Annexa Prime 2025 Review: Everything You Need to Know

Executive Summary

Annexa Prime is an unregulated forex broker that has raised significant red flags within the trading community. This Annexa Prime review reveals concerning information about the broker's operations and regulatory status. The broker lacks FCA authorization and has been flagged by multiple review sites as potentially fraudulent.

According to various reports from scam-monitoring websites, Annexa Prime operates without proper regulatory oversight. This creates substantial risks to trader funds and account security. The broker claims to offer diverse trading assets including stocks, indices, and commodities.

It positions itself toward investors seeking portfolio diversification. However, the lack of transparent trading conditions raises serious concerns. The absence of clear fee structures and numerous warning signals from user feedback suggest that potential clients should exercise extreme caution.

Multiple fraud reporting websites have classified Annexa Prime as a high-risk broker. Some explicitly label it as a scam operation. Our investigation found that Annexa Prime established operations in 2019 but has failed to secure authorization from major regulatory bodies like the FCA.

The broker's business model remains unclear. Critical information about trading conditions, minimum deposits, and withdrawal processes is notably absent from available sources. User testimonials and expert reviews consistently warn against engaging with this platform.

Important Disclaimers

Regional Entity Differences: Annexa Prime's regulatory status varies significantly across different jurisdictions. The broker has not obtained FCA authorization in the UK and appears to operate without proper licensing in multiple regions.

This inconsistent regulatory approach creates substantial risks for client fund protection and legal recourse options. Review Methodology: This evaluation is based on publicly available information, user feedback from fraud reporting websites, and data from broker monitoring platforms. Our assessment aims to provide objective analysis while highlighting potential risks.

Given the limited transparent information available from official sources, this review prioritizes warning signals identified by multiple independent review platforms.

Rating Framework

Broker Overview

Annexa Prime emerged in the forex market in 2019. It positioned itself as a multi-asset trading platform. Despite its relatively recent establishment, the broker has quickly gained attention for concerning reasons rather than positive developments.

The company's headquarters location and corporate structure remain unclear. This is itself a significant warning sign for potential clients. According to fraud reporting websites, Annexa Prime operates without transparent disclosure of its management team or parent company information.

The broker's business model appears to focus on attracting traders with promises of diverse asset access. However, specific operational details remain deliberately vague. This lack of transparency extends to fundamental aspects of the trading service, including fee structures, execution methods, and risk management protocols.

The absence of clear business registration information and regulatory compliance documentation suggests potential issues with operational legitimacy. Annexa Prime claims to provide access to stocks, indices, commodities, and bonds across various global markets. However, the specific trading platform technology, execution speed capabilities, and market access arrangements are not clearly documented in available materials.

This Annexa Prime review found that the broker's marketing materials emphasize asset variety while avoiding detailed discussions of trading conditions. They also avoid discussing regulatory protections or operational transparency that legitimate brokers typically provide to build client confidence.

Regulatory Status: Annexa Prime operates without FCA authorization. It appears to lack proper licensing from other major regulatory bodies. Multiple review sites have flagged this broker as potentially fraudulent due to its unregulated status.

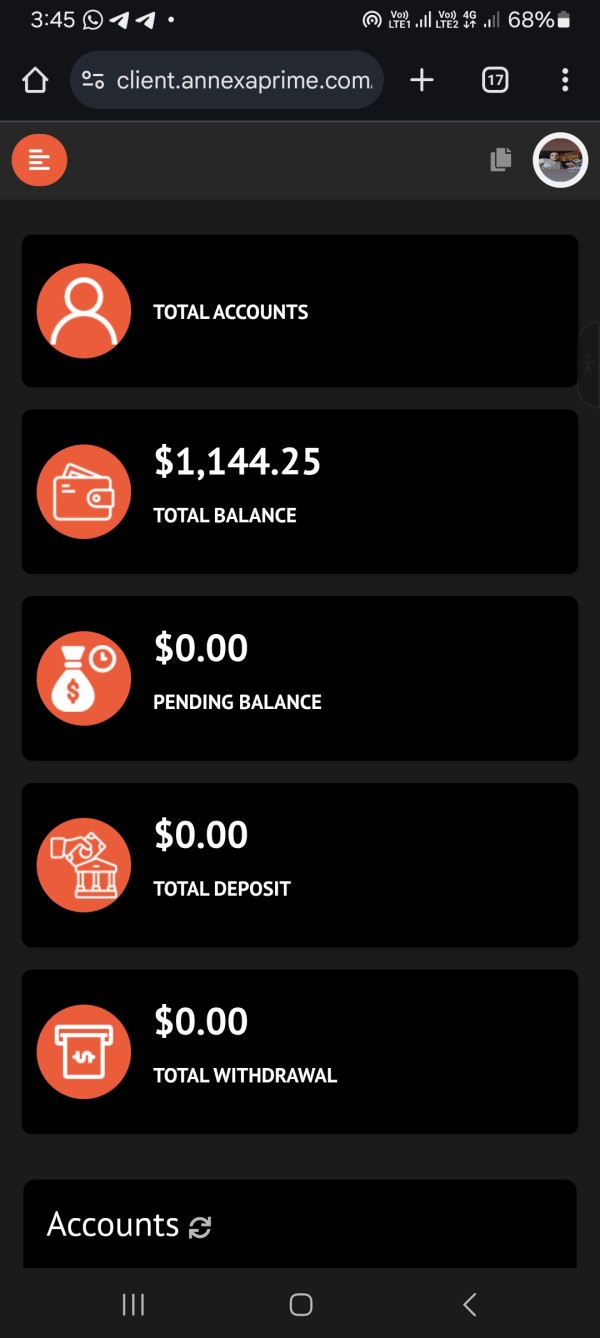

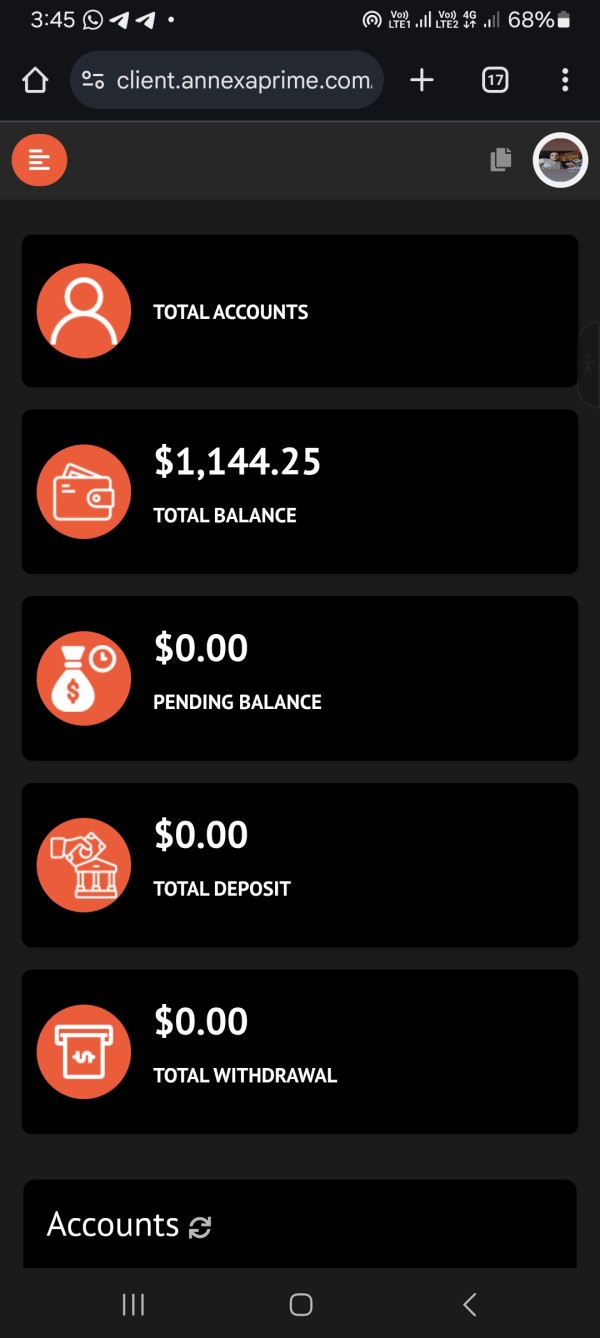

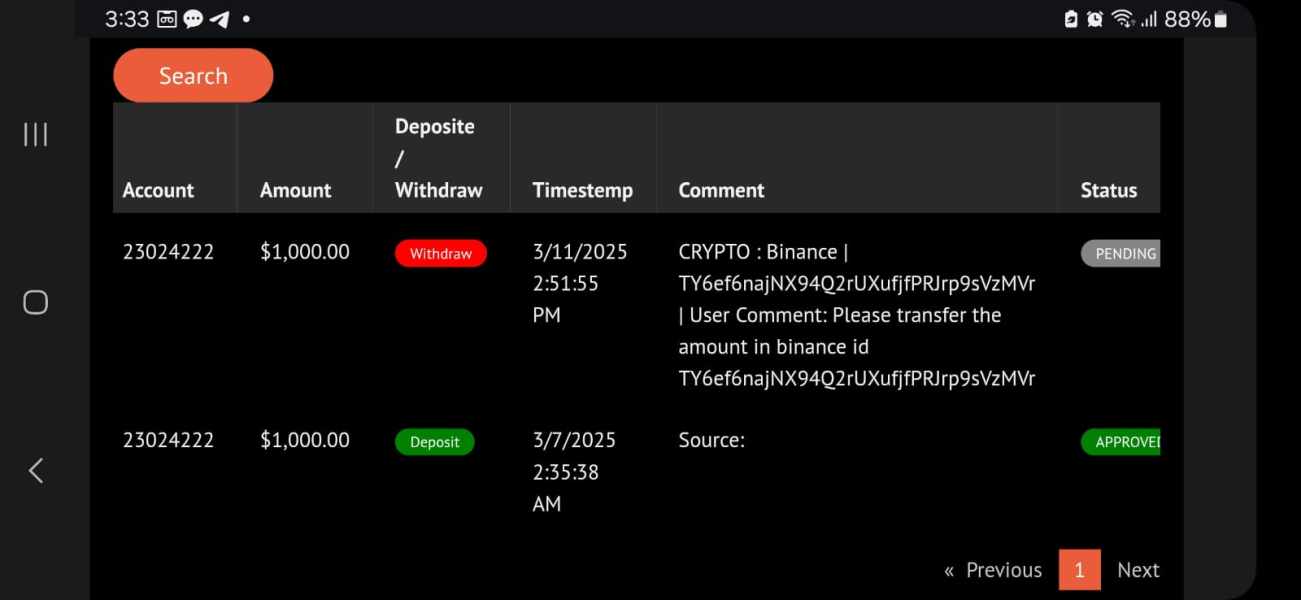

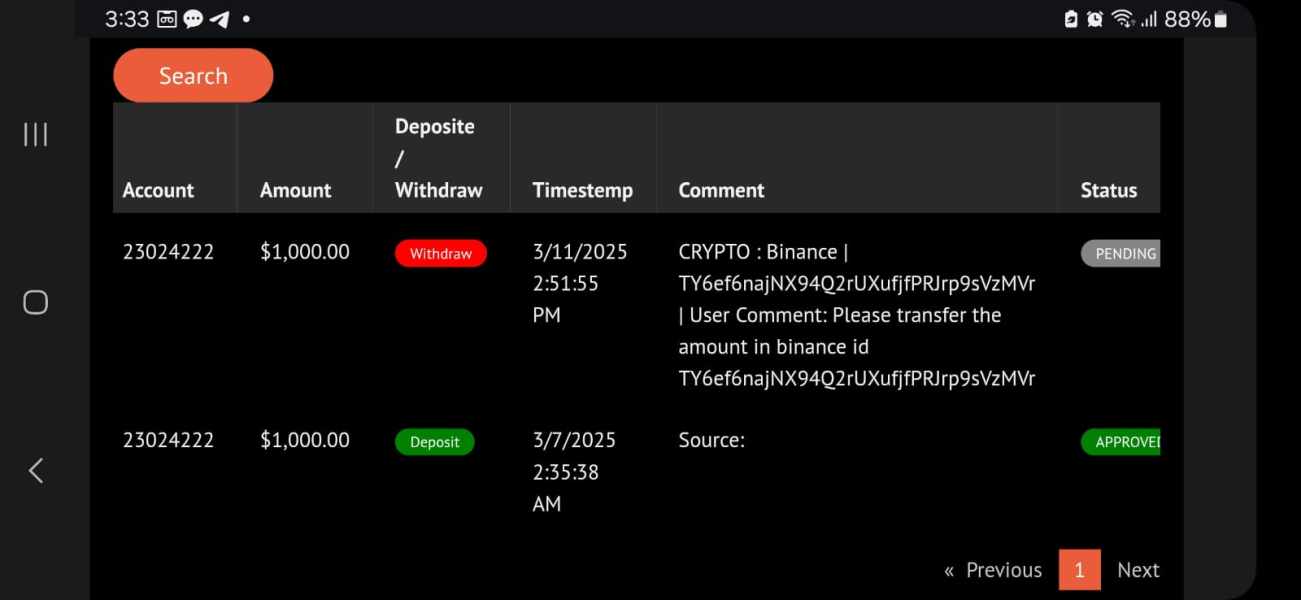

Deposit and Withdrawal Methods: Specific information about accepted payment methods, processing times, and withdrawal procedures is not clearly disclosed in available sources. This raises additional concerns about fund accessibility.

Minimum Deposit Requirements: The broker has not transparently disclosed minimum deposit thresholds. This makes it impossible for potential clients to understand entry requirements or account tier structures.

Bonus and Promotions: No specific information about promotional offers or bonus programs is available in the reviewed materials. This suggests either absence of such programs or lack of transparent marketing practices.

Tradable Assets: Annexa Prime claims to offer access to stocks, indices, commodities, and bonds. However, specific instrument lists, market coverage, and trading conditions for each asset class remain unclear.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs is not transparently disclosed. This makes cost comparison with legitimate brokers impossible.

Leverage Ratios: Specific leverage offerings and risk management protocols are not clearly documented in available materials.

Platform Options: The trading platform technology, features, and capabilities are not specifically detailed in accessible information sources.

Geographic Restrictions: Specific jurisdictional limitations or service availability by region is not clearly communicated.

Customer Support Languages: Available customer service languages and communication channels are not specifically documented in reviewed materials.

This Annexa Prime review highlights the concerning lack of transparency across fundamental service aspects. Legitimate brokers typically disclose this information prominently.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

The account conditions offered by Annexa Prime present significant transparency issues. These issues contribute to its low rating in this category. Available information fails to detail specific account types, tier structures, or the features associated with different account levels.

This lack of clarity makes it impossible for potential traders to understand what services they would receive. It also prevents them from knowing how account progression might work. Minimum deposit requirements remain undisclosed, which prevents traders from understanding the financial commitment required to begin trading.

Legitimate brokers typically provide clear deposit thresholds for different account types. They also explain how deposit levels affect available features, spreads, or support services. The absence of this fundamental information suggests either poor operational organization or deliberate obscuration of terms.

The account opening process is not clearly documented. This leaves potential clients uncertain about verification requirements, documentation needs, or time frames for account activation. Professional brokers typically provide detailed onboarding guides that help clients understand regulatory compliance requirements and set appropriate expectations for account setup procedures.

Special account features such as Islamic accounts, professional trader classifications, or institutional services are not mentioned in available materials. This Annexa Prime review found no evidence of accommodations for different trader needs or regulatory requirements that vary by jurisdiction. This suggests a one-size-fits-all approach that may not serve diverse client needs effectively.

The trading tools and resources provided by Annexa Prime receive a moderate score. This is primarily because specific information about available tools is largely absent from accessible sources. While the broker claims to offer access to multiple asset classes, the actual trading tools, analytical resources, and research materials that would support effective trading decisions are not clearly documented or demonstrated.

Market analysis resources, economic calendars, technical analysis tools, and research reports are standard offerings from legitimate brokers. However, Annexa Prime's provision of such resources remains unclear. The absence of detailed information about analytical capabilities suggests either limited tool availability or poor communication of existing resources to potential clients.

Educational resources, which are crucial for trader development and success, appear to be minimal or non-existent based on available information. Legitimate brokers typically provide extensive educational materials including webinars, tutorials, market guides, and trading strategy resources to help clients improve their trading skills and market understanding.

Automated trading support, expert advisor capabilities, and algorithmic trading features are not specifically mentioned in available materials. These tools have become standard expectations for modern trading platforms. Their absence or lack of documentation suggests potential limitations in platform sophistication and trader support capabilities.

Customer Service and Support Analysis (Score: 4/10)

Customer service quality at Annexa Prime has received concerning feedback from users. These users have attempted to engage with the broker's support systems. Available user reports suggest that response times are inadequate and that service quality does not meet standard industry expectations for professional forex brokers.

Communication channels available to clients are not clearly documented. This leaves potential traders uncertain about how they would receive support when needed. Professional brokers typically provide multiple contact methods including live chat, email, phone support, and sometimes social media channels, along with clear information about availability hours and response time expectations.

The quality of support interactions, based on available user feedback, appears to fall short of industry standards. Users have reported difficulties in obtaining clear answers to basic questions about trading conditions, account features, and operational procedures. This suggests either inadequately trained support staff or systemic issues with information transparency.

Multilingual support capabilities and global service availability are not clearly documented. This could create additional barriers for international clients seeking assistance. The absence of clear support structure information contributes to overall concerns about the broker's operational professionalism and client service commitment.

Trading Experience Analysis (Score: 3/10)

The trading experience offered by Annexa Prime has received negative feedback from users. These users have attempted to engage with the platform. Reports suggest that platform stability issues and execution quality problems have created frustrating experiences for traders attempting to execute their strategies effectively.

Platform stability and execution speed are critical factors for successful trading. This is particularly true in fast-moving forex markets where timing can significantly impact trade outcomes. User feedback indicates that Annexa Prime's platform may not provide the reliable, fast execution that serious traders require for effective market participation.

Order execution quality, including fill rates, slippage management, and price accuracy, appears to be problematic based on available user reports. These technical issues can significantly impact trading profitability and create additional risks for traders who depend on precise order execution for their strategies.

Mobile trading capabilities and cross-device synchronization features are not clearly documented. This is concerning given that mobile trading has become essential for modern forex participation. The absence of clear information about mobile app features, functionality, and reliability suggests potential limitations in trading accessibility and convenience.

This Annexa Prime review found that the overall trading environment appears to lack the professional standards and technical reliability that successful forex trading requires.

Trust and Regulation Analysis (Score: 2/10)

Trust and regulatory compliance represent the most concerning aspects of Annexa Prime's operations. The broker operates without FCA authorization and appears to lack proper licensing from other major regulatory bodies. This creates substantial risks for client fund protection and legal recourse options.

Fund safety measures, including segregated client accounts, deposit protection schemes, and regulatory oversight of client fund handling, are not clearly documented or verified through independent regulatory sources. This absence of verifiable fund protection creates significant risks for traders considering depositing funds with this broker.

Company transparency regarding management, ownership, financial stability, and operational procedures is notably lacking. Legitimate brokers typically provide detailed company information, regulatory filings, and financial disclosures that allow clients to verify operational legitimacy and financial stability before committing funds.

Industry reputation has been severely damaged by multiple independent review sites flagging Annexa Prime as potentially fraudulent. These warnings from fraud monitoring websites and scam reporting platforms represent serious red flags that potential clients should consider carefully before engaging with this broker.

User Experience Analysis (Score: 4/10)

Overall user satisfaction with Annexa Prime appears to be poor. This assessment is based on available feedback from multiple independent sources. Users have reported various issues ranging from platform functionality problems to difficulties with customer service interactions and concerns about fund safety.

Interface design and platform usability information is not clearly available. This makes it difficult to assess whether the trading environment would be intuitive and efficient for different types of traders. Professional trading platforms typically emphasize user-friendly design that accommodates both novice and experienced traders effectively.

Registration and verification processes are not clearly documented. This leaves potential clients uncertain about onboarding requirements and time frames. Smooth, transparent account setup procedures are important for establishing positive initial client relationships and setting appropriate service expectations.

Fund operation experiences, based on available user feedback, suggest potential difficulties with deposit and withdrawal processes. Users have expressed concerns about fund accessibility and transaction processing. These are fundamental aspects of broker reliability and operational integrity.

Common user complaints center around service quality, platform reliability, and transparency issues. The pattern of negative feedback across multiple review sources suggests systemic problems rather than isolated incidents. This indicates that potential clients should carefully consider these warning signals before proceeding.

Conclusion

This comprehensive Annexa Prime review reveals significant concerns about the broker's legitimacy, regulatory compliance, and operational transparency. The absence of proper regulatory authorization, combined with multiple warnings from fraud monitoring websites, creates substantial risks for potential clients considering this broker.

Annexa Prime is not recommended for new traders or risk-averse investors due to the numerous red flags identified in this analysis. The lack of transparent trading conditions, unclear fee structures, and poor user feedback suggest that traders would be better served by choosing properly regulated alternatives with established track records of client protection and service quality.

The primary disadvantages include unregulated status, poor transparency, negative user feedback, and lack of verifiable fund protection measures. While the broker claims to offer diverse trading assets, these potential advantages are overshadowed by fundamental concerns about operational legitimacy and client fund safety that make Annexa Prime a high-risk choice for serious traders.