Is DUOCAI LIMITED safe?

Business

License

Is Duocai Limited Safe or a Scam?

Introduction

Duocai Limited is a forex broker that claims to provide a range of trading services to both institutional and individual traders. Operating under the premise of being an ECN (Electronic Communication Network) broker, Duocai Limited offers various financial instruments, including 30 currency pairs and CFDs on commodities and indices. However, as the forex market continues to grow, so does the necessity for traders to carefully evaluate the legitimacy and safety of their chosen brokers. This article aims to investigate whether Duocai Limited is a safe trading platform or simply another scam in the crowded forex market. Our investigation will rely on a comprehensive review of available online resources, focusing on regulatory status, company background, trading conditions, client feedback, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial factor in determining its legitimacy. A well-regulated broker provides a level of security and assurance to traders, ensuring that their funds are protected and that the broker adheres to established financial standards. In the case of Duocai Limited, the situation appears concerning.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

Duocai Limited claims to be regulated by the UK's Financial Conduct Authority (FCA) and mentions being based in Hong Kong. However, multiple sources have confirmed that these claims are false. A thorough check of the FCA and the local Securities and Futures Commission (SFC) registers shows that Duocai Limited is not listed as a regulated entity. This lack of regulation raises significant concerns about the safety of funds deposited with the broker. The absence of oversight means that traders have little recourse in the event of disputes or issues with fund withdrawals, making it essential to question is Duocai Limited safe for trading.

Company Background Investigation

A deeper look into the company history and ownership structure of Duocai Limited reveals a lack of transparency. There is minimal information available regarding the founding members, their qualifications, and the company's operational history. This opacity is a red flag, as reputable brokers typically provide detailed information about their management teams and corporate structure. The absence of such information may indicate that the broker has something to hide, further leading to the question of is Duocai Limited safe for traders.

Moreover, the company's website appears to be poorly designed, with broken links and a lack of critical information about trading conditions and policies. This unprofessional presentation can often be associated with scam brokers aiming to lure unsuspecting traders with flashy promises but lacking the infrastructure to support legitimate trading activities.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. Duocai Limited promotes low spreads and various trading instruments, but the lack of transparency regarding its fee structure raises concerns.

Trading Costs Comparison Table

| Fee Type | Duocai Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | $5 - $10 per lot |

| Overnight Interest Range | N/A | Varies by broker |

The absence of disclosed fees and commissions is alarming. Many brokers provide clear information about their spreads, commissions, and overnight fees, allowing traders to make informed decisions. The lack of such information from Duocai Limited suggests that traders may face unexpected costs or unfavorable trading conditions. This uncertainty contributes to the overall risk profile of the broker and raises further questions about is Duocai Limited safe for trading.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. Duocai Limited does not offer segregated accounts or any investor protection mechanisms, which are standard practices among reputable brokers.

Traders should be particularly wary of brokers that do not provide information on how funds are held or protected. In the case of Duocai Limited, the absence of segregated accounts means that client funds may be at risk, as they could be mixed with the broker's operating funds. Additionally, without regulatory oversight, there is no guarantee that funds will be returned in the event of the broker's insolvency or misconduct.

Client Experience and Complaints

Customer feedback is a vital aspect of assessing a broker's reliability. Reviews and complaints about Duocai Limited indicate a pattern of negative experiences, particularly concerning fund withdrawals and customer service.

Complaint Types and Severity Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Service | Medium | Poor |

| Misleading Information | High | Poor |

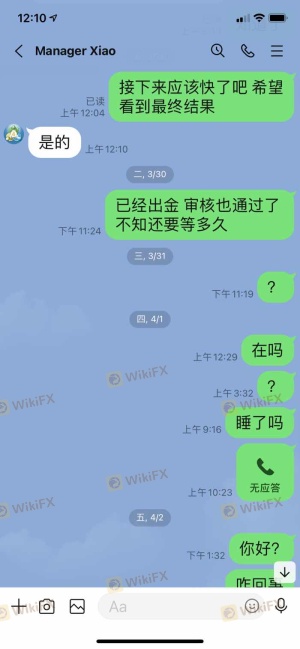

Numerous users have reported difficulties in withdrawing their funds, with some claiming that their accounts were blocked or that they were subjected to unreasonable withdrawal conditions. The company's lack of responsiveness to these complaints further exacerbates the situation, suggesting a lack of accountability. This pattern of behavior raises significant concerns about is Duocai Limited safe for traders.

Platform and Execution

The trading platform offered by Duocai Limited claims to be MetaTrader 4, a popular choice among traders for its user-friendly interface and robust features. However, reviews suggest that the platform may not function as advertised, with reports of technical issues, slippage, and rejected orders.

A broker's execution quality is critical for traders, as delays or rejections can lead to significant financial losses. If Duocai Limited's platform is indeed plagued by such issues, it would further contribute to the risk of trading with this broker.

Risk Assessment

When considering the use of Duocai Limited for trading, it is essential to evaluate the overall risk associated with the broker.

Risk Rating Summary Table

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Financial Risk | High | No protection for client funds |

| Operational Risk | Medium | Technical issues reported |

| Customer Service Risk | High | Poor response to complaints |

Given the findings, the risk of trading with Duocai Limited is substantial. Traders should consider these factors seriously and weigh their options carefully.

Conclusion and Recommendations

In conclusion, the evidence suggests that Duocai Limited exhibits several characteristics typically associated with scam brokers. The lack of regulation, transparency issues, and negative customer feedback point to a high-risk trading environment. Therefore, it is crucial for traders to exercise caution and conduct thorough due diligence before engaging with Duocai Limited.

For those seeking a safer trading experience, we recommend exploring brokers that are well-regulated by reputable authorities, offer transparent fee structures, and have positive customer reviews. Always remember to ask yourself, is Duocai Limited safe? Based on the current information, it is advisable to look for alternatives that prioritize client safety and regulatory compliance.

Is DUOCAI LIMITED a scam, or is it legit?

The latest exposure and evaluation content of DUOCAI LIMITED brokers.

DUOCAI LIMITED Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DUOCAI LIMITED latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.