Regarding the legitimacy of Sway Markets forex brokers, it provides ASIC and WikiBit, .

Is Sway Markets safe?

Pros

Cons

Is Sway Markets markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Deriv Trading License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Inst Deriv Trading License (STP)

LiquidBrokers

ASTROPIPS

Licensed Entity:

PULSE MARKETS PTY LTD

Effective Date: Change Record

2002-06-07Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

TRISHELLE GEITZ LEVEL 19 GOLD TOWER 10 EAGLE STREET BRISBANE QLD 4000Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is SWAY MARKETS A Scam?

Introduction

Sway Markets is a relatively new entrant in the forex trading landscape, having been established in 2022. It positions itself as an online broker offering a variety of trading services, including forex, commodities, and cryptocurrencies. As the forex market continues to grow, so does the number of brokers vying for traders' attention. However, with this increase comes the necessity for traders to exercise caution and thoroughly evaluate brokers before committing their funds. The potential for scams and unregulated entities in the forex market is significant, making it crucial for traders to conduct due diligence.

In this article, we will investigate whether Sway Markets is a legitimate broker or a potential scam. Our approach involves analyzing the broker's regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks. By synthesizing data from various sources, we aim to provide a comprehensive assessment of Sway Markets.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. Sway Markets claims to be regulated by the Australian Securities and Investments Commission (ASIC). However, it also operates under the jurisdiction of Saint Vincent and the Grenadines, a region known for its lax regulatory environment. This duality raises questions about the broker's compliance and the level of protection it offers to traders.

| Regulatory Body | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| ASIC | 220383 | Australia | Confirmed |

| SVG FSA | 1661 | St. Vincent | Unregulated |

ASIC is a reputable regulatory authority that imposes strict requirements on brokers, including maintaining sufficient capital reserves and providing negative balance protection. However, Sway Markets' claim of being regulated by ASIC is questionable, as the ASIC register does not explicitly list the broker's domain or provide clear evidence of its compliance. Furthermore, the high leverage of 1:500 offered by Sway Markets significantly exceeds ASIC's regulatory limits, which typically cap leverage at 1:30 for retail clients. This discrepancy indicates that the broker may not be adhering to the regulations it claims to follow.

Company Background Investigation

Sway Markets Pty Ltd is the official name of the company behind the broker. It is registered in Australia, with a secondary registration in Saint Vincent and the Grenadines. The broker's establishment in 2022 means it has a limited track record in the industry, which can be a red flag for potential investors.

The management team behind Sway Markets has not been widely publicized, leading to concerns about transparency and accountability. The lack of information regarding the team's qualifications and experience raises questions about the broker's operational integrity. Furthermore, the broker's website does not provide comprehensive details about its ownership structure or corporate governance, which are essential for assessing its credibility.

Overall, the opacity surrounding Sway Markets' management and ownership further complicates the evaluation of its legitimacy. Traders may find it challenging to trust a broker that lacks transparency in its operations and leadership.

Trading Conditions Analysis

Sway Markets offers various trading accounts, including ECN, no commission, VIP, and Islamic accounts. The minimum deposit to open an account is set at a low threshold of $10, which is attractive for new traders. However, the broker's overall fee structure and policies warrant a closer examination.

| Fee Type | Sway Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.3 pips | From 0.6 pips |

| Commission Model | From $3.5 | Varies |

| Overnight Interest Range | Not disclosed | Varies |

While the spreads offered by Sway Markets appear competitive, the lack of transparency regarding commissions and overnight fees is concerning. Traders should be wary of brokers that do not clearly disclose their fee structures, as hidden fees can significantly impact profitability. Additionally, the commission model varies by account type, which may lead to confusion for traders who are not well-versed in the specifics.

Customer Fund Safety

The safety of customer funds is paramount when choosing a broker. Sway Markets claims to implement measures to protect client funds, but the specifics remain vague. There is no clear indication of whether the broker segregates client funds from its operational funds, a practice that is crucial in safeguarding investors' capital.

Furthermore, the absence of investor protection schemes raises concerns about fund security. Reputable brokers regulated by authorities like ASIC typically offer some form of compensation scheme to protect traders in the event of insolvency. However, Sway Markets does not provide such assurances, leaving traders vulnerable to potential financial losses.

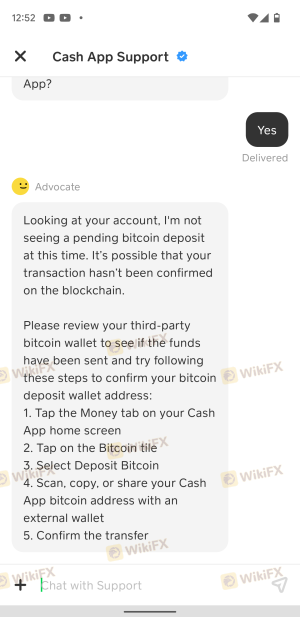

Customer Experience and Complaints

User feedback is a vital component in assessing a broker's reliability. A review of customer experiences with Sway Markets reveals a mixed bag of opinions. While some users report satisfactory experiences, others highlight significant issues, particularly regarding withdrawal processes and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or unresponsive |

| Customer Support | Medium | Limited availability |

Common complaints revolve around difficulties in withdrawing funds, with several users expressing frustration over delayed transactions. Additionally, reports of unresponsive customer support indicate a lack of adequate assistance for traders facing issues. Such feedback is concerning and suggests that Sway Markets may not prioritize customer service.

Platform and Trade Execution

The trading platform offered by Sway Markets is the widely recognized MetaTrader 5 (MT5). While MT5 is known for its robust features and user-friendly interface, the overall performance and execution quality provided by Sway Markets remain uncertain.

Traders have reported varying experiences with order execution, including instances of slippage and order rejections. Such issues can significantly affect trading outcomes, particularly in a fast-moving market. If traders suspect any form of platform manipulation, it could further erode trust in the broker.

Risk Assessment

Engaging with Sway Markets presents several risks that potential traders should consider. The lack of regulatory oversight, combined with the broker's questionable practices, creates a high-risk environment for investors.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Unclear regulatory adherence |

| Fund Security | High | No segregation or investor protection |

| Customer Support | Medium | Poor response times and assistance |

To mitigate risks, traders should conduct thorough research and consider using risk management strategies, such as setting stop-loss orders and limiting exposure to any single trade.

Conclusion and Recommendations

In conclusion, Sway Markets presents several red flags that warrant caution. While it claims to be regulated by ASIC, the lack of transparency, questionable practices, and mixed customer feedback raise significant concerns about its legitimacy. The broker's high leverage offerings and low minimum deposit may attract new traders, but the potential risks associated with trading with Sway Markets cannot be overlooked.

For traders seeking a reliable forex broker, it may be advisable to explore alternatives that are fully regulated and have a proven track record of customer satisfaction. Brokers with strong regulatory oversight, transparent fee structures, and responsive customer support should be prioritized to ensure a safer trading experience.

Is Sway Markets a scam, or is it legit?

The latest exposure and evaluation content of Sway Markets brokers.

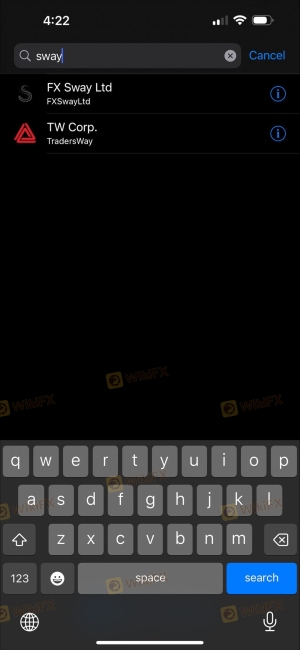

Sway Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Sway Markets latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.