Is GANAR MARKETS safe?

Business

License

Is Ganar Markets Safe or Scam?

Introduction

Ganar Markets is a forex brokerage that has recently emerged in the trading landscape, offering a variety of financial instruments, including forex, commodities, indices, and cryptocurrencies. As traders increasingly seek opportunities in the foreign exchange market, it becomes essential to evaluate the credibility and safety of brokers like Ganar Markets. The forex market is rife with potential risks, including scams and fraudulent activities, making it crucial for traders to conduct thorough due diligence before committing their funds. This article aims to provide an objective assessment of Ganar Markets, utilizing a comprehensive framework that includes regulatory status, company background, trading conditions, customer fund security, and client experiences. By analyzing these aspects, we aim to answer the pressing question: Is Ganar Markets safe?

Regulation and Legitimacy

One of the primary factors in determining the safety of a forex broker is its regulatory status. A well-regulated broker is typically more trustworthy and operates under stringent compliance standards, which helps protect traders' interests. Unfortunately, Ganar Markets is not regulated by any top-tier financial authority, which raises significant concerns regarding its legitimacy and operational practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Revoked |

| FCA | N/A | United Kingdom | N/A |

| CySEC | N/A | Cyprus | N/A |

The absence of regulation from recognized authorities such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) is alarming. The revocation of ASIC's license indicates that Ganar Markets may have failed to meet the rigorous standards required for operation. This lack of oversight can expose traders to significant risks, including the potential for unfair trading practices and the mismanagement of client funds. Consequently, the question of Is Ganar Markets safe? becomes increasingly concerning.

Company Background Investigation

Ganar Markets, founded in 2018, positions itself as a global broker offering access to various financial markets. However, the company's history and ownership structure remain somewhat opaque. It is registered in offshore jurisdictions, which often lack the regulatory rigor found in more established financial markets. This offshore registration can be a red flag, as it may indicate a lack of accountability and transparency.

The management teams background is also crucial in assessing the broker's reliability. Unfortunately, there is limited publicly available information regarding the qualifications and experience of the individuals leading Ganar Markets. The absence of a well-documented leadership team can further exacerbate concerns about the broker's operational integrity. Transparency in company operations and management is essential for building trust with clients, and Ganar Markets appears to fall short in this regard.

Trading Conditions Analysis

When evaluating Is Ganar Markets safe?, it's essential to consider the trading conditions offered by the broker. Ganar Markets provides a variety of trading accounts with different spreads, leverage, and commission structures. However, the overall fee structure may not be as competitive as other brokers in the market.

| Fee Type | Ganar Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | $7 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Ganar Markets can be higher than the industry average, potentially impacting traders' profitability. Additionally, the commission structure, which includes a fee of $7 per lot, may deter some traders from engaging with the platform. Such costs can accumulate, particularly for high-frequency traders. The lack of transparency regarding other potential fees, such as withdrawal or inactivity fees, could further complicate the trading experience.

Customer Fund Security

Ensuring the safety of client funds is paramount when assessing the reliability of any broker. In the case of Ganar Markets, there are concerns regarding its fund safety measures. The broker does not appear to have a robust system for segregating client funds, which is a common practice among reputable brokers. This lack of segregation can lead to potential issues in the event of the broker facing financial difficulties.

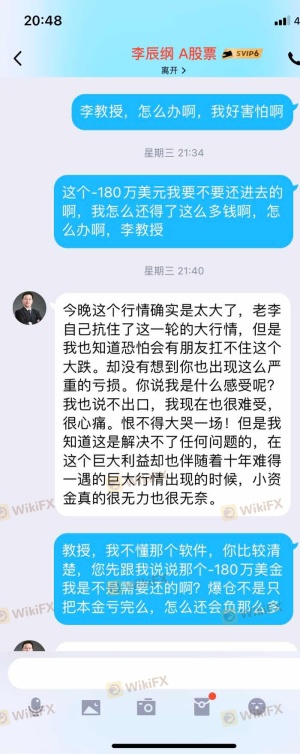

Additionally, Ganar Markets does not offer any investor protection schemes, such as compensation funds, which are often provided by regulated brokers to safeguard client funds. The absence of negative balance protection is another significant concern, as it could leave traders vulnerable to losses exceeding their account balance. Historical issues related to fund security have also been reported, with some clients alleging difficulties in withdrawing their funds, further raising the question, Is Ganar Markets safe?

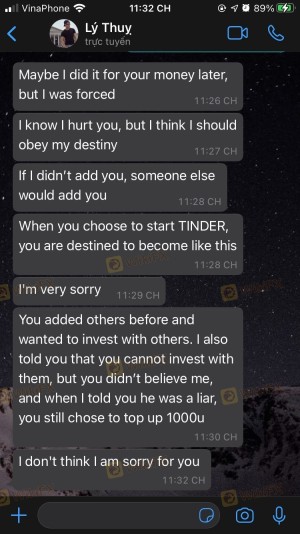

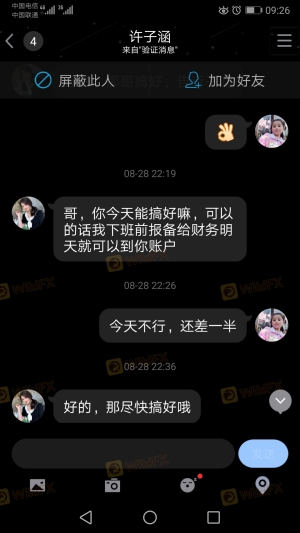

Customer Experience and Complaints

Analyzing customer feedback and experiences is crucial for understanding the overall reputation of Ganar Markets. Many traders have reported mixed experiences with the broker, highlighting both positive and negative aspects of their interactions. Common complaints include difficulties in fund withdrawals, lack of responsive customer support, and issues with account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Fair |

| Account Management Problems | High | Poor |

Some users have reported feeling frustrated with the response times from customer support and the lack of resolution for their issues. In particular, the withdrawal complaints have raised significant alarms, as timely access to funds is critical for traders. Such patterns of complaints can damage the broker's reputation and lead to distrust among potential clients.

Platform and Trade Execution

The trading platform offered by Ganar Markets is another critical aspect to consider when evaluating its safety. While the broker provides access to the popular MetaTrader 4 (MT4) platform, user experiences regarding its performance and stability have been mixed. Some traders report satisfactory execution speeds, while others have encountered slippage and order rejections.

The quality of order execution is vital for traders, especially in the fast-paced forex market. Instances of slippage, particularly during volatile market conditions, can lead to unfavorable trading outcomes. Additionally, any signs of platform manipulation or unfair practices can further exacerbate concerns about the broker's reliability.

Risk Assessment

Using Ganar Markets poses several risks that potential traders should be aware of. The lack of regulation, combined with the company's opaque background and mixed customer feedback, creates an environment filled with uncertainty.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No top-tier regulation. |

| Fund Security Risk | High | Lack of fund segregation and protection. |

| Customer Service Risk | Medium | Poor response to complaints. |

To mitigate these risks, traders should approach Ganar Markets with caution. It is advisable to start with a small investment, if at all, and to conduct thorough research before engaging with the broker. Exploring alternative brokers with better regulatory standing and customer feedback may also be beneficial.

Conclusion and Recommendations

In conclusion, the evaluation of Ganar Markets raises several red flags that suggest it may not be a safe choice for traders. The lack of regulation, opaque company background, and mixed customer experiences collectively contribute to a concerning picture. While the broker offers a range of trading instruments and competitive trading conditions, the risks associated with using Ganar Markets cannot be overlooked.

For traders seeking a reliable and trustworthy forex broker, it is advisable to consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers such as IG, OANDA, or Forex.com may provide a more secure trading environment. Ultimately, the question remains: Is Ganar Markets safe? The evidence suggests that potential traders should exercise caution and consider other options.

Is GANAR MARKETS a scam, or is it legit?

The latest exposure and evaluation content of GANAR MARKETS brokers.

GANAR MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GANAR MARKETS latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.