Is FXLINK safe?

Software Index

License

Is Fxlink Safe or a Scam?

Introduction

Fxlink, a forex broker that has recently entered the market, claims to provide a wide range of trading instruments, including forex, stocks, commodities, and cryptocurrencies. As online trading continues to grow in popularity, it is essential for traders to carefully evaluate the legitimacy and safety of their chosen brokers. The forex market, while potentially lucrative, is also fraught with risks, particularly from unregulated or poorly regulated entities. This article aims to assess the safety and reliability of Fxlink by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risks involved. Our investigation is based on a thorough review of online resources, regulatory databases, and user feedback.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its trustworthiness. Regulation provides a framework within which brokers must operate, ensuring transparency and accountability. Unfortunately, Fxlink has been flagged as unregulated, which raises significant concerns about its legitimacy. Below is a summary of the core regulatory information related to Fxlink:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0538938 | United States | Unauthorized |

| - | - | - | - |

The above table indicates that Fxlink is not regulated by any reputable authority. The absence of oversight from recognized regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US means that traders have limited recourse in case of disputes or financial losses. Moreover, the lack of proper regulation raises concerns about the broker's compliance with industry standards and its ability to safeguard client funds. Historically, unregulated brokers have been associated with fraudulent activities, making it imperative for traders to exercise extreme caution when dealing with such entities.

Company Background Investigation

Understanding the background and ownership structure of a broker can provide insights into its reliability. Fxlink, registered as Fxlink Corp Limited, claims to operate from the United Kingdom. However, further investigation reveals that it may be operating from offshore jurisdictions, which often lack stringent regulatory frameworks. The company's history is relatively short, having been established in 2020, and it does not provide clear information about its ownership or management team. This opacity is concerning, as reputable brokers typically disclose their leadership and operational history.

The lack of transparency regarding the company's management raises questions about its accountability and operational integrity. A well-structured management team with relevant expertise is crucial for maintaining a trustworthy brokerage. Unfortunately, Fxlink does not provide sufficient information about its leadership, which could indicate a lack of professionalism and commitment to ethical trading practices.

Trading Conditions Analysis

A broker's trading conditions, including fees and spreads, play a significant role in a trader's overall experience. Fxlink offers various trading instruments but has been criticized for its cost structure. The following table summarizes the core trading costs associated with Fxlink:

| Fee Type | Fxlink | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 20 pips | 1-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not Specified | 0.5% - 3% |

The table indicates that Fxlink's spreads are significantly higher than the industry average, which could lead to increased trading costs for clients. Additionally, the absence of a clear commission structure may result in hidden fees that could surprise traders. The lack of transparency regarding overnight interest rates further complicates the cost assessment, potentially leading to unexpected charges.

Traders should be wary of any broker that does not clearly outline its fee structure, as this could indicate a lack of commitment to fair trading practices. High spreads and unclear fees can erode profit margins, making it essential for traders to thoroughly investigate a broker's trading conditions before committing their funds.

Customer Fund Security

The safety of customer funds is paramount in the trading industry. Regulated brokers are typically required to maintain segregated accounts, ensuring that client funds are protected in the event of financial difficulties. Unfortunately, Fxlink does not provide clear information regarding its fund security measures. There are no indications that it maintains segregated accounts or offers investor protection schemes.

Moreover, the absence of negative balance protection raises concerns about the potential for clients to lose more than their initial investment. Historically, unregulated brokers have faced significant scrutiny for mishandling client funds, leading to losses for traders. Without a robust framework for protecting client assets, Fxlink poses a considerable risk to potential investors.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews of Fxlink indicate a mixed bag of experiences, with numerous complaints highlighting issues such as withdrawal difficulties and poor customer service. The following table summarizes the primary types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Inadequate |

| High Spreads | Medium | Ignored |

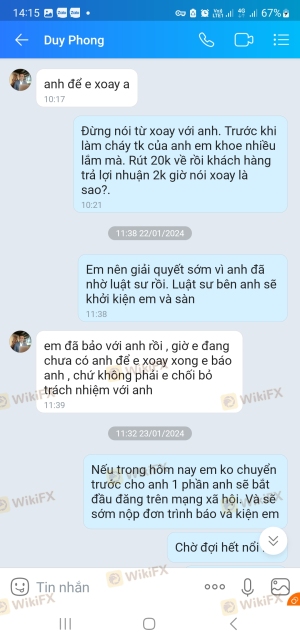

Common complaints include difficulties in withdrawing funds, which is a significant red flag for any broker. Traders have reported that their withdrawal requests were either delayed or denied, leading to frustration and financial losses. Additionally, the lack of transparency regarding fees and trading conditions has contributed to a negative perception of the broker.

One notable case involved a trader who reported being unable to withdraw their funds after several attempts. Despite multiple inquiries, the broker's customer service provided vague responses, further exacerbating the situation. Such experiences highlight the importance of choosing a broker with a proven track record of addressing customer concerns promptly and effectively.

Platform and Trade Execution

The trading platform's performance is critical for a smooth trading experience. Fxlink claims to offer the popular MetaTrader 5 platform, known for its advanced features and user-friendly interface. However, user reviews suggest that the platform may suffer from stability issues, including slow execution times and occasional outages.

Moreover, traders have expressed concerns about order execution quality, reporting instances of slippage and rejected orders. These issues can significantly impact trading outcomes, especially for those employing high-frequency trading strategies. Any signs of platform manipulation or consistent execution problems should raise alarms for potential investors.

Risk Assessment

Engaging with an unregulated broker like Fxlink comes with inherent risks. Below is a summary of the key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from financial authorities, increasing the likelihood of fraud. |

| Financial Risk | High | High spreads and unclear fees can erode trading profits. |

| Operational Risk | Medium | Potential platform instability and execution issues. |

| Customer Support Risk | High | Poor response to customer complaints and withdrawal issues. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with any broker, particularly those lacking regulation. It is advisable to seek brokers with strong regulatory oversight, transparent fee structures, and a proven track record of customer support.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Fxlink operates in a highly risky environment, characterized by a lack of regulation, transparency, and customer support. The absence of a reputable regulatory framework raises significant red flags, indicating potential fraud and mismanagement of client funds. Traders are strongly advised to exercise caution and consider alternative, regulated brokers that offer greater security and reliability.

For those seeking safer trading options, consider established brokers such as OANDA, IG Group, or Forex.com, all of which are regulated by reputable authorities and have demonstrated a commitment to customer safety and transparency. By prioritizing safety and due diligence, traders can protect their investments and enhance their trading experience.

Is FXLINK a scam, or is it legit?

The latest exposure and evaluation content of FXLINK brokers.

FXLINK Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXLINK latest industry rating score is 2.04, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.04 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.