CFD Trader Review 1

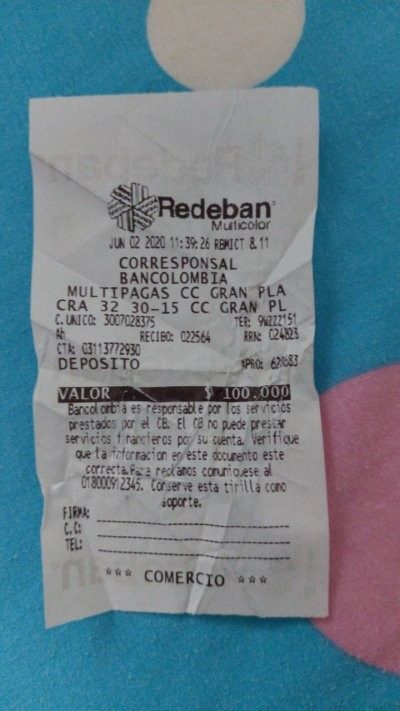

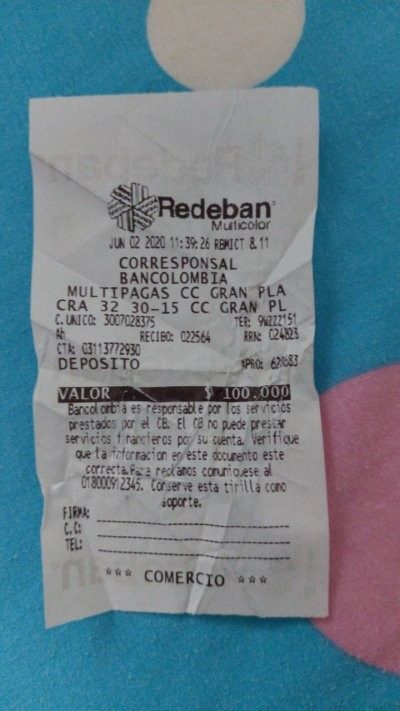

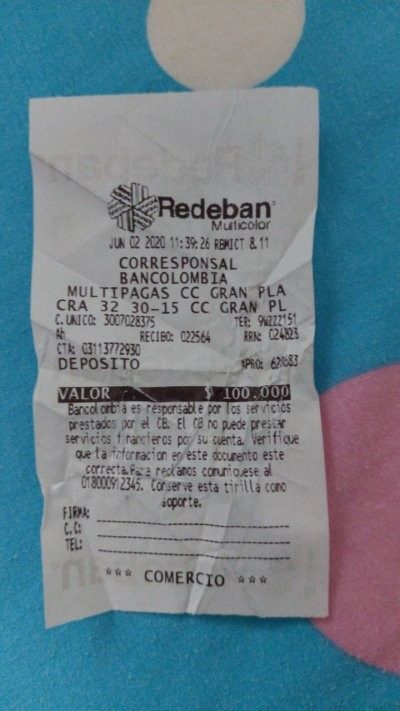

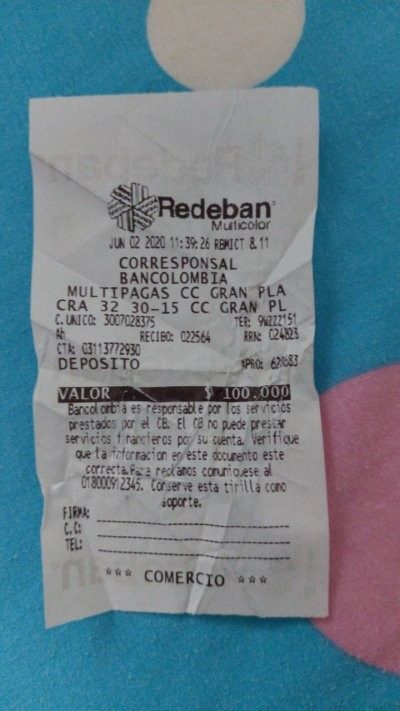

They pretended to be a broker but they stole $100 from me.

CFD Trader Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

They pretended to be a broker but they stole $100 from me.

CFD Trader is a trading platform with potential high profits. Users should be careful when checking its safety because it lacks regulatory information. The platform's main highlights include its user-friendly interface and different trading asset types, covering forex, stocks, cryptocurrencies, and other financial instruments. The main users are investors who want high-risk, high-reward trading opportunities.

CFD Trader uses a complete algorithm that looks at over fifty aspects when searching for new transactions. User reviews show attention to its profit potential, while also expressing concerns about safety aspects. This cfd trader review aims to provide a thorough analysis of the platform's features, capabilities, and potential risks for traders considering this service in 2025.

The platform targets traders worldwide, offering access to multiple asset classes through its own trading system. However, the absence of clear regulatory oversight creates uncertainty about user protection and fund security, making thorough research essential before use.

Users may face different legal and compliance risks in various regions due to the absence of regulatory information. The review method is based on user feedback and market observations, without conducting on-site investigations. Traders should check all information independently and talk with financial advisors before making investment decisions. The lack of specific regulatory details in available information sources means potential users must be extra careful when considering this platform.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Information not mentioned in available sources |

| Tools and Resources | 8/10 | CFD Trader platform uses comprehensive algorithm analysis, provides multiple asset class trading |

| Customer Service and Support | N/A | Information not mentioned in available sources |

| Trading Experience | 7/10 | User-friendly interface, but trading conditions require evaluation |

| Trust and Reliability | 5/10 | Lack of regulatory information, users express safety concerns |

| User Experience | 8/10 | User-friendly interface, but comprehensive evaluation needed |

CFD Trader has gained attention in the forex market mainly due to its high profit claims and user-friendly interface. The platform positions itself as a complete trading solution, offering access to various financial markets through its own algorithm-based system. While the establishment year is not mentioned in available sources, the platform appears to focus on providing traders with advanced analytical tools for market participation.

The company's business model centers on providing CFD trading services across multiple asset categories including forex, stocks, indices, cryptocurrencies, and commodities. This varied approach aims to serve traders with different risk appetites and market preferences. The platform emphasizes its technology capabilities, particularly its complete algorithm that analyzes many market factors to find trading opportunities.

CFD Trader's trading platform uses a sophisticated algorithm system for trading analysis, setting it apart from regular trading platforms. The system reportedly analyzes over fifty different aspects when searching for new transactions, suggesting a data-driven approach to market analysis. The platform supports trading in forex, stocks, indices, cryptocurrencies, and commodities, providing users with a complete range of investment options. However, specific information about regulatory oversight remains unavailable in current sources, which represents a significant consideration for potential users evaluating the platform's credibility and safety measures.

Regulatory Regions: Specific regulatory regions are not mentioned in available information sources, creating uncertainty about the platform's compliance status across different jurisdictions.

Deposit and Withdrawal Methods: Available information sources do not provide details about supported deposit and withdrawal methods, leaving users without clear guidance on funding options.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in current information sources, making it difficult for potential users to plan their initial investment.

Bonus and Promotions: Information about bonus offers and promotional programs is not available in current sources, suggesting either absence of such programs or lack of disclosure.

Tradeable Assets: The platform offers access to forex, stocks, indices, cryptocurrencies, and commodities, providing a complete range of trading instruments for diverse investment strategies.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not mentioned in available sources, which is crucial information for traders evaluating platform economics.

Leverage Ratios: Specific leverage ratios offered by the platform are not mentioned in current information sources, leaving traders without clarity on risk management parameters.

Platform Options: CFD Trader operates through its own platform that uses complete algorithms for trading analysis and market evaluation.

Regional Restrictions: Information about geographical limitations or restricted regions is not mentioned in available sources.

Customer Support Languages: Available customer service languages are not specified in current information sources.

This cfd trader review highlights significant information gaps that potential users should consider when evaluating the platform's suitability for their trading needs.

The evaluation of CFD Trader's account conditions faces significant limitations due to insufficient information in available sources. Account type varieties and their specific characteristics are not detailed in current materials, making it challenging for potential users to understand what options might be available. The absence of minimum deposit requirement information prevents traders from assessing the platform's accessibility and planning their initial investment accordingly.

Account opening procedures and requirements remain unclear based on available information sources. This lack of transparency regarding the onboarding process creates uncertainty for potential users who need to understand verification requirements, documentation needs, and approval timelines. Special account features, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, are not mentioned in current sources.

The absence of detailed account condition information represents a significant gap in this cfd trader review. Without clear information about account tiers, benefits, or specific features associated with different account types, traders cannot make informed decisions about whether the platform meets their specific needs. This information deficit suggests potential users should seek direct clarification from the platform before proceeding with account registration.

CFD Trader's technology infrastructure centers around its complete algorithm that analyzes over fifty aspects when searching for new transactions. This algorithmic approach suggests a data-driven method for market analysis, potentially providing users with sophisticated trading insights. The platform's emphasis on complete analysis indicates an attempt to offer professional-grade analytical capabilities to its user base.

However, specific details about research and analysis resources beyond the algorithmic system are not mentioned in available information sources. Educational resources, which are crucial for trader development and platform adoption, are not detailed in current materials. The absence of information about educational content, webinars, market analysis reports, or trading guides represents a significant gap in understanding the platform's commitment to user education and development.

Automated trading support capabilities remain unclear based on available information. While the platform uses algorithms for analysis, whether users can implement automated trading strategies or access expert advisors is not specified. The lack of detailed information about trading tools, charting capabilities, technical indicators, and other analytical resources makes it difficult to assess the platform's suitability for different trading styles and experience levels.

Customer service and support evaluation for CFD Trader faces substantial limitations due to the absence of relevant information in available sources. Customer service channels, availability, and accessibility are not detailed in current materials, leaving potential users without understanding of how they might receive assistance when needed. The lack of information about support ticket systems, live chat availability, phone support, or email response protocols creates uncertainty about platform accessibility.

Response time expectations and service quality standards are not mentioned in available information sources. This absence of performance metrics makes it impossible to assess whether the platform maintains professional support standards or meets user expectations for timely assistance. The evaluation of multilingual support capabilities is similarly limited, as available sources do not specify supported languages or regional support availability.

Customer service hours and availability across different time zones are not detailed in current sources. For a trading platform that potentially serves international users across multiple markets, the absence of clear support availability information represents a significant service gap. Without user feedback about customer service experiences or problem resolution case studies, this aspect of the platform remains largely unverified.

The trading experience evaluation reveals both strengths and limitations in available information about CFD Trader. The platform is characterized as having a user-friendly interface, suggesting attention to user experience design and accessibility. However, this positive aspect requires further evaluation of trading conditions to provide a complete picture of the platform's trading environment.

Platform stability and execution speed metrics are not detailed in available information sources. For active traders, these technical performance factors are crucial for successful trading outcomes. The absence of specific data about order execution quality, slippage rates, or platform uptime creates uncertainty about the platform's reliability during critical trading moments.

Mobile trading experience and platform functionality completeness are not addressed in current sources. Given the importance of mobile trading in modern financial markets, the lack of information about mobile app availability, features, and performance represents a significant evaluation gap. This cfd trader review cannot provide definitive conclusions about mobile trading capabilities based on available information.

Trust and reliability assessment for CFD Trader reveals significant concerns due to the absence of regulatory information in available sources. Regulatory qualifications, which form the foundation of trader protection and platform credibility, are not mentioned in current materials. This regulatory gap creates substantial uncertainty about user fund safety, dispute resolution mechanisms, and compliance with financial service standards.

Fund security measures and client protection protocols are not detailed in available information sources. Without clear information about segregated accounts, insurance coverage, or regulatory oversight, users cannot adequately assess the safety of their investments. The absence of transparency regarding company registration, licensing, and regulatory compliance represents a major concern for potential platform users.

User feedback indicates concerns about safety aspects, suggesting that the trading community has identified potential risks associated with the platform. The lack of third-party verification, regulatory body endorsements, or independent audits further compounds trust concerns. Industry reputation and track record information are not available in current sources, making it difficult to assess the platform's standing within the broader financial services community.

User experience evaluation for CFD Trader shows mixed indicators based on available information. The platform is noted for having a user-friendly interface, suggesting positive attention to design and accessibility. This characteristic indicates potential strengths in user engagement and platform adoption, particularly for traders who prioritize ease of use in their trading environment.

However, complete user experience assessment faces limitations due to insufficient detail about interface design specifics, navigation efficiency, and overall usability features. Registration and verification processes are not described in available sources, preventing evaluation of onboarding experience and user journey optimization. Fund operation experiences, including deposit and withdrawal processes, remain unclear based on current information.

The platform appears suitable for high-risk, high-reward traders based on available user profiling information. This targeting suggests the platform may cater to experienced traders comfortable with aggressive trading strategies. However, without detailed user feedback summaries or complete satisfaction surveys, the overall user experience assessment remains limited. Potential improvement areas and user-suggested enhancements are not documented in available sources.

CFD Trader presents itself as a trading platform with potential for high profits, using sophisticated algorithmic analysis across multiple asset classes. The platform's user-friendly interface and diverse trading options, including forex, stocks, indices, cryptocurrencies, and commodities, may appeal to traders seeking complete market access. The algorithmic approach to market analysis, examining over fifty different aspects for trading opportunities, suggests technology sophistication in trade identification.

However, significant concerns arise from the absence of regulatory information and transparency gaps in crucial operational details. The lack of clear regulatory oversight, combined with user safety concerns, creates substantial risk considerations for potential users. Essential information about account conditions, costs, customer support, and fund security remains unavailable, limiting informed decision-making capabilities.

The platform appears most suitable for experienced, high-risk tolerance traders who prioritize potential returns over regulatory security. However, the information deficits highlighted in this review suggest that prospective users should conduct extensive research and seek direct clarification from the platform before committing funds.

FX Broker Capital Trading Markets Review