International Forex Review 96

I met a netizen while playing games a while ago. He introduced me to investing in forex and said that he could make money by trading forex and playing games every day. After I saw the photo of the cash he sent me, I thought it was true and wanted to drop out of school and play games every day, so I asked him How to enter the market. He said that I must deposit my principal before I can make a profit. However, it is too difficult to gain financial freedom. I didn’t have the principal, so he asked me to negotiate with customer service. When I wanted to deposit money later, I couldn’t borrow it from my roommate, so I had to Who knew it was a scam when I used food expenses as principal and couldn't get the money back at all? I was constantly being made difficult by customer service. Now I am too hungry to tell my family, so I can only survive by eating food from my roommates. I share this to prevent others from being victimized in the same way as me. I hope you all can be wary of netizens.

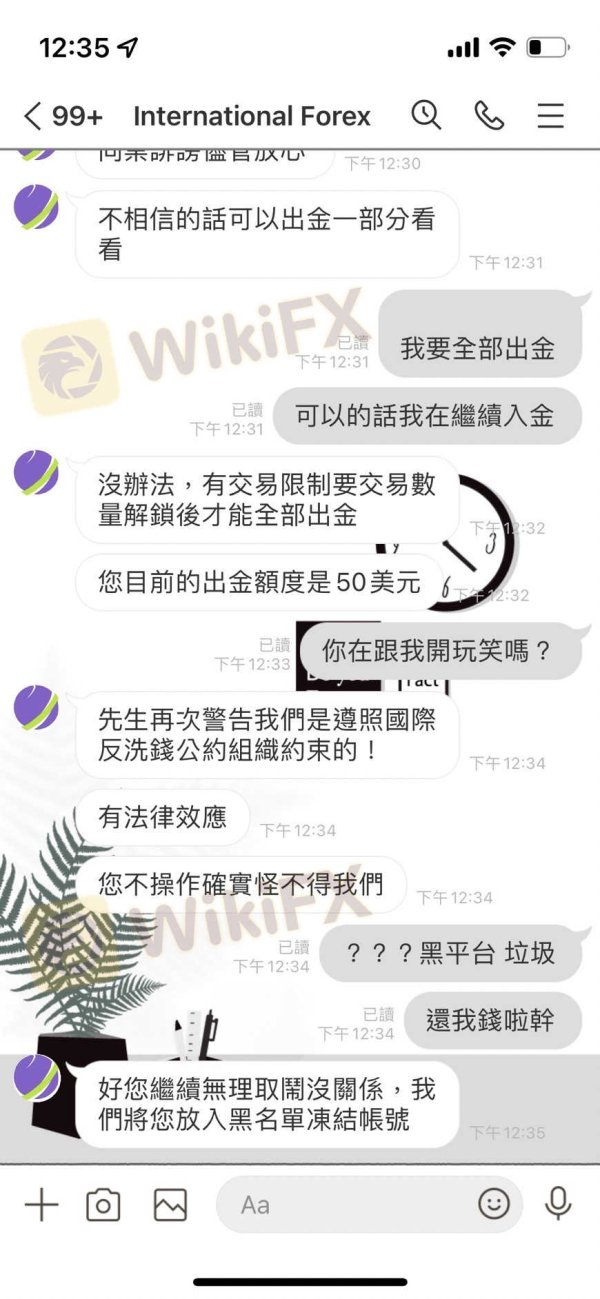

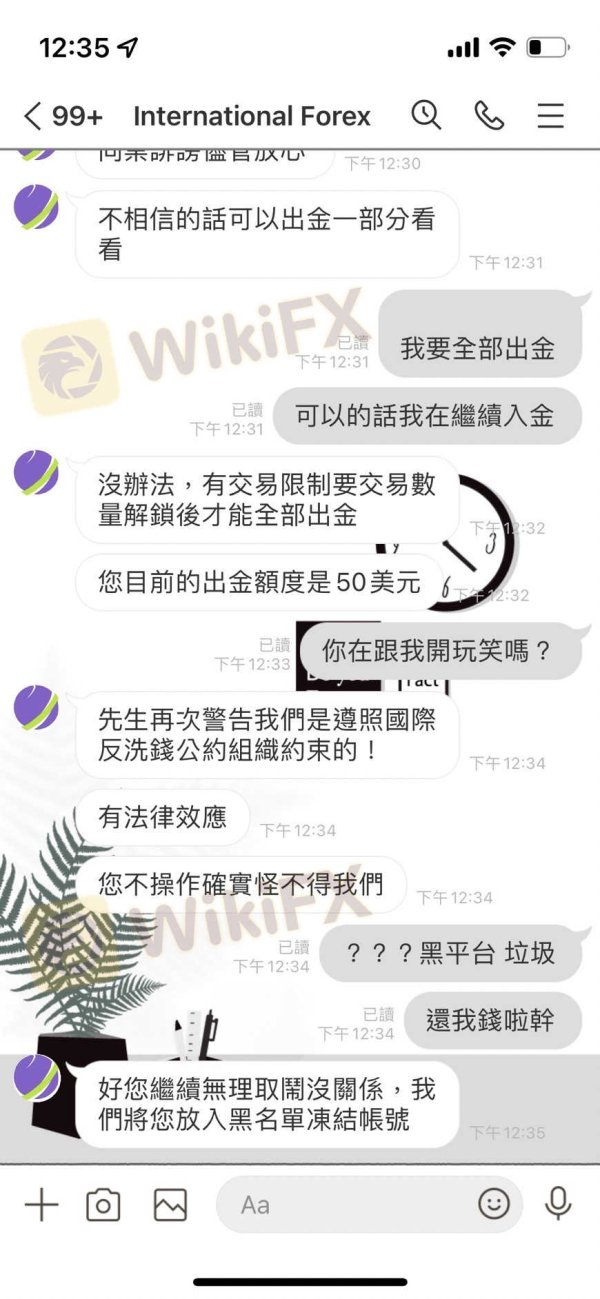

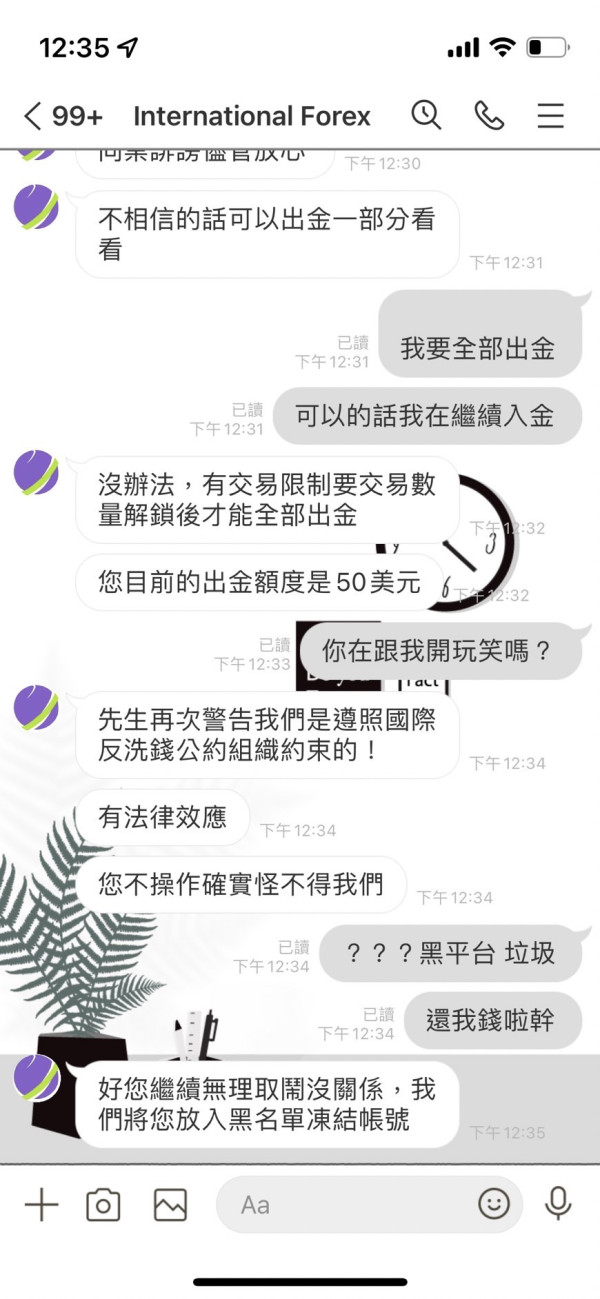

This company is a fraud company! Once I declined the withdrawal, I was unable to withdraw and the customer service would not reply to me

It has been reviewed for a month, and the money has not been received yet, and the customer service has not responded. I was scammed!

International Forex is a scam company! Not long after I made a deposit, I couldn’t log in to my account, and the customer service told me it was because the system was being maintained. As a result, it has not been well maintained until now, and even the website cannot be opened!

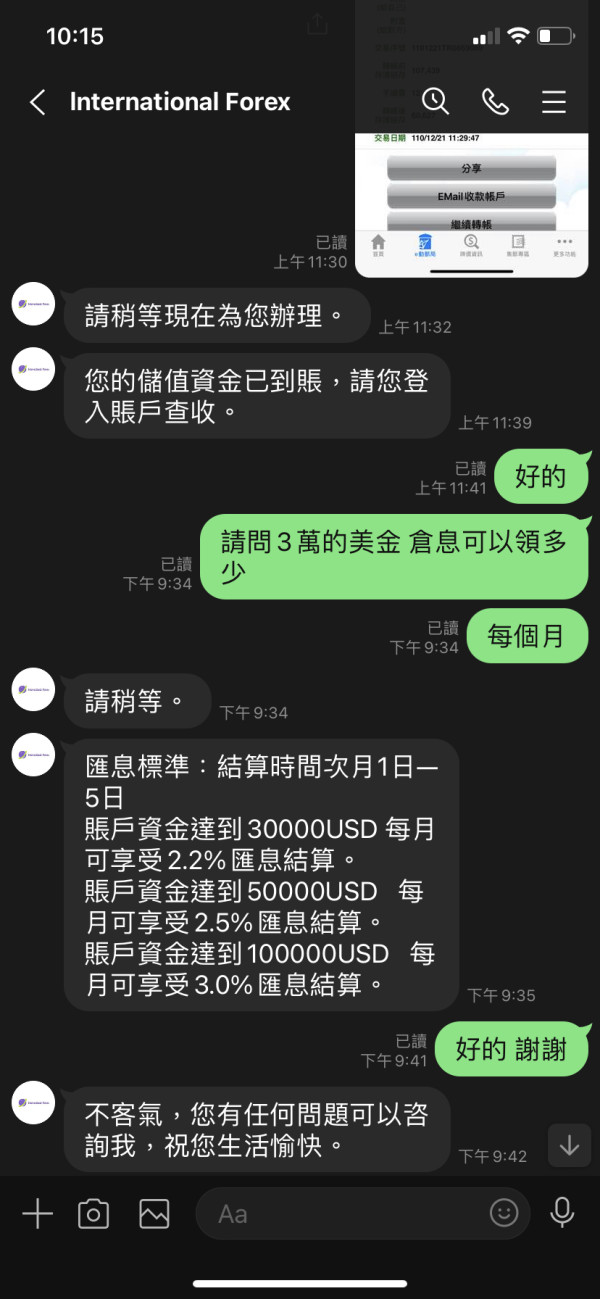

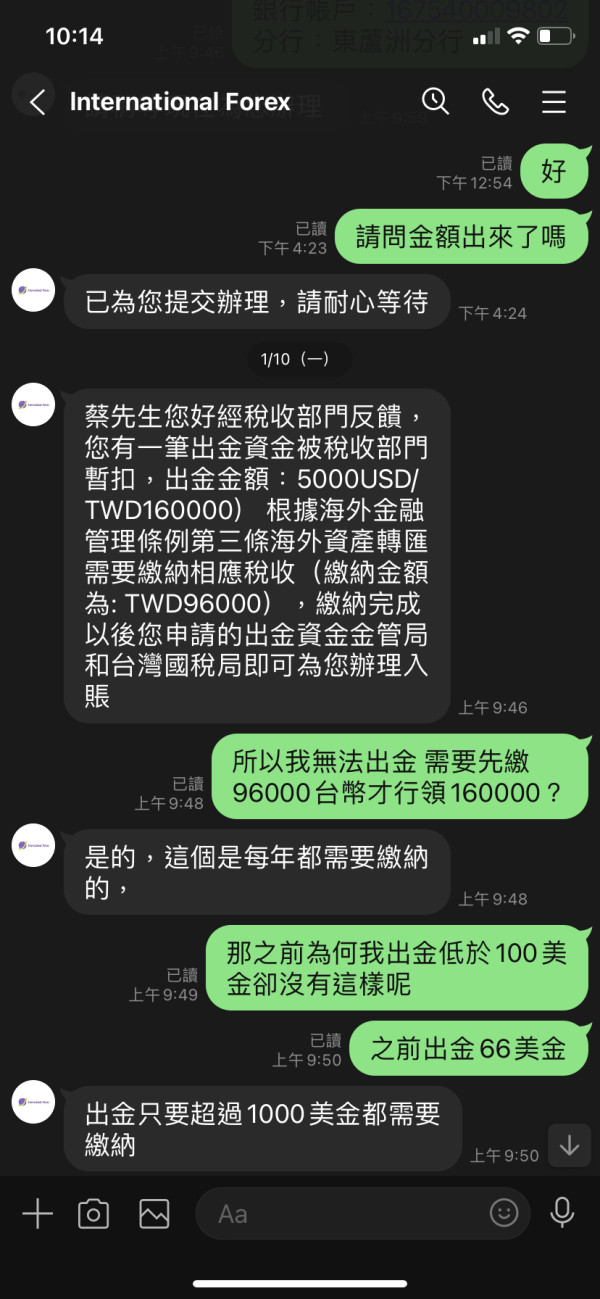

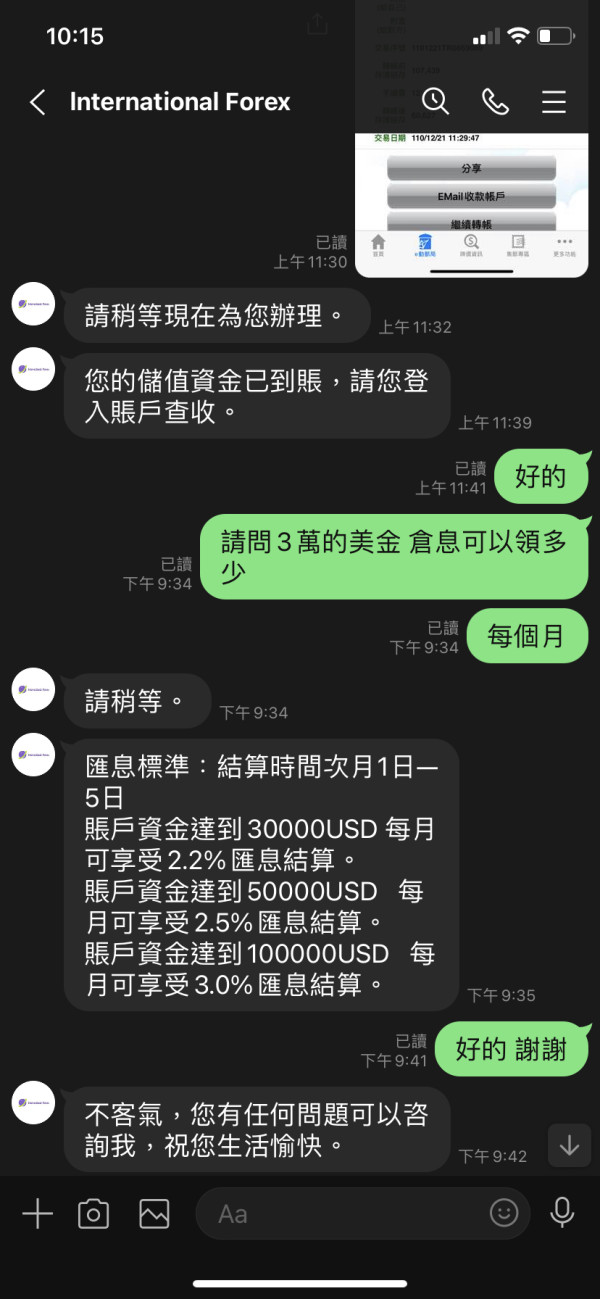

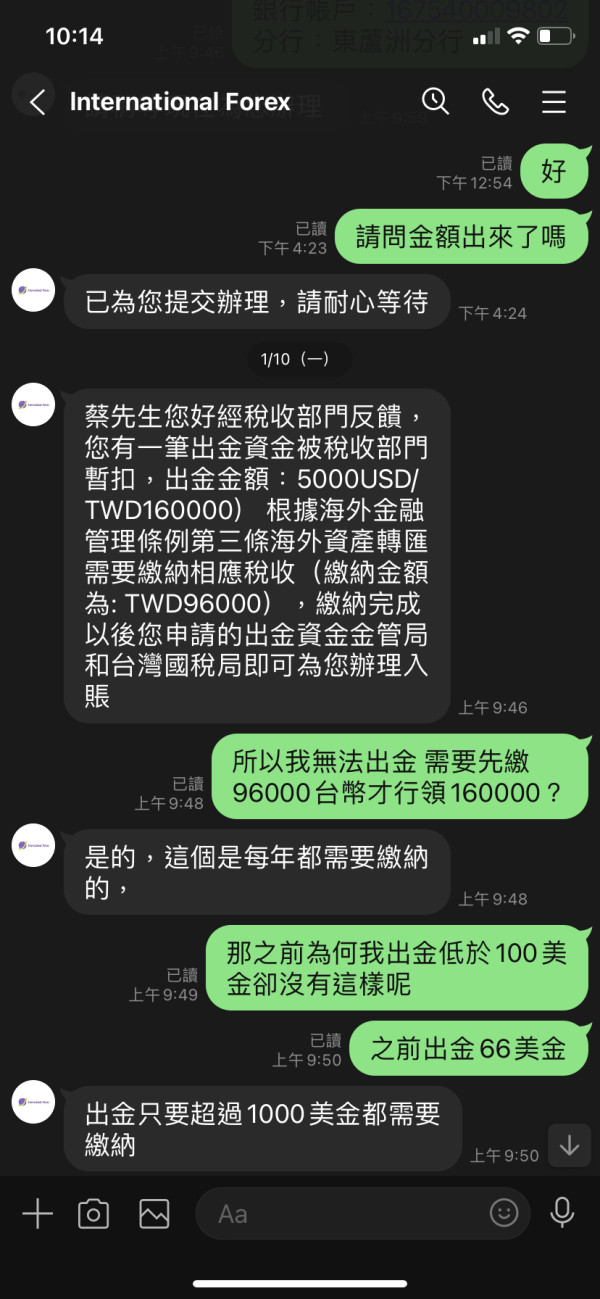

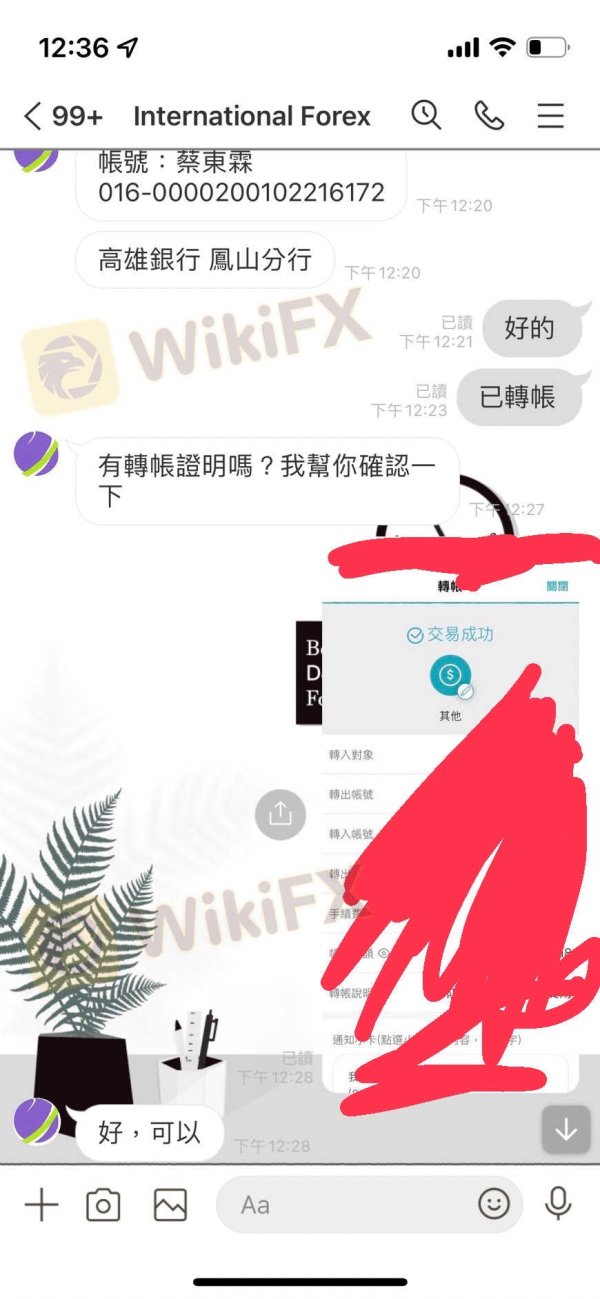

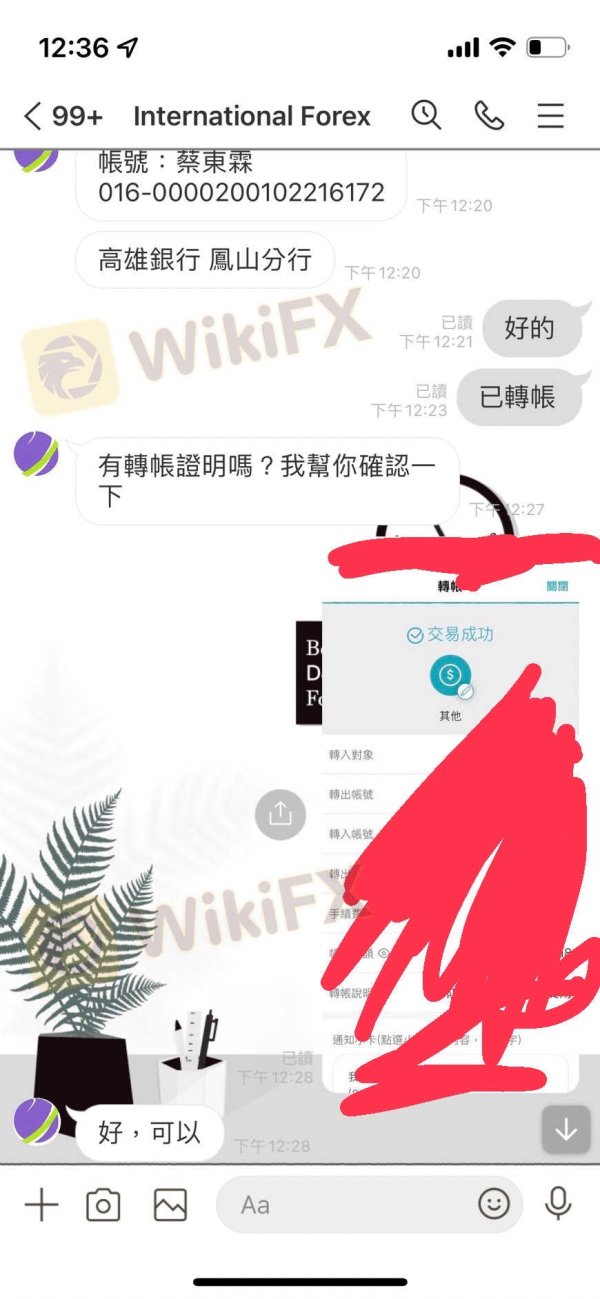

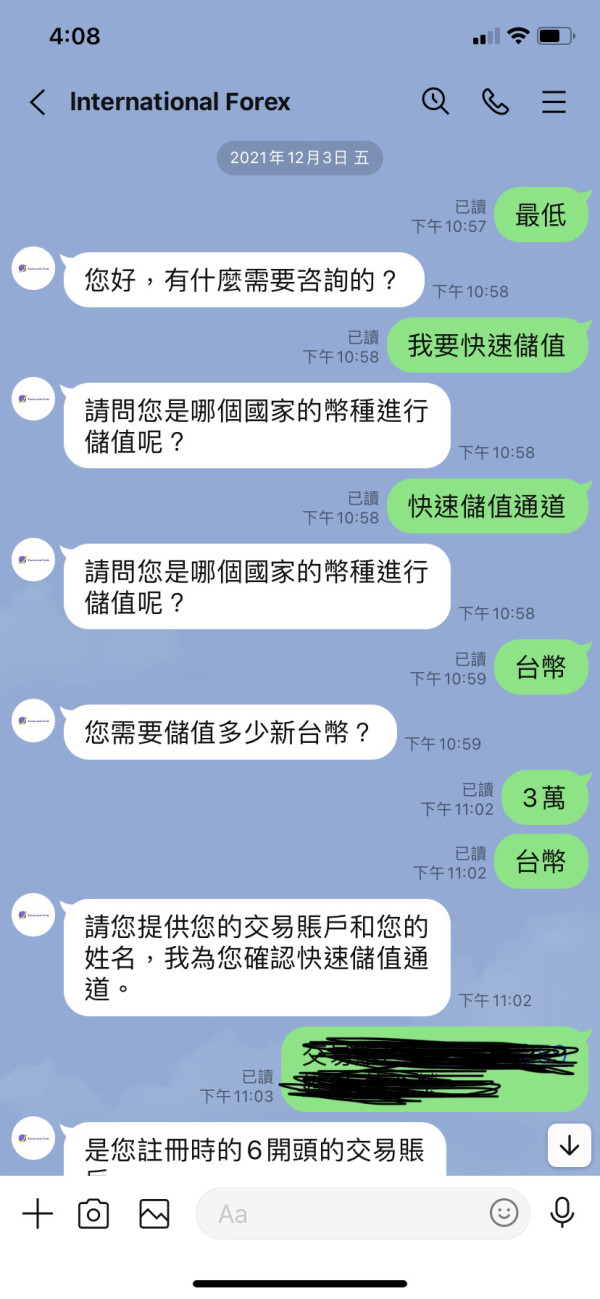

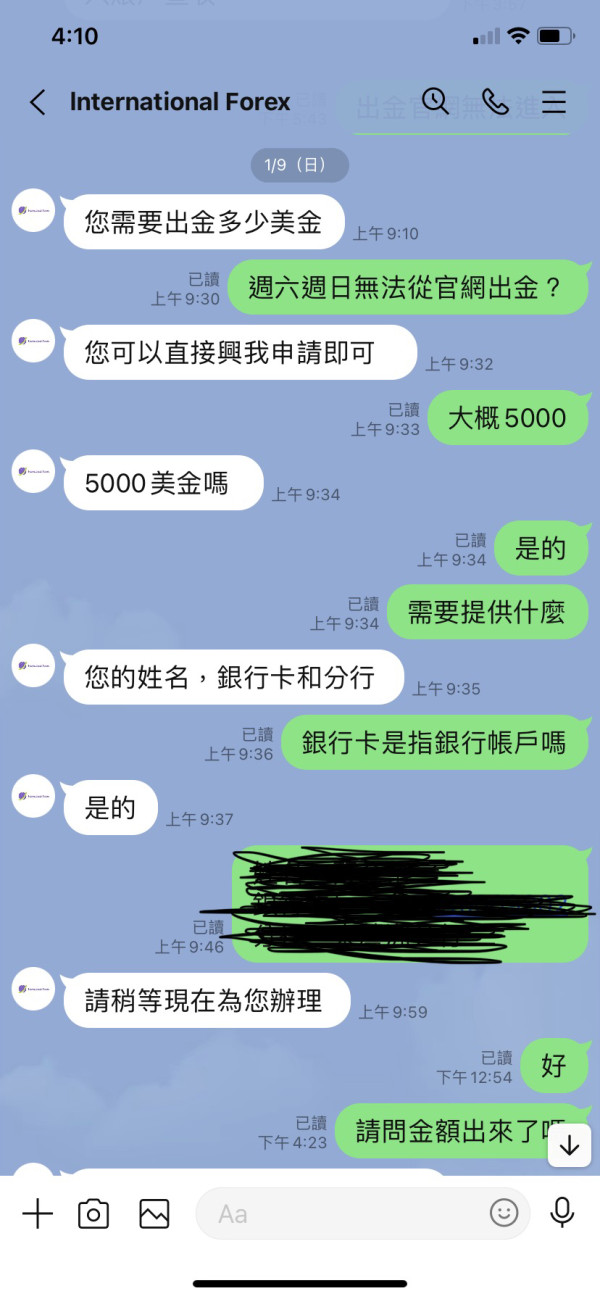

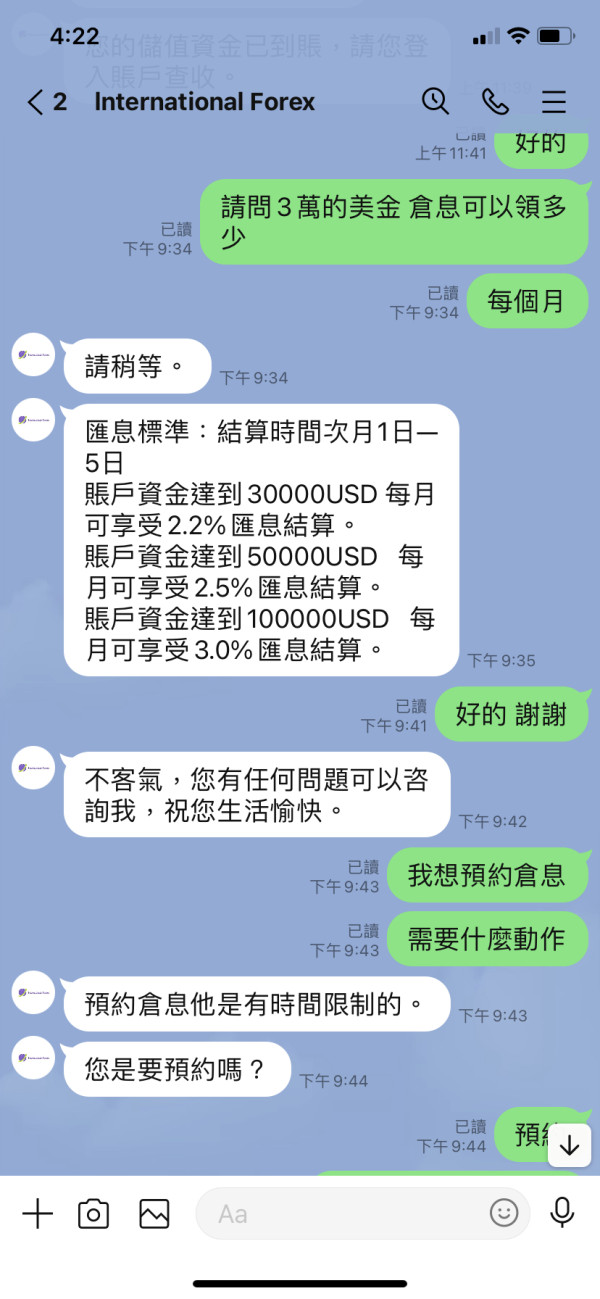

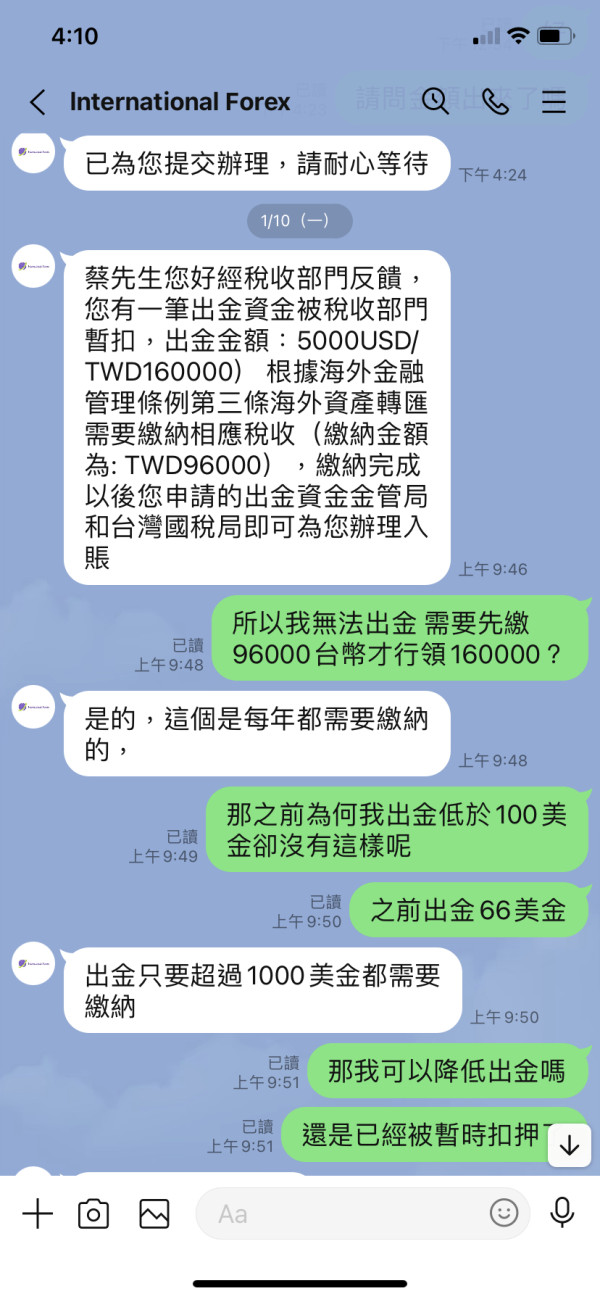

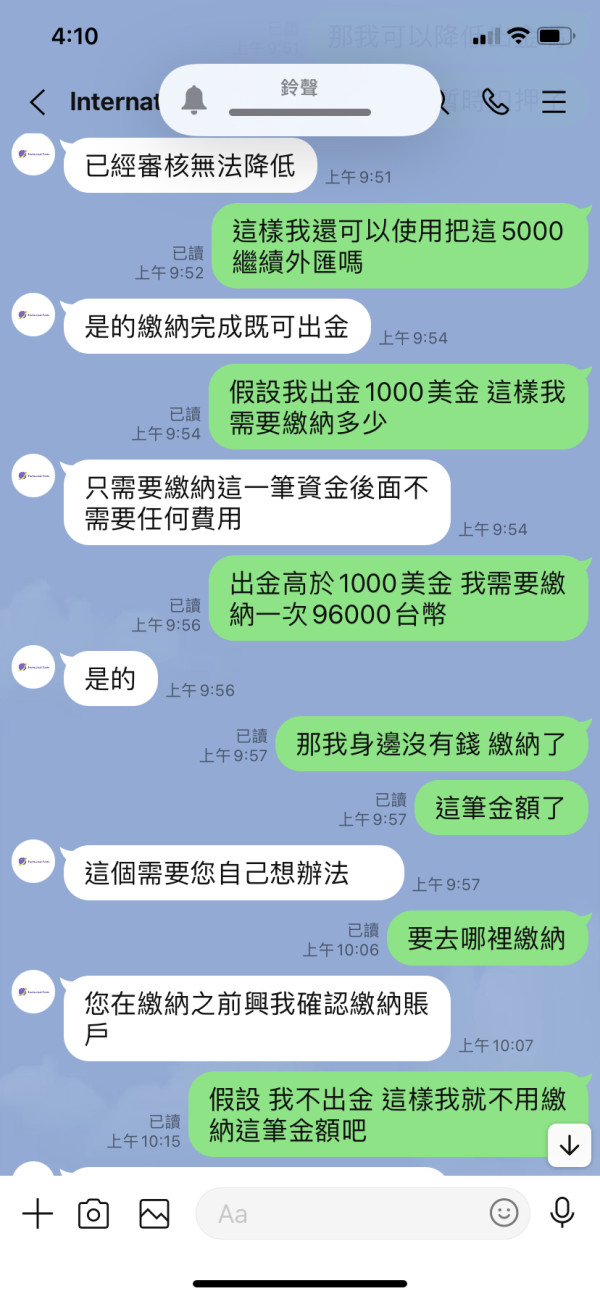

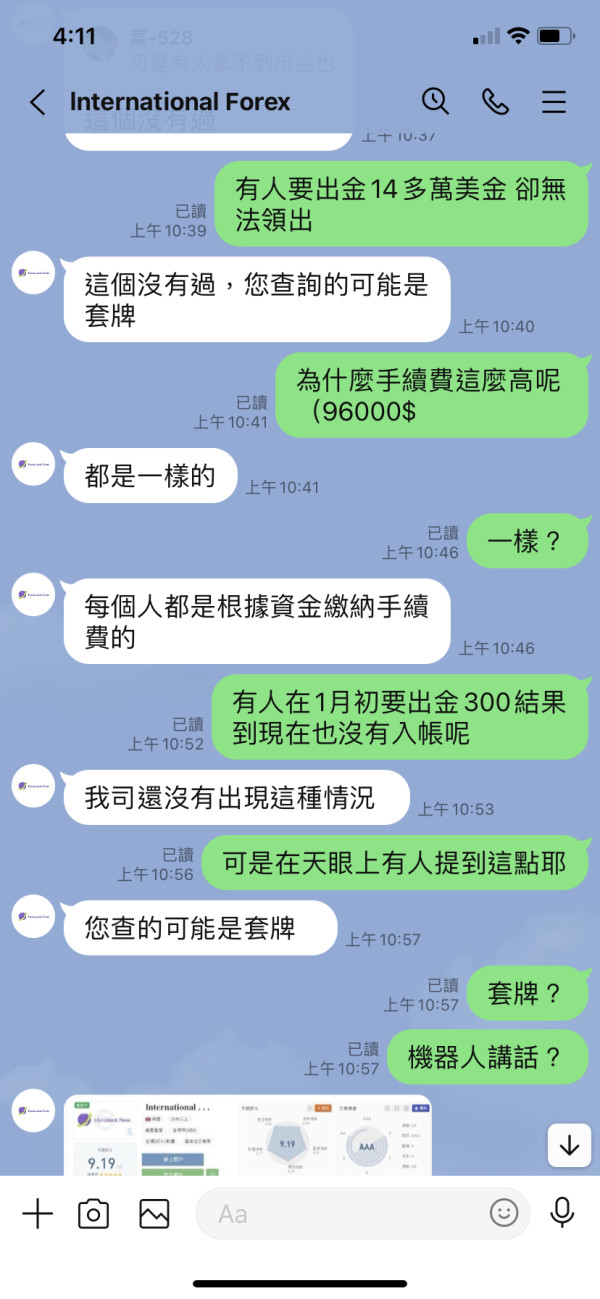

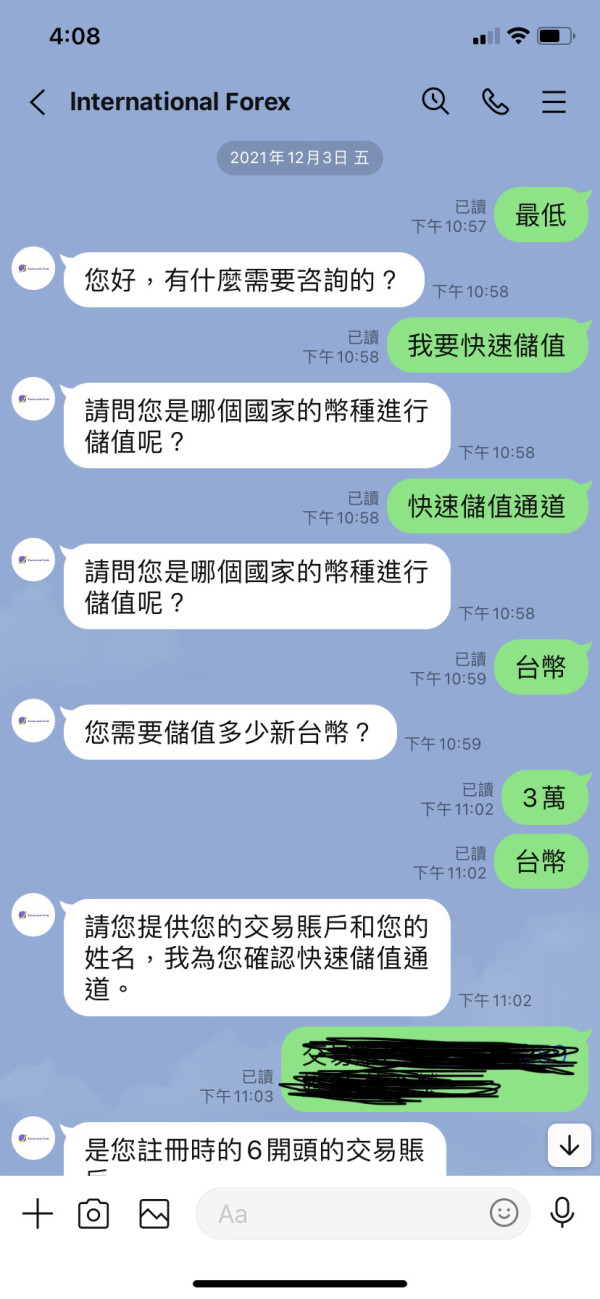

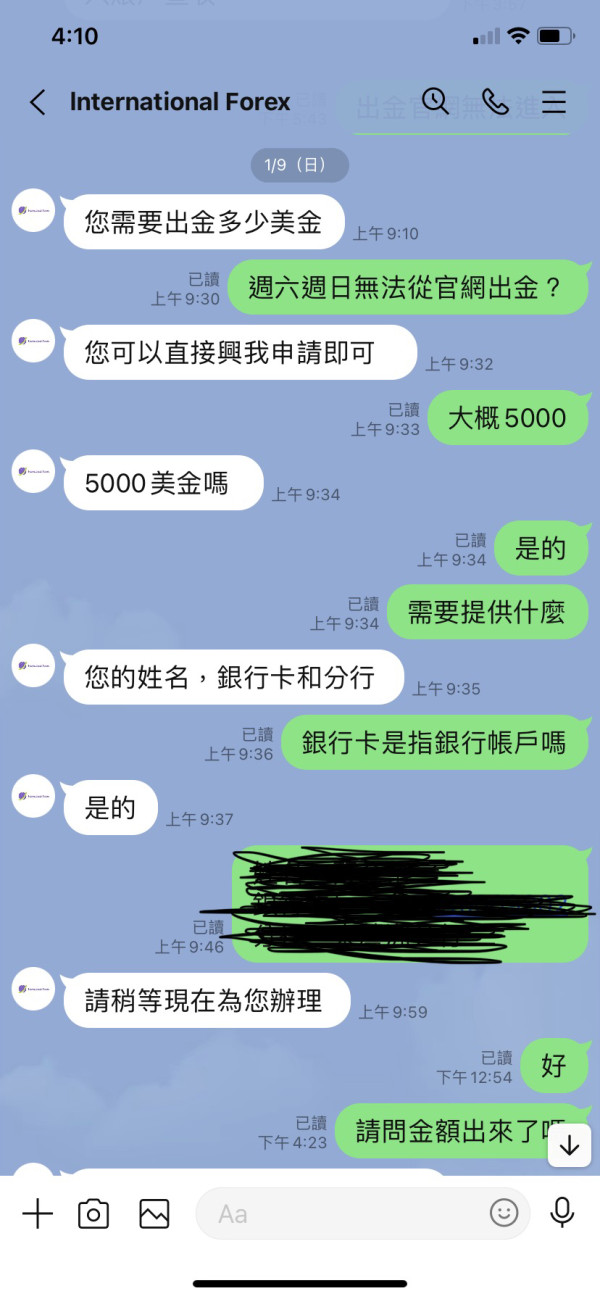

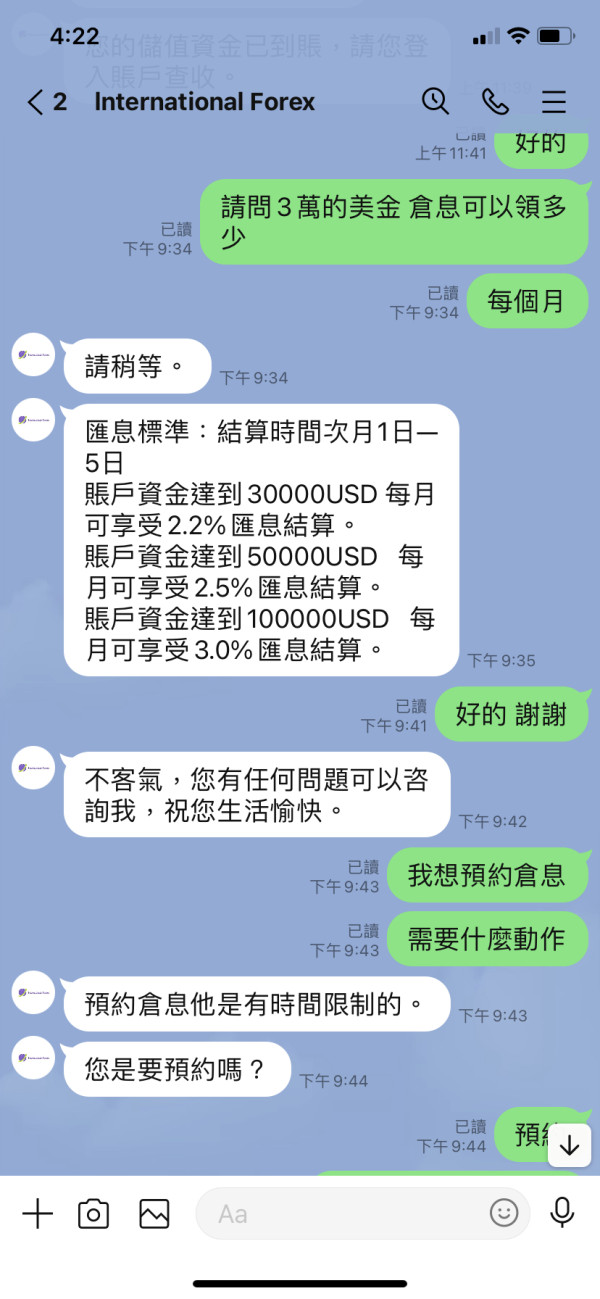

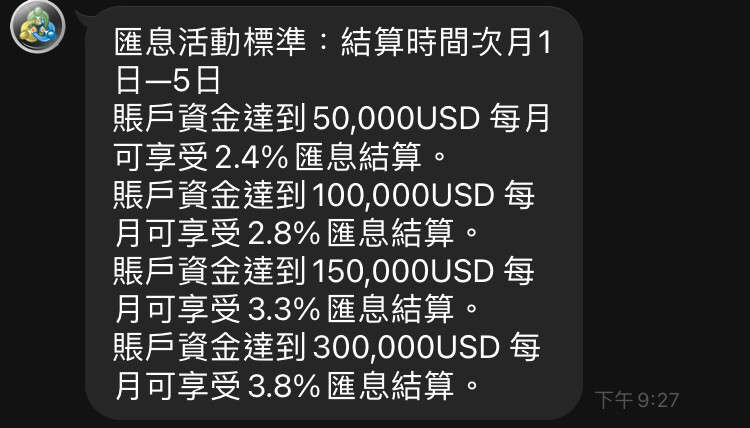

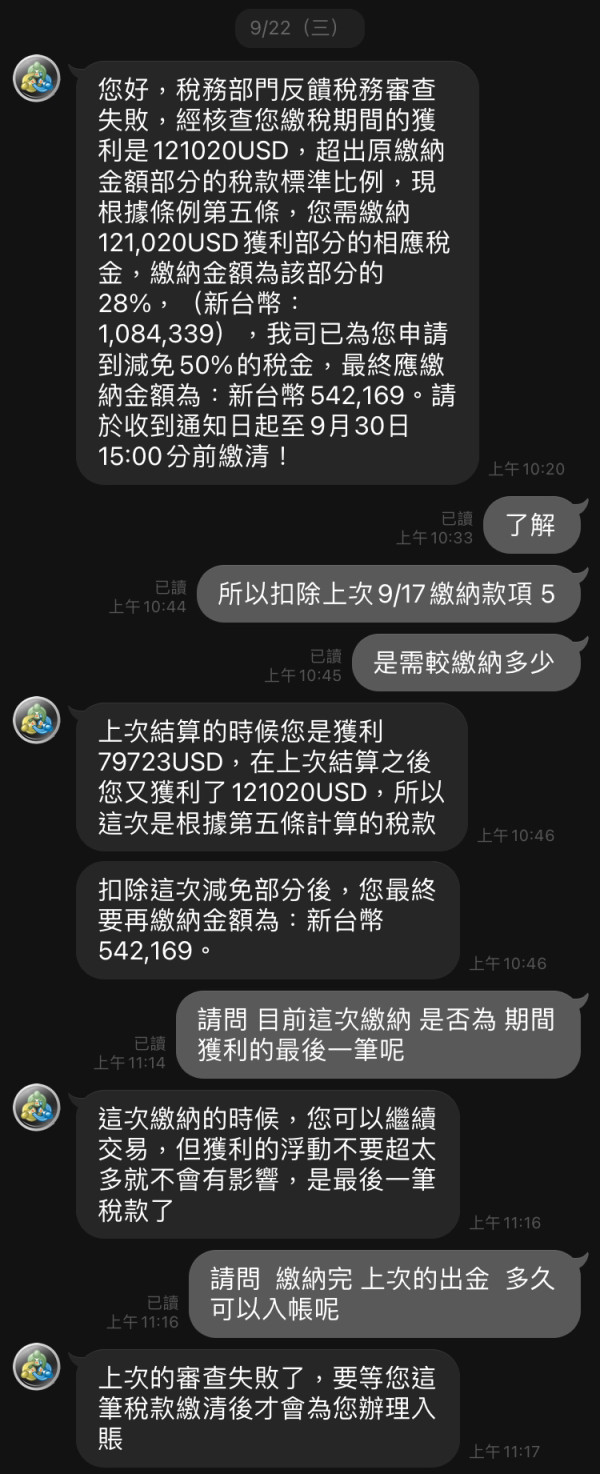

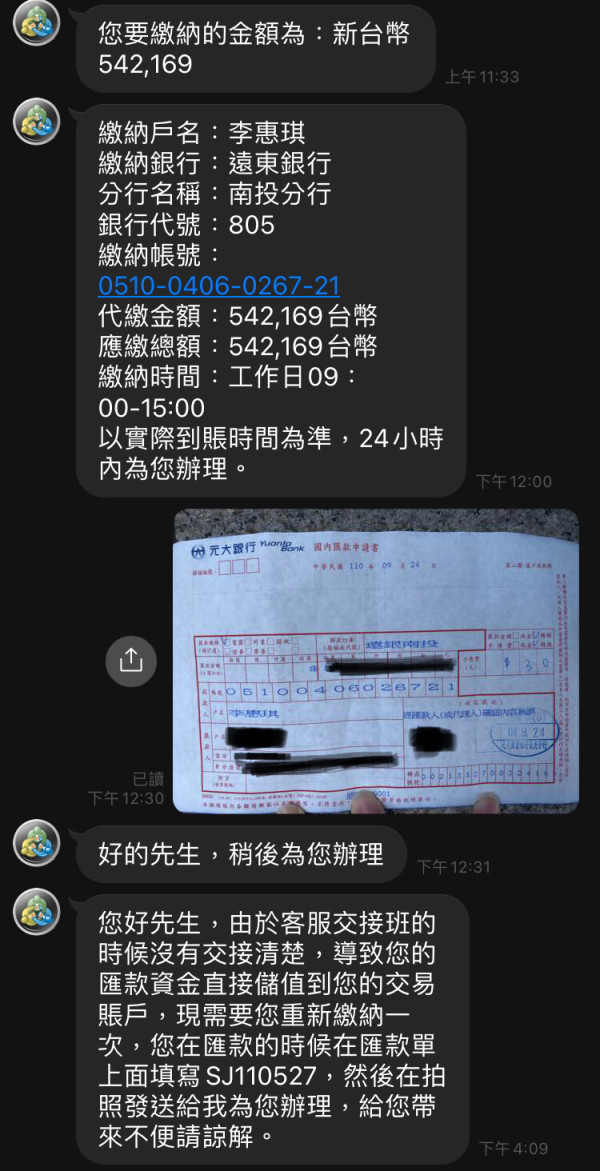

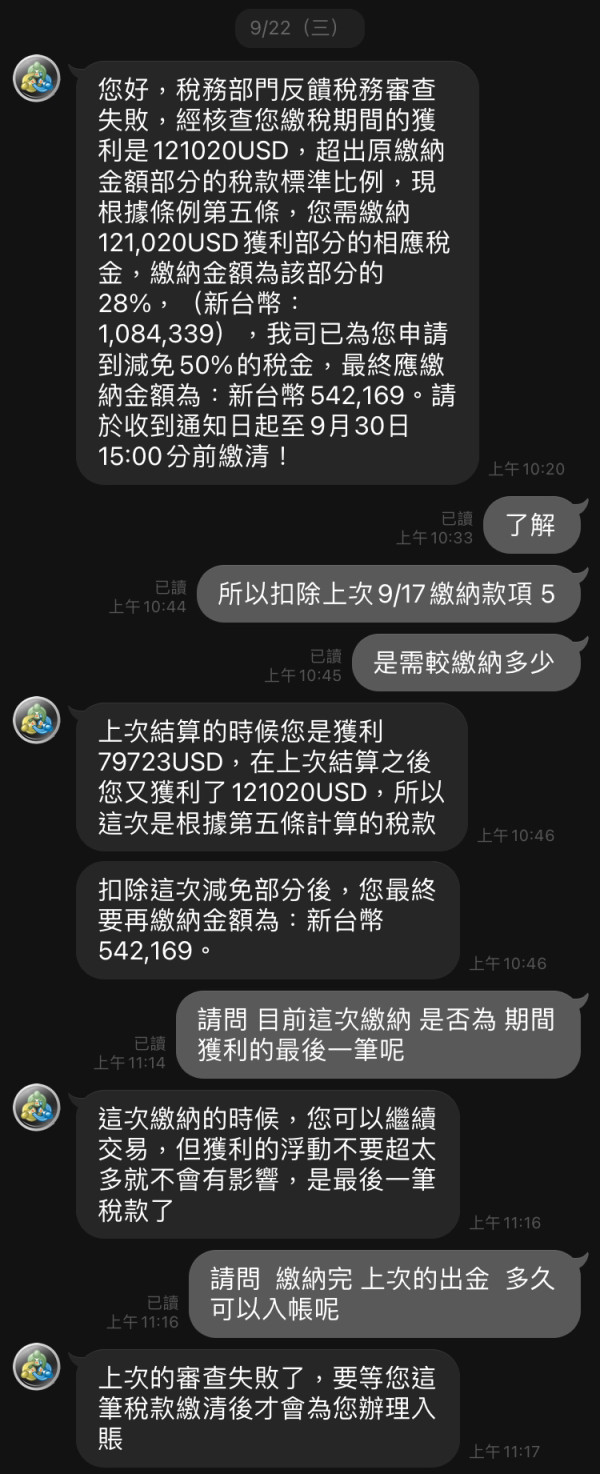

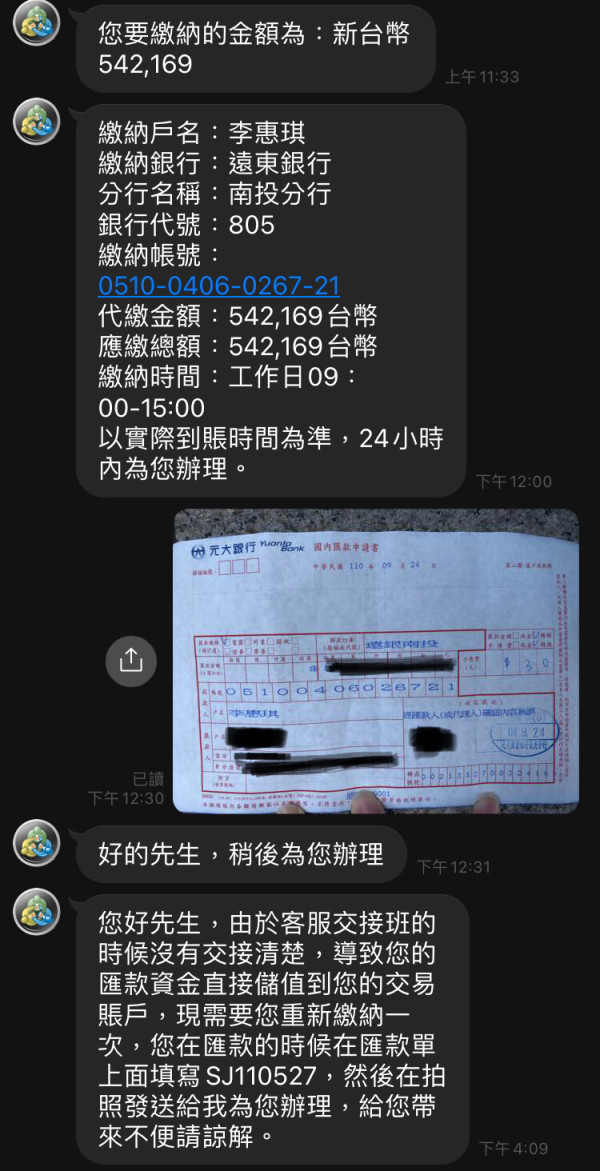

On 2021.12.3, I met a woman on a dating app who introduced me as a trader, and recommended me to the customer service. After depositing $1,000, the customer service contacted me and said that after the deposit of $30,000, there will be a warehouse that can be collected. Wait until me After slowly depositing in, it has not yet reached 30,000 US dollars. I want to withdraw funds and do not want to do any more. The customer service said that I need to pay a fee of 96,000. I also asked the woman from the dating software, and he also said that I have to pay the fee, right? It didn't take long for him to be contacted, and he was deceived by more than 440,000 yuan. In the end, I still can't withdraw the money, and now the customer service is still telling me that I need to pay 3,000 US dollars to withdraw the money.

Many people have been deceived, and I am also a victim. It has been a few months since the incident, and I am still very tormented and under great pressure. I have seen many victims appear so far. The possibility of illicit money is not high, but at least the top households will be frozen by the judiciary, and it is hoped that the judiciary will sanction them one day.

I met a netizen who was playing games a while ago. He introduced me to play foreign exchange and said that he relied on playing foreign exchange to freely play games every day. I believed that he really wanted to drop out of school and play games every day, so I asked him how to get in and he said that he must store the principal after He can take me to fly, but it’s too hard to get wealth and wealth freedom. I don’t have the principal. He asked me to negotiate with the customer service. When I want to deposit money later, I can’t borrow it from my roommate. I can only use my money to be principle and who will know that it is a scam that cannot withdraw. The customer service keeps looking for troubles and cannot withdraw.

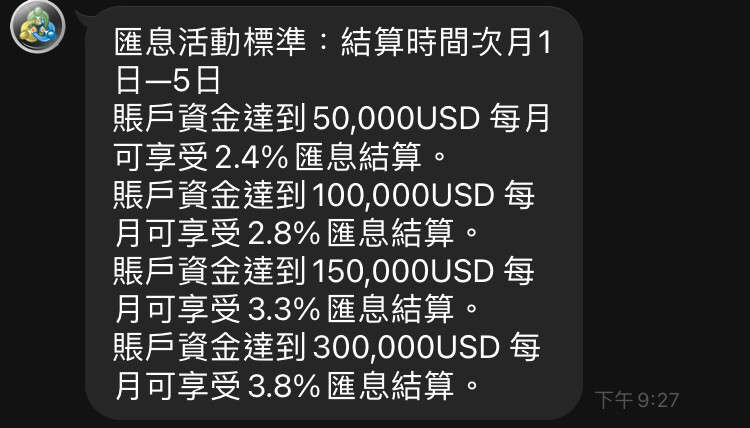

I met a girl from Pai Ai, and started contacting mt5 on 110/12/3. At first, I made a deposit of 1,000 and she slowly taught me how to operate. The receiver told you that if the amount reached 30,000 US dollars, you could get the interest. When you want to withdraw money, the customer service will tell you that you need to pay 96,000 (the deposit of the Financial Regulatory Commission). Even if you withdraw 1 USD, you still need to pay, but I did not pay. I just didn’t see it and didn’t contact me because I saw that some netizens had paid and failed to withdraw the money, so I was shocked to realize that I was cheated of more than 440,000 yuan.