Celox Review 2

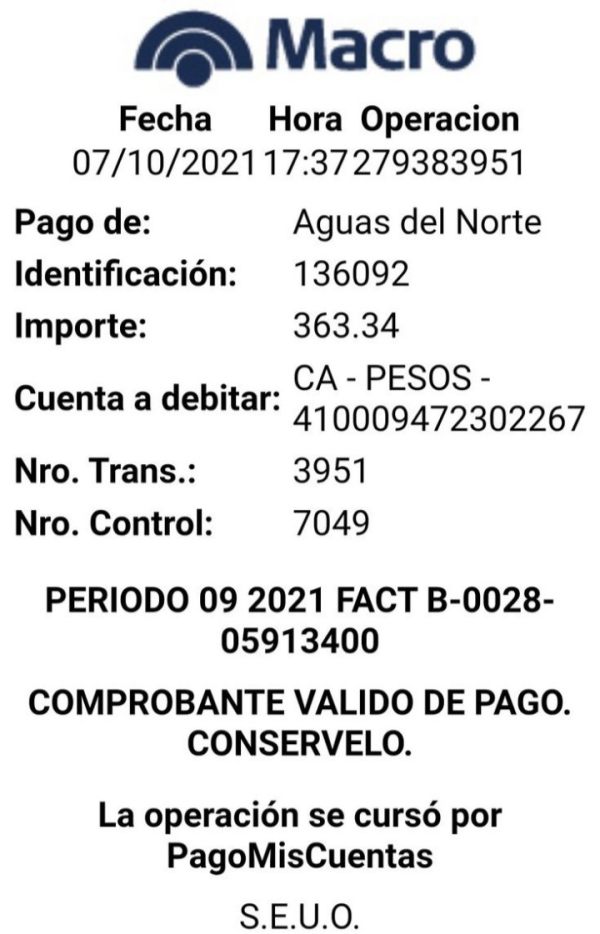

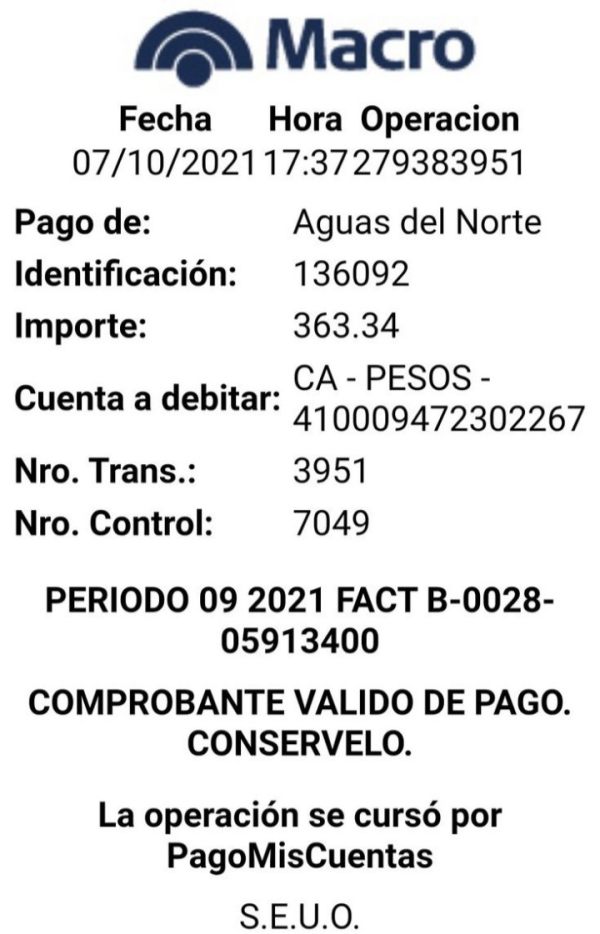

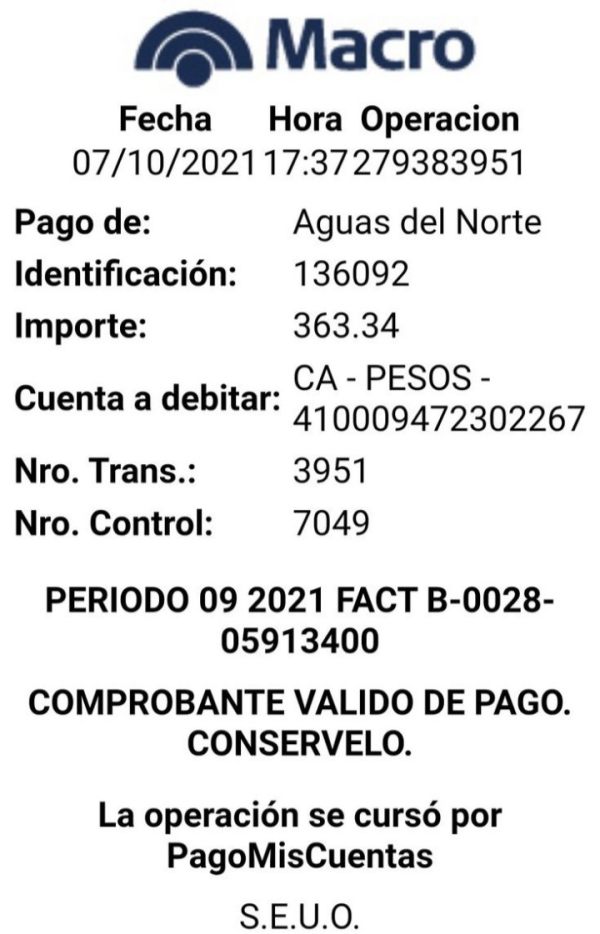

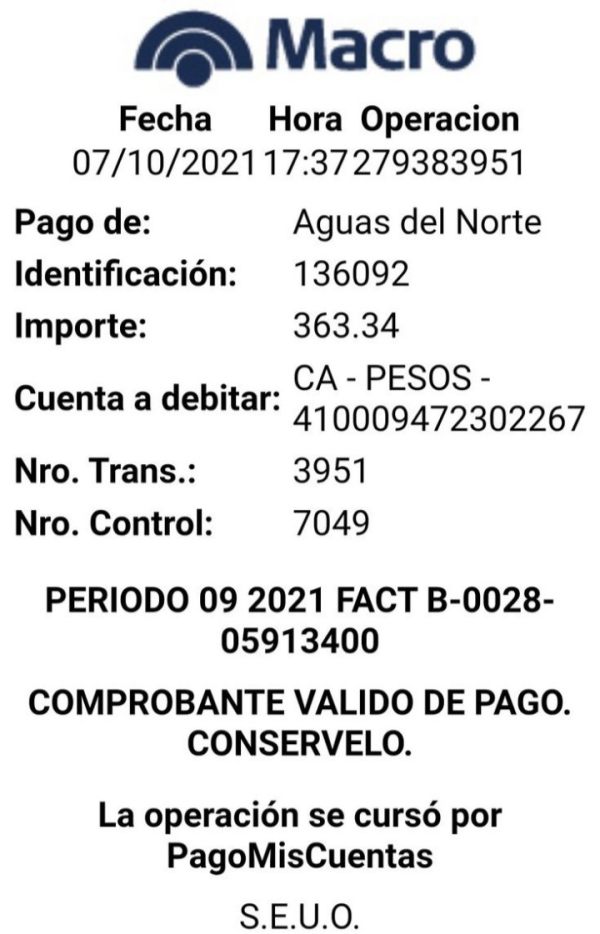

I deposited 363.34 pesos but could not withdraw. Please help.

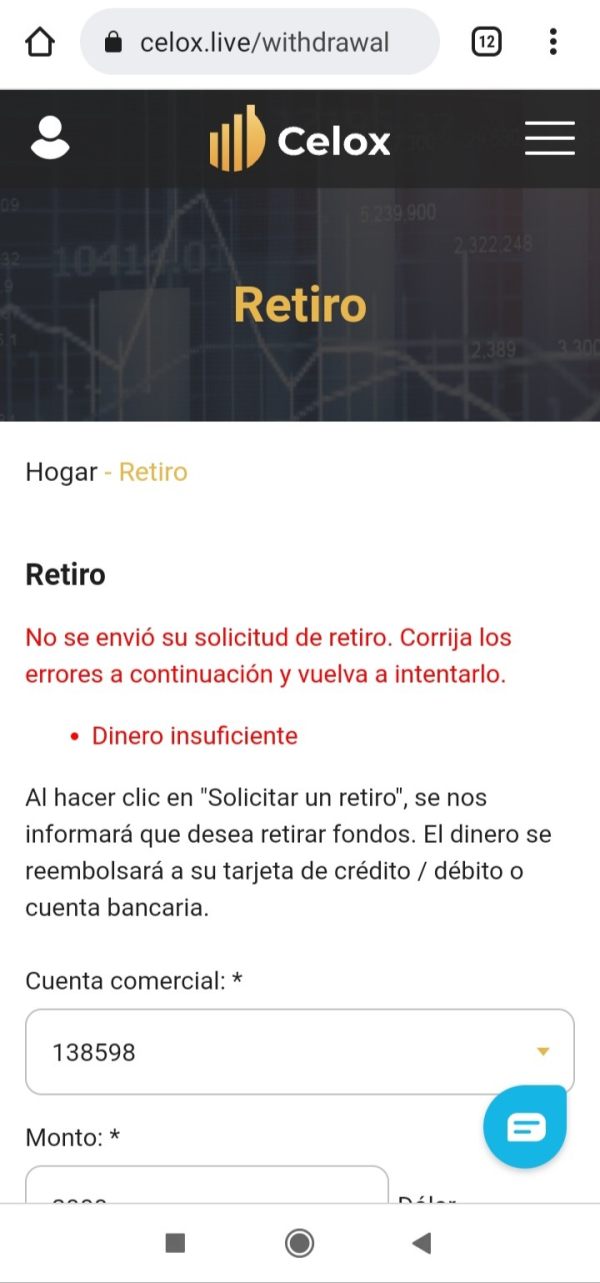

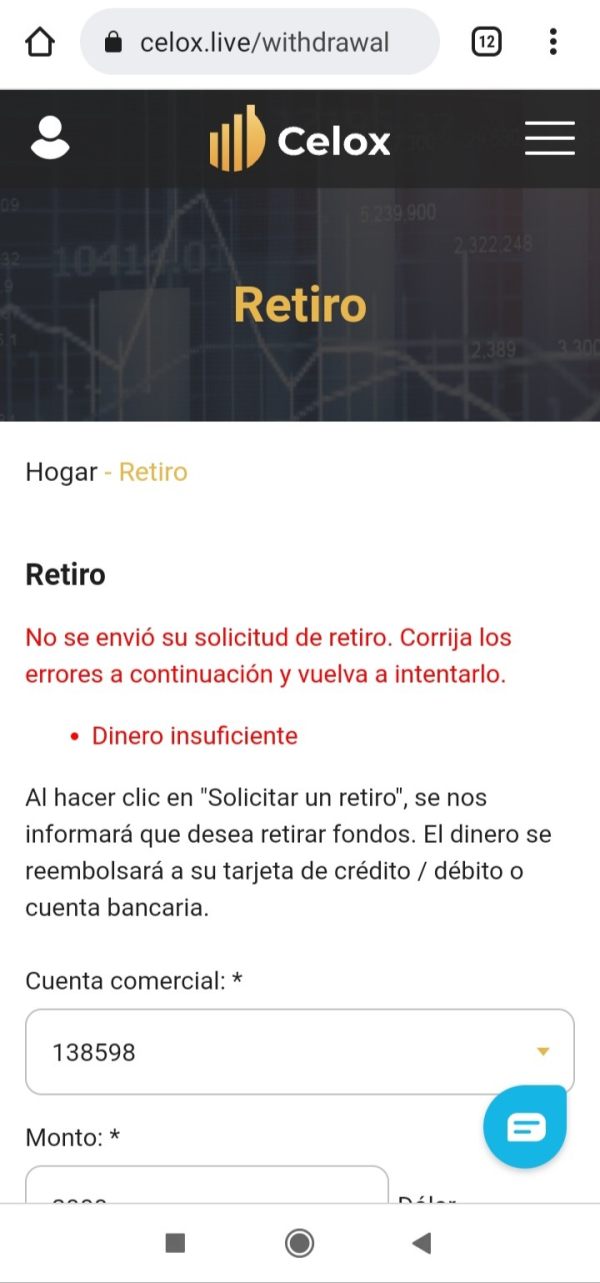

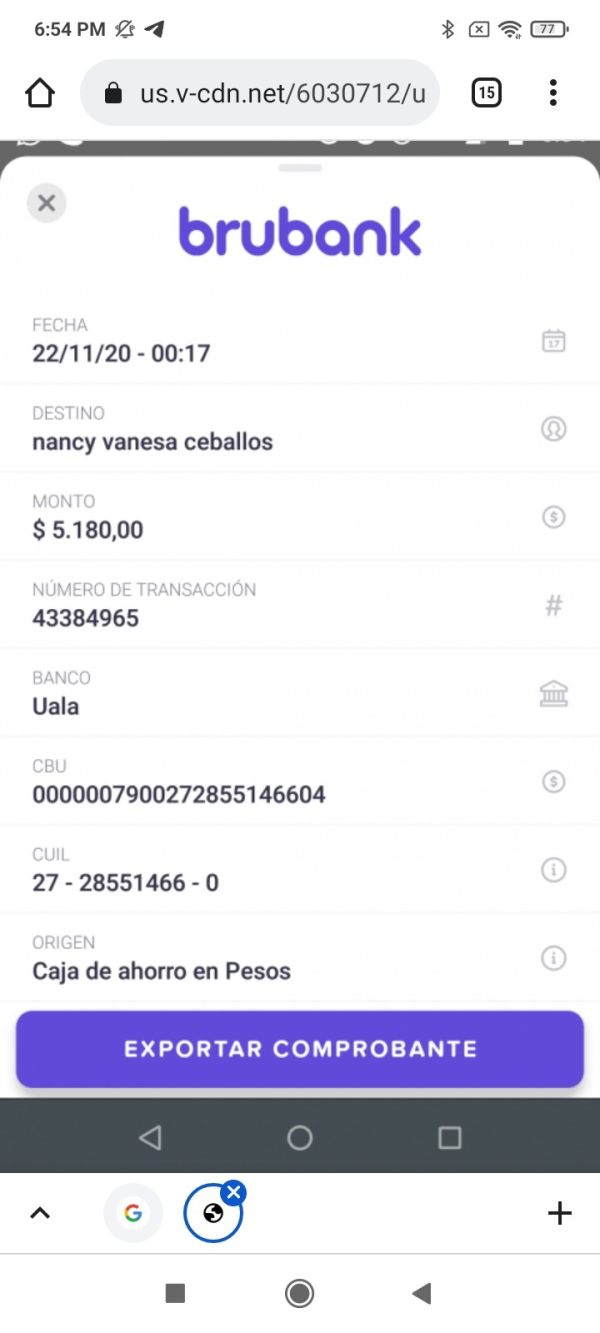

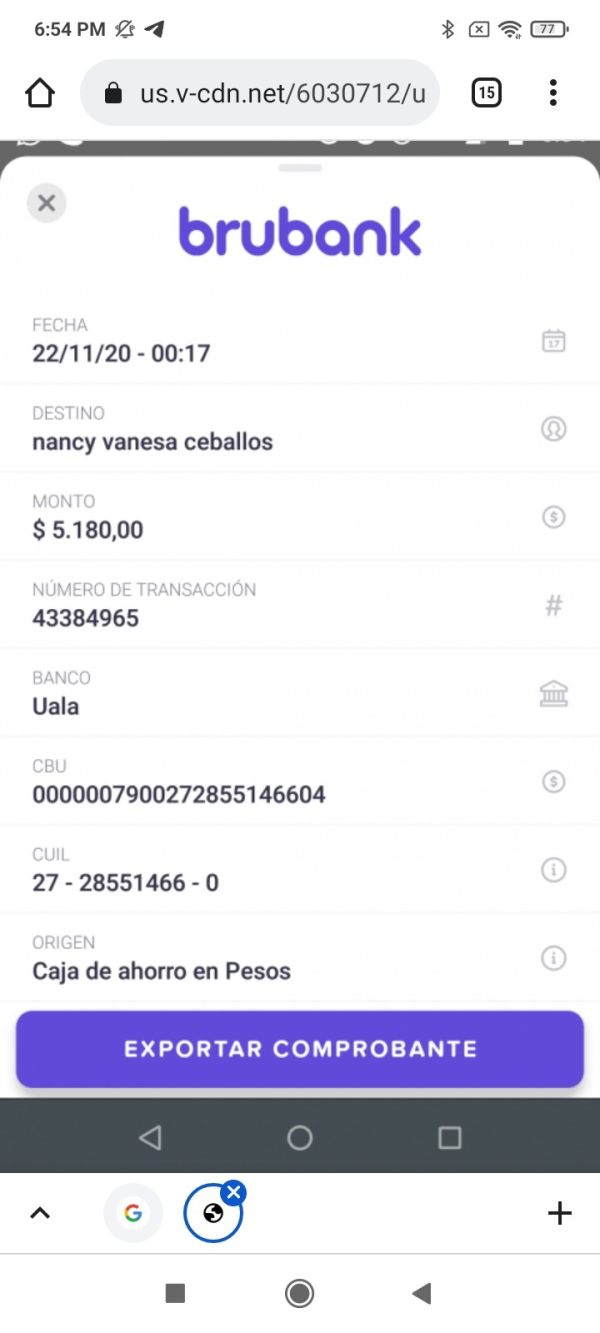

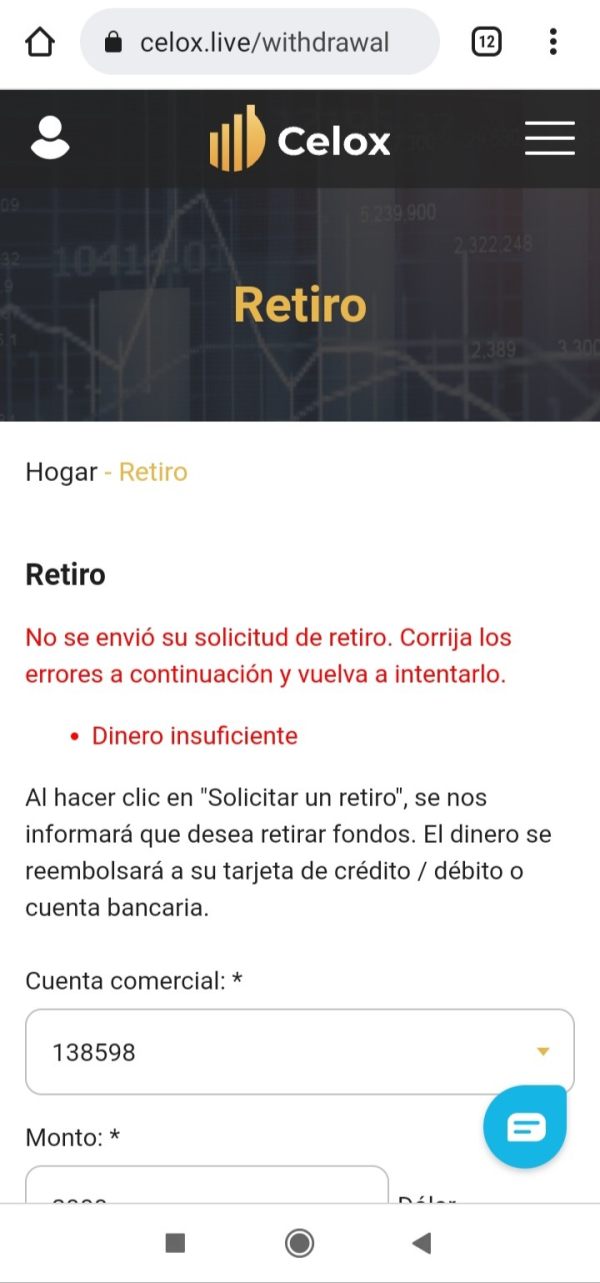

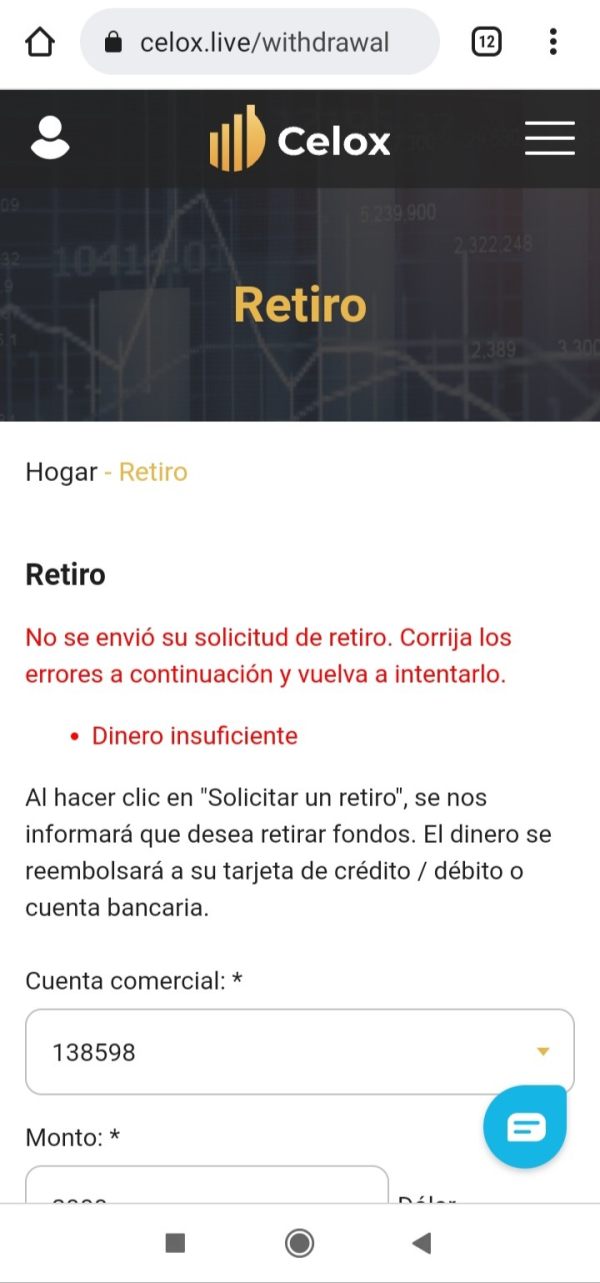

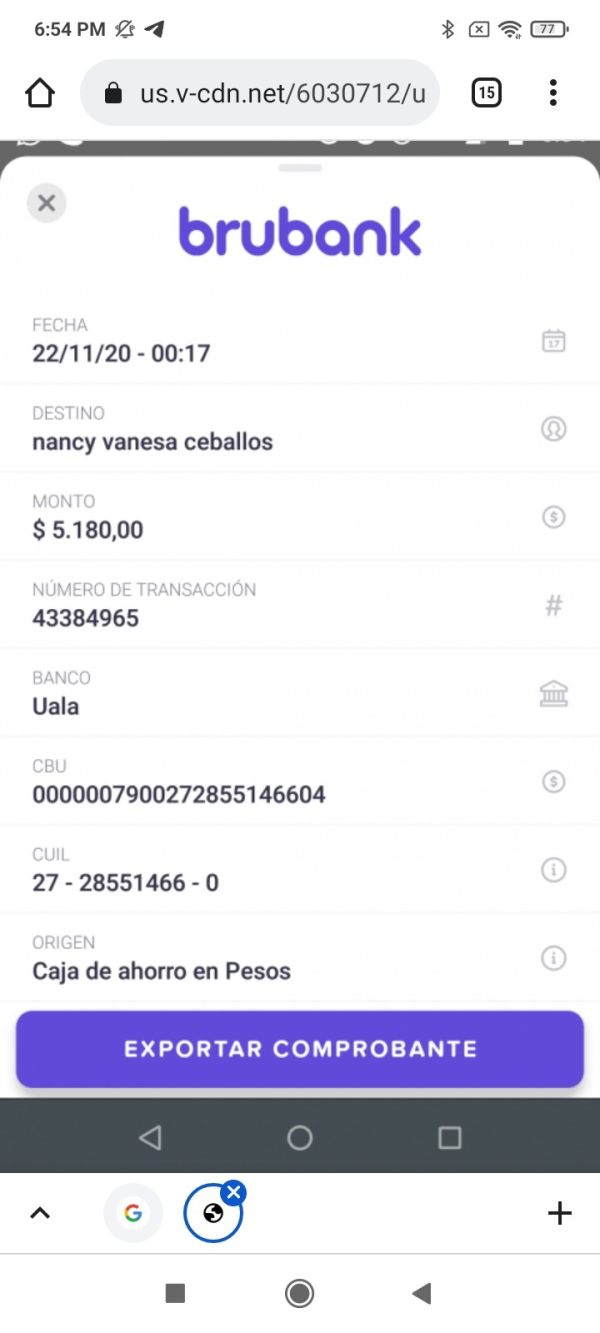

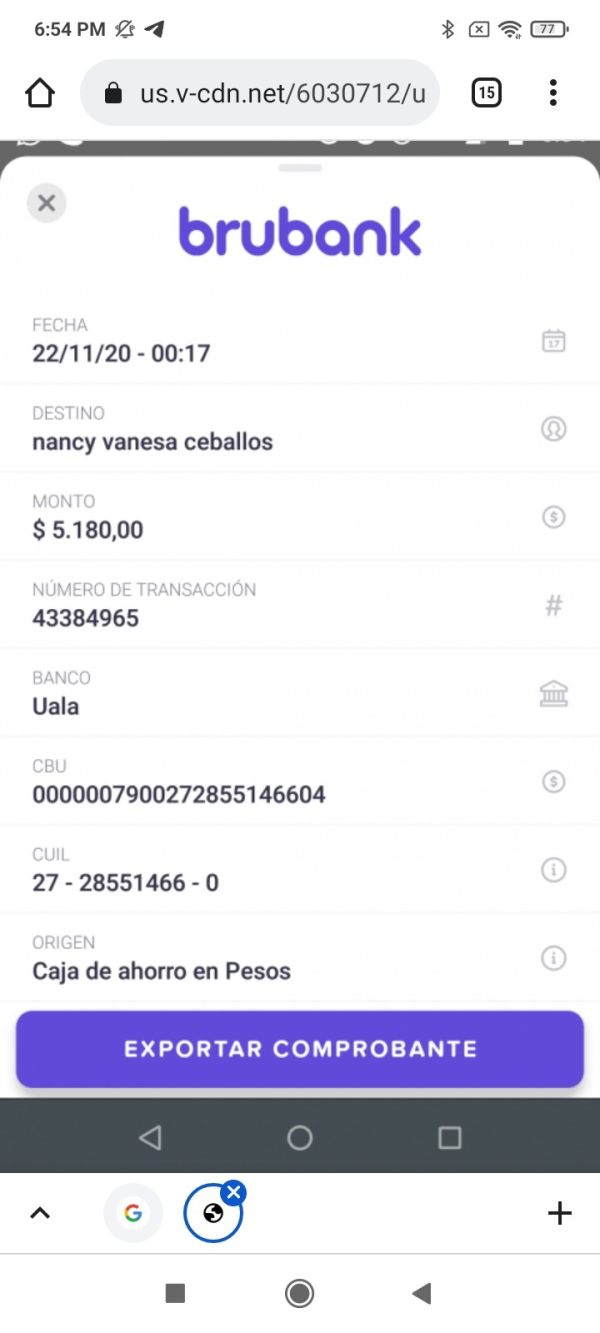

They took 5,180 pesos from me and rejected my withdrawal.

Celox Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

I deposited 363.34 pesos but could not withdraw. Please help.

They took 5,180 pesos from me and rejected my withdrawal.

This comprehensive celox review examines what appears to be a highly problematic offshore broker that has garnered significant negative attention from the trading community. Based on available information and user feedback, Celox presents itself as a multi-service trading and investment platform, yet lacks the fundamental regulatory oversight that legitimate brokers maintain. The broker has been flagged by multiple sources as potentially fraudulent. Users report various issues ranging from withdrawal problems to questionable business practices.

The primary concern surrounding Celox centers on its complete absence of credible financial regulatory licenses. While the company claims to offer diverse trading and investment services, it operates without proper authorization from recognized financial authorities. User reviews consistently paint a negative picture. Many traders describe their experiences as problematic and warn others to avoid the platform entirely. This broker may initially attract traders seeking high-risk, high-return opportunities. However, the associated risks are extremely elevated and potentially devastating for investors.

Regulatory Status Warning: Celox operates as an offshore broker without proper regulatory oversight, meaning users have limited legal protection and recourse in case of disputes or financial losses. The absence of regulation from credible financial authorities significantly increases the risk of fraud and misconduct.

Review Methodology: This evaluation is based on available user feedback, regulatory warnings, and publicly accessible information about Celox. Due to the broker's lack of transparency and official documentation, some information may be limited or unverifiable. Traders are strongly advised to conduct their own thorough research before considering any engagement with this platform.

| Evaluation Category | Score | Justification |

|---|---|---|

| Account Conditions | 1/10 | No reliable information available about account types, minimum deposits, or terms |

| Tools and Resources | 1/10 | Lack of documented trading tools, educational materials, or analytical resources |

| Customer Service | 1/10 | No evidence of professional customer support infrastructure or service standards |

| Trading Experience | 2/10 | User feedback indicates poor trading conditions and problematic platform performance |

| Trust and Safety | 1/10 | Absence of regulatory oversight combined with numerous negative user reports |

| User Experience | 1/10 | Overwhelmingly negative user feedback characterizing the broker as fraudulent |

Celox presents itself as a trading platform offering various investment and trading services. However, specific details about its establishment date and corporate background remain unclear in available documentation. The company appears to target traders interested in multiple asset classes. It operates without the regulatory framework that legitimate brokers maintain. This lack of proper licensing and oversight represents a fundamental red flag that distinguishes Celox from reputable financial service providers.

The broker's business model claims to encompass diverse trading and investment opportunities, yet the absence of verifiable licensing raises serious questions about its legitimacy. Unlike established brokers that operate under strict regulatory guidelines from authorities such as the FCA, CySEC, or ASIC, Celox functions in a regulatory gray area that leaves traders vulnerable to potential fraud and misconduct. This celox review emphasizes the critical importance of regulatory compliance in the financial services industry. It highlights how Celox's lack of proper authorization creates substantial risks for potential users.

The platform's operational structure appears designed to attract traders seeking alternative investment opportunities. However, the combination of regulatory absence and negative user feedback suggests that these apparent opportunities may be illusory or fraudulent in nature.

Regulatory Jurisdiction: Available information does not specify any legitimate regulatory jurisdiction under which Celox operates, which is a significant warning sign for potential traders.

Deposit and Withdrawal Methods: Specific information about accepted payment methods, processing times, and withdrawal procedures is not clearly documented in available sources.

Minimum Deposit Requirements: The broker's minimum deposit requirements are not specified in accessible documentation. This makes it difficult for traders to assess entry-level costs.

Promotional Offers: Details about bonuses, promotional campaigns, or special offers are not available in the reviewed materials.

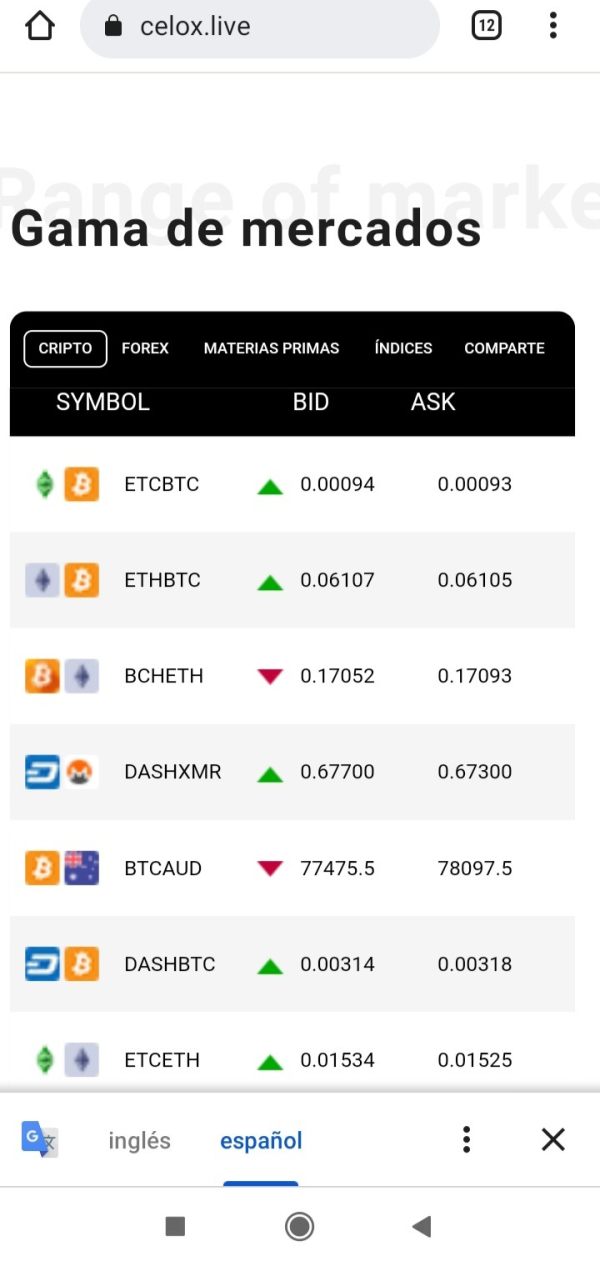

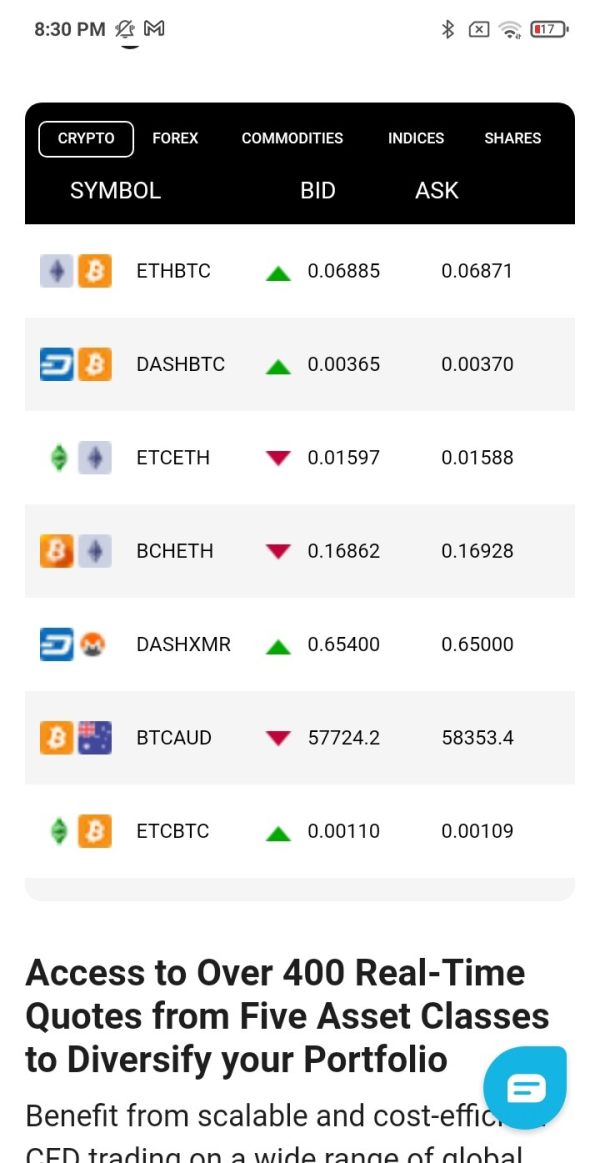

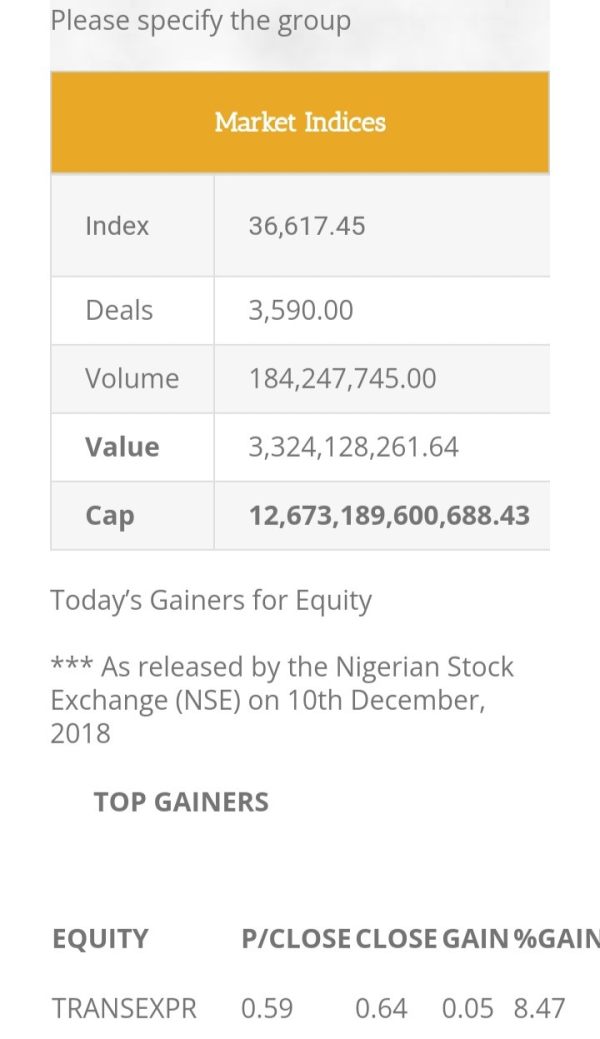

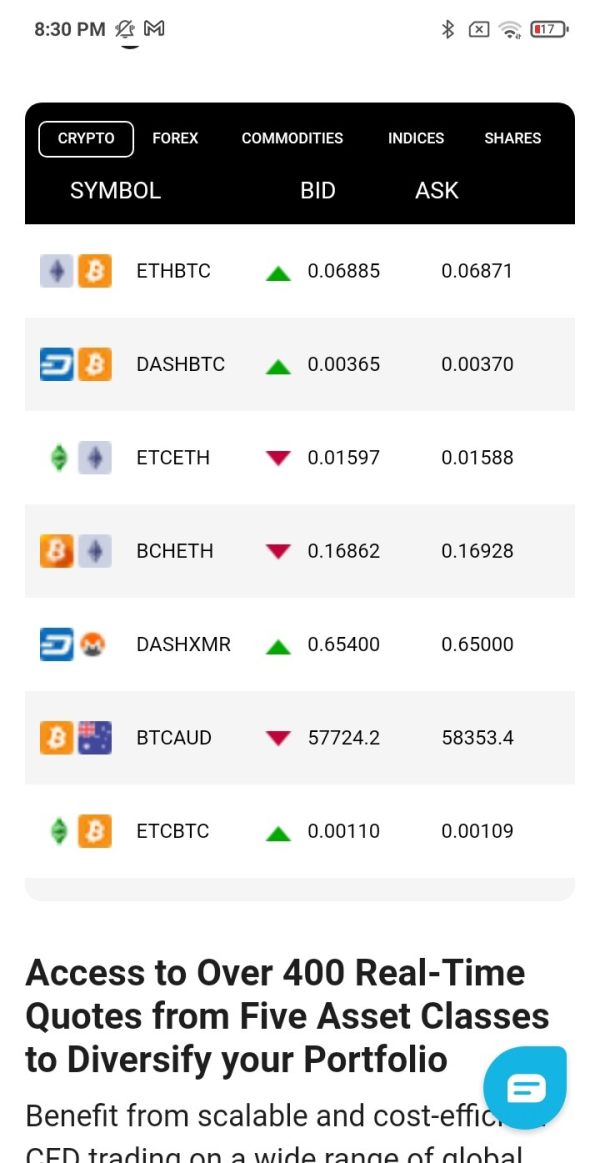

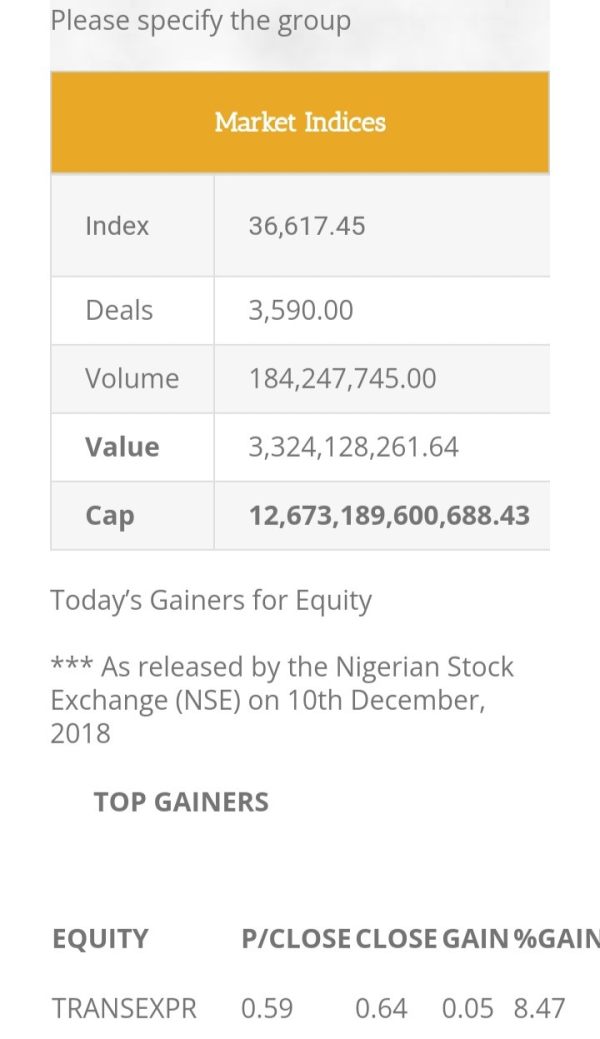

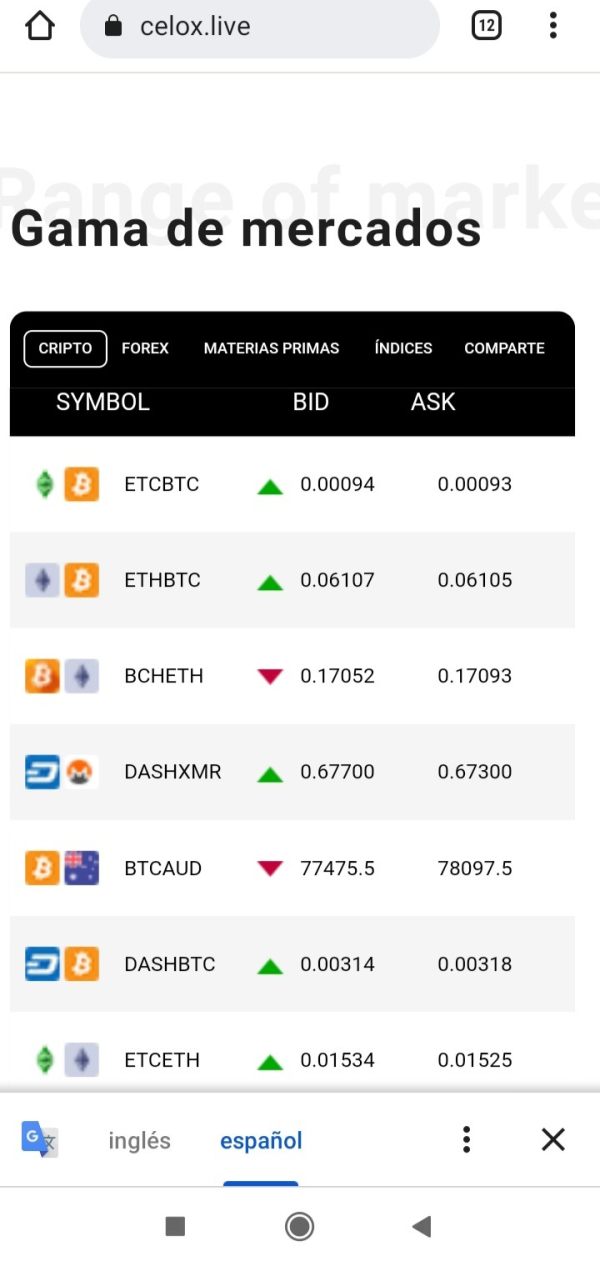

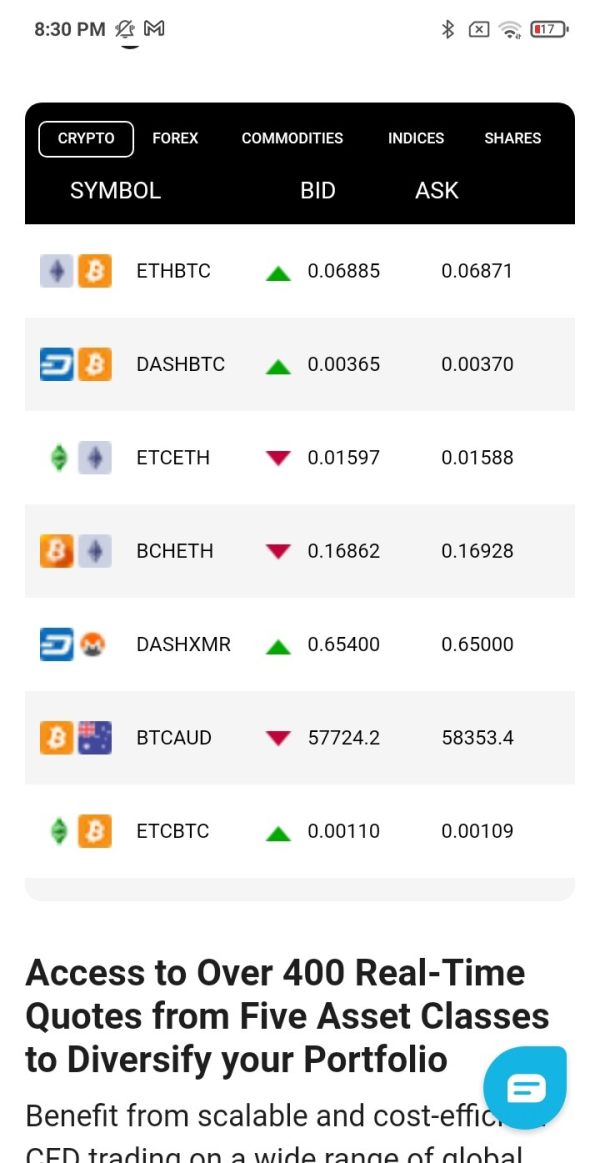

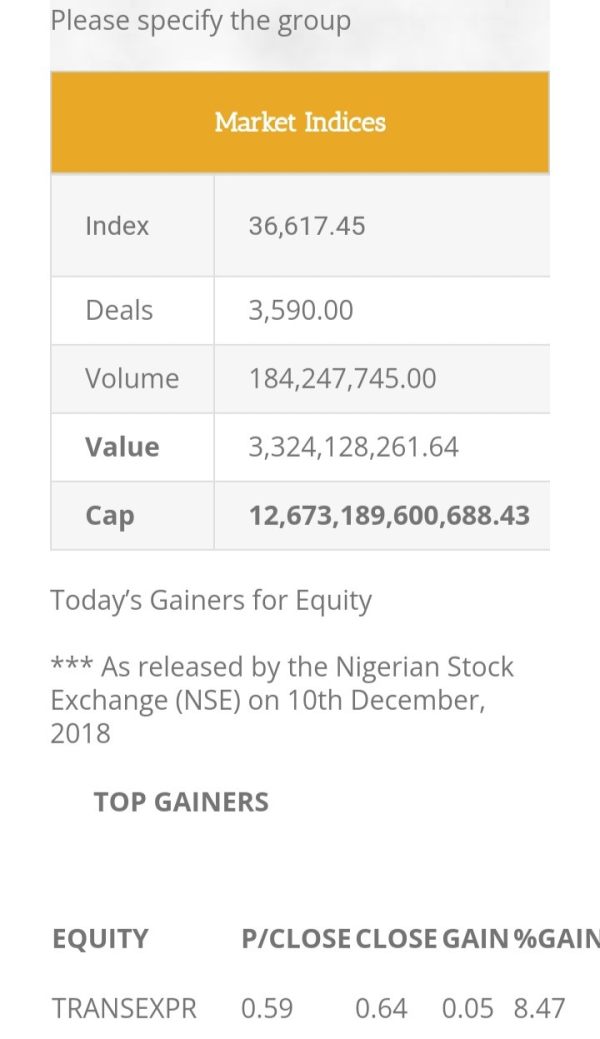

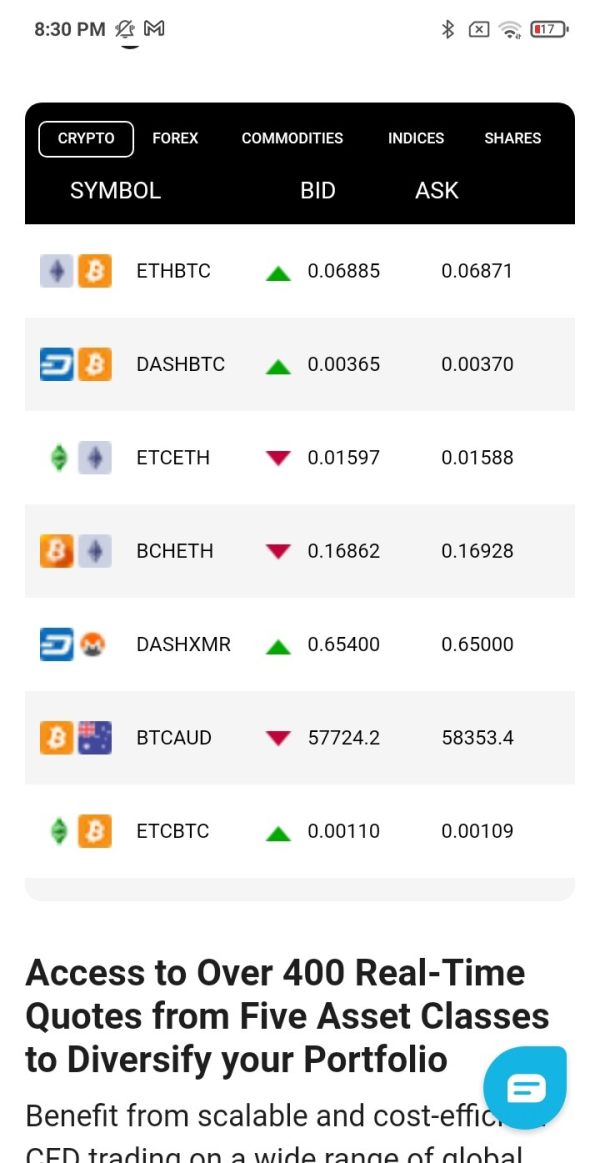

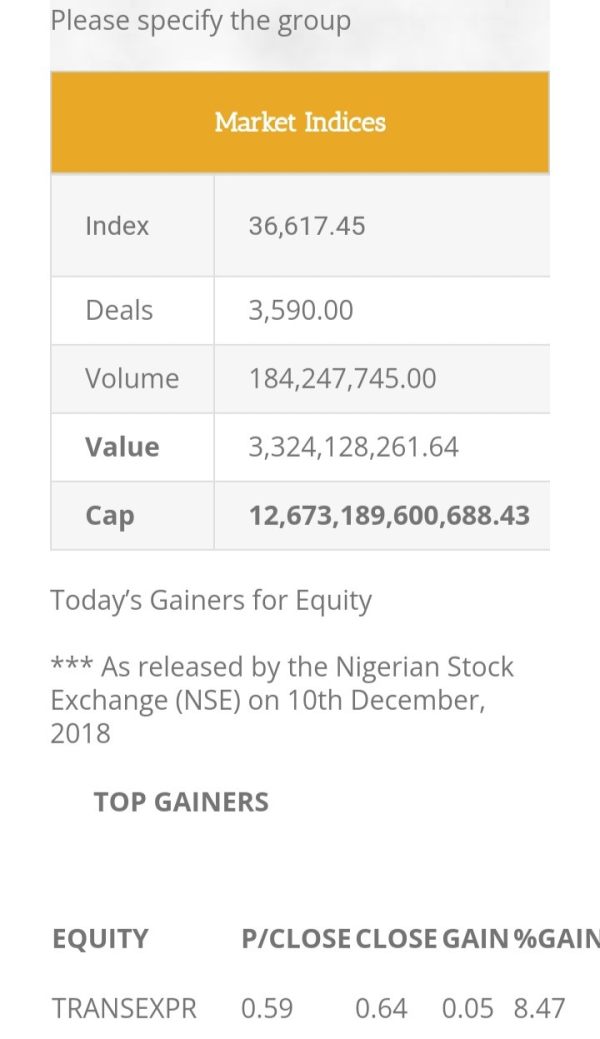

Available Trading Assets: While Celox claims to offer various trading and investment services, specific asset classes, instruments, and markets are not clearly outlined in available documentation.

Fee Structure: Comprehensive information about spreads, commissions, overnight fees, and other trading costs is not readily available. This is concerning for potential traders trying to assess the true cost of trading.

Leverage Options: Specific leverage ratios and margin requirements are not documented in available sources.

Trading Platform Options: The types of trading platforms offered, their features, and compatibility are not clearly specified in accessible materials.

Geographic Restrictions: Information about which countries or regions are restricted from using Celox services is not available.

Customer Support Languages: Details about multilingual support options are not documented in available sources.

This celox review notes that the lack of transparent information about these fundamental aspects of the broker's services represents another significant red flag for potential users.

The evaluation of Celox's account conditions reveals a concerning lack of transparency and available information. Unlike legitimate brokers that provide detailed documentation about their various account types, minimum deposit requirements, and terms of service, Celox offers virtually no accessible information about these fundamental aspects of their service. This absence of basic account information makes it impossible for potential traders to make informed decisions. They cannot determine whether the platform meets their trading needs and financial capabilities.

Reputable brokers typically offer multiple account tiers designed to accommodate different trader profiles, from beginners to professional investors. These accounts usually come with clearly defined features, benefits, and requirements. However, in this celox review, we find no evidence of such structured account offerings or transparent terms. The lack of information about account opening procedures, verification requirements, or special account features like Islamic accounts further emphasizes the broker's lack of professional standards.

The absence of clear account conditions also raises questions about the broker's ability to provide adequate customer protection and service standards. Legitimate brokers maintain detailed terms of service, account agreements, and clear policies regarding account management. Unfortunately, Celox appears to lack this essential infrastructure.

The analysis of trading tools and resources available through Celox reveals a significant void in what traders would expect from a legitimate broker. Professional trading platforms typically provide comprehensive suites of analytical tools, charting capabilities, technical indicators, and research resources to help traders make informed decisions. However, available information about Celox provides no evidence of such professional-grade tools or resources.

Educational resources represent another critical component that legitimate brokers offer to support trader development and success. These typically include webinars, tutorials, market analysis, economic calendars, and educational materials covering various aspects of trading. The absence of documented educational offerings from Celox suggests either a lack of commitment to trader education or a fundamental absence of such resources entirely.

Automated trading support, including Expert Advisors, algorithmic trading capabilities, and API access, has become standard among reputable brokers. However, there is no available information suggesting that Celox provides these advanced trading functionalities. This lack of technological sophistication further distinguishes the platform from legitimate, well-established brokers. These brokers invest heavily in providing comprehensive trading environments for their clients.

Customer service quality represents a fundamental differentiator between legitimate brokers and questionable operations. Celox's customer support infrastructure appears to be significantly lacking based on available information. Professional brokers typically maintain multiple communication channels including live chat, telephone support, email assistance, and comprehensive FAQ sections. However, there is limited evidence of such professional customer support infrastructure at Celox.

Response time and service quality are critical factors that determine trader satisfaction and problem resolution effectiveness. Legitimate brokers usually provide 24/5 or 24/7 support with guaranteed response times and professional service standards. The absence of documented customer service standards or contact information for Celox raises serious concerns. These concerns relate to the broker's ability to address trader inquiries, technical issues, or account-related problems.

Multilingual support has become increasingly important in the global forex market. Reputable brokers offer assistance in multiple languages to serve their international client base. However, available information does not indicate whether Celox provides multilingual support or operates primarily in specific languages. The lack of clear customer service information contributes to the overall pattern of transparency issues that characterize this broker.

User feedback regarding the trading experience with Celox paints a distinctly negative picture that aligns with concerns about the broker's legitimacy and operational standards. Unlike reputable brokers that maintain stable, fast-executing platforms with transparent pricing, user reports suggest that Celox provides a substandard trading environment. This environment may be deliberately designed to disadvantage traders.

Platform stability and execution speed are fundamental requirements for successful trading, particularly in volatile markets where timing is critical. However, available user feedback indicates that Celox's platform performance falls well below industry standards. Traders have reported various technical issues and execution problems. These problems significantly impact their ability to trade effectively and profitably.

The trading environment encompasses factors such as spread competitiveness, order execution quality, slippage rates, and overall platform reliability. Based on this celox review and user feedback analysis, these fundamental aspects of the trading experience appear to be problematic at Celox. Mobile trading capabilities, which have become essential for modern traders, also lack documentation or positive user feedback regarding their functionality and reliability.

The trust and safety evaluation of Celox reveals the most concerning aspects of this broker, particularly regarding regulatory compliance and fund security. The complete absence of legitimate financial regulatory oversight represents the primary red flag that distinguishes Celox from reputable brokers. Established financial authorities such as the FCA, CySEC, ASIC, and other recognized regulators provide essential investor protections, dispute resolution mechanisms, and operational oversight. These protections are entirely absent in Celox's case.

Fund security measures, including segregated client accounts, deposit insurance, and transparent fund handling procedures, are standard requirements imposed by financial regulators. However, Celox's unregulated status means that such protections are likely non-existent. This leaves trader funds vulnerable to misappropriation or loss. The broker's corporate transparency is also questionable, with limited verifiable information about company ownership, management, or operational structure.

Industry reputation analysis reveals predominantly negative feedback and warnings from users and industry observers. The characterization of Celox as a potentially fraudulent operation by multiple sources significantly undermines any claims of legitimacy the broker might make. This pattern of negative feedback and regulatory warnings creates a compelling case against trusting this platform with trading funds.

The overall user experience with Celox, based on available feedback and reports, is overwhelmingly negative and consistent with patterns typically associated with fraudulent brokers. User satisfaction levels appear to be extremely low. Traders report various problems ranging from technical issues to more serious concerns about fund security and withdrawal processing.

The user interface and platform usability, while not extensively documented, appear to lack the professional polish and functionality that traders expect from legitimate brokers. Registration and account verification processes may exist, but the lack of transparent procedures and clear documentation suggests that these processes may not meet professional standards. They may also be designed to create barriers for users seeking to withdraw funds.

The most significant user complaints center around the fundamental trustworthiness of the platform and its operators. Reports consistently describe experiences that suggest fraudulent intent, including withdrawal difficulties, manipulated trading conditions, and poor customer service responses. This celox review emphasizes that such patterns of user complaints represent serious warning signs. Potential traders should carefully consider these warnings.

The user demographic that might initially be attracted to Celox likely consists of traders seeking high-risk, high-return opportunities. It may also include those who may not be fully aware of the importance of regulatory oversight in broker selection. However, the extreme risks associated with unregulated brokers make Celox unsuitable for any responsible trading strategy.

This comprehensive review of Celox reveals a broker that exhibits numerous characteristics associated with fraudulent operations in the financial services industry. The complete absence of legitimate regulatory oversight, combined with overwhelmingly negative user feedback and lack of transparency in operations, creates a compelling case against using this platform for trading activities. Unlike reputable brokers that maintain strict compliance with financial regulations and provide transparent, professional services, Celox operates in a manner that puts trader funds and interests at extreme risk.

The evaluation across all key dimensions - from account conditions to user experience - consistently reveals deficiencies that are incompatible with legitimate broker operations. The lack of documented trading tools, unclear fee structures, absent customer service standards, and poor trading experience reports all contribute to a picture of a platform that should be avoided by responsible traders. Most critically, the absence of regulatory protection means that traders have virtually no recourse in case of problems or disputes.

Based on this analysis, Celox cannot be recommended to any category of trader, regardless of experience level or risk tolerance. The potential for financial loss and fraud far outweighs any claimed benefits or opportunities the platform might advertise.

FX Broker Capital Trading Markets Review