tc global capital 2025 Review: Everything You Need to Know

1. Abstract

The tc global capital review shows a negative picture of this broker. Concerns about regulatory transparency and many user complaints are major problems that affect trust and safety. The broker does offer access to many asset types like forex, precious metals, stocks, cryptocurrencies, and energy. It also provides good leverage options from 1:100 to 1:300. However, these good points are hurt by the lack of clear regulatory information. Six user complaints have been documented, the WikiFX rating is only 1.34, and the Glassdoor score is 3.9/5. Potential clients should be very careful, especially when putting their money at risk. The broker seems to target intermediate and advanced traders who want different trading options. But the lack of transparency about minimum deposits, account types, funding methods, and bonus offers creates red flags. While the variety of assets and high leverage might appeal to some traders, the many concerns about oversight and service quality need careful thought before moving forward.

2. Notice

This evaluation uses available user feedback, industry standards, and market analysis. Several key details are missing from the provided summary. These include specific regulatory agencies, deposit and withdrawal methods, minimum deposit requirements, bonus promotions, trading platform types, and certain tool details. The assessment shows these information gaps. The methodology relies on documented user reviews, ratings from platforms like WikiFX and Glassdoor, and analysis of the broker's available service features. Users should treat this review as one factor in making a complete decision because critical regulatory and operational data is missing.

3. Rating Framework

4. Broker Overview

TC Global Capital started in 2022 and has its headquarters in Australia. It positions itself as a forex broker with global reach. The broker's business model focuses on providing different types of trading services, with foreign exchange being the main feature. It also offers other asset classes to traders. TC Global Capital targets active traders who want variety by offering high leverage ratios between 1:100 and 1:300. This appeals to those who want a more aggressive trading approach. However, the lack of complete regulatory disclosure has raised concerns about transparency and investor security. Despite these problems, the firm continues to attract traders because of its broad asset coverage and competitive leverage options.

TC Global Capital works to serve clients around the world by providing trading access to forex, precious metals, stocks, cryptocurrencies, and energy. The broker's specific trading platform details are not disclosed in the information summary. But it is clear that their business model targets traders who are comfortable with the complexities of each asset class. Regulatory oversight is missing from the available data. No specific regulatory bodies or licensing details were mentioned, which is something potential clients should think about carefully. The diverse asset base combined with high-risk, high-leverage options appeals mainly to intermediate and advanced traders who already know the potential risks and rewards of margin trading.

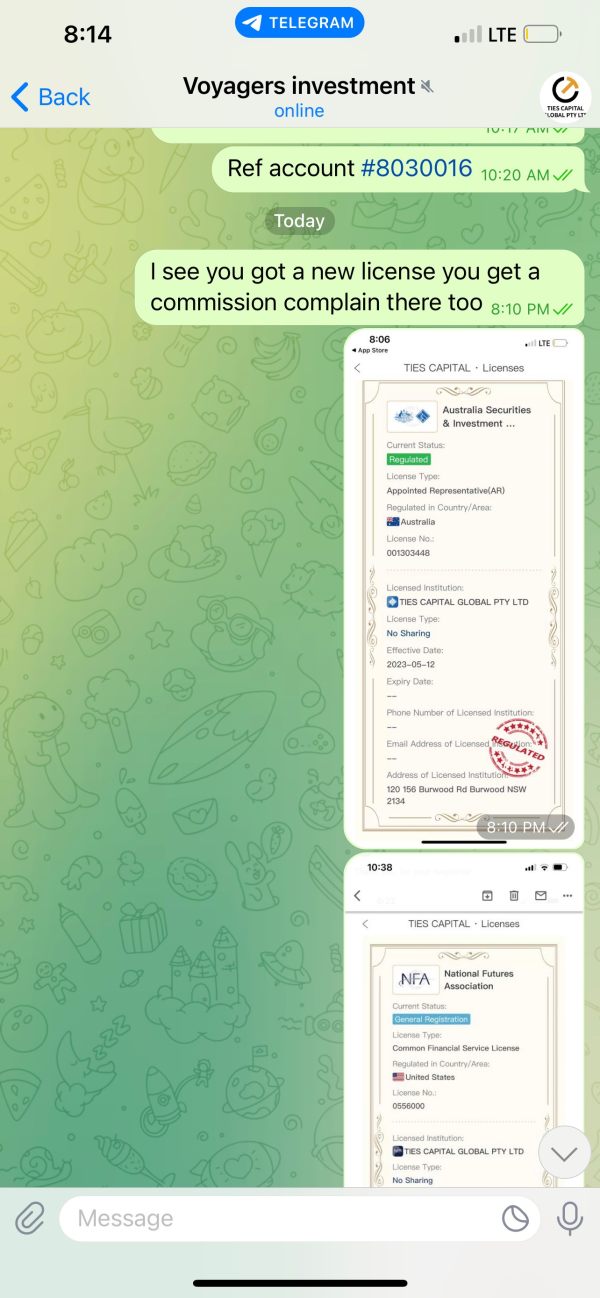

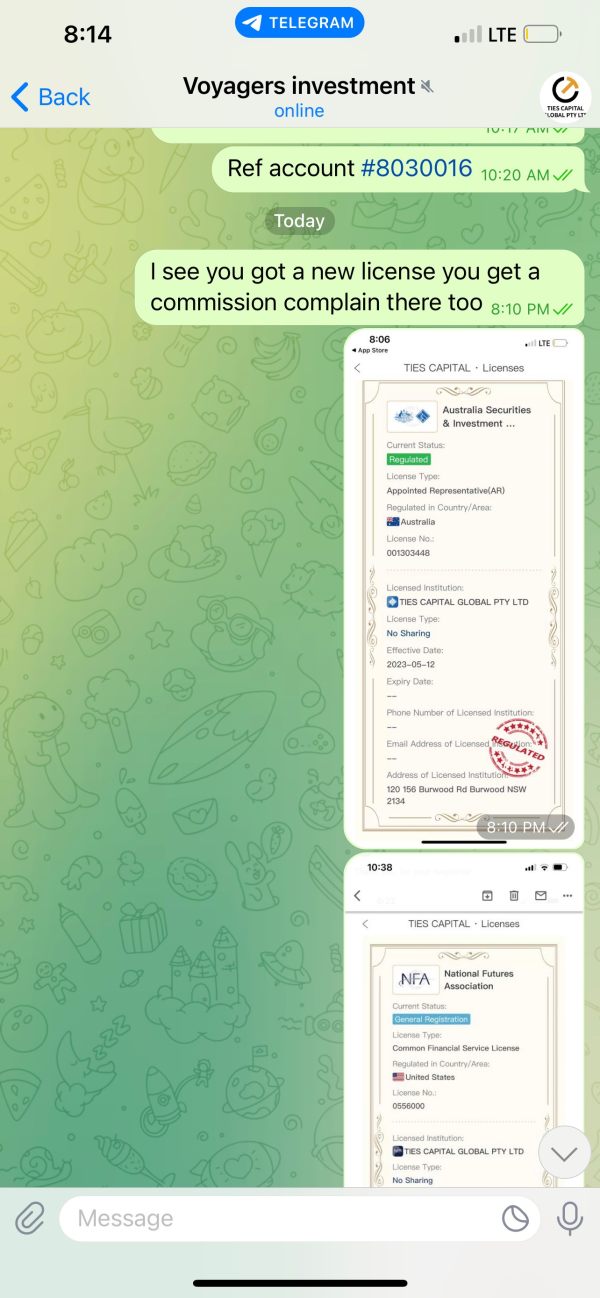

The regulatory environment for TC Global Capital is unclear because no concrete regulatory agencies or license numbers were provided. Details about deposit and withdrawal methods are also not mentioned. This leaves potential clients unsure about their funding options. The minimum deposit requirement has not been specified either. This creates more difficulties for new traders in understanding entry barriers. Information about bonus and promotion schemes is not available in the summary.

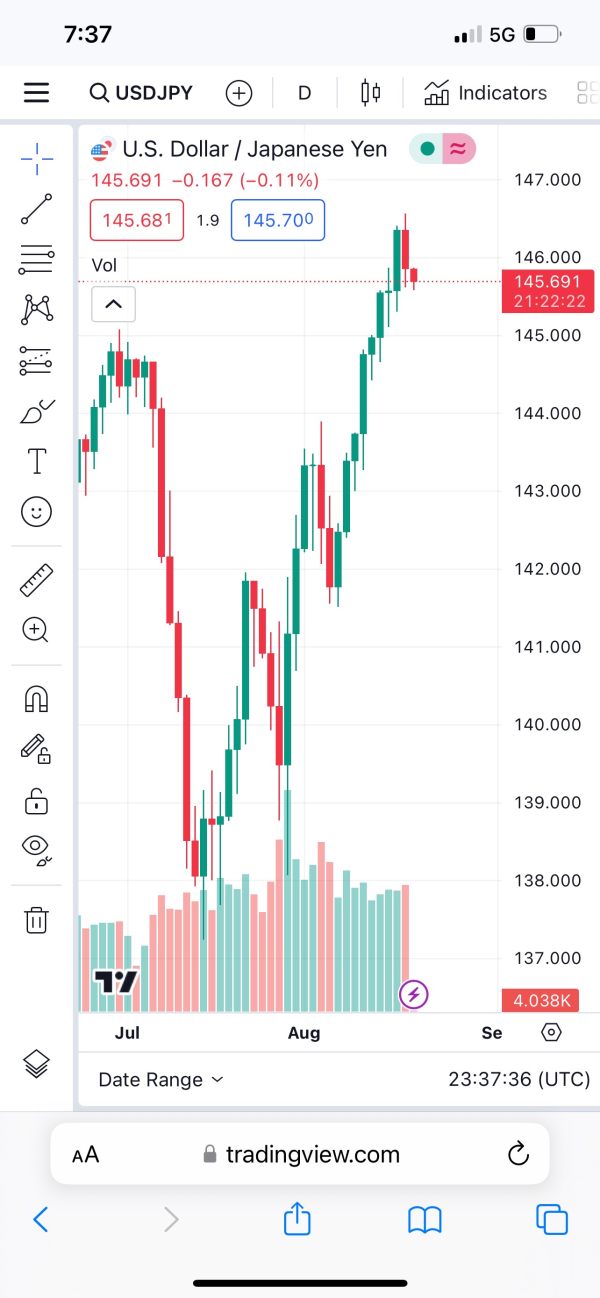

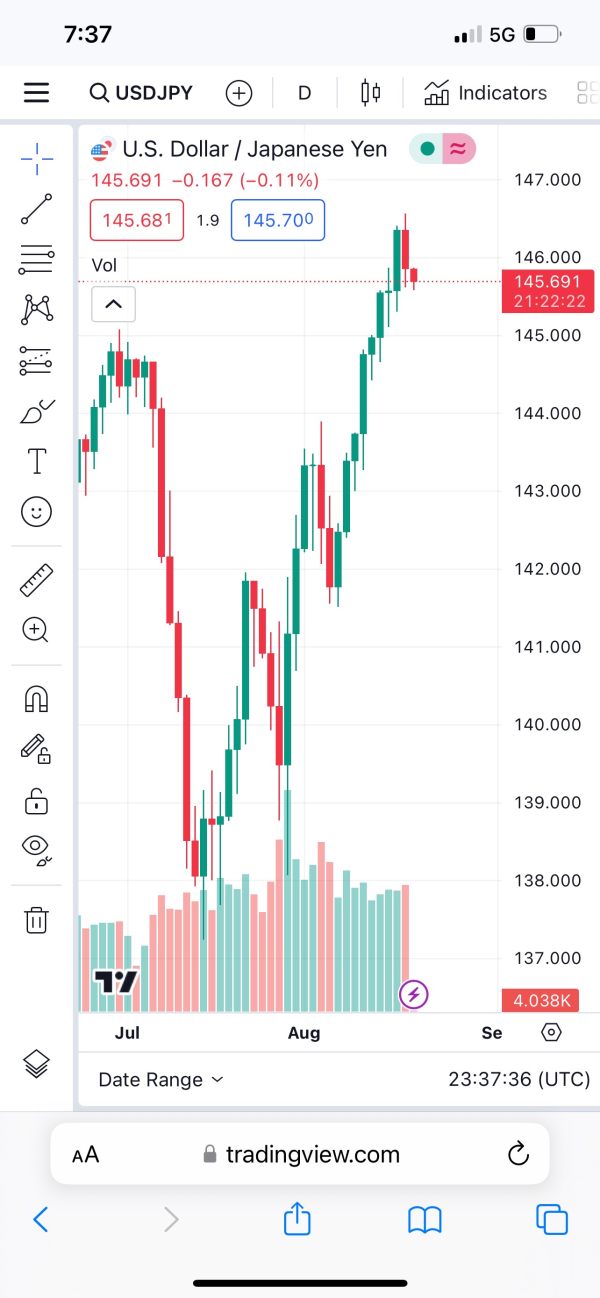

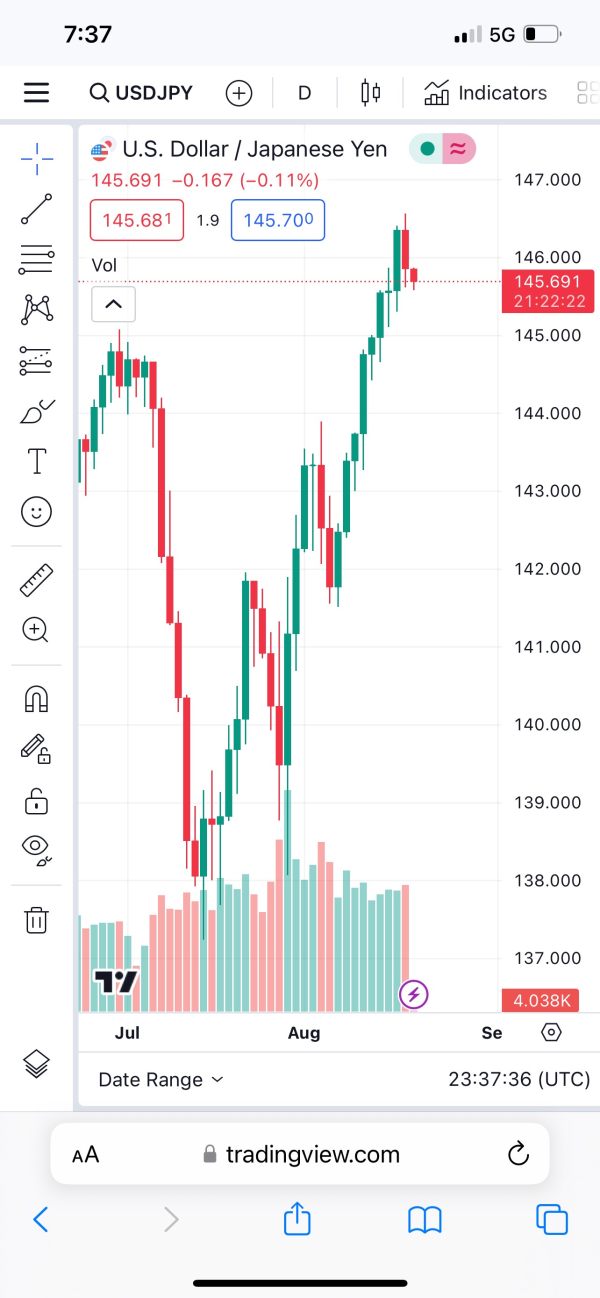

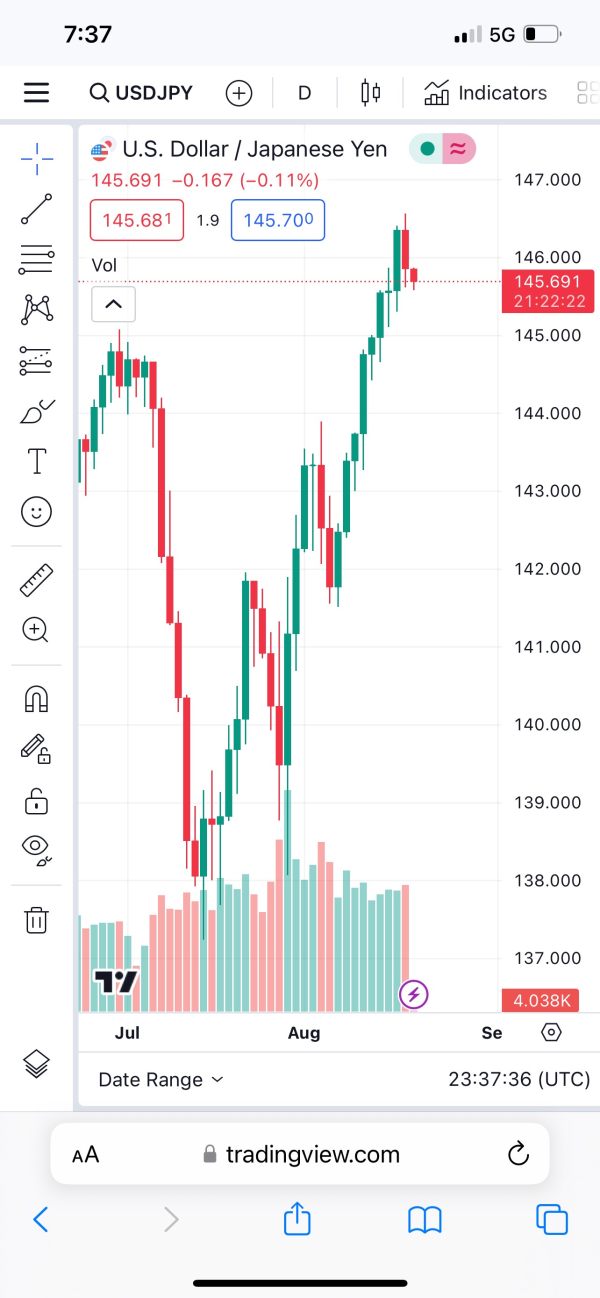

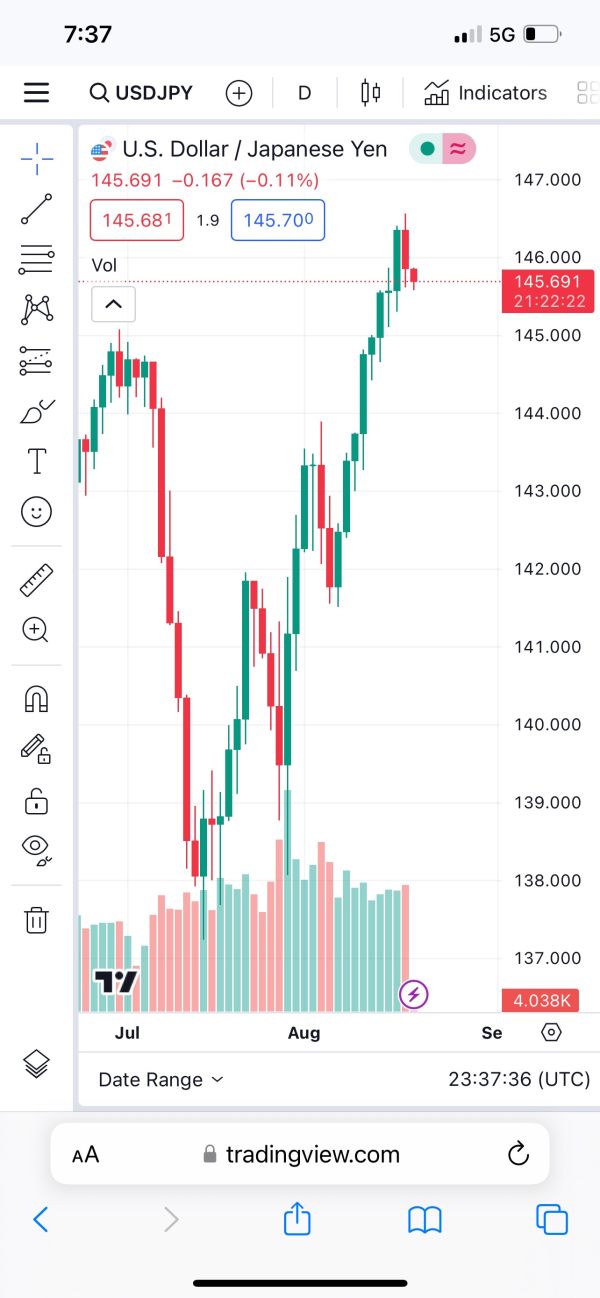

TC Global Capital offers trading in forex, precious metals, stocks, cryptocurrencies, and energy. This variety appeals to traders who want diversification. However, specifics about the cost structure, such as spreads and commission details, are not mentioned. Traders should seek more precise data before trading. The broker's leverage options range from 1:100 to 1:300, which is one of the few clear pieces of information available. This may attract high-risk traders who want to amplify their positions. Details on platform choices or the functionality and variety of available trading platforms are missing from the summary. There is also no reference to regional restrictions or limitations. The summary does not provide information on supported customer service languages either. While some aspects of the offering are clearly defined, significant operational details remain unspecified in this tc global capital review.

6. Detailed Rating Analysis

6.1 Account Conditions Analysis

The account conditions of TC Global Capital leave many critical details unaddressed. The information summary does not clarify the range of account types available. It also does not explain the minimum deposit requirements or the specifics of the account opening process. There is no mention of specialized accounts like Islamic accounts, which may be relevant for certain traders. This information gap contributes to an average score of 5/10. Potential clients are left without necessary details to make an informed decision. User feedback does not elaborate on the account opening experience or any associated benefits. No comparative data is available to benchmark these conditions against industry standards. The absence of concrete details about account functionality hurts the broker's appeal to cautious traders. These traders often require transparency in fee structures and account management processes. Due to these missing elements, this tc global capital review highlights the need for further disclosure to earn higher trust and a more robust account-based offering.

The analysis of TC Global Capital's trading tools and resources shows a significant lack of specific details. The broker offers access to forex, precious metals, stocks, cryptocurrencies, and energy. However, the information summary does not explain the quality or variety of trading tools available. There is no description of the charting software, risk management tools, or automated trading support. These tools could enhance trading performance for users. Resources like market analysis, research reports, or educational materials are not mentioned either. This lack of detailed information raises concerns about whether the broker's toolkit can meet the needs of advanced traders. These traders typically rely on sophisticated resources for decision-making. The scarcity of this information in our tc global capital review adds to existing uncertainties about overall service quality. Without comprehensive data on the technologies and resources provided, users wonder if the broker truly supports an efficient and resourceful trading environment.

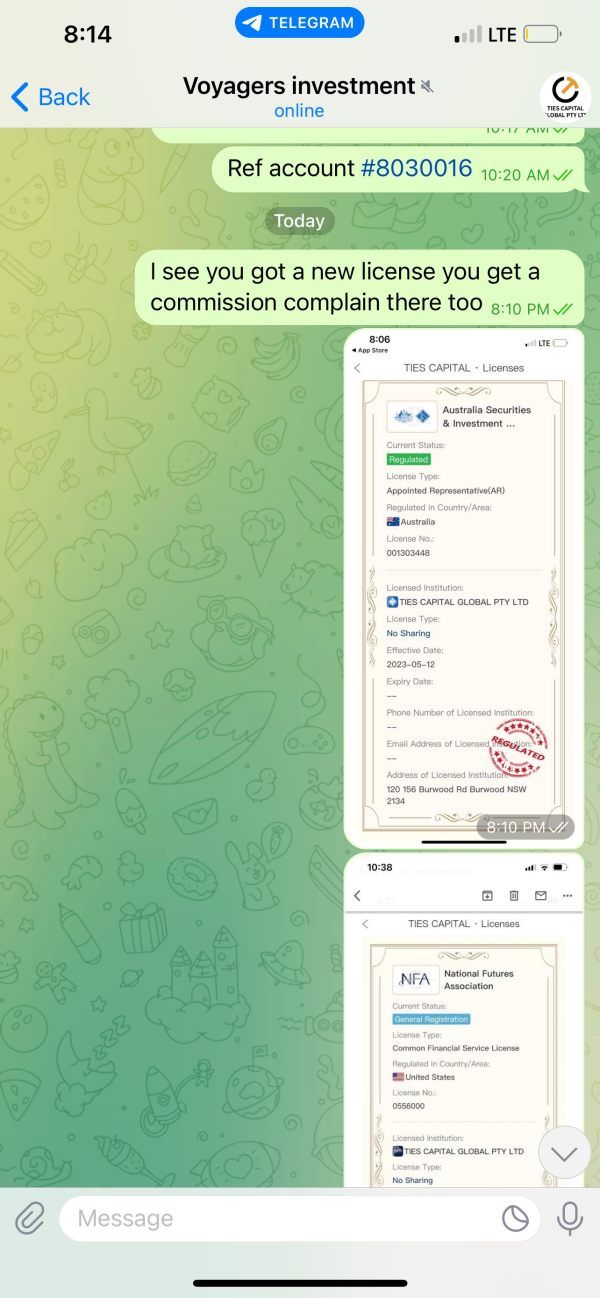

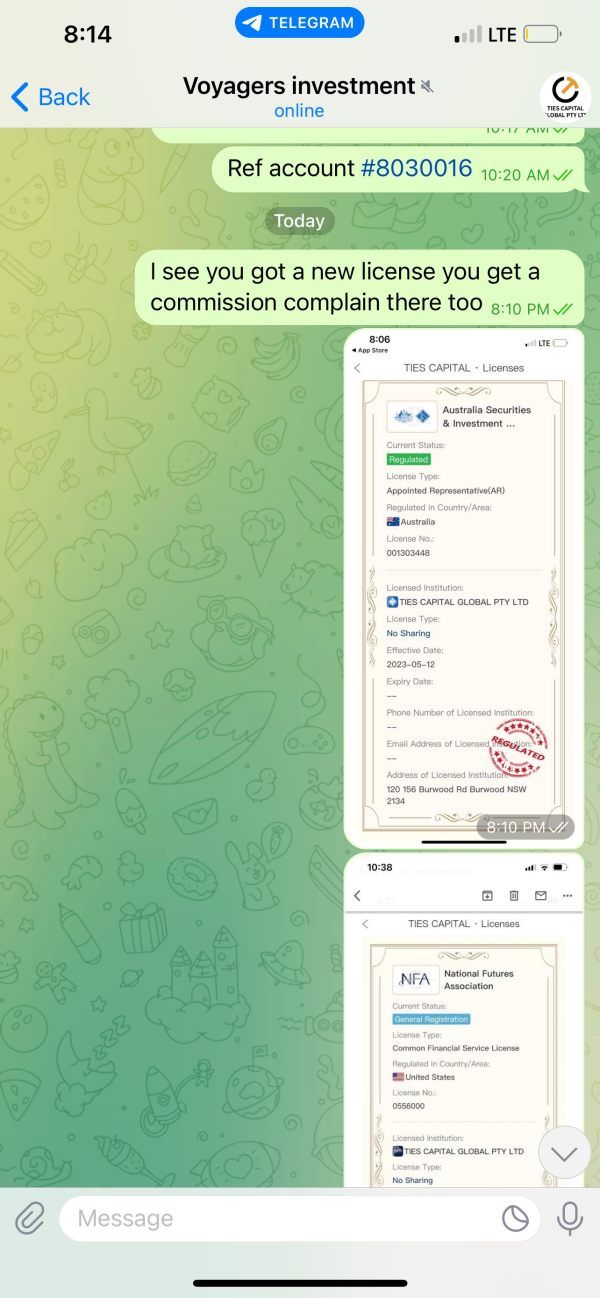

6.3 Customer Service and Support Analysis

TC Global Capital's customer service and support evaluation reveals several shortcomings. The information summary does not clarify available support channels. It also does not mention business hours or the languages in which support is offered, which is crucial for global clients. User feedback indicates a high number of complaints with six documented incidents. This signals potential issues with response times or the professionalism of assistance provided. The lack of specific details about the support process makes it hard to determine if the broker has an efficient problem-resolution mechanism. Several users said their issues were not properly addressed. This further supports the low score of 4/10 in this category. Effective customer service is a cornerstone of reliable brokerage operations, so the deficiencies in this area are concerning. The absence of a robust customer support framework, combined with multiple unresolved complaints, highlights a significant weakness in the broker's overall operational strategy.

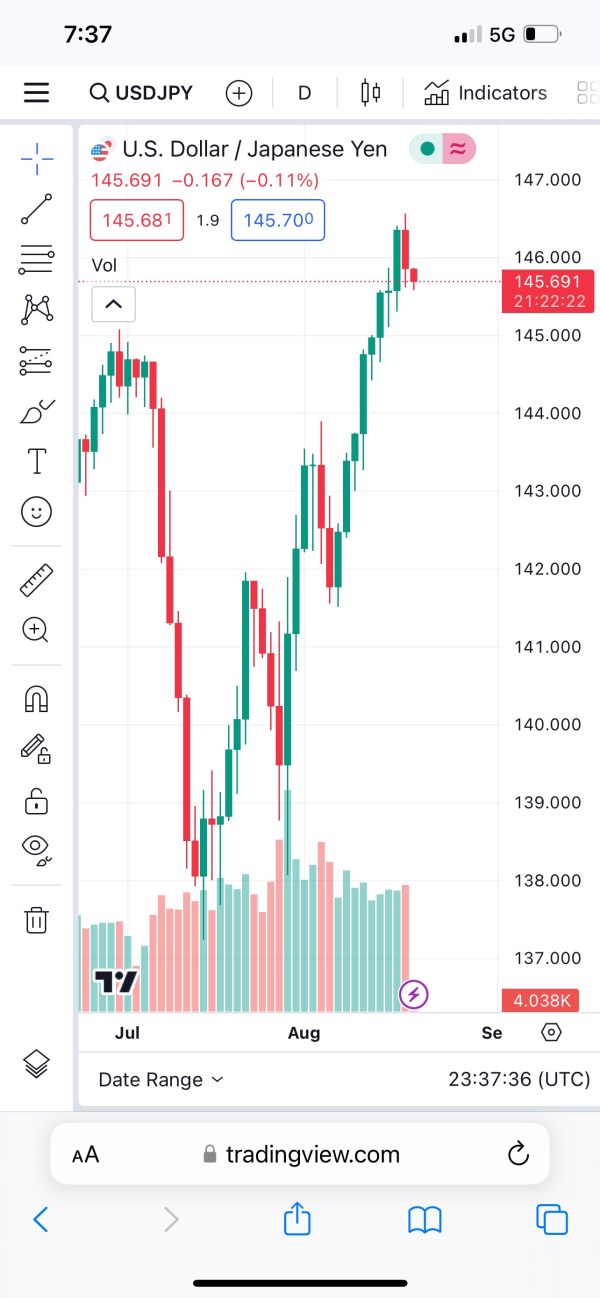

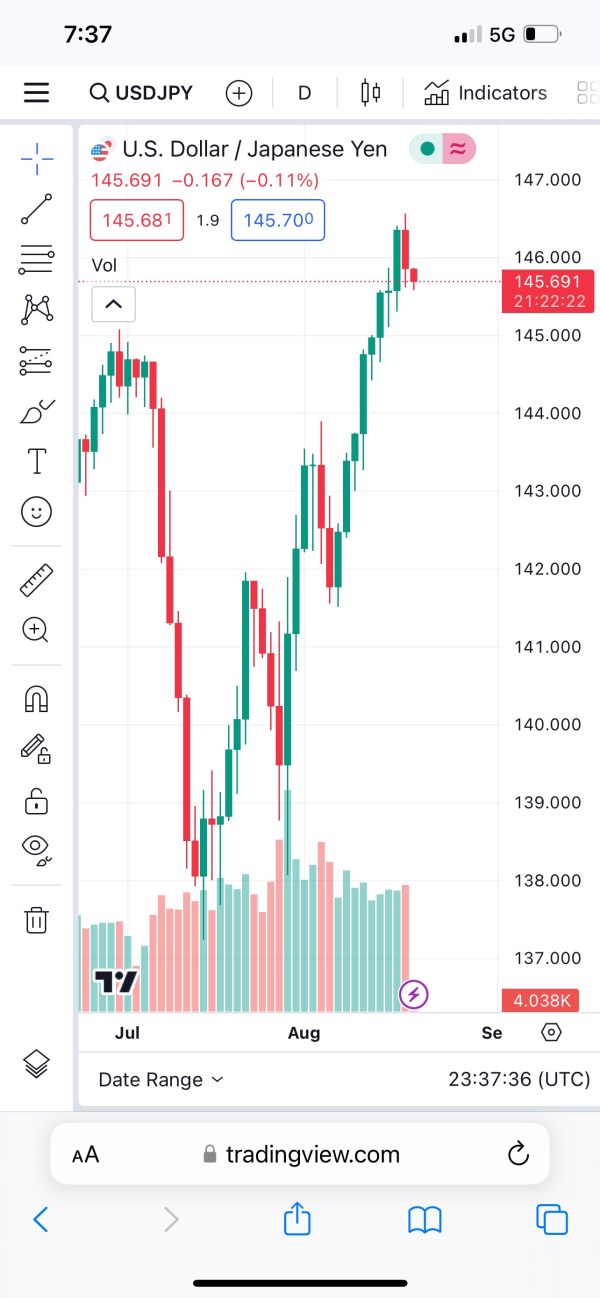

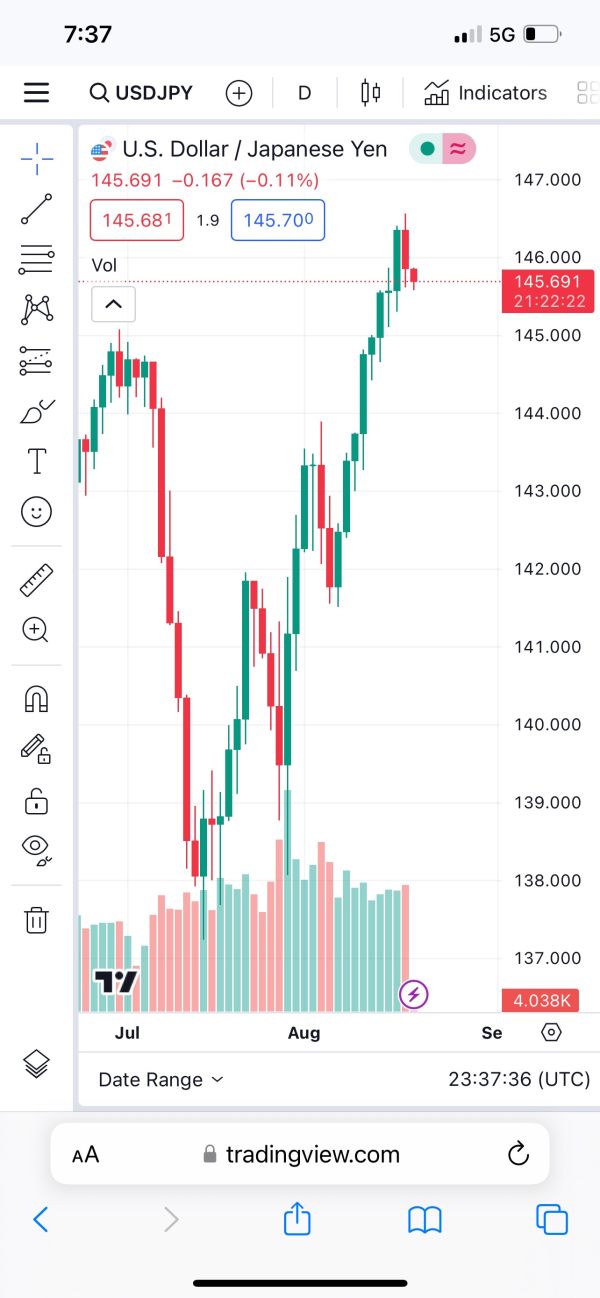

6.4 Trading Experience Analysis

The trading experience offered by TC Global Capital presents mixed results. User feedback shows that while the platform executes orders quickly, there are technical issues that cause problems. These include occasional crashes and high battery consumption on mobile devices that disrupt trading. Specific details on other platform features like order execution quality or advanced trading options are not provided. These technical problems hurt the otherwise positive aspects of execution speed and convenience. The mobile application is praised for its intuitive design. However, it still faces challenges that result in instability under certain operating conditions. Such performance problems can lead to significant disruptions during volatile market periods. This affects both execution and risk management abilities. This mix of good and bad performance justifies a moderate score of 6/10. While the tc global capital review highlights a platform that is functionally capable and user-friendly, its reliability issues require urgent attention and improvement to elevate the overall trading experience.

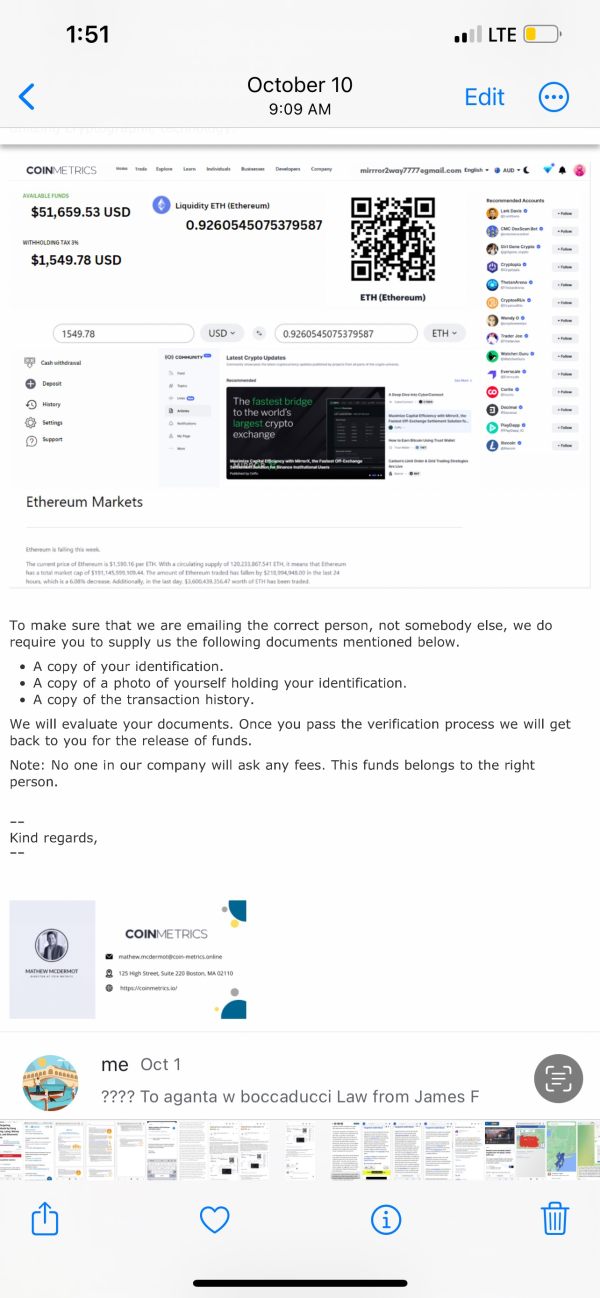

6.5 Trust Analysis

Trust is critical when selecting a broker, and TC Global Capital falls short in this area. The provided information offers no clear regulatory credentials. No specific regulatory agencies or license numbers were disclosed, which raises valid concerns about oversight and investor protection. The WikiFX rating of 1.34 is alarmingly low. This serves as a strong indicator of underlying issues that affect reliability and credibility. Multiple user complaints further highlight this lack of trust. This suggests that funds may not be as secure as traders would expect. Transparency is essential for establishing trust, but it is notably compromised by the absence of detailed background information. The broker also lacks adherence to industry norms regarding regulation and financial safeguards. The trust score has been rated at 3/10, emphasizing the need for the broker to address these critical gaps immediately.

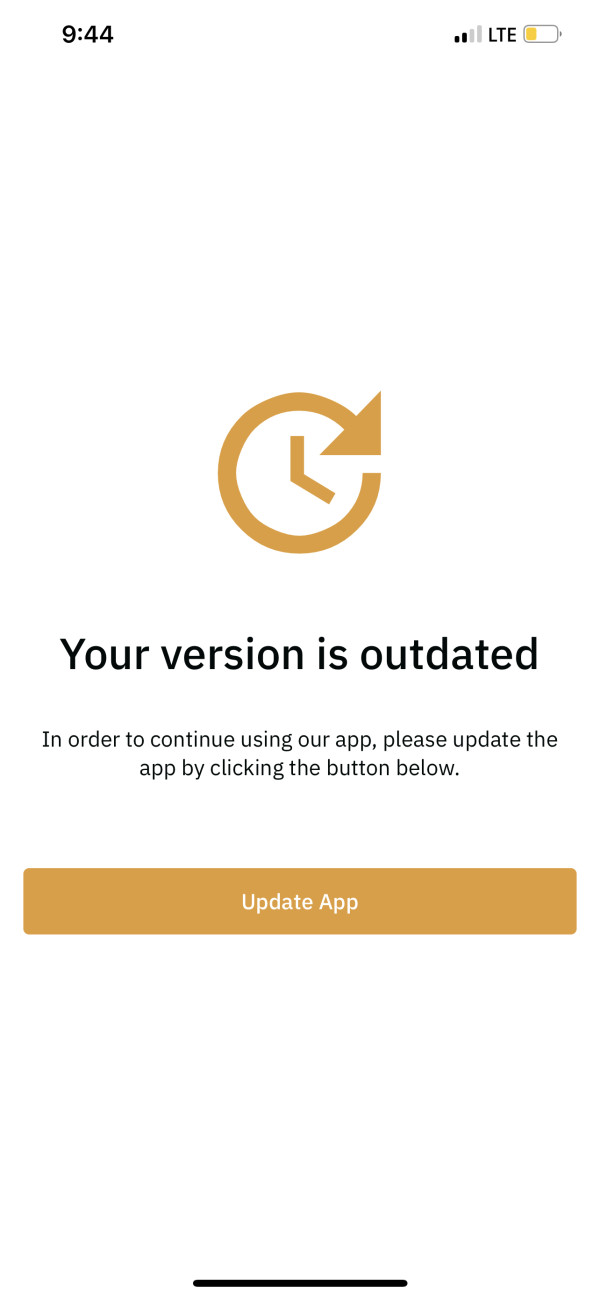

6.6 User Experience Analysis

The user experience of TC Global Capital appears to be a mix of positive and negative elements. The platform is reported to be convenient and user-friendly. It has an intuitive interface that appeals to traders seeking a straightforward execution environment. However, repeated issues like high battery consumption and intermittent platform crashes have hurt the overall experience. The summary does not provide comprehensive details on the registration or verification process. It also does not discuss the ease of making transactions. These unresolved issues contribute to an overall rating of 5/10 in the user experience category. The feedback indicates that while the broker attracts users with its diverse asset offerings and competitive leverage, persistent technical glitches and service interruptions reduce overall satisfaction. As highlighted in this tc global capital review, improvements in platform stability and responsiveness could substantially enhance the trader's day-to-day interaction with the service.

7. Conclusion

The overall evaluation of TC Global Capital reveals significant concerns, particularly in trust and user support areas. The broker offers an attractive range of asset classes and high leverage options. These could suit intermediate and advanced traders looking for diversification. However, its lack of regulatory transparency, unspecified account details, and technical inconsistencies raise critical warnings. The mixed trading experience, combined with recurring customer complaints and a low WikiFX rating, shows the importance of caution when considering this broker. The tc global capital review suggests that while there are some appealing features, prospective clients should conduct thorough research and consider these risk factors before getting involved.