Is Bftbot safe?

Business

License

Is BFTBOT Safe or Scam?

Introduction

BFTBOT is an online trading platform that positions itself in the forex market, offering a variety of financial instruments including forex, cryptocurrencies, commodities, indices, and shares. As the popularity of online trading continues to rise, it is essential for traders to carefully evaluate the legitimacy and reliability of trading platforms like BFTBOT. The lack of regulation and oversight in the forex industry can lead to potential risks, making it crucial for traders to conduct thorough research before committing their funds. This article aims to provide a comprehensive assessment of BFTBOT by examining its regulatory status, company background, trading conditions, customer feedback, and overall safety.

Regulation and Legitimacy

A fundamental aspect of evaluating any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that the broker adheres to specific standards and practices that protect customer funds. In the case of BFTBOT, it operates without any recognized regulatory oversight. The absence of valid licenses raises significant concerns regarding the safety of traders' investments and the transparency of the broker's business practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The lack of regulation means that BFTBOT is not subject to the rigorous compliance checks that regulated brokers face. This can lead to inadequate client fund protection and potentially unfair trading practices. Furthermore, unregulated brokers often have limited avenues for dispute resolution, which can leave traders vulnerable in the event of issues or conflicts. Therefore, when considering whether BFTBOT is safe, traders must weigh the risks associated with trading with an unregulated entity.

Company Background Investigation

BFTBOT was founded in 2017 and is headquartered in the United Kingdom. However, the company lacks transparency regarding its ownership structure and management team. The absence of publicly available information about the individuals behind BFTBOT raises red flags about its credibility. A legitimate trading platform typically provides clear details about its leadership and operational framework to build trust with potential clients.

Moreover, the company has faced complaints regarding its business practices, including issues with fund withdrawals and customer support. The lack of a verifiable history and the anonymity surrounding its ownership can contribute to the perception that BFTBOT may not be a trustworthy entity. In light of these factors, traders should exercise caution and conduct further research before investing with BFTBOT.

Trading Conditions Analysis

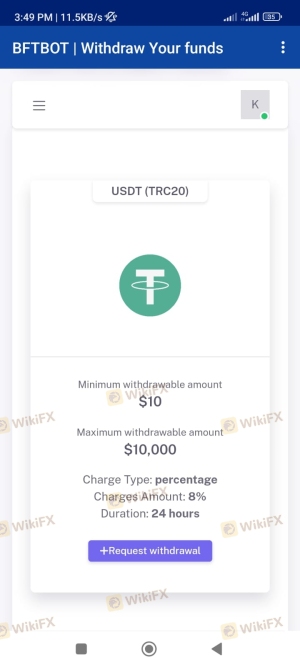

BFTBOT offers a range of trading conditions, but the absence of regulation raises concerns about the overall fee structure and potential hidden costs. Understanding the fee model is crucial for traders to assess the true cost of trading on the platform. BFTBOT's fee structure includes spreads, commissions, and overnight interest charges, which can vary significantly depending on the asset class and account type.

| Fee Type | BFTBOT | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (3 pips on average) | 1-2 pips |

| Commission Model | $0.10 per lot traded (Forex) | $0.05 per lot |

| Overnight Interest Range | Variable | 0.5% - 1.5% |

The spreads on BFTBOT can be unpredictable, and the variable commission structure adds complexity to the overall trading costs. Traders should be particularly cautious of any fees that deviate significantly from industry standards, as this can impact overall profitability. The potential for hidden fees or unfavorable trading conditions should raise concerns about the platform's transparency and fairness.

Customer Fund Safety

When it comes to trading, the safety of customer funds is paramount. BFTBOT's lack of regulation raises significant questions about its fund security measures. Regulated brokers typically implement strict policies regarding fund segregation, investor protection, and negative balance protection. However, BFTBOT does not provide clear information on these critical aspects.

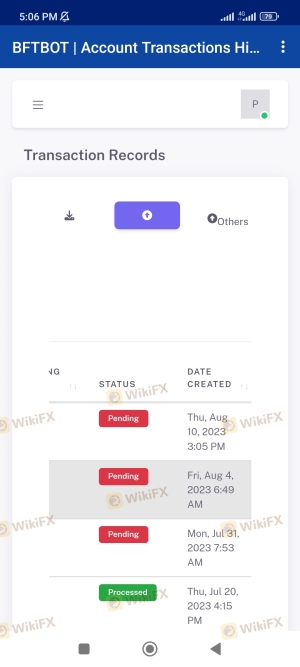

The absence of fund protection mechanisms means that traders' investments may be at risk in the event of financial difficulties faced by the broker. Additionally, there have been reports of withdrawal issues, where customers have experienced delays or failed attempts to withdraw their funds. Such incidents highlight the importance of ensuring that any trading platform has robust measures in place to safeguard client assets.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the reliability of a trading platform. Reviews of BFTBOT reveal a mix of experiences, with several users expressing dissatisfaction regarding withdrawal processes and customer support. Common complaints include difficulties in accessing funds and slow response times from the support team.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Average |

For instance, one user reported that their withdrawal request was pending for an extended period, leading to frustration and a lack of trust in the platform's operations. Such patterns of complaints can indicate systemic issues within the company and should be carefully considered by potential traders. The overall sentiment surrounding BFTBOT suggests that caution is warranted when engaging with the platform.

Platform and Trade Execution

The performance of the trading platform is another critical factor in evaluating whether BFTBOT is safe. The platform offers users access to various trading instruments, but the quality of execution can vary. Issues such as slippage and order rejections have been reported by some users, which can significantly affect trading outcomes.

A well-functioning trading platform should provide stable performance, minimal slippage, and high execution quality. However, the absence of detailed information about the platform's infrastructure and execution policies raises concerns. Traders should be wary of platforms that do not provide transparency regarding their execution processes and potential manipulation.

Risk Assessment

Engaging with an unregulated broker like BFTBOT carries inherent risks. The lack of oversight can lead to a range of issues, from inadequate fund protection to unfair trading practices.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight, increasing vulnerability |

| Financial Risk | Medium | Potential for hidden fees and costs |

| Operational Risk | Medium | Issues with withdrawals and support |

To mitigate these risks, traders should consider using regulated brokers with established reputations. Additionally, conducting thorough research and reading user reviews can provide valuable insights into the platform's reliability.

Conclusion and Recommendations

In conclusion, the assessment of BFTBOT raises significant concerns regarding its legitimacy and safety. The lack of regulation, combined with customer complaints and transparency issues, suggests that traders should approach this platform with caution. While BFTBOT offers a range of trading instruments and educational resources, the risks associated with trading on an unregulated platform may outweigh the potential benefits.

For traders seeking safer alternatives, it is advisable to consider regulated brokers that provide robust fund protection, transparent fee structures, and reliable customer support. Some reputable options include brokers like IG, OANDA, and Forex.com, which have established a track record of trustworthiness in the forex market. Ultimately, careful consideration and thorough research are essential for anyone contemplating trading with BFTBOT or similar platforms.

Is Bftbot a scam, or is it legit?

The latest exposure and evaluation content of Bftbot brokers.

Bftbot Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Bftbot latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.