Is OneUp Trader safe?

Pros

Cons

Is OneUp Trader A Scam?

Introduction

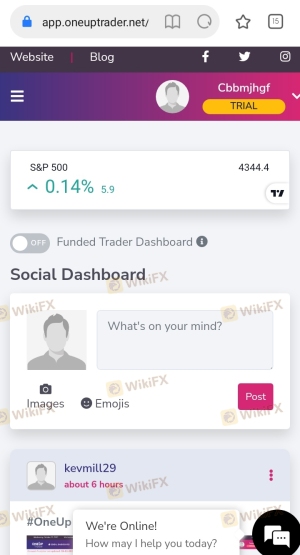

OneUp Trader is a proprietary trading firm that has emerged as a notable player in the futures trading space since its establishment in 2017. Positioned to provide aspiring traders with access to funded accounts, it offers a unique opportunity to trade without the need for substantial personal capital. However, as with any trading firm, it is imperative for traders to exercise caution and conduct thorough evaluations before engaging with OneUp Trader. The financial landscape is rife with potential pitfalls, and understanding the legitimacy and reliability of a trading firm is crucial for safeguarding one‘s investments. This article aims to provide a comprehensive analysis of OneUp Trader, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety. The evaluation is based on extensive research, including user reviews, expert opinions, and the firm’s official documentation.

Regulation and Legitimacy

One of the most critical aspects of assessing whether OneUp Trader is safe is understanding its regulatory framework. Proprietary trading firms like OneUp Trader often operate under a different set of regulations compared to traditional forex brokers. While they are registered companies, they do not typically possess a forex broker license, which subjects them to less stringent oversight. This lack of regulation can raise concerns regarding investor safety and the firms operational integrity.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| N/A | N/A | United States | Registered Company |

Despite being a registered entity in the U.S. (Company Number 6371102), OneUp Trader does not fall under the purview of major financial regulators, which implies a lower level of oversight. This can be a double-edged sword; while it allows for greater operational flexibility, it also means that traders may have limited recourse in cases of disputes or issues arising from trading activities. The absence of a robust regulatory framework necessitates that potential users carefully consider the implications of trading with OneUp Trader and weigh the risks involved.

Company Background Investigation

OneUp Trader was founded in 2017 in Wilmington, Delaware, and has since positioned itself as a reputable firm in the proprietary trading niche. However, details regarding the ownership structure and the management team are somewhat opaque, as the identities of the founders and key executives are not publicly disclosed. This lack of transparency can be a red flag for potential traders, as understanding the leaderships experience and credibility is essential for building trust in a financial institution.

The firm has developed a straightforward one-step evaluation process that allows traders to demonstrate their trading abilities and gain access to funded accounts ranging from $25,000 to $250,000. While the company promotes a community-oriented approach, encouraging traders to share strategies and insights, the absence of publicly available information regarding its leadership can create uncertainty regarding its operational integrity and long-term stability.

Trading Conditions Analysis

When evaluating whether OneUp Trader is safe, it is essential to analyze the trading conditions the firm offers. OneUp Trader operates under a monthly subscription model, where traders pay fees based on the account size they choose to trade. This structure allows traders to engage in futures trading without the requirement of a significant upfront deposit. However, it is crucial to scrutinize the fee structure for any hidden charges that could impact profitability.

| Fee Type | OneUp Trader | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable | 1.0-2.0 pips |

| Commission Model | $0 | $5-10 per round trip |

| Overnight Interest Range | N/A | Varies by broker |

OneUp Trader does not charge for data feeds or impose hidden fees, which is a positive aspect of their fee structure. However, traders must be aware of the minimum withdrawal threshold of $1,000 and the implications of account resets, which incur additional costs. The profit-sharing model is relatively generous, allowing traders to retain 90% of profits after the first $10,000 earned. Nevertheless, the monthly fees can accumulate, particularly if traders need to reset their accounts frequently, thus impacting overall profitability.

Customer Funds Safety

A crucial element in determining if OneUp Trader is safe involves examining the measures taken to protect customer funds. OneUp Trader claims to implement various safety protocols, including fund segregation, which ensures that client funds are kept separate from the companys operating capital. However, the specifics of these measures are not extensively detailed in their documentation.

In terms of investor protection, OneUp Trader does not provide traditional safeguards typically found in regulated environments, such as insurance against insolvency or fraud. This lack of formal protection can be concerning, especially for traders who prioritize the security of their investments. It is essential for potential users to consider these factors and understand the risks associated with trading with a firm that operates outside of a regulated framework.

Customer Experience and Complaints

Customer feedback plays a significant role in determining whether OneUp Trader is a scam or a legitimate trading firm. Reviews on platforms such as Trustpilot indicate a generally positive reception, with many users praising the firms straightforward evaluation process and responsive customer support. However, there are also notable complaints regarding technical issues during evaluations and concerns about the clarity of the rules governing trading activities.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Technical Issues | Moderate | Timely resolution |

| Lack of Transparency | High | Limited information provided |

| Evaluation Process Clarity | Moderate | Clarification offered upon request |

Several users have reported difficulties with the trading platform, including being logged out unexpectedly or facing challenges with order execution. These technical issues can significantly impact the trading experience and raise concerns about the reliability of the platform. Additionally, some traders have expressed dissatisfaction with the perceived lack of transparency regarding evaluation criteria and trading rules, which can lead to confusion and frustration.

Platform and Trade Execution

The performance and reliability of the trading platform are critical factors in assessing whether OneUp Trader is safe. The primary platform used by OneUp Trader is NinjaTrader, which is well-regarded in the trading community for its advanced features and user-friendly interface. However, traders should be aware that the use of automated trading systems is prohibited, which may deter those who prefer algorithmic strategies.

The order execution quality has been a point of contention among users, with reports of slippage and rejections during high volatility periods. While slippage is an inherent risk in trading, the frequency and severity of these incidents can indicate potential issues with the platform's stability and execution reliability.

Risk Assessment

Trading with OneUp Trader entails several risks that potential users should be aware of. The absence of regulatory oversight, combined with the challenges associated with the evaluation process and technical issues, contributes to a higher risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight can lead to potential fraud |

| Technical Risk | Medium | Platform instability may affect trading performance |

| Financial Risk | Medium | Monthly fees and withdrawal thresholds can impact profitability |

To mitigate these risks, prospective traders should ensure they have a solid understanding of the evaluation criteria and trading conditions before committing to a funded account. Additionally, diversifying trading strategies and maintaining a disciplined approach to risk management can help protect against potential losses.

Conclusion and Recommendations

In conclusion, while there is no concrete evidence to suggest that OneUp Trader is a scam, potential users should approach with caution. The firm operates under a less regulated framework, which necessitates a careful evaluation of its legitimacy and reliability. The generally positive customer feedback indicates that many traders have had satisfactory experiences; however, complaints regarding technical issues and transparency should not be overlooked.

For traders considering OneUp Trader, it is advisable to conduct thorough research and weigh the risks involved. If you are an experienced trader who can navigate the challenges presented by the evaluation process, OneUp Trader may offer a valuable opportunity. However, beginners or those seeking a more regulated environment may want to explore alternative options, such as TopstepTrader or Earn2Trade, which provide similar funding opportunities with a more robust regulatory framework.

Is OneUp Trader a scam, or is it legit?

The latest exposure and evaluation content of OneUp Trader brokers.

OneUp Trader Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OneUp Trader latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.