Is SCE Group safe?

Pros

Cons

Is SCE Group Safe or a Scam?

Introduction

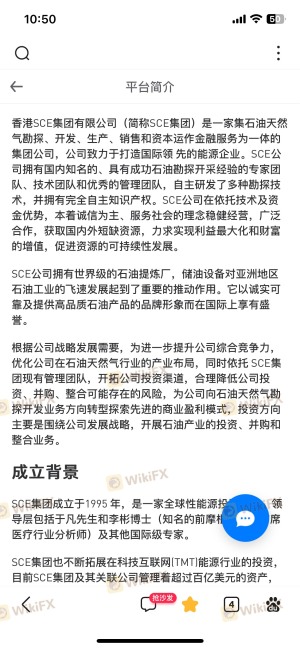

SCE Group, officially known as SCE Group Co., Ltd, is a financial services company based in Hong Kong that primarily operates in the Forex market. Established with the ambition of becoming a leading player in the international financial services sector, SCE Group offers a wide range of trading instruments, including Forex, commodities, and indices. Given the rapid growth of online trading and the increasing number of brokerage firms, it is crucial for traders to meticulously evaluate the legitimacy and safety of trading platforms before committing their funds. This article aims to provide a comprehensive analysis of SCE Group's regulatory status, company background, trading conditions, customer safety, client experiences, and overall risk assessment. Our investigation is based on a review of multiple reputable sources, including financial regulatory bodies and trader feedback platforms, ensuring a well-rounded evaluation of whether SCE Group is safe or a scam.

Regulation and Legitimacy

The regulatory status of a brokerage firm is a critical factor in assessing its safety and credibility. SCE Group operates without any valid regulatory oversight, which significantly raises concerns about its practices and investor protection. The absence of regulation means that the company is not subject to the scrutiny of any financial authority, potentially exposing traders to higher risks. Below is a summary of the core regulatory information regarding SCE Group:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Hong Kong | Unverified |

The lack of regulation is alarming, especially considering that reputable brokers are typically licensed by recognized financial authorities that enforce compliance with strict operational standards. Without such oversight, traders are left vulnerable to potential misconduct, including issues related to fund mismanagement and withdrawal difficulties. Additionally, reports have surfaced regarding clients experiencing challenges when attempting to withdraw their funds, further substantiating claims that SCE Group is not safe.

Company Background Investigation

SCE Group has been operational for approximately 2 to 5 years, with its headquarters situated in Hong Kong. Despite its relatively short history, the company claims to have a dedicated team of experienced professionals in the financial sector. However, the absence of a well-documented history raises questions about its ownership structure and overall transparency.

The management teams background is critical in evaluating the credibility of the firm. Unfortunately, specific details regarding the qualifications and professional experiences of the management team are limited, making it difficult to ascertain their expertise in financial services. Furthermore, the company's communication is predominantly through email, which may limit accessibility for some clients. Transparency in operations is essential for building trust, and the lack of comprehensive information about the management team contributes to the skepticism surrounding whether SCE Group is safe.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. SCE Group presents itself as a competitive option in the Forex market, but its trading conditions warrant scrutiny. The broker has a high minimum deposit requirement of $10,000, which could be a barrier for many potential traders.

The following table summarizes the core trading costs associated with SCE Group:

| Cost Type | SCE Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Variable | Varies |

While SCE Group claims to offer competitive spreads, the high minimum deposit requirement and lack of clarity regarding commission structures may deter retail traders. Additionally, the absence of a transparent fee structure raises concerns about potential hidden fees, which could further complicate the trading experience. These conditions contribute to the perception that SCE Group may not be a safe choice for traders seeking a reliable and transparent trading environment.

Customer Fund Safety

The safety of customer funds is paramount in any trading environment. SCE Group asserts that it employs measures to protect client funds by keeping them segregated in reputable banks. However, the absence of regulatory oversight raises questions about the effectiveness of these measures.

Key aspects of fund safety include:

- Segregation of Funds: While SCE Group claims to maintain segregated accounts, the lack of verification from a regulatory body means there is no assurance that these practices are consistently adhered to.

- Investor Protection: Without regulation, clients' investments are not safeguarded by any legal frameworks, leaving them exposed to significant risks.

- Negative Balance Protection: There is no information available regarding whether SCE Group offers negative balance protection, which is a crucial feature for risk management.

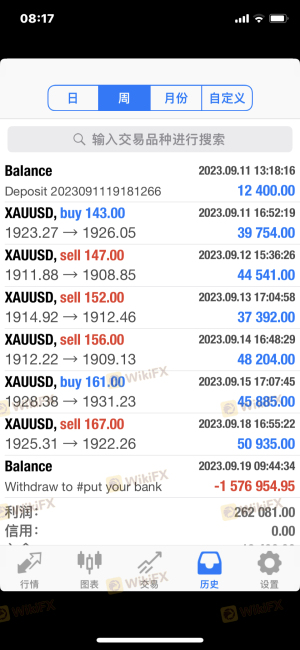

The historical context of fund safety issues is also concerning, as numerous reports have surfaced regarding clients facing difficulties with withdrawals. Such incidents highlight the potential risks associated with trading through an unregulated broker, leading to the conclusion that SCE Group is not safe.

Customer Experience and Complaints

Customer feedback serves as a valuable indicator of a broker's reliability and service quality. Reviews of SCE Group reveal a mixed bag of experiences, with several clients reporting significant issues, particularly related to fund withdrawals.

The following table outlines the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Average |

| High Minimum Deposit Concern | Medium | Average |

Common complaints include challenges in accessing funds, lack of communication from customer support, and concerns regarding the transparency of trading conditions. For instance, some users have reported being unable to withdraw their funds after depositing, which poses a serious red flag regarding the broker's operations. Such complaints contribute to the growing sentiment that SCE Group may be a scam rather than a trustworthy trading platform.

Platform and Trade Execution

The trading platform offered by SCE Group is crucial in determining the overall trading experience. The broker provides access to the widely used MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading tools. However, the platform's performance, stability, and execution quality are essential factors to consider.

Users have reported mixed experiences with order execution, with some noting instances of slippage and rejection of orders during volatile market conditions. These issues can significantly impact trading outcomes, especially for those employing high-frequency trading strategies. The potential for platform manipulation, although not explicitly reported, remains a concern due to the lack of regulatory oversight and transparency in operations.

Risk Assessment

Engaging with SCE Group involves several risks that traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight |

| Fund Safety Risk | High | Reports of withdrawal issues |

| Transparency Risk | Medium | Limited information on management |

| Trading Conditions Risk | Medium | High minimum deposit and unclear fees |

To mitigate these risks, potential traders should conduct thorough research and consider engaging with well-regulated brokers that offer clear and transparent trading conditions. Additionally, traders should only invest funds they can afford to lose and utilize risk management strategies to protect their capital.

Conclusion and Recommendations

In conclusion, the evidence suggests that SCE Group is not a safe trading option for Forex traders. The lack of regulatory oversight, coupled with reports of withdrawal issues and a high minimum deposit requirement, raises significant red flags regarding the broker's legitimacy. While the company may present itself as a viable trading platform, the risks associated with trading through an unregulated broker far outweigh any potential benefits.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are properly regulated and have a proven track record of customer satisfaction. Some recommended alternatives include brokers regulated by recognized financial authorities, which can provide the necessary protections and transparency that SCE Group lacks. Always prioritize safety and due diligence when selecting a trading platform to protect your investments.

Is SCE Group a scam, or is it legit?

The latest exposure and evaluation content of SCE Group brokers.

SCE Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SCE Group latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.