UNX Markets Review 1

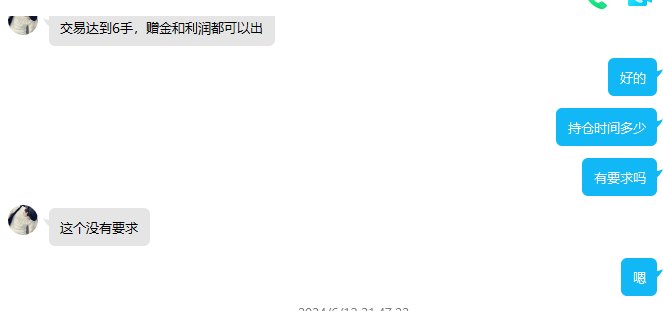

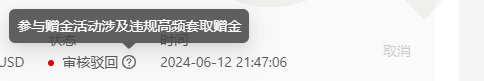

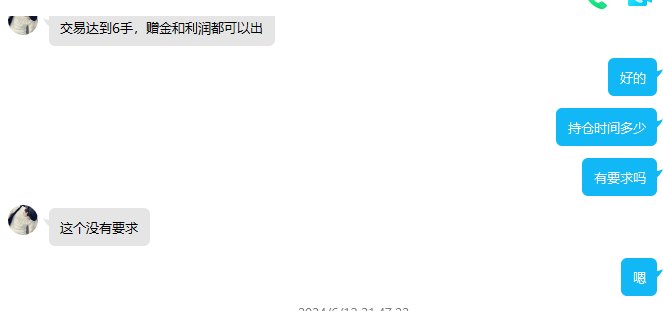

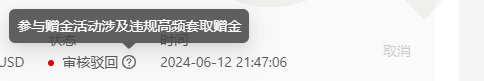

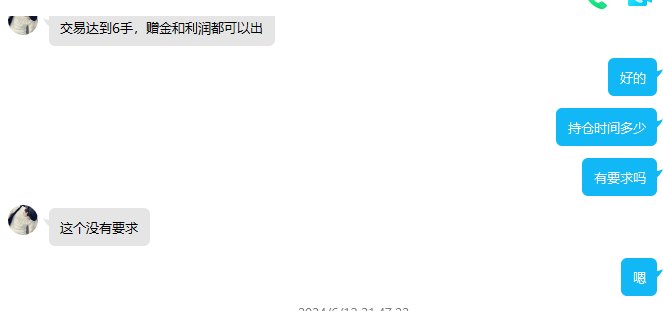

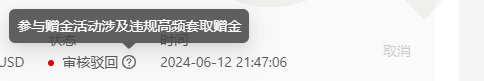

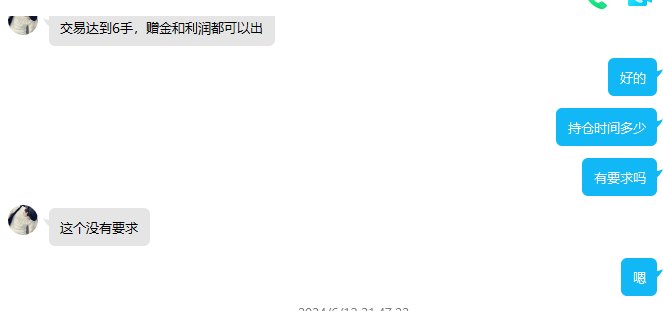

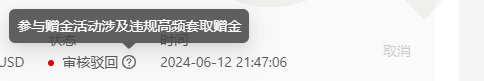

Scam platform. Unable to withdraw. Agents and platforms work together to deceive users into opening accounts.

UNX Markets Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

Scam platform. Unable to withdraw. Agents and platforms work together to deceive users into opening accounts.

UNX Markets presents itself as a foreign exchange broker offering no-dealing-desk transactions. The broker has received generally positive feedback from users, particularly regarding support services and withdrawal processes that work efficiently. This unx markets review reveals that the broker attracts traders with competitive spreads, advanced charting tools, and multiple technical indicators across their trading platforms.

The broker caters primarily to intermediate and advanced traders. These traders often have higher requirements for technical analysis capabilities that help them make better trading decisions. User feedback from September 2023 indicates satisfaction with UNX Markets' services, support quality, and rapid withdrawal processing. With over 140 trading instruments available and support for both MetaTrader 4 and MetaTrader 5 platforms, UNX Markets positions itself as a comprehensive trading solution for serious forex traders who need reliable tools.

However, potential traders should note that regulatory information remains unclear in available documentation. This lack of clarity may impact the broker's appeal to security-conscious investors seeking fully transparent regulatory oversight that protects their investments.

UNX Markets operates across different regions around the world. Traders should be aware that regulatory environments and associated risks may vary depending on their geographical location and local laws. The specific regulatory information for UNX Markets was not detailed in available sources. This means users in different jurisdictions may face varying legal protections and compliance requirements that affect their trading experience.

This review is based on available user feedback and market analysis conducted through September 2023. Traders are advised to conduct their own due diligence regarding regulatory status and verify current terms and conditions before opening accounts with any broker. The evaluation methodology focuses on user experience data and publicly available information about the broker's services and offerings.

| Criteria | Score | Rationale |

|---|---|---|

| Account Conditions | Not Rated | Insufficient information available regarding minimum deposits and commission structures |

| Tools and Resources | 9/10 | Excellent offering with advanced charting tools, multiple technical indicators, and 140+ trading instruments |

| Customer Service and Support | 8/10 | High user satisfaction with support quality and rapid withdrawal processing |

| Trading Experience | Not Rated | Limited specific information available about detailed trading environment and execution |

| Trustworthiness | Not Rated | Regulatory information not clearly specified in available documentation |

| User Experience | 8/10 | Generally positive user feedback and satisfaction with overall service quality |

UNX Markets operates as a foreign exchange broker specializing in no-dealing-desk transactions. This means trades are executed without broker intervention in the pricing or execution process that could affect final results. The business model typically appeals to traders seeking direct market access and transparent pricing structures. The broker has developed a reputation for providing comprehensive trading solutions, though specific founding details and company background information were not detailed in available sources that we reviewed.

The broker's core offering centers around providing access to major forex markets and CFD trading opportunities. User testimonials from September 2023 highlight satisfaction with the broker's service approach, particularly praising the support team's responsiveness and the efficiency of withdrawal processes that work quickly. This unx markets review indicates that the broker has successfully built a user base that appreciates both technical capabilities and service quality.

UNX Markets provides trading access through industry-standard MetaTrader 4 and MetaTrader 5 platforms. These platforms ensure traders have access to familiar and robust trading environments that support their strategies. The broker offers more than 140 trading instruments across various asset classes, including foreign exchange pairs and contracts for difference. This provides sufficient diversity for most trading strategies and portfolio requirements that traders might have.

Regulatory Regions: Specific regulatory oversight information for UNX Markets was not clearly detailed in available documentation. This represents a significant information gap for potential traders seeking regulatory transparency that protects their investments.

Deposit and Withdrawal Methods: Available sources did not specify the range of funding options or supported payment methods for account deposits and withdrawals.

Minimum Deposit Requirements: Specific minimum deposit thresholds for different account types were not detailed in accessible information.

Bonus and Promotions: Current promotional offerings and bonus structures were not mentioned in available documentation.

Tradeable Assets: UNX Markets provides access to over 140 trading instruments. These encompass foreign exchange pairs and CFD products across multiple asset classes, offering substantial variety for diverse trading approaches that suit different investor needs.

Cost Structure: The broker advertises attractive spreads for their clients. However, specific numerical values and commission details were not provided in available sources that we could access.

Leverage Ratios: Maximum leverage offerings and margin requirements were not specified in accessible documentation.

Platform Options: Trading is conducted through MetaTrader 4 and MetaTrader 5 platforms. These provide users with industry-standard trading environments and advanced technical analysis capabilities that support informed decision-making.

Regional Restrictions: Information about geographical trading restrictions was not detailed in available sources.

Customer Service Languages: Supported languages for customer service were not specified in accessible documentation.

This unx markets review highlights the need for potential traders to contact the broker directly for specific details about trading conditions and account requirements.

The account conditions evaluation for UNX Markets faces significant limitations due to insufficient information availability regarding specific account structures and requirements. Available documentation does not detail the variety of account types offered, making it difficult to assess whether the broker provides tiered account options suitable for different trader profiles and capital levels that vary widely.

Minimum deposit requirements are crucial for trader decision-making. These were not specified in accessible sources that we reviewed. This information gap prevents a comprehensive assessment of the broker's accessibility to traders with varying capital constraints. Additionally, the account opening process details, including verification requirements and timeframes, were not documented in available materials that provide clear guidance.

Special account features were not mentioned in the available information. These might include Islamic accounts for Sharia-compliant trading or managed account options that some traders prefer. The absence of detailed account condition information makes it challenging for potential traders to evaluate whether UNX Markets' offerings align with their specific trading needs and financial circumstances.

This unx markets review emphasizes the importance of directly contacting the broker to obtain comprehensive account condition details before making trading decisions. Without clear information about account structures, fees, and requirements, traders cannot make fully informed comparisons with other market participants who offer similar services.

UNX Markets demonstrates strong performance in the tools and resources category. The broker earns a high rating of 9/10 based on available information that shows comprehensive offerings. The broker provides advanced charting tools and multiple technical indicators, which are essential components for serious technical analysis and informed trading decisions that lead to better outcomes.

The availability of over 140 trading instruments represents a significant strength for traders. This offering provides substantial diversity across different asset classes and markets that suit various investment approaches. This extensive instrument selection enables portfolio diversification and supports various trading strategies, from focused currency pair trading to broader multi-asset approaches that spread risk effectively.

Both MetaTrader 4 and MetaTrader 5 platform support ensures that traders have access to industry-leading trading environments. These platforms provide comprehensive technical analysis capabilities that meet professional standards. These platforms are renowned for their stability, functionality, and extensive customization options, meeting the needs of both intermediate and advanced traders who require sophisticated tools.

However, available information did not detail additional research resources, educational materials, or automated trading support capabilities. The absence of information about market analysis, trading signals, or educational content represents potential areas for improvement or clarification in the broker's service offering that could enhance user experience.

UNX Markets receives strong ratings in customer service and support categories. The broker achieves an 8/10 score based on positive user feedback and demonstrated service capabilities that meet client expectations. User testimonials from September 2023 consistently highlight satisfaction with the broker's customer support quality and responsiveness.

The broker provides customer support contact information, including telephone access for direct communication. However, specific availability hours and multi-language support details were not specified in available documentation that we reviewed. User feedback particularly emphasizes the efficiency of withdrawal processing, which is often a critical concern for traders evaluating broker reliability and trustworthiness.

Response times appear to meet user expectations based on available feedback from actual clients. Users express satisfaction with the speed and quality of support interactions that resolve their concerns effectively. The positive user sentiment regarding support services suggests that UNX Markets has invested in building competent customer service capabilities.

However, this evaluation is limited by the lack of detailed information about support channels, operating hours, and language support options. The absence of specific service level commitments or documented support procedures prevents a more comprehensive assessment of the broker's customer service infrastructure that supports client needs.

The trading experience evaluation for UNX Markets is constrained by limited specific information about platform performance and execution quality. Available sources confirm that the broker utilizes MetaTrader 4 and MetaTrader 5 platforms, which are industry standards known for their reliability and comprehensive functionality that traders trust.

The platforms provide access to multiple technical indicators and advanced charting capabilities for detailed analysis. These features support sophisticated technical analysis approaches that appeal to intermediate and advanced traders who need professional tools. The no-dealing-desk transaction model suggests that traders receive direct market pricing without broker intervention, which typically enhances execution transparency and fairness.

Spread competitiveness is mentioned as an attractive feature that draws traders to the platform. However, specific numerical values or comparative data were not provided in available sources that we could access. The stability of trading conditions and actual spread performance during different market conditions remains unclear without detailed user feedback or performance data.

Mobile trading capabilities, platform stability during high-volatility periods, and order execution speeds were not specifically addressed in available documentation. This unx markets review indicates that while the fundamental trading infrastructure appears sound, detailed performance metrics would strengthen the evaluation of the overall trading experience that users can expect.

The trustworthiness evaluation for UNX Markets faces significant challenges due to the absence of clear regulatory information in available documentation. Regulatory oversight is a fundamental component of broker trustworthiness, and the lack of specific regulatory details represents a notable concern for security-conscious traders who prioritize safety.

Fund safety measures, segregated account policies, and investor protection schemes were not detailed in accessible sources. These elements are crucial for assessing the security of client funds and the broker's commitment to maintaining appropriate safeguards for trader assets that need protection.

Company transparency regarding ownership, financial backing, and operational history was not provided in available information. The absence of detailed company background information makes it difficult to assess the broker's stability and long-term viability in the competitive forex market where many brokers compete.

Industry reputation and any potential negative events or regulatory actions were not documented in available sources. Without access to comprehensive regulatory status information and third-party verification of the broker's standing, traders cannot fully evaluate the trustworthiness and security aspects of choosing UNX Markets as their trading partner for long-term relationships.

UNX Markets achieves a strong 8/10 rating in user experience based on generally positive user feedback and satisfaction indicators. Available testimonials from September 2023 show users expressing satisfaction with the broker's services, indicating that the overall user experience meets or exceeds expectations for the target audience that values quality service.

The broker appears to attract intermediate and advanced traders who value technical analysis capabilities and responsive customer service. User feedback particularly highlights satisfaction with withdrawal processing speed, which is often a critical factor in overall user experience and broker satisfaction that builds long-term relationships.

Fast withdrawal processing demonstrates the broker's commitment to efficient client service effectively. This capability suggests well-developed operational procedures for handling client fund requests that work smoothly. This capability contributes significantly to positive user experience and builds confidence in the broker's reliability.

However, available information did not provide details about user interface design, account registration processes, or common user concerns and complaints. The absence of comprehensive user feedback across different aspects of the trading experience limits the depth of this evaluation, though available indicators suggest generally positive user sentiment toward UNX Markets' service delivery that meets client needs.

UNX Markets emerges as a forex broker with notable strengths in customer support and trading tools. The broker earns positive user feedback particularly for withdrawal efficiency and service quality that meets professional standards. This unx markets review reveals a broker well-suited for intermediate and advanced traders who prioritize technical analysis capabilities and responsive customer service.

The broker's strengths include comprehensive trading tools with over 140 instruments, advanced charting capabilities, and industry-standard MetaTrader platform support. User satisfaction with customer service and rapid withdrawal processing represents significant advantages in the competitive forex market where many brokers compete for clients.

However, the absence of clear regulatory information and specific account condition details represents notable limitations. These gaps may concern security-focused traders who prioritize transparency and regulatory protection. Potential users should conduct additional due diligence regarding regulatory status and specific trading terms before committing to this broker for their trading activities.

FX Broker Capital Trading Markets Review