Is UNITED safe?

Pros

Cons

Is United Safe or Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, brokers like United have emerged as key players, attracting traders with promises of competitive trading conditions and a wide array of financial instruments. However, as the forex market continues to grow, so does the number of unscrupulous entities looking to exploit unsuspecting traders. This makes it imperative for traders to conduct thorough due diligence before engaging with any broker. In this article, we will investigate whether United is a safe broker or a potential scam. Our assessment will be based on a comprehensive review of regulatory status, company background, trading conditions, client experience, and overall risk factors.

Regulation and Legitimacy

The regulatory framework surrounding forex brokers is crucial in determining their legitimacy and trustworthiness. A regulated broker is typically subject to stringent oversight, which can provide traders with a level of protection against fraud. In the case of United, our investigation reveals concerning details about its regulatory status.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

United claims to be a licensed broker; however, upon closer inspection, it appears to operate without any valid regulatory oversight. This lack of regulation raises significant red flags. Regulatory bodies like the FCA (Financial Conduct Authority) in the UK and ASIC (Australian Securities and Investments Commission) in Australia enforce strict guidelines to ensure that brokers operate fairly and transparently. The absence of such oversight for United suggests that traders may be exposed to higher risks, including potential fraud and mismanagement of funds.

Company Background Investigation

Understanding the background of a broker is essential for assessing its reliability. United's operational history is shrouded in ambiguity, with limited information available regarding its ownership structure and management team. This lack of transparency can be a significant warning sign for potential traders.

United is reportedly operated by a shell company based in the Marshall Islands, known as Fortune Investment Group Ltd. This offshore structure often serves as a tactic for brokers to evade regulatory scrutiny, making it difficult for clients to pursue legal action in case of disputes. Furthermore, the management team behind United lacks publicly available credentials or professional experience in the financial sector, which further diminishes the broker's credibility.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is crucial. United presents itself as a competitive broker with various account types and trading instruments. However, a closer look reveals a potentially exploitative fee structure that traders should be aware of.

| Fee Type | United | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | High | Low |

| Overnight Interest Range | 5% | 2-3% |

United's spreads for major currency pairs are higher than the industry average, which can significantly impact trading profitability. Moreover, the commission model appears to be unfavorable, with additional hidden fees that may not be clearly disclosed to clients. Such practices are often indicative of brokers that prioritize profits over client satisfaction.

Client Fund Safety

The safety of client funds is paramount in the forex trading environment. A brokers policies regarding fund security can greatly influence a trader's decision to engage with them. United's approach to fund safety raises several concerns.

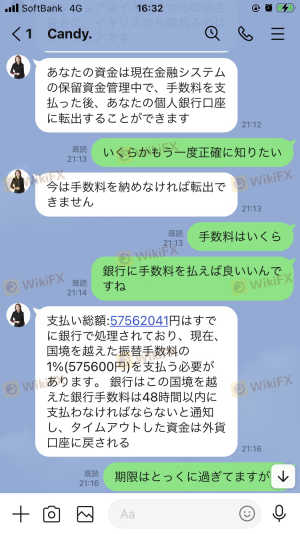

United claims to implement measures for fund segregation; however, the lack of regulatory oversight means that there is no guarantee that these claims are upheld. Additionally, the absence of investor protection schemes, such as those provided by the FCA or ASIC, leaves traders vulnerable to potential losses. Historical complaints against United regarding fund withdrawals further exacerbate concerns about the security of client funds.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into a broker's operational integrity. Reviews and testimonials regarding United indicate a pattern of dissatisfaction among clients, particularly concerning withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Average |

| Transparency | High | Poor |

Many clients have reported difficulties in withdrawing their funds, with some claiming that their accounts were frozen without explanation. Such complaints signal potential operational issues and a lack of transparency that could be detrimental to traders. Additionally, United's customer service has received mixed reviews, with many customers expressing frustration at the lack of timely assistance.

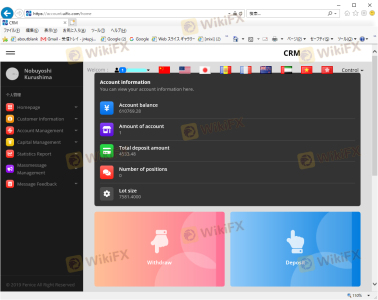

Platform and Trade Execution

The trading platform offered by a broker can significantly impact the trading experience. United provides a proprietary trading platform, which may lack the robustness and reliability of well-known platforms like MetaTrader 4 or 5.

Users have reported issues with platform stability, including frequent outages and slow execution times. Such performance issues can lead to missed trading opportunities and increased slippage, raising further concerns about the broker's reliability. The absence of transparent information regarding order execution quality and slippage rates adds to the skepticism surrounding United's trading environment.

Risk Assessment

Engaging with any forex broker carries inherent risks. In the case of United, the following risk factors have been identified:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing vulnerability to fraud. |

| Financial Risk | High | Ambiguous financial practices and high trading costs. |

| Operational Risk | Medium | Issues with platform stability and customer service. |

Traders should be acutely aware of these risks when considering whether to engage with United. To mitigate these risks, it is advisable to explore alternative brokers with established regulatory oversight and positive customer feedback.

Conclusion and Recommendations

In conclusion, the findings of this investigation strongly suggest that United is not a safe broker. The lack of regulatory oversight, coupled with a history of client complaints and questionable trading practices, paints a concerning picture. Traders should exercise extreme caution when considering United as their forex broker.

For those seeking reliable alternatives, we recommend brokers that are regulated by top-tier authorities, such as the FCA or ASIC. These brokers typically offer better protection for client funds, transparent fee structures, and a more robust trading environment. Always prioritize due diligence and choose brokers that align with your trading needs and risk tolerance.

Is UNITED a scam, or is it legit?

The latest exposure and evaluation content of UNITED brokers.

UNITED Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UNITED latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.