Is BTCSWAP safe?

Business

License

Is BTCSwap Safe or Scam?

Introduction

BTCSwap positions itself as a broker in the forex and cryptocurrency markets, claiming to offer a user-friendly platform for traders seeking to capitalize on the volatility of digital assets. However, the need for traders to carefully evaluate the legitimacy and safety of trading platforms has never been more critical. The rise of online trading has been accompanied by an increase in scams and fraudulent activities, making it essential for investors to perform due diligence before committing their funds. This article aims to provide a comprehensive analysis of BTCSwap, focusing on its regulatory status, company background, trading conditions, customer experiences, and potential risks.

Regulation and Legitimacy

One of the most significant aspects to consider when assessing whether BTCSwap is safe or a scam is its regulatory status. Regulated brokers are held to strict standards that protect investors, while unregulated brokers operate with little oversight, increasing the risk of fraud. Unfortunately, BTCSwap is not regulated by any reputable financial authority. Below is a summary of the regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation is a substantial red flag. A quick search of financial regulators' databases reveals that BTCSwap lacks authorization to operate as a broker. This raises concerns about the platform's legitimacy and the safety of client funds. Without regulatory oversight, traders have limited recourse in the event of disputes or fraud, making it crucial to approach BTCSwap with caution.

Company Background Investigation

Understanding the company behind BTCSwap is essential in determining its credibility. The broker claims to operate from the Marshall Islands, a location often associated with unregulated financial services. However, the website offers little information regarding its history, ownership structure, or management team. This lack of transparency is concerning, as reputable brokers typically provide detailed information about their operations and leadership.

Moreover, the absence of identifiable management raises questions about the expertise and accountability of those running the platform. Traders should be wary of companies that do not disclose key information, as this can indicate potential fraud. The overall lack of transparency further supports the notion that BTCSwap may not be a safe option for traders.

Trading Conditions Analysis

BTCSwap advertises competitive trading conditions, including high leverage and low spreads, which may initially attract traders. However, it is crucial to scrutinize the fee structure for any hidden costs that could affect profitability. The following table outlines the core trading costs associated with BTCSwap:

| Fee Type | BTCSwap | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 3% |

The absence of specific figures in the table indicates that BTCSwap may not be transparent about its trading costs, which is a common tactic employed by scam brokers. Traders should be cautious of platforms that do not clearly outline their fees, as this can lead to unexpected charges and losses.

Client Fund Security

The safety of client funds is paramount when evaluating a trading platform. BTCSwap does not provide adequate information regarding its security measures, such as fund segregation, investor protection, or negative balance protection policies. Without these safeguards, traders may find their investments at risk. Historical complaints from users indicate that some have experienced difficulties in withdrawing their funds, a common issue with unregulated brokers.

In the absence of a robust security framework, investors should be highly cautious. The lack of transparency regarding fund safety measures further raises concerns about whether BTCSwap is a safe trading platform.

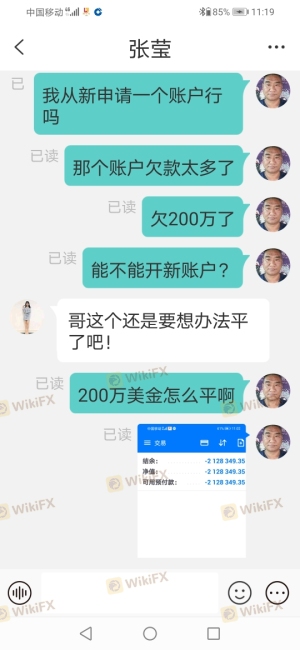

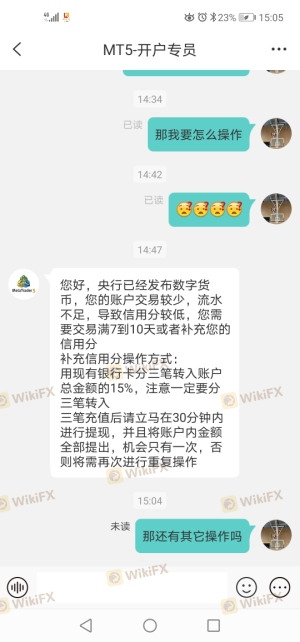

Customer Experience and Complaints

Analyzing customer feedback is vital in assessing the overall trustworthiness of BTCSwap. Numerous online reviews indicate a pattern of dissatisfaction among users, with many reporting issues related to withdrawals and customer service. The following table summarizes the main types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Misleading Information | High | Non-responsive |

Typical cases include users claiming that their withdrawal requests were ignored or delayed indefinitely. Such complaints are significant warning signs that BTCSwap may not be a reliable broker. The overall negative sentiment surrounding customer experiences raises serious questions about whether BTCSwap is safe for traders.

Platform and Trade Execution

The performance and reliability of the trading platform are critical for successful trading. BTCSwap claims to offer a stable platform, but user reviews suggest otherwise. Traders have reported issues such as slippage, frequent downtime, and difficulty executing trades. These problems can significantly impact trading performance and lead to financial losses.

Additionally, there are concerns about potential market manipulation, which is more likely to occur in unregulated environments. Without oversight, the risk of unethical practices increases, further emphasizing the need for caution when dealing with BTCSwap.

Risk Assessment

Using BTCSwap comes with inherent risks that traders must acknowledge. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Fund Safety Risk | High | Lack of security measures for client funds |

| Customer Service Risk | Medium | Poor response to customer complaints |

| Platform Reliability Risk | High | Frequent downtime and execution issues |

To mitigate these risks, traders should consider using regulated brokers with transparent practices and robust security measures. Conducting thorough research and reading user reviews can also help identify potential issues before engaging with a broker like BTCSwap.

Conclusion and Recommendations

In conclusion, the evidence suggests that BTCSwap raises numerous red flags that warrant serious concern. The lack of regulation, transparency issues, negative customer feedback, and potential risks associated with fund safety and platform reliability paint a troubling picture. Therefore, it is prudent to approach BTCSwap with caution.

For traders seeking a safe environment to invest, it is advisable to consider regulated alternatives with proven track records. Reputable brokers typically offer better security, customer service, and overall trading conditions. In light of the findings, it is clear that BTCSwap is not a safe option for traders, and potential investors should be prepared to lose their funds if they choose to engage with this platform.

Is BTCSWAP a scam, or is it legit?

The latest exposure and evaluation content of BTCSWAP brokers.

BTCSWAP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BTCSWAP latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.