Regarding the legitimacy of XTrend forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is XTrend safe?

Pros

Cons

Is XTrend markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 20

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Rynat Trading Ltd

Effective Date:

2016-06-30Email Address of Licensed Institution:

info@rynattrading.comSharing Status:

Website of Licensed Institution:

www.rynattrading.com, www.thextrend.com, www.thextrend.eu, www.xtrend.eu, www.xtrendprime.com, www.xtrendprime.euExpiration Time:

--Address of Licensed Institution:

18 Monis Machera Street, 4th Floor, Office 401, 3020, LimassolPhone Number of Licensed Institution:

+357 25 258 020Licensed Institution Certified Documents:

Is XTrend A Scam?

Introduction

XTrend is a forex and CFD trading platform that has positioned itself as a competitive player in the financial markets since its establishment in 2016. With its headquarters in Cyprus and regulatory oversight from the Cyprus Securities and Exchange Commission (CySEC) and the Financial Sector Conduct Authority (FSCA) in South Africa, XTrend aims to provide a diverse range of trading instruments, including forex, commodities, indices, and cryptocurrencies. However, as the forex market continues to attract both seasoned investors and newcomers, it is essential for traders to carefully evaluate their brokers. This scrutiny is vital to ensure that their funds are secure and that they are trading with a legitimate entity.

In this article, we will conduct a thorough investigation into XTrend's legitimacy, focusing on its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks. Our evaluation methodology involves analyzing multiple credible sources, including user reviews, regulatory filings, and expert analyses, to provide a well-rounded perspective on whether XTrend is a safe trading option or a potential scam.

Regulation and Legitimacy

A broker's regulatory status is one of the most critical factors in assessing its legitimacy. Regulatory bodies enforce strict guidelines to protect investors and ensure fair trading practices. XTrend operates under the regulation of CySEC and FSCA, which are recognized authorities in Europe and South Africa, respectively. Below is a summary of XTrend's regulatory information:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 303/16 | Cyprus | Verified |

| Financial Sector Conduct Authority (FSCA) | FSP No. 23497 | South Africa | Verified |

CySEC is known for its rigorous oversight and compliance requirements, which include maintaining sufficient capital reserves and safeguarding client funds through segregation. FSCA, while a reputable authority, is considered a tier-2 regulator, which may imply slightly less stringent oversight compared to tier-1 regulators like the FCA in the UK.

Despite being regulated, some concerns arise regarding the absence of a top-tier license, which could be a red flag for traders who prioritize high regulatory standards. However, both CySEC and FSCA impose strict rules that enhance the safety and reliability of XTrend's operations. Overall, the broker's regulatory status appears to provide a reasonable level of security for traders.

Company Background Investigation

XTrend is operated by Ryn at Trading Ltd, a company registered in Cyprus. The broker has been in operation since 2016, and its establishment coincides with a growing trend of online trading platforms catering to retail investors. The management team behind XTrend consists of individuals with experience in the financial sector, although specific details about their backgrounds may not be readily available.

Transparency is a key aspect of a broker's credibility. XTrend provides information about its ownership and regulatory status on its website, which is a positive sign. However, potential clients should be aware that the broker primarily operates through mobile platforms, which may not appeal to all traders, particularly those who prefer desktop trading solutions like MetaTrader 4 or 5.

To assess the company's transparency further, it is essential to look at its communication practices and responsiveness to inquiries. While the broker offers customer support via various channels, including email and phone, the absence of a demo account could be seen as a limitation for traders looking to familiarize themselves with the platform before committing funds.

Trading Conditions Analysis

Understanding a broker's trading conditions is crucial for evaluating its competitiveness and transparency. XTrend offers a low minimum deposit requirement of $50, making it accessible to a broader range of traders. However, the overall fee structure and trading costs must be analyzed to determine the broker's value proposition.

XTrend's fee structure includes spreads, commissions, and overnight interest rates. Below is a comparison of XTrend's core trading costs with industry averages:

| Fee Type | XTrend | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips (EUR/USD) | 1.2 pips |

| Commission Model | None (spread-only) | Varies (may include commission) |

| Overnight Interest Range | Varies | Varies |

XTrend's spreads are notably competitive, particularly for major currency pairs, significantly lower than the industry average. However, it is important to note that withdrawal fees may apply, which could affect overall trading costs. Traders should review the broker's terms and conditions carefully to understand any hidden fees that may arise during trading or withdrawal processes.

Customer Fund Safety

The safety of customer funds is paramount in the forex trading industry. XTrend implements several measures to ensure the security of client funds, including segregating client accounts from operational funds. This practice is essential for protecting traders' capital in the event of financial difficulties faced by the broker.

In addition to fund segregation, XTrend is subject to regulatory requirements that mandate the maintenance of sufficient capital reserves. Moreover, XTrend offers negative balance protection, which prevents traders from losing more than their initial investment, thereby enhancing financial security.

Despite these measures, there have been reports of fund withdrawal issues and negative experiences from some users. It is crucial for potential clients to remain vigilant and conduct thorough research before depositing funds with any broker, including XTrend.

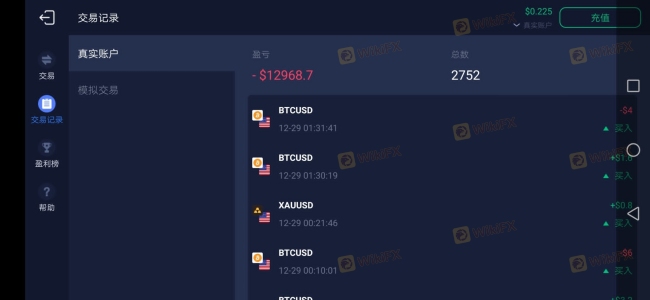

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into a broker's reputation and service quality. XTrend has received mixed reviews from users, with some praising its competitive trading conditions and user-friendly platform, while others have raised concerns about withdrawal difficulties and customer support responsiveness.

Common complaints about XTrend include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed; some users report slow responses |

| Customer Support Issues | Medium | Generally responsive, but limited hours |

| Lack of Demo Account | Low | No demo account available for practice |

One notable case involved a user who reported difficulties withdrawing funds, claiming that their requests were delayed without clear communication from the broker. Such experiences can significantly impact a trader's confidence in the broker's reliability.

Platform and Trade Execution

The performance of a trading platform is critical for a trader's success. XTrend primarily operates through its proprietary mobile trading app, which offers a range of features for both novice and experienced traders. While the app is user-friendly and provides access to various trading instruments, the lack of desktop trading options may deter some traders.

In terms of execution quality, users have reported a generally positive experience, with minimal slippage and a low rejection rate for orders. However, the absence of popular platforms like MetaTrader may limit the trading strategies available to users accustomed to those environments.

Risk Assessment

Trading forex and CFDs involves inherent risks, and it is essential for traders to understand the potential pitfalls associated with using any broker. The following risk assessment summarizes the key risk areas associated with XTrend:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Regulated by CySEC and FSCA, but lacks a top-tier license. |

| Fund Safety | Medium | Segregated accounts and negative balance protection are in place, but historical complaints exist. |

| Withdrawal Issues | High | Reports of withdrawal difficulties may indicate potential issues. |

To mitigate these risks, traders should ensure they fully understand the broker's policies and maintain realistic expectations regarding trading outcomes. Additionally, using a demo account or starting with a small investment can help familiarize oneself with the platform before committing larger sums.

Conclusion and Recommendations

In conclusion, XTrend presents itself as a regulated forex and CFD broker with competitive trading conditions and a user-friendly mobile platform. While its regulatory status under CySEC and FSCA provides a level of assurance, the lack of a top-tier license and reports of withdrawal issues warrant caution.

Traders considering XTrend should conduct thorough research, review user experiences, and assess whether the broker aligns with their trading needs. For those seeking alternatives, brokers with higher regulatory standards, such as FCA-regulated firms, may offer additional peace of mind. Overall, while XTrend is not outrightly a scam, potential clients should proceed with caution and remain vigilant regarding their trading activities.

Is XTrend a scam, or is it legit?

The latest exposure and evaluation content of XTrend brokers.

XTrend Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XTrend latest industry rating score is 6.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.