Is Bostonmex safe?

Business

License

Is Bostonmex Safe or Scam?

Introduction

Bostonmex is a forex broker that has emerged in the online trading landscape, claiming to offer a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. Established in 2020 and based in Saint Lucia, Bostonmex aims to attract traders with its promises of competitive trading conditions and advanced trading platforms. However, with the proliferation of online trading scams, it is essential for traders to exercise caution and conduct thorough due diligence before engaging with any broker. This article aims to evaluate the safety and legitimacy of Bostonmex by examining its regulatory status, company background, trading conditions, client fund security, customer feedback, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory environment is a critical aspect of any forex broker's credibility. A regulated broker is subject to oversight by financial authorities, which helps ensure the protection of client funds and adherence to industry standards. Unfortunately, Bostonmex operates without any legitimate regulatory oversight. According to various reviews, the broker claims to be registered with the Financial Services Regulatory Authority (FSRA) of Saint Lucia; however, no verification could confirm this claim.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSRA | Not Available | Saint Lucia | Not Verified |

The absence of regulation raises significant concerns regarding the safety of client funds. Unregulated brokers like Bostonmex are not required to maintain segregated accounts for client funds, nor do they offer investor protection schemes. This lack of oversight can lead to increased risks of fraud and financial mismanagement. Furthermore, the regulatory history of Bostonmex shows no compliance with established standards, making it a potentially dangerous choice for traders seeking a reliable trading partner.

Company Background Investigation

Bostonmex presents itself as a reputable trading platform, but its background raises several red flags. The company claims to be registered in Saint Lucia, a known offshore jurisdiction that often attracts unregulated brokers. The lack of detailed information regarding the ownership structure and management team further complicates the assessment of Bostonmex's legitimacy.

The management team behind Bostonmex remains largely anonymous, which is a common trait among fraudulent brokers. This lack of transparency can lead to a lack of accountability, making it difficult for traders to seek recourse in case of disputes or issues with the broker. Furthermore, the company's website does not provide sufficient information about its operational history or any verifiable credentials, which further diminishes its credibility.

In summary, the opaque nature of Bostonmex's ownership and management raises concerns about its legitimacy. The absence of transparency and accountability could potentially put traders' funds at risk, leading many to question: Is Bostonmex safe?

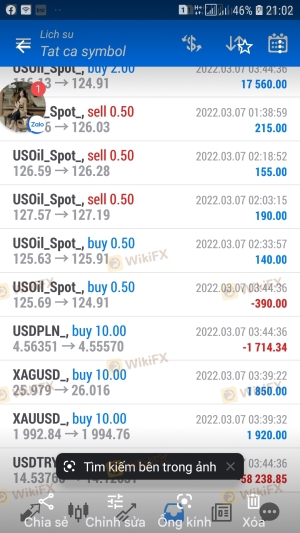

Trading Conditions Analysis

When evaluating a broker's reliability, understanding its trading conditions is crucial. Bostonmex claims to offer competitive trading fees, including low spreads and high leverage, which can be enticing for traders. However, it is essential to scrutinize these claims closely, as many unregulated brokers use attractive trading conditions as bait to lure unsuspecting clients.

Bostonmex provides various account types with different trading conditions, including standard, fixed, premium, ECN, and crypto accounts. The broker advertises spreads starting from 0.0 pips and leverage ratios as high as 1:1000. However, such high leverage can significantly increase the risk of substantial losses, especially for inexperienced traders.

| Fee Type | Bostonmex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0-1.5 pips |

| Commission Structure | $0 | $4-10 |

| Overnight Interest Range | Varies | Varies |

While Bostonmex's fee structure appears competitive, the broker's lack of regulatory oversight raises concerns about potential hidden fees or unfavorable trading practices. Traders should be cautious about engaging with a broker that offers high leverage and low spreads without proper regulatory backing, as these conditions can lead to significant financial risks.

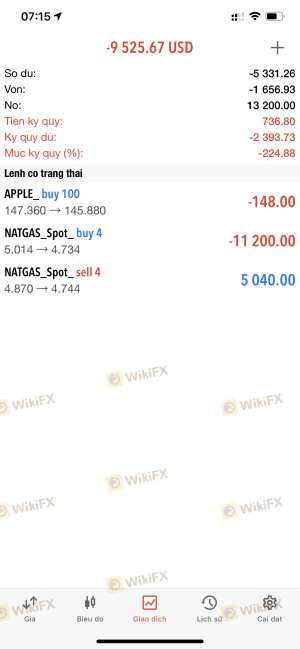

Client Fund Security

The security of client funds is paramount when considering a forex broker. Bostonmex claims to prioritize the safety of its clients' funds by maintaining segregated accounts. However, without regulatory oversight, there is no guarantee that these claims are genuine.

Unregulated brokers often lack the necessary safeguards to protect client funds, which can lead to potential financial losses. For instance, if Bostonmex were to face financial difficulties or insolvency, clients may find it challenging to recover their funds. Additionally, the absence of negative balance protection means that traders could lose more than their initial investment, further increasing the risks associated with trading on this platform.

In conclusion, the lack of regulatory oversight and transparency regarding client fund security practices raises serious concerns about whether Bostonmex is safe for traders.

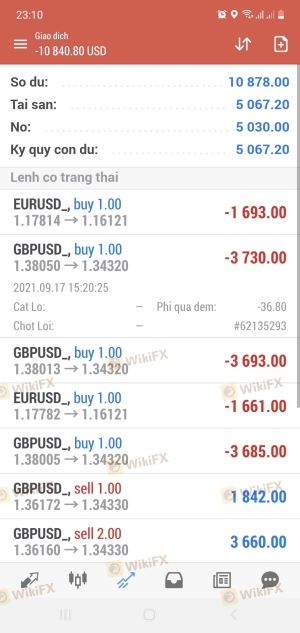

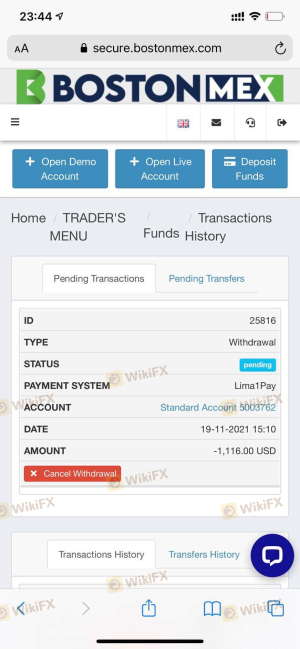

Customer Experience and Complaints

Customer feedback is an invaluable resource when assessing a broker's reliability and performance. Reviews and complaints about Bostonmex reveal a troubling pattern of dissatisfaction among users. Many traders report issues related to withdrawal delays, unresponsive customer support, and aggressive sales tactics aimed at encouraging further deposits.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Fair |

| High-Pressure Sales Tactics | High | Poor |

Several user testimonials highlight the difficulty in withdrawing funds from Bostonmex, with many clients experiencing unexplained delays or being asked to pay additional fees before they could access their funds. These complaints suggest that Bostonmex may engage in practices that are not in the best interest of its clients, raising further questions about the broker's legitimacy.

One notable case involved a trader who deposited a significant amount of money but faced numerous obstacles when attempting to withdraw their funds. Despite multiple requests for assistance, the trader received little support from the company, highlighting a concerning trend among clients.

Platform and Trade Execution

The trading platform offered by Bostonmex is based on the popular MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, the performance of the platform and the quality of trade execution are critical factors that can significantly impact a trader's experience.

While MT5 is generally reliable, reports from users indicate that Bostonmex may have issues with order execution quality, including slippage and rejected orders. Such issues can lead to unfavorable trading outcomes and contribute to trader frustration. Furthermore, the lack of transparency regarding the broker's execution policies raises concerns about potential manipulation or unfair practices.

Risk Assessment

Trading with Bostonmex involves various risks that traders should be aware of. The absence of regulatory oversight, high leverage, and questionable customer service practices contribute to an overall high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing fraud risk. |

| Financial Risk | High | High leverage can lead to significant losses. |

| Customer Service Risk | Medium | Poor support response can hinder problem resolution. |

To mitigate these risks, traders should consider implementing robust risk management strategies, such as setting strict stop-loss orders and limiting their exposure to high-leverage trading. Additionally, conducting thorough research and due diligence before engaging with any broker is crucial to safeguarding one's investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that Bostonmex raises several red flags that may indicate it is not a safe choice for traders. The lack of regulatory oversight, questionable trading conditions, and numerous customer complaints point to a potentially high-risk environment.

Traders seeking a reliable and trustworthy broker should consider alternatives that are properly regulated and have a proven track record of positive customer experiences. Regulatory bodies such as the FCA, ASIC, and CySEC oversee brokers that adhere to strict compliance standards, ensuring a safer trading environment.

In summary, if you are considering trading with Bostonmex, it is essential to weigh the risks and consider whether Bostonmex is safe for your trading activities. Opt for regulated brokers that can provide the necessary safeguards and transparency to protect your investments.

Is Bostonmex a scam, or is it legit?

The latest exposure and evaluation content of Bostonmex brokers.

Bostonmex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Bostonmex latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.