XTrend 2025 Review: Everything You Need to Know

Summary

This comprehensive xtrend review examines a relatively new forex broker that has been operating since 2016. XTrend positions itself as an innovative trading platform. It focuses on mobile trading experiences and offers access to multiple asset classes including forex, stocks, indices, commodities, and cryptocurrencies. The broker operates under CySEC regulation. It provides both MetaTrader 4 and its proprietary STrader platform.

Based on available user feedback, XTrend receives a mixed reception with a TrustScore of 2.92 from 17 user reviews. This indicates some areas of concern that potential clients should carefully consider. The broker's key strengths lie in its mobile-first approach and diverse asset offerings. This makes it potentially suitable for retail traders seeking varied trading instruments and on-the-go trading capabilities. However, user feedback suggests there are notable areas for improvement in service quality and overall user satisfaction.

The broker's regulatory status under CySEC provides a foundation of legitimacy. However, the relatively low user ratings suggest that prospective clients should thoroughly evaluate both advantages and disadvantages before committing to open an account with this platform.

Important Notice

Regional Entity Differences: XTrend operates under different regulatory frameworks across various jurisdictions. The primary regulatory oversight comes from CySEC (Cyprus Securities and Exchange Commission). However, potential users should verify the specific regulatory requirements and protections available in their respective regions before opening an account.

Review Methodology: This evaluation is based on publicly available information, user feedback analysis, and market research data. Our assessment aims to provide readers with an objective and comprehensive evaluation of the broker's services, features, and overall market position. All information presented reflects the most current data available at the time of writing. Readers should independently verify key details before making trading decisions.

Rating Framework

Overall Rating: 5.5/10

Broker Overview

XTrend emerged in the forex and CFD trading landscape in 2016. It established itself as a South Africa-headquartered broker with a focus on providing innovative trading solutions. According to multiple sources, the company operates as a CFD broker offering access to various financial instruments through modern trading platforms. The broker has positioned itself to serve the growing demand for mobile-first trading experiences. It recognizes the shift in trader preferences toward accessible, on-the-go trading solutions.

The company's business model centers around providing retail traders with access to global financial markets through competitive trading conditions and user-friendly platforms. XTrend's approach emphasizes accessibility and innovation. It particularly targets traders who prioritize mobile trading capabilities and diverse asset exposure. The broker's relatively young age in the industry means it continues to develop its market presence and refine its service offerings based on user feedback and market demands.

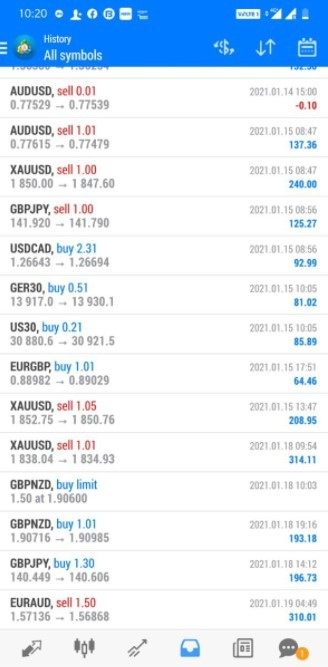

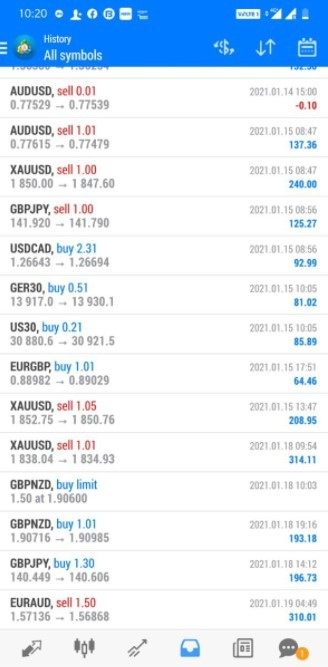

XTrend operates primarily through two trading platforms: the industry-standard MetaTrader 4 (MT4) and its proprietary STrader platform. This dual-platform approach allows the broker to cater to both traditional traders familiar with MT4's comprehensive features and those seeking a more streamlined, modern trading interface. The available trading assets span multiple categories including foreign exchange pairs, individual stocks, market indices, various commodities, and cryptocurrency instruments. This provides traders with significant diversification opportunities within a single brokerage account.

Regulatory Jurisdiction: XTrend operates under the regulatory oversight of CySEC (Cyprus Securities and Exchange Commission). This provides European Union-level regulatory standards and client protection measures for eligible traders.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods was not detailed in available sources. Potential clients need to contact the broker directly for comprehensive payment processing information.

Minimum Deposit Requirements: The minimum deposit threshold for opening an account with XTrend was not specified in available documentation. This indicates that prospective traders should inquire directly with the broker regarding initial funding requirements.

Bonus and Promotional Offers: Current promotional campaigns and bonus structures were not detailed in the available information. This suggests that any such offers would need to be confirmed through direct broker contact.

Tradeable Assets: The broker provides access to a comprehensive range of financial instruments including major and minor currency pairs, individual company stocks, global market indices, precious metals and energy commodities, and popular cryptocurrency pairs.

Cost Structure: According to available information, XTrend implements a spread-plus-commission pricing model with spreads starting from 2 pips plus additional commission charges. While this structure provides transparency in pricing, the specific commission rates require clarification from the broker for accurate cost calculations.

Leverage Ratios: The broker offers leverage up to 1:30. This aligns with European regulatory standards under CySEC oversight and provides appropriate risk management for retail traders.

Platform Options: Traders can choose between MetaTrader 4 for comprehensive technical analysis and automated trading capabilities, or STrader for a more modern, streamlined trading experience designed with mobile users in mind.

This xtrend review finds that while basic information is available, several key details require direct verification with the broker. This may impact the decision-making process for potential clients.

Account Conditions Analysis

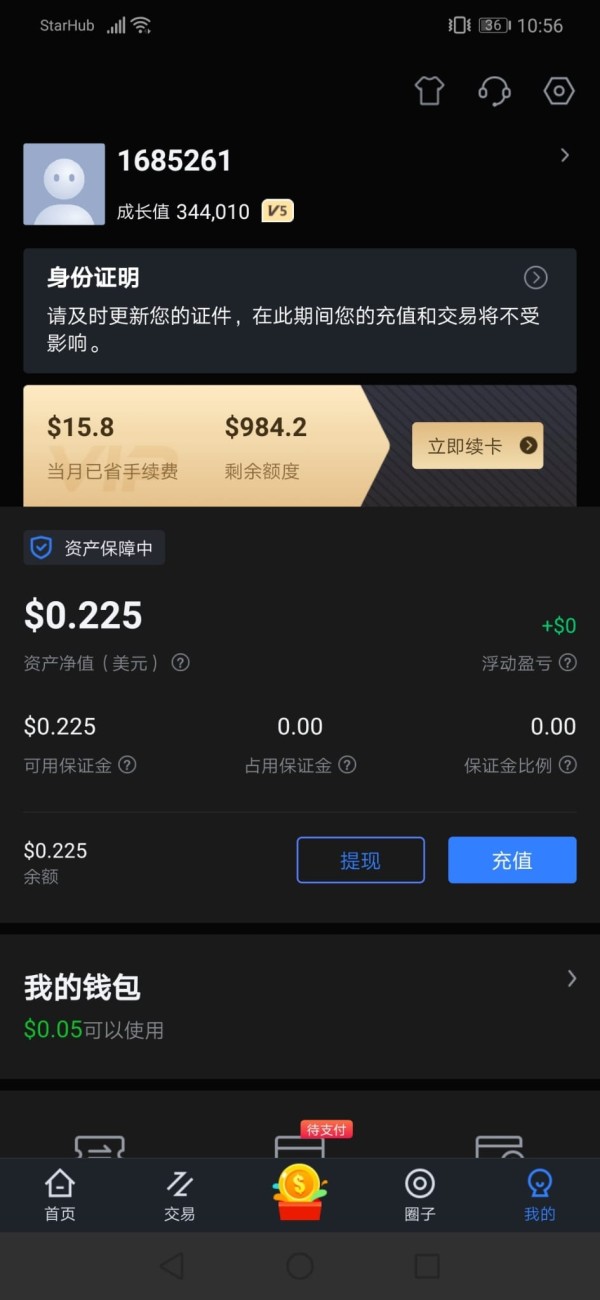

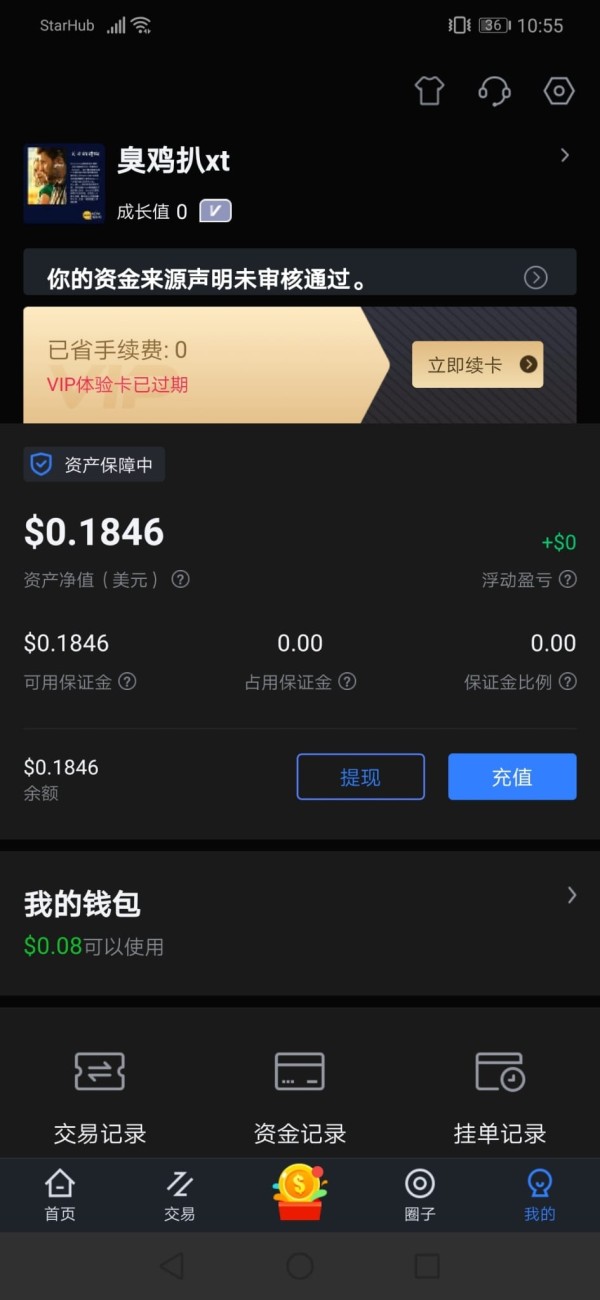

XTrend's account structure presents a mixed picture for potential traders. While specific account types were not detailed in available sources, the broker appears to offer standard trading accounts compatible with both MT4 and STrader platforms. The lack of transparent information regarding minimum deposit requirements represents a significant gap in publicly available data. This makes it difficult for traders to assess the accessibility of the broker's services.

The pricing structure, featuring 2 pips spreads plus commission, positions XTrend in the middle range of industry pricing. However, without specific commission rates, traders cannot accurately calculate total trading costs. This is essential for strategy development and profitability analysis. This transparency issue has been reflected in user feedback, with some traders expressing frustration over unclear fee structures.

Account opening processes, based on user reports, appear relatively straightforward. However, verification procedures may experience delays. The broker's CySEC regulation ensures certain client protection standards, including segregated client funds and compensation scheme participation. This adds credibility to the account security framework.

The absence of information regarding specialized account features, such as Islamic accounts for Sharia-compliant trading, limits the broker's appeal to specific trader demographics. Additionally, without clear details on account tiers or premium services, traders cannot assess potential benefits of maintaining higher account balances.

Overall, while XTrend's account conditions meet basic industry standards, the lack of detailed public information and transparency issues highlighted in this xtrend review suggest that prospective clients should seek comprehensive clarification before committing to account opening.

XTrend demonstrates strength in its platform offerings. It provides traders with both established and innovative trading solutions. The MetaTrader 4 platform brings comprehensive technical analysis capabilities, expert advisor support, and extensive charting tools that experienced traders expect. The inclusion of automated trading features through EA support adds significant value for systematic trading approaches.

The proprietary STrader platform represents XTrend's commitment to innovation, particularly in mobile trading experiences. This platform appears designed for modern traders who prioritize simplicity and accessibility over complex analytical tools. The mobile-first approach aligns with current market trends and trader preferences for flexible trading access.

However, available sources do not detail specific research and analysis resources provided by the broker. Market analysis, economic calendars, and educational materials are crucial components of comprehensive broker services. Their absence from available information represents a notable gap in the service offering assessment.

The broker's support for various asset classes through both platforms indicates robust technical infrastructure capable of handling diverse trading requirements. The integration of cryptocurrency trading alongside traditional instruments demonstrates adaptability to evolving market demands.

User feedback suggests general satisfaction with platform functionality and stability. However, some users have noted areas for improvement in advanced analytical tools and research resources. The dual-platform strategy effectively caters to different trader preferences, from traditional MT4 users to mobile-focused traders seeking streamlined experiences.

Customer Service and Support Analysis

Customer service represents one of XTrend's weaker areas based on available user feedback and rating information. With a TrustScore of 2.92 from user reviews, customer support quality appears to be a significant concern for the broker's client base. User feedback indicates inconsistent response times and varying levels of service quality that fall short of industry standards.

The specific customer service channels available were not detailed in accessible information. This makes it difficult to assess the comprehensiveness of support options. Modern brokers typically offer multiple contact methods including live chat, email, phone support, and social media channels. However, XTrend's specific offerings in this area require clarification.

Response time issues mentioned in user feedback suggest that the broker may be understaffed or lacking efficient support processes. In the fast-paced trading environment, delayed customer service responses can significantly impact trader experiences. They can potentially affect trading outcomes during critical market periods.

The absence of detailed information regarding multilingual support capabilities limits assessment of the broker's international service capacity. For a CySEC-regulated broker serving diverse European markets, comprehensive language support would be expected as a standard service feature.

Professional competency concerns raised in user feedback indicate potential training or knowledge gaps among customer service representatives. Effective broker support requires staff capable of addressing both technical platform issues and complex trading-related inquiries with accuracy and efficiency.

The customer service challenges highlighted in user reviews represent a significant area requiring improvement for XTrend to enhance overall client satisfaction and retention rates.

Trading Experience Analysis

XTrend's trading experience receives generally positive feedback regarding platform stability and execution quality. Users report satisfactory performance in terms of order execution speed and minimal slippage occurrences. These are critical factors for successful trading outcomes. The broker's technical infrastructure appears capable of handling standard trading volumes without significant performance issues.

The dual-platform approach enhances trading experience flexibility. It allows users to choose between MT4's comprehensive functionality and STrader's streamlined interface based on their specific needs and preferences. This adaptability particularly benefits traders who switch between detailed analysis and quick mobile trading throughout their trading day.

Platform functionality completeness varies between the two offerings, with MT4 providing extensive technical indicators, charting tools, and customization options that experienced traders require. The STrader platform, while more limited in analytical depth, offers improved user interface design and mobile optimization. This appeals to contemporary trading preferences.

Mobile trading experience appears to be a particular strength for XTrend. User feedback indicates satisfaction with the mobile platform's responsiveness and functionality. This aligns with the broker's stated focus on mobile-first trading solutions and represents a competitive advantage in the current market environment.

However, some users have noted limitations in advanced trading features and analytical tools compared to more established brokers. The trading environment, while stable, may lack some sophisticated features that professional traders expect from comprehensive trading platforms.

This xtrend review finds that while the basic trading experience meets industry standards, there remains room for enhancement in advanced functionality and feature completeness to compete with top-tier brokers.

Trust and Reliability Analysis

XTrend's trust profile presents mixed signals that require careful consideration by potential clients. The broker's CySEC regulatory status provides a foundation of legitimacy. It ensures compliance with European Union financial services standards, including client fund segregation and participation in investor compensation schemes.

However, the TrustScore of 2.92 from user reviews indicates significant trust concerns within the existing client base. This relatively low rating suggests that users have experienced issues that have negatively impacted their confidence in the broker's reliability and service quality.

The company's transparency regarding its background and operations appears adequate, with basic corporate information readily available through various sources. The 2016 establishment date provides several years of operational history. However, this is still relatively recent compared to more established industry players.

Regulatory compliance under CySEC oversight ensures certain minimum standards for client protection, including segregated client funds and professional indemnity insurance. However, the specific details of these protections and their implementation were not elaborated in available sources.

User feedback suggests concerns about fund security and withdrawal processes. However, specific incidents were not detailed in accessible information. The handling of client complaints and dispute resolution processes appears to be an area where improvements are needed based on the overall trust rating.

Industry reputation remains developing, with XTrend not yet achieving recognition among top-tier brokers. The combination of regulatory legitimacy and concerning user feedback creates a complex trust profile. This requires individual risk assessment by potential clients.

User Experience Analysis

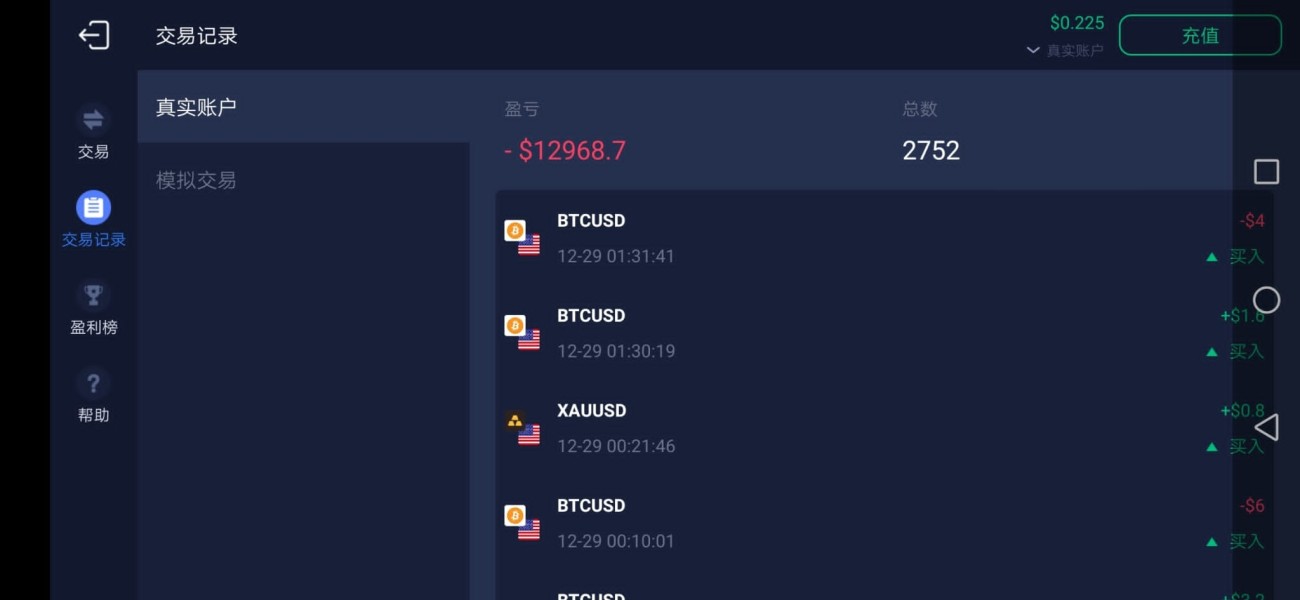

User experience represents XTrend's most challenging area. The overall user satisfaction rating reflects significant room for improvement. The low user ratings indicate widespread dissatisfaction with various aspects of the broker's service delivery and platform experience.

Interface design and usability appear to vary significantly between platforms, with the STrader platform receiving better feedback for modern design elements compared to the standard MT4 implementation. However, overall ease of use concerns suggest that both platforms may benefit from user experience enhancements.

The account registration and verification process, while reportedly straightforward initially, appears to suffer from delays and complications during the verification stage. Slow verification processing can significantly impact new client onboarding experiences. It creates frustration during the critical initial interaction period.

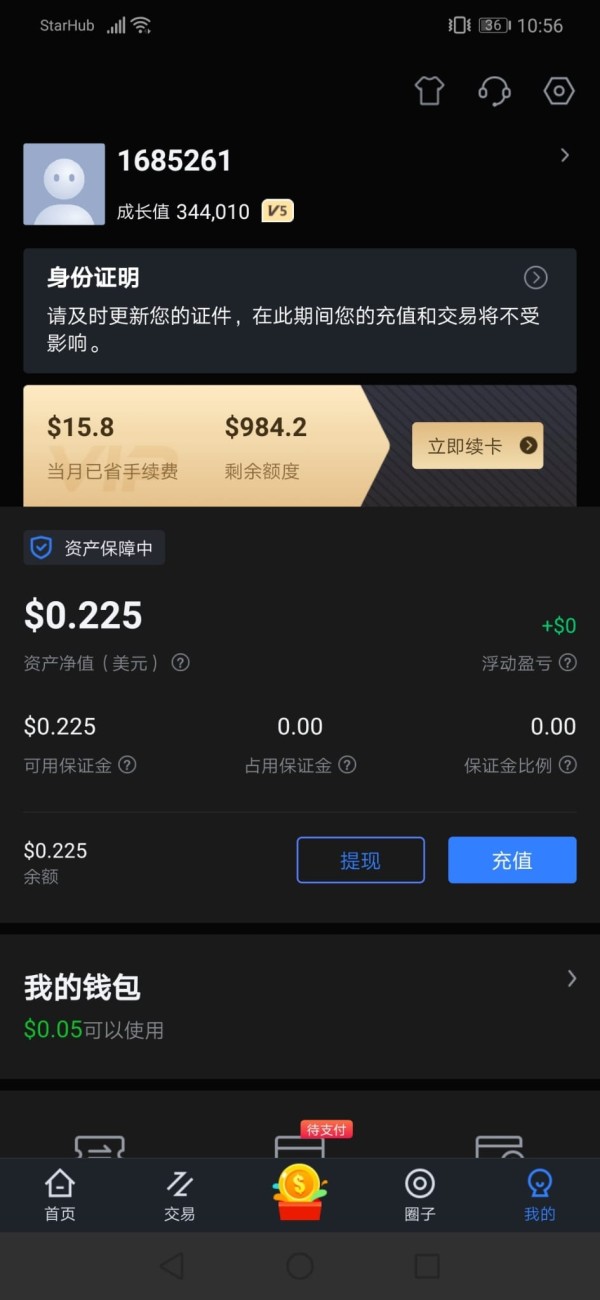

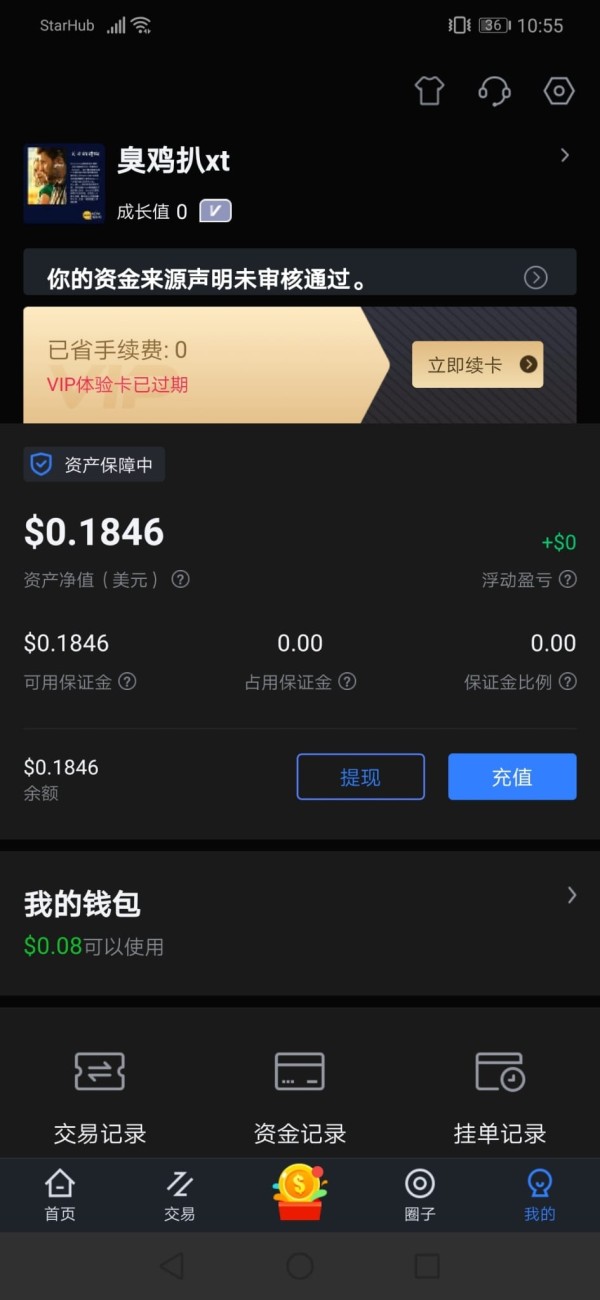

Fund operation experiences were not specifically detailed in available feedback, but the overall low satisfaction ratings suggest potential issues with deposit and withdrawal processes. Efficient money management is crucial for trader satisfaction. It represents a fundamental broker service requirement.

Common user complaints center around customer service inadequacy and lack of transparency in account conditions and fee structures. These issues directly impact daily trading experiences. They contribute to the overall negative user sentiment reflected in the ratings.

The user demographic appears to include traders seeking innovative mobile trading solutions, but the execution of these services has not met expectations based on feedback patterns. Improvements in service delivery, transparency, and customer support would be essential for enhancing overall user experience ratings.

Conclusion

This comprehensive xtrend review reveals a broker with innovative aspirations but significant execution challenges. XTrend demonstrates potential in mobile trading solutions and platform diversity. It offers traders access to multiple asset classes through both established and proprietary trading platforms. The CySEC regulatory framework provides necessary legitimacy and basic client protections.

However, the broker faces substantial challenges in service delivery, customer satisfaction, and overall reliability as evidenced by the low TrustScore and user feedback patterns. The lack of transparency in key areas such as fees, account conditions, and service details creates additional concerns for potential clients.

XTrend may be suitable for traders specifically seeking mobile-first trading experiences and diverse asset access, provided they can accept the associated risks highlighted in user feedback. However, traders prioritizing reliable customer service, comprehensive support, and established track records may find better alternatives among more established brokers.

The broker's young age provides potential for improvement and development. However, current service levels suggest that significant enhancements in customer service, transparency, and user experience delivery are necessary to achieve competitive market positioning and improved client satisfaction rates.