Is Easy safe?

Pros

Cons

Is Easy Safe or a Scam?

Introduction

Easy, a foreign exchange broker, has gained attention among traders for its user-friendly platform and competitive offerings. As the forex market continues to expand, traders face an overwhelming number of options, making it crucial to assess the legitimacy and safety of brokers like Easy. Given the potential for scams in the trading industry, it is essential for traders to conduct thorough research before committing their funds. This article aims to evaluate whether Easy is a safe trading option or if it raises red flags that warrant caution. Our investigation is based on a comprehensive review of regulatory status, company background, trading conditions, client safety measures, customer experiences, and overall risk assessment.

Regulation and Legitimacy

Understanding the regulatory framework within which a broker operates is vital for determining its legitimacy. Easy is regulated by the Netherlands Authority for the Financial Markets (AFM), which oversees the broker's operations and ensures compliance with financial regulations. Regulation is critical as it provides a layer of protection for traders, ensuring that brokers adhere to established standards and practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| AFM | N/A | Netherlands | Verified |

The AFM is known for its stringent regulatory environment, which adds credibility to Easy's operations. Notably, there have been no significant compliance issues reported against Easy, indicating a clean regulatory history. However, while Easy is regulated, it does not offer the same level of investor protection as some other brokers, particularly those based in jurisdictions with more comprehensive safety nets. For instance, while the European investor protection scheme typically covers up to €20,000, Easy does not provide additional deposit guarantee schemes for cash held in client accounts. This lack of extensive protection may raise concerns for potential clients.

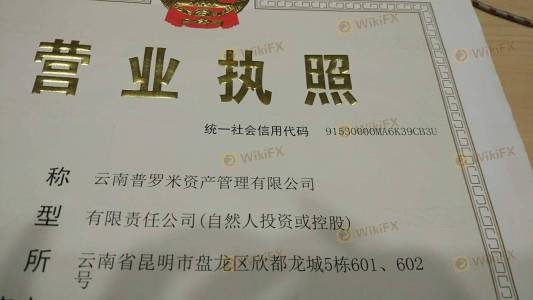

Company Background Investigation

Easy's history is relatively short but notable. Established in 2014, the broker has focused on serving the Belgian and Dutch markets, claiming to have over 15,000 active clients. Despite its rapid growth, the company's ownership structure and management team remain somewhat opaque, which can be a cause for concern for potential investors.

The management team consists of professionals with a background in finance and trading, but detailed profiles are not readily available. This lack of transparency can hinder investors' ability to assess the competence and integrity of the company's leadership. Additionally, Easy's website primarily operates in Dutch, which may limit accessibility for non-Dutch speakers, further complicating transparency efforts.

Trading Conditions Analysis

Easy's trading conditions present a mixed bag for potential clients. The broker offers a transparent fee structure, which is a significant advantage. However, certain fees may be considered unusual or problematic, particularly for novice traders who may not be familiar with the intricacies of forex trading.

| Fee Type | Easy | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.8 pips | 1.0 pips |

| Commission Model | 0.08% per trade | 0.1% per trade |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Easy are competitive, particularly for major currency pairs, which can benefit active traders. However, the commission structure may be less favorable for those who engage in frequent trading. Additionally, the broker's withdrawal fees and limitations on the frequency of withdrawals (once every 30 days) could pose challenges for traders needing quick access to their funds.

Client Funds Safety

When it comes to client funds safety, Easy implements several measures, including the segregation of client funds from company operating funds. This is a standard practice that helps protect clients' assets in the event of financial difficulties faced by the broker. However, while Easy is regulated, it does not offer a deposit guarantee scheme, which can be a significant drawback for potential clients concerned about the safety of their investments.

Furthermore, there have been no historical incidents reported regarding fund security issues with Easy. However, the lack of additional safety nets, such as negative balance protection, may expose clients to risks in volatile market conditions. Traders should be aware of these limitations when considering whether Easy is safe for their trading activities.

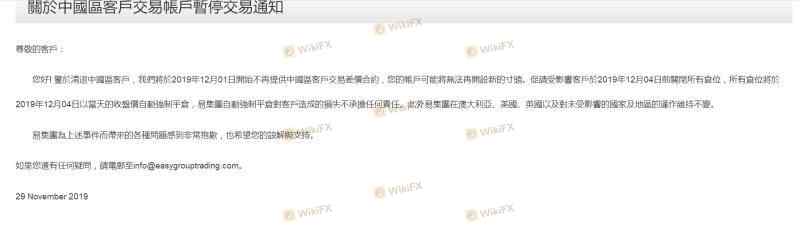

Customer Experience and Complaints

Customer feedback is a crucial component in assessing a broker's reliability. Reviews of Easy indicate a mixed customer experience, with some users praising the platform's ease of use and competitive fees, while others have reported issues with customer service and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Platform Usability Issues | Medium | Addressed |

| Language Barriers | Low | Not addressed |

Common complaints include delays in the withdrawal process, which can be particularly frustrating for traders needing quick access to their funds. Additionally, some users have noted usability issues with the platform, especially for those who are not fluent in English or Dutch. The company has made efforts to address these concerns, but the effectiveness of their responses remains a topic of debate among users.

Platform and Trade Execution

The performance of Easy's trading platform is another critical factor in evaluating its reliability. Users have reported that the platform is generally stable and user-friendly, with a variety of trading tools and features. However, concerns have been raised regarding order execution quality, particularly during times of high market volatility.

In terms of slippage, some traders have reported experiencing significant slippage during rapid market movements, which can adversely affect trading outcomes. Additionally, there have been isolated reports of order rejections, which can be detrimental to a trader's strategy. Overall, while the platform performs well under normal conditions, traders should be cautious during volatile periods.

Risk Assessment

Using Easy comes with inherent risks, which potential clients should carefully consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Limited investor protection available |

| Fund Safety Risk | High | No deposit guarantee scheme |

| Customer Service Risk | Medium | Mixed feedback on support responsiveness |

| Execution Risk | Medium | Potential slippage and order rejections |

To mitigate these risks, traders are advised to conduct thorough research, utilize risk management strategies, and consider diversifying their investment across multiple brokers.

Conclusion and Recommendations

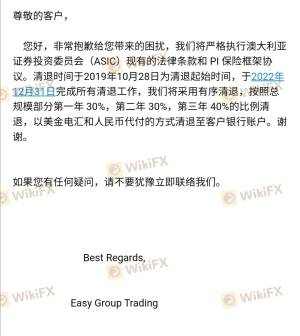

In conclusion, while Easy presents itself as a competitive option in the forex market, potential clients should approach with caution. The broker is regulated, which adds a layer of legitimacy, but the lack of comprehensive investor protection and transparency raises concerns.

For traders seeking a reliable broker, it is advisable to consider alternatives that offer stronger regulatory oversight and better client protection. Brokers with a proven track record, such as those regulated by top-tier authorities like the FCA or ASIC, may provide a safer trading environment.

In summary, while Easy may not be a scam, it does present certain risks that traders should be aware of before committing their funds. Always conduct thorough due diligence and consider your risk tolerance before choosing a broker.

Is Easy a scam, or is it legit?

The latest exposure and evaluation content of Easy brokers.

Easy Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Easy latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.