Is Admfx safe?

Business

License

Is ADMFX A Scam?

Introduction

ADMFX is a forex broker that has recently entered the market, claiming to offer a range of trading services including forex, CFDs, and cryptocurrencies. As with any trading platform, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with opportunities, but it also attracts its fair share of scams. Therefore, understanding the regulatory environment, company background, trading conditions, and customer experiences is essential for evaluating whether ADMFX is safe for trading. This article employs a comprehensive framework that includes regulatory analysis, company background investigation, trading conditions review, and customer feedback to assess the legitimacy of ADMFX.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. A regulated broker is often subject to stringent oversight, which helps protect traders from fraud and malpractice. Unfortunately, ADMFX is not regulated by any major financial authority, which raises significant red flags. The absence of regulation means that traders have limited recourse in the event of disputes or financial losses.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulatory oversight is concerning, especially given the potential for fraudulent activities in unregulated environments. Historical compliance issues and the broker's operational transparency are also critical considerations. Without a regulatory framework, ADMFX is not held accountable to any external standards, making it risky for traders to invest their money. This lack of oversight raises the question: Is ADMFX safe? The answer is complicated, but the absence of regulatory protections is a significant risk factor.

Company Background Investigation

Understanding the company behind a trading platform is vital for assessing its reliability. ADMFX claims to be based in Hong Kong, but information about its ownership structure and operational history is scarce. The company appears to have been established recently, which could indicate a lack of experience in the industry.

The management team‘s background is also a critical factor. A well-experienced team can enhance a broker's credibility, but information about ADMFX’s management appears to be minimal. This lack of transparency raises questions about the broker's intentions and operational integrity. It is essential to have access to detailed company information and disclosures to determine whether ADMFX is safe for trading.

Furthermore, the overall transparency of the broker is lacking, which compounds the concerns surrounding its legitimacy. Traders should be wary of companies that do not provide clear and verifiable information about their operations, team, and regulatory status.

Trading Conditions Analysis

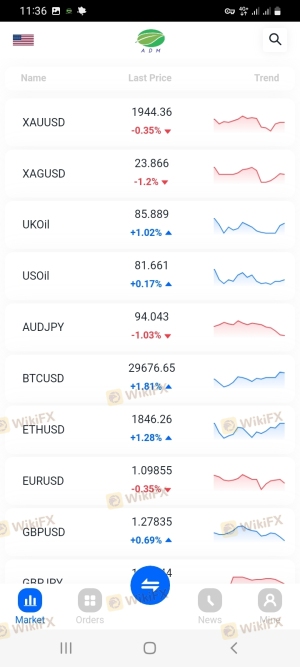

The trading conditions offered by a broker can significantly impact a trader's profitability. ADMFX claims to offer competitive spreads and a variety of trading instruments, but the lack of clarity regarding its fee structure is concerning.

| Fee Type | ADMFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

Without specific details on spreads, commissions, and overnight interest rates, it is challenging to assess whether ADMFX's trading conditions are competitive. Unusual or hidden fees can erode profits and make trading less viable. This uncertainty leads to the question: Is ADMFX safe? The answer hinges on the clarity and fairness of its trading conditions, which currently remain ambiguous.

Client Fund Safety

Client fund safety is paramount in the trading industry. A reputable broker should implement stringent measures to protect traders' funds, including segregated accounts and investor protection schemes. However, ADMFXs lack of regulatory oversight raises questions about its fund safety protocols.

The absence of clear information regarding fund segregation, negative balance protection, and investor compensation schemes is alarming. Historical issues related to fund security can also indicate a broker's reliability. In the case of ADMFX, the lack of transparency raises doubts about whether ADMFX is safe for traders to deposit their funds.

Customer Experience and Complaints

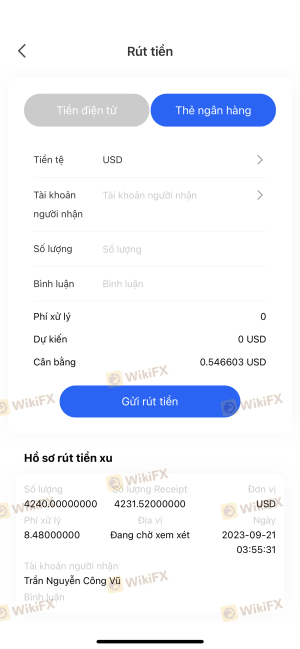

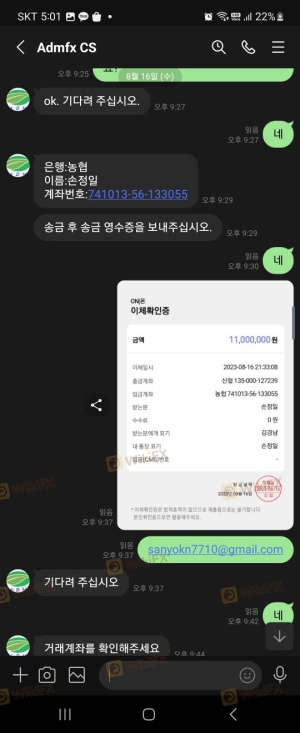

Customer feedback is a valuable indicator of a broker's reliability. A review of online forums and complaint boards reveals a pattern of negative experiences from ADMFX users. Common complaints include difficulties in withdrawing funds, unresponsive customer support, and pressure to deposit more money.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

| Misleading Information | High | Poor |

One notable case involved a trader who reported being unable to withdraw their funds after multiple requests. The broker's lack of communication and transparency exacerbated the situation, leading to significant frustration. Such complaints raise serious questions about the integrity of ADMFX and whether ADMFX is safe for trading.

Platform and Trade Execution

The trading platform's performance is crucial for ensuring a smooth trading experience. ADMFX claims to offer a user-friendly platform, but the lack of detailed reviews regarding its stability and execution quality is concerning. Issues like slippage and order rejections can significantly impact trading outcomes.

If traders experience frequent issues with order execution, it raises the question of whether the broker is manipulating trades. This potential for platform manipulation is a significant risk factor that traders must consider when evaluating if ADMFX is safe.

Risk Assessment

Using ADMFX as a trading platform presents several risks. The absence of regulation, unclear trading conditions, and negative customer experiences contribute to a high-risk profile.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Lack of clarity in fee structure |

| Operational Risk | Medium | Poor customer service and support |

To mitigate these risks, traders should consider diversifying their investments, using a demo account to test the platform, and thoroughly researching any broker before committing funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that ADMFX raises several red flags that warrant caution. The lack of regulatory oversight, negative customer feedback, and unclear trading conditions all point to potential risks. Therefore, it is reasonable to question whether ADMFX is safe for trading.

For traders seeking reliable alternatives, consider brokers that are well-regulated, have transparent trading conditions, and maintain a positive reputation among users. Some recommended brokers include those regulated by the FCA or ASIC, which offer robust protections for traders. Always prioritize safety and transparency when selecting a trading platform.

Is Admfx a scam, or is it legit?

The latest exposure and evaluation content of Admfx brokers.

Admfx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Admfx latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.