FXLINK 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive fxlink review examines a forex broker that has gotten a lot of attention in the trading community. However, this attention is not for good reasons. FXLINK is widely seen as an unregulated forex broker with mostly negative user reviews, and many traders think it might be a scam. The broker does offer multiple account types including Standard, Micro, and ECN accounts, with maximum leverage reaching up to 1:300.

The platform targets investors who want specific trading conditions and have strong risk tolerance. But potential clients should know that 25% of retail investor accounts lose money when trading CFDs with FXLink Corp Limited. The broker's lack of oversight from major financial authorities raises serious questions about client fund security and how transparent their operations are.

FXLINK gives access to the MetaTrader 5 trading platform and offers various asset classes including forex and CFDs. However, the lack of proper regulatory compliance, combined with widespread negative user feedback, suggests that this broker may not meet the standards that serious retail traders expect. This fxlink review will explore all aspects of the broker's services to give traders the information they need to make smart decisions.

Important Notice

Regional Entity Differences: FXLINK operates as an unregulated broker without oversight from major regulatory authorities such as the FCA, ASIC, or CySEC. This lack of regulatory compliance means that traders do not have access to standard investor protection schemes that are typically available with properly licensed brokers. The absence of regulatory oversight raises big concerns about fund security and dispute resolution mechanisms.

Review Methodology: This evaluation is based on comprehensive analysis of user feedback, available market information, and platform functionality assessment. Given the limited transparent information available about FXLINK's operations, this review relies heavily on user experiences and publicly available data to provide an accurate assessment of the broker's services.

Rating Framework

Broker Overview

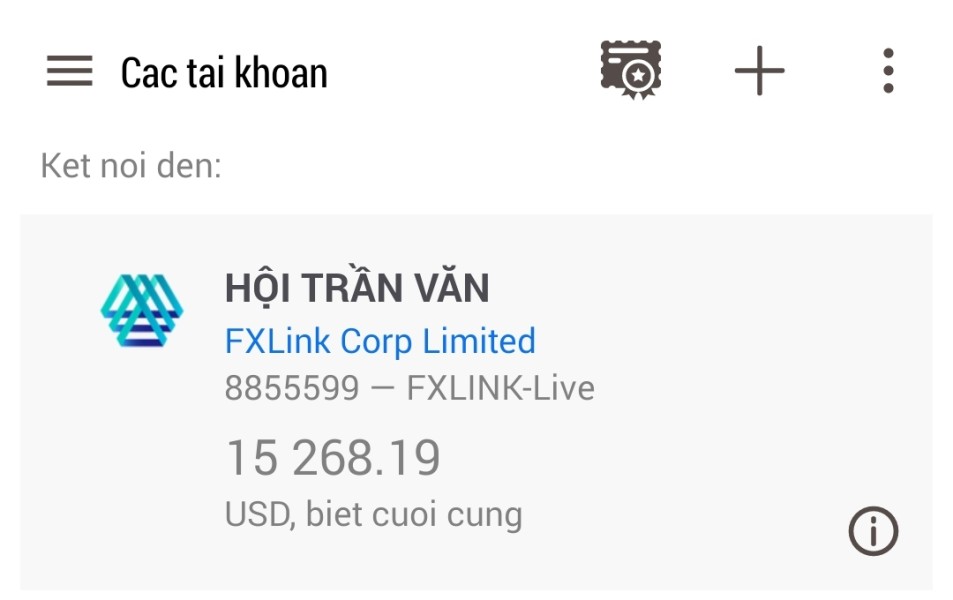

FXLINK operates as an unregulated forex broker that has attracted considerable negative attention within the trading community. While specific establishment details remain unclear in available documentation, the broker positions itself as a provider of forex and CFD trading services to retail investors. The company operates under the name FXLink Corp Limited, though comprehensive background information about its founding and corporate structure is notably absent from public records.

The broker's business model centers around providing multiple account types to accommodate different trading preferences and capital levels. However, the lack of transparency regarding company history, leadership, and operational headquarters raises immediate red flags for potential clients. User feedback consistently shows that FXLINK fails to meet basic industry standards for broker operations.

FXLINK offers trading services through the MetaTrader 5 platform, providing access to various financial instruments including forex pairs and CFDs. The broker claims to serve retail investors seeking diverse trading opportunities, though the absence of proper regulatory oversight means that clients operate without standard investor protections. The company's failure to secure licensing from recognized financial authorities such as the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), or Cyprus Securities and Exchange Commission (CySEC) represents a significant operational problem that potential clients must carefully consider.

Regulatory Status: FXLINK operates without regulation from any major financial authority, making it an unregulated broker. This status means clients lack access to compensation schemes, regulatory dispute resolution, and other standard investor protections typically available with licensed brokers.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options is not clearly outlined in available documentation. This itself represents a transparency concern for potential clients.

Minimum Deposit Requirements: The minimum deposit requirement is not specified in available sources. This shows a lack of transparency in the broker's account opening procedures.

Bonuses and Promotions: Available information does not detail specific bonus structures or promotional offerings, though unregulated brokers often use unrealistic bonus schemes as client acquisition tools.

Tradeable Assets: The broker provides access to forex and CFD trading across multiple asset classes. However, specific instrument counts and market coverage details remain unclear.

Cost Structure: ECN accounts feature a commission structure of $6 per lot, though spread information and other potential fees are not transparently disclosed. This makes it difficult for traders to calculate true trading costs.

Leverage Ratios: Maximum leverage is advertised at 1:300. This represents a high-risk offering that can amplify both profits and losses significantly.

Platform Options: FXLINK supports MetaTrader 5 trading platform, providing access to standard MT5 functionality and features.

Geographic Restrictions: Specific regional limitations are not detailed in available information.

Customer Support Languages: Available support languages are not specified in accessible documentation.

This fxlink review reveals concerning gaps in basic broker information that legitimate, regulated brokers typically provide transparently to potential clients.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

FXLINK's account offerings include Standard, Micro, and ECN account types, providing some variety for different trader preferences and capital levels. However, the lack of transparent information regarding minimum deposit requirements immediately raises concerns about the broker's operational transparency. The ECN account structure features a commission of $6 per lot, though spread information remains undisclosed, making it impossible for traders to accurately calculate total trading costs.

User feedback consistently shows dissatisfaction with account conditions, particularly regarding hidden fees and unclear terms of service. The absence of detailed account specifications, such as minimum trade sizes, maximum position limits, and margin requirements, suggests poor operational standards. Additionally, the lack of information about Islamic accounts or other specialized account features shows limited accommodation for diverse trading needs.

Compared to regulated brokers that provide comprehensive account documentation and transparent fee structures, FXLINK's account conditions appear inadequate and potentially misleading. The broker's failure to clearly outline account opening procedures, verification requirements, and ongoing account maintenance policies further undermines confidence in their account management capabilities. This fxlink review finds that the account conditions fail to meet industry standards for transparency and user-friendliness.

FXLINK provides access to the MetaTrader 5 platform, which offers standard charting tools, technical indicators, and automated trading capabilities that many traders require. However, beyond the basic MT5 functionality, the broker appears to lack comprehensive trading tools and analytical resources that would enhance the trading experience.

The absence of proprietary research materials, market analysis, daily market commentary, and economic calendars represents a significant problem in the broker's service offering. Most reputable brokers provide extensive educational resources, webinars, trading guides, and market insights to support client success, but such resources are notably absent from FXLINK's documented offerings.

User feedback suggests that the available tools are limited and that the broker does not provide adequate support for traders seeking to improve their skills or stay informed about market developments. The lack of advanced charting packages, sentiment analysis tools, or third-party research partnerships further limits the value proposition for serious traders. Additionally, information about automated trading support, expert advisors, and API access remains unclear, suggesting limited accommodation for algorithmic trading strategies.

Customer Service and Support Analysis (Score: 3/10)

User feedback regarding FXLINK's customer service is mostly negative, with multiple reports of poor response times and inadequate problem resolution. The specific customer service channels available, such as live chat, email support, or telephone assistance, are not clearly documented, which itself represents a service problem.

Response time complaints from users suggest that the broker fails to provide timely assistance when clients encounter issues with their accounts or trading platforms. The quality of service appears to be substandard, with users reporting that customer service representatives lack the knowledge and authority to resolve complex issues effectively.

The absence of documented multilingual support capabilities may limit accessibility for international clients, while unclear customer service hours could result in extended periods without available assistance. User reports show that the broker's customer service team may not be adequately trained to handle technical trading issues or account-related problems, leading to frustrated clients and unresolved complaints. The lack of escalation procedures or management contact information further compounds service quality issues.

Trading Experience Analysis (Score: 4/10)

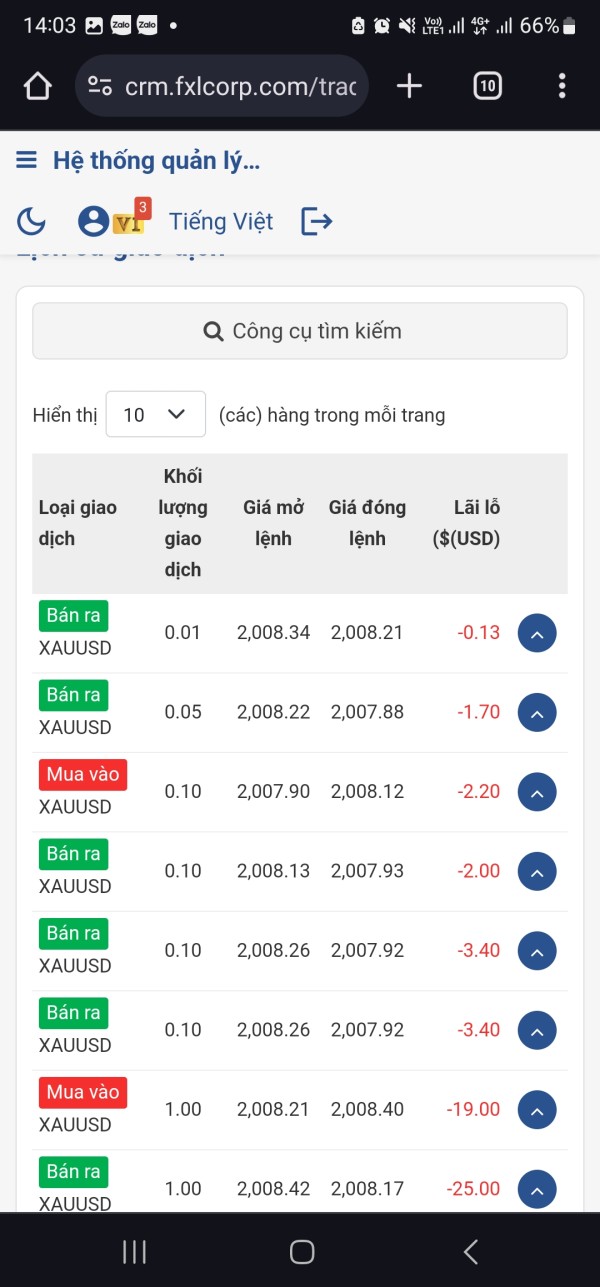

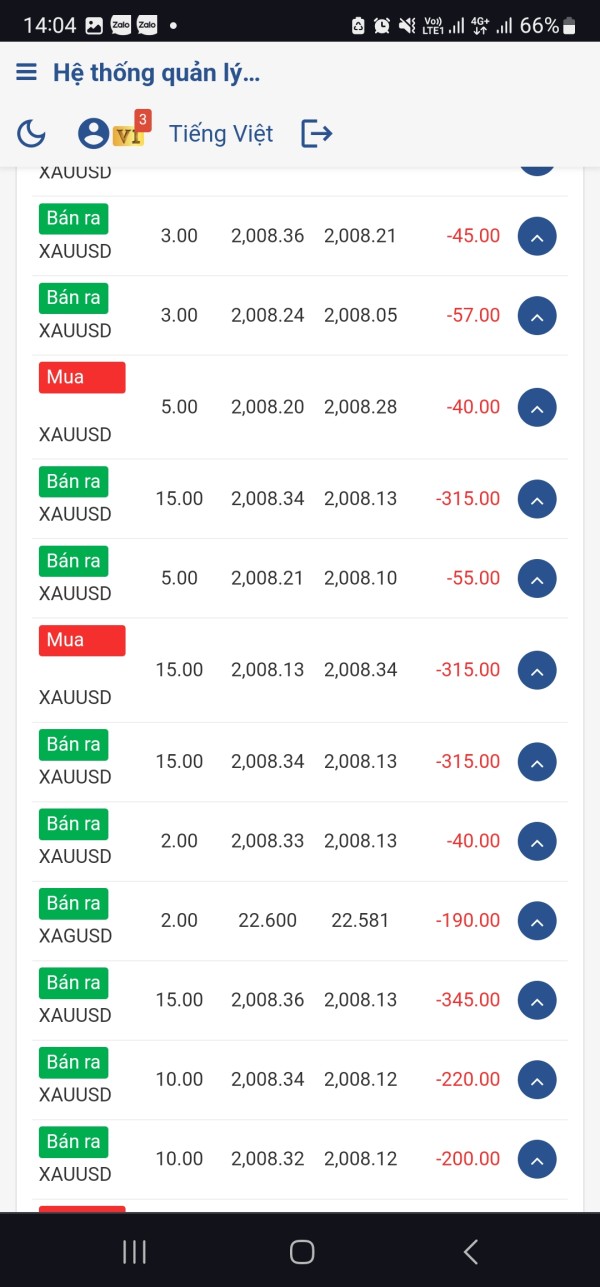

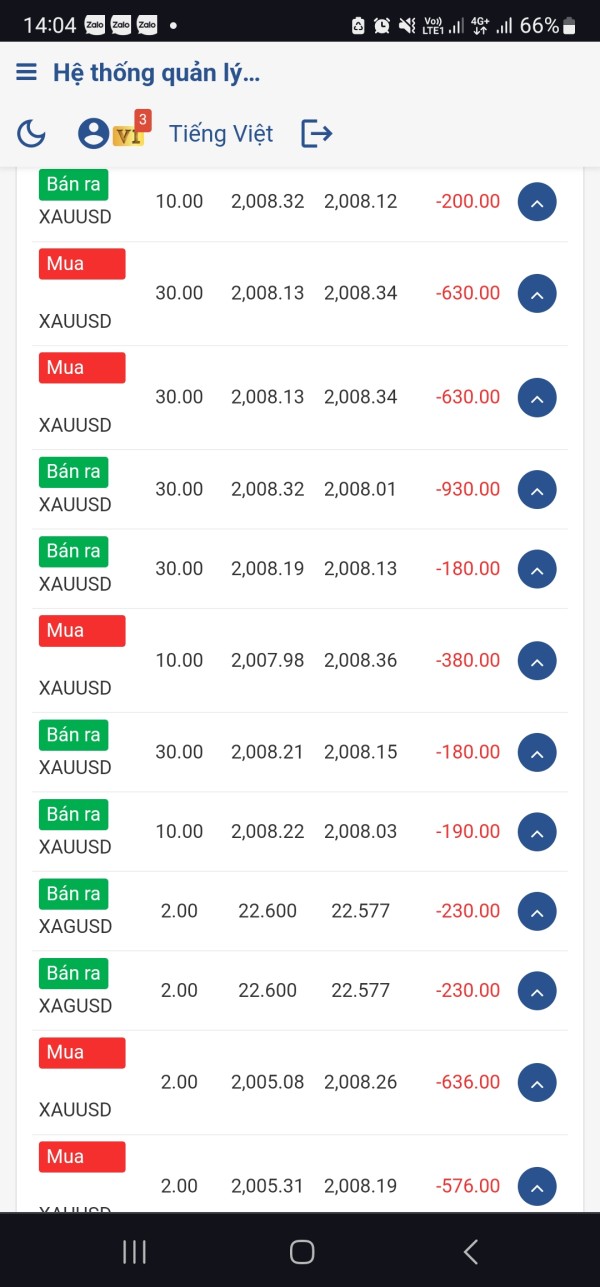

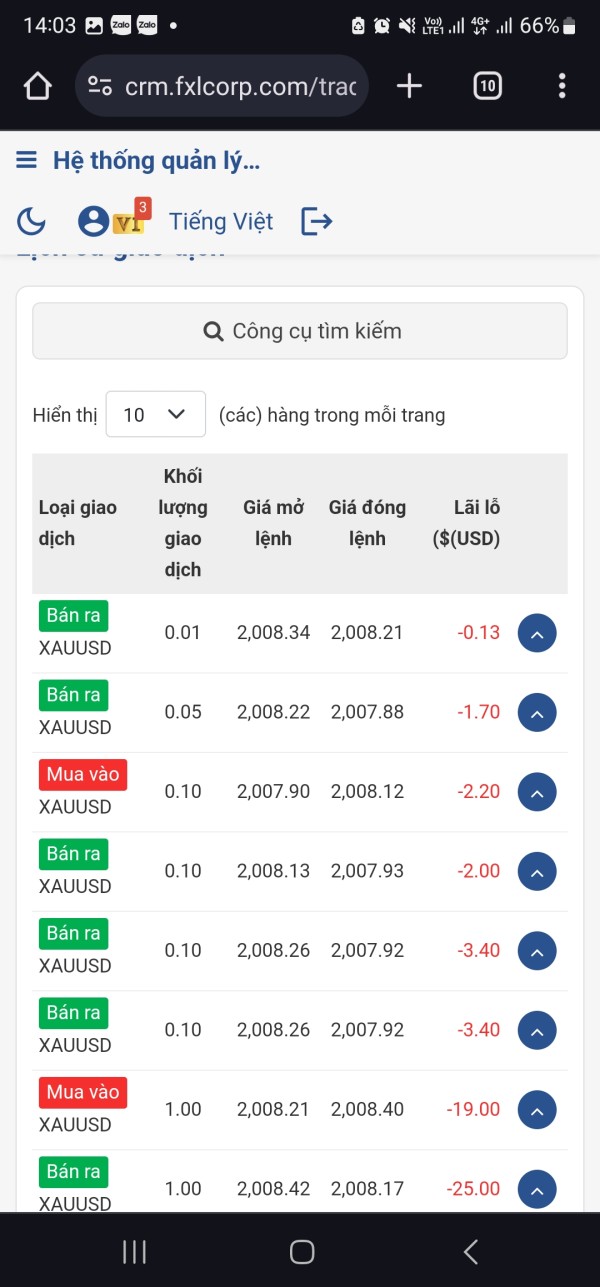

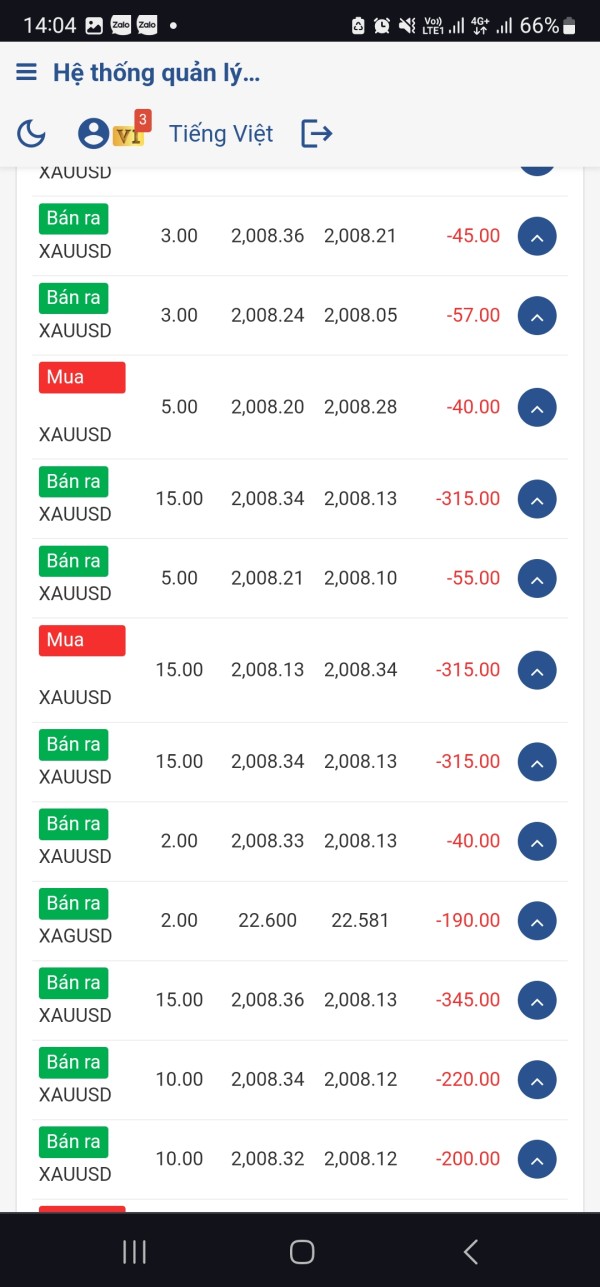

User reports regarding FXLINK's trading experience are consistently negative, with complaints about platform stability and execution quality. Traders have reported instances of slippage and requoting, which can significantly impact trading profitability and strategy effectiveness. These execution issues suggest that the broker may not provide the reliable trading environment that serious traders require.

Platform stability concerns include reports of disconnections during volatile market conditions, which could result in missed trading opportunities or unmanaged risk exposure. The lack of detailed information about execution speeds, server locations, and infrastructure quality raises questions about the broker's technical capabilities.

Users have expressed dissatisfaction with spread competitiveness and liquidity provision, suggesting that trading costs may be higher than advertised or that market access may be limited during certain trading sessions. The absence of detailed execution statistics, such as average execution speeds and slippage data, prevents traders from making informed decisions about the platform's suitability for their trading strategies.

Mobile trading experience details are not well documented, though MT5 mobile functionality should provide basic trading capabilities. However, user feedback suggests that overall trading conditions may not meet the expectations of experienced traders who require reliable execution and competitive pricing. This fxlink review shows that the trading experience falls short of industry standards.

Trust and Security Analysis (Score: 2/10)

FXLINK's unregulated status represents the most significant trust and security concern for potential clients. Operating without oversight from major financial authorities such as the FCA, ASIC, CySEC, or other recognized regulators means that clients have no access to investor compensation schemes, regulatory dispute resolution, or standard consumer protections.

The lack of information about client fund segregation, bank partnerships, and financial auditing practices raises serious questions about fund security. Regulated brokers are required to maintain client funds in segregated accounts with tier-1 banks and undergo regular financial audits, but FXLINK's unregulated status means no such protections are guaranteed.

User perception of FXLINK as a potential scam operation significantly impacts the broker's reputation within the trading community. The widespread negative feedback and warnings from users suggest that the broker may not operate with the transparency and integrity expected from legitimate financial service providers. The statistic that 25% of retail investor accounts lose money when trading CFDs with FXLink Corp Limited, while legally required disclosure, also highlights the high-risk nature of trading with this provider.

The absence of clear company registration details, management information, and operational transparency further undermines trust. Legitimate brokers typically provide comprehensive information about their corporate structure, regulatory compliance, and operational procedures, but such transparency is notably lacking with FXLINK.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with FXLINK is mostly negative, with multiple reports of dissatisfaction across various aspects of the broker's services. Users consistently report problems with account management, trading conditions, and customer service quality, suggesting systemic issues with the broker's operations.

The registration and account verification process details are not clearly documented, though user feedback suggests that these procedures may not be as streamlined or transparent as those offered by regulated competitors. The lack of clear information about required documentation, verification timeframes, and account approval processes creates uncertainty for potential clients.

User complaints frequently focus on transparency issues, particularly regarding fee structures, trading conditions, and withdrawal procedures. The absence of detailed terms of service, privacy policies, and operational procedures that are easily accessible to clients represents a significant user experience problem.

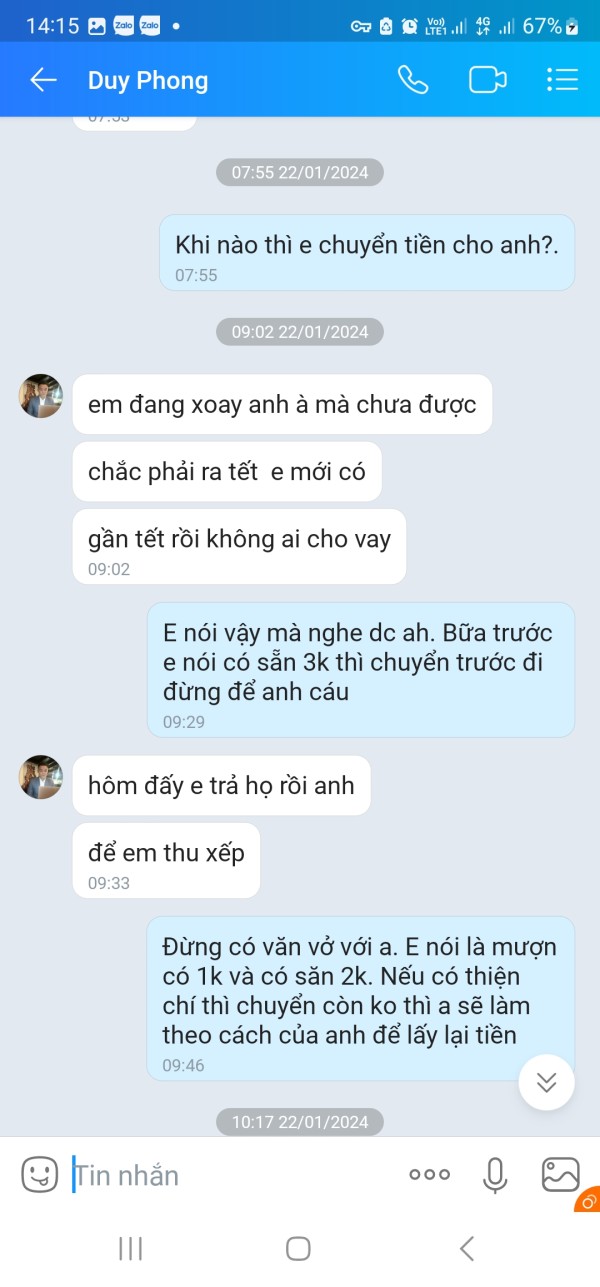

Common user complaints include difficulties with fund withdrawals, unexpected fees, poor execution quality, and inadequate customer support. The pattern of negative feedback suggests that FXLINK may not prioritize client satisfaction or operational excellence. For the broker to improve user experience, significant enhancements in transparency, regulatory compliance, and service quality would be necessary.

Conclusion

This comprehensive fxlink review reveals that FXLINK operates as an unregulated forex broker with mostly negative user feedback and significant operational problems. While the broker offers multiple account types and access to the MetaTrader 5 platform, these limited advantages are overshadowed by serious concerns about regulatory compliance, fund security, and service quality.

The broker may only be suitable for traders who fully understand and accept the high risks associated with unregulated brokers, including potential loss of funds and lack of regulatory recourse. However, given the widespread negative user feedback and absence of regulatory oversight, most traders would be better served by choosing properly licensed and regulated alternatives.

The main advantages include multiple account types and high leverage options, while significant disadvantages encompass the unregulated status, poor user reviews, lack of transparency, and questionable trustworthiness. Potential clients should carefully consider these factors and explore regulated alternatives that provide proper investor protections and transparent operations.