Is FXTRATEGY safe?

Pros

Cons

Is FXTrategy A Scam?

Introduction

FXTrategy is a forex broker that positions itself within the competitive landscape of online trading, offering a wide range of financial instruments including forex, cryptocurrencies, stocks, and commodities. As the forex market continues to attract a growing number of traders, it is crucial for individuals to carefully assess the legitimacy and reliability of brokers like FXTrategy. A thorough evaluation can help traders avoid potential scams and ensure that their investments are secure. This article employs a comprehensive investigation methodology, utilizing data from multiple sources to assess FXTrategys regulatory standing, company background, trading conditions, customer experiences, and overall safety.

Regulation and Legitimacy

The regulatory environment is a fundamental aspect of any brokerage's credibility. FXTrategy claims to be registered in the United States; however, it lacks regulation from any recognized financial authority. This absence of oversight raises significant concerns regarding the safety of client funds and the broker's operational transparency.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of a valid regulatory license means FXTrategy does not adhere to the rigorous standards set by financial regulators, which typically include measures for protecting client funds and ensuring fair trading practices. Historical compliance issues further compound these concerns, as unregulated brokers often operate with minimal accountability. Therefore, it is essential for potential clients to approach FXTrategy with caution, as the absence of regulation indicates a higher risk of fraud.

Company Background Investigation

FXTrategy is operated by a company named Estrategias Comerciales Pallay, which claims to be based in Mexico. However, the details surrounding the company's history, ownership structure, and management team are notably vague. There is limited information available about the experience and qualifications of the individuals behind the broker, which raises questions about their expertise in the financial sector.

Transparency is crucial when evaluating a brokerage, and FXTrategy's lack of clear communication regarding its management and operational history is concerning. Without sufficient disclosure, traders may find it difficult to ascertain the legitimacy of the broker. This opacity can be a red flag, indicating that FXTrategy may not prioritize the interests of its clients.

Trading Conditions Analysis

FXTrategys trading conditions are another critical area of evaluation. The broker does not provide transparent information regarding its fee structure, which can lead to unexpected costs for traders. A detailed examination of their fees reveals a lack of clarity that could be detrimental to potential clients.

| Fee Type | FXTrategy | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Typically 0.5% - 2% |

The absence of clearly defined spreads and commissions can indicate that FXTrategy may impose hidden fees or unfavorable trading conditions. Traders should be particularly wary of brokers that do not disclose all potential costs upfront, as this could lead to significant financial losses. In light of these concerns, it is prudent for traders to question whether FXTrategy is truly a safe option for their trading endeavors.

Customer Funds Safety

The safety of client funds is paramount when choosing a broker. FXTrategy has not provided adequate information regarding its security measures. There are no clear indications of fund segregation practices, investor protection schemes, or negative balance protection policies.

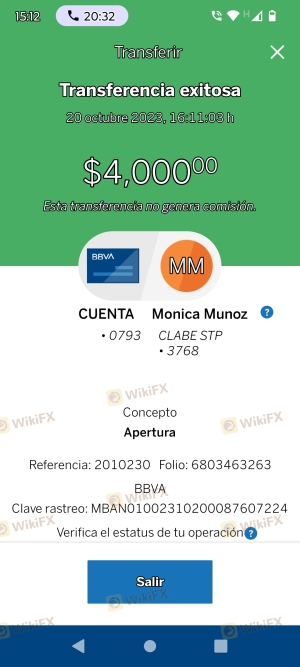

The lack of these fundamental safety measures is alarming, especially considering the numerous complaints regarding difficulties in fund withdrawals. Many users have reported being unable to retrieve their investments after depositing funds, which raises serious questions about the broker's reliability. Historical issues surrounding fund safety and withdrawal problems further emphasize the need for traders to exercise caution when considering FXTrategy, as the risks associated with unregulated brokers can be substantial.

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a broker's trustworthiness. Reviews of FXTrategy reveal a pattern of negative experiences, particularly concerning withdrawal issues and inadequate customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Difficulty with Withdrawals | High | Poor |

| Unresponsive Customer Support | Medium | Poor |

| Misleading Promotions | High | Poor |

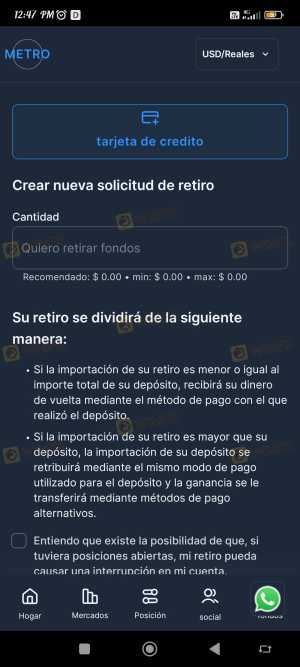

Many users have reported that after making deposits, they faced challenges when attempting to withdraw their funds. Some even noted that the broker became unresponsive once their money was secured. Such complaints suggest a concerning trend that potential clients should be aware of. Notably, FXTrategy's customer service is limited to WhatsApp communication, which lacks the professionalism and reliability typically expected from reputable brokers.

Platform and Trade Execution

The trading platform offered by FXTrategy is another critical aspect to consider. While they claim to use the Sirix web trader platform, reviews indicate that the platform may not deliver the performance and reliability expected by traders. Users have reported issues with order execution, including slippage and rejections, which can significantly impact trading outcomes.

A reliable trading platform should facilitate smooth execution and provide traders with the tools necessary for effective market analysis. However, the feedback surrounding FXTrategy suggests that users may encounter difficulties that could hinder their trading experience.

Risk Assessment

Using FXTrategy poses several risks that traders should carefully consider. The broker's unregulated status, combined with numerous complaints about fund withdrawal and customer support, creates a high-risk environment for investors.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight. |

| Financial Risk | High | Withdrawal issues reported. |

| Operational Risk | Medium | Platform performance concerns. |

To mitigate these risks, potential clients should conduct thorough due diligence before engaging with FXTrategy. It may be beneficial to seek alternatives that offer robust regulatory oversight and proven customer satisfaction.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that FXTrategy exhibits several characteristics commonly associated with fraudulent brokers. The lack of regulation, coupled with numerous complaints regarding fund withdrawals and poor customer service, raises significant concerns about the safety and reliability of this broker.

For traders seeking a secure and trustworthy trading environment, it is advisable to avoid FXTrategy. Instead, consider regulated brokers that prioritize client protection and transparency. Reliable alternatives may include well-established platforms with a proven track record in the industry. Ultimately, exercising caution and conducting thorough research is essential to safeguard your investments in the forex market.

Is FXTRATEGY a scam, or is it legit?

The latest exposure and evaluation content of FXTRATEGY brokers.

FXTRATEGY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXTRATEGY latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.