OneUp Trader 2025 Review: Everything You Need to Know

Summary

OneUp Trader stands out in the proprietary trading landscape as a futures-focused trading firm that offers a streamlined approach to funded trading opportunities. This comprehensive oneup trader review reveals a company that emphasizes simplicity through its one-step evaluation program. The firm makes itself particularly attractive for traders seeking quick access to capital without the complexity of multi-phase challenges.

The firm's key distinguishing features include monthly fees starting from $65 and minimum account sizes beginning at $25,000. This positioning makes it an accessible option for traders with moderate capital requirements. OneUp Trader places significant emphasis on risk management and trading discipline, which forms the cornerstone of their evaluation and ongoing trader support programs.

Target audience analysis indicates that OneUp Trader primarily caters to novice traders and those seeking capital backing who prefer a straightforward evaluation process over complex multi-tier systems. According to user feedback on Trustpilot, the platform has garnered positive responses from traders who appreciate the simplified approach to prop trading. The firm's focus on futures trading makes it particularly suitable for traders specializing in commodities, indices, and other futures markets rather than forex or equity trading.

Important Notice

Regional Entity Differences: The available information sources do not provide comprehensive regulatory details for OneUp Trader across different jurisdictions. Traders must independently verify the regulatory status and compliance requirements applicable to their specific region before engaging with the platform.

Review Methodology Declaration: This evaluation is based on publicly available information and user feedback collected from various trading community sources and review platforms. Specific regulatory information was not detailed in the available materials. Potential traders should exercise due diligence in verifying the firm's credentials and regulatory standing in their jurisdiction before making any financial commitments.

Rating Framework

Broker Overview

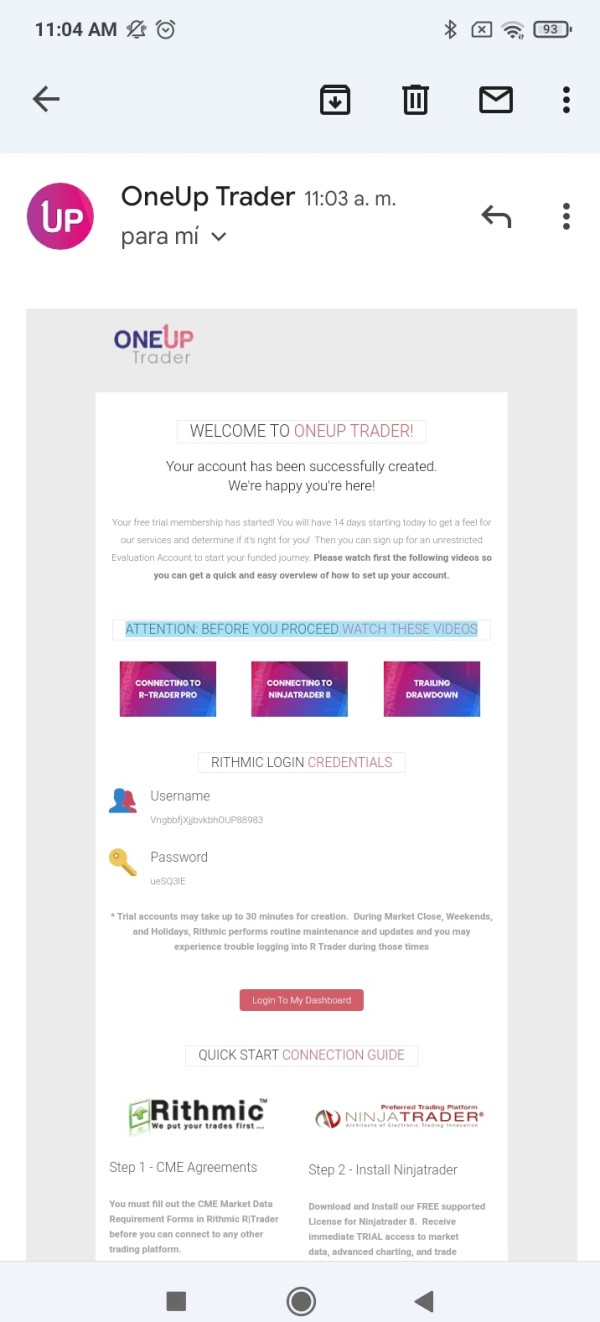

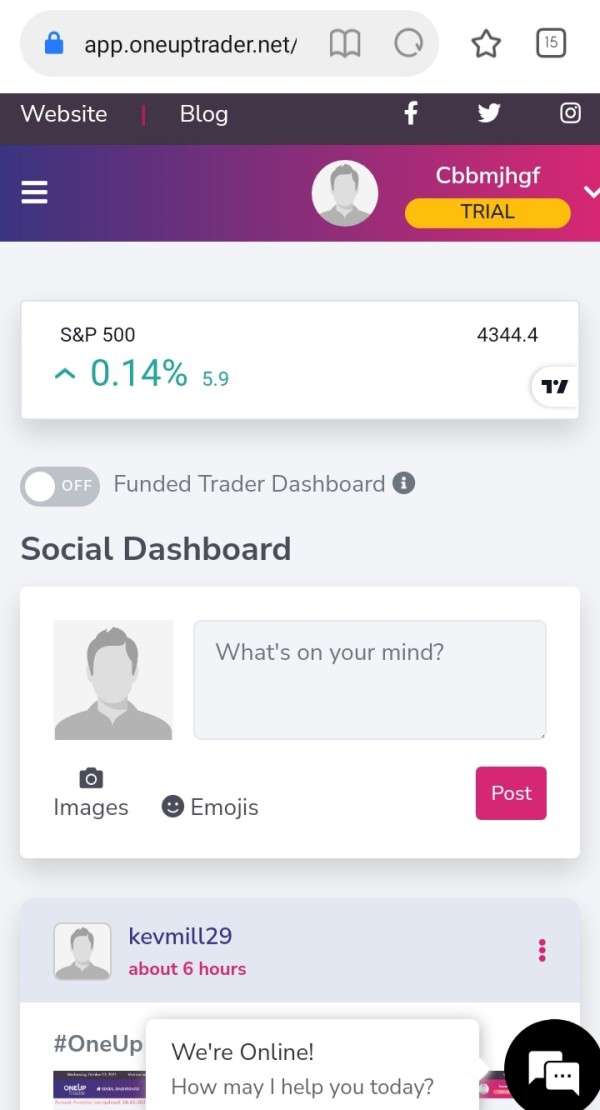

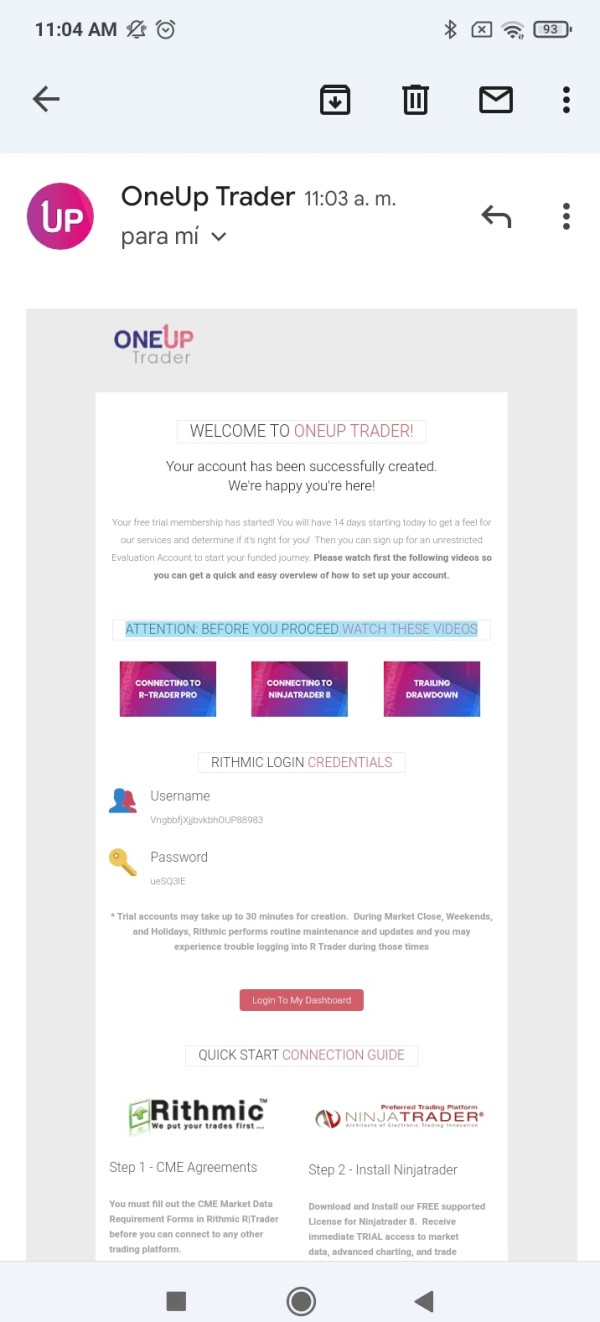

OneUp Trader operates as a proprietary futures trading company that has carved out a niche in the competitive prop trading market through its emphasis on simplification and accessibility. While the exact founding date is not specified in available sources, the company has established itself as a recognizable name in the futures prop trading sector. The firm's core business philosophy revolves around providing traders with a straightforward path to funded trading opportunities. This approach eliminates the multi-phase evaluation processes that characterize many competing firms.

The company's business model centers on offering capital to qualified traders who demonstrate consistent profitability and adherence to risk management protocols. OneUp Trader's approach emphasizes risk management and trading discipline as fundamental requirements for success, reflecting industry best practices for capital preservation. According to available information, the firm maintains a focus on futures markets, which distinguishes it from prop firms that offer broader asset classes including forex and equities.

OneUp Trader's evaluation methodology employs a single-step assessment program. This contrasts with the two or three-phase challenges common among competitors. This oneup trader review finds that this simplified approach appeals to traders who prefer immediate evaluation opportunities without extended preliminary phases. The firm's fee structure, beginning at $65 monthly, positions it competitively within the prop trading market while maintaining accessibility for traders with varying capital levels.

Regulatory Oversight: Available sources do not provide specific information regarding OneUp Trader's regulatory status or oversight bodies. Traders should independently verify regulatory compliance in their jurisdiction.

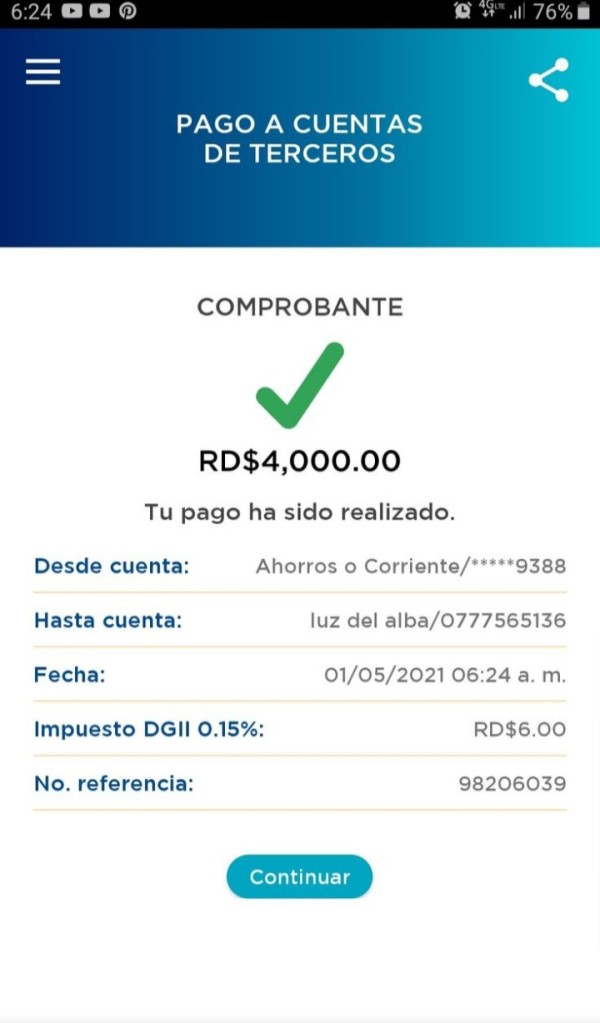

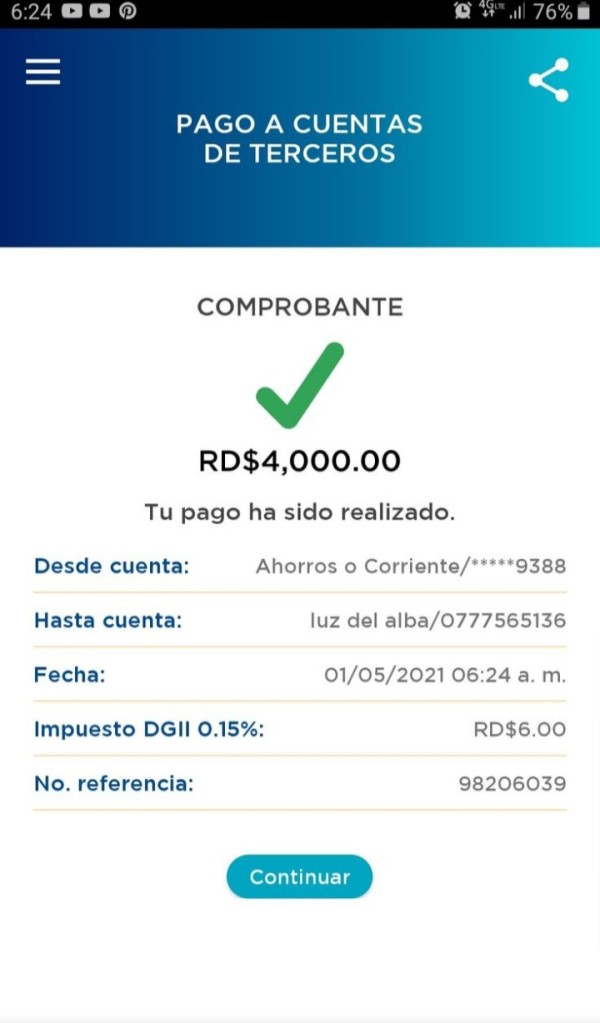

Deposit and Withdrawal Methods: Specific information about funding and withdrawal procedures is not detailed in available sources. The firm appears to follow standard prop trading practices where traders pay evaluation fees rather than depositing trading capital.

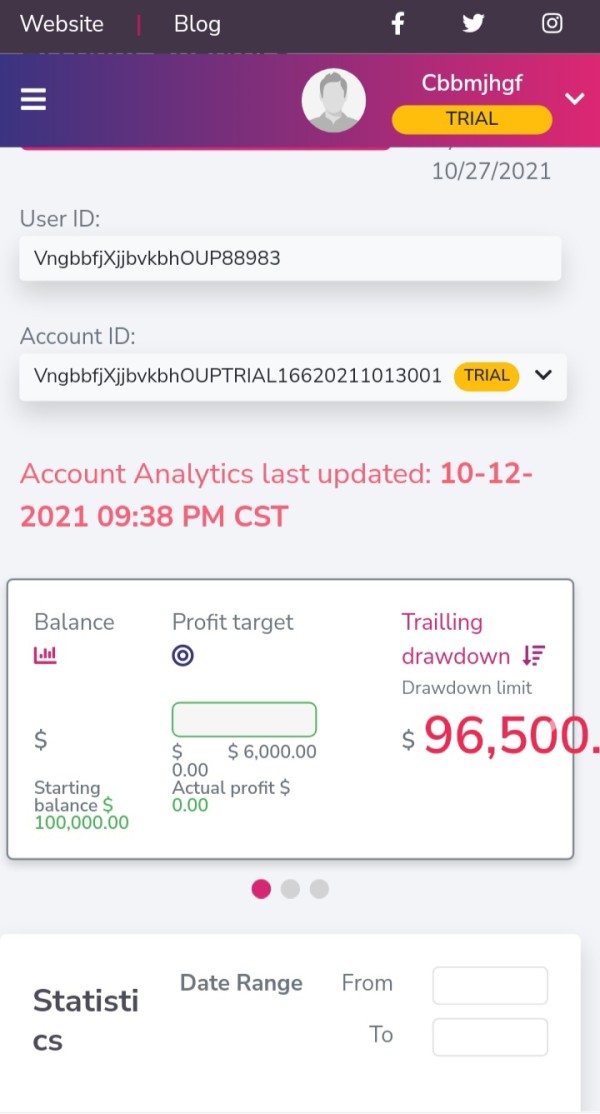

Minimum Capital Requirements: OneUp Trader offers account sizes starting at $25,000. This makes it accessible to traders seeking moderate funding levels compared to firms requiring higher minimum thresholds.

Promotional Offerings: Current promotional programs or bonus structures are not specified in available documentation. Traders should contact the firm directly for current promotional details.

Available Trading Assets: The firm specializes in futures trading, covering commodities, indices, and other futures instruments. This focus differentiates OneUp Trader from multi-asset prop firms.

Cost Structure: Monthly fees begin at $65, with additional setup costs of $125 reported in some sources. Specific spread markups, commission structures, and profit-sharing arrangements require direct inquiry with the firm.

Leverage Provisions: Leverage ratios and margin requirements are not detailed in available sources. Futures trading typically involves significant leverage capabilities subject to risk management constraints.

Platform Technology: Specific trading platform information is not comprehensively covered in available sources. This oneup trader review notes that platform details represent a significant information gap for prospective traders.

Geographic Restrictions: Regional availability and restrictions are not specified in accessible documentation.

Support Languages: Customer service language options are not detailed in available materials.

Detailed Rating Analysis

Account Conditions Analysis

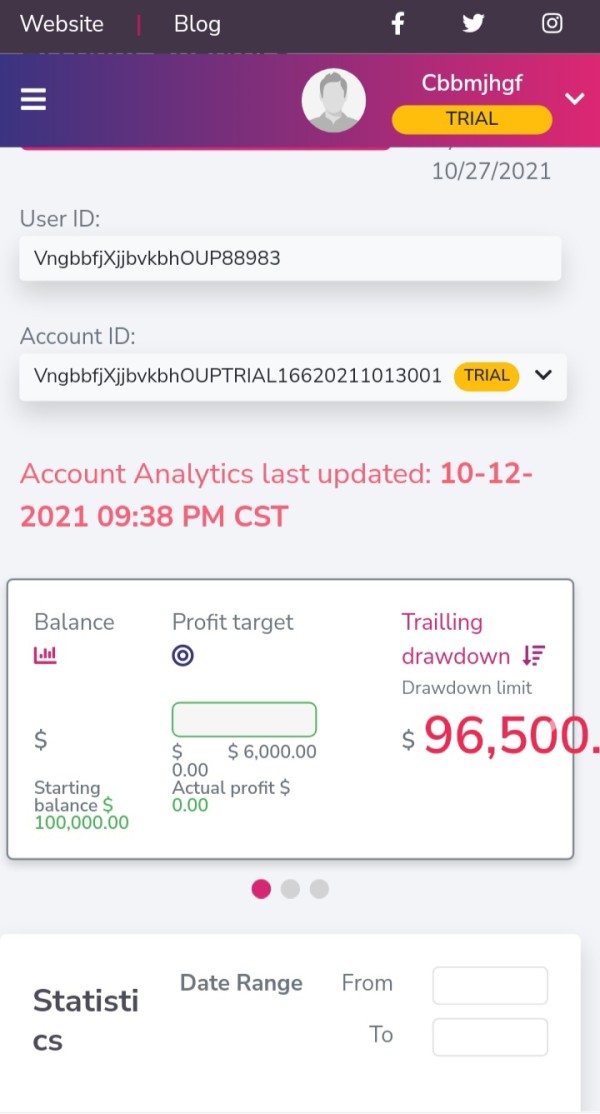

OneUp Trader's account structure reflects a balanced approach to accessibility and selectivity in the prop trading market. The firm's minimum account size of $25,000 positions it favorably for traders seeking substantial funding without requiring the higher capital commitments demanded by premium-tier prop firms. This entry level accommodates traders with proven strategies who need sufficient capital to implement their approaches effectively.

The monthly fee structure starting at $65 represents a competitive pricing model within the industry. This fee arrangement suggests a subscription-based approach rather than one-time evaluation costs, indicating ongoing support and platform access. However, the additional $125 setup fee mentioned in some sources adds to initial costs. This brings total entry expenses to approximately $190 for the first month.

Account opening procedures are not extensively detailed in available sources, though the emphasis on a "simple one-step evaluation" suggests streamlined onboarding processes. The lack of detailed information about account types, Islamic account availability, or specialized trading conditions represents areas where prospective traders should seek direct clarification from the firm.

User feedback from Trustpilot indicates positive experiences with account management. Specific details about account features, profit-sharing arrangements, and withdrawal procedures require further investigation. This oneup trader review notes that while the basic account conditions appear competitive, the limited transparency regarding specific terms and conditions may concern detail-oriented traders.

The available information reveals significant gaps in documented trading tools and resources offered by OneUp Trader. Unlike many prop firms that extensively market their educational materials, analytical tools, and trading resources, OneUp Trader's public information focuses primarily on account conditions and evaluation processes rather than comprehensive tool offerings.

Research and analytical resources are not specifically mentioned in available sources. This represents a notable omission for traders who rely on fundamental analysis, market research, or proprietary indicators. Most competitive prop firms provide extensive market analysis, economic calendars, and research reports as value-added services for their funded traders.

Educational resource availability remains unclear from public information. Many successful prop firms invest heavily in trader education through webinars, courses, mentorship programs, and trading psychology resources. The absence of detailed educational offerings in OneUp Trader's public materials may indicate either limited educational support or insufficient marketing of existing resources.

Automated trading support, including expert advisor compatibility, algorithmic trading capabilities, and API access, is not addressed in available documentation. For traders employing systematic strategies or requiring automated execution capabilities, this information gap represents a significant concern requiring direct inquiry with the firm.

Customer Service and Support Analysis

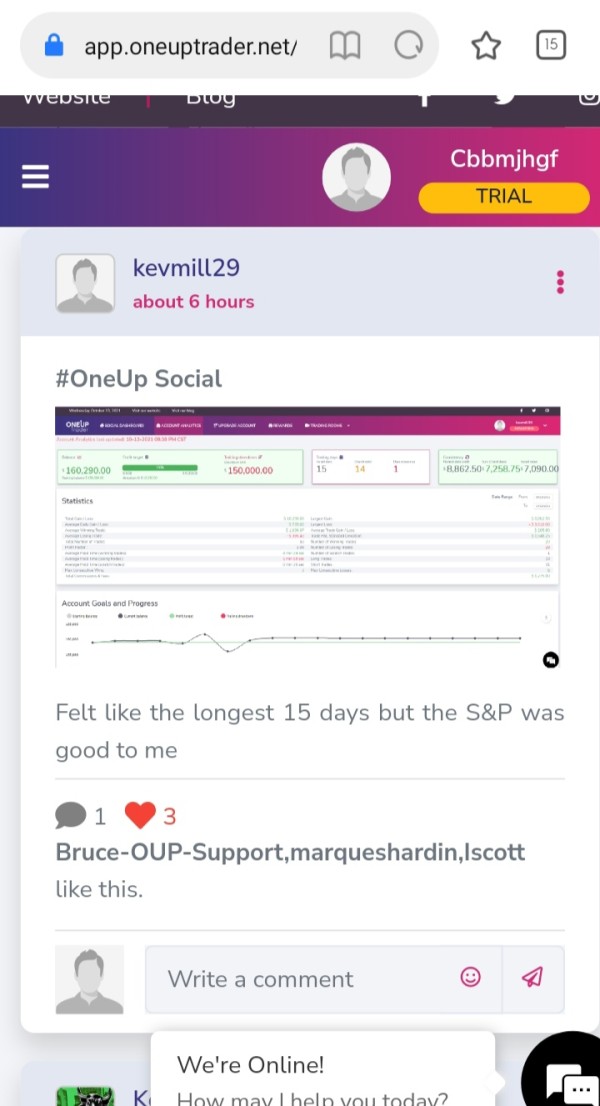

Customer service evaluation for OneUp Trader relies primarily on user feedback from Trustpilot, where traders have reported generally positive experiences. The platform shows favorable user sentiment, suggesting that traders who have interacted with the firm's support systems have found them satisfactory. However, the lack of specific information about support channels, response times, and service scope limits comprehensive evaluation.

Support channel availability is not detailed in accessible sources. Most professional prop firms offer multiple contact methods including live chat, email support, phone assistance, and comprehensive FAQ sections. The absence of specific support channel information in OneUp Trader's public materials suggests either limited support infrastructure or insufficient documentation of available services.

Response time performance cannot be accurately assessed from available information. Positive Trustpilot feedback suggests reasonable responsiveness to user inquiries. Professional prop firms typically maintain support standards including specific response time commitments and escalation procedures for complex issues.

Service quality indicators from user feedback appear positive, with Trustpilot reviews mentioning satisfactory experiences. However, the limited scope of available feedback prevents comprehensive assessment of support quality across different issue types, user segments, and service scenarios.

Trading Experience Analysis

OneUp Trader's trading experience assessment faces limitations due to insufficient platform-specific information in available sources. User feedback suggests satisfactory trading conditions, but detailed platform performance metrics, execution quality data, and specific feature assessments are not comprehensively documented.

Platform stability and performance cannot be thoroughly evaluated from available information. Critical factors including server uptime, execution speed, slippage rates, and system reliability require direct user experience or comprehensive platform testing. The positive user feedback suggests adequate performance, but specific technical metrics remain unavailable.

Order execution quality represents another area where detailed information is limited. Professional trading requires precise execution with minimal slippage, competitive spreads, and reliable order processing. While no significant execution complaints appear in available user feedback, comprehensive execution quality assessment requires more detailed performance data.

Platform functionality completeness cannot be assessed without specific information about charting capabilities, order types, risk management tools, and analytical features. Most professional traders require comprehensive platform functionality including advanced charting, multiple order types, and sophisticated risk management capabilities.

The mobile trading experience is not addressed in available sources. This represents a significant information gap given the importance of mobile access for modern traders. This oneup trader review notes that mobile platform capabilities increasingly influence trader satisfaction and operational flexibility.

Trust and Safety Analysis

OneUp Trader's trust and safety evaluation reveals significant transparency challenges that may concern security-conscious traders. The most notable concern is the absence of detailed regulatory information in available sources. This represents a fundamental transparency issue for a financial services provider.

Regulatory compliance status cannot be verified from available public information. Professional prop firms typically maintain clear regulatory disclosure including license numbers, regulatory body oversight, and compliance certifications. The lack of readily available regulatory information raises questions about oversight and consumer protection measures.

Fund security measures are not specifically detailed in available documentation. Traders typically expect information about segregated accounts, insurance coverage, and capital protection protocols. The absence of specific security measure disclosure limits confidence assessment for risk-conscious traders.

Company transparency levels appear limited based on available public information. While the firm maintains operational presence and user feedback suggests legitimate business operations, the limited disclosure of operational details, regulatory status, and security measures may concern traders prioritizing transparency.

Industry reputation assessment is hindered by limited available information about the firm's track record, management team, and industry standing. Positive user feedback suggests operational legitimacy, but comprehensive reputation evaluation requires broader industry recognition and track record documentation.

User Experience Analysis

User experience evaluation for OneUp Trader shows generally positive sentiment based on available Trustpilot feedback, with traders expressing satisfaction with their overall experience. The firm's emphasis on simplicity appears to resonate with users who appreciate streamlined processes over complex multi-phase evaluations.

Overall user satisfaction indicators from Trustpilot suggest that traders who have engaged with OneUp Trader report positive experiences. The feedback indicates satisfaction with the evaluation process and general platform experience, though specific satisfaction metrics and detailed user surveys are not available.

Interface design and usability cannot be comprehensively assessed without detailed platform information. User feedback suggests adequate usability, but specific interface features, navigation efficiency, and design quality require direct platform experience for proper evaluation.

Registration and verification processes appear streamlined based on the firm's emphasis on "simple one-step evaluation." User feedback suggests efficient onboarding, though specific process details, documentation requirements, and verification timeframes are not extensively documented.

Common user concerns are not extensively documented in available sources. While Trustpilot feedback appears generally positive, comprehensive user experience assessment requires broader feedback collection including detailed satisfaction surveys and systematic user experience studies.

Conclusion

OneUp Trader presents a simplified approach to prop trading that appeals to traders seeking straightforward access to funded accounts without complex multi-phase evaluations. The firm's competitive fee structure starting at $65 monthly and minimum account sizes of $25,000 provide reasonable entry points for aspiring funded traders. However, this oneup trader review identifies significant transparency limitations that may concern detail-oriented traders.

Recommended user types include traders comfortable with futures markets who prioritize simple evaluation processes over extensive educational resources or comprehensive platform features. The firm appears suitable for experienced traders who understand prop trading fundamentals and require primarily capital access rather than extensive support services.

Key advantages include competitive pricing, simplified evaluation procedures, and positive user feedback suggesting satisfactory operational performance. Primary limitations encompass limited regulatory transparency, insufficient platform documentation, and gaps in tool and resource information that may concern traders requiring comprehensive service offerings.