United 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive United review examines a complex entity that operates across multiple sectors, including aviation, real estate, and financial services. United presents a mixed picture for potential clients and investors based on available information. United Airlines demonstrates strong employee satisfaction with 71% positive reviews. The IT team achieves an impressive 100% positive rating on AmbitionBox with an overall score of 4.0/5. United Real Estate has emerged as the 8th largest residential real estate brokerage in the nation by transaction volume. The company experienced remarkable 447% transaction growth in 2020. However, our assessment remains neutral due to insufficient information regarding specific trading conditions, regulatory oversight, and detailed service offerings. The primary user base appears to consist of professionals in the aviation industry and financial investment sectors. The lack of comprehensive trading platform details limits our ability to provide definitive recommendations for forex and CFD traders.

Important Notice

This United review addresses multiple entities operating under the "United" brand, including United Airlines, United Real Estate, and potential brokerage services. Each entity operates with distinct business models and regulatory frameworks. United Airlines functions as a major commercial carrier. United Real Estate operates as a residential brokerage company, and any associated United brokerage services would fall under different regulatory jurisdictions. Our evaluation methodology relies on available user feedback and market performance data. The absence of specific regulatory information for trading services significantly impacts our overall assessment. Readers should exercise caution and conduct independent verification of regulatory status before engaging with any United-branded financial services. The operational differences between these entities mean that positive performance in one sector does not necessarily translate to quality service in others.

Rating Framework

Broker Overview

United operates as a multifaceted organization with significant presence in various industries. United Real Estate has rapidly grown to become the 8th largest residential real estate brokerage company in the United States. The company has headquarters located in Dallas, Texas. The organization represents relationships with over 30 insurance companies and has demonstrated exceptional growth trajectories. According to reports from April 2021, United Real Estate experienced an impressive 447% transaction growth in 2020. This positioned the company as one of the most dynamic players in the residential real estate market.

The organization's business model centers around providing comprehensive financial services and real estate brokerage solutions. United Real Estate credits its remarkable growth to its proprietary, cloud-based Agent and Brokerage Productivity Platform called Bullseye™. The platform combines with an innovative business model and complete commitment to agent and broker success. This United review reveals that the company has made the most impressive advance within large company rankings. The advancement demonstrates both operational excellence and market adaptability. The platform's virtual buying and selling experiences have proven particularly valuable. These experiences allow clients to navigate real estate transactions effectively despite market challenges.

Regulatory Regions: Specific regulatory information not mentioned in available sources for trading services. Real estate operations are subject to standard real estate licensing requirements.

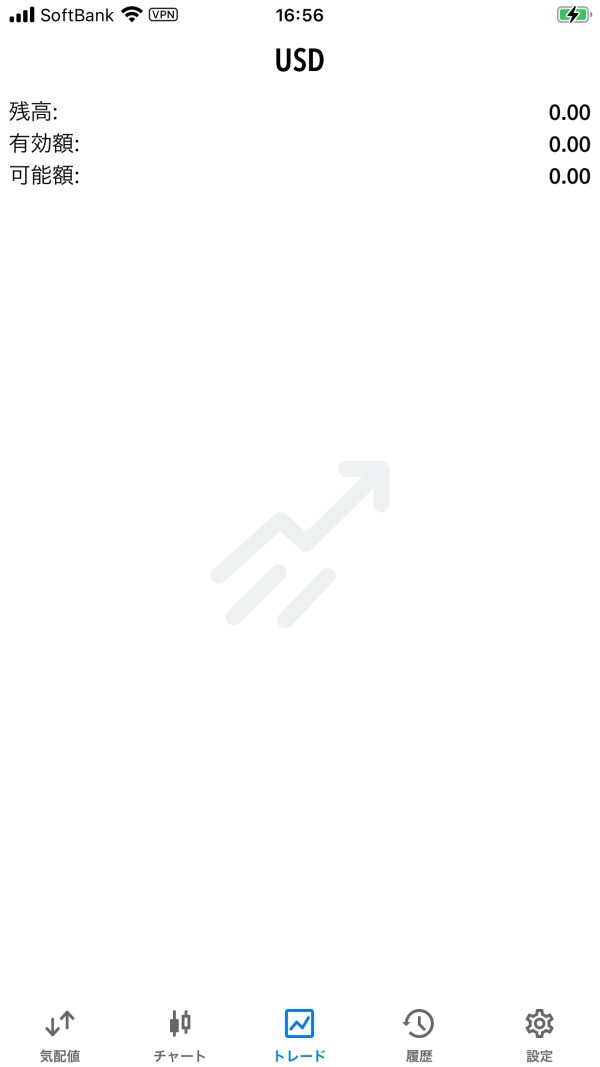

Deposit and Withdrawal Methods: Payment processing methods and banking options not detailed in available sources.

Minimum Deposit Requirements: Minimum account funding requirements not specified in available sources.

Bonuses and Promotions: Current promotional offerings and incentive programs not mentioned in available sources.

Tradeable Assets: Available trading instruments and asset classes not detailed in available sources.

Cost Structure: Fee schedules, spreads, and commission structures not comprehensively outlined in available sources. Real estate operations follow standard industry commission models.

Leverage Ratios: Maximum leverage offerings and margin requirements not specified in available sources.

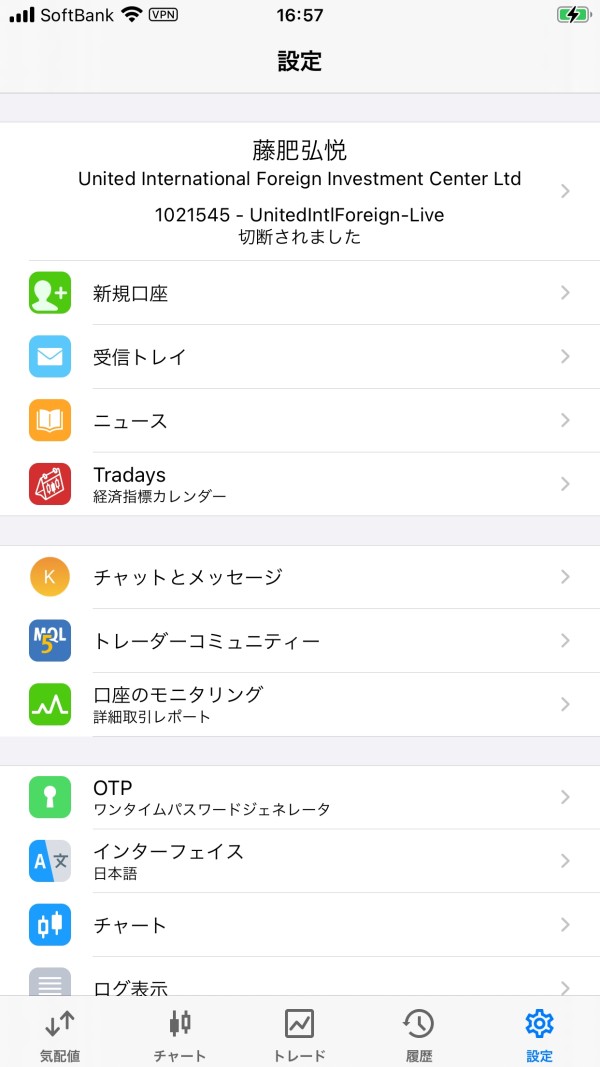

Platform Options: Trading platform selections and software offerings not mentioned in available sources.

Regional Restrictions: Geographic limitations and availability constraints not detailed in available sources.

Customer Support Languages: Multi-language support options not specified in available sources.

This United review acknowledges significant information gaps that prevent comprehensive evaluation of trading services. Real estate operations demonstrate strong market performance and growth metrics.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of United's account conditions faces significant limitations due to insufficient publicly available information. Available sources do not mention details about minimum deposit requirements. This makes it impossible to assess the accessibility of services for different investor categories. The account opening process and user experience descriptions are not detailed in current documentation. This prevents analysis of onboarding efficiency and customer journey quality. Special account features are not mentioned in available sources. These features include Islamic accounts for Sharia-compliant trading, limiting our understanding of the platform's inclusivity for diverse religious and cultural requirements.

Without specific user feedback regarding account setup experiences, this United review cannot provide concrete insights into customer satisfaction. The absence of comparative information with other brokers in the industry makes it challenging to position United's account offerings within the broader market context. The lack of detailed account tier structures or premium account benefits prevents assessment of value propositions for different investor segments. Until more comprehensive account information becomes available, potential clients should seek direct communication with United representatives. They need to understand specific account conditions and requirements.

The assessment of United's trading tools and resources encounters substantial information gaps that limit comprehensive evaluation. Available sources do not specify the types and quality of trading tools offered to clients. This makes it impossible to evaluate the platform's analytical capabilities or technical analysis features. Research and analysis resources are not mentioned in current documentation. These resources are crucial for informed trading decisions, preventing assessment of the platform's educational and market intelligence offerings. Educational resources are not detailed in available sources. These include webinars, tutorials, and market analysis content, limiting understanding of the platform's commitment to trader development.

Automated trading support is not mentioned in available sources. This includes expert advisors, algorithmic trading capabilities, and API access, preventing evaluation of the platform's suitability for advanced trading strategies. User feedback regarding tool effectiveness and ease of use is not available in current documentation. This makes it impossible to gauge real-world performance and user satisfaction. Expert opinions on tool quality and competitive positioning are not referenced in available sources. This limits independent validation of platform capabilities. This United review acknowledges that without detailed information about trading tools and resources, potential clients cannot make informed decisions. They cannot determine the platform's suitability for their trading needs.

Customer Service and Support Analysis

The evaluation of United's customer service and support capabilities faces significant challenges due to limited available information. Customer service channels and availability are not specified in current sources. This prevents assessment of accessibility and convenience for clients seeking assistance. Response time metrics are not mentioned in available documentation. These metrics are crucial indicators of service quality, making it impossible to evaluate the efficiency of support operations. Service quality assessments and customer satisfaction ratings are not detailed in current sources. This limits understanding of actual support experiences.

Multi-language support capabilities are not mentioned in available sources. This prevents evaluation of the platform's accessibility for international clients and non-English speaking users. Customer service operating hours and timezone coverage are not specified. This makes it difficult to assess support availability for global trading activities. User feedback regarding customer service experiences is not available in current documentation. This prevents analysis of real-world support quality and problem resolution effectiveness. Problem-solving case studies and examples of successful issue resolution are not referenced in available sources. This United review acknowledges that comprehensive customer service evaluation requires more detailed information. The evaluation needs support infrastructure, response protocols, and user satisfaction metrics.

Trading Experience Analysis

The analysis of United's trading experience encounters substantial information limitations that prevent comprehensive evaluation. Platform stability and speed metrics are not mentioned in available sources. This makes it impossible to assess the technical reliability crucial for successful trading operations. Order execution quality is not detailed in current documentation. This includes slippage rates, fill speeds, and rejection frequencies, preventing evaluation of trading efficiency and cost-effectiveness. Platform functionality completeness is not specified in available sources. This includes charting capabilities, order types, and analytical tools.

Mobile trading experience is not mentioned in current documentation. This experience is increasingly important for modern traders, limiting assessment of platform accessibility and convenience. Trading environment features are not detailed in available sources. These features include one-click trading, risk management tools, and portfolio tracking capabilities. User feedback regarding actual trading experiences is not available in current documentation. This prevents analysis of real-world platform performance and user satisfaction. Technical performance data are not referenced in available sources. This includes uptime statistics, latency measurements, and system reliability metrics. This United review acknowledges that without detailed trading experience information, potential clients cannot adequately evaluate platform suitability. They cannot assess the platform for their trading requirements and expectations.

Trust and Reliability Analysis

The assessment of United's trust and reliability faces significant challenges due to limited regulatory and transparency information. Regulatory qualifications and licensing details are not mentioned in available sources for trading services. This prevents verification of legal compliance and investor protection measures. Fund safety measures are not detailed in current documentation. These include segregated accounts, insurance coverage, and regulatory oversight mechanisms, limiting assessment of client asset protection. Company transparency is not comprehensively outlined in available sources. This includes ownership structure, financial statements, and operational procedures.

Industry reputation and peer recognition are not extensively documented in current sources. This makes it difficult to evaluate market standing and professional credibility. Negative event handling and crisis management capabilities are not mentioned in available documentation. This prevents assessment of risk management and client protection protocols. Regulatory authority verification and compliance monitoring are not detailed in current sources. This limits understanding of oversight mechanisms. Third-party evaluations and independent assessments are not extensively referenced in available documentation. User trust feedback and security-related reviews are not available in current sources. This prevents analysis of client confidence levels and safety perceptions.

User Experience Analysis

The evaluation of United's user experience faces substantial information gaps that limit comprehensive assessment. Overall user satisfaction metrics are not mentioned in available sources. This prevents analysis of customer contentment and platform effectiveness. Interface design and usability features are not detailed in current documentation. This makes it impossible to evaluate the platform's accessibility and ease of navigation. Registration and verification process descriptions are not available in current sources. This limits understanding of onboarding efficiency and user-friendliness.

Fund operation experiences are not mentioned in available documentation. These include deposit and withdrawal processes, preventing assessment of transaction convenience and reliability. Common user complaints and recurring issues are not detailed in current sources. This limits understanding of potential platform weaknesses and areas for improvement. User demographic analysis and client profiling information are not available in current documentation. This prevents assessment of target market alignment and service customization. Balanced presentation of positive and negative user feedback is not possible due to limited available reviews and testimonials. Potential improvement suggestions and platform enhancement opportunities cannot be adequately identified. This requires comprehensive user experience data.

Conclusion

This United review concludes with a neutral assessment due to significant information gaps that prevent comprehensive evaluation of trading services and platform capabilities. United Real Estate demonstrates impressive growth metrics and market positioning as the 8th largest residential brokerage in the nation. The lack of specific trading-related information limits our ability to provide definitive recommendations for forex and CFD traders. The platform appears most suitable for users interested in real estate services and those with connections to the aviation and financial industries. This assessment is based on positive employee satisfaction ratings and operational growth indicators.

The primary advantages identified include strong employee satisfaction rates and demonstrated business growth, particularly in real estate operations. However, the main disadvantage remains insufficient transparency regarding trading conditions, regulatory compliance, and specific service offerings for financial markets. Potential clients should conduct thorough due diligence and seek direct communication with United representatives. They need to obtain detailed information about trading services, regulatory status, and platform capabilities before making investment decisions.