Regarding the legitimacy of YaMarkets forex brokers, it provides FSCA, FSC and WikiBit, (also has a graphic survey regarding security).

Is YaMarkets safe?

Pros

Cons

Is YaMarkets markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

YAMARKETS (PTY) LTD

Effective Date:

2020-12-11Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

129 PATRICIA ROADSANDOWNSANDTON2196Phone Number of Licensed Institution:

545 407280Licensed Institution Certified Documents:

FSC Securities Trading License (EP)

The Financial Services Commission

The Financial Services Commission

Current Status:

RegulatedLicense Type:

Securities Trading License (EP)

Licensed Entity:

YA GROUP LTD

Effective Date: Change Record

2019-06-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

40 Silicon Avenue c/o Legacy Capital Co Ltd, Level 2, Suite 201, The Catalyst, Cybercity, Ebene, MauritiusPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is YaMarkets A Scam?

Introduction

YaMarkets is an online forex and CFD broker that has been making a name for itself since its inception in 2016. With its headquarters located in Saint Vincent and the Grenadines, the broker claims to offer a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies. As the forex market continues to grow, traders are increasingly cautious about selecting brokers, given the prevalence of scams and unregulated entities. This article aims to provide a comprehensive analysis of YaMarkets to determine whether it is a trustworthy broker or a potential scam. The evaluation will be based on a variety of factors, including regulatory status, company background, trading conditions, customer experiences, and risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its legitimacy. YaMarkets is regulated by the Vanuatu Financial Services Commission (VFSC) and the Mwali International Services Authority (MISA). While these regulators provide a degree of oversight, they are not considered top-tier regulators like the UKs Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC).

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| VFSC | 14819 | Vanuatu | Yes |

| MISA | T2022091 | Comoros | Yes |

The quality of regulation is paramount; it ensures that brokers adhere to strict operational standards and provides a safety net for traders. Unfortunately, the VFSC and MISA are often criticized for their loose regulations, which can lead to potential risks for traders. Reports indicate that YaMarkets has faced scrutiny regarding its compliance with these regulations, raising concerns about its operational integrity.

Company Background Investigation

YaMarkets was founded in 2016 and operates under the ownership of YaMarkets Limited. The company has positioned itself as a global broker, targeting primarily the Southeast Asian market. However, its lack of substantial regulatory oversight raises questions about its credibility. The management teams background is not extensively detailed in available resources, which could indicate a lack of transparency in the company's operations.

The company's headquarters in Saint Vincent and the Grenadines, a well-known offshore jurisdiction, allows it to operate with lower costs but also less regulatory scrutiny. This offshore status can be a red flag for potential investors, as it often signifies less accountability and protection for client funds.

Trading Conditions Analysis

YaMarkets offers a variety of trading accounts with different conditions, including the Ultimate, Standard, Royale, and ECN accounts. The minimum deposit to start trading is as low as $10, making it accessible for beginner traders. However, the overall fee structure has raised eyebrows among traders.

| Fee Type | YaMarkets | Industry Average |

|---|---|---|

| Spread for Major Pairs | 1.8 pips (Ultimate) | 1.0 - 1.5 pips |

| Commission Model | None (Standard) | Varies |

| Overnight Interest Range | Competitive | Varies |

While the low minimum deposit is attractive, the spreads, particularly on the Ultimate account, are notably higher than the industry average. Furthermore, the ECN account, which offers lower spreads, requires a significantly higher minimum deposit of $5,000. This tiered fee structure may not be favorable for all traders, especially those who are cost-conscious.

Customer Funds Security

The security of customer funds is a crucial consideration for any trader. YaMarkets claims to implement several security measures, including segregated accounts, which should theoretically protect client funds in the event of financial difficulties. However, the effectiveness of these measures remains questionable given the broker's offshore regulatory status.

The broker also offers negative balance protection, ensuring that clients cannot lose more than their deposited amounts. This is a positive aspect, especially for novice traders. However, the absence of a robust investor protection scheme, such as those provided by top-tier regulators, raises concerns about the safety of funds.

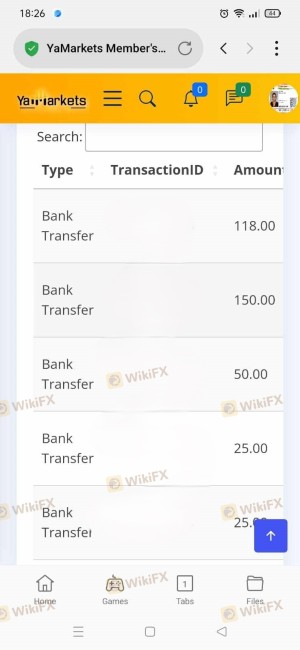

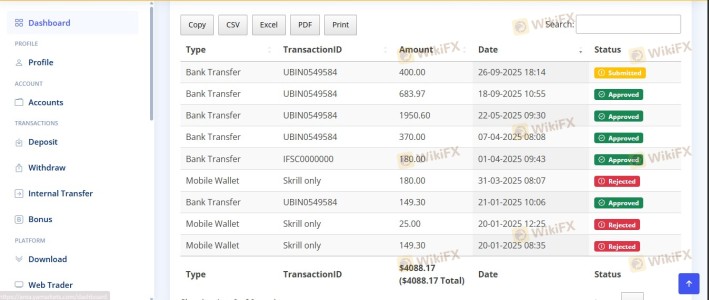

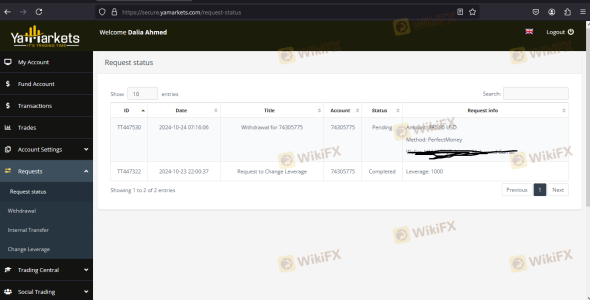

Customer Experience and Complaints

Customer feedback regarding YaMarkets has been mixed, with numerous reviews highlighting both positive and negative experiences. Many users appreciate the broker's low minimum deposit and the availability of a demo account. However, there are significant complaints regarding withdrawal issues and high spreads.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow, often no response |

| High Spreads | Medium | Limited explanation provided |

For instance, one user reported difficulties in withdrawing funds, claiming that their account was blocked without explanation. Such experiences contribute to the perception that YaMarkets may not be a reliable broker.

Platform and Trade Execution

YaMarkets offers the widely used MetaTrader 4 and MetaTrader 5 platforms, known for their user-friendly interfaces and comprehensive trading tools. However, issues have been reported regarding order execution quality, including slippage and rejections.

The broker's execution speed is generally considered satisfactory, but the prevalence of slippage during volatile market conditions may deter some traders. Additionally, there are concerns about potential platform manipulation, which can undermine trader confidence.

Risk Assessment

Engaging with YaMarkets comes with inherent risks, primarily due to its offshore regulation and mixed customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight |

| Withdrawal Risk | Medium | Reports of withdrawal issues and account blocking |

| Trading Cost Risk | Medium | Higher than average spreads for certain accounts |

Traders should exercise caution when considering this broker. It is advisable to start with a demo account to gauge the platform's functionality and reliability before committing real funds.

Conclusion and Recommendations

In conclusion, while YaMarkets presents itself as a viable option for traders, several red flags warrant caution. The broker's offshore regulatory status, combined with mixed customer reviews and concerns about withdrawal issues, raises doubts about its reliability.

For traders seeking a trustworthy broker, it may be prudent to consider alternatives that are regulated by top-tier authorities, such as FCA or ASIC. Brokers like IG, OANDA, and Forex.com offer robust regulatory frameworks and a proven track record, making them safer choices for forex trading.

Is YaMarkets a scam, or is it legit?

The latest exposure and evaluation content of YaMarkets brokers.

YaMarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

YaMarkets latest industry rating score is 5.86, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.86 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.