Is Varot safe?

Business

License

Is Varot Safe or a Scam?

Introduction

Varot Financial, often referred to as Varot, positions itself as a player in the forex trading market, offering various financial instruments including forex pairs, commodities, and indices. However, the influx of unregulated brokers in the forex market necessitates that traders exercise caution and conduct thorough evaluations before committing their funds. The potential risks associated with trading with unregulated brokers can lead to significant financial losses. In this article, we will analyze the legitimacy and safety of Varot by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

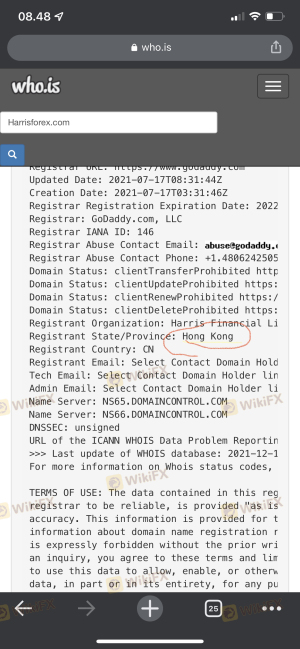

The regulatory status of a broker is one of the most crucial factors to consider when assessing its safety. Varot claims to operate from Hong Kong, yet it lacks a license from the Hong Kong Securities and Futures Commission (SFC), which is a requirement for all brokers operating in the region. The absence of regulatory oversight raises significant red flags regarding the legitimacy of Varot.

Here is a summary of Varot's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Hong Kong SFC | N/A | Hong Kong | Not Verified |

The SFC has issued warnings against Varot, labeling it as a "clone firm," which is a common tactic used by fraudulent brokers to mislead investors by adopting names similar to legitimate entities. This lack of regulation and the SFC's warnings indicate that trading with Varot could expose clients to substantial risks, as there are no guarantees for fund protection or adherence to fair trading practices.

Company Background Investigation

Varot Financial Limited was established in 2015 and claims to offer a comprehensive range of financial investment services. However, details regarding its ownership structure and management team are scarce. The absence of transparent information about the company's leadership raises concerns about its accountability and operational integrity.

The management team's background and professional experience are critical in assessing a broker's reliability. Unfortunately, Varot does not provide sufficient information regarding its executives, which further complicates the evaluation of its trustworthiness. Moreover, the company's website lacks essential corporate disclosures, such as incorporation details and contact information, which are fundamental for establishing credibility in the financial services industry.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions, including fees and spreads, is vital. Varot appears to have an unusually high minimum deposit requirement of $5,000, which is significantly above the industry average. This raises concerns about accessibility for retail traders and indicates a potential strategy to limit client participation.

The following table compares Varot's core trading costs with industry averages:

| Cost Type | Varot | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The high spread of 3 pips for major currency pairs is three times more than the industry standard, indicating that trading costs with Varot may be excessive. Such high costs can significantly affect a trader's profitability and suggest that Varot may not be the most cost-effective option for forex trading.

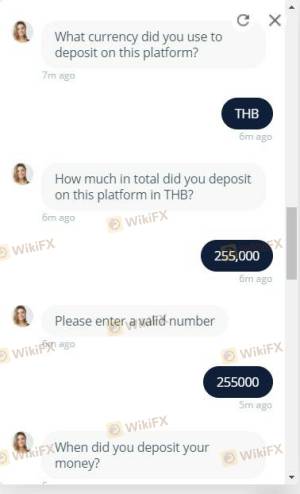

Client Fund Security

The safety of client funds is paramount when evaluating a broker's reliability. Varot does not provide clear information regarding its client fund security measures. There is no indication of segregated accounts or investor protection mechanisms in place, which are crucial for safeguarding client deposits.

Furthermore, the lack of transparency regarding the broker's fund management practices raises concerns about the potential misuse of client funds. Historical issues regarding fund security or disputes with clients have not been disclosed, which adds to the uncertainty surrounding Varot's operations.

Customer Experience and Complaints

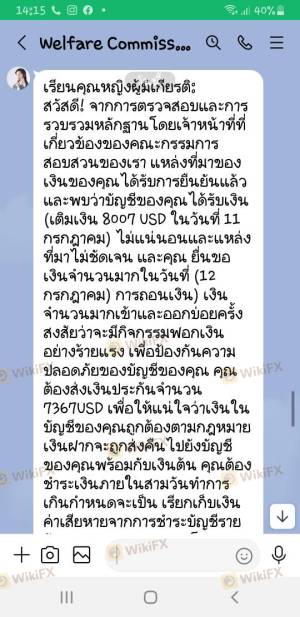

Analyzing customer feedback is essential for understanding a broker's reputation. Varot has garnered numerous negative reviews, with clients frequently reporting difficulties in withdrawing funds and poor customer service.

The following table summarizes the main types of complaints received about Varot:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Transparency Concerns | High | None |

Common patterns in complaints include unresponsive customer service and challenges in accessing funds, which are significant red flags for potential investors. For instance, one user reported an inability to withdraw their funds despite multiple requests, highlighting the operational inefficiencies and lack of support from Varot.

Platform and Trade Execution

Varot offers the MetaTrader 5 (MT5) platform, a widely recognized trading software known for its advanced features. However, the quality of execution on this platform is crucial for traders. Reports of slippage and order rejections have surfaced, suggesting that Varot may not provide the reliable execution expected from a reputable broker.

Moreover, any signs of platform manipulation or irregularities during trading sessions could further undermine the trustworthiness of Varot. The absence of detailed performance metrics and user feedback regarding execution quality raises concerns about the overall trading experience with this broker.

Risk Assessment

Using Varot for trading presents several risks that traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Fund Security Risk | High | Lack of client fund protection |

| Trading Cost Risk | Medium | High spreads and fees |

| Customer Service Risk | High | Poor response and support |

To mitigate these risks, traders should consider engaging only with regulated brokers that offer robust client protections, transparent fee structures, and responsive customer service.

Conclusion and Recommendations

In conclusion, the evidence strongly indicates that Varot is not a safe trading option. The lack of regulation, high trading costs, and numerous client complaints suggest that Varot operates in a manner that could jeopardize client funds and trust.

For traders seeking to engage in forex trading, it is advisable to explore alternatives that are regulated and have demonstrated a commitment to transparency and client support. Brokers such as OANDA, IG, or Forex.com are examples of reputable firms that provide a safer trading environment.

Ultimately, traders must prioritize their financial security and carefully assess the risks associated with any broker before investing their hard-earned money.

Is Varot a scam, or is it legit?

The latest exposure and evaluation content of Varot brokers.

Varot Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Varot latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.