Is Primus safe?

Business

License

Is Primus Safe or a Scam?

Introduction

Primus is a forex broker that has gained attention in the trading community for its various offerings in the foreign exchange market. Established in the United Kingdom, Primus markets itself as a platform for both novice and experienced traders, providing a range of trading instruments, including forex, commodities, and cryptocurrencies. However, as with any financial service, it is crucial for traders to exercise caution and thoroughly evaluate a broker's legitimacy before committing their funds. This article aims to provide an objective analysis of whether Primus is a safe trading option or a potential scam. Our investigation is based on a comprehensive review of regulatory status, company background, trading conditions, customer experiences, and risk factors associated with using Primus.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in assessing its safety. Primus claims to operate under the oversight of financial authorities; however, multiple sources indicate that it lacks regulation from reputable bodies. Below is a summary of the core regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulatory oversight raises significant concerns regarding the safety of traders' funds. Regulated brokers are subject to stringent guidelines that protect investors, including the segregation of client funds and adherence to fair trading practices. In contrast, Primus's lack of regulation suggests that it operates without such safeguards, leaving traders vulnerable to potential fraud or mismanagement. Furthermore, past compliance history reveals no records of adherence to regulatory standards, which further exacerbates the risk associated with trading through Primus. In summary, the lack of a regulatory framework makes it difficult to consider Primus a safe trading option.

Company Background Investigation

Primus was founded with the intention of catering to traders in the forex market, but the specifics surrounding its ownership structure and historical development remain unclear. The company's background suggests a relatively recent establishment, with little information available regarding its history or the individuals behind it. This lack of transparency raises questions about the broker's credibility and reliability.

The management teams qualifications and experience are crucial in determining the broker's operational integrity. However, detailed profiles of the management team are not readily available, which limits the ability to assess their expertise in the financial sector. Additionally, the company's information disclosure practices appear to be lacking, as there are no comprehensive reports or audits provided to the public. This opacity can be a significant red flag, suggesting that Primus may not prioritize transparency, which is essential for building trust with its clients.

Trading Conditions Analysis

When evaluating the trading conditions offered by a broker, it is essential to consider the overall cost structure and any potential hidden fees. Primus advertises competitive spreads and various account types, yet the specifics of these costs are often vague. Below is a comparison of core trading costs associated with Primus:

| Fee Type | Primus | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | 0.5% | 0.3% |

The spreads offered by Primus appear to be higher than the industry average, which could significantly impact trading profitability. Additionally, the absence of a clear commission structure raises concerns about potential hidden fees that traders might encounter. Such lack of transparency in fee disclosure can be particularly problematic, as it complicates the ability for traders to fully understand the true cost of trading. Overall, the trading conditions at Primus do not inspire confidence, making it difficult to conclude that it is a safe choice for traders.

Client Fund Security

The safety of client funds is a paramount concern for any trader. Primus's approach to fund security appears to be inadequate, as there are no clear indications of client funds being held in segregated accounts. Segregation of funds is a standard practice among regulated brokers, designed to protect clients' investments in the event of company insolvency. Without this measure, traders risk losing their funds if the broker faces financial difficulties.

Furthermore, the lack of investor protection mechanisms raises additional alarms. Many reputable brokers offer compensation schemes that provide a safety net for clients, ensuring that they can recover a portion of their funds if the broker fails. Unfortunately, Primus does not provide such assurances, leaving traders exposed to the risk of total loss. Historical incidents or disputes involving fund security have not been reported, but the absence of a robust security framework makes it difficult to trust that Primus prioritizes the protection of client funds.

Customer Experience and Complaints

Analyzing customer feedback and real user experiences can provide valuable insights into the operational integrity of a broker. Reviews of Primus reveal a mixed bag of experiences, with numerous complaints regarding withdrawal processes and customer support responsiveness. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Limited availability |

| Account Management | Low | Inconsistent |

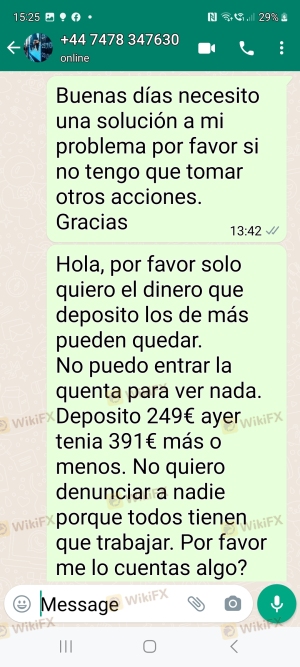

The most common complaint revolves around difficulties in withdrawing funds, with users reporting delays and lack of communication from the support team. This pattern of complaints can be particularly concerning, as it indicates potential operational inefficiencies that could hinder traders' ability to access their money. Moreover, the company's response to these complaints has been criticized as inadequate, further eroding trust in its services.

Platform and Trade Execution

The performance and stability of a trading platform are crucial for an optimal trading experience. Primus offers a proprietary trading platform, but user reviews suggest that it may not meet the standards expected by traders. Issues such as slow execution times, slippage, and occasional downtime have been reported.

A thorough analysis of order execution quality reveals that traders have experienced significant slippage during high volatility periods, which can adversely affect trading outcomes. Furthermore, there are no clear indicators of platform manipulation, but the combination of execution issues and customer complaints raises concerns about the overall reliability of Primus's trading environment.

Risk Assessment

Utilizing Primus as a trading platform comes with inherent risks that potential clients must consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases vulnerability |

| Financial Risk | Medium | Lack of fund segregation poses risks |

| Operational Risk | High | Customer complaints about withdrawals |

| Market Risk | Medium | High spreads can affect profitability |

To mitigate these risks, potential traders are advised to conduct thorough research and consider trading with regulated brokers that offer better security and transparency. It is crucial to prioritize safety over potential returns, especially when dealing with an unregulated entity like Primus.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about the safety of trading with Primus. The absence of regulatory oversight, lack of transparency regarding fees, and various customer complaints collectively suggest that Primus may not be a safe option for traders. While it may offer a range of trading instruments, the risks associated with using this broker outweigh the potential benefits.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are regulated by reputable financial authorities. Options such as FP Markets or other well-established brokers provide the necessary safeguards and transparency that traders should look for when entering the forex market. Ultimately, while the allure of trading with Primus may be tempting, the risks involved warrant a cautious approach, making it essential to ask, "Is Primus safe?" and to seek safer alternatives.

Is Primus a scam, or is it legit?

The latest exposure and evaluation content of Primus brokers.

Primus Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Primus latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.