YaMarkets 2025 Review: Everything You Need to Know

Executive Summary

This complete yamarkets review looks at a forex and CFD trading broker that has gotten mixed feedback from traders. YaMarkets started in 2016 and registered in Mauritius. The company calls itself a multi-asset trading platform that gives access to forex, commodities, indices, and cryptocurrencies through MT4 and MT5 platforms.

YaMarkets won the Best Fintech and Solutions Broker award in 2023. However, the broker faces big credibility problems. Many user reports show unpaid commission issues. Some traders claim they lost about $5,000 in unpaid introducing broker (IB) commissions. The broker's owner, Lalit Matta, has been named in several complaints. This raises serious concerns about the company's trustworthiness.

YaMarkets targets traders who want diversified asset exposure and familiar trading platforms. But the growing evidence of payment issues and negative user experiences suggests potential traders should be very careful. The broker offers standard trading tools and multiple asset classes. However, the basic trust issues overshadow these features, making it hard to recommend for serious trading activities.

Important Notice

YaMarkets works across different jurisdictions. Regulatory clarity stays limited. The broker's registration in Mauritius does not guarantee complete regulatory oversight that traders might expect from more established financial centers.

Users must understand their local legal framework and the limited recourse available when dealing with offshore brokers. This evaluation is based on available user feedback, industry reports, and official website information. The assessment aims to provide objective analysis while highlighting significant concerns raised by the trading community.

Given the serious allegations about unpaid commissions, potential users should do thorough research before engaging with this broker.

Rating Framework

Broker Overview

YaMarkets started in the competitive forex brokerage landscape in 2016. The company set up its headquarters in Vanuatu while keeping registration in Mauritius. YaMarkets positions itself as a complete trading solutions provider. The company focuses on delivering multi-asset trading capabilities to retail and institutional clients.

According to Forex Daily Info, YaMarkets dedicates itself to providing educational resources alongside practical trading platform access. The broker supports various instruments including forex, indices, commodities, and cryptocurrencies. YaMarkets' business model centers on providing familiar trading environments through industry-standard platforms. The company tries to stand out through customer service and educational support.

However, recent developments have cast shadows over these goals. Mounting user complaints suggest significant operational challenges. YaMarkets offers MT4 and MT5 trading platforms, catering to different trader preferences and experience levels.

The platform selection shows understanding of market demands, as these platforms remain industry standards for forex and CFD trading. The broker's asset coverage includes major forex pairs, popular commodities, global indices, and emerging cryptocurrency markets. This positions the company to serve traders seeking portfolio diversification across multiple asset classes.

Regulatory Status: YaMarkets keeps registration in Mauritius. However, specific regulatory authority oversight details remain unclear from available information. This regulatory uncertainty presents potential concerns for traders seeking complete protection.

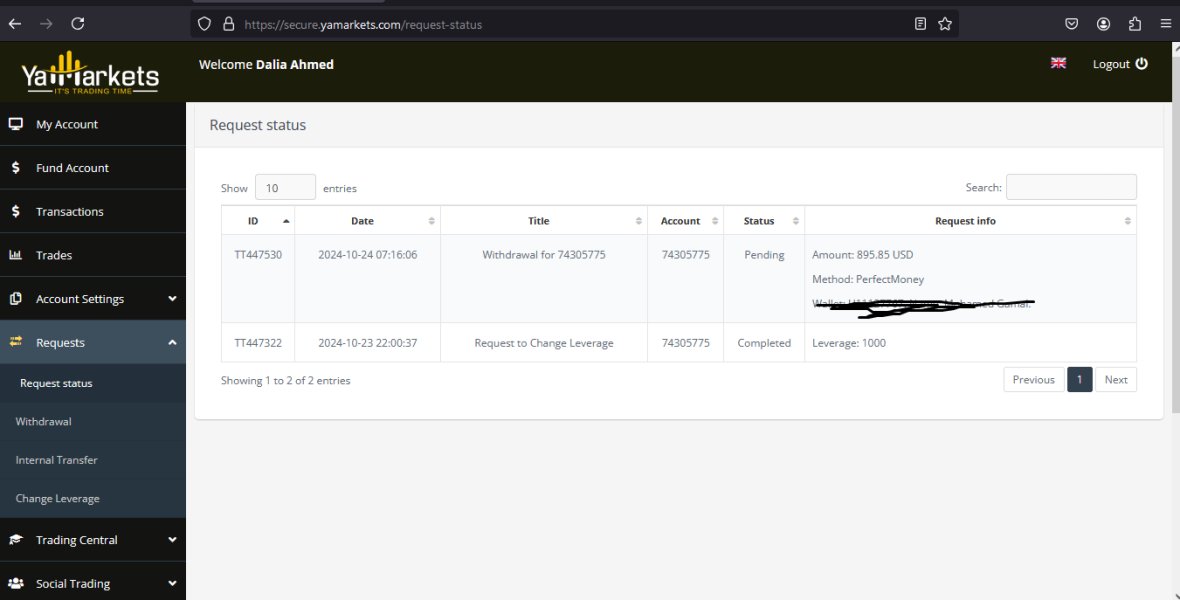

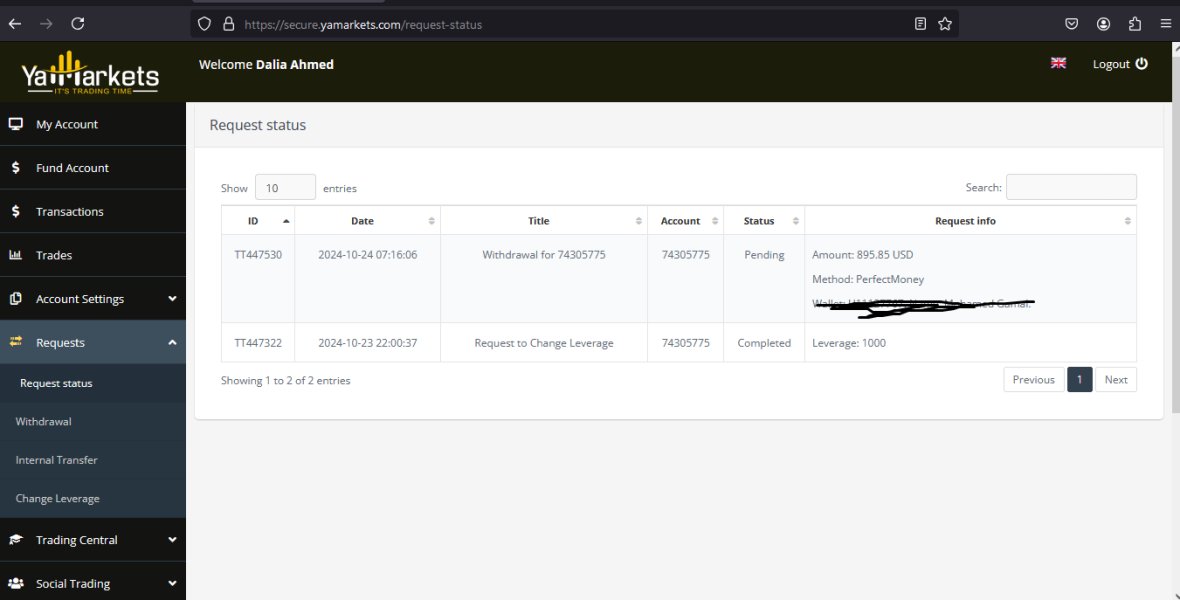

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available sources. This represents a significant information gap for potential users. Minimum Deposit Requirements: Available materials do not specify minimum deposit amounts.

This makes it difficult for traders to assess accessibility. Bonus and Promotions: Current promotional offerings and bonus structures are not detailed in accessible information sources. Tradeable Assets: The broker provides access to forex currency pairs, commodities, global indices, and cryptocurrency instruments.

This offers reasonable diversification opportunities for multi-asset traders. Cost Structure: Detailed information about spreads, commissions, and fee structures is not fully available in reviewed sources. This hinders cost comparison analysis.

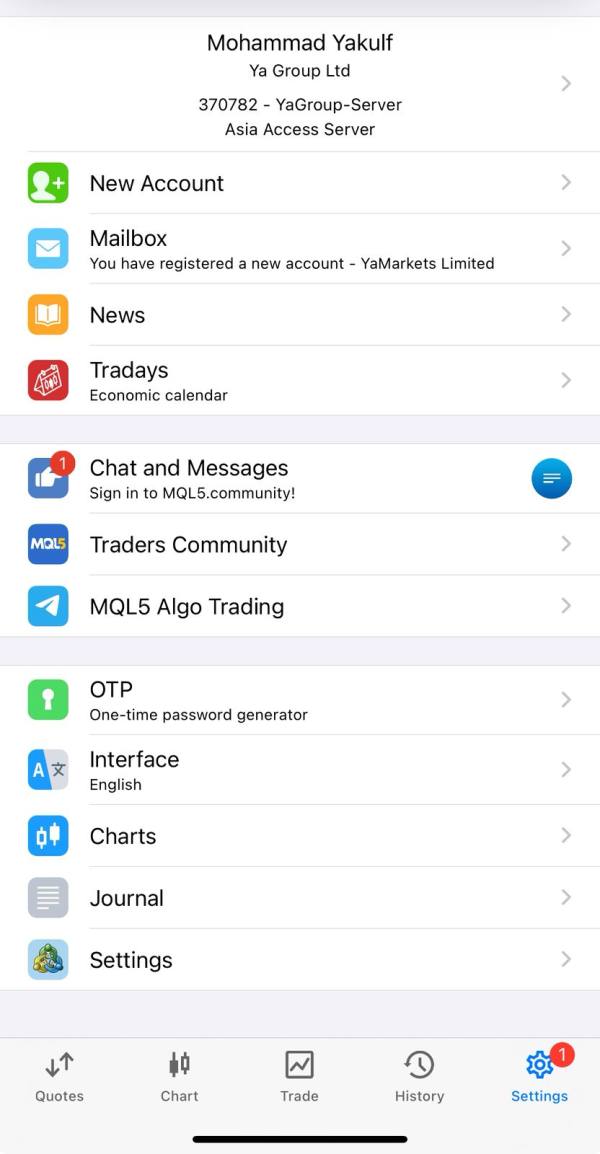

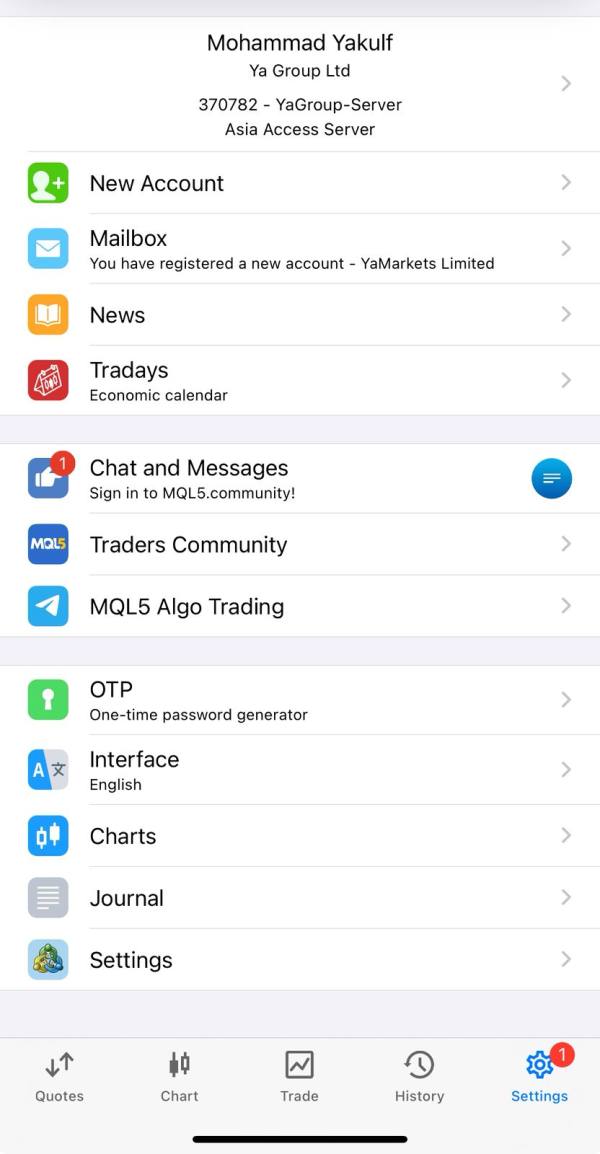

Leverage Ratios: Specific leverage offerings are not detailed in available information. This represents another crucial data gap. Platform Options: YaMarkets provides MT4 and MT5 trading platforms.

This meets industry standard expectations for platform reliability and functionality. Geographic Restrictions: Specific regional limitations are not detailed in available sources. Customer Support Languages: Available customer service language options are not specified in reviewed materials.

This yamarkets review reveals concerning information gaps that potential users should consider when evaluating the broker's transparency and operational clarity.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

YaMarkets' account conditions present a mixed picture with limited publicly available information creating uncertainty for potential traders. The broker appears to offer standard account structures. However, specific details about account types, their distinguishing features, and associated benefits remain unclear from available sources.

This lack of transparency immediately raises concerns about the broker's commitment to clear communication with potential clients. The absence of clearly stated minimum deposit requirements makes it difficult for traders to assess whether YaMarkets targets retail or institutional clients, or both. Most reputable brokers provide detailed account specifications, including deposit thresholds, to help traders make informed decisions.

The information gap suggests either poor marketing communication or deliberate opacity. Neither of these inspires confidence. Account opening procedures are not well-documented in available sources.

This leaves potential users uncertain about verification requirements, documentation needs, and time frames for account activation. The uncertainty becomes particularly problematic given the trust issues surrounding the broker. Additionally, there's no mention of specialized account features such as Islamic accounts for Muslim traders.

This indicates limited accommodation for diverse client needs. The scoring reflects these transparency issues combined with the lack of competitive differentiation in account offerings. While the broker may provide adequate basic account functionality, the absence of clear, detailed information about account conditions significantly impacts the user experience and decision-making process.

YaMarkets shows reasonable capability in platform provision by offering both MT4 and MT5 trading platforms. These represent industry standards for forex and CFD trading. These platforms provide complete charting capabilities, technical analysis tools, and automated trading support through Expert Advisors (EAs).

The dual platform offering suggests understanding of different trader preferences, with MT4 appealing to traditional forex traders and MT5 offering enhanced features for multi-asset trading. However, beyond platform provision, the broker's additional tools and resources appear limited based on available information. There's no mention of proprietary trading tools, advanced market analysis resources, or complete educational materials that could enhance the trading experience.

Most competitive brokers supplement standard platforms with market research, economic calendars, trading signals, or analytical tools to add value for their clients. The absence of detailed information about research and analysis resources represents a significant weakness. Successful trading often depends on access to market insights, economic analysis, and timely information about market-moving events.

The lack of mention of such resources suggests either their absence or poor communication about available offerings. Educational resources, crucial for trader development and retention, are not fully detailed in available sources. While Forex Daily Info mentions YaMarkets' dedication to providing access to learning, specific educational offerings, their quality, and accessibility remain unclear.

This represents a missed opportunity to demonstrate value beyond basic platform access.

Customer Service and Support Analysis (4/10)

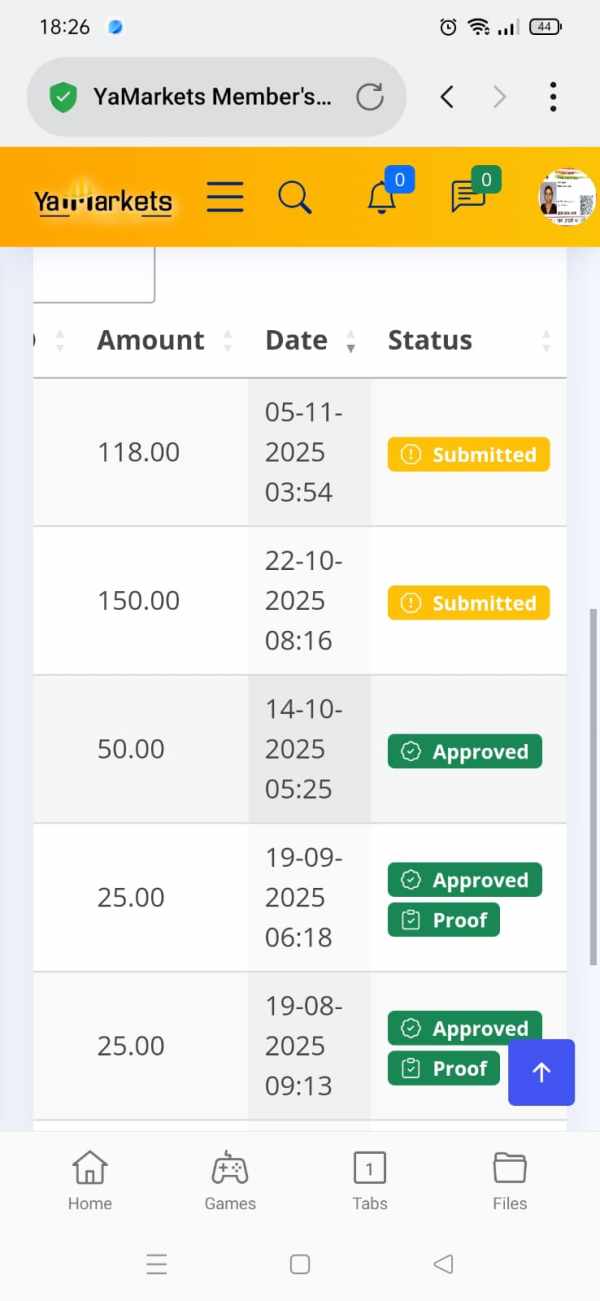

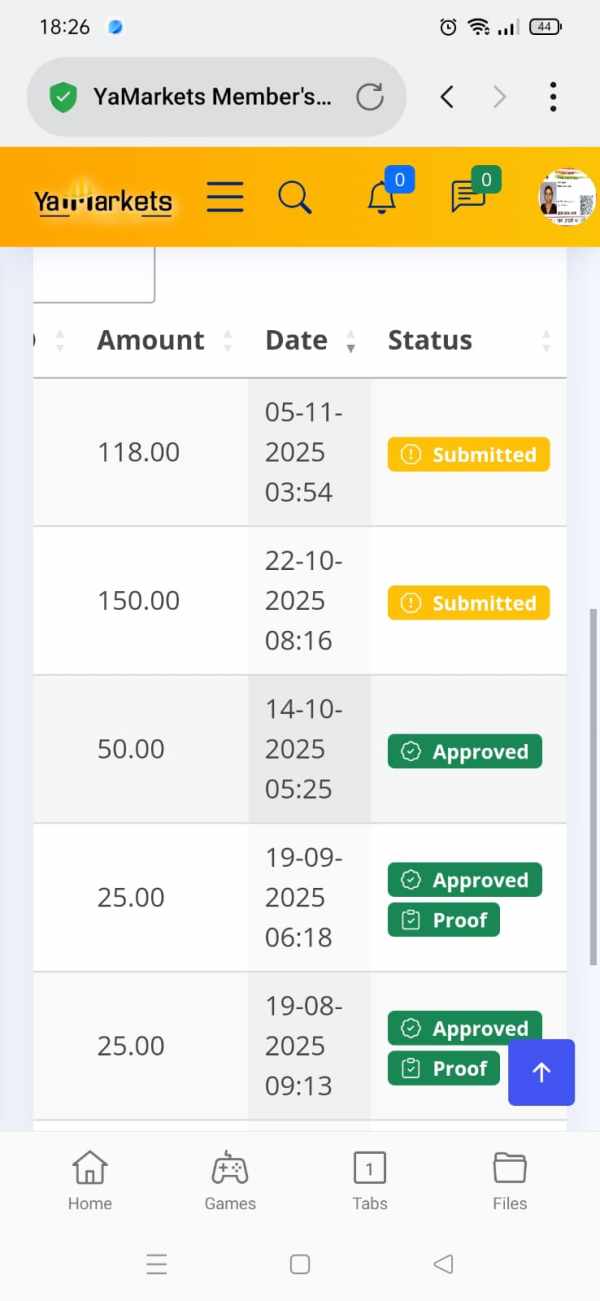

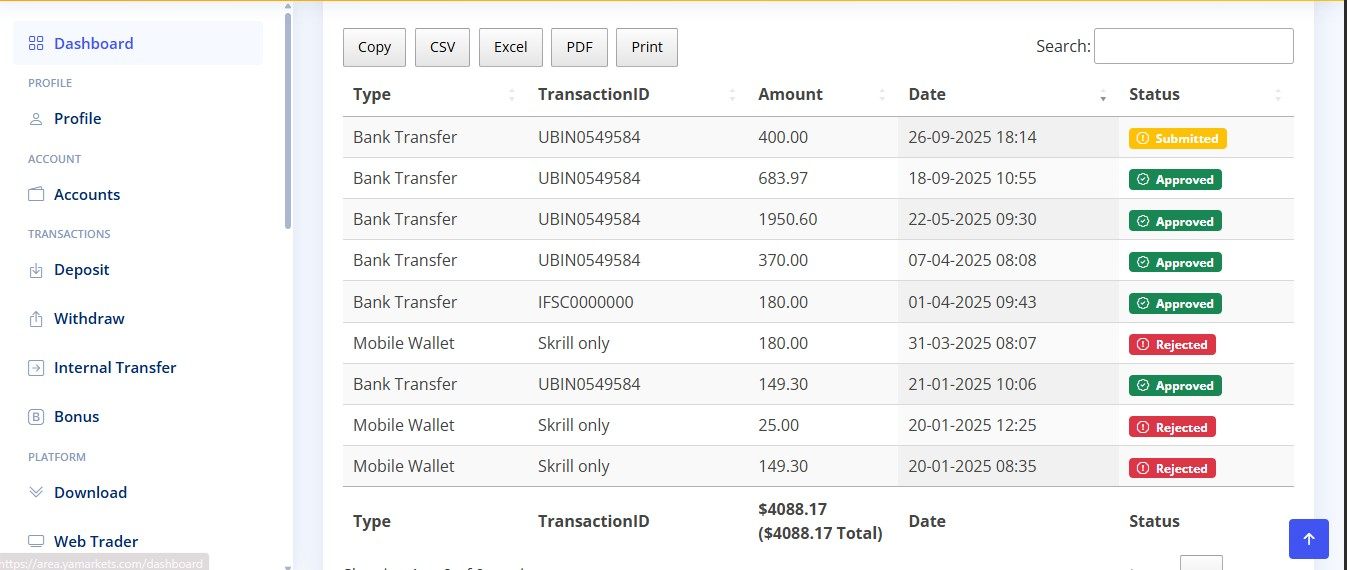

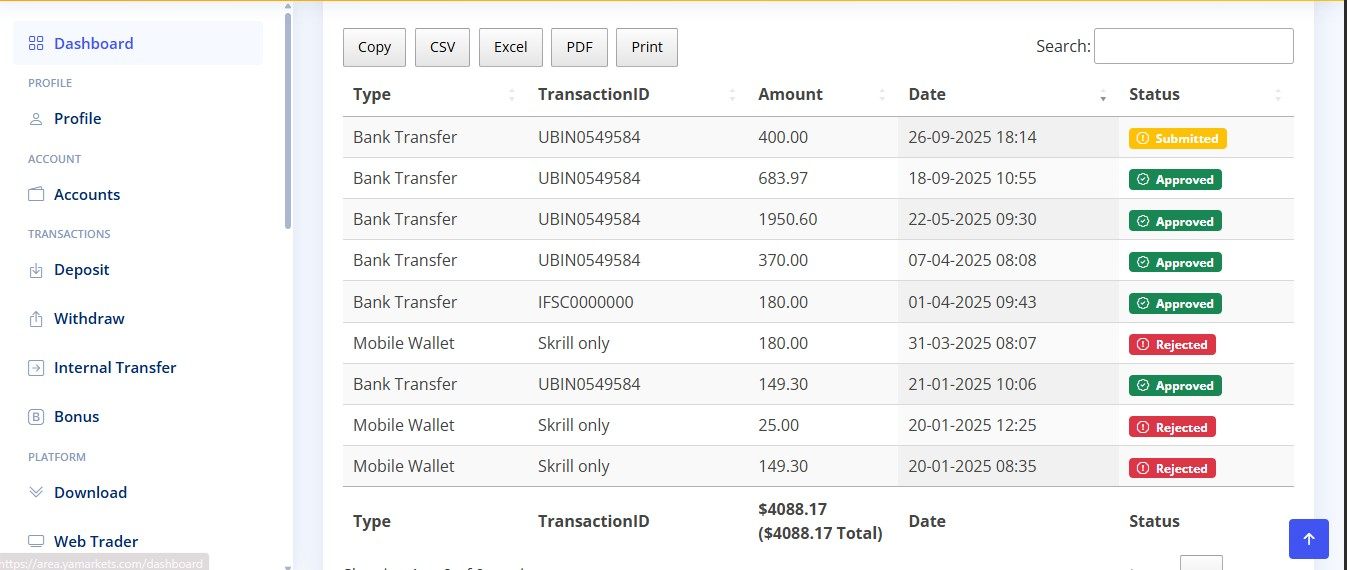

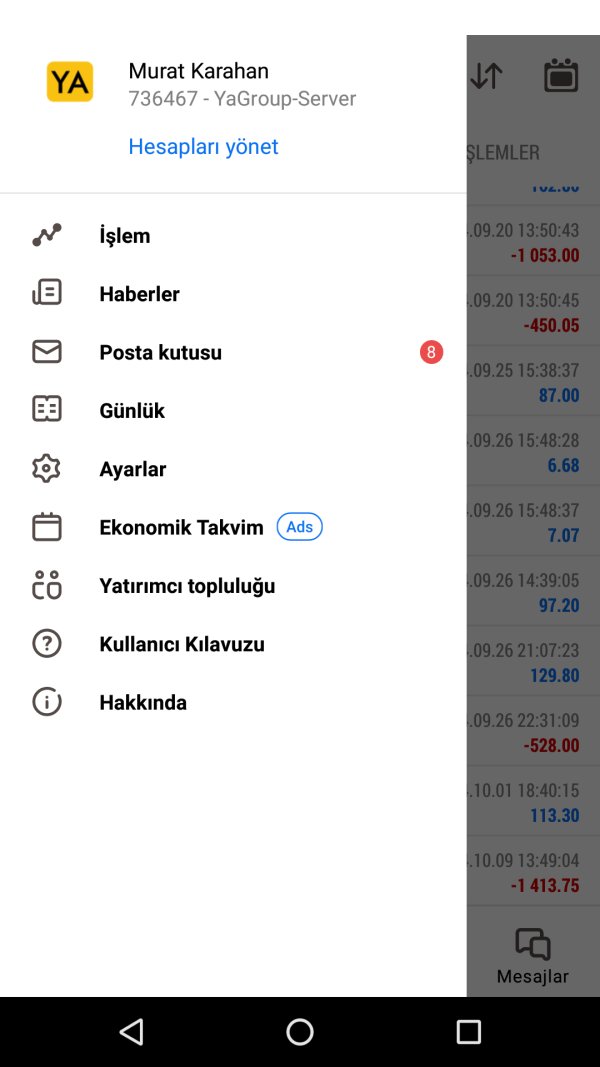

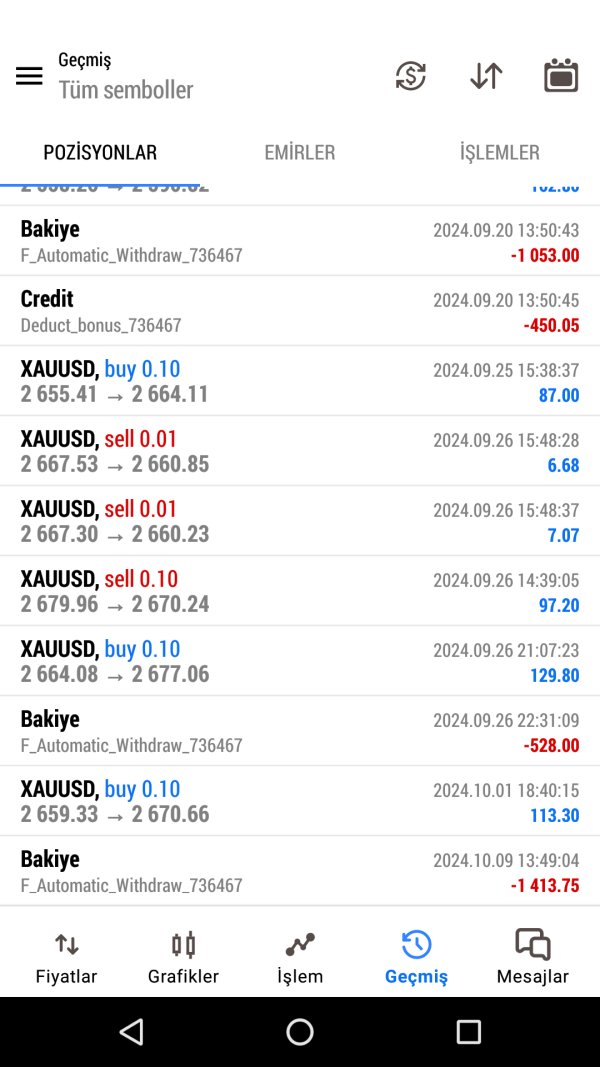

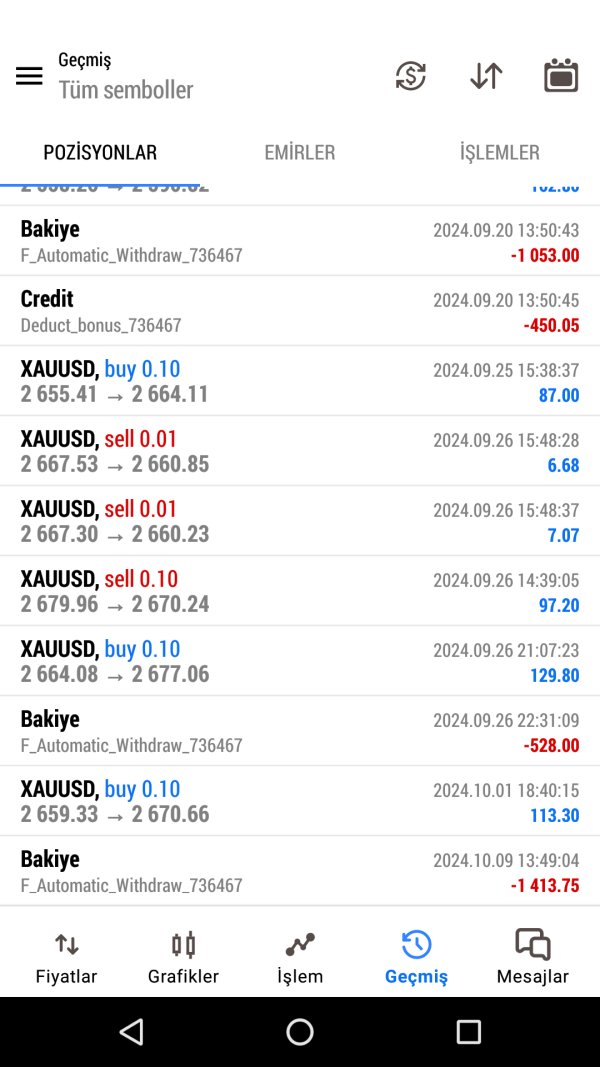

Customer service represents one of YaMarkets' most significant weaknesses based on available user feedback and reported experiences. The most concerning issue involves allegations of unpaid commissions to introducing brokers. Specific claims reach approximately $5,000 in unpaid IB commissions.

These allegations suggest serious problems with the broker's payment systems, financial management, or business integrity. According to Trustpilot reviews referenced in available sources, users have specifically named the broker's owner, Lalit Matta, in complaints about unpaid commissions and described him as "a big scamster." Such direct accusations from users indicate severe customer service failures.

This suggests that complaint resolution processes are either inadequate or non-existent. The absence of detailed information about customer service channels, availability hours, and response time commitments further compounds these concerns. Professional brokers typically provide multiple contact methods, clearly stated service hours, and response time guarantees to ensure client satisfaction.

The lack of such information suggests either poor service infrastructure or reluctance to commit to service standards. Multi-language support details are not available in reviewed sources. This potentially limits accessibility for international clients.

Given the global nature of forex trading, complete language support is essential for effective customer service. The information gap suggests limited international service capabilities or poor communication about available support options. These customer service issues, particularly the unpaid commission allegations, significantly impact the broker's credibility and represent major red flags for potential users.

Trading Experience Analysis (5/10)

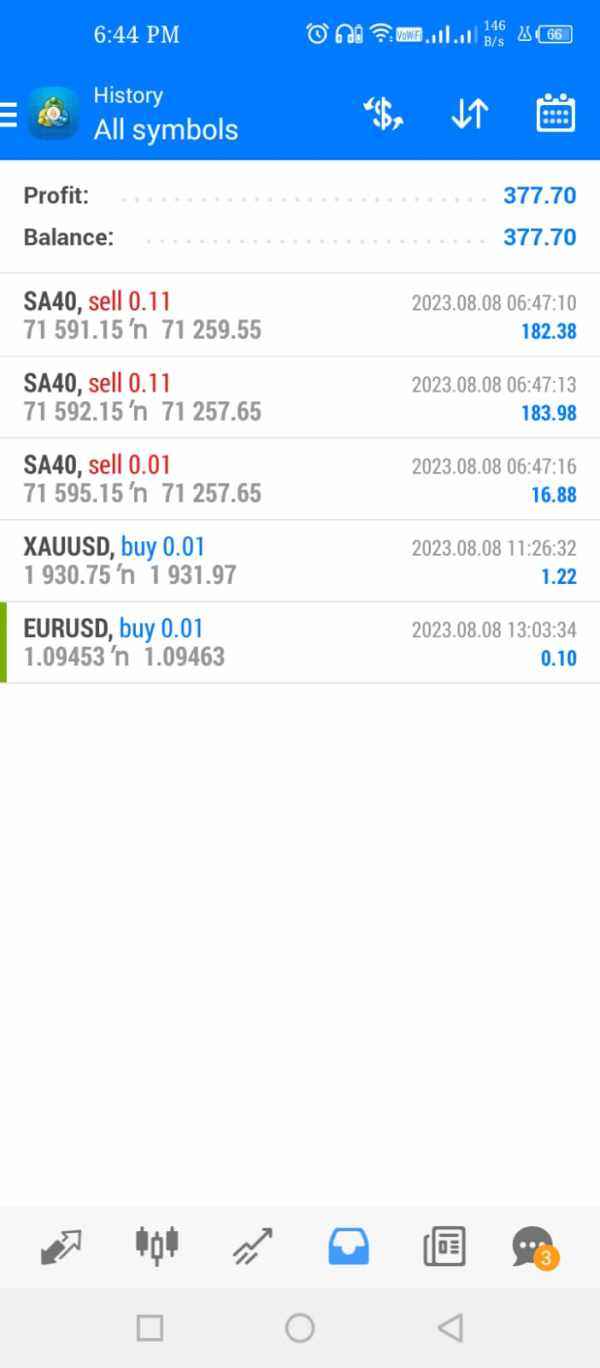

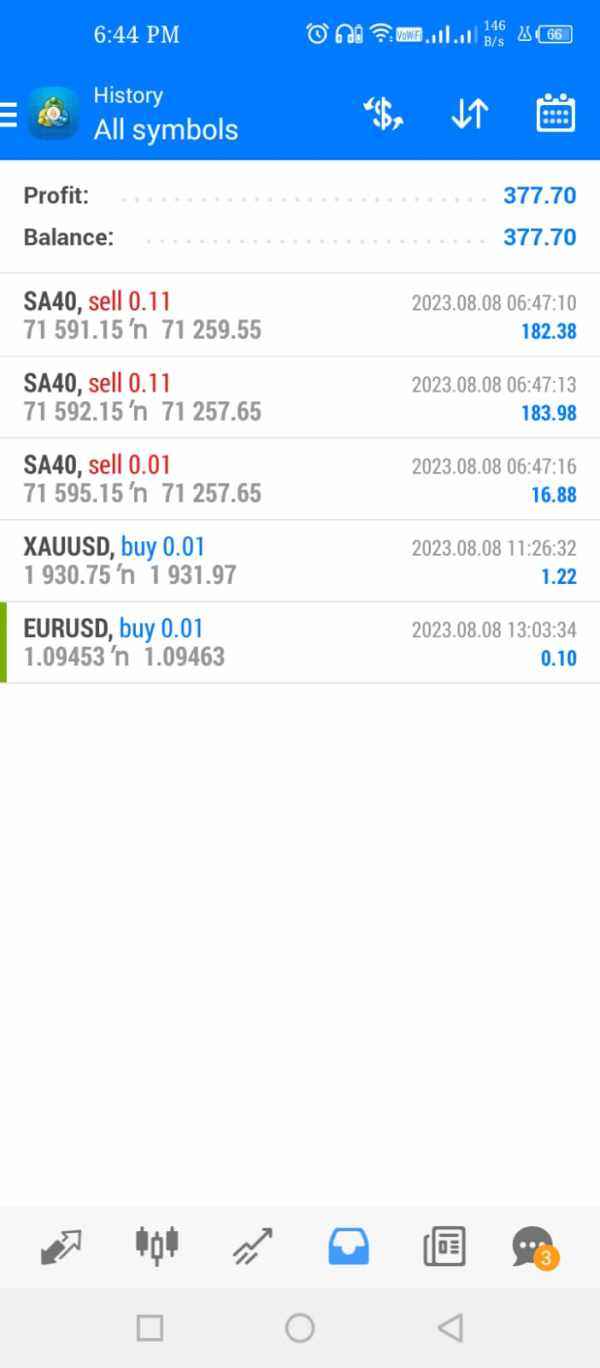

The trading experience with YaMarkets appears to be standard but unremarkable based on available information. The provision of MT4 and MT5 platforms ensures access to familiar trading environments with established functionality. This includes advanced charting, technical analysis tools, and automated trading capabilities.

These platforms are known for their stability and complete feature sets, providing a solid foundation for trading activities. However, user feedback about actual trading experience quality is mixed and limited in available sources. There are no specific mentions of execution speed, slippage rates, or platform stability issues.

These are crucial factors in determining trading experience quality. The absence of detailed performance metrics makes it difficult to assess whether YaMarkets provides competitive execution quality compared to other brokers. Order execution quality, a critical component of trading experience, is not specifically addressed in available information.

Factors such as requotes, execution delays, and price manipulation concerns are not discussed. This leaves potential users without crucial information about trading conditions they might encounter. Mobile trading experience details are not provided in reviewed sources.

This represents a significant information gap given the importance of mobile trading in today's market. Most traders expect seamless mobile platform functionality. The absence of specific mobile trading information suggests either limited mobile offerings or poor communication about available features.

The overall trading environment assessment is hampered by the lack of concrete user experience data and the overshadowing trust issues that could impact trader confidence and psychological comfort during trading activities.

Trust and Reliability Analysis (3/10)

Trust and reliability represent YaMarkets' most significant weaknesses. Multiple serious concerns undermine confidence in the broker's operations. The most damaging issue involves allegations of unpaid commissions to introducing brokers.

Specific claims reach approximately $5,000. Such allegations directly challenge the broker's financial integrity and operational reliability. The regulatory framework provides limited reassurance, with registration in Mauritius offering less complete oversight compared to major financial centers like the UK, Australia, or Cyprus.

While Mauritius registration is legitimate, it doesn't provide the same level of regulatory protection and recourse that traders might expect from more established regulatory environments. Fund security measures are not detailed in available sources. This leaves users uncertain about client money protection, segregated accounts, or deposit insurance coverage.

Professional brokers typically provide clear information about fund protection measures to reassure clients about their capital safety. The absence of such information raises additional concerns about transparency and client protection. Despite receiving the Best Fintech and Solutions Broker award in 2023, this recognition is overshadowed by the serious allegations about unpaid commissions and user complaints.

Awards can sometimes be purchased or obtained through less rigorous evaluation processes. This makes them less reliable indicators of actual service quality compared to genuine user experiences. The specific naming of the broker's owner in negative user reviews represents particularly damaging evidence.

This suggests that trust issues may extend to the leadership level. Such personal accusations indicate severe relationship breakdowns between the broker and its business partners or clients.

User Experience Analysis (4/10)

Overall user satisfaction with YaMarkets appears mostly negative based on available feedback and reported experiences. The most significant user experience issue involves the alleged non-payment of commissions. This directly impacts user financial outcomes and creates negative experiences that extend beyond trading platform functionality.

User interface design and platform usability are not specifically addressed in available sources. However, the provision of MT4 and MT5 platforms suggests access to proven, user-friendly trading interfaces. The overall user experience extends beyond platform design to include account management, customer service interactions, and financial transaction reliability.

Registration and account verification processes are not detailed in available information. This makes it difficult to assess the user-friendliness of onboarding procedures. Smooth account opening and verification processes are crucial for positive first impressions and overall user satisfaction.

The information gap suggests either problematic processes or poor communication about procedures. Fund management experience, particularly about deposits and withdrawals, appears problematic based on the unpaid commission allegations. If the broker faces challenges paying business partner commissions, similar issues might affect client withdrawal processing.

This creates significant user experience problems. Common user complaints center around payment issues and alleged fraudulent behavior. These represent the most serious possible user experience problems.

When users characterize a broker owner as a "scamster," it indicates complete breakdown of trust and extremely negative user experiences that extend far beyond minor service inconveniences.

Conclusion

This yamarkets review reveals a broker facing significant credibility challenges that overshadow any potential benefits it might offer. While YaMarkets provides access to popular trading platforms and multiple asset classes, the serious allegations about unpaid commissions and negative user experiences create substantial concerns for potential traders. The broker may appeal to traders seeking diversified asset exposure through familiar MT4 and MT5 platforms.

However, the fundamental trust issues make it difficult to recommend for any serious trading activities. The lack of regulatory clarity, combined with specific allegations against company leadership, suggests that traders should exercise extreme caution. The main advantages include access to industry-standard trading platforms and multi-asset trading capabilities.

However, these benefits are significantly outweighed by major disadvantages including alleged payment issues, poor customer service experiences, limited transparency, and serious trust concerns raised by user feedback. Given these substantial red flags, traders would be well-advised to consider more established and reputable alternatives in the competitive forex brokerage market.