Is ANNEXA PRIME safe?

Business

License

Is Annexa Prime A Scam?

Introduction

Annexa Prime is a relatively new player in the forex market, having been established in 2022. It positions itself as a trading platform offering a wide range of trading instruments, including forex, indices, commodities, cryptocurrencies, and stocks. As with any financial service, traders need to exercise caution when evaluating brokers, especially in an industry rife with scams and unregulated entities. This article aims to provide a comprehensive analysis of Annexa Prime, examining its regulatory status, company background, trading conditions, customer feedback, and overall safety. The investigation is based on a review of multiple sources, including user reviews, regulatory databases, and industry reports.

Regulation and Legitimacy

The regulatory status of a broker is crucial for traders as it indicates the level of oversight and protection afforded to clients. Annexa Prime currently lacks valid regulation, which poses significant risks for potential investors. The absence of oversight from a recognized financial authority means that there are no guarantees regarding the broker's operations or the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The lack of regulation raises concerns about the broker's legitimacy and operational transparency. While Annexa Prime claims to implement certain protective measures, such as negative balance protection and segregation of funds, the absence of a governing body overseeing these claims makes them less credible. In general, it is advisable for traders to operate with brokers regulated by top-tier authorities like the FCA or ASIC to ensure their investments are protected.

Company Background Investigation

Annexa Prime was founded in 2022, and information about its ownership and management is scarce. The company claims to be based in the United Kingdom, but it has not disclosed significant details about its ownership structure. The management teams background and professional experience are also not readily available, which raises red flags regarding the broker's transparency.

The lack of information about the company's history and its founders can be concerning for potential clients. Transparency is a key factor in establishing trust, and Annexa Prime's failure to provide this information may deter traders from engaging with the platform. In the financial services industry, a clear understanding of who is managing your investments is essential for building confidence and ensuring accountability.

Trading Conditions Analysis

The trading conditions offered by Annexa Prime are competitive, with various account types available to cater to different trader needs. However, the overall fee structure and any unusual charges require careful examination. Traders should be aware of potential hidden costs that could impact their profitability.

| Fee Type | Annexa Prime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.5 pips |

| Commission Model | $3 per lot | $2 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Annexa Prime begin at 2.0 pips for major currency pairs, which is higher than the industry average. Additionally, the commission structure may not be as favorable as that of other brokers. While the broker claims to provide various account types with different benefits, the higher costs may deter traders, particularly those with smaller accounts.

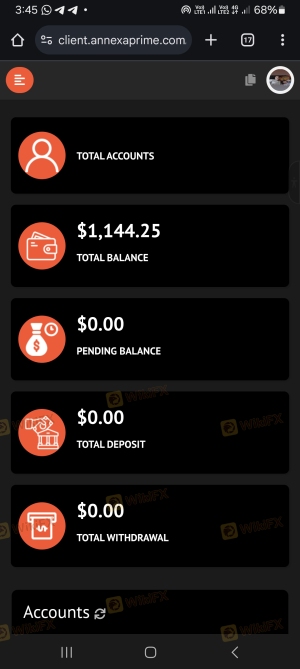

Client Fund Safety

The safety of client funds is paramount when choosing a broker. Annexa Prime claims to implement several measures to protect client funds, including fund segregation and negative balance protection. However, the absence of regulation raises questions about the effectiveness of these measures.

The broker's website states that client funds are kept separate from the company's operational funds, which is a standard practice in the industry. However, without regulatory oversight, there is no guarantee that these claims are upheld. Additionally, there have been no reported incidents of fund security breaches, but the lack of transparency surrounding the broker's operations leaves room for concern.

Customer Experience and Complaints

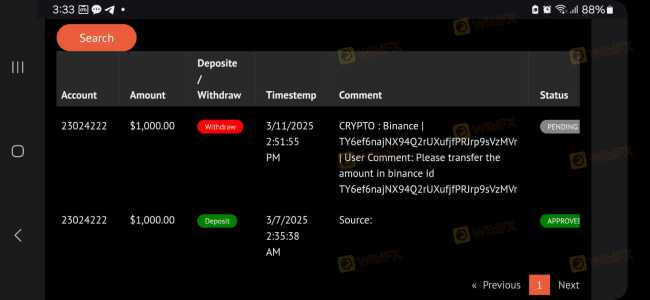

Customer feedback is an essential aspect of evaluating a broker's credibility. A thorough analysis of user reviews reveals a mixed bag of experiences with Annexa Prime. While some users report satisfactory trading conditions and customer service, others express concerns about withdrawal issues and lack of support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Limited availability |

| High Fees | Medium | No clear explanation |

Common complaints include delays in withdrawal processing and inadequate customer support. These issues can significantly impact a trader's experience and trust in the broker. However, the company appears to be responsive to some complaints, although resolution times may vary.

Platform and Execution

The trading platform provided by Annexa Prime is the popular MetaTrader 5 (MT5), known for its advanced features and user-friendly interface. However, the performance of the platform, including order execution quality and slippage rates, is crucial for traders.

Users have reported mixed experiences regarding order execution, with some experiencing slippage during volatile market conditions. Additionally, there are concerns about the potential for platform manipulation, which can occur in unregulated environments. A reliable broker should ensure that their platform operates smoothly and transparently, without any signs of manipulation.

Risk Assessment

Using Annexa Prime carries inherent risks that traders should consider before opening an account. The lack of regulation, combined with mixed customer feedback, presents a medium to high-risk profile for potential clients.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Safety Risk | Medium | Claims of fund segregation but unverified |

| Execution Risk | Medium | Reports of slippage and potential manipulation |

To mitigate these risks, traders should conduct thorough research and consider using risk management strategies, such as setting stop-loss orders and limiting their investment amounts.

Conclusion and Recommendations

In conclusion, the evidence suggests that Annexa Prime may not be the safest choice for traders. The lack of regulation, coupled with mixed customer feedback and potential issues with fund safety and execution, raises significant concerns. While the broker offers competitive trading conditions and a user-friendly platform, the associated risks may outweigh the benefits.

For traders seeking a reliable and secure trading environment, it is advisable to consider well-regulated alternatives. Brokers with established reputations and oversight from recognized regulatory bodies provide a higher level of security and peace of mind for investors. If you are contemplating trading with Annexa Prime, proceed with caution and ensure you are fully aware of the potential risks involved.

Is ANNEXA PRIME a scam, or is it legit?

The latest exposure and evaluation content of ANNEXA PRIME brokers.

ANNEXA PRIME Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ANNEXA PRIME latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.