Fidelity Market 2025 Review: Everything You Need to Know

Executive Summary

This fidelity market review looks at a company that has worked since 1946 as an online brokerage and wealth management firm. Fidelity Market gives trading services across many asset classes, offering a complete platform for different investment needs. The broker puts itself as a solution for investors who want low-cost trading options, featuring zero-commission online trading as one of its main attractions.

The platform offers advanced trading tools and services made to support both new and experienced traders. According to available information, Fidelity gives market research, news, and insights to help users make smart investment decisions. The broker serves mainly investors looking for cost-effective trading solutions and those needing substantial market research and analysis resources.

However, our evaluation shows a neutral overall assessment due to the lack of complete regulatory information in publicly available sources. While the platform offers attractive features such as zero commissions and advanced tools, the absence of clear regulatory details raises questions about transparency that potential users should consider.

Important Notice

Due to the limited regulatory information available in public sources, users should know that different regional entities may operate under varying legal and regulatory frameworks. This fidelity market review is based on publicly available information summaries and general user feedback patterns. Potential clients are advised to verify specific regulatory compliance and licensing information directly with the broker before opening accounts, particularly regarding their local jurisdiction's requirements and protections.

Rating Framework

Broker Overview

Fidelity Market represents a well-established player in the financial services industry, having operated since 1946. The company has grown from traditional brokerage services into a complete online trading and wealth management platform. Fidelity offers a range of services from robo-advisor solutions to advisor-driven investment management, catering to diverse investor preferences and experience levels.

The broker's business model focuses on providing accessible online trading combined with strong wealth management services. This dual approach allows Fidelity to serve both active traders seeking advanced tools and passive investors preferring managed solutions. The platform emphasizes educational resources and market insights, positioning itself as more than just a trading venue but as a complete investment partner.

According to available information, Fidelity operates through its own online trading platform, offering access to multiple asset classes including stocks, bonds, and commodities such as crude oil and gold. The broker's approach combines traditional investment principles with modern technology, though specific regulatory oversight details remain unclear in publicly available documentation. This fidelity market review notes that while the company's long history suggests stability, the lack of transparent regulatory information requires careful consideration by potential users.

Regulatory Jurisdiction: Available information does not specify particular regulatory authorities overseeing Fidelity Market's operations, which represents a significant information gap for potential users.

Deposit and Withdrawal Methods: Specific funding options and withdrawal procedures are not detailed in accessible public information, requiring direct inquiry with the broker.

Minimum Deposit Requirements: The exact minimum deposit amount needed to open accounts is not specified in available sources.

Bonus and Promotional Offers: Current promotional activities or bonus structures are not mentioned in publicly available information.

Tradeable Assets: The platform provides access to stocks, bonds, and commodities including crude oil and gold, offering diversified investment opportunities across traditional asset classes.

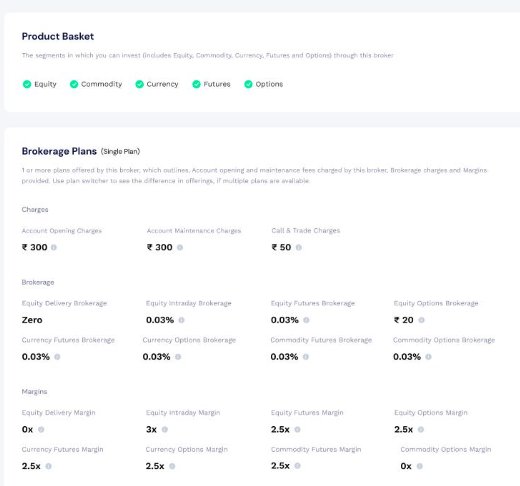

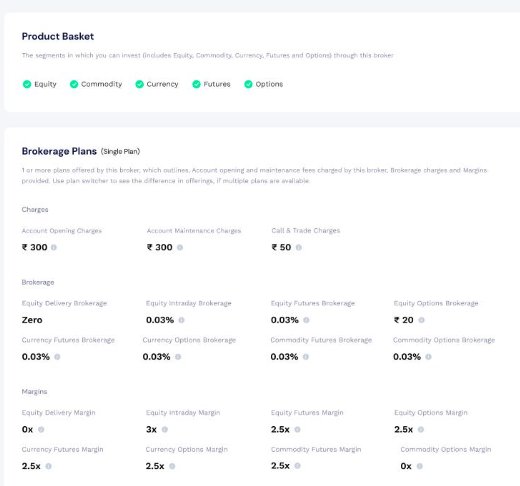

Cost Structure: Commission-free trading is confirmed as a key feature, though spread information and other potential fees are not detailed in available sources.

Leverage Ratios: Specific leverage offerings are not mentioned in accessible public documentation.

Platform Options: Fidelity's own online trading platform serves as the primary trading interface, though detailed platform specifications are not provided.

Geographic Restrictions: Regional limitations or availability restrictions are not specified in current information sources.

Customer Support Languages: Available customer service language options are not detailed in accessible materials.

This fidelity market review emphasizes that while basic service information is available, many crucial details require direct verification with the broker.

Detailed Rating Analysis

Account Conditions Analysis

Fidelity Market's account structure centers around its zero-commission trading model, which represents a significant advantage for cost-conscious investors. However, the evaluation is limited by the lack of detailed information about account types and their specific features. The absence of clear minimum deposit requirements makes it difficult for potential users to understand entry barriers.

The account opening process details are not specified in available sources, creating uncertainty about verification requirements and timeline expectations. Additionally, specialized account options such as Islamic accounts or professional trader accounts are not mentioned, suggesting either limited variety or insufficient public documentation.

While the zero-commission structure is attractive, the overall account conditions assessment suffers from incomplete information about account management fees, maintenance requirements, and additional service charges that might apply. This fidelity market review notes that potential users should seek complete fee schedules directly from the broker to fully understand account cost implications.

The scoring reflects the positive aspect of commission-free trading balanced against significant information gaps that prevent a complete evaluation of account value propositions.

Fidelity Market demonstrates strength in providing advanced trading tools and complete market resources. According to available information, the platform offers sophisticated trading tools designed to support various investment strategies and experience levels. The broker emphasizes market research, news, and insights as core components of its service offering.

The platform includes features that allow users to review and submit evaluations, suggesting an interactive environment that values user feedback and community input. This approach indicates a commitment to continuous improvement and user engagement beyond basic trading functionality.

Market research capabilities appear strong, with access to news and analytical insights that can support informed decision-making. The emphasis on providing complete market information suggests that Fidelity positions itself as an educational resource as well as a trading platform.

However, specific details about automated trading support, backtesting capabilities, or advanced charting features are not detailed in available sources. The high score reflects the confirmed presence of advanced tools and research resources, though a complete assessment would benefit from more detailed feature specifications.

Customer Service and Support Analysis

Customer service evaluation for Fidelity Market is challenging due to limited specific information about support channels and service quality metrics. The platform does provide mechanisms for users to view and submit reviews, indicating some level of customer feedback integration, though this doesn't necessarily reflect direct customer service quality.

Response time data and service availability hours are not specified in accessible sources, making it difficult to assess service accessibility and efficiency. Multi-language support capabilities, which are crucial for international users, are not detailed in available information.

The scoring reflects a moderate assessment based on the presence of user feedback systems and the company's established market presence, which typically correlates with developed customer support infrastructure. However, without specific service quality data or user testimonials about support experiences, a higher rating cannot be justified.

Problem resolution procedures and escalation processes are not documented in available sources, representing a significant information gap for users who might need assistance with complex issues or disputes.

Trading Experience Analysis

The trading experience on Fidelity's platform appears centered around their own online trading system, though specific performance metrics are not detailed in available sources. Platform stability and execution speed data, which are crucial for active traders, are not provided in accessible documentation.

Order execution quality information is notably absent from public sources, making it difficult to assess how effectively the platform handles different order types and market conditions. This represents a significant limitation for traders who prioritize execution performance.

The platform's functionality completeness cannot be fully evaluated without detailed feature specifications, though the mention of advanced trading tools suggests reasonable capability levels. Mobile trading experience details are not provided, which is increasingly important for modern traders who require flexibility.

The moderate scoring reflects the confirmed presence of an established trading platform with advanced tools, balanced against the lack of specific performance data and user experience metrics. This fidelity market review emphasizes that traders should seek platform demonstrations or trial access to properly evaluate trading experience quality.

Trust and Reliability Analysis

Trust assessment for Fidelity Market is significantly impacted by the absence of specific regulatory information in publicly available sources. While the company's operation since 1946 suggests institutional stability, the lack of clear regulatory oversight details creates uncertainty about user protection and compliance standards.

Fund security measures are not detailed in accessible information, leaving questions about client asset protection and segregation practices. Company transparency regarding financial reporting, management structure, and operational procedures is not evident in available sources.

Industry reputation and recognition information is not provided, making it difficult to assess peer recognition or regulatory standing. The absence of information about negative events or their handling further limits trust evaluation capabilities.

The low scoring reflects the critical importance of regulatory clarity and transparency in financial services, areas where available information is insufficient for confident assessment. Users should prioritize obtaining regulatory verification and fund protection details before committing to the platform.

User Experience Analysis

Overall user satisfaction metrics are not available in accessible sources, limiting the ability to assess general user experience quality. Interface design and usability details are not provided, though the mention of advanced tools suggests some level of sophistication in platform design.

Registration and verification process information is not detailed, creating uncertainty about account opening complexity and timeline expectations. Fund operation experience, including deposit and withdrawal convenience and processing times, is not documented in available sources.

Common user complaints or satisfaction patterns are not evident in accessible information, making it difficult to identify typical user experience strengths or weaknesses. The absence of user testimonials or detailed feedback summaries limits complete experience assessment.

The moderate scoring reflects the platform's established presence and advanced tool offerings, balanced against significant information gaps about actual user experience quality and satisfaction levels. Potential users should seek current user feedback and platform demonstrations to better understand experience quality.

Conclusion

This fidelity market review reveals a broker with notable strengths in cost structure and tool availability, but significant transparency limitations that affect overall assessment. Fidelity Market's zero-commission trading model and advanced trading tools represent clear advantages for cost-conscious investors and those seeking complete market research support.

The platform appears best suited for investors who prioritize low-cost trading and value access to market research and analysis resources. However, the lack of detailed regulatory information and limited transparency about key operational aspects create important considerations for potential users.

Primary advantages include commission-free trading and sophisticated tool availability, while main concerns center on insufficient regulatory disclosure and limited detailed information about customer support and platform performance. Prospective users should conduct thorough due diligence and seek direct clarification on regulatory status and operational details before account opening.