Maxxi Markets 2025 Review: Everything You Need to Know

Executive Summary

This maxxi markets review gives you a complete look at the Comoros-based forex broker that has caused mixed reactions in the trading community. Our research shows that Maxxi Markets has serious red flags that potential traders should think about carefully before investing.

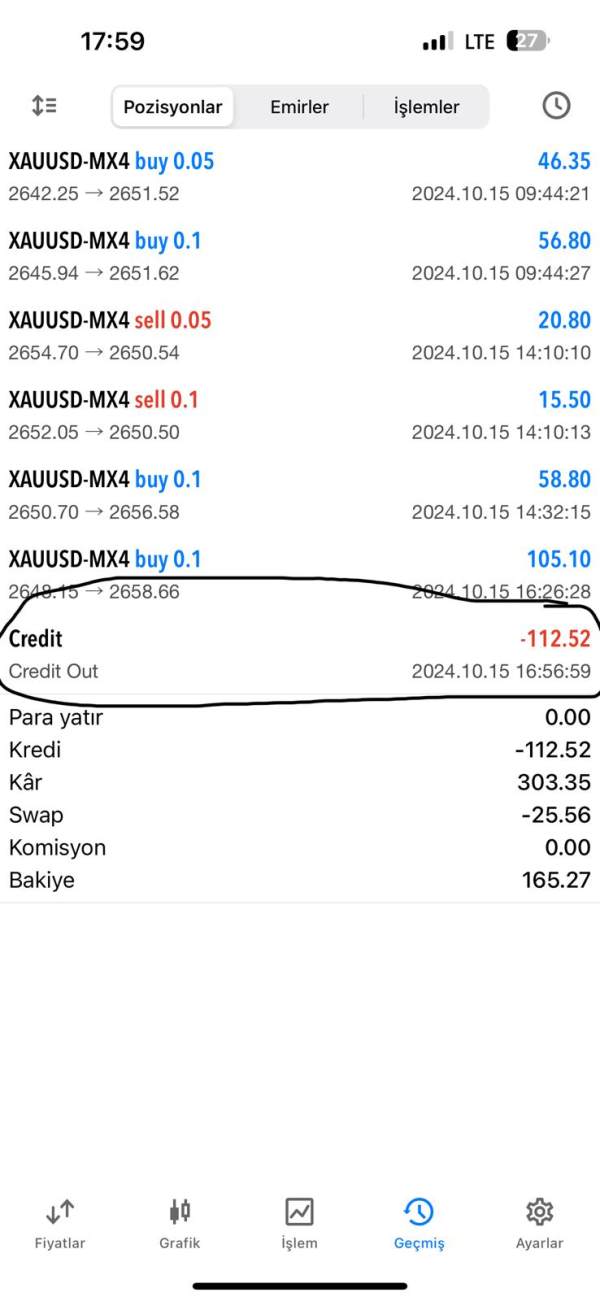

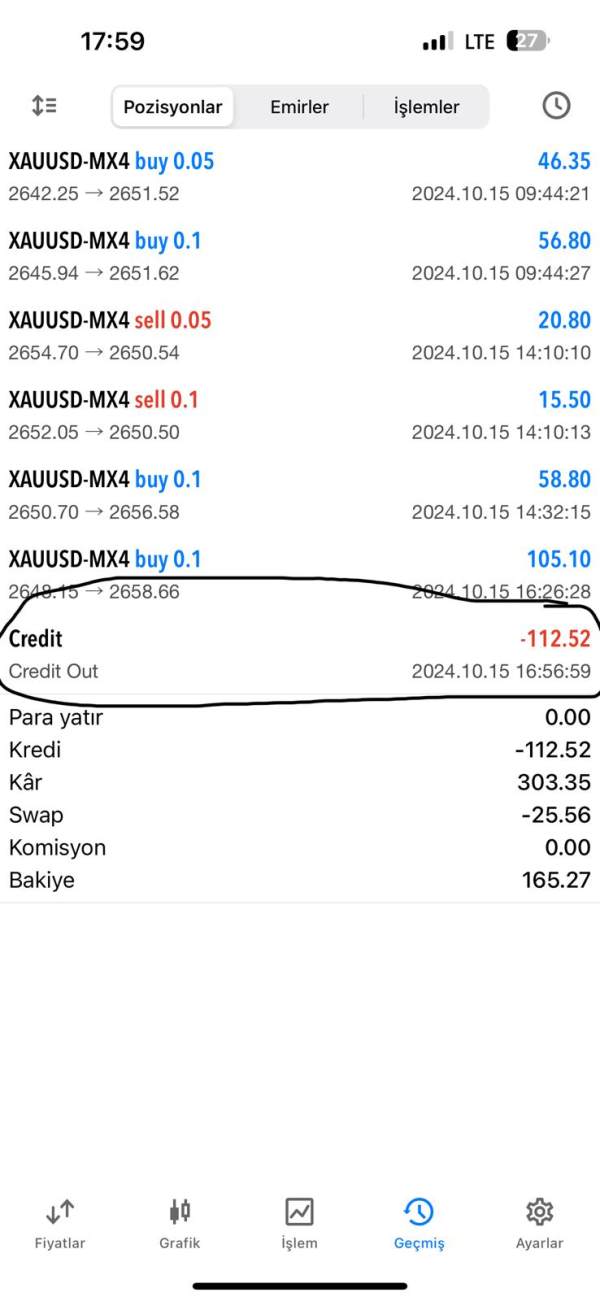

Maxxi Markets works as an offshore forex broker. They offer many trading tools including forex, commodities, indices, precious metals, cryptocurrencies, and bonds. The company gives traders their own platform plus MetaTrader 5 (MT5) support and 24/7 customer service around the clock. But our research shows big problems with fund security and getting your money out that make these features less appealing.

The broker wants traders who seek different investment choices across many types of assets. However, growing evidence of scam claims and user complaints about withdrawal problems raises serious questions about whether this platform is real. Liberty Reviews reports that users say they were "scammed out of money" with no profit returns, which is a major warning sign for people thinking about investing.

Even though they appear on various review sites, our overall check shows a broker with major trust and operational problems that potential traders should avoid or approach very carefully.

Important Disclaimers

Regional Entity Differences: Maxxi Markets works under the Mwali International Services Authority, which is an offshore regulatory body from the Comoros Islands. This type of regulation usually gives much weaker investor protection compared to major financial regulators like the FCA, ASIC, or CySEC. Traders should know that offshore regulation often means you have limited options if disputes happen or if you need to recover your funds.

Review Methodology: This assessment uses detailed analysis of user feedback from multiple platforms, regulatory information checks, market analysis, and available public information about how the broker operates. Our review looks at both positive and negative user experiences while focusing on documented complaints and checkable regulatory status.

Overall Rating Framework

Broker Overview

Maxxi Markets calls itself a top forex broker that gives access to global financial markets, but the reality looks much more worrying than their marketing claims. The company operates from the Comoros Islands using offshore regulatory status that immediately makes people question oversight and investor protection standards.

Their business model focuses on giving multi-asset trading opportunities across forex, commodities, indices, precious metals, cryptocurrencies, and bonds. Their promotional materials emphasize "transparent pricing" and "dedicated support," but user experiences show a big gap between these claims and actual service delivery. The platform targets traders who want portfolio variety, but growing negative feedback shows serious operational problems.

Maxxi Markets uses both their own trading technology and the popular MetaTrader 5 platform to try to serve different trader preferences. The company operates under regulatory oversight from the Mwali International Services Authority, which gives minimal investor protection compared to established financial regulators. This regulatory choice is especially concerning given the serious claims of fraudulent activity reported by multiple users.

The broker's market position as a "gateway to global financial markets" looks increasingly questionable when you examine it against user testimonials and withdrawal complaints that have appeared across various review platforms.

Regulatory Status: Maxxi Markets operates under the Mwali International Services Authority from the Comoros Islands, which represents offshore regulation with limited investor protections.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not clearly shown in available materials, which itself represents a transparency concern for potential traders.

Minimum Deposit Requirements: The minimum deposit requirements are not specified in available documentation. This indicates a lack of transparency in basic trading conditions.

Bonuses and Promotions: No specific bonus or promotional offers are detailed in available materials, though this may be intentionally hidden.

Trading Assets: The platform offers forex pairs, commodities, stock indices, precious metals, cryptocurrencies, and bonds. This provides a diverse range of trading instruments.

Cost Structure: Critical information about spreads, commissions, and fees remains undisclosed in available materials. This represents a significant transparency failure that should concern potential traders.

Leverage Ratios: Specific leverage information is not provided in available documentation. This makes it impossible for traders to assess risk parameters.

Platform Options: The broker supports both proprietary trading platforms and MetaTrader 5. However, the quality and reliability of these platforms remain questionable based on user feedback.

Geographic Restrictions: Information about geographic trading restrictions is not specified in available materials.

Customer Service Languages: The range of supported languages for customer service is not detailed in available documentation.

This maxxi markets review reveals concerning gaps in basic transparency that reputable brokers typically provide upfront.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

The account conditions at Maxxi Markets present significant concerns because they lack transparent information about basic trading parameters. Available materials fail to specify account types, minimum deposit requirements, or detailed fee structures, which represents a major red flag for any legitimate brokerage operation.

The absence of clear information about account opening procedures, verification requirements, and account maintenance conditions suggests either poor operational standards or deliberate hiding of important details. Reputable brokers typically provide complete account information upfront, making this lack of transparency particularly concerning.

User feedback indicates confusion and frustration regarding account conditions. Many traders report unexpected fees and unclear terms of service. The offshore regulatory status further adds to these concerns, as traders have limited options when disputes arise over account conditions or unexpected charges.

The lack of information about specialized account types, such as Islamic accounts for Muslim traders, indicates a limited approach to serving diverse client needs. This maxxi markets review finds that the overall account conditions framework fails to meet industry standards for transparency and client protection.

Maxxi Markets offers a moderate selection of trading tools across multiple asset classes, including forex, commodities, indices, precious metals, cryptocurrencies, and bonds. The platform supports both proprietary trading software and MetaTrader 5, potentially giving traders familiar interface options.

However, the quality and reliability of these trading tools remain questionable based on user feedback. While the diversity of available instruments appears comprehensive on paper, user reports suggest significant issues with execution quality and platform stability that undermine the practical value of these offerings.

The broker's research and analysis resources are not clearly detailed in available materials. This indicates either limited analytical support or poor communication of available resources. Educational materials and market analysis tools, which are standard offerings from reputable brokers, appear to be either absent or inadequately promoted.

Automated trading support through MT5 provides some technical capability, but the overall infrastructure concerns raised by users suggest that even standard features may not function reliably. The lack of detailed information about trading tools and their specifications further diminishes confidence in the broker's technical offerings.

Customer Service Analysis (Score: 4/10)

Maxxi Markets advertises 24/7 customer support, which appears to be one of their stronger service commitments. Some users report responsive customer service interactions, particularly regarding initial inquiries and account setup processes.

However, the quality of customer service gets much worse when users encounter serious issues, particularly regarding withdrawals and fund access. Multiple user reports indicate that customer service becomes unresponsive or provides inadequate solutions when traders attempt to withdraw profits or resolve account problems.

The lack of specified communication channels, supported languages, and escalation procedures indicates poor customer service infrastructure. While 24/7 availability is advertised, the practical effectiveness of this support appears limited based on user experiences with critical issues.

Response times may be reasonable for basic inquiries, but user feedback suggests that complex problems, especially those involving fund withdrawals, receive inadequate attention or resolution. This pattern is particularly concerning given the serious nature of the withdrawal complaints reported across multiple platforms.

Trading Experience Analysis (Score: 3/10)

The trading experience at Maxxi Markets appears severely compromised based on user feedback and operational concerns. While the platform supports MetaTrader 5, which is generally considered reliable trading software, user reports indicate significant issues with order execution and platform stability.

Traders report problems with slippage, requotes, and execution delays that significantly impact trading performance. The lack of transparent information about spreads, commissions, and execution policies makes it difficult for traders to assess the true cost of trading or plan effective strategies.

Platform stability issues compound these execution problems. Users report connectivity issues and platform freezes during critical trading moments. The mobile trading experience is not well-documented, suggesting either limited mobile support or poor promotion of available mobile solutions.

The overall trading environment appears compromised by the broader operational issues affecting the broker, particularly the withdrawal problems that make it difficult for traders to access any profits they may generate. This maxxi markets review finds that the trading experience fails to meet basic industry standards for reliability and transparency.

Trust and Safety Analysis (Score: 2/10)

Trust and safety represent the most critical concerns in this Maxxi Markets evaluation. The broker's regulatory status under the Mwali International Services Authority provides minimal investor protection, as offshore regulators typically lack the authority and resources to effectively oversee broker operations or assist in fund recovery.

Multiple user reports of withdrawal difficulties and scam allegations create serious questions about fund safety. According to Liberty Reviews, users report being "scammed out of money" with no profit realization, which represents the most serious possible concern for any trading platform.

The lack of transparency regarding fund segregation, insurance coverage, and audit procedures further undermines confidence in the broker's safety measures. Reputable brokers typically provide detailed information about client fund protection, making this absence particularly concerning.

The company's offshore structure and limited regulatory oversight create an environment where user recourse is severely limited in case of disputes or fund recovery needs. The mounting negative feedback and scam allegations suggest systemic issues that potential traders should consider as prohibitive risk factors.

User Experience Analysis (Score: 3/10)

User experience at Maxxi Markets appears significantly compromised based on available feedback and operational analysis. While some users report satisfactory initial experiences, particularly with account opening and early trading activities, the overall user journey appears to get much worse over time.

The registration and verification processes are not clearly documented. This indicates either streamlined procedures or inadequate communication of requirements. The lack of detailed information about user interface design and platform usability suggests limited attention to user experience optimization.

Fund operation experiences represent the most critical user experience failure, with multiple reports of withdrawal difficulties and fund access problems. Users report frustration with unclear fee structures, unexpected charges, and poor communication regarding account operations.

The disconnect between advertised services and actual user experiences creates a pattern of disappointed expectations and frustrated users. This maxxi markets review concludes that the user experience fails to meet basic standards for customer satisfaction and operational reliability.

Final Verdict

This comprehensive analysis reveals that Maxxi Markets presents significant risks that outweigh any potential benefits for traders. The combination of offshore regulation, withdrawal complaints, scam allegations, and operational transparency failures creates a risk profile that suggests potential traders should seek alternative brokerage options.

The broker may appeal to traders seeking diverse asset exposure and 24/7 support, but the fundamental safety and operational concerns make it unsuitable for serious trading activities. The lack of transparent pricing, unclear account conditions, and mounting user complaints indicate systemic issues that are unlikely to improve without major operational changes.

Primary advantages include multi-asset trading opportunities and advertised round-the-clock support, while critical disadvantages encompass regulatory inadequacy, withdrawal difficulties, transparency failures, and serious scam allegations that make the platform unsuitable for recommended use.