BTCSWAP 2025 Review: Everything You Need to Know

Executive Summary

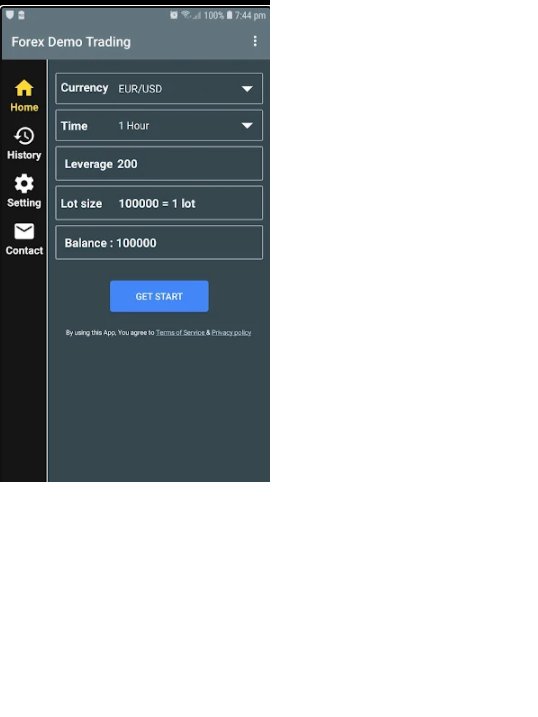

This comprehensive btcswap review reveals concerning findings about BTCSWAP Ltd, a trading platform that presents significant red flags for potential investors. Our investigation shows that BTCSWAP operates as an unregulated broker with multiple fraud warnings and extremely low trust ratings from the trading community. The platform advertises maximum leverage up to 1:200 and claims to offer various financial products including forex currency pairs, cryptocurrencies, indices, and precious metals. However, the overwhelming evidence suggests serious credibility issues.

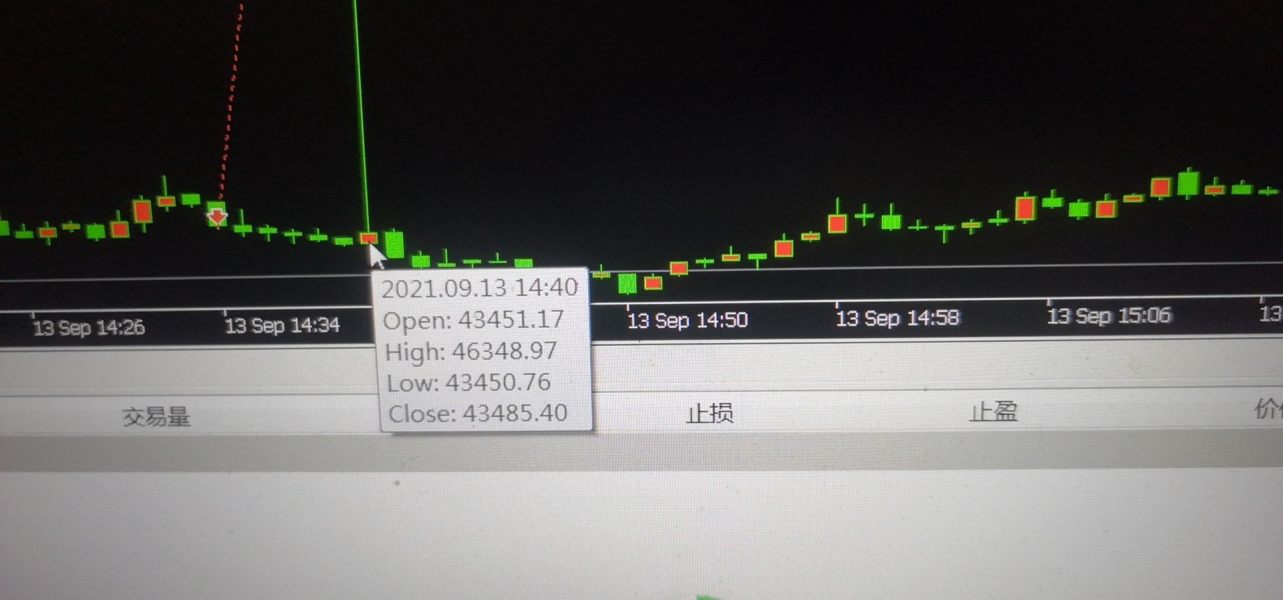

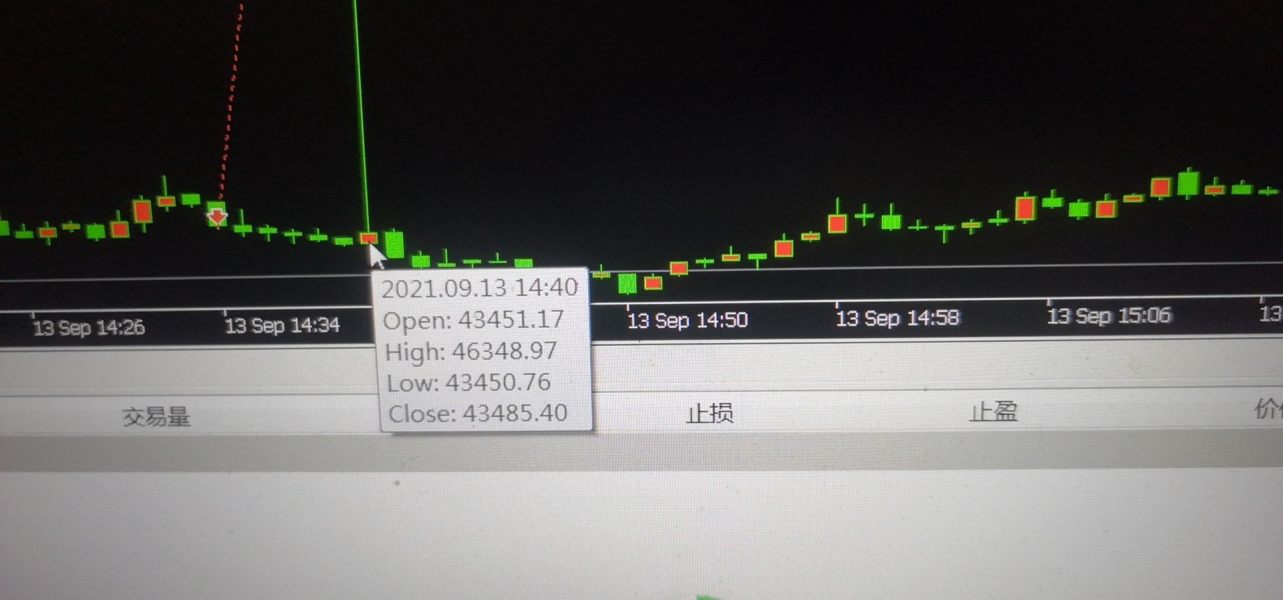

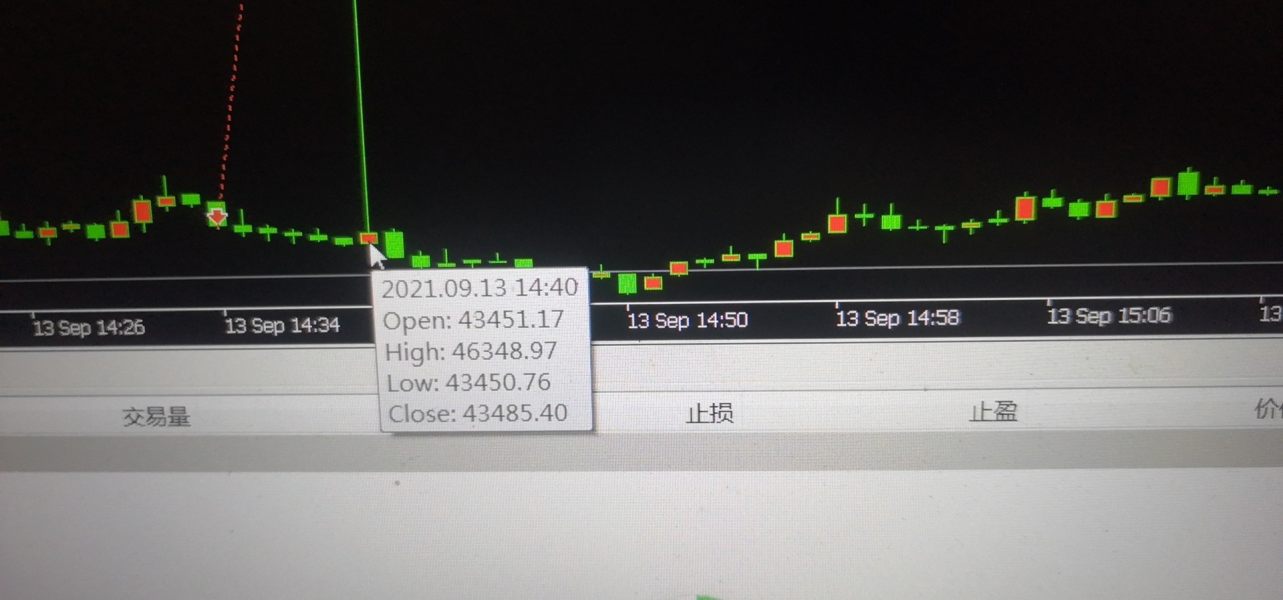

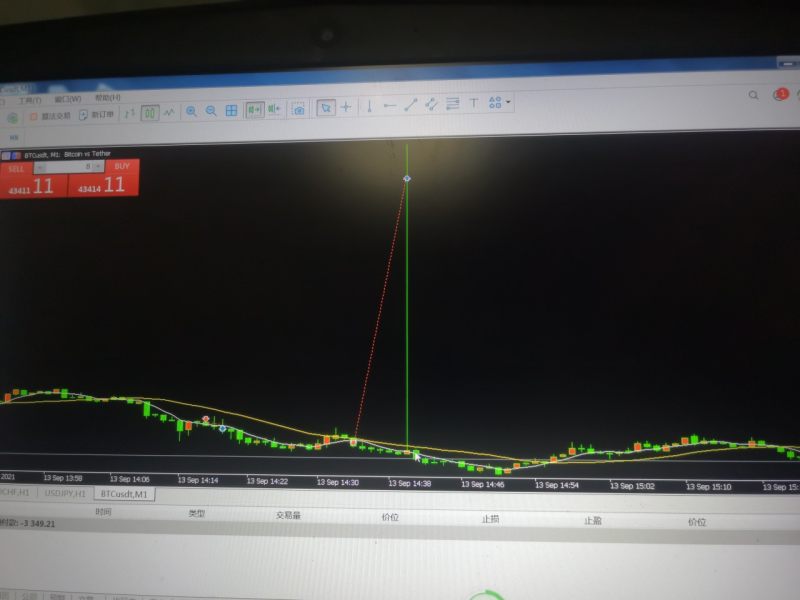

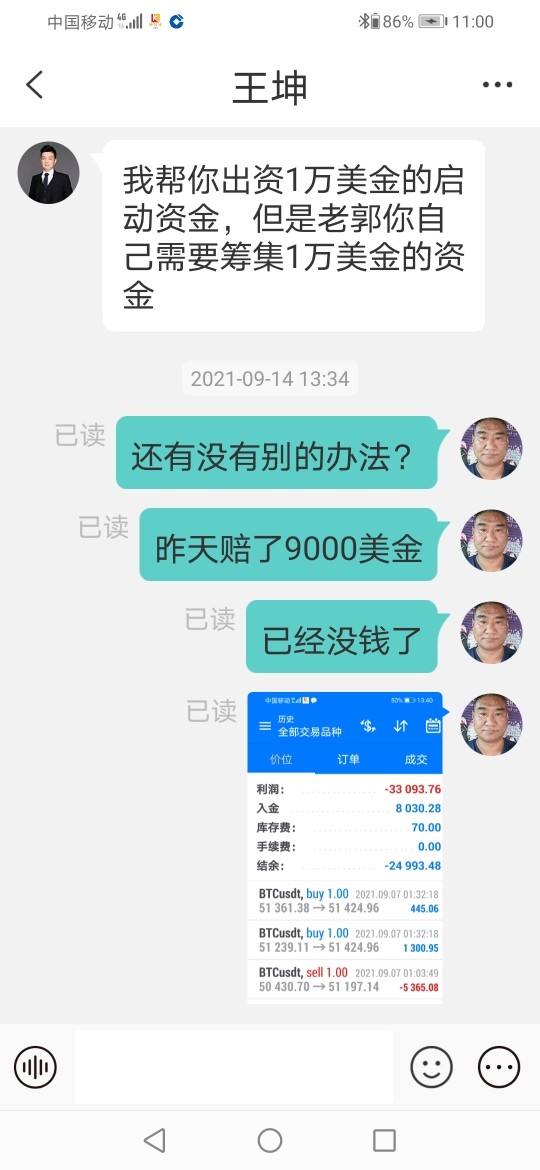

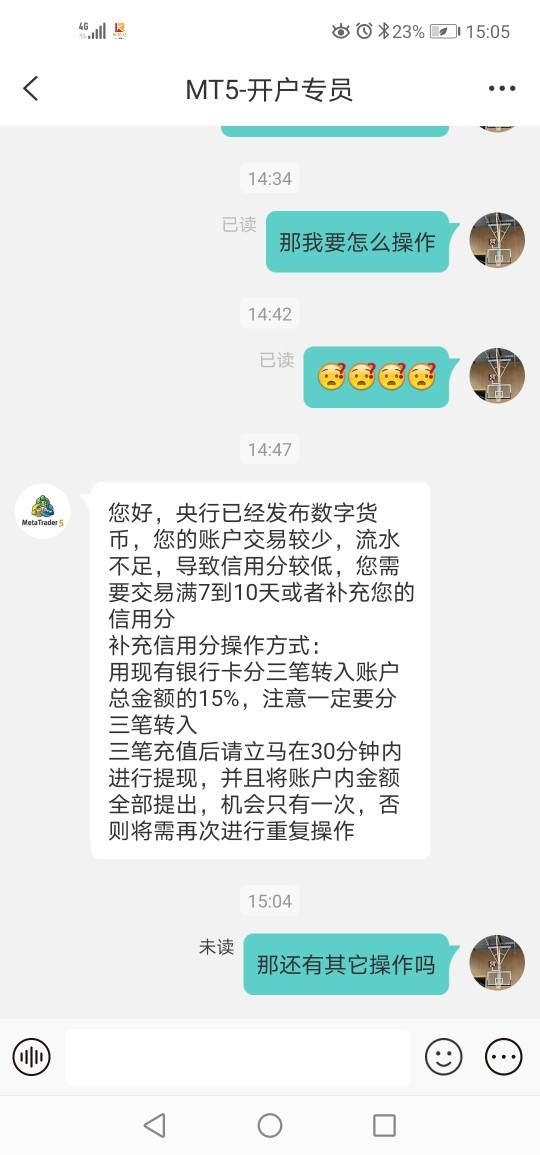

The platform targets global clients but has garnered mostly negative feedback from users who report poor trading experiences and questionable business practices. Multiple exposure reviews and fraud allegations have emerged. Users specifically cite deceptive live streams and fraudulent activities associated with the platform. The lack of proper regulatory oversight, combined with numerous user complaints about trust and reliability, positions BTCSWAP as a high-risk option for traders. Our analysis strongly advises potential investors to exercise extreme caution when considering this platform, as the evidence points toward potential fraudulent operations rather than legitimate brokerage services.

Important Notice

This btcswap review is based on available public information and user feedback collected from various sources. BTCSWAP operates without clear regulatory oversight, which creates varying levels of trust and legal protection across different jurisdictions. Users from different countries may experience different levels of service quality and legal recourse options.

Our evaluation methodology incorporates user testimonials, available regulatory information, and industry reports. However, due to the limited transparency of BTCSWAP's operations, some information remains unverified. Readers should conduct their own due diligence and consider consulting with financial advisors before making any investment decisions. The absence of proper regulatory credentials significantly limits the reliability of information provided by the platform itself.

Rating Overview

Broker Overview

BTCSWAP Ltd positions itself as a global financial services provider offering multiple trading instruments to international clients. The company claims to facilitate trading across various asset classes including foreign exchange currency pairs, cryptocurrencies, digital indices, and precious metals. The platform markets itself as providing comprehensive trading solutions with competitive leverage ratios. However, specific operational details remain largely undisclosed.

The company's business model appears to center around providing online trading services through their proprietary platform. The exact nature of their technological infrastructure and operational framework lacks transparency. BTCSWAP claims to serve a global clientele, suggesting an international scope of operations. Yet the absence of clear regulatory compliance raises significant questions about their legitimacy and operational standards.

Despite marketing claims about offering diverse financial products and services, the platform has attracted substantial negative attention from the trading community. Multiple sources indicate that BTCSWAP operates without proper regulatory authorization. This fundamentally undermines the credibility of their service offerings and creates substantial risks for potential clients seeking legitimate trading opportunities.

Regulatory Status: Available information indicates that BTCSWAP operates without oversight from recognized financial regulatory authorities. This absence of regulatory compliance represents a significant concern for potential traders seeking legitimate and protected trading environments.

Available Assets: The platform claims to offer forex currency pairs, cryptocurrencies, indices, and precious metals. However, specific details about spreads, available instruments, and trading conditions remain largely undisclosed in available materials.

Leverage Ratios: BTCSWAP advertises maximum leverage up to 1:200, which represents relatively high leverage ratios. However, the lack of regulatory oversight means these leverage offerings may not comply with standard industry protection measures.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options, processing times, and associated fees is not detailed in available sources. This creates uncertainty about fund management procedures.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not clearly specified in available materials. This makes it difficult for potential traders to assess the true cost of trading.

Platform Options: The specific trading platforms offered by BTCSWAP are not detailed in available information. This leaves questions about technological capabilities and user interface quality.

Geographic Restrictions: Clear information about regional limitations or service availability across different countries is not specified in available sources. The platform claims global reach.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions offered by BTCSWAP present a mixed picture with significant concerns overshadowing any potential benefits. The platform advertises maximum leverage up to 1:200, which could be attractive to some traders seeking higher exposure. However, the absence of detailed information about account types, minimum deposit requirements, and specific trading conditions raises immediate red flags.

User feedback consistently indicates dissatisfaction with account-related services. Many traders report difficulties in account management and unclear terms of service. The lack of transparency regarding account opening procedures, verification processes, and ongoing account maintenance requirements suggests poor operational standards that fall well below industry norms.

The absence of information about specialized account features, such as Islamic accounts for Muslim traders or professional account categories, indicates limited service customization. Furthermore, the unregulated status of BTCSWAP means that account holders lack the standard protections typically associated with regulated brokers. This includes deposit insurance and regulatory oversight of account management practices. This btcswap review finds that the account conditions fail to meet basic industry standards for safety and transparency.

BTCSWAP's trading tools and educational resources appear severely limited based on available information and user feedback. The platform fails to provide clear details about analytical tools, research capabilities, or educational materials that traders typically expect from legitimate brokers. This lack of comprehensive trading support significantly hampers the potential for informed trading decisions.

User reports consistently indicate inadequate access to market analysis, economic calendars, or professional research resources. The absence of detailed information about charting capabilities, technical indicators, or automated trading support suggests that BTCSWAP offers minimal technological infrastructure. This compares poorly to established brokers in the industry.

Educational resources, which are crucial for trader development, appear to be either non-existent or poorly developed based on available evidence. The lack of webinars, tutorials, market insights, or educational content indicates that BTCSWAP does not prioritize trader education or skill development. This is typically a hallmark of reputable brokerage services.

Customer Service and Support Analysis (2/10)

Customer service represents one of BTCSWAP's most significant weaknesses. User feedback consistently highlights poor support quality and responsiveness. Multiple reports indicate that traders experience difficulties in contacting customer support representatives and receiving timely assistance for their inquiries and concerns.

The lack of detailed information about available support channels, operating hours, and multilingual capabilities suggests inadequate customer service infrastructure. Users report frustration with response times and the quality of assistance provided when issues arise. This is particularly true regarding account access and fund-related concerns.

Most concerning are reports indicating that customer service fails to address serious user concerns about platform reliability and fund security. The combination of poor communication, limited availability, and inadequate problem resolution creates a customer service environment that falls far below industry standards. This contributes to the overall negative user experience with BTCSWAP.

Trading Experience Analysis (3/10)

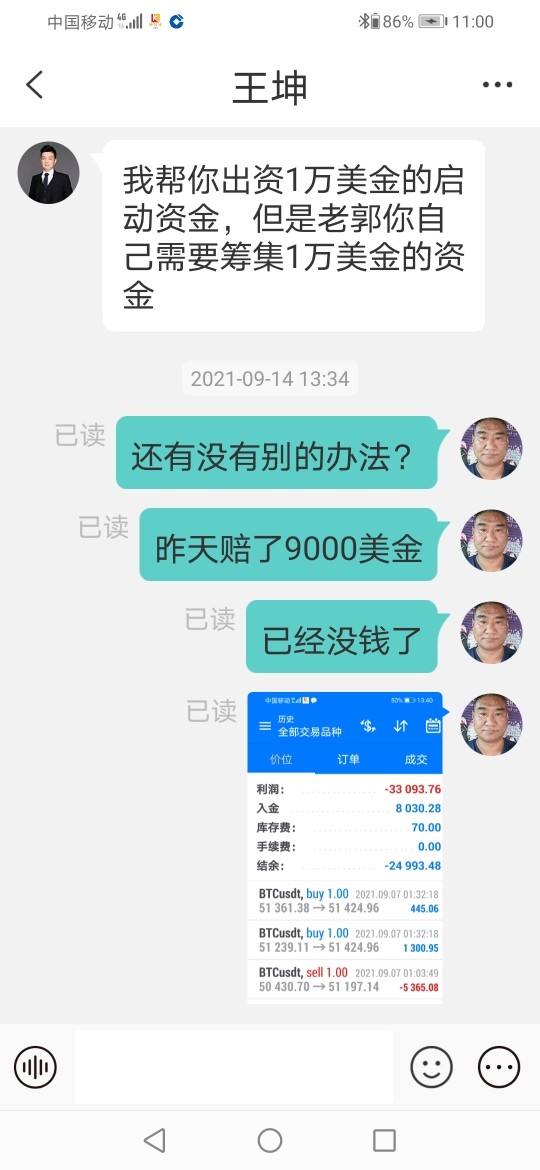

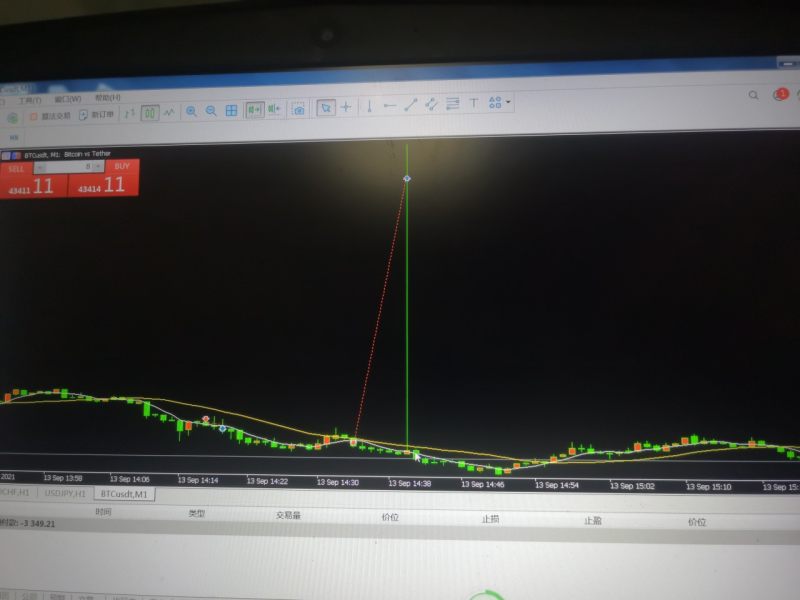

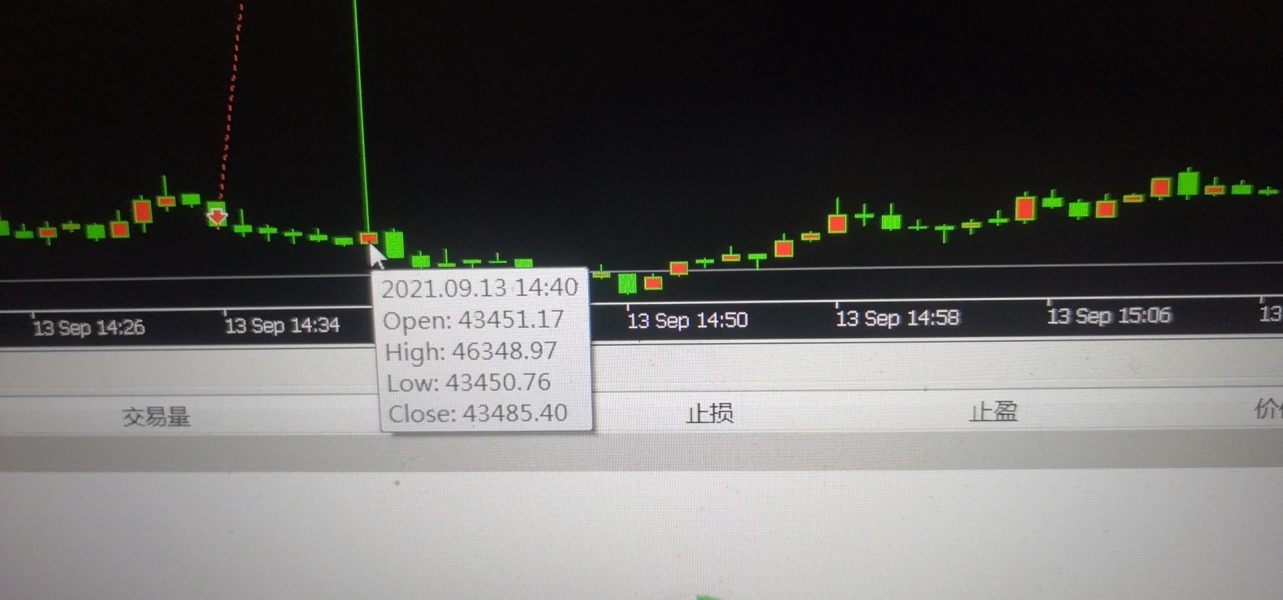

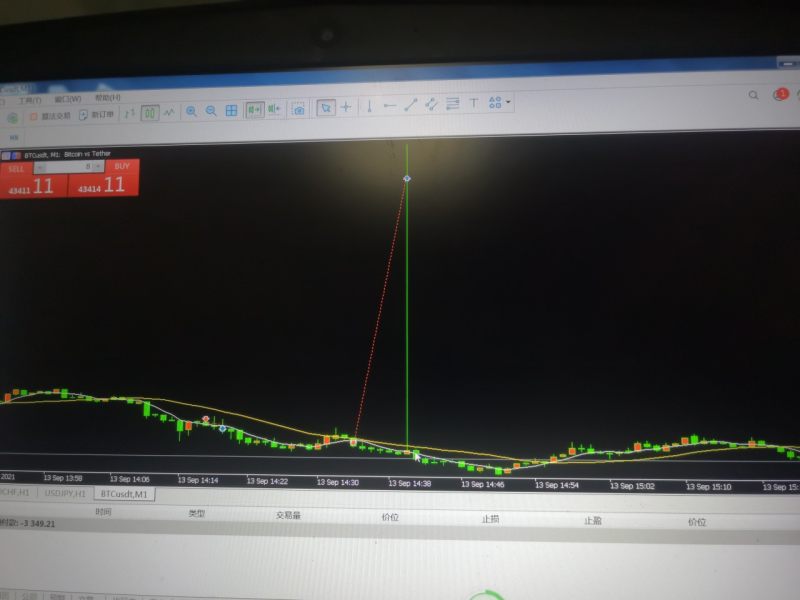

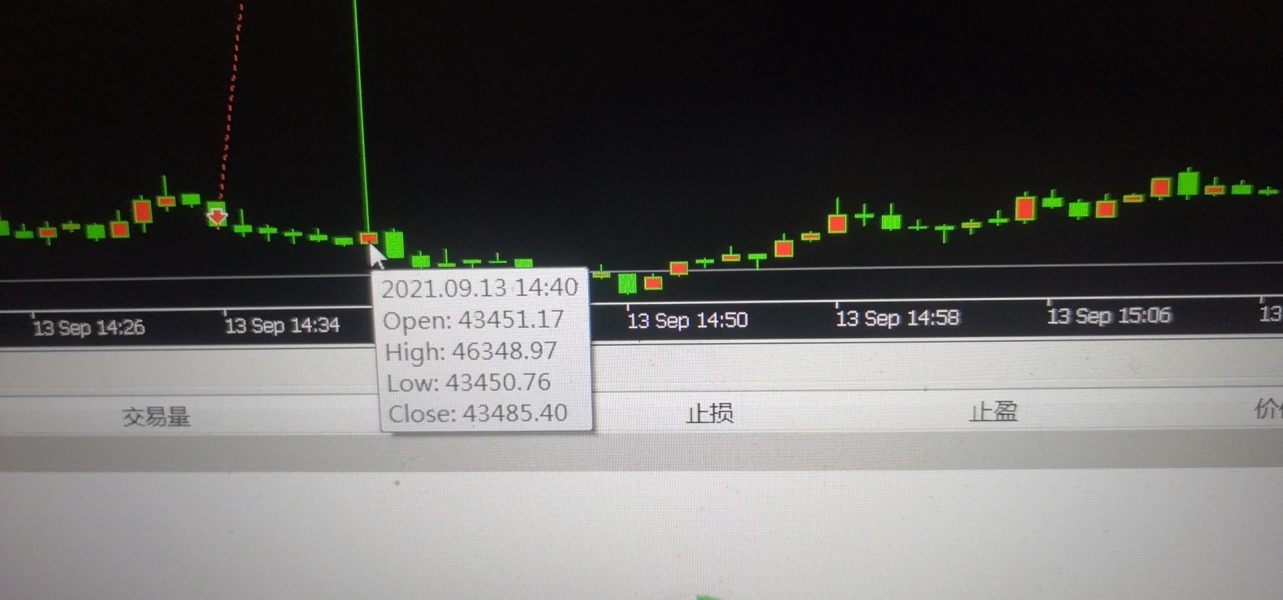

The trading experience provided by BTCSWAP receives consistently negative feedback from users. This indicates significant deficiencies in platform performance and execution quality. Reports suggest that traders encounter various technical difficulties and operational issues that severely impact their ability to execute trades effectively and manage their positions properly.

User feedback indicates problems with platform stability, order execution speed, and overall system reliability. These technical issues create substantial barriers to successful trading and contribute to user frustration and financial losses. The absence of detailed information about platform specifications and technological capabilities further undermines confidence in the trading infrastructure.

Mobile trading capabilities and cross-platform functionality appear limited based on available information. This restricts traders' ability to manage their accounts and execute trades across different devices. The combination of technical limitations, poor execution quality, and inadequate platform features creates a trading environment that fails to meet modern standards for online trading platforms. This btcswap review finds the trading experience substantially below acceptable industry standards.

Trust and Reliability Analysis (1/10)

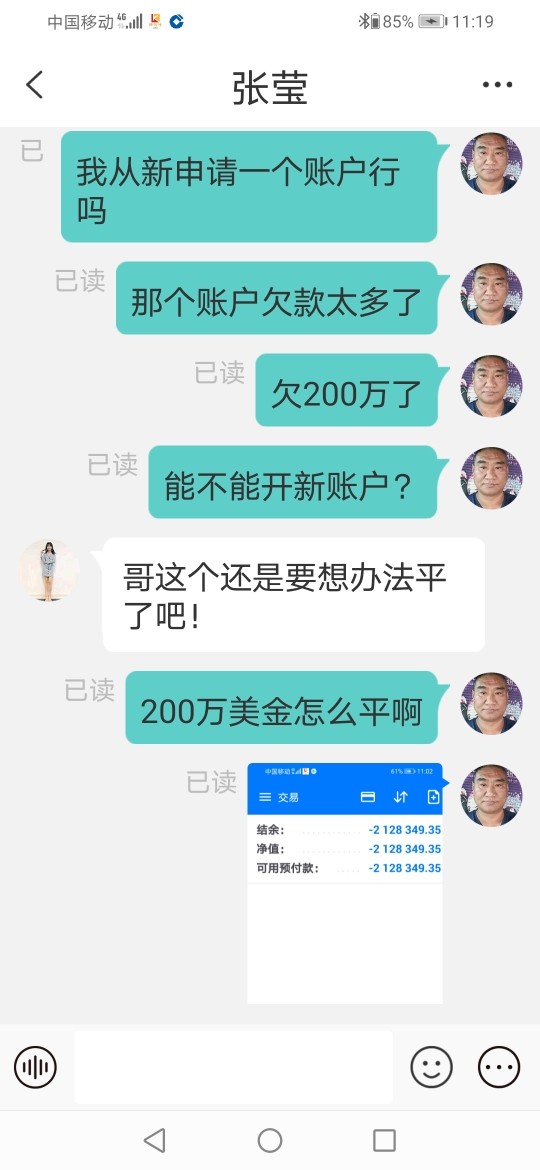

Trust and reliability represent BTCSWAP's most critical failure areas. Overwhelming evidence indicates serious concerns about the platform's legitimacy and operational integrity. The broker operates without regulatory oversight from recognized financial authorities, which immediately raises red flags about fund security and operational transparency.

Multiple fraud warnings and exposure reviews have emerged from various sources. Users specifically report deceptive practices and questionable business operations. The lack of regulatory compliance means that traders have no institutional protection or recourse in case of disputes or fraudulent activities. This creates an extremely high-risk environment for potential investors.

Industry monitoring services and user communities have consistently flagged BTCSWAP as a potentially fraudulent operation. There are specific allegations about deceptive live streams and misleading marketing practices. The absence of transparent company information, verified business credentials, and regulatory authorization creates a trust deficit that cannot be overcome through marketing claims alone.

The overwhelming consensus from user feedback and industry analysis indicates that BTCSWAP should be considered a high-risk entity with questionable legitimacy. This makes it unsuitable for serious traders seeking reliable and trustworthy brokerage services.

User Experience Analysis (2/10)

Overall user satisfaction with BTCSWAP remains extremely low. The vast majority of feedback indicates negative experiences across multiple aspects of the platform. Users consistently report dissatisfaction with various elements of the service, from initial registration difficulties to ongoing operational problems that significantly impact their trading activities.

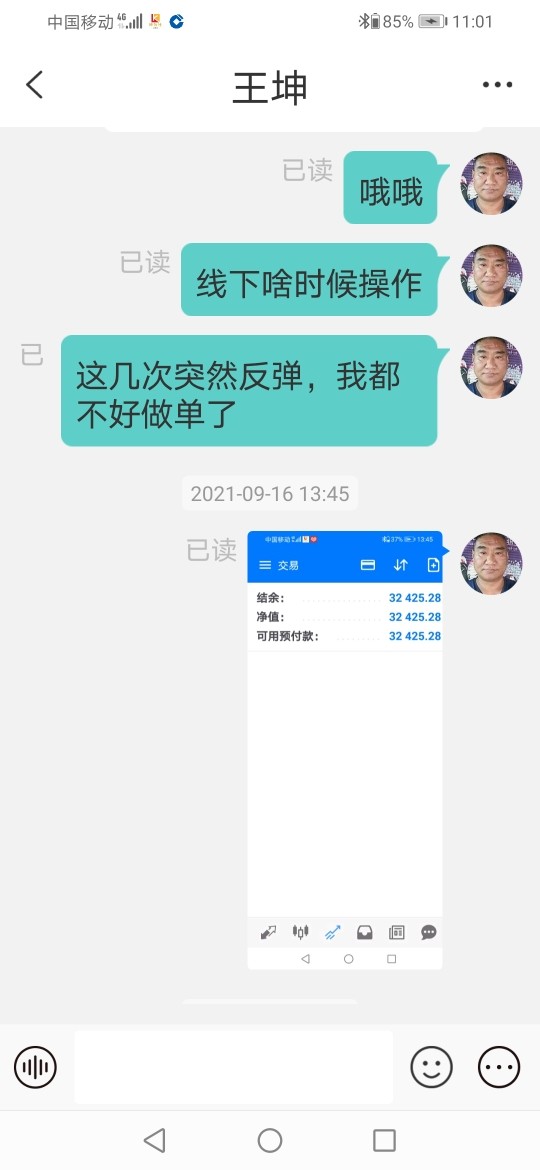

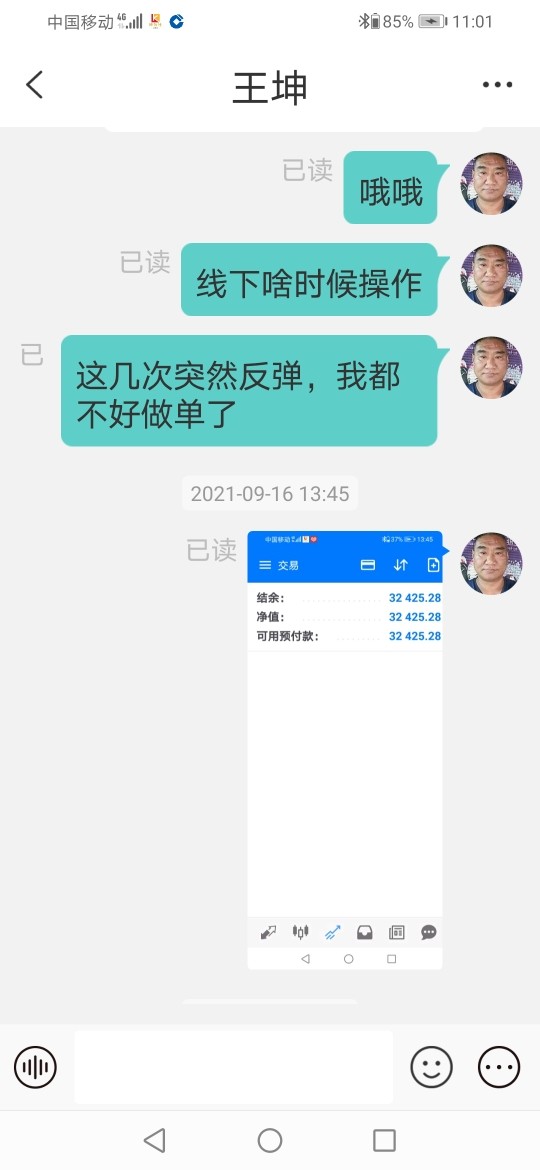

The registration and verification processes appear problematic based on user reports. Many traders experience delays and complications in account setup procedures. Fund management operations, including deposits and withdrawals, generate particular user complaints with reports of difficulties in accessing funds and unclear processing procedures.

Interface design and platform usability receive criticism for poor functionality and limited features compared to industry standards. Users report navigation difficulties and limited customization options that restrict their ability to optimize their trading environment according to their preferences and requirements.

The accumulation of negative user experiences across all aspects of the platform creates an overall user experience that falls far below acceptable standards for modern online trading services. The consistent pattern of user dissatisfaction reinforces the concerns about BTCSWAP's legitimacy and operational quality.

Conclusion

This comprehensive btcswap review reveals that BTCSWAP operates as an unregulated broker with extremely concerning credibility issues that make it unsuitable for serious traders. The overwhelming evidence from user feedback, industry monitoring, and operational analysis indicates significant risks associated with this platform. These include potential fraudulent activities and operational deficiencies.

The platform fails to meet basic industry standards across all evaluated criteria. It has particularly severe deficiencies in trust and reliability, customer service, and user experience. While BTCSWAP advertises high leverage ratios and multiple trading instruments, these apparent advantages are completely overshadowed by fundamental operational and credibility problems.

We strongly advise potential investors to avoid BTCSWAP and instead seek regulated, reputable brokers with proven track records of reliable service and regulatory compliance. The risks associated with unregulated platforms like BTCSWAP far outweigh any potential benefits. This is particularly true given the numerous fraud warnings and negative user experiences documented in this review.