Capital Street FX 2025 Review: Everything You Need to Know

Capital Street FX has garnered mixed reviews in the forex brokerage community, with various user experiences highlighting both strengths and weaknesses. Overall, while some users praise the platform's ease of use and customer service, others raise concerns about its high leverage and bonus requirements, which can be challenging for traders. Notably, the broker operates under the regulation of the Financial Services Commission (FSC) in Mauritius, which has led to questions about its credibility compared to brokers regulated by stricter authorities.

Note: It is essential to be aware that Capital Street FX operates under different entities across various regions, and the regulatory environment may differ significantly depending on the user's location. This review aims for fairness and accuracy by incorporating multiple sources.

Rating Box

How We Rate Brokers: Our ratings are based on comprehensive reviews, user feedback, and expert analysis.

Broker Overview

Established in 2002, Capital Street FX operates under Capital Street Intermarkets Limited and is regulated by the Financial Services Commission (FSC) in Mauritius. The broker provides access to a proprietary trading platform known as ActTrader, which is designed to cater to both novice and experienced traders. Users can trade a wide range of assets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies. However, the lack of a widely recognized platform like MT4 or MT5 has been a point of contention among users.

Detailed Section

Regulated Geographic Areas/Regions:

Capital Street FX is primarily regulated in Mauritius, which is considered an offshore jurisdiction. This raises concerns about the level of investor protection compared to brokers regulated by tier-one authorities like the FCA in the UK or ASIC in Australia.

Deposit/Withdrawal Currencies/Cryptocurrencies:

The broker accepts deposits in USD, EUR, and various cryptocurrencies, including Bitcoin and Ethereum. However, users have reported withdrawal fees that can range from $50 to $70 for bank wire transactions, which is higher than average.

Minimum Deposit:

The minimum deposit required to open an account with Capital Street FX is $100, making it accessible for many traders. However, higher-tier accounts with better trading conditions require significantly larger deposits.

Bonuses/Promotions:

Capital Street FX offers a range of bonus promotions, including deposit bonuses that can be as high as 900%. However, users have reported that the bonus conditions can be stringent, requiring traders to meet high trading volume requirements before they can withdraw any profits associated with the bonus.

Tradable Asset Categories:

Traders can access a diverse array of assets, including over 70 currency pairs, commodities like gold and oil, indices, stocks, bonds, and cryptocurrencies. This variety allows traders to diversify their portfolios effectively.

Costs (Spreads, Fees, Commissions):

The broker's spreads start from 2.5 pips for standard accounts, which can be considered high compared to industry standards. Additionally, while there are no deposit fees, withdrawal fees can be a drawback for frequent traders.

Leverage:

Capital Street FX offers high leverage options, up to 1:3500, which can amplify both potential gains and losses. This level of leverage is significantly higher than what is permitted by regulators in many jurisdictions, making it a double-edged sword for traders.

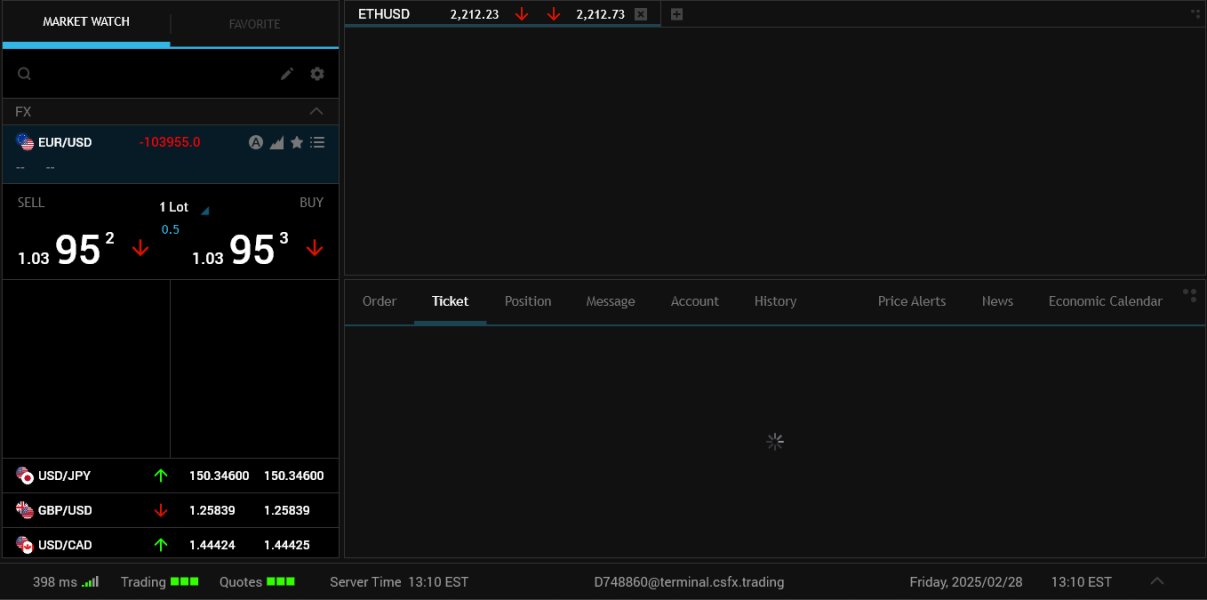

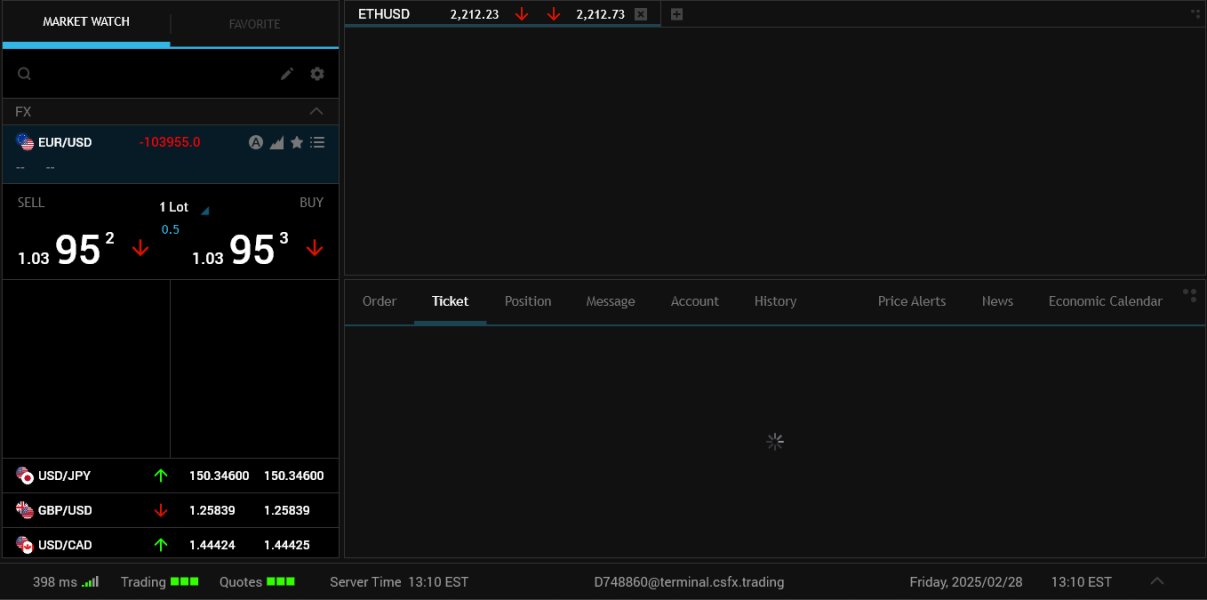

Allowed Trading Platforms:

The primary trading platform offered by Capital Street FX is ActTrader. While it provides essential trading functionalities, many users have expressed a preference for more established platforms like MT4 or MT5, which are not available through this broker.

Restricted Regions:

Capital Street FX does not accept clients from certain countries, including the United States and the United Kingdom, due to regulatory restrictions. Traders should verify the broker's availability in their respective regions before opening an account.

Available Customer Service Languages:

Customer support is available in multiple languages, catering to a global audience. Users have reported positive experiences with the responsiveness and helpfulness of the customer service team.

Repeat Rating Box

Detailed Breakdown Section

-

Account Conditions:

The minimum deposit requirement is relatively low at $100, which is appealing for new traders. However, the account conditions vary significantly based on the type of account chosen, with higher deposits needed for better trading conditions, which can be a barrier for beginners.

Tools and Resources:

Capital Street FX offers a variety of trading tools, including educational resources and market analysis. However, the proprietary ActTrader platform may not be as user-friendly for those accustomed to MT4 or MT5.

Customer Service and Support:

The customer support team has received positive feedback for their responsiveness and assistance. Users have noted that they can reach out via live chat, email, or phone, which adds to the overall positive user experience.

Trading Setup (Experience):

While the trading experience is generally smooth, some users have reported issues with spread discrepancies and execution speed, particularly during volatile market conditions.

Trustworthiness:

The regulatory status of Capital Street FX remains a concern, as the FSC in Mauritius is not considered a top-tier regulator. This has led to mixed reviews regarding the broker's trustworthiness.

User Experience:

Overall, user experiences vary widely, with some traders praising the platform's ease of use and customer service, while others express concerns about the bonus structure and withdrawal processes.

In conclusion, the Capital Street FX review indicates that while the broker offers a range of features and a user-friendly interface, potential traders should weigh the pros and cons carefully, especially regarding regulatory oversight and bonus conditions.