FXTrategy 2025 Review: Everything You Need to Know

Executive Summary

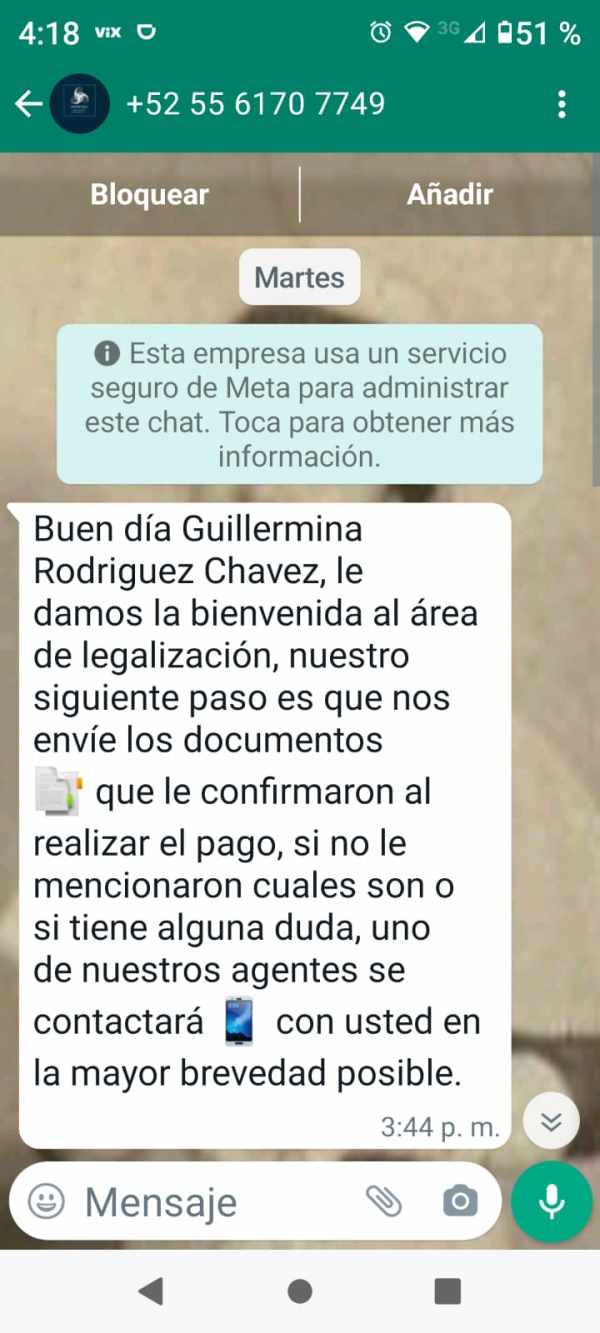

This fxtrategy review shows a troubling picture of a broker that has gotten lots of negative attention from traders. FXTrategy says it offers competitive forex and CFD trading with low costs starting from zero fees, but the truth looks much more complex and worrying.

FXTrategy claims it gives access to different trading assets like forex pairs and contracts for difference. The company targets traders who want low costs with competitive fee structures. However, many sources show serious concerns about whether this broker is legitimate and how it operates. Scam Brokers Reviews has flagged the platform for questionable business practices, and their review suggests traders should completely avoid this broker.

The broker's regulatory status stays unclear with no real licensing information from major financial authorities. This lack of transparency combines with many user complaints and warnings from industry watchdogs to raise big red flags about FXTrategy's reliability and trustworthiness as a trading partner.

Some positive user feedback highlights the platform's competitive pricing structure. The overwhelming consensus from regulatory bodies and review platforms suggests extreme caution when considering FXTrategy for trading activities.

Important Notice

This review uses available information from multiple sources as of 2025. FXTrategy's regulatory status and operational details may vary across different jurisdictions, so potential clients should do their own research before working with any financial services provider.

Readers should know that forex and CFD trading involves substantial risk and may not suit all investors. Always verify a broker's regulatory status independently before making any financial commitments.

Rating Overview

Broker Overview

FXTrategy presents itself as a forex and CFD trading broker that targets retail traders with promises of competitive fees and diverse assets. The company's establishment date and corporate background remain unclear in available documentation, which immediately raises concerns about transparency and regulatory compliance.

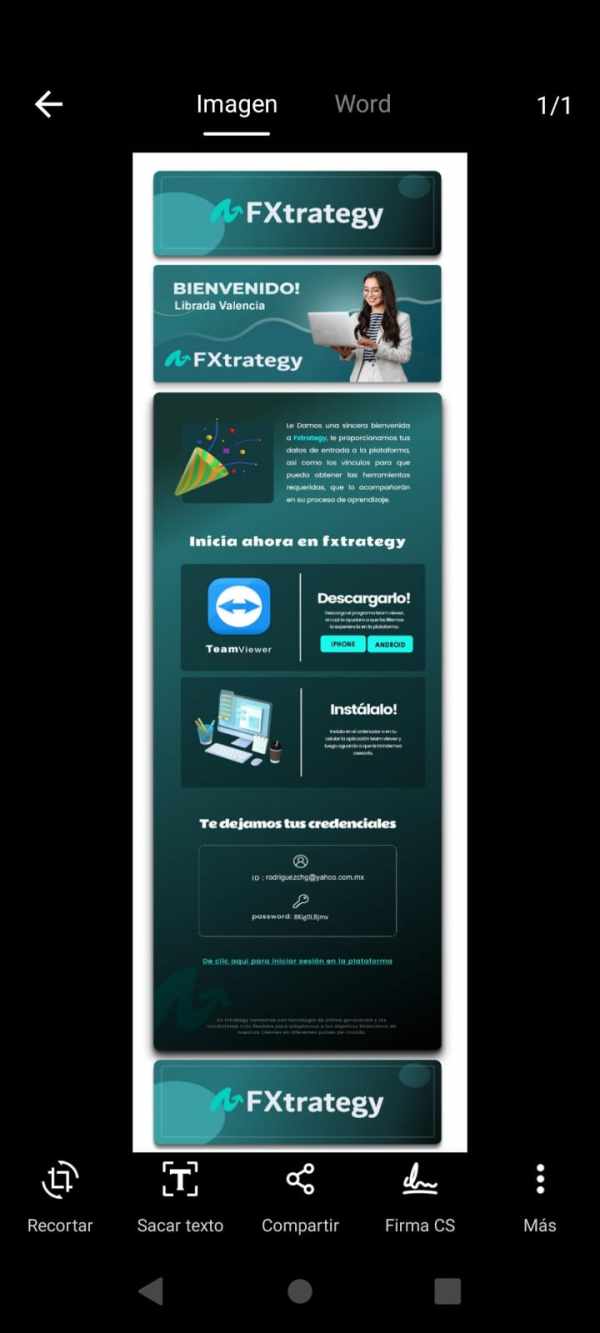

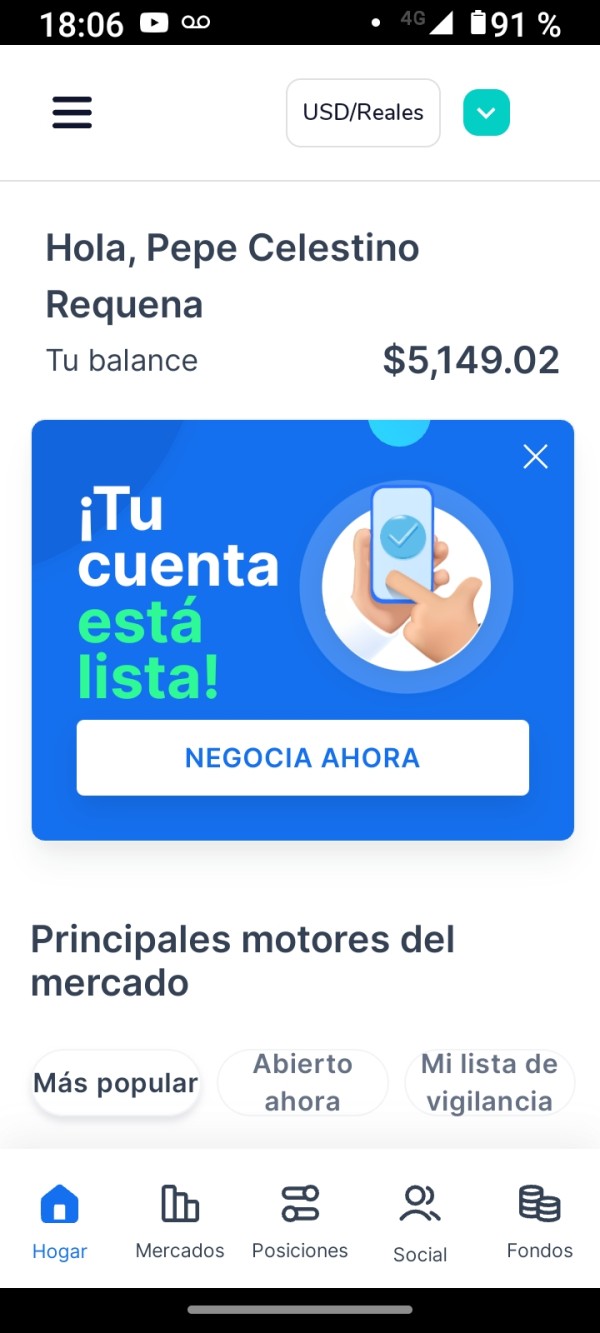

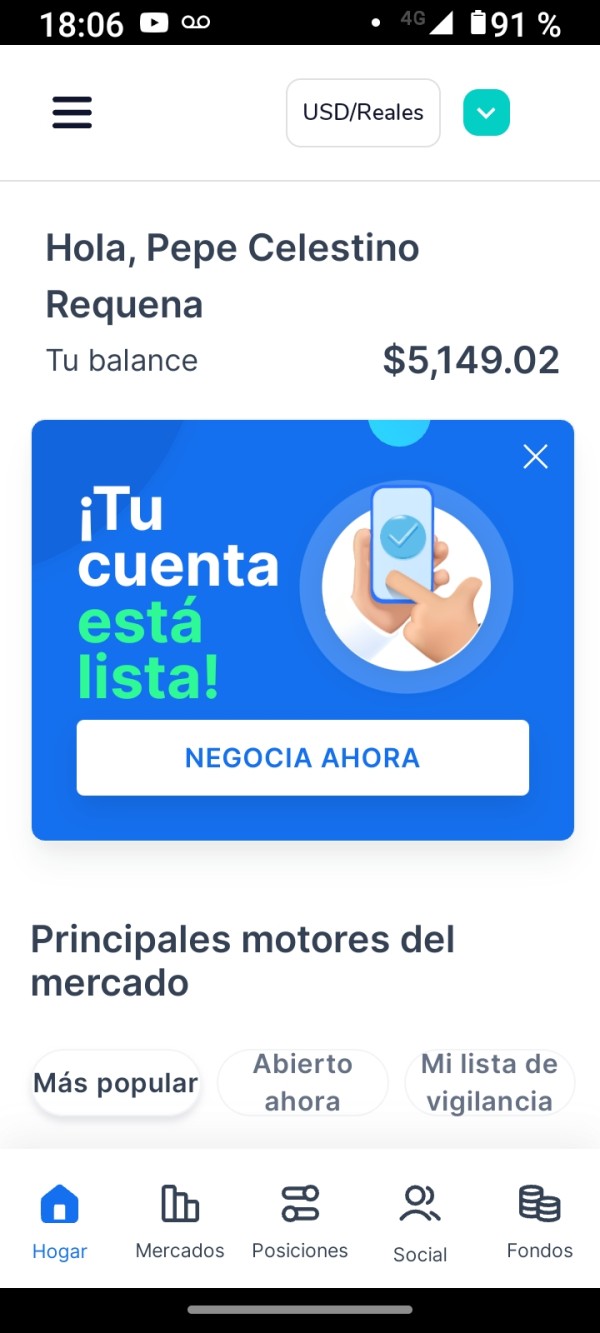

The broker's business model focuses on attracting cost-sensitive traders through promotional claims of zero-cost trading options and competitive spreads. However, WikiBit and other industry monitoring services have flagged FXTrategy for potential fraudulent activities, suggesting that the attractive pricing may hide more concerning operational practices.

FXTrategy claims to offer trading access to major forex pairs and various CFD instruments. Specific details about trading platforms, execution methods, and actual trading conditions remain vague in official communications. This lack of detailed information about core trading infrastructure is particularly concerning for a company operating in the highly regulated financial services sector.

The broker's regulatory status is notably absent from major financial authority databases. No verifiable licensing information has been identified through standard regulatory channels. This regulatory vacuum combines with negative industry assessments to position FXTrategy as a high-risk option for potential traders.

Regulatory Status: Available information does not show any verifiable regulatory oversight from recognized financial authorities. This absence of regulatory supervision represents a significant risk factor for potential clients.

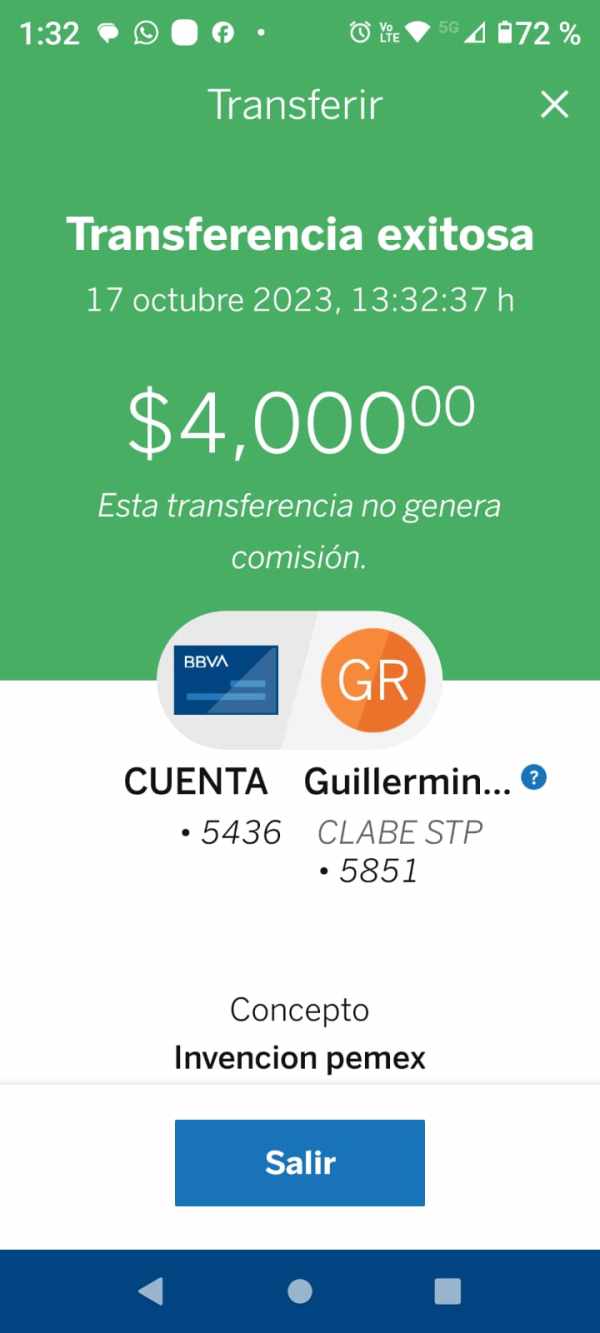

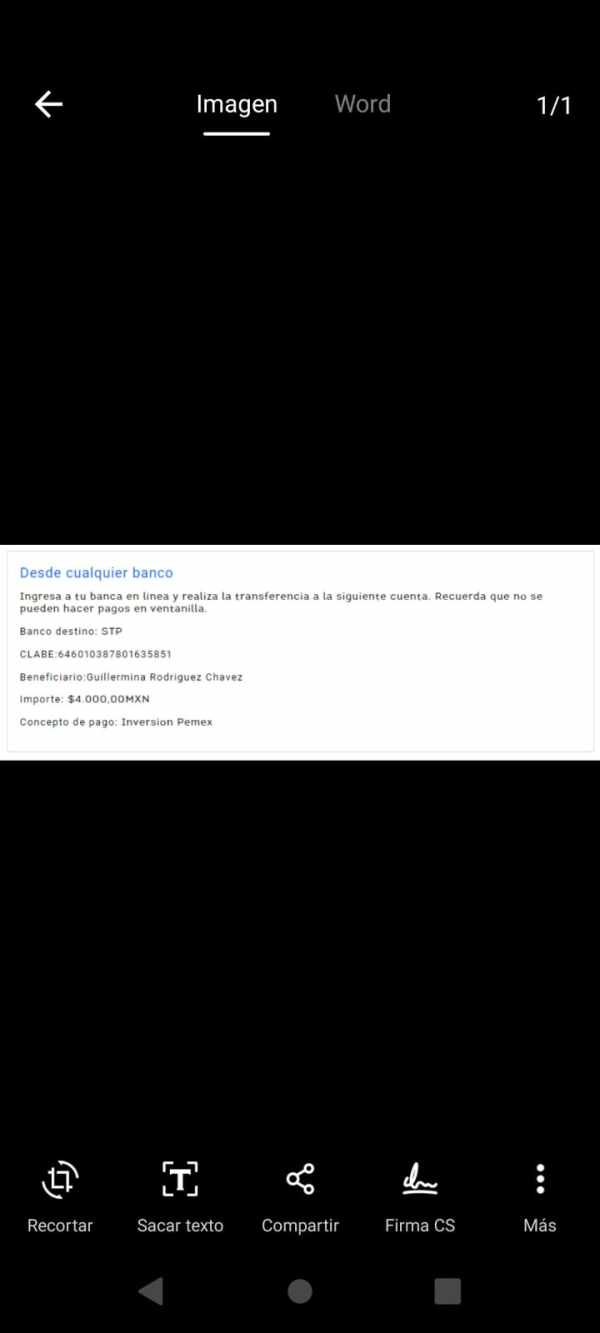

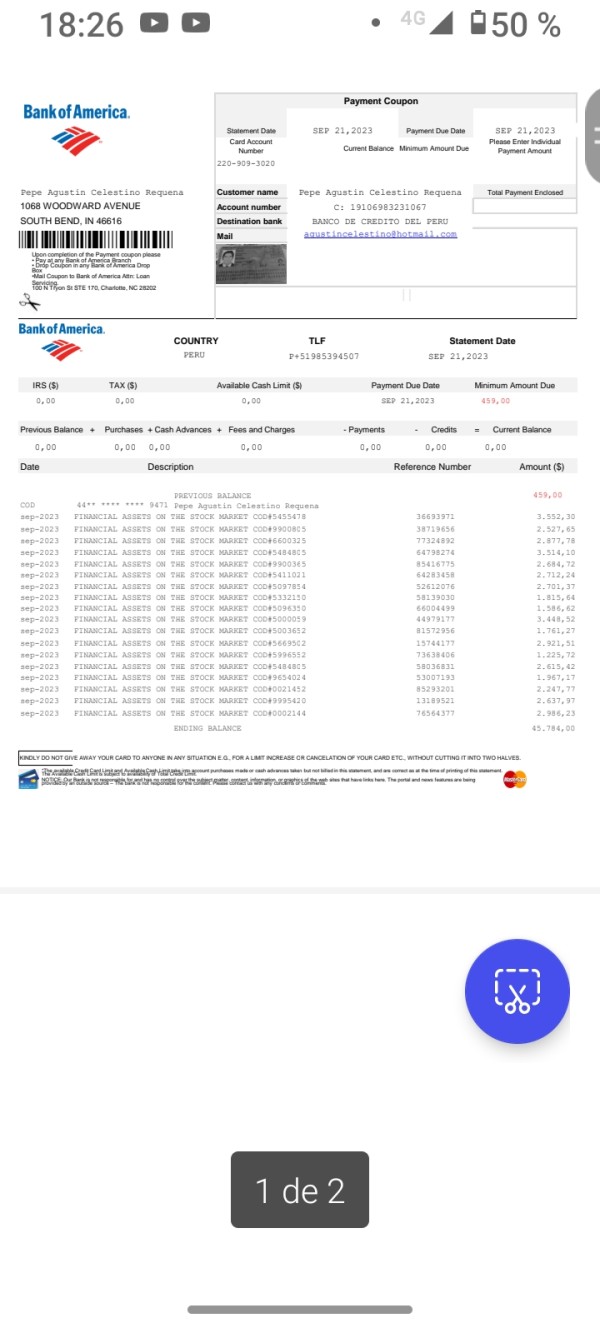

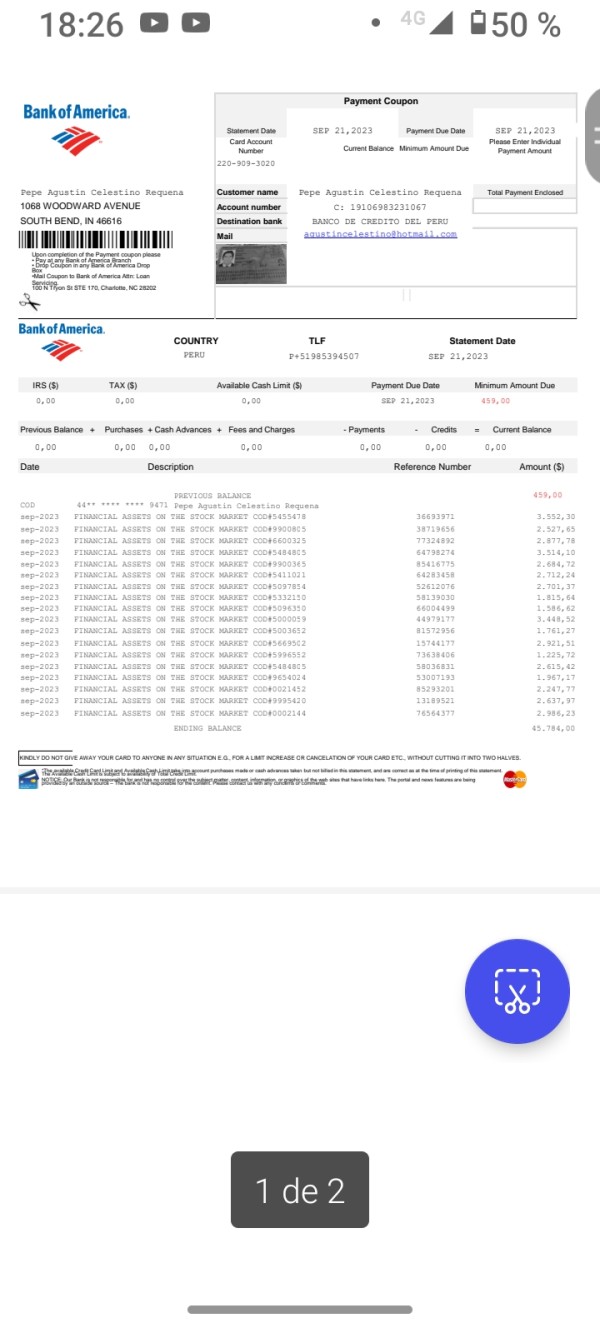

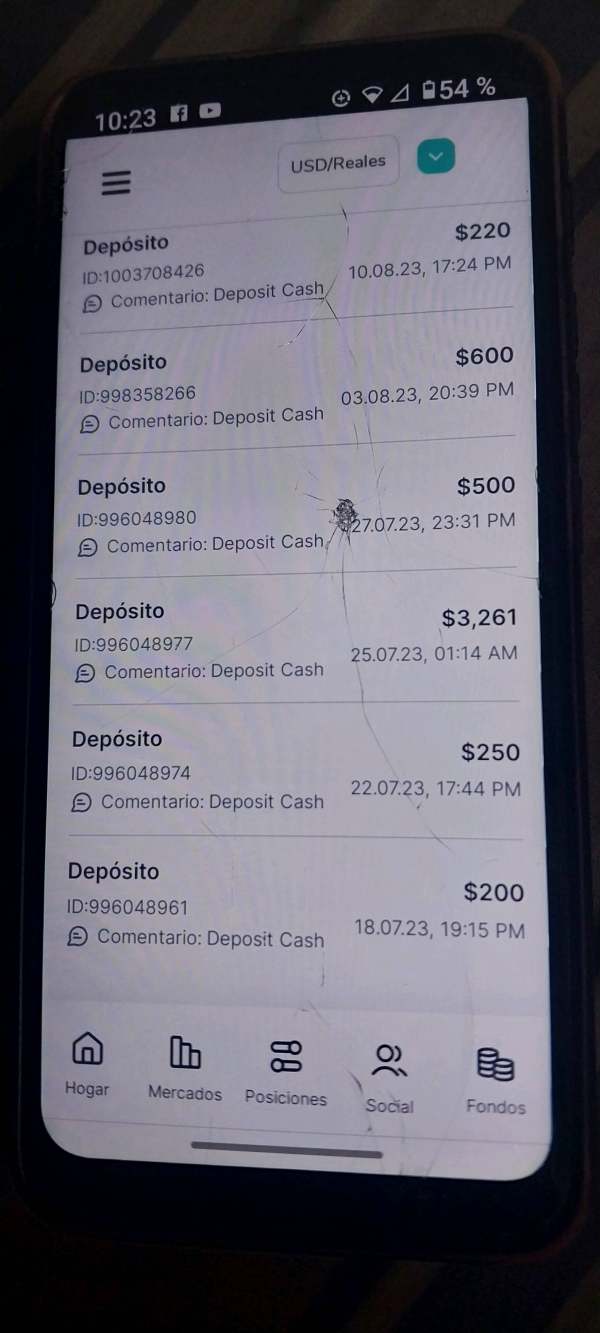

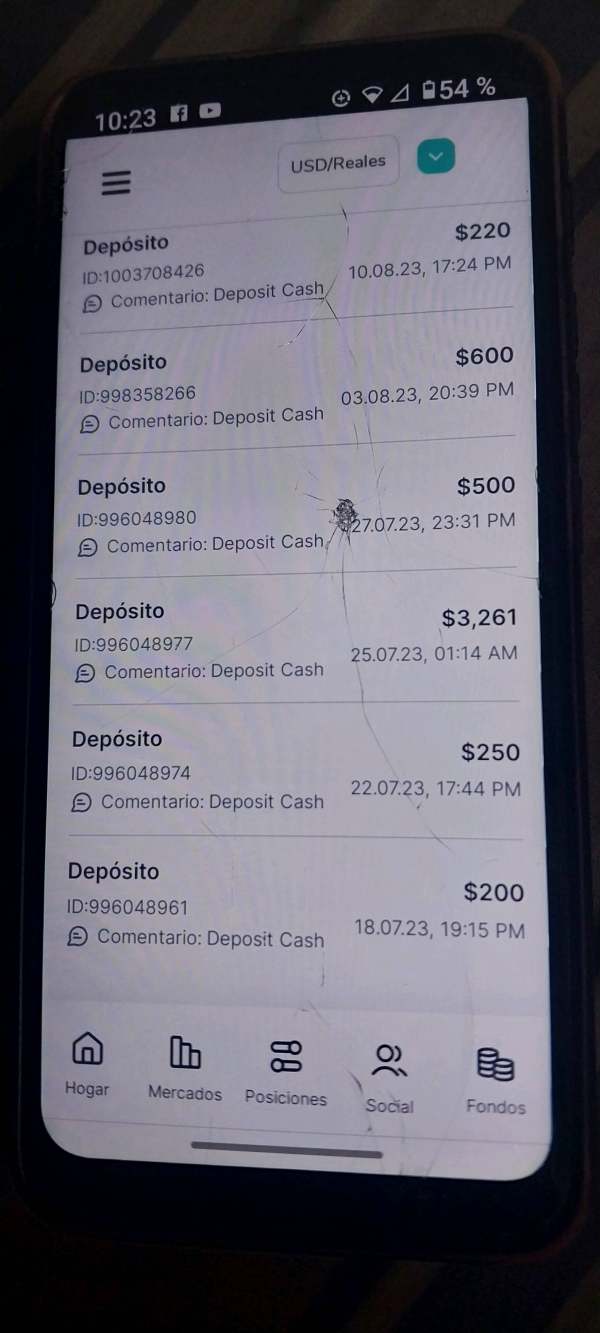

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal procedures is not detailed in available documentation. This creates uncertainty about money handling processes.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in available materials. The broker claims to offer competitive entry-level options.

Bonuses and Promotions: Current promotional offerings and bonus structures are not detailed in accessible information sources.

Tradeable Assets: FXTrategy advertises access to forex pairs and CFD instruments. Specific asset counts and availability details remain unspecified.

Cost Structure: The broker promotes competitive fees starting from zero, but detailed information about spreads, commissions, and additional charges is not comprehensively available. This lack of fee transparency is concerning for traders seeking to understand true trading costs.

Leverage Ratios: Specific leverage offerings and risk management parameters are not detailed in available documentation.

Platform Options: Information about trading platform types, features, and technical capabilities is not comprehensively provided in accessible sources.

Geographic Restrictions: Specific regional limitations and service availability details are not clearly outlined in available materials.

Customer Support Languages: Supported languages and communication options for client services are not specified in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

FXTrategy's account conditions receive a below-average rating due to significant transparency issues and lack of detailed information about account structures. The broker claims to offer competitive fee arrangements starting from zero costs, but the absence of clear account type specifications and minimum deposit requirements creates uncertainty for potential traders.

The lack of detailed account documentation makes it impossible to properly evaluate the true value proposition offered by FXTrategy. Industry standards typically require clear disclosure of account types, minimum funding requirements, and associated benefits, none of which are comprehensively available for this broker.

User feedback regarding account conditions is mixed. Some traders report satisfactory initial experiences while others express concerns about hidden fees and unexpected charges that emerge after account opening. This inconsistency in user experiences suggests potential issues with account terms transparency.

The absence of specialized account options such as Islamic accounts or professional trader classifications further limits the broker's appeal to diverse trading communities. This fxtrategy review finds that the account conditions fail to meet industry standards for transparency and comprehensiveness.

The trading tools and resources offered by FXTrategy receive a poor rating due to insufficient information about available analytical tools, research capabilities, and educational resources. Modern forex trading requires sophisticated analytical tools and comprehensive market research, areas where FXTrategy appears to fall short.

Available information does not indicate the presence of advanced charting tools, technical analysis capabilities, or fundamental research resources that experienced traders typically expect. The absence of detailed platform specifications makes it difficult to assess whether the broker provides adequate tools for informed trading decisions.

Educational resources appear to be limited or non-existent based on available documentation. These resources are crucial for trader development. This lack of educational support is particularly concerning for novice traders who require guidance and learning materials to develop their trading skills effectively.

User feedback suggests that the available tools are basic and may not meet the needs of serious traders who require comprehensive analytical capabilities and real-time market data access.

Customer Service and Support Analysis (4/10)

Customer service receives a poor rating based on limited information about support channels, response times, and service quality. Effective customer support is crucial in forex trading, where technical issues and account problems require immediate attention.

Available documentation does not provide clear information about customer service hours, available communication channels, or expected response times for different types of inquiries. This lack of support structure transparency is concerning for traders who may need assistance during critical trading moments.

User feedback regarding customer service quality is predominantly negative. Reports include delayed responses, unhelpful support staff, and difficulty resolving account-related issues. These service quality concerns align with broader questions about the broker's operational standards and client commitment.

The absence of multilingual support options and regional customer service centers further limits the broker's ability to serve an international client base effectively.

Trading Experience Analysis (5/10)

The trading experience with FXTrategy receives a below-average rating due to concerns about platform reliability, execution quality, and overall trading environment. Without detailed platform specifications or performance data, it's challenging to assess the actual trading experience quality.

User reports suggest inconsistent platform performance with occasional connectivity issues and execution delays that can impact trading outcomes. These technical problems are particularly problematic in fast-moving forex markets where timing is crucial for trade success.

The absence of mobile trading platform information limits accessibility for traders who require on-the-go trading capabilities. Modern forex trading increasingly relies on mobile access, making this a significant limitation for active traders.

Order execution quality reports are mixed. Some users experience satisfactory fills while others report slippage and requotes during volatile market conditions. This inconsistency in execution quality raises questions about the broker's technical infrastructure and liquidity arrangements. This fxtrategy review indicates that the trading experience may not meet professional standards.

Trust and Safety Analysis (3/10)

Trust and safety receive the lowest rating due to serious concerns about regulatory compliance, operational transparency, and industry reputation. The absence of verifiable regulatory oversight from recognized financial authorities represents a fundamental risk factor for potential clients.

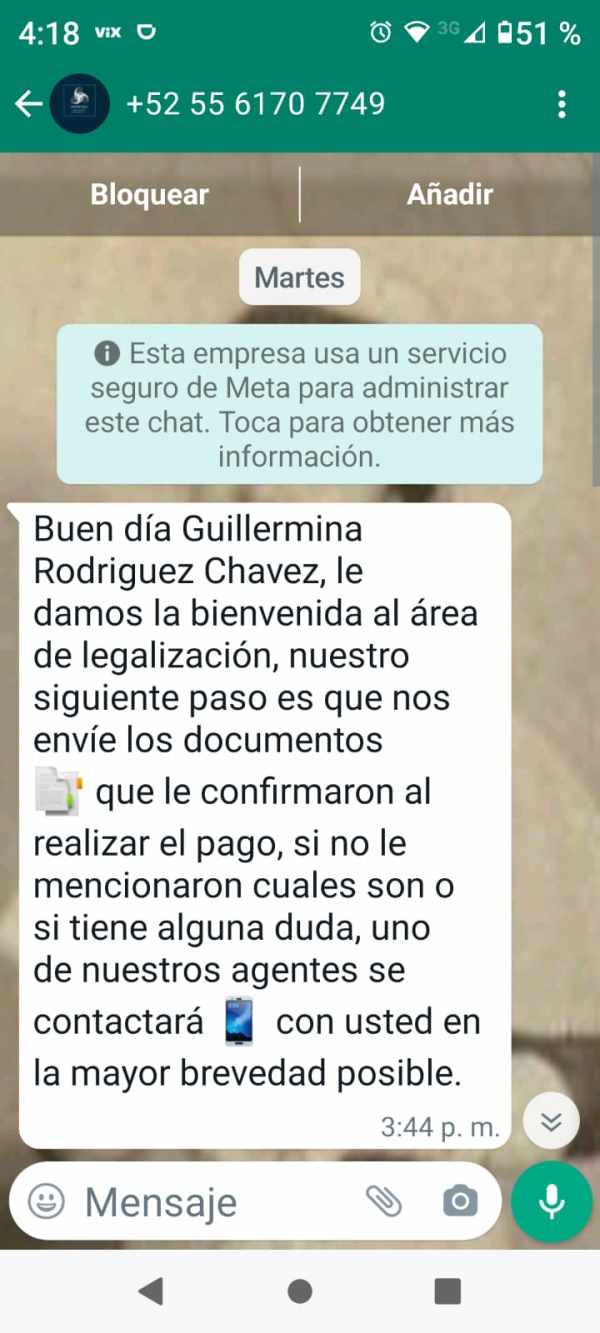

Scam Brokers Reviews has specifically warned against FXTrategy. The warning suggests that the broker employs questionable business practices that may put client funds at risk. These warnings from industry watchdogs carry significant weight in assessing broker trustworthiness.

The lack of clear information about client fund segregation, deposit protection schemes, and operational transparency further undermines confidence in the broker's safety measures. Legitimate brokers typically provide detailed information about fund protection and regulatory compliance, which is notably absent for FXTrategy.

WikiBit has also flagged concerns about FXTrategy's legitimacy. This adds to the growing body of evidence suggesting that potential clients should exercise extreme caution when considering this broker for trading activities.

User Experience Analysis (4/10)

Overall user experience receives a poor rating based on mixed feedback and concerning reports from the trading community. Some users report satisfactory initial experiences, but the predominant feedback suggests significant issues with various aspects of the service.

User interface and platform usability information is limited. This makes it difficult to assess the actual user experience quality. However, available feedback suggests that the platforms may lack the sophistication and user-friendly features that modern traders expect.

Account registration and verification processes appear to be problematic based on user reports. Some clients experience delays and complications during the onboarding process. These procedural issues can create frustration and delays for traders seeking to begin trading activities.

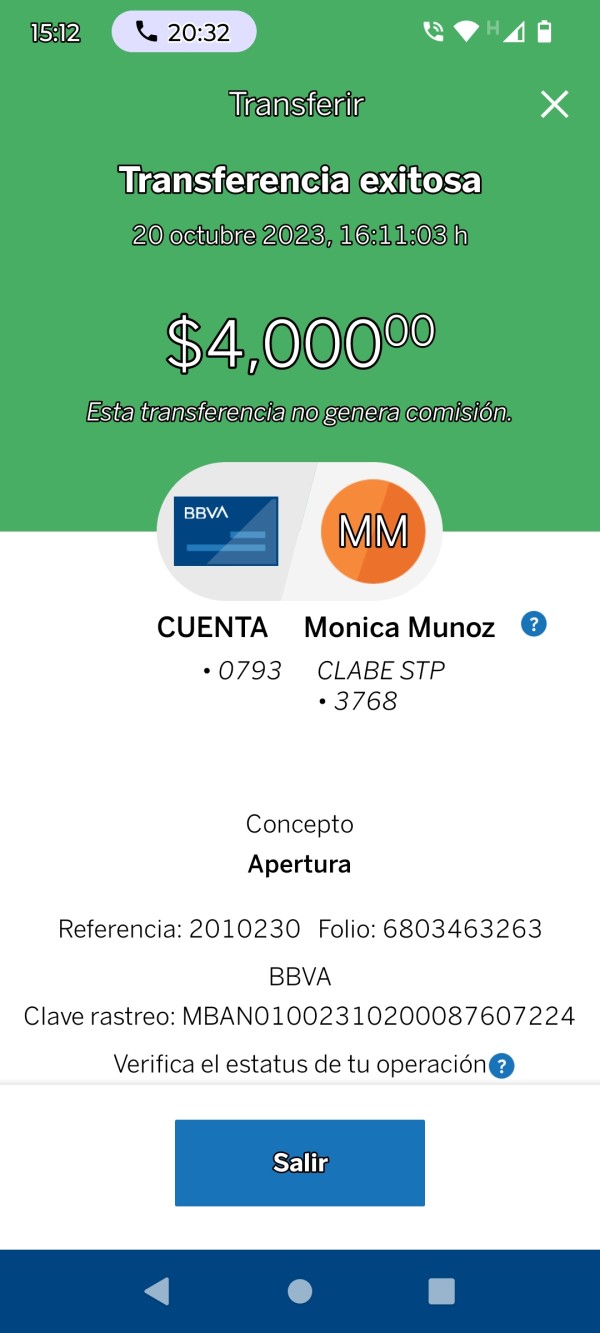

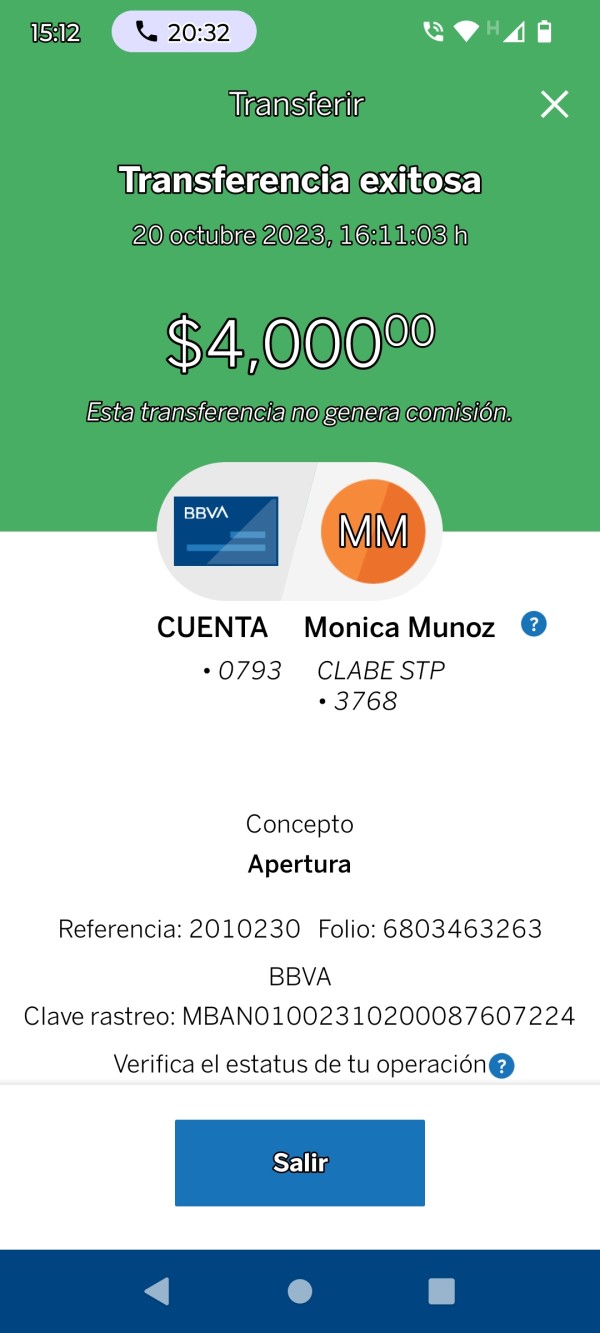

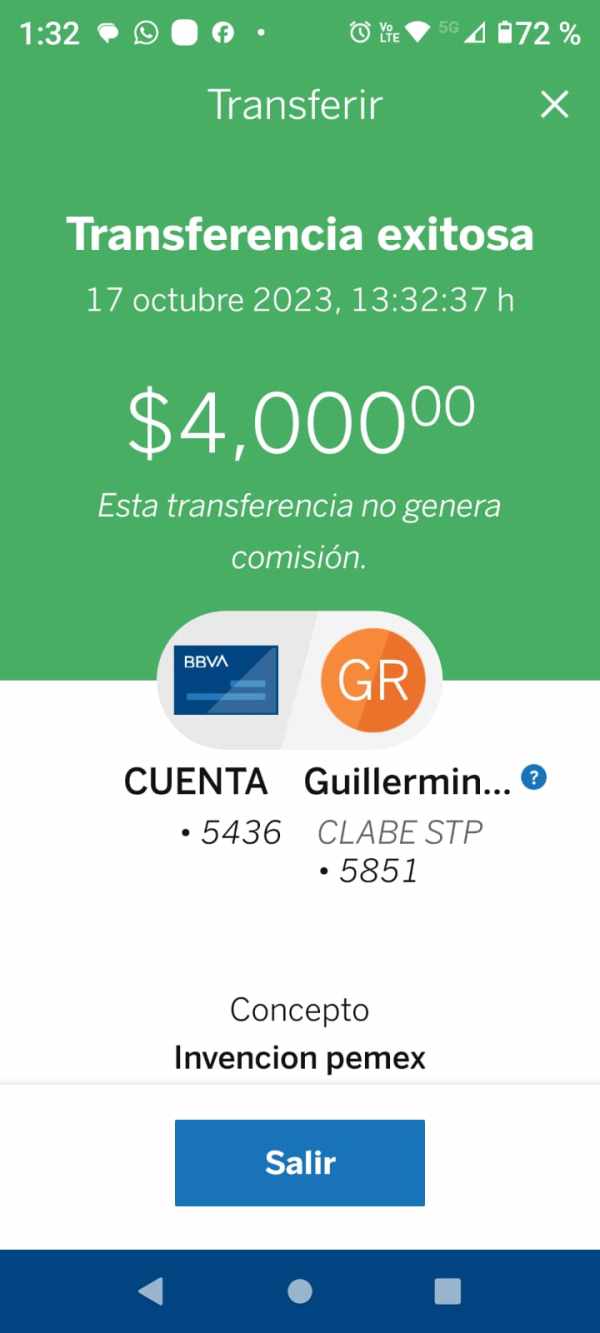

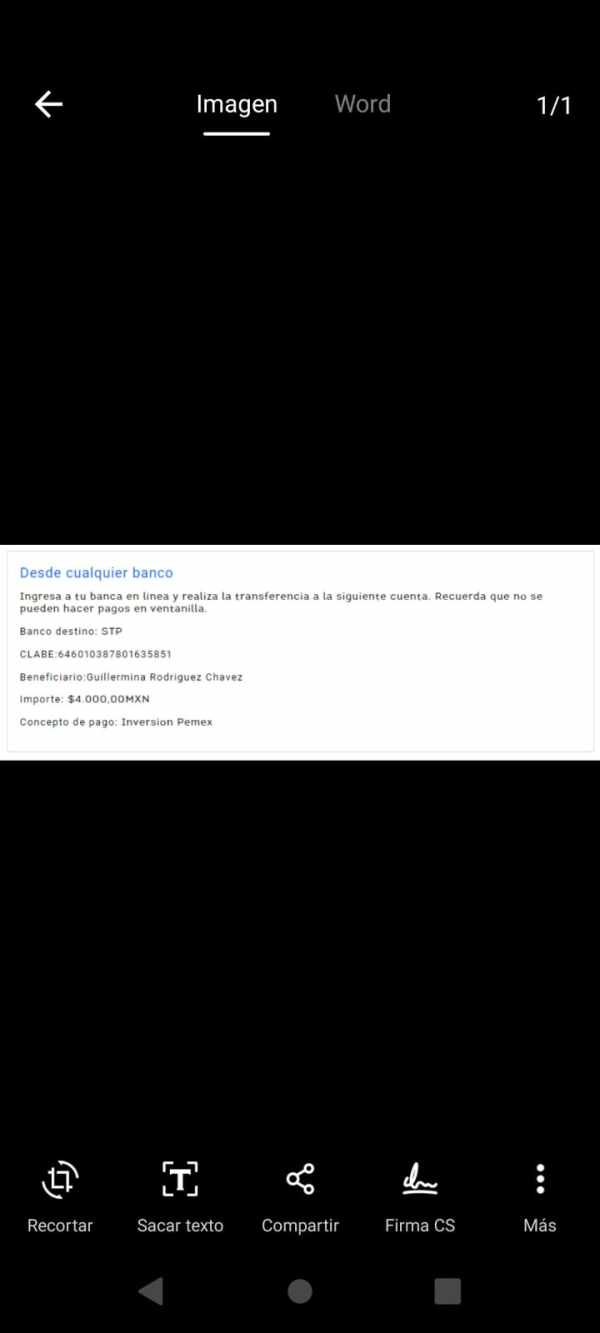

The most concerning aspect of user feedback relates to withdrawal difficulties and account closure problems reported by some clients. These issues align with broader concerns about the broker's operational legitimacy and suggest that users may face challenges when attempting to access their funds.

Conclusion

This comprehensive fxtrategy review reveals significant concerns about the broker's legitimacy, regulatory compliance, and operational standards. FXTrategy may appeal to cost-conscious traders through competitive fee claims, but the numerous red flags and negative industry assessments suggest extreme caution is warranted.

The broker's lack of regulatory oversight combines with warnings from industry watchdogs and mixed user feedback to position FXTrategy as a high-risk option for forex and CFD trading. Potential clients should prioritize regulated brokers with transparent operations and positive industry reputations over platforms that may put their trading capital at risk.

Traders seeking reliable forex and CFD trading services should explore well-regulated alternatives with proven track records and comprehensive client protections. This would be a more prudent approach than engaging with FXTrategy given the current concerns surrounding the platform.