Is Celox safe?

Pros

Cons

Is Celox Safe or a Scam?

Introduction

Celox is a forex and CFD broker that has emerged in the competitive landscape of online trading. Established in 2020 and based in Saint Vincent and the Grenadines, Celox aims to attract traders with its diverse account options and high leverage offerings. However, as with any trading platform, it is crucial for traders to exercise caution and thoroughly evaluate the credibility and safety of the broker before committing their funds. Many traders have fallen victim to scams in the forex market, making it imperative to conduct due diligence.

In this article, we will investigate whether Celox is safe for trading or if it exhibits characteristics of a scam. Our assessment will be based on a comprehensive review of regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and overall risk assessment. We will utilize data from various credible sources to provide an objective analysis of Celox's standing in the forex market.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety for traders. Regulation serves as a protective measure, ensuring that brokers adhere to specific standards and practices that safeguard traders' interests. Unfortunately, Celox operates without any regulatory oversight, which raises significant concerns regarding its legitimacy and integrity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Celox is not subject to the rigorous checks and balances enforced by financial authorities. This lack of oversight can lead to increased risks for traders, as unregulated brokers are not obligated to follow strict guidelines designed to protect clients. Furthermore, historical data indicates that brokers operating in jurisdictions like Saint Vincent and the Grenadines often face scrutiny due to their lax regulatory frameworks, attracting a higher number of scams and fraudulent activities.

Given these concerns, it is essential to question is Celox safe? The lack of any regulatory backing should serve as a significant red flag for potential investors. Without the safety net of a regulatory authority, traders may find it challenging to seek recourse in the event of disputes or issues related to withdrawals, making it imperative to consider alternatives that offer regulatory protection.

Company Background Investigation

Celox is owned by Plex Ecom LLC, a company registered in Saint Vincent and the Grenadines. The broker claims to provide an array of trading services, including access to forex, CFDs, and other financial instruments. However, the company's transparency regarding its ownership structure and operational history is limited.

The management team behind Celox has not been publicly disclosed, which raises questions about their qualifications and experience in the financial sector. A lack of information about the management can lead to concerns regarding the broker's operational integrity and accountability. Transparency is vital in the financial services industry, as it fosters trust between the broker and its clients.

In terms of information disclosure, Celox's website provides basic details about its services but lacks comprehensive educational resources or insights into its trading practices. This opacity further complicates the question of is Celox safe? The absence of clear and accessible information about the company's operations, management, and compliance history may deter potential traders from engaging with the platform.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is crucial. Celox offers several account types, including mini, standard, and gold accounts, with varying minimum deposit requirements and leverage options. However, the overall cost structure and potential hidden fees warrant careful consideration.

| Fee Type | Celox | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1-2 pips |

| Commission Model | N/A | 0.1-0.5% |

| Overnight Interest Range | Varies | Varies |

Celox's spreads appear to be higher than the industry average, which may impact profitability for traders. Furthermore, the commission model is not clearly defined, leading to uncertainty regarding the total costs of trading. Additionally, the broker may impose withdrawal fees, which could further diminish traders' returns. These factors collectively raise concerns about the transparency and fairness of Celox's trading conditions.

Given these insights, the question remains: is Celox safe? Traders should be wary of platforms that impose high spreads and unclear commission structures, as they can significantly affect overall trading performance. It is advisable to compare these conditions with those of regulated brokers to ensure a more favorable trading environment.

Customer Fund Security

The safety of customer funds is paramount when choosing a broker. Celox claims to implement various security measures; however, the lack of regulatory oversight raises concerns about the effectiveness of these measures.

Traders should inquire about the segregation of client funds, which ensures that their deposits are kept separate from the broker's operational funds. Additionally, the presence of investor protection schemes is crucial in safeguarding traders' money in case of broker insolvency. Unfortunately, Celox does not provide any information regarding these critical aspects of fund security.

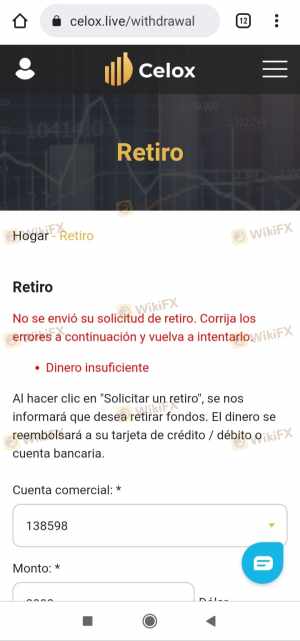

Moreover, there have been reports of withdrawal issues from users, further emphasizing the need for caution. Instances of clients being unable to withdraw funds raise significant alarms about the broker's reliability and operational integrity. Therefore, the question of is Celox safe becomes even more pressing, as the absence of robust fund protection measures could lead to significant financial losses for traders.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Celox reveal a mixed bag of experiences, with numerous complaints regarding withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Support Complaints | Medium | Inconsistent |

Common complaints include clients reporting their inability to withdraw funds after making deposits, leading to frustration and distrust. The company's response to these complaints has been criticized for being slow and ineffective, which further exacerbates the issues faced by traders.

For instance, one user reported being unable to withdraw their funds despite multiple requests, highlighting a potential pattern of behavior that raises red flags about the broker's operational practices. Such experiences lead to the conclusion that is Celox safe is a question that requires serious consideration before engaging with the platform.

Platform and Trade Execution

The trading platform offered by Celox is web-based, which may lack the advanced features and reliability of industry-standard platforms like MetaTrader 4 or 5. Users have reported issues with platform stability and execution quality, which can significantly impact trading outcomes.

Concerns about slippage and order rejections have also been noted, which could indicate potential manipulation or inefficiencies in trade execution. A reliable trading platform should provide seamless order execution and minimal slippage, as these factors are critical to a trader's success.

Given these issues, the question of is Celox safe becomes increasingly relevant. The platform's performance and execution quality are essential for ensuring a positive trading experience. Traders should carefully evaluate these factors before committing funds to Celox.

Risk Assessment

Engaging with an unregulated broker like Celox inherently carries significant risks. The lack of regulatory oversight, combined with the broker's questionable practices, contributes to a high-risk trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Potential withdrawal issues |

| Transparency Risk | High | Limited information disclosure |

To mitigate these risks, traders should consider the following recommendations:

- Avoid investing significant amounts: Start with a minimal investment to test the platform's reliability.

- Research alternative brokers: Look for regulated brokers with positive reviews and transparent practices.

- Utilize secure payment methods: Use credit cards where possible to facilitate chargebacks in case of issues.

Conclusion and Recommendations

In conclusion, the investigation into Celox raises numerous concerns about its safety and reliability as a forex broker. The combination of its unregulated status, high complaint volume, and questionable trading practices suggests that potential traders should approach with caution.

The question of is Celox safe is met with significant skepticism, given the broker's operational history and the experiences of current and former clients. For traders seeking a secure trading environment, it is advisable to consider regulated alternatives that provide robust protections and transparent operations.

In summary, while Celox may present itself as an attractive option for trading, the associated risks and lack of regulatory oversight warrant serious consideration before proceeding.

Is Celox a scam, or is it legit?

The latest exposure and evaluation content of Celox brokers.

Celox Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Celox latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.