Easy 2025 Review: Everything You Need to Know

Summary

EasyBroker has made its mark in the Belgian market. It stands out as one of the cheaper brokerage options for traders. However, this easy review shows that the platform works better for experienced traders than beginners. The broker gets a neutral rating overall, showing both good points and areas that need work.

The platform offers complete real estate trading tools and strong support for worldwide stock market trading. EasyBroker has built a large network that supports over 15,000 agents, manages more than 500,000 property listings, and runs 3,000 client websites. This big network shows the broker wants to serve both individual traders and big investors.

The main users are experienced traders and big investors who can handle the platform's advanced features well. EasyBroker offers good pricing, but it lacks beginner-friendly resources and learning materials, making it less suitable for new traders who are just starting out.

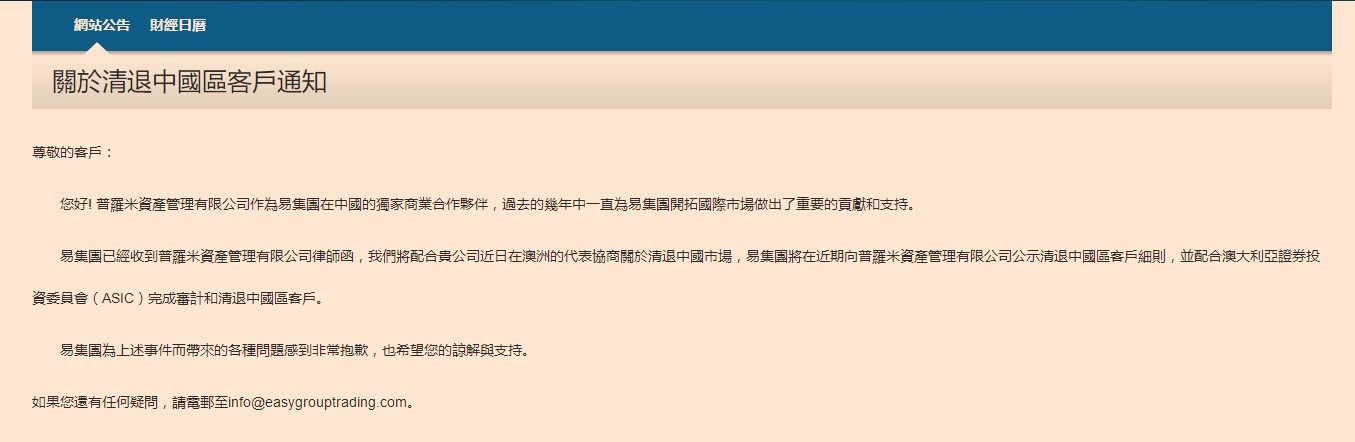

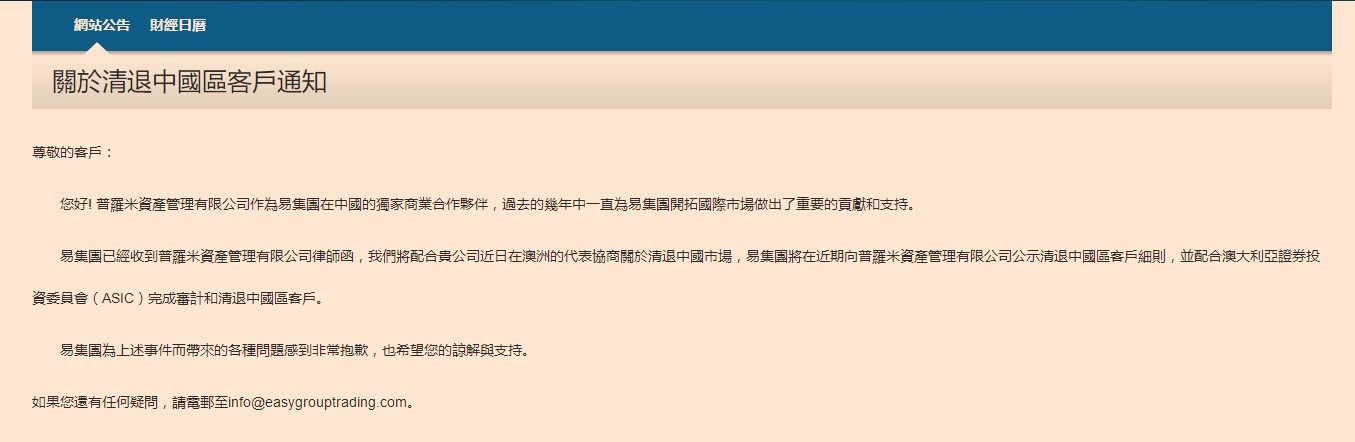

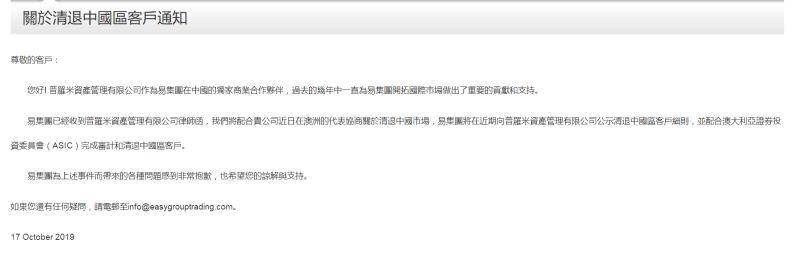

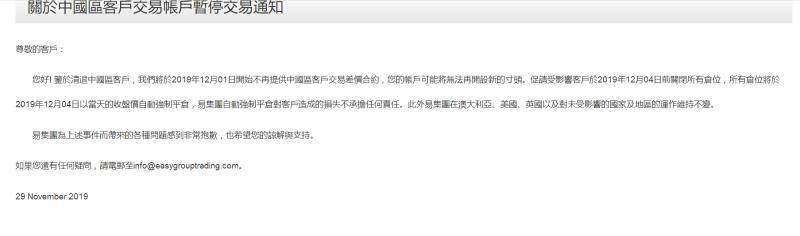

Important Notice

Traders should know that brokerage services can be very different across regions because of different rules and local requirements. Users should check the specific terms, conditions, and rules that apply in their area before opening an account.

This review is based on detailed analysis of available market information, user feedback, and public data. The review method uses multiple sources to give a balanced view of the broker's performance and service quality.

Rating Framework

Broker Overview

EasyBroker runs from its headquarters in Mexico. The company focuses on giving complete tools and services for real estate agents and agencies. The company has built a strong business model that focuses on tech solutions for property market professionals. The establishment date is not given in available information, but the broker has shown significant growth in market presence and user adoption.

The platform's business model centers on supporting a huge network of over 15,000 agents while managing an impressive collection of more than 500,000 property listings. EasyBroker also maintains 3,000 client websites, showing its commitment to providing complete digital solutions for real estate professionals and investors.

EasyBroker operates mainly through its own platform, offering access to global stock markets alongside its main real estate trading abilities. The broker focuses on serving both individual agents and larger institutional clients, which has positioned it as a flexible option in the market. However, this easy review notes that specific regulatory oversight details are not clearly outlined in available documentation, which may be something for potential users to consider.

Regulatory Regions: Specific regulatory areas and oversight bodies are not detailed in available information sources, requiring users to check regulatory status on their own.

Deposit and Withdrawal Methods: The available information does not specify the particular payment methods, processing times, or fees for deposits and withdrawals.

Minimum Deposit Requirements: Specific minimum deposit amounts are not outlined in the current information set. Users need to ask the broker directly.

Bonuses and Promotions: Details about welcome bonuses, promotional offers, or loyalty programs are not specified in available documentation.

Tradeable Assets: The platform provides access to global stock markets and complete real estate investment opportunities. This serves diverse investment strategies.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not detailed in available sources. This requires further investigation.

Leverage Ratios: Leverage options and maximum ratios available to traders are not specified in current information.

Platform Options: EasyBroker operates through its own trading platform. Technical specifications and features require additional research.

Regional Restrictions: Geographic limitations or restricted countries are not specified in available information.

Customer Service Languages: Supported languages for customer service are not detailed in current documentation.

This easy review emphasizes the need for potential users to ask EasyBroker directly to get complete details about these important trading parameters.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of EasyBroker's account conditions faces limits due to insufficient detailed information in available sources. Account type varieties, their specific features, and benefits are not fully outlined, making it challenging to assess the broker's offerings in this important area.

Minimum deposit requirements, which greatly impact accessibility for different trader categories, are not specified in current documentation. This lack of clarity may create challenges for potential users trying to evaluate whether the platform fits their financial abilities and investment goals.

The account opening process, including required documentation, verification procedures, and timeline expectations, remains unclear from available information. Special account features such as premium services, institutional accounts, or specialized trading tools are also not detailed.

This easy review cannot provide a definitive rating for account conditions due to the absence of complete information. Potential users should contact EasyBroker directly to get detailed account specifications, terms, and conditions before making any commitment decisions.

EasyBroker shows significant strength in providing complete tools and resources. It earns a solid 8/10 rating in this category. The platform's extensive real estate trading tools represent a unique offering in the market, serving professionals seeking specialized property investment solutions.

The broker's global stock market trading abilities expand the available opportunities for diversified portfolio management. This combination of real estate and traditional securities trading creates a complete investment environment for experienced traders seeking multiple asset class exposure.

However, specific details about research and analysis resources are not thoroughly documented in available information. Educational resources, which are crucial for trader development and platform optimization, are not clearly outlined, potentially limiting the platform's appeal to less experienced users.

Automated trading support capabilities, including algorithmic trading tools, expert advisors, or API access, are not specified in current documentation. These features are increasingly important for modern trading operations, particularly for institutional clients and advanced retail traders.

The platform's infrastructure supporting over 15,000 agents and managing 500,000+ property listings shows strong technological capabilities and resource allocation.

Customer Service and Support Analysis

The assessment of EasyBroker's customer service and support capabilities is limited by the lack of detailed information in available sources. Customer service channels, including phone, email, live chat, or ticket systems, are not specifically outlined, making it difficult to evaluate accessibility and convenience.

Response time expectations, which are crucial for time-sensitive trading situations, are not documented in available information. Service quality metrics, customer satisfaction ratings, or performance benchmarks are similarly absent from current documentation.

Multi-language support capabilities, essential for serving diverse international clientele, are not specified. This information gap may be particularly relevant for traders operating in different geographical regions or requiring support in specific languages.

Customer service availability, including operating hours, timezone coverage, and weekend support, remains unclear from available sources. These factors significantly impact the overall trading experience, especially for active traders requiring immediate assistance.

Without complete customer service information, this evaluation cannot provide a definitive rating for this crucial aspect of broker operations. Potential users should ask directly about support structures and service level commitments.

Trading Experience Analysis

Evaluating EasyBroker's trading experience presents challenges due to limited specific information about platform performance and functionality. Platform stability and execution speed, which are fundamental to successful trading operations, are not detailed in available documentation.

Order execution quality, including fill rates, slippage characteristics, and execution speed metrics, remains unspecified. These factors significantly impact trading profitability and overall user satisfaction, particularly for active traders and scalping strategies.

Platform functionality completeness, including charting tools, technical indicators, order types, and analytical capabilities, is not fully outlined. Mobile trading experience, increasingly important for modern traders, lacks detailed documentation regarding features and performance.

Trading environment characteristics, such as market depth access, news feeds, economic calendars, and real-time data quality, are not specifically addressed in available information. These elements contribute significantly to informed decision-making and trading effectiveness.

This easy review cannot provide a complete trading experience rating without access to detailed platform specifications and user experience data. Potential users should consider demo testing or direct platform evaluation before committing to live trading.

Trustworthiness Analysis

The trustworthiness evaluation of EasyBroker faces significant limitations due to the absence of detailed regulatory information in available sources. Regulatory licensing, oversight bodies, and compliance status are not clearly documented, creating uncertainty about the broker's legal standing and operational legitimacy.

Fund safety measures, including segregated accounts, deposit protection schemes, and insurance coverage, are not specified in current documentation. These protections are fundamental to trader security and confidence, particularly when dealing with substantial investment amounts.

Company transparency regarding ownership structure, financial reporting, and operational procedures is not adequately addressed in available information. Industry reputation, peer recognition, and professional standings lack complete documentation.

Negative event handling, including dispute resolution procedures, complaint processes, and regulatory actions, remains unclear from available sources. Historical performance during market stress periods and crisis management capabilities are not documented.

Without complete regulatory and safety information, this evaluation cannot assign a definitive trustworthiness rating. Potential users should conduct independent regulatory verification and due diligence before engaging with the platform.

User Experience Analysis

EasyBroker's user experience evaluation benefits from the platform's Easy Reviews system, which helps collect user feedback and emphasizes customer evaluation importance. This feature shows the broker's commitment to understanding and improving user satisfaction levels.

However, overall user satisfaction metrics, including retention rates, satisfaction surveys, and user testimonials, are not fully available in current documentation. Interface design quality, navigation efficiency, and platform usability require direct evaluation rather than relying on available information.

Registration and verification processes, including required steps, documentation needs, and completion timeframes, are not detailed in available sources. Fund operation experiences, covering deposit and withdrawal procedures, processing times, and associated costs, remain unspecified.

Common user complaints, recurring issues, and platform limitations are not documented in available information, limiting the ability to provide balanced perspective on potential challenges users might encounter.

The platform's support for over 15,000 agents suggests positive user adoption. However, specific satisfaction metrics and user feedback summaries are not available for complete analysis.

Conclusion

EasyBroker presents itself as a specialized brokerage option mainly suited for experienced traders and institutional investors seeking complete real estate tools combined with global stock market access. The platform's strength lies in its extensive infrastructure supporting thousands of agents and managing substantial property portfolios.

The broker appears most appropriate for experienced traders who can navigate advanced features independently and require specialized real estate investment capabilities. Institutional investors may find value in the platform's complete tools and extensive network support.

Key advantages include complete tool offerings and strong resource allocation, while notable limitations involve insufficient transparency regarding regulatory oversight, customer service specifics, and detailed trading conditions. This easy review recommends potential users conduct thorough due diligence and direct platform evaluation before making commitment decisions.