Is TC GLOBAL CAPITAL safe?

Business

License

Is TC Global Capital A Scam?

Introduction

TC Global Capital is a forex brokerage that has positioned itself in the competitive landscape of online trading platforms. With a promise of diverse trading options and user-friendly interfaces, it aims to attract both novice and experienced traders. However, as the online trading environment grows, so does the risk of encountering untrustworthy brokers. This makes it essential for traders to conduct thorough evaluations of any broker before committing their funds. In this article, we will assess TC Global Capital through a comprehensive investigation that includes its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

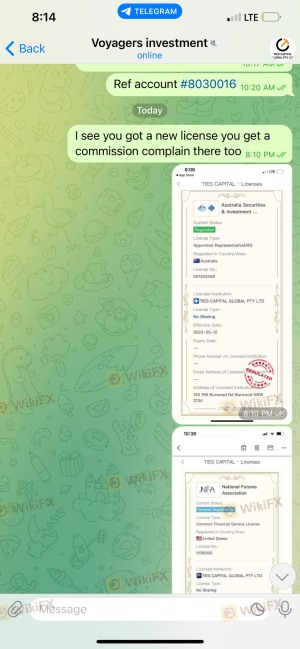

The regulatory environment is a critical factor in determining the trustworthiness of a forex broker. Regulatory bodies ensure that brokers adhere to strict standards, providing a layer of security for traders. Unfortunately, TC Global Capital has raised several red flags regarding its regulatory status.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | Not Available | Australia | Unverified |

Despite claiming to be regulated by the Australian Securities and Investments Commission (ASIC), multiple sources indicate that TC Global Capital lacks the necessary licenses. This absence of regulatory oversight is concerning, as it suggests that the broker may not be subject to the rigorous compliance checks that reputable firms undergo. Furthermore, there have been reports of fraudulent activity associated with the broker, including claims of fabricated regulatory information. This situation highlights the importance of verifying a broker's regulatory status through official channels before engaging in trading.

Company Background Investigation

TC Global Capital was reportedly established in 2017, but details about its ownership and operational history remain vague. The company is listed under the name Ties Capital Global Pty Ltd, yet there is a lack of transparency regarding its corporate structure and management team. The absence of publicly available information raises concerns about the legitimacy of the broker.

The management team‘s background is also unclear, which is troubling for potential investors. A reputable broker typically has a well-documented history of experienced professionals in the finance industry. In contrast, TC Global Capital appears to lack this essential aspect, making it difficult to assess the competency of its leadership. Moreover, the company’s website does not provide sufficient information about its operations, which further diminishes its credibility and transparency.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is crucial. TC Global Capital offers various trading instruments, including forex, commodities, and cryptocurrencies. However, the specifics of its fee structure are not clearly outlined, which can lead to unexpected costs for traders.

| Fee Type | TC Global Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1.0 - 1.5 pips |

| Commission Model | Not Disclosed | $5 - $10 per lot |

| Overnight Interest Range | Not Disclosed | Varies by broker |

The lack of transparency regarding spreads, commissions, and overnight interest rates is concerning. Traders may find themselves facing hidden fees that can significantly impact their profitability. Moreover, the absence of well-defined trading conditions raises questions about the broker's reliability and fairness. It is vital for traders to seek brokers that provide clear and competitive pricing structures to avoid unexpected financial burdens.

Client Fund Security

The security of client funds is a paramount concern when selecting a forex broker. TC Global Capital claims to implement various security measures, but the effectiveness of these measures remains unverified. The broker's approach to fund segregation, investor protection, and negative balance protection is unclear.

Historically, there have been reports of fund mismanagement and withdrawal issues associated with TC Global Capital. Clients have expressed concerns about the safety of their deposits and the brokers responsiveness in addressing these issues. A reliable broker should have robust mechanisms in place to safeguard client funds and ensure quick access to withdrawals. Unfortunately, the lack of clarity regarding TC Global Capital's security measures raises significant concerns about the safety of investor capital.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's operational integrity. Reviews and testimonials for TC Global Capital reveal a mixed bag of experiences. Many users have reported issues with withdrawals, unresponsive customer service, and difficulties in account verification.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Service Issues | Medium | Slow |

| Account Verification | High | Unresolved |

Typical complaints include delays in processing withdrawals, which can be particularly alarming for traders looking to access their funds promptly. Additionally, the quality of customer support has been criticized, with many users reporting long wait times and unhelpful responses. These patterns of complaints indicate a systemic issue within the broker that potential clients should consider before opening an account.

Platform and Trade Execution

The trading platform's performance is another critical aspect of the trading experience. TC Global Capital offers a web-based platform and mobile applications; however, user reviews suggest that the platform suffers from stability issues and slow execution times.

Traders have reported instances of slippage and rejected orders, which can severely impact trading outcomes. The presence of these issues raises questions about the broker's technological capabilities and commitment to providing a seamless trading experience. A reliable broker should offer a stable platform with efficient order execution to ensure that traders can capitalize on market opportunities without hindrance.

Risk Assessment

Using TC Global Capital presents several risks that potential traders should be aware of. The absence of regulatory oversight, unclear trading conditions, and a lack of transparency regarding fund security contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | Lack of transparency in fees |

| Operational Risk | Medium | Platform stability issues |

To mitigate these risks, traders should exercise caution and conduct thorough research before engaging with TC Global Capital. It is advisable to consider alternative brokers with established reputations and transparent practices to ensure a safer trading environment.

Conclusion and Recommendations

In conclusion, TC Global Capital exhibits several concerning characteristics that warrant caution. The lack of regulatory oversight, combined with a history of customer complaints and unclear trading conditions, raises significant red flags. While the broker may offer a variety of trading options, the associated risks appear to outweigh the potential benefits.

For traders seeking a more secure trading experience, it is advisable to consider reputable alternatives that are well-regulated and transparent in their operations. Brokers such as [insert reputable alternatives here] have established a track record of reliability and customer satisfaction, making them safer choices for trading in the forex market. Always prioritize due diligence when selecting a broker to safeguard your investments effectively.

Is TC GLOBAL CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of TC GLOBAL CAPITAL brokers.

TC GLOBAL CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TC GLOBAL CAPITAL latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.