Is Warwick safe?

Pros

Cons

Is Warwick Safe or a Scam?

Introduction

Warwick, a recent entrant in the forex trading arena, has garnered attention for its purportedly innovative trading solutions and customer-centric approach. As the forex market continues to expand, traders are increasingly faced with a plethora of options, making it essential to carefully evaluate the legitimacy and safety of brokers like Warwick. This article aims to dissect the various facets of Warwick, assessing its regulatory standing, company background, trading conditions, customer experiences, and overall safety. The investigation draws from multiple online sources, expert analyses, and user feedback to provide a comprehensive evaluation.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical determinant of its trustworthiness. A well-regulated broker is typically subject to stringent oversight, ensuring compliance with financial laws and providing a safety net for traders. Warwick, however, presents a concerning picture, as it lacks regulation from any top-tier financial authority. This absence of oversight raises significant red flags for potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulation means that Warwick operates without the protective framework that reputable brokers offer. This situation is particularly alarming because regulatory bodies like the FCA (UK), ASIC (Australia), and SEC (USA) enforce strict rules that safeguard traders' interests. Furthermore, brokers under low-tier regulations often engage in practices that can jeopardize traders' funds, creating an environment ripe for potential scams. Thus, it is prudent for traders to exercise caution and consider whether they want to engage with a broker that operates outside the purview of established regulatory frameworks.

Company Background Investigation

Warwick's history is relatively short, and information about its ownership structure is scarce. This lack of transparency can be a significant concern for traders. A broker's management team plays a vital role in its operations, and the absence of detailed information about Warwick's leadership raises questions about its credibility.

The company's website offers minimal insights into its history, development, and operational structure, which is often a tactic used by less reputable firms to obscure their true nature. Transparency is crucial in the financial sector, as it builds trust and confidence among clients. Without clear information regarding its founders, management experience, and operational history, potential investors may find it challenging to assess the broker's reliability.

In light of this, the lack of transparency surrounding Warwick's company background further fuels suspicions about its legitimacy. Traders should be wary of brokers that do not provide comprehensive information about their operations and management, as this could indicate a lack of accountability.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is paramount. Warwick claims to offer competitive spreads and a user-friendly trading platform, but the specifics of its fee structure are not clearly outlined. This ambiguity can lead to unexpected costs for traders, making it essential to scrutinize any broker's fees before committing funds.

| Fee Type | Warwick | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | None specified | Varies widely |

| Overnight Interest Range | 0.5% | 0.3% |

The spread on major currency pairs appears to be higher than the industry average, which could significantly impact profitability, especially for high-frequency traders. Furthermore, the lack of clarity regarding commission structures raises concerns about hidden fees that could erode traders' capital over time.

Traders should be particularly cautious of brokers that do not transparently disclose their fee structures, as this can lead to unexpected costs and diminish overall trading profitability. Therefore, it is vital to approach Warwick with a discerning eye, ensuring that all potential fees and charges are understood before proceeding.

Customer Funds Security

The safety of customer funds is a critical aspect of any forex broker's credibility. Warwick's website provides limited information regarding its fund security measures, which is a significant concern. A reputable broker typically employs stringent measures to protect client funds, including segregated accounts and investor protection schemes.

Warwick's lack of clear policies on fund segregation, negative balance protection, and investor compensation schemes raises serious questions about the safety of client deposits. Without established protocols to safeguard funds, traders may be exposing themselves to significant risks, particularly in the event of the broker's insolvency or operational issues.

Furthermore, the absence of any historical incidents or controversies related to fund safety can be seen as a double-edged sword. On one hand, it suggests that there have been no significant breaches; on the other hand, it raises questions about the broker's operational transparency and accountability. Traders must prioritize their financial security and consider whether they are comfortable with the potential risks associated with trading with a broker that lacks robust fund protection measures.

Customer Experience and Complaints

Customer feedback is often a telling indicator of a broker's reliability. Reviews of Warwick are mixed, with some users praising its trading platform while others express dissatisfaction with customer service and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

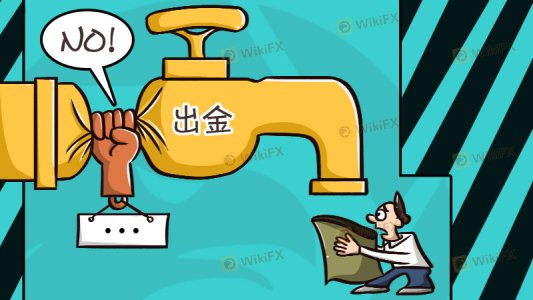

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Inconsistent |

| Platform Stability | Low | Generally stable |

Common complaints include difficulties in withdrawing funds and slow response times from customer support. A broker's responsiveness to customer issues is crucial, as it reflects its commitment to client satisfaction. The negative feedback surrounding withdrawal issues is particularly concerning, as it can indicate potential liquidity problems or operational inefficiencies.

While some users report a satisfactory trading experience, the prevalence of complaints related to customer support and withdrawal processes should not be overlooked. Traders must weigh these experiences against their own risk tolerance and investment goals when considering whether to engage with Warwick.

Platform and Execution

The trading platform's performance is another critical factor in assessing a broker's reliability. Warwick claims to offer a user-friendly interface and robust trading tools, but user experiences vary.

Traders have reported mixed reviews regarding order execution quality, with some mentioning instances of slippage and delayed order fulfillment. Such issues can significantly impact trading outcomes, particularly for those employing scalping or high-frequency trading strategies.

The absence of detailed information regarding platform stability and execution metrics raises concerns about potential manipulation or operational inefficiencies. Traders should be vigilant about the execution quality and overall performance of the trading platform before committing significant capital.

Risk Assessment

Engaging with a broker like Warwick comes with inherent risks that traders must consider. The absence of regulation, lack of transparency, and mixed customer feedback all contribute to a heightened risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities |

| Operational Risk | Medium | Limited information on fund security measures |

| Customer Service Risk | High | Poor response to complaints and withdrawal issues |

To mitigate these risks, traders should conduct thorough due diligence, consider starting with a smaller investment, and remain vigilant about monitoring their trading activities. Engaging with well-regulated brokers with a proven track record may offer a safer alternative for those concerned about the risks associated with Warwick.

Conclusion and Recommendations

In conclusion, the evidence suggests that traders should approach Warwick with caution. The lack of regulation, transparency issues, and mixed customer feedback raise significant concerns about its legitimacy and safety. While some users may have positive experiences, the potential risks associated with trading with an unregulated broker cannot be overlooked.

For traders seeking a more secure trading environment, it is advisable to consider well-established brokers regulated by top-tier authorities. Platforms like OANDA, IG, and Forex.com offer robust regulatory frameworks, transparent fee structures, and a proven track record of customer satisfaction. Ultimately, the decision to engage with Warwick should be made with a clear understanding of the associated risks, ensuring that traders prioritize the safety of their investments.

Is Warwick a scam, or is it legit?

The latest exposure and evaluation content of Warwick brokers.

Warwick Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Warwick latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.