Regarding the legitimacy of Markets4you forex brokers, it provides FSC, FSC and WikiBit, (also has a graphic survey regarding security).

Is Markets4you safe?

Pros

Cons

Is Markets4you markets regulated?

The regulatory license is the strongest proof.

FSC Market Making License (MM)

British Virgin Islands Financial Services Commission

British Virgin Islands Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

E-Global Trade & Finance Group, Inc.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSC Securities Trading License (EP)

The Financial Services Commission

The Financial Services Commission

Current Status:

RegulatedLicense Type:

Securities Trading License (EP)

Licensed Entity:

TRADE4YOU INTERNATIONAL

Effective Date: Change Record

2021-09-06Email Address of Licensed Institution:

pnarain@credentiainternational.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

C/O CREDENTIA INTERNATIONAL MANAGEMENT LTD, THE CYBERATI LOUNGE, GROUND FLOOR, THE CATALYST, SILICON AVENUE, 40 CYBERCITY, EBENE 72201 , MauritiusPhone Number of Licensed Institution:

+2304672000Licensed Institution Certified Documents:

Is Markets4you A Scam?

Introduction

Markets4you is an online forex broker that has been operating since 2007, primarily catering to retail traders in the foreign exchange market. With its headquarters in the British Virgin Islands, Markets4you has positioned itself as a competitive player in the trading industry, offering a variety of trading instruments, including forex, commodities, stocks, and indices. As the forex market continues to grow, traders must exercise caution when selecting a broker, as the potential for scams and unreliable operations exists. This article aims to provide a comprehensive analysis of Markets4you by evaluating its regulatory status, company background, trading conditions, customer safety measures, user experiences, platform performance, and associated risks. The investigation is based on a review of multiple sources, including user feedback, regulatory information, and market analysis.

Regulation and Legitimacy

Understanding a broker's regulatory status is crucial for assessing its legitimacy. Markets4you operates under the regulatory oversight of the Financial Services Commission (FSC) of the British Virgin Islands and Mauritius. While these regulatory bodies provide some level of oversight, they are often considered less stringent than top-tier regulators like the FCA (UK) or ASIC (Australia). Below is a summary of the regulatory information for Markets4you:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSC (BVI) | SIBA/L/12/1027 | British Virgin Islands | Active |

| FSC (Mauritius) | Not specified | Mauritius | Active |

The FSC is responsible for ensuring that licensed entities adhere to the laws and regulations governing financial services. Although Markets4you holds valid licenses, its offshore regulatory status may raise concerns for some traders. The quality of regulation is essential, as it often dictates the level of investor protection and operational transparency. Markets4you has faced scrutiny in the past regarding its compliance and operational practices, which could impact traders' confidence in the platform.

Company Background Investigation

Markets4you is owned by E-Global Trade & Finance Group, Inc., which has been in operation for over 15 years. The company has expanded its services to cater to a global audience, boasting millions of accounts and a wide range of financial instruments. The management team comprises experienced professionals with backgrounds in finance and trading, contributing to the company's growth and reputation in the industry.

Transparency is a critical aspect of any brokerage, and Markets4you appears to maintain a reasonable level of information disclosure. The company's website provides details about its operational history, regulatory licenses, and trading conditions. However, some users have expressed concerns about the accessibility and clarity of this information, particularly regarding how regulatory compliance is communicated.

Trading Conditions Analysis

The trading conditions offered by Markets4you are a significant factor in its attractiveness to potential clients. The broker provides several account types, including cent accounts and standard accounts, catering to both novice and experienced traders. The overall fee structure is competitive, with spreads starting as low as 0.1 pips on certain accounts. Below is a comparison of core trading costs:

| Fee Type | Markets4you | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 0.1 pips | From 0.2 pips |

| Commission Model | $7 per lot (Pro) | $8 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads are attractive, some users have reported high withdrawal fees and inactivity charges, which could deter potential clients. Additionally, the lack of support for cryptocurrency trading may limit the appeal for traders looking for diversification.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker. Markets4you claims to implement several security measures to protect client funds, including segregated accounts and negative balance protection. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, reducing the risk of loss in case of insolvency. However, the absence of a specific investor compensation scheme may raise concerns for traders looking for additional layers of protection.

Historically, Markets4you has faced some issues related to fund withdrawals and transfer delays, which could indicate underlying problems with liquidity or operational efficiency. Traders should be aware of these potential risks when considering Markets4you as their broker.

Customer Experience and Complaints

Customer feedback is an essential aspect of assessing a broker's reliability. Reviews of Markets4you reveal a mixed bag of experiences. While some users praise the platform for its user-friendly interface and responsive customer support, others have raised concerns about withdrawal delays and account verification processes. Below is a summary of common complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Account Verification Issues | Medium | Slow |

| Customer Support Responsiveness | Medium | Generally Positive |

Several users have reported significant delays in processing withdrawals, with some claiming that their accounts were blocked without warning. These issues can severely impact traders' trust in the broker and should be carefully considered before opening an account.

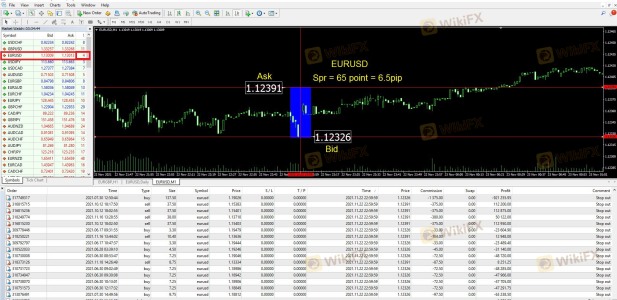

Platform and Trade Execution

The performance and reliability of the trading platform are critical for traders. Markets4you offers popular platforms like MetaTrader 4 and 5, known for their robust features and user-friendly interfaces. However, some users have reported issues with order execution quality, including slippage and rejection rates. The broker's claim of executing orders within 0.1 seconds may not always hold true during volatile market conditions, leading to potential frustrations for traders.

Risk Assessment

Using Markets4you comes with inherent risks that traders should be aware of. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may lack stringent oversight. |

| Operational Risk | Medium | Historical issues with withdrawals and account management. |

| Market Risk | High | High leverage can amplify both gains and losses. |

To mitigate these risks, traders should conduct thorough research, utilize risk management strategies, and consider starting with a demo account to familiarize themselves with the platform.

Conclusion and Recommendations

In conclusion, while Markets4you has established itself as a viable option for traders, several factors warrant caution. The broker's offshore regulatory status, mixed customer feedback, and historical issues with fund withdrawals raise potential red flags. However, its competitive trading conditions and user-friendly platforms may appeal to many traders, especially those just starting.

For traders considering Markets4you, it's essential to weigh the pros and cons carefully. If you prioritize stringent regulation and a proven track record, you may want to explore other options, such as brokers regulated by top-tier authorities like the FCA or ASIC. Alternatively, if you value flexibility and competitive trading conditions, Markets4you could still be a suitable choice, provided you remain vigilant and informed about the associated risks.

Is Markets4you a scam, or is it legit?

The latest exposure and evaluation content of Markets4you brokers.

Markets4you Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Markets4you latest industry rating score is 5.80, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.80 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.