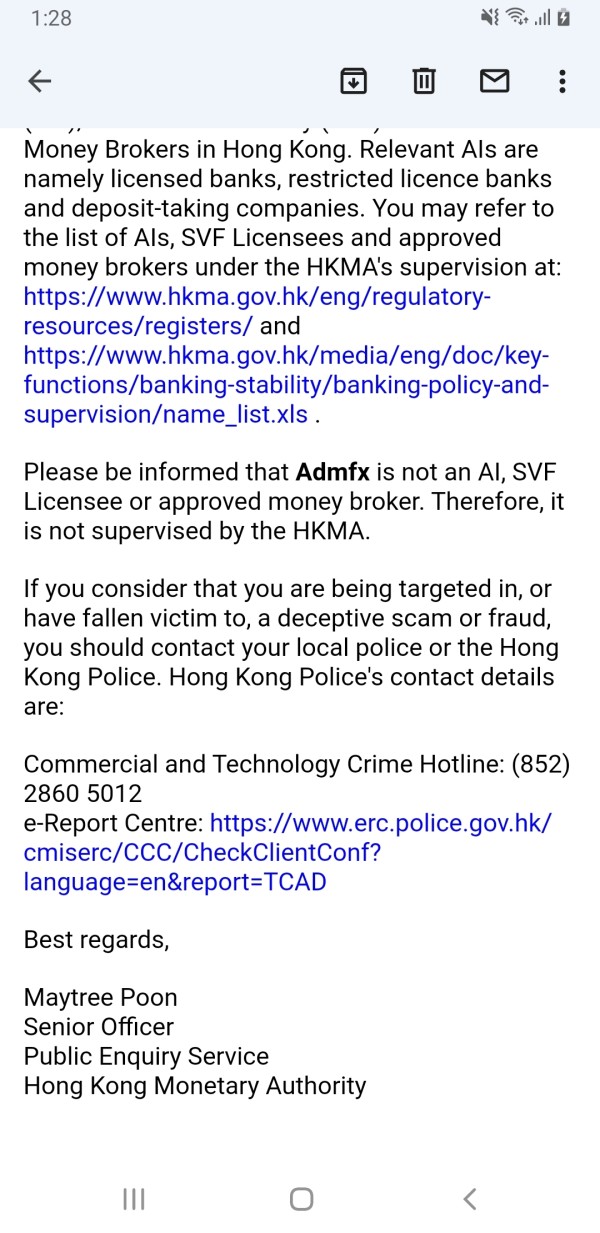

Regulatory Status: Available documentation does not provide specific information about admfx's regulatory oversight or compliance with established financial authorities. This lack of clear regulatory information represents a significant red flag for potential investors seeking secure trading environments that protect their funds.

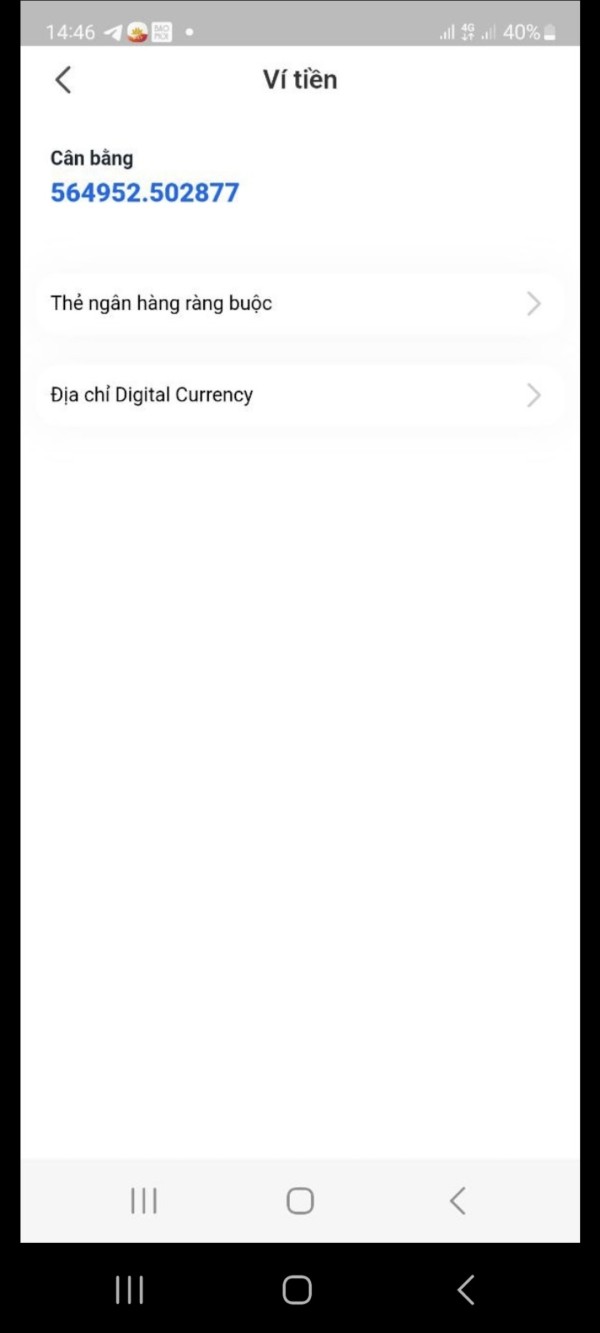

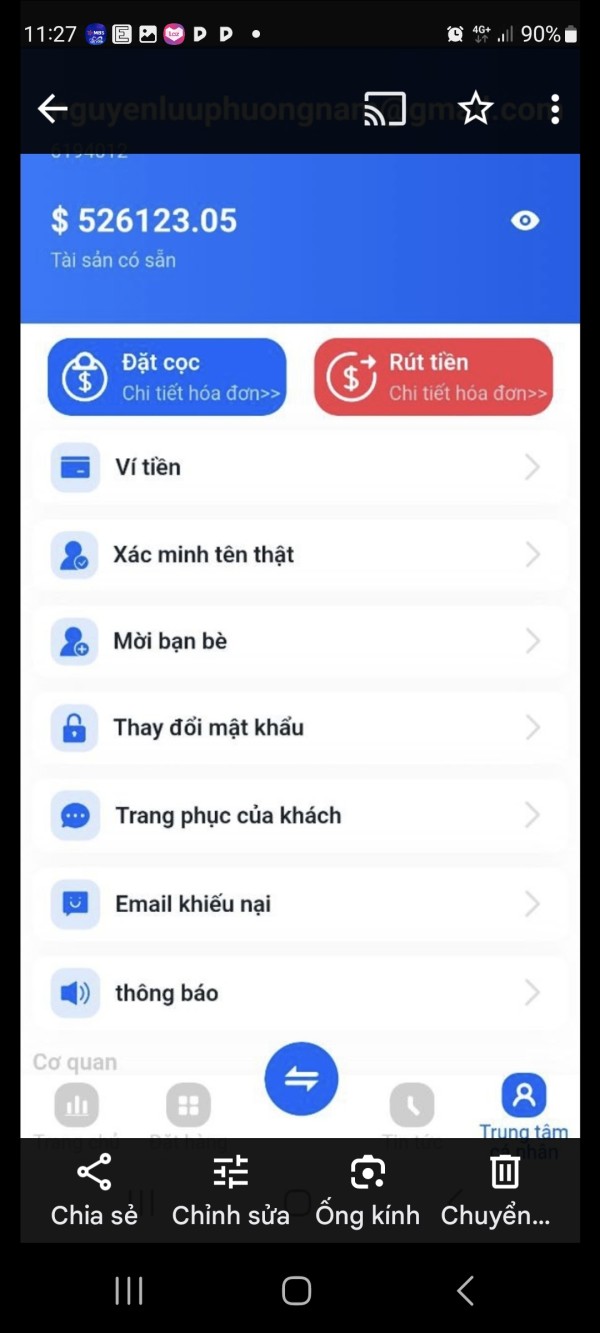

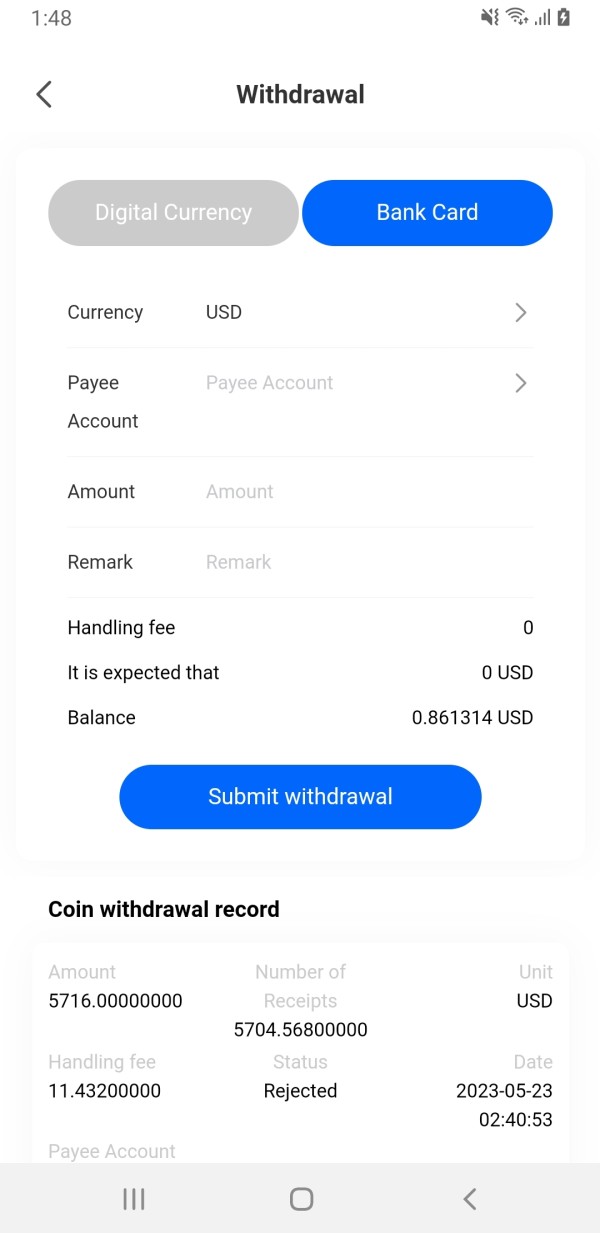

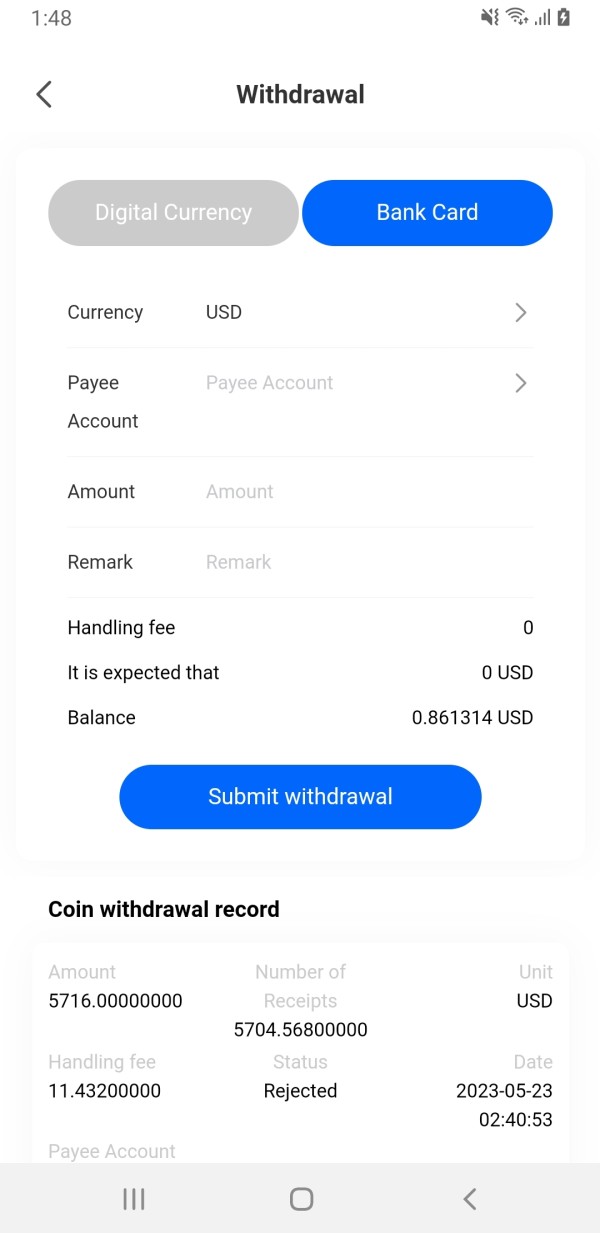

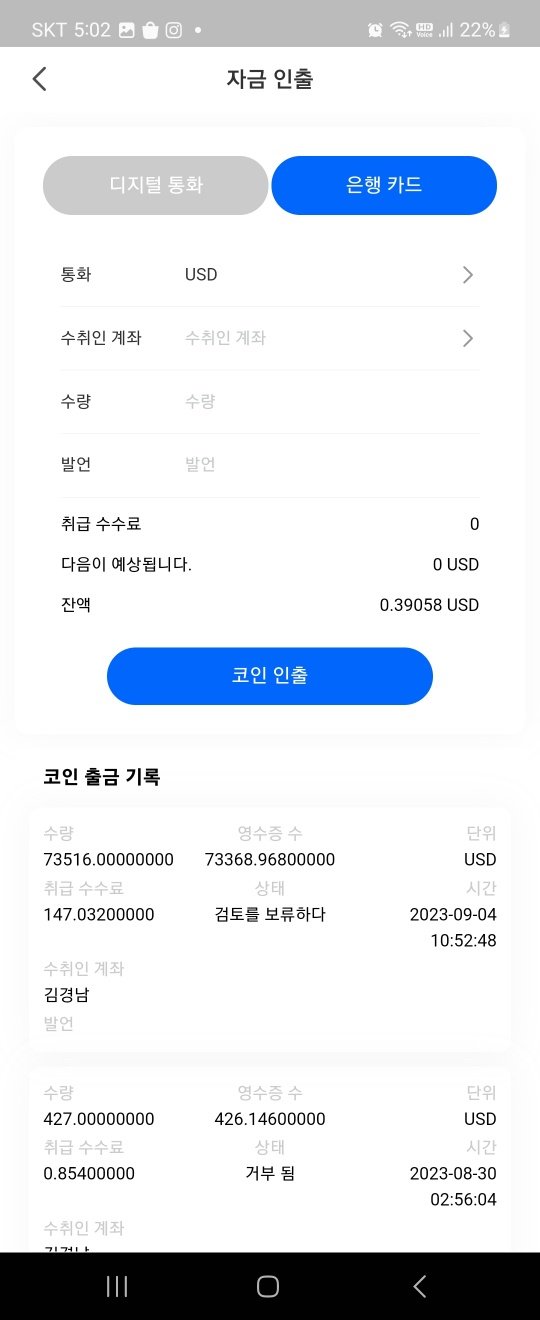

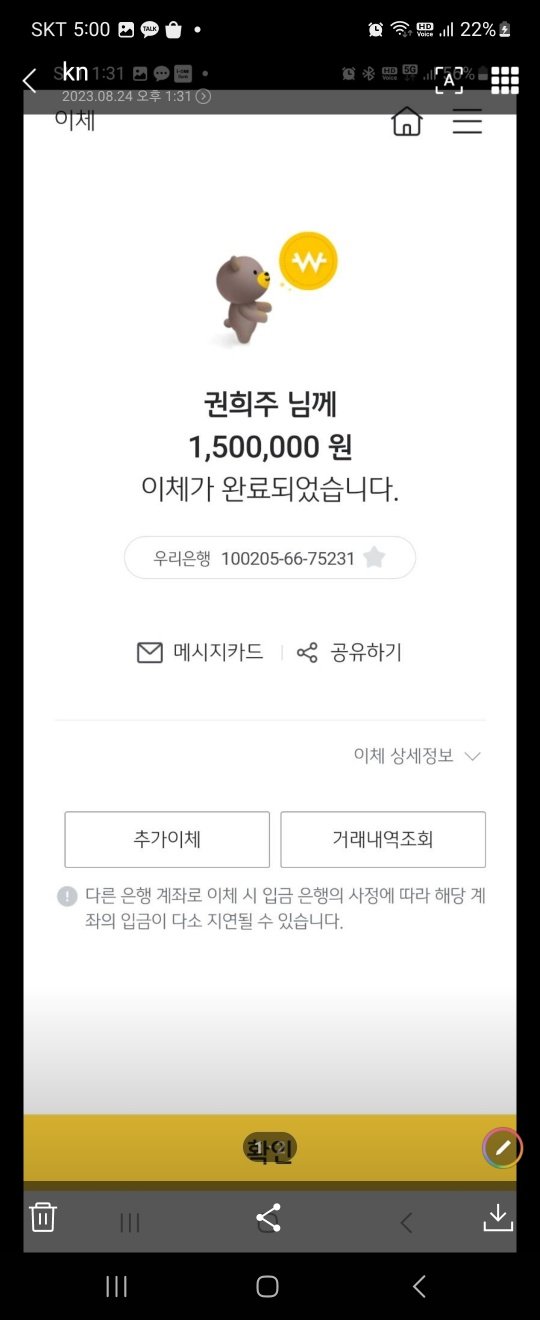

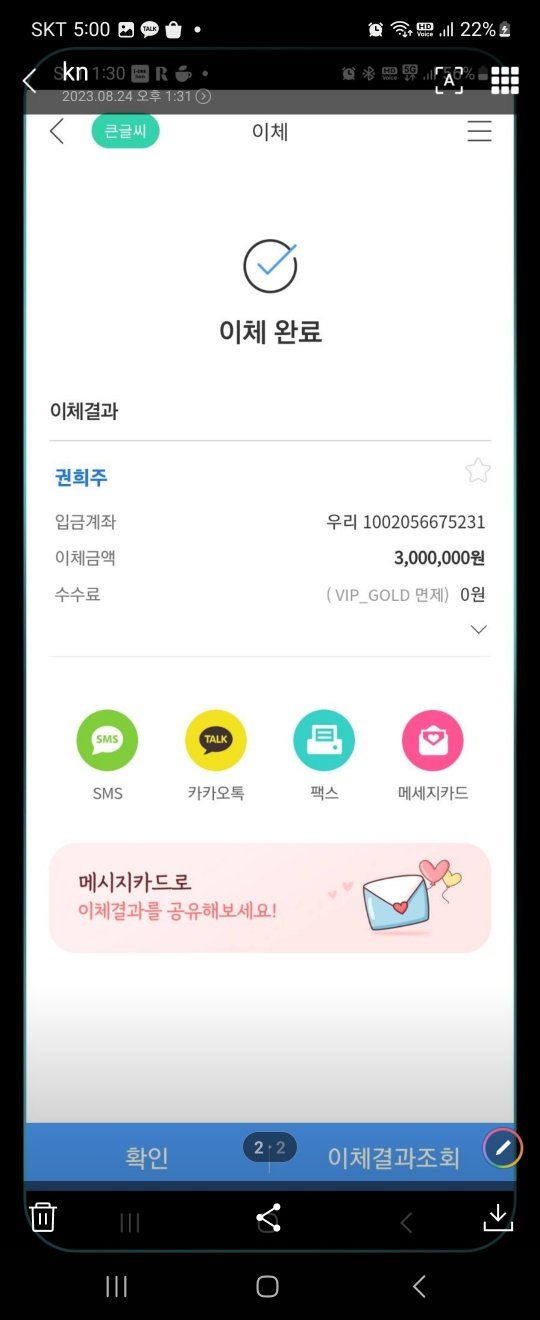

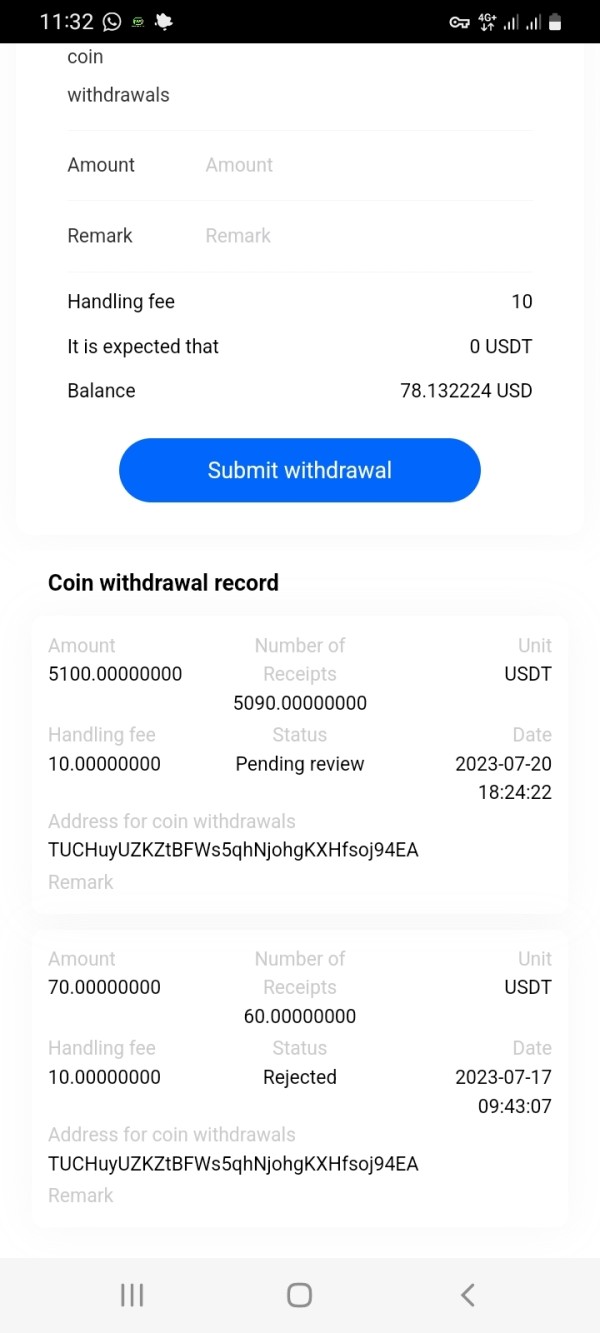

Deposit and Withdrawal Methods: Specific information regarding accepted payment methods, processing times, and associated fees was not detailed in available sources, though user feedback suggests significant difficulties with withdrawal processes. The lack of transparency about payment methods raises concerns about fund security.

Minimum Deposit Requirements: The exact minimum deposit amount required to open an account with admfx was not specified in available documentation, leaving potential clients without clear information about entry requirements.

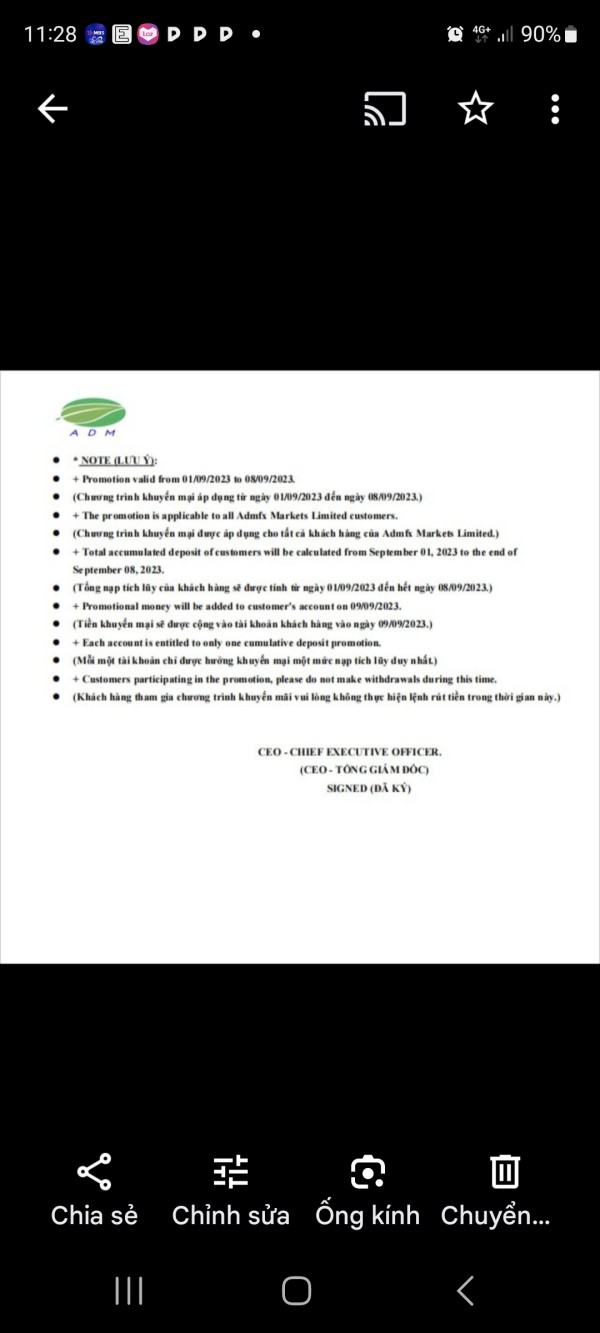

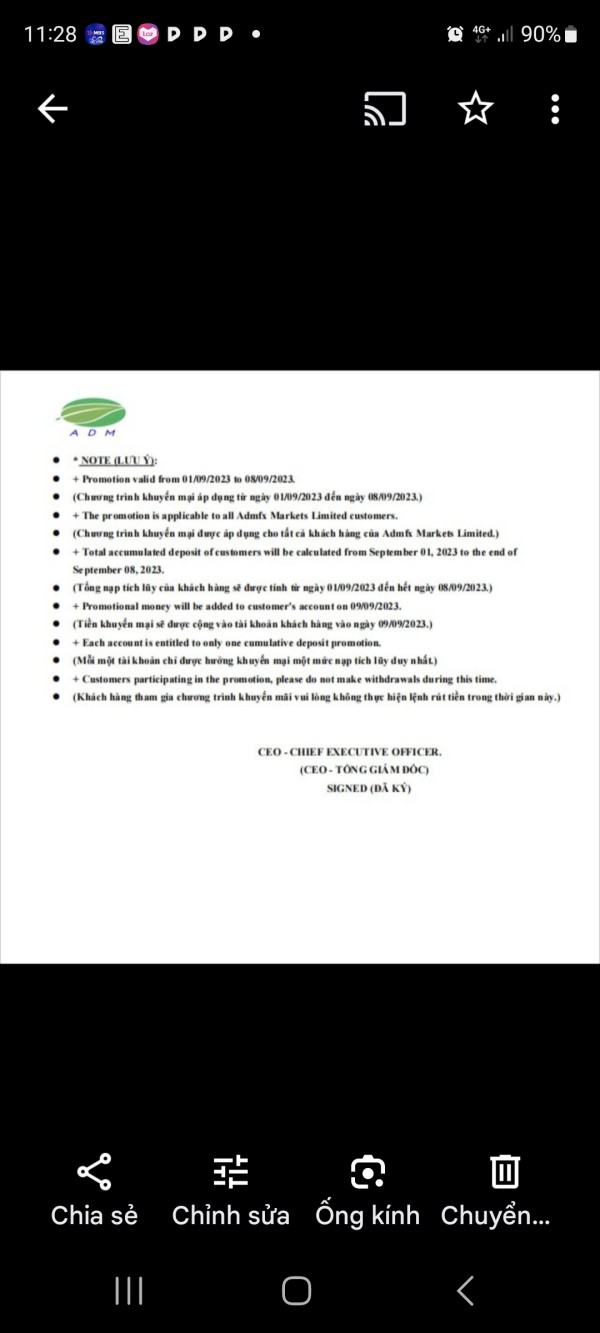

Bonuses and Promotions: No specific information about promotional offers, welcome bonuses, or ongoing incentive programs was found in available sources.

Tradeable Assets: admfx offers access to forex currency pairs, futures contracts, contracts for difference, and cryptocurrency trading instruments, providing a diverse range of investment options for traders seeking market exposure across multiple asset classes. The variety of assets may appeal to traders looking for diversification opportunities.

Cost Structure: Detailed information about spreads, commission structures, overnight fees, and other trading costs was not available in source materials, making it difficult for potential clients to assess the true cost of trading with this broker.

Leverage Options: The broker advertises maximum leverage ratios up to 1:500, which represents significant market exposure amplification but also substantially increases risk exposure for traders. High leverage can lead to both substantial gains and devastating losses.

Platform Options: Specific information about trading platforms, software compatibility, and technical features was not detailed in available sources.

Geographic Restrictions: Information about regional availability and restrictions was not specified in available documentation.

Customer Support Languages: Available support languages and communication options were not detailed in source materials, though this admfx review notes significant user concerns about service quality. The lack of clear support information suggests limited customer service capabilities.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by admfx present significant concerns for potential traders. Available information lacks specific details about account types, tier structures, or differentiated service levels that established brokers typically provide to their clients. This absence of clear account information makes it difficult for traders to understand what services they can expect or how their trading experience might differ based on deposit levels or trading volume.

User feedback consistently indicates dissatisfaction with account-related services, suggesting that even basic account management functions may not meet industry standards. The lack of transparency regarding account opening procedures, verification requirements, and ongoing account maintenance represents a significant weakness in the broker's service offering that affects trader confidence.

Without clear information about minimum deposit requirements, account maintenance fees, or inactivity charges, potential clients cannot accurately assess the true cost of maintaining an account with admfx. This opacity in account conditions, combined with negative user experiences, contributes to the poor rating in this category and should be a major consideration factor in any admfx review evaluation.

The trading tools and educational resources provided by admfx appear limited based on available information and user feedback. Established forex brokers typically offer comprehensive trading platforms, market analysis tools, economic calendars, and educational materials to support trader success in competitive markets. However, specific information about admfx's tool offerings was not detailed in available sources, suggesting either limited availability or poor communication of available resources.

User feedback indicates insufficient access to quality trading tools, which hampers the ability to conduct thorough market analysis and execute informed trading decisions. The absence of detailed information about research resources, market commentary, or analytical support further undermines the broker's value proposition for serious traders who rely on these tools.

Educational resources, which are crucial for developing trader skills and understanding market dynamics, appear to be either non-existent or inadequately promoted. This limitation particularly affects newer traders who rely on broker-provided education to develop their trading capabilities and market understanding for long-term success.

Customer Service and Support Analysis (Score: 2/10)

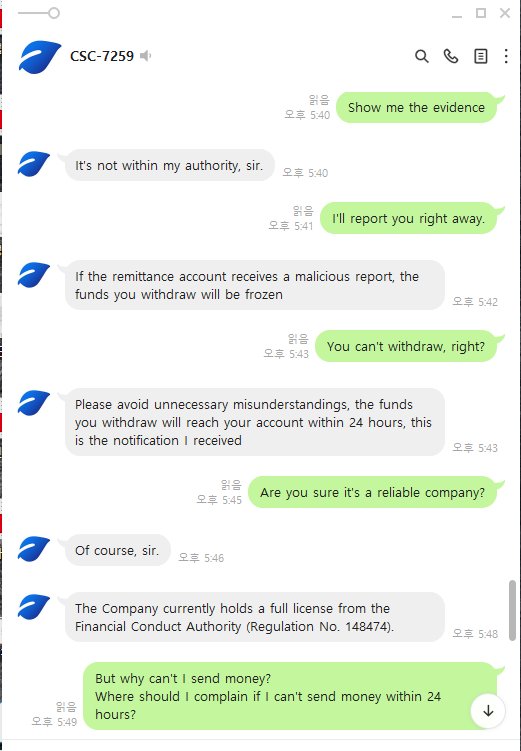

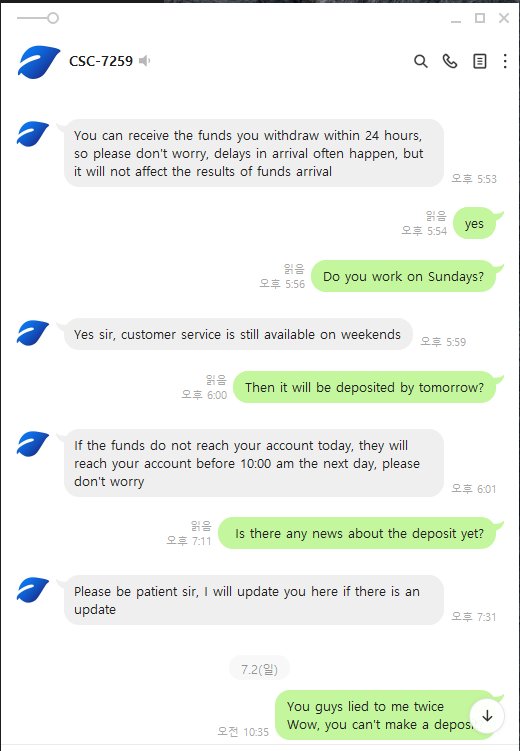

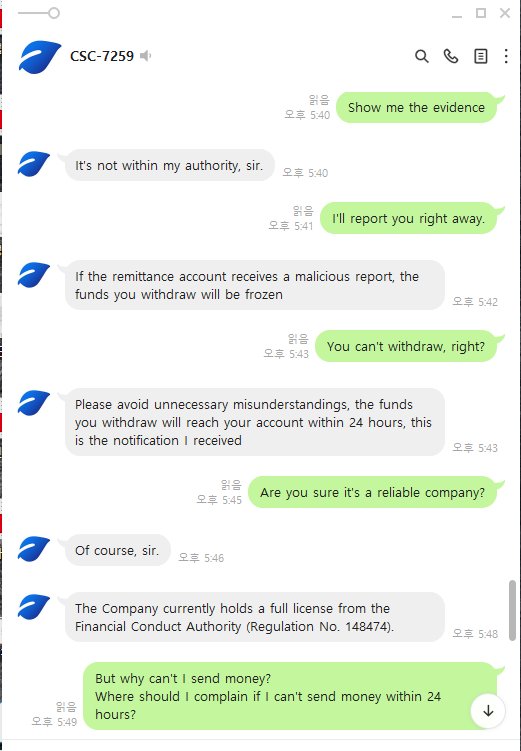

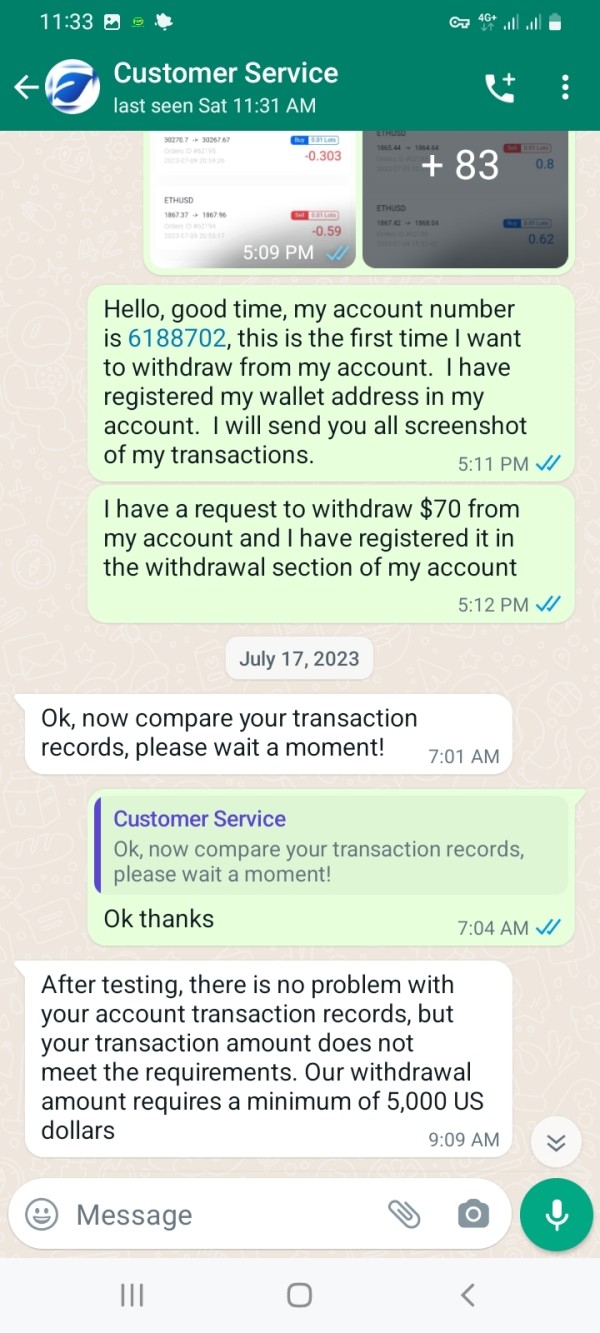

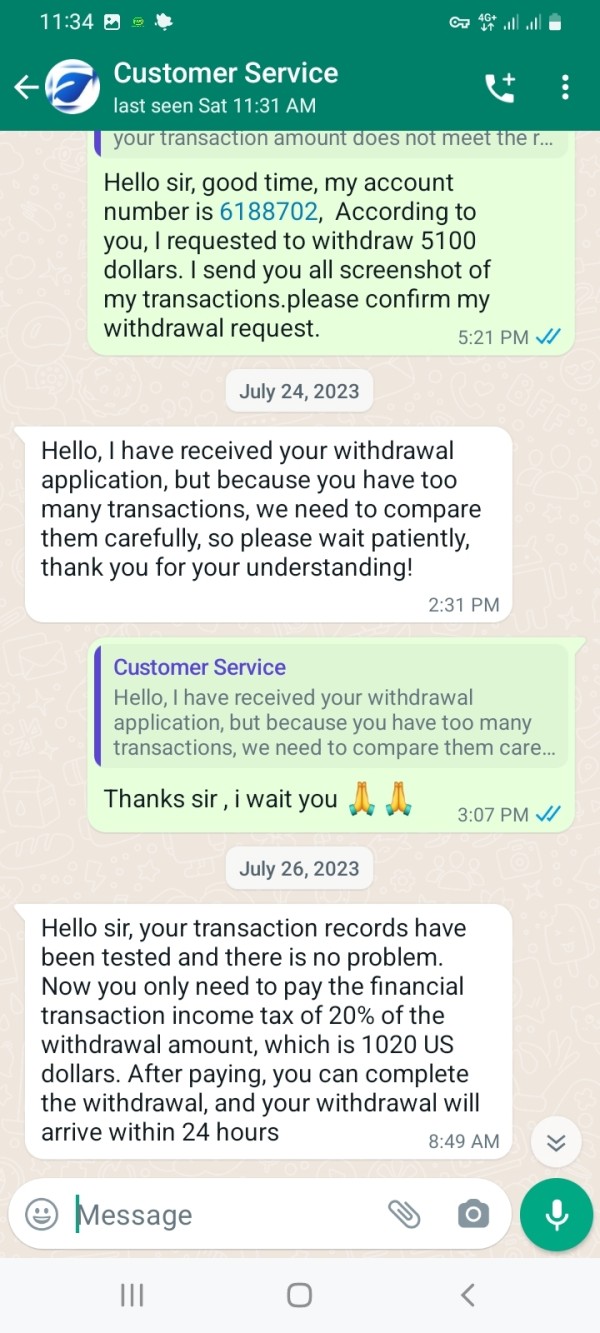

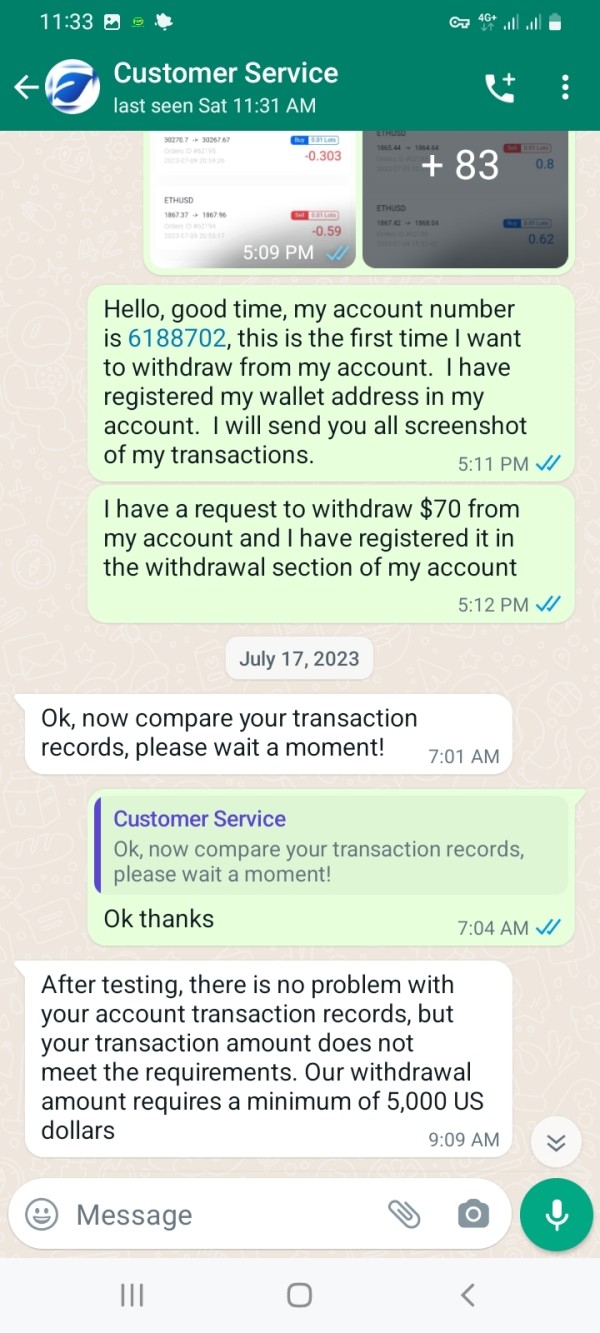

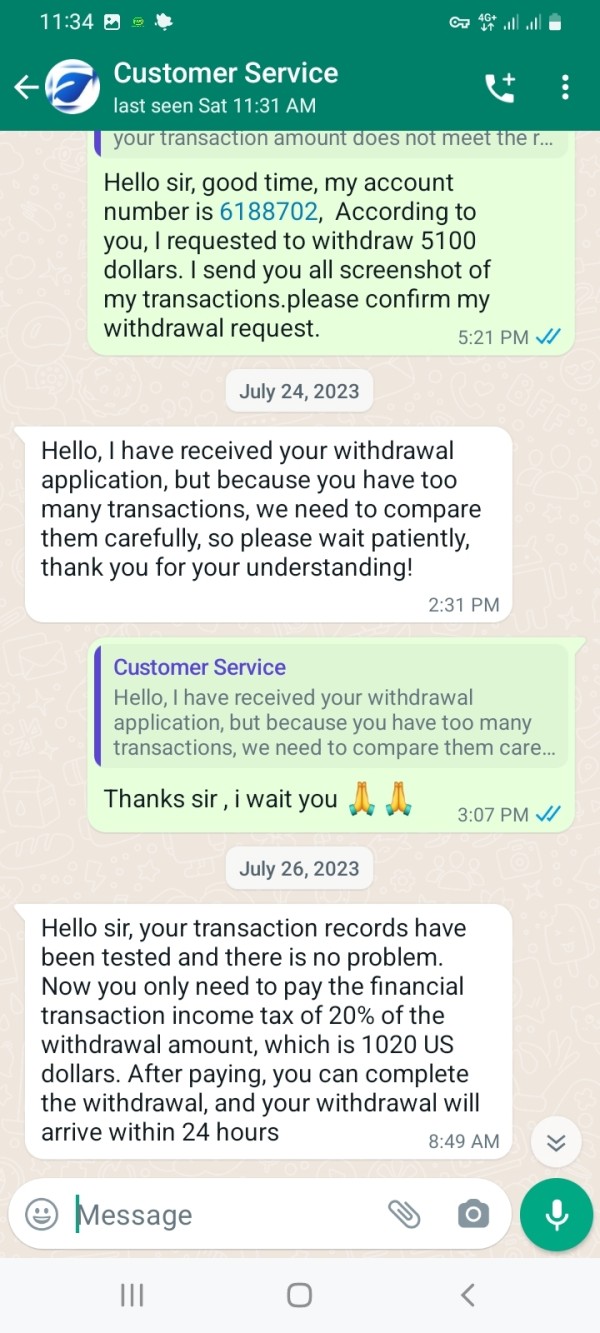

Customer service represents one of the most problematic areas for admfx, based on consistent user feedback and complaints. Users report significant difficulties in reaching customer support representatives and receiving timely responses to inquiries and problems that require immediate attention. This poor responsiveness becomes particularly concerning when traders face urgent issues related to account access or trading problems.

The quality of support provided appears inadequate for resolving complex issues, with users reporting that customer service representatives lack the knowledge or authority to address serious concerns effectively. This limitation becomes especially problematic when traders encounter technical difficulties or require assistance with account-related issues that affect their trading activities.

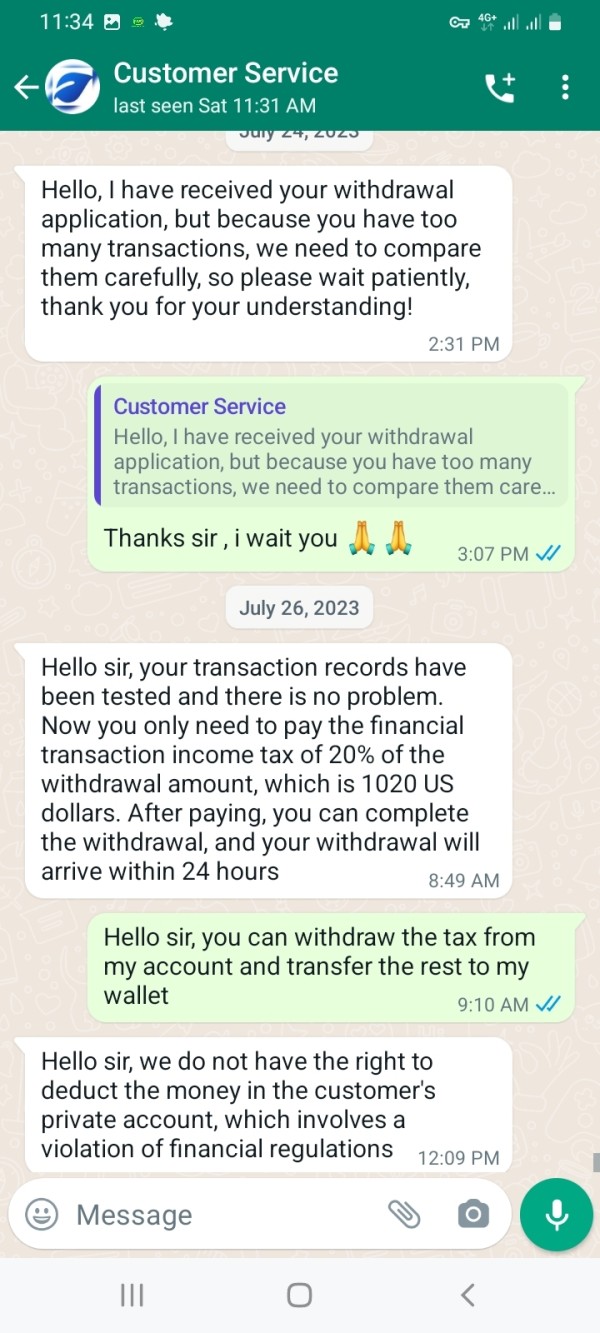

Most concerning are the numerous reports of customer service failing to assist with withdrawal requests and account access problems. Users describe frustrating experiences where support requests go unanswered or receive inadequate responses that fail to resolve underlying issues completely. This pattern of poor customer service significantly undermines trader confidence and represents a major operational weakness that affects the overall trading experience.

Trading Experience Analysis (Score: 4/10)

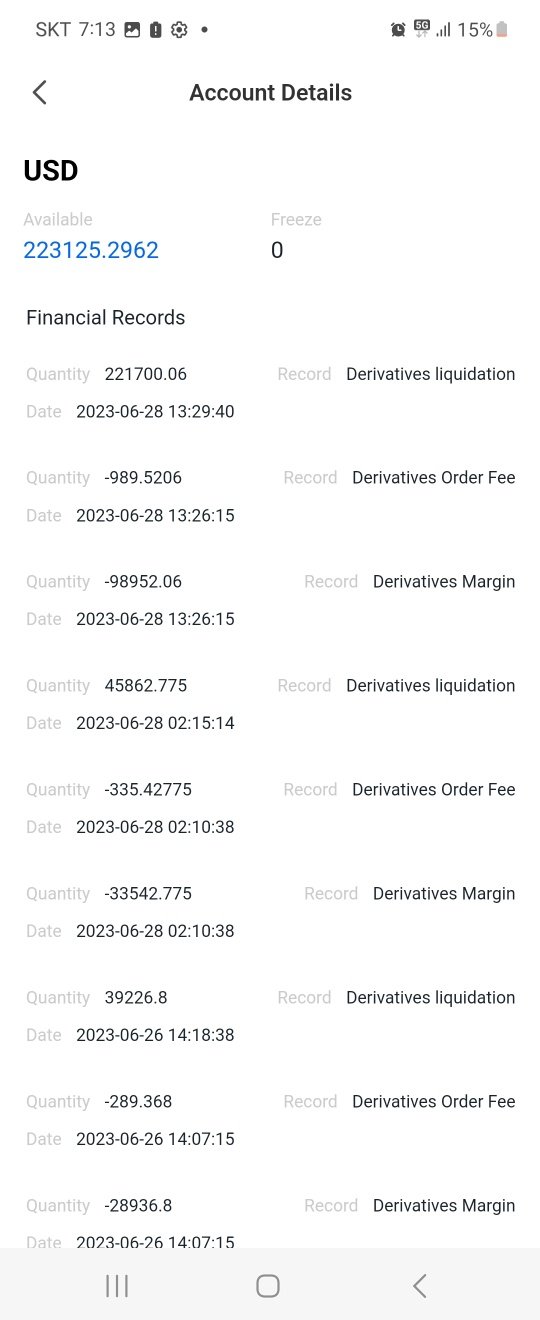

The trading experience provided by admfx shows mixed results, with some technical capabilities offset by significant operational concerns. User feedback indicates that the trading platform experiences stability issues that can interfere with order execution and market access during critical trading periods when timing is essential. These technical problems can result in missed trading opportunities and increased frustration for active traders.

Platform functionality appears limited compared to industry-standard offerings, though specific details about trading interface features, order types, and execution capabilities were not comprehensively detailed in available sources. Users report concerns about platform reliability during volatile market conditions, which is particularly problematic for traders who require consistent access during important market movements that could affect their positions.

The overall trading environment appears to suffer from inconsistencies that affect trader confidence and execution quality. While the broker offers high leverage options that some traders find attractive for amplifying their market exposure, the underlying platform issues and operational concerns significantly detract from the overall trading experience. This admfx review notes that platform stability and execution quality are fundamental requirements that appear inadequately addressed by this broker.

Trustworthiness Analysis (Score: 1/10)

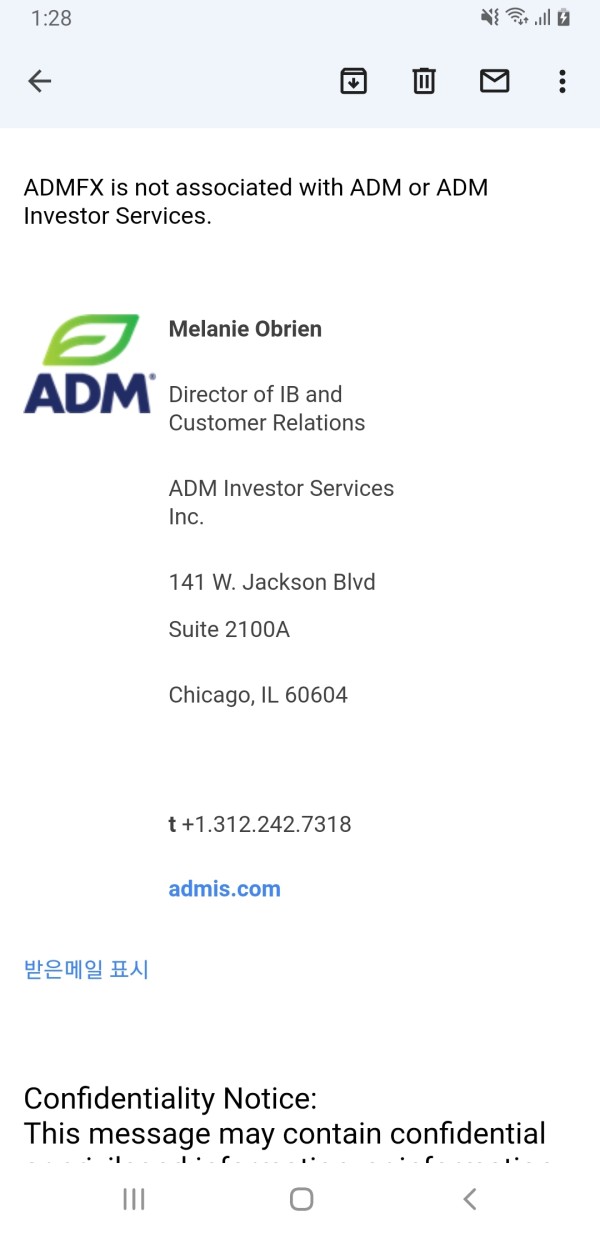

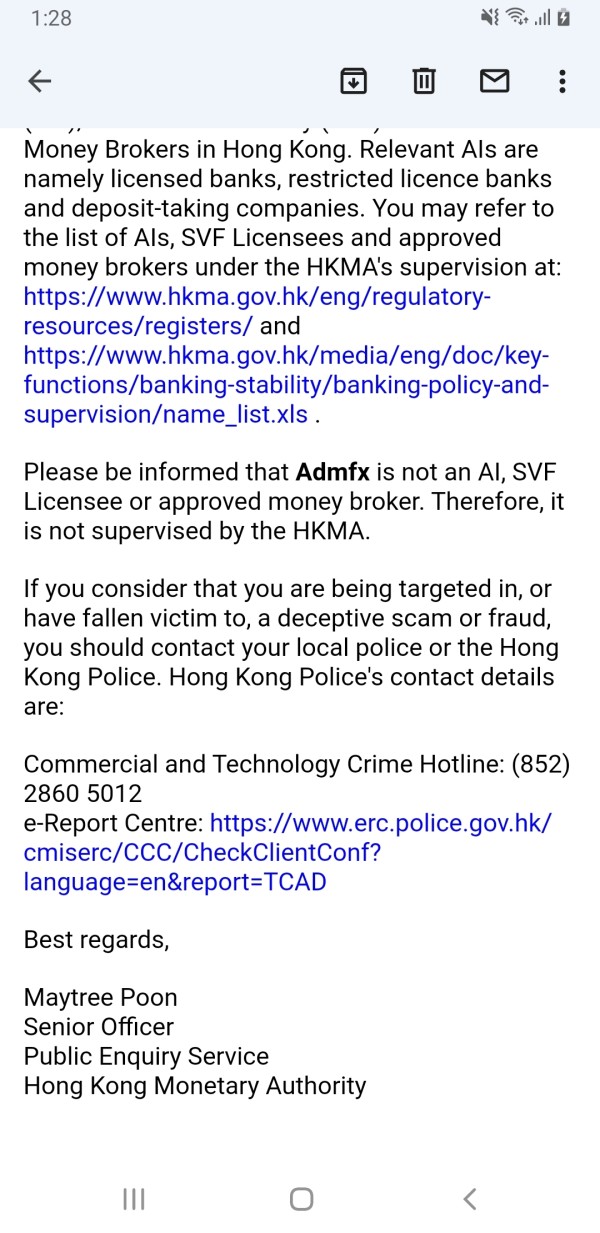

Trustworthiness represents the most serious concern area for admfx, with multiple factors contributing to significant credibility issues. The absence of clear regulatory oversight information raises immediate questions about the broker's compliance with established financial industry standards and investor protection measures that legitimate brokers maintain. Legitimate forex brokers typically provide transparent information about their regulatory status and compliance obligations.

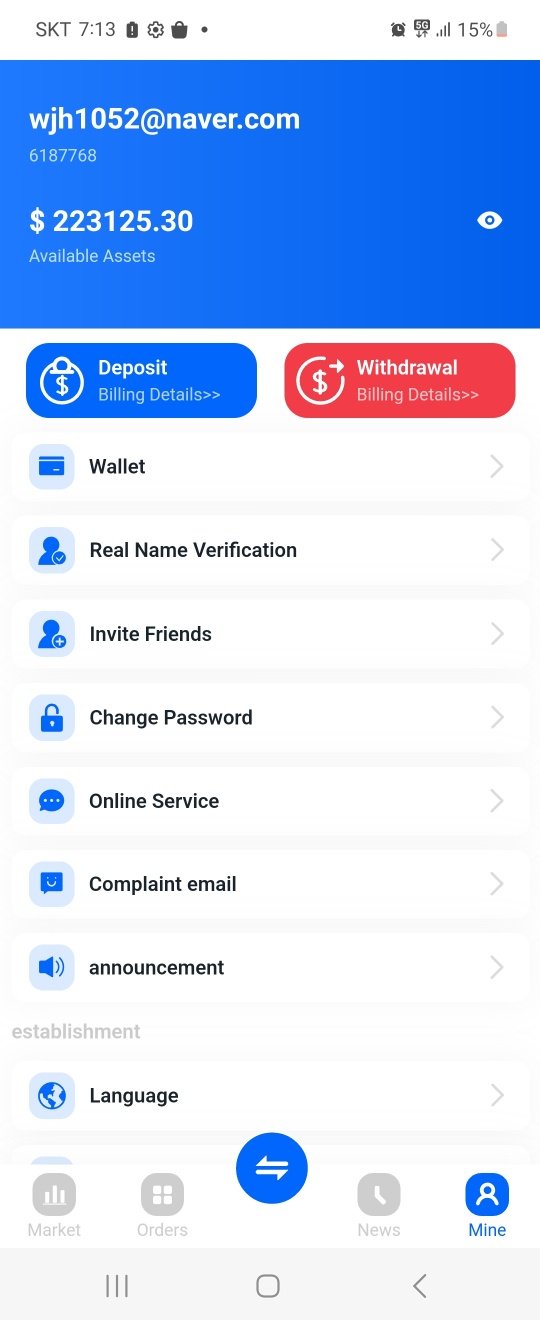

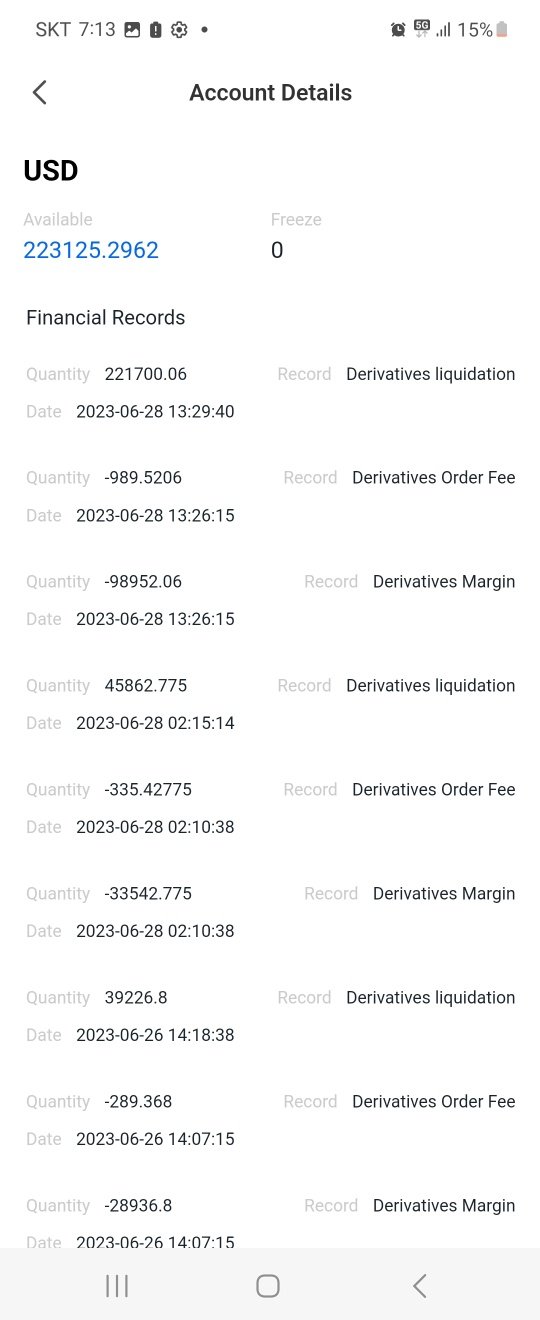

User feedback consistently raises concerns about the broker's reliability and operational integrity, with multiple reports suggesting potential fraudulent activities. These allegations, combined with widespread difficulties in fund withdrawal, create a pattern that seriously undermines the broker's credibility and trustworthiness within the trading community where reputation is crucial.

The lack of transparency regarding company operations, regulatory compliance, and financial safeguards represents a fundamental breach of industry standards for trustworthy financial service providers. Without clear regulatory oversight and transparent operational practices, traders face significant risks that extend beyond normal market exposure to include potential loss of deposited funds through operational failures or fraudulent activities that could devastate their accounts.

User Experience Analysis (Score: 2/10)

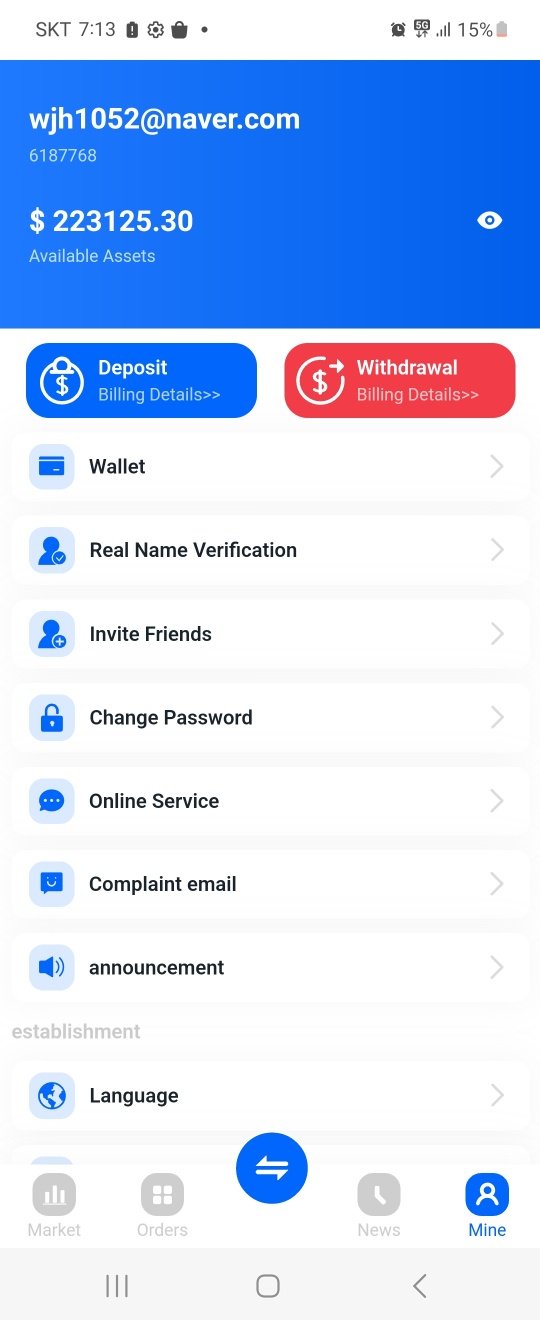

Overall user satisfaction with admfx appears extremely low based on available feedback and user testimonials. The combination of technical platform issues, poor customer service, and withdrawal difficulties creates a negative user experience that affects all aspects of the trading relationship between clients and the broker. Users consistently report frustration with basic operational functions that should be seamlessly handled by professional forex brokers.

The account opening and verification processes appear problematic, with users reporting unnecessary delays and complications in establishing trading accounts. These initial difficulties set a negative tone for the ongoing trading relationship and suggest operational inefficiencies that permeate the entire service offering throughout the customer journey.

Most concerning are the widespread reports of withdrawal difficulties that prevent users from accessing their deposited funds. This fundamental operational failure represents the most serious user experience issue and suggests systemic problems with the broker's financial operations that could affect all clients. The combination of these factors creates an overall user experience that falls far below industry standards and poses significant risks for potential clients considering this broker.

Conclusion

Based on this comprehensive admfx review, the broker presents significant risks and operational concerns that make it unsuitable for most traders. The combination of poor customer service, platform stability issues, withdrawal difficulties, and lack of regulatory transparency creates a risk profile that extends far beyond normal trading risks that traders typically face. The overwhelmingly negative user feedback and concerning operational patterns suggest that potential clients should exercise extreme caution.

This broker is not recommended for any category of trader, particularly beginners who may be more vulnerable to operational problems and less equipped to identify warning signs of problematic brokers. While the advertised high leverage and multiple asset classes may appear attractive to traders seeking diverse opportunities, these features are overshadowed by fundamental operational failures that affect basic trading functions.

The main advantages of high leverage ratios and diverse asset offerings are completely negated by serious disadvantages including withdrawal difficulties, poor customer support, platform instability, and lack of regulatory oversight. Traders seeking reliable forex trading services should consider established, well-regulated brokers with proven track records of operational excellence and customer satisfaction that protect their investments.